Ledger sits at the center of the hardware wallet and self‑custody ecosystem for digital assets, reflecting how security concerns and crypto adoption shape user behavior. Self‑custody devices like Ledger’s signers help both retail and institutional holders protect keys offline, while platforms like Ledger Live integrate management tools used by millions globally. In finance and cyber defense, demand for secure key storage influences risk strategies and regulatory planning. Explore detailed Ledger statistics below to understand the latest trends in usage, sales, and market impact.

Editor’s Choice

- Ledger Live and Ledger devices serve over 7–8 million customers across 160+ countries, with the company stating it secures more than 20% of the world’s crypto assets.

- Ledger has sold over 7 million hardware wallets globally, with more recent company communications indicating around 8 million devices sold as its product line expanded.

- Hardware wallet sales grew ~31% in 2025 vs 2024.

- Ledger revenue surpassed triple‑digit millions in 2025, a company record.

- Hardware wallets make up ~22% of all crypto wallets in 2025.

Recent Developments

- Ledger reported revenues in the triple-digit millions amid surging self-custody demand.

- $2.2 billion in crypto was stolen in the first half of 2025, with 23% targeting individual wallets.

- Ledger employs over 700 staff across 8 offices, focusing on US financial hubs.

- 56.58% of crypto users now prefer self-custody solutions like Ledger signers.

- Rebranded hardware wallets as “signers” and launched Nano Gen5 touchscreen device.

- Institutional wallet usage rose 51% year-on-year, boosting Ledger enterprise demand.

Hardware Wallets Market Forecast

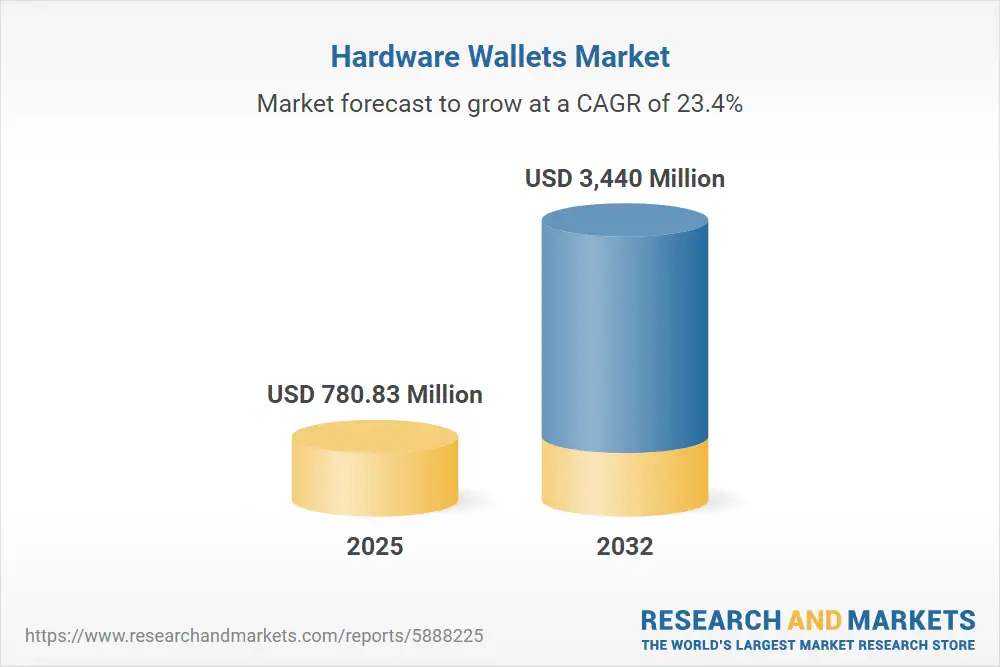

- The hardware wallet market is projected to grow at a CAGR of 23.4% from 2025 to 2032.

- The global market size is estimated at $780.83 million in 2025.

- By 2032, the market is expected to reach $3.44 billion, reflecting rapid adoption.

- This growth underscores rising demand for secure self-custody solutions amid increasing crypto adoption and cyber threats.

- The market forecast suggests a strong shift toward hardware-based cold storage over the next 7 years.

Global Ledger User Base Statistics

- Over 7–8 million users globally engage with Ledger Live and self‑custody workflows in 2025.

- Ledger’s device base includes over 7 million units sold historically.

- Hardware wallets represent ~22% of all crypto wallets in 2025, reflecting increasing interest in non‑custodial solutions.

- Market research estimates over 5.8 million hardware wallets shipped globally by the end of 2024.

- Retail crypto holders account for the majority of hardware wallet adoption, though the precise Ledger share is not published separately.

- Institutional adoption of self‑custody is rising, extrapolated from broader hardware wallet trends.

- Hardware wallets are increasingly preferred in regions with high crypto penetration and security concerns.

- Ledger’s global footprint expanded beyond Europe to North America and Asia, aligning with wallet sales patterns.

Ledger Hardware Wallet Sales

- Ledger has sold more than 7 million devices across markets.

- Hardware wallet shipments worldwide exceeded ~5.8 million units by 2024.

- Sales growth in 2025 was ~31% higher than in 2024.

- USB remains the dominant interface for hardware wallets, commanding a significant share of devices sold.

- North America led the hardware wallet market in 2024, likely driving continued sales.

- Asia Pacific shows the highest regional growth rate in hardware wallet adoption trends.

- Institutional purchases contribute larger order sizes, influencing overall sales value.

Live Usage Statistics

- Over 7–8 million cold wallet users actively rely on Ledger Live.

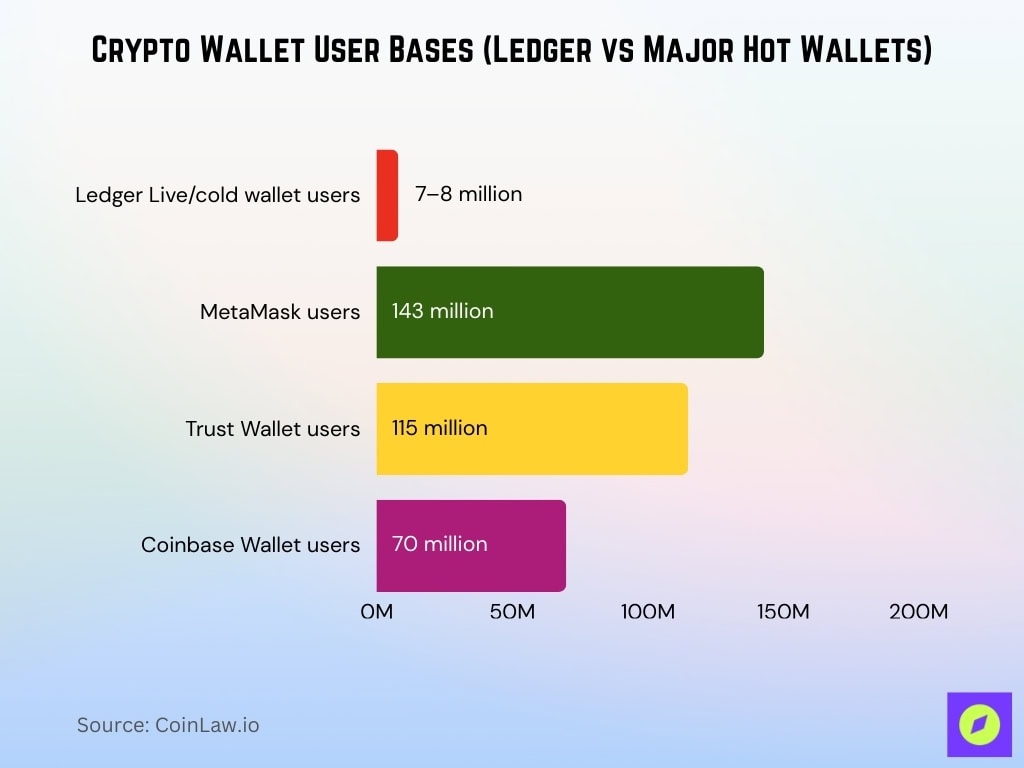

- Comparative wallet data shows MetaMask with 143 million users in 2025, situating Ledger Live in context.

- Trust Wallet records 115 million active users across platforms.

- Coinbase Wallet has 70 million users, highlighting competitive dynamics.

- Hardware wallets like Ledger’s are preferred by 71% of users, citing security reasons.

- Estimates indicate roughly 20–30% of global crypto users rely on cold wallets (including hardware) as primary storage, while around 69–78% still use hot wallets as their main option, highlighting both growth and remaining upside.

- Hardware wallet preference correlates with higher asset values per user.

- Monthly active usage patterns show steady engagement with self‑custody tools as markets stabilize.

Ledger Assets Under Custody

- Ledger states its signers secure over 20% of the world’s crypto assets, which external estimates value at around $400 billion in assets under protection, rather than $100 billion.

- The surge in thefts and hacks in 2025, $2.2 billion stolen in the first half alone, has driven increased self‑custody storage and multi‑factor offline key storage awareness.

- Retail investors increasingly move assets off exchanges and into cold wallets, contributing to rising assets under self‑custody.

- Institutional cold wallet adoption grew by about 51% year‑over‑year in 2025 as firms responded to compliance and custody requirements.

- Hardware wallet adoption increased by roughly 30‑34% year‑over‑year among retail users in 2025.

- North America remains a leading region for asset custody growth, partly driven by regulatory emphasis on secure private key custody.

- Crypto institutional funds often require multi‑signature hardware custody, boosting asset volumes held on Ledger‑secured signers.

Revenue and Funding

- Ledger reported triple‑digit millions in revenue in 2025, marking a record growth year.

- Prior public data shows Ledger revenue reached $70.9 million in 2024, up from $36.7 million in 2023.

- The growth trajectory reflects heightened crypto adoption and security demand.

- Ledger is reportedly considering a New York IPO or additional fundraising to support expansion efforts.

- Investor interest centers on Ledger’s position in hardware‑based self‑custody amid a fractured custody services market.

- Increased revenue is also tied to seasonal shopping demand spikes for hardware wallets.

- Funding activities may accelerate enterprise and institutional product development.

- Ledger’s revenue growth contrasts with broader industry revenue patterns, where secure custody providers command premium services.

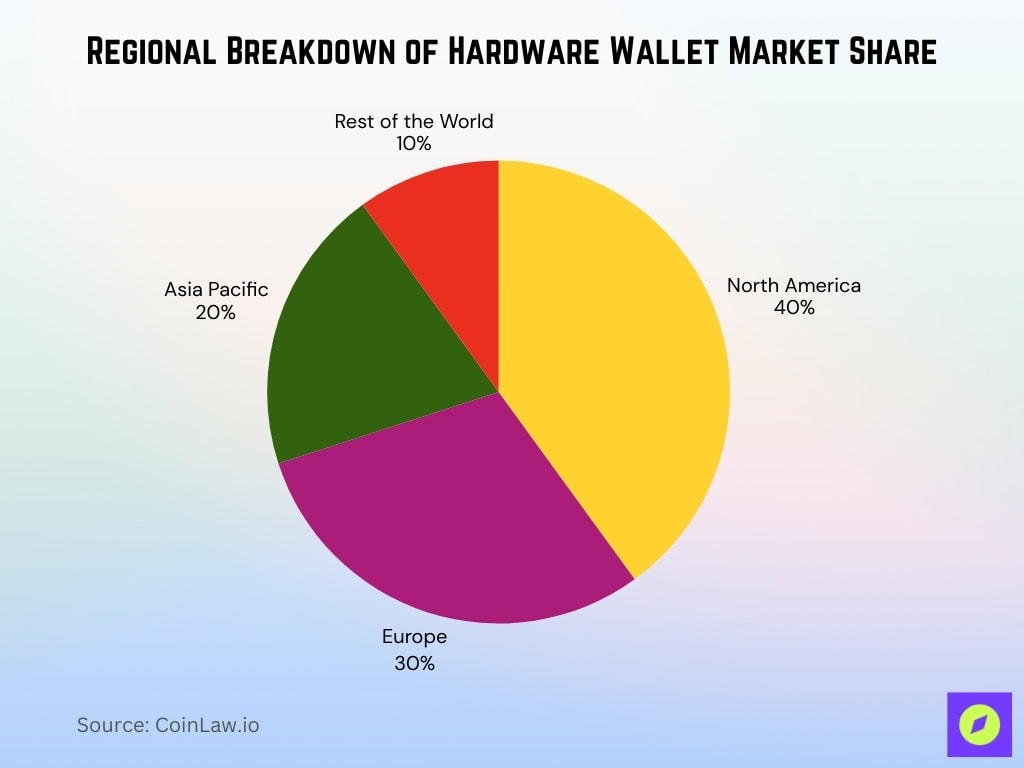

Regional Breakdown of Hardware Wallet Market Share

- North America holds the largest market share at 40%, driven by strong institutional demand and regulatory awareness.

- Europe accounts for 30% of the global hardware wallet market, reflecting high adoption across the EU and UK.

- The Asia Pacific region captures 20%, supported by growing crypto activity in countries like Japan, South Korea, and Australia.

- Rest of the World represents 10%, showing rising interest in cold storage solutions across emerging markets.

- Combined, North America and Europe make up 70% of the global hardware wallet demand.

- This distribution highlights where crypto self-custody adoption is most mature, while also pointing to future growth potential in underpenetrated regions.

Ledger Product Lineup Breakdown

- Ledger Nano Gen5 features a 2.76-inch E Ink touchscreen with 400×300 pixel resolution.

- Nano Gen5 storage capacity 1.5 MB supports 10-20 simultaneous blockchain apps.

- Ledger Flex dominates as the best-selling hardware wallet priced at $249.

- Ledger Stax offers a 3.7-inch curved E Ink display with 400×670 pixels and Qi charging.

- Nano S Plus supports up to 100 apps and over 5,500 cryptocurrencies.

- Ledger Flex provides a 2.8-inch Gorilla Glass touchscreen at 480×600 resolution.

- Ledger Vault includes multisig support, hardware security modules, and 24/7 monitoring.

- Ledger Live app (now Ledger Wallet) records 1.8M monthly visits with 3.01 pages per visit.

- Nano Gen5 weighs 46g with dimensions 79.4×53.35×8.64 mm and a 10-hour battery.

Ledger Supported Assets and Networks

- Ledger supports thousands of crypto assets, both directly and via integrations.

- The official list covers 1000s of cryptocurrencies, including Bitcoin and Ethereum.

- Third‑party wallet integration expands support to over 5,500 coins and tokens.

- Popular coins supported include BTC, ETH, XRP, USDC, and many EVM‑compatible tokens.

- NFTs on major blockchains like Ethereum and Polygon can be stored and viewed via Ledger Live.

- Staking support exists for coins like Ethereum, Polkadot, Tezos, and Solana.

- Ledger’s extensive asset support attracts diversified crypto portfolios.

- Compatibility with Metamask, Phantom, and other wallets increases access to network features.

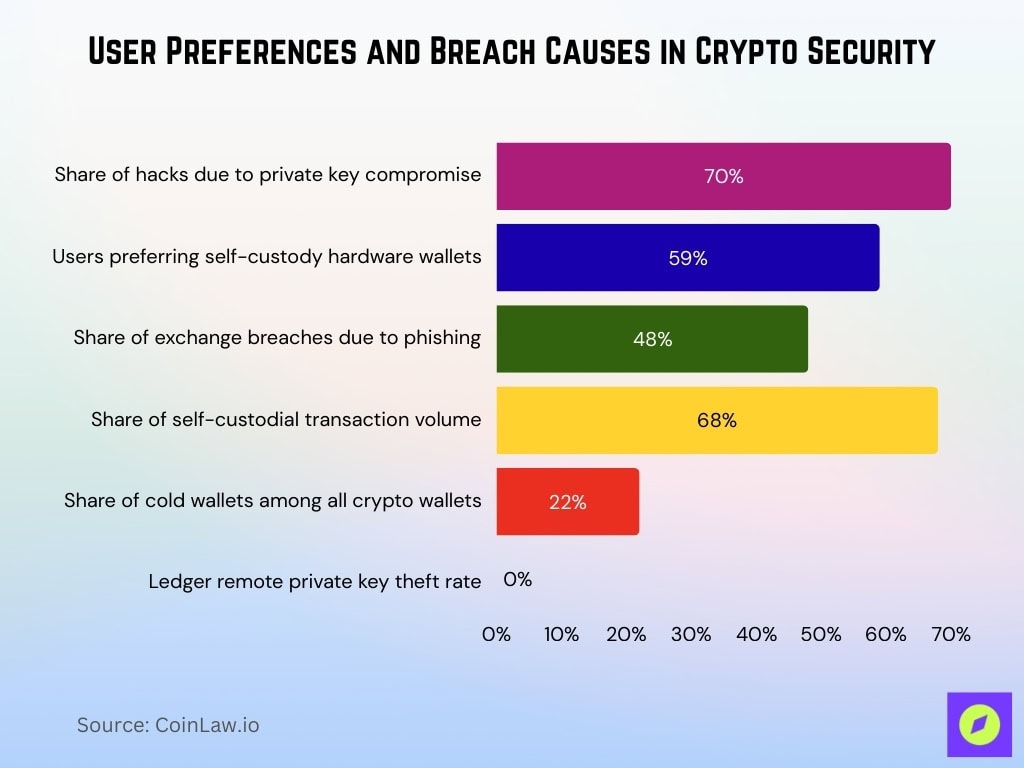

Device Security Statistics

- Ledger secure element chips resist physical attacks like those in passports and credit cards.

- No known widescale private key compromises from Ledger hardware devices despite data breaches.

- $2.37 billion lost to crypto hacks in H1, with 70% from private key compromises.

- 59% of users prefer self-custody hardware wallets over custodial options.

- 48% of exchange breaches are due to phishing, while hardware wallets require physical confirmation.

- $2.2 billion stolen in custodial hacks, driving 68% self-custodial transaction share.

- Cold wallets represent 22% of all crypto wallets with minimal air-gapped failures.

- Ledger devices maintain 0% remote private key theft amid rising threats.

Ledger Customer Demographics

- Younger adults continue to dominate crypto ownership, with ages 25‑34 well represented among users.

- Retail users represent approximately 82% of all crypto holders globally, with institutions comprising the remainder.

- North America, Europe, and the Asia‑Pacific region remain leading regions for crypto wallet usage and adoption.

- Crypto wallet users skew male, with some studies showing a roughly two‑thirds male share in ownership.

- The median age of U.S. crypto owners is around 45 years, though younger cohorts are more active.

- Average crypto owners hold multiple cryptocurrencies and wallets, suggesting diversified assets.

- Institutional users are increasing their self‑custody profiles significantly in 2025.

- Regional differences reflect broader crypto adoption patterns across markets.

Institutional and Enterprise Clients

- Institutional interest in self‑custody grew about 51% year‑over‑year in 2025, with firms citing compliance and risk management as drivers.

- Enterprise clients increasingly integrate hardware signers for multi‑signature and governance controls, especially in asset management and custody businesses.

- Corporate crypto treasuries that hold assets offline now make up a larger share of Ledger’s business‑to‑business segment.

- More than 60% of institutional crypto holders use cold storage solutions as part of diversified custody strategies.

- Financial firms in regulated markets, the U.S. and, EU, adopt offline key management to meet audit and compliance requirements.

- Ledger Vault and enterprise‑grade key governance tools saw increased deployments among hedge funds and trading desks in 2025.

- Institutional clients emphasize security certifications and hardware‑backed key storage in vendor evaluations.

- Demand from fintech and DeFi custodians also expanded, especially in North America and Europe.

Website and App Traffic

- Most users check a business’s online presence before engagement, with 97% of consumers reviewing websites before interacting with a brand.

- Search engines contribute ~93% of total website traffic for brands in 2025, emphasizing SEO importance.

- Average daily time users spend on social platforms worldwide is 2 h 21 min, reflecting broader digital engagement trends relevant to app‑driven services.

- Mobile usage continues to dominate web and wallet traffic, with most access from smartphones and tablets.

- Bounce rates for wallet and security sites hover around industry norms, ~37% average, indicating strong user intent traffic.

- High bounce rates can signal mismatches between user expectations and landing page content.

- App traffic peaks often correlate with crypto market volatility, showing spikes in engagement during price movements.

- Desktop sessions still matter for deep‑dive interactions such as security configurations and portfolio analysis.

Customer Satisfaction and Reviews

- Ledger holds a 3.5/5 overall Trust Index across review platforms with a strong popularity score.

- Trustpilot features 2,018 reviews averaging 2.5/5 with 39.54% 5-star ratings.

- 13,000+ users rate Ledger Nano devices 4.5/5 for ease of use and security.

- Ledger website traffic surged 155% year-over-year, indicating high user engagement.

- 47.82% 1-star reviews cite customer support delays on Trustpilot.

- Best Buy customer reviews average 4.8/5, praising security and setup ease.

- Ledger Live app earns 4.7/5 for portfolio management and DeFi features.

- 83% customer retention rate correlates with positive backup recovery feedback.

Security Breaches and Data Leaks

- 270,000 Ledger customers had emails, names, and addresses exposed in a 2020 e-commerce breach.

- $484,000 was stolen during a 5-hour Ledger Connect Kit exploit affecting DeFi dApps.

- $3.1 billion lost to crypto scams and hacks in the first half, with phishing as the top vector.

- 42% of Ledger scam victims are located in North America, per security incident analysis.

- $2.5 billion in crypto scam losses H1 driven by $1.71 billion wallet compromises.

- $33 million total estimated financial impact from Ledger incidents since 2020.

- 1 million email addresses leaked via a third-party API in the initial 2020 breach scope.

- Ongoing phishing uses stolen data, with a spike in sophisticated campaigns H1.

Social Media and Community Metrics

- Ledger X account maintains 1.2M+ followers with high engagement on security posts.

- r/ledgerwallet subreddit reaches 45K subscribers discussing products and scams.

- Ledger Discord server hosts 25K+ members active in support channels.

- Ledger YouTube channel garners 500K subscribers and 50M total views.

- Social media drives 68% of Ledger’s website traffic from community referrals.

- 2h 21min average daily social engagement aligns with Ledger educational content.

- 63.9% global population is on social media, which boosts Ledger’s self-custody awareness.

- Ledger posts achieve a 4.2% engagement rate, exceeding the crypto industry average.

Marketing and Brand Awareness Metrics

- Ledger.com receives 2.02M monthly visits with 40.83% from organic search.

- 48.65% direct traffic reflects strong brand recall and loyalty.

- “Ledger” keyword generates 60,500 monthly searches at position 1.

- Social networks drive 12% traffic, mainly from YouTube and X.

- Paid search contributes 1.68% traffic supporting acquisition goals.

- $315 billion US digital ad spend with 77% allocated to channels like Ledger’s.

- 97% consumers research online before purchase, aiding Ledger’s web presence.

- Average session duration reaches 7:28 minutes, indicating engaged visitors.

Frequently Asked Questions (FAQs)

Ledger has sold over 7 million devices worldwide.

On average, modern hardware wallets support over 150 cryptocurrencies.

The global cryptocurrency adoption rate reached about 9.9% in 2025, equating to ~559 million crypto holders worldwide.

Conclusion

Ledger stands as a critical pillar in the crypto self‑custody landscape, balancing security, adoption, and market visibility. Institutional uptake, rising assets under custody, and elevated demand for offline key protection reflect deeper trust in its ecosystem. Yet with evolving threats and competitive marketing dynamics, Ledger and its community must continue innovating on security, communication, and user experience to stay ahead. As blockchain adoption grows and threat environments evolve, self‑custody statistics will remain a key barometer for both industry health and user confidence, inviting you to explore patterns and insights beyond these headline figures.