KuCoin continues to stand as a major player in the crypto exchange world. With millions of users globally, it combines spot, derivatives, and novel products in one ecosystem. Real‑world use includes traders leveraging KuCoin for global arbitrage, and DeFi projects listing on KuCoin’s token launchpads to reach international audiences. Explore how the numbers behind KuCoin reveal its influence, and why they matter to industry watchers.

Editor’s Choice

- Over 41 million registered users as of H1 2025.

- More than 1,000 listed coins/assets on the spot market.

- Daily trading volume hit up to $1.9 billion in H1.

- 1,019 coins and 1,316 trading pairs are currently supported.

- KuCoin ranks among the top 10 exchanges by net inflows in 2024 with ~$262 million.

- The KuCoin Token (KCS) price is around $15.50, with a circulating supply of ~129.7 million.

- In 2025, KuCoin pleaded guilty to U.S. charges and agreed to pay nearly $297 million in fines, exiting U.S. trading operations for 2 years.

Recent Developments

- In H1 2025, KuCoin reported achieving double‑digit growth in spot trading, especially in the MENA and LATAM regions.

- In 2025, BC Wong was appointed CEO of KuCoin.

- KuCoin launched xStocks, a USDT‑denominated tokenized equity product, via a Swiss firm on Solana.

- KuCoin admitted guilt to operating an unlicensed money transmitter in the U.S., paying ~$297 million, and suspending U.S. trading.

- In Canada, FINTRAC in 2025 imposed a $19.6 million penalty for regulatory noncompliance, which KuCoin is appealing.

- KuCoin’s EU CEO, Oliver Stauber, advanced trust and innovation messaging at the 2025 HODL Summit.

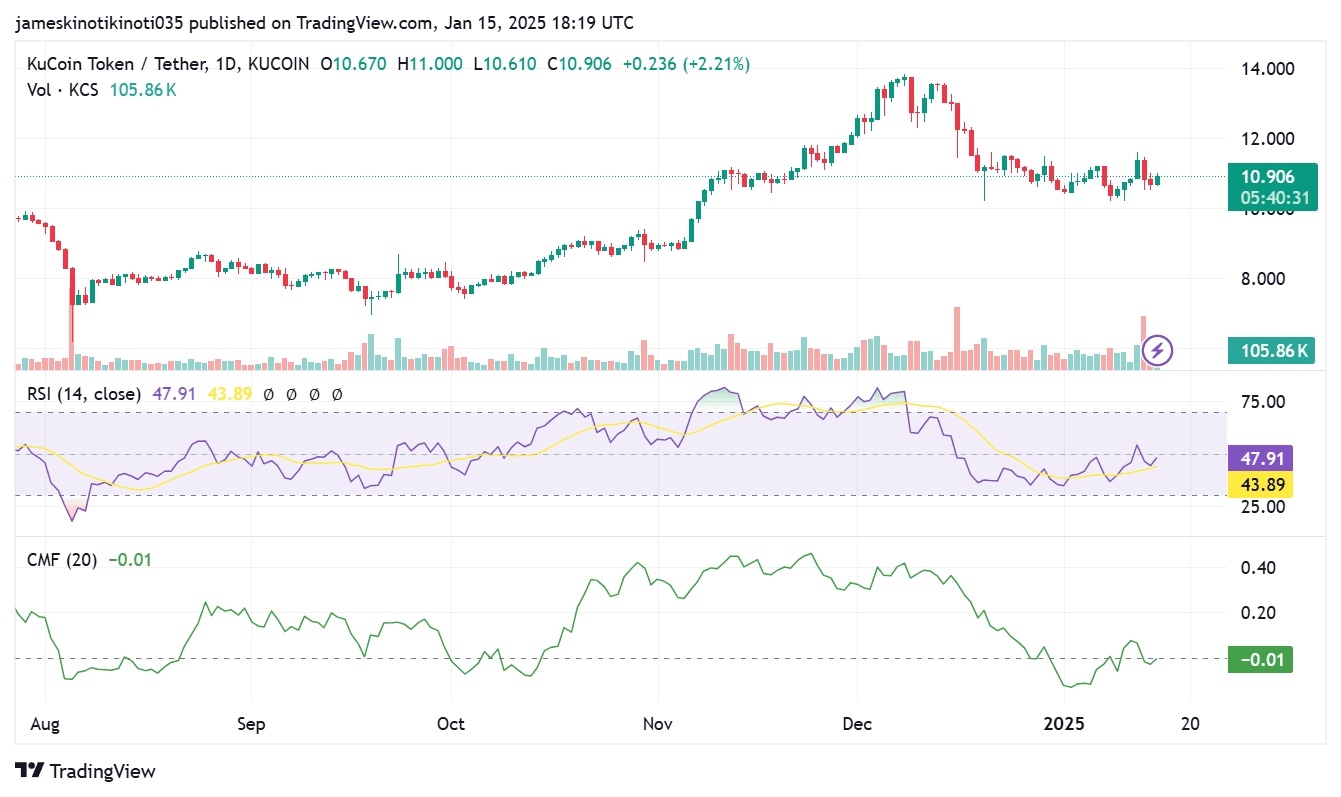

KuCoin Token (KCS) Market Snapshot

- Closing price: $10.91, showing a +2.21% daily gain.

- Trading volume: 105.86K KCS, indicating moderate market activity.

- Price range: Traded between $10.61 (low) and $11.00 (high) for the day.

- RSI (14-day): 47.91, placing KCS in the neutral zone (neither overbought nor oversold).

- CMF (20-day): –0.01, suggesting slightly negative money flow, with marginal selling pressure.

- Recent trend: Price recovering after a correction from the December 2024 peak near $14.00.

- Momentum indicator crossover: RSI is approaching the midline, hinting at potential bullish momentum if sustained.

Number of Users

- KuCoin reports 41+ million registered users as of mid‑2025.

- Earlier sources list “over 40 million users across 200+ countries”.

- In 2024, KuCoin had roughly 30 million users before accelerated growth.

- Growth in 2025 has been driven by expansion in emerging markets and increased listing activity.

- The active monthly user count is not always disclosed publicly; many users remain dormant or non‑trading.

- The user base spans over 200 countries and regions.

- Regional growth in Latin America and MENA contributed significantly to the new users in H1 2025.

Global Reach and Supported Countries

- KuCoin operates across 200+ countries and regions.

- The exchange maintains a broad presence in Latin America, Asia, Africa, and Europe, with a recent push into MENA.

- Restricted jurisdictions include the U.S. (suspended trading) and some countries under local bans on crypto.

- KuCoin established a partnership to launch KuCoin Thailand via ERX Company, supervised by the Thai SEC, effective April 2025.

- EU operations see visible leadership presence (e.g., EU CEO) and promotional activity.

- Despite regulatory pressures, KuCoin continues to expand into frontier markets seeking crypto adoption.

- Some countries may still have limited features (e.g., no fiat on‑ramp) depending on local rules.

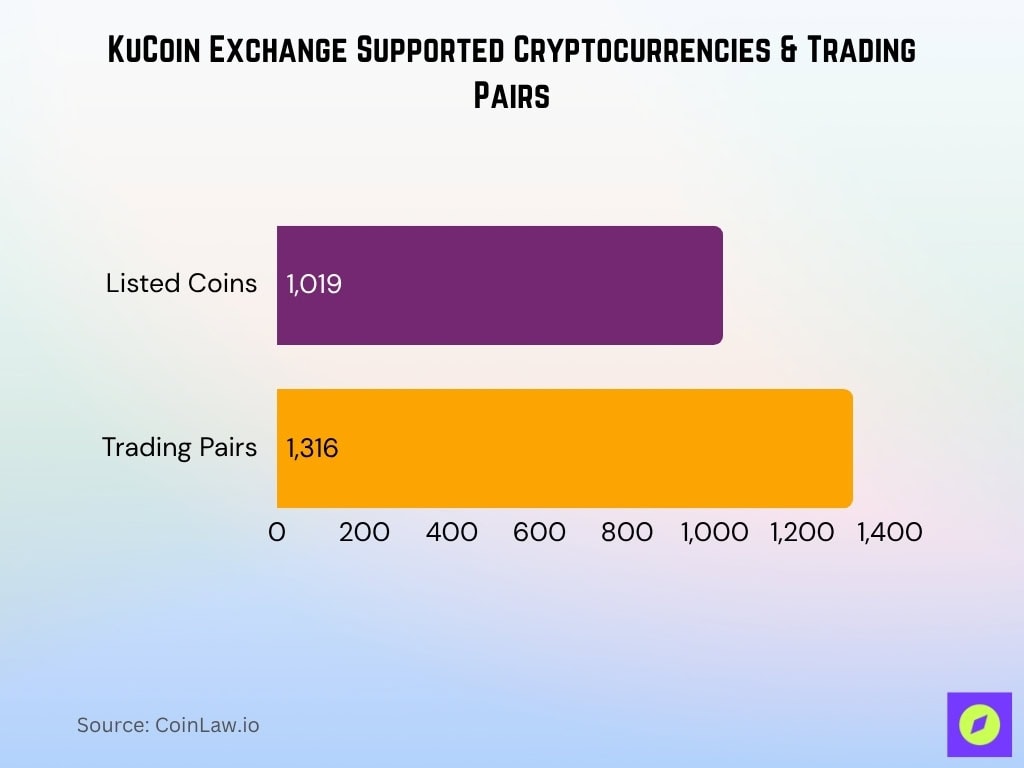

Supported Cryptocurrencies & Trading Pairs

- There are 1,019 coins and 1,316 trading pairs on KuCoin as of the latest data.

- The exchange regularly exceeds the 1,000-asset threshold in H1 2025.

- KuCoin supports top assets: BTC, ETH, USDT, BNB, ADA, XRP, DOGE, DOT, UNI, etc.

- Many pairs are quoted versus USDT, with some against BTC and other base currencies.

- KuCoin lists trending “meme” and novelty tokens alongside mainstream ones, expanding its niche appeal.

- It maintains liquidity support for lower‑cap tokens via listing programs.

- Occasionally delists assets that no longer meet listing criteria or liquidity thresholds.

- KuCoin aggregates deep liquidity across many trading pairs to support arbitrage and cross‑market strategies.

Market Share and Exchange Rankings

- In 2025, the top 10 exchanges control over one‑third of the global crypto exchange market, and Binance leads with a 12.6% share.

- KuCoin ranks among the top 10 exchanges by net inflows (8th) in 2024 with ~$262 million.

- KuCoin holds a spot among large centralized exchanges by traffic, liquidity, and trading volume.

- In mid‑2025, KuCoin often sees daily volumes near $1.9 billion.

- Its 24h volume is over $1.63 billion in recent statistics.

- 24‑hour volume ~ $821 million and weekly volume approaching $547 billion (data estimation).

- Exchange ranking services list KuCoin among mid‑to high-tier in exchange depth and market share metrics.

- In June 2025, KuCoin’s volume dropped alongside others (plunged ~39%) in a broader market slump.

KuCoin Token (KCS) Statistics

- Price / Market Cap: As of the latest data, KCS trades at ~$15.45, with a market cap of ~$1.89 billion and a circulating supply of ~129.77 million KCS.

- Total vs Max Supply: The total (max) supply is 200 million KCS, with a deflationary goal to reduce to 100 million via burns.

- Burn Mechanism: In September 2025, KuCoin burned 62,386 KCS (~$726k) in the 62nd monthly burn, reducing the circulating supply.

- Trade Volume: 24h trading volume for KCS is modest, ~$6–8 million range.

- Price History / Volatility: In June 2025, the KCS price ranged in the $11.12–$11.23 window.

- Predictions / Forecasts: Some forecasts expect KCS to reach between $14.85 and $17.65 during 2025.

- Technical Signals: The token often trades above its 30-day SMA and is close to key resistance levels around $16.13.

- Utility / Tokenomics: KCS is used for fee discounts, staking, and as part of profit‑sharing mechanisms.

Trading Fees Structure

- Spot Base Fee: Standard spot trading fees start at 0.1% maker and 0.1% taker.

- Futures Fees: For perpetual futures, maker fee = 0.020%, taker fee = 0.060%.

- Tiered VIP Discounts: Users with higher volumes or large KCS holdings can qualify for fee discounts.

- Leverage / Margin Fees: The same base trading fees apply to leveraged token trading.

- Funding Rate / Floating Fees: Funding fees are charged every 8 hours based on position value × funding rate.

- Fee Calculation: Trading fees for futures = Position Value × Fee Rate.

- Maker / Taker Definition: Orders that provide liquidity (maker) pay a different rate than taker orders.

Margin, Futures, and Leverage Statistics

- Contract Type: KuCoin supports USDT-margined perpetual contracts, e.g., XBTUSDTM, with mark price and zero expiry.

- Max Leverage: Up to 100× leverage is available on some contracts.

- Funding Interval: Funding rates are settled every 8 hours.

- Initial / Maintenance Margins: Maintenance margin is ~0.40%; initial margin corresponds to the leverage used.

- Funding Rate Dynamics: If futures trade above spot, longs pay shorts, and vice versa.

- Open Interest / Contracts: XBTUSDTM shows open interest in millions of contracts.

- Liquidation Fee: The Typical liquidation fee is ~0.06% on futures contracts.

- Volatility & Risk Metrics: Futures markets show higher volatility and funding swings compared to spot.

Security and Insurance Metrics

- Security Reserves / Trust Fund: KuCoin has a “Trust Project” reserve of $2 billion.

- Profit‑based Insurance: Part of profits go toward reserves.

- Past Breach History: Major 2020 hack led to updated security protocols.

- Bug Bounty Program: An Active program for finding vulnerabilities.

- Multi‑factor and Withdrawal Safety: 2FA, cold storage, and multi‑sig are used.

- KCS Burn & Profit Usage: 10% of profit funds monthly KCS burns.

- Transparency / Audits: KuCoin occasionally publishes audits and security updates.

- Risk Management Controls: Mechanisms monitor large withdrawals and trading anomalies.

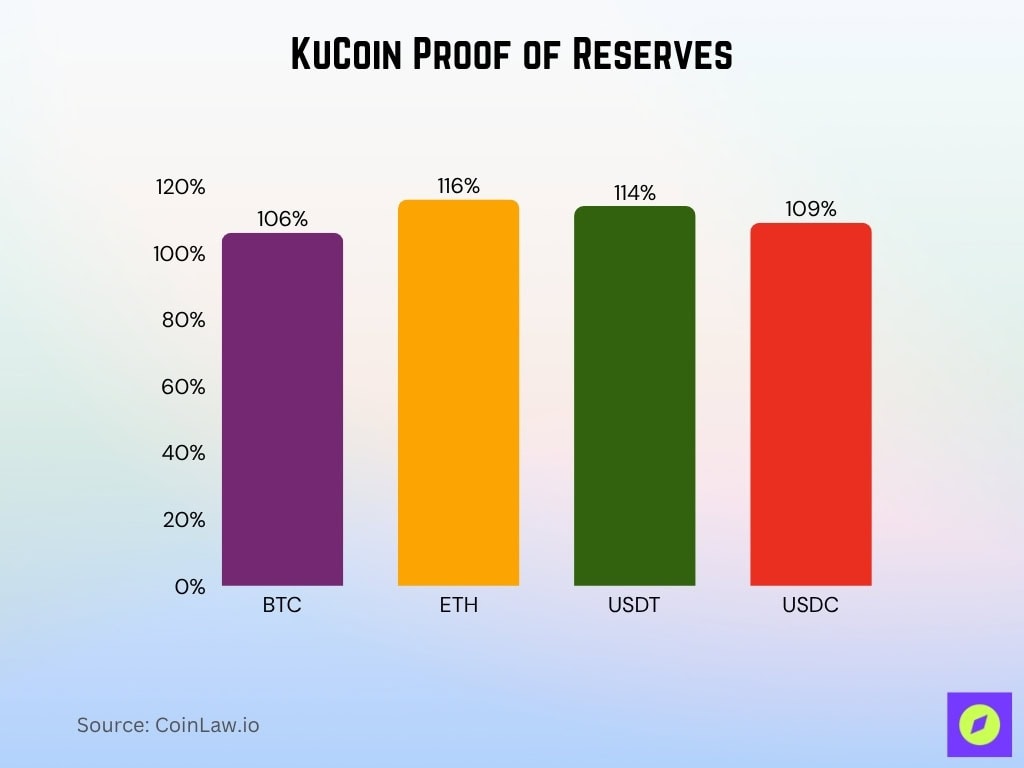

KuCoin Proof of Reserves

- BTC Reserve Ratio: 106%, KuCoin holds 10,306.78 BTC vs. 9,751.17 BTC in user assets. This shows a surplus of 555.61 BTC, indicating full backing plus extra liquidity.

- ETH Reserve Ratio: 116%, KuCoin holds 168,779.13 ETH vs. 145,807.40 ETH owed to users. This reflects a strong buffer of 22,971.73 ETH, signaling healthy reserves.

- USDT Reserve Ratio: 114%, KuCoin wallets contain 1.34 billion USDT, while user assets total 1.18 billion USDT. The 159 million USDT surplus provides high assurance of solvency.

- USDC Reserve Ratio: 109%, KuCoin holds 93.42 million USDC vs. 85.71 million USDC in customer accounts. The 7.71 million USDC excess reinforces confidence in reserve transparency.

Regulatory Compliance Milestones

- U.S. Guilty Plea & Penalty: KuCoin pleaded guilty and paid ~$297 million, exiting U.S. trading.

- Departure from the U.S. Market: U.S. operations suspended for two years.

- Canadian Penalty: FINTRAC imposed C$19.6 million penalty, currently being appealed.

- EU Engagement: EU CEO appointed, increased regulatory visibility.

- Thailand Licensing Cooperation: KuCoin Thailand launched under Thai SEC supervision.

- KCS Burn Disclosure: Monthly burns are published to support transparency.

- AML / KYC Strengthening: Legal settlement mandates improved compliance.

- Future Reentry Planning: KuCoin plans U.S. reentry post-compliance.

Employee and Team Size

- Headcount Estimates: No public estimate currently disclosed.

- Global Presence: Teams operate across Asia, Europe, MENA, and LATAM.

- Leadership Roles: CEO BC Wong and EU CEO Oliver Stauber lead operations.

- Regulatory / Compliance Staff: Teams expanded post-legal settlements.

- Engineering & Security Teams: Invested in core infrastructure and security.

- Support & Operations Staff: Large support presence globally.

- Third‑party Contractors: Used for local operations and legal compliance.

Customer Support Performance

- Over 1.2 million service requests handled in H1 2024.

- 34 million users during that time indicate rising support demands.

- Multilingual support spans 20+ languages.

- Offers email, chat, ticketing, and social media channels.

- Public status page reports incidents and support escalations.

- Reviews indicate slower support during peak activity periods.

- Developer API support via a dedicated contact.

- CoinGecko gives a 0.5 / 10 score for team transparency.

Passive Income and Staking Statistics

- KuCoin Earn offers flexible and fixed staking.

- Flexible yields range from 1% to 13% APY.

- Locked staking products offer up to 24% APY.

- Rewards are often credited daily.

- 40+ assets supported across staking products.

- KCS Loyalty Program offers enhanced staking benefits.

- Loyalty tiers K1–K4 are unlocked via staking levels.

- Liquid staking options like ksETH are supported.

- Redemption delays apply to some plans.

Trading Volume by Region

- ~70% of users are from EMEA and Southeast Asia.

- LATAM volume grew 31%, MENA grew 25% in H1 2024.

- Lifetime platform volume exceeds $1.7 trillion.

- ETH/USDT accounts for ~40.9% of spot volume.

- BTC/USDT makes up ~17.3%.

- The top 5 pairs contribute ~82% of daily volume.

- Public API endpoints allow access to market data.

- Regional breakdowns not officially published.

Mobile and API Usage Data

- API supports trading across 600+ assets.

- SDKs and test environments are available.

- CoinGecko gives KuCoin’s API an A grade.

- Websockets support real-time data and trading.

- Mobile app covers staking, spot, futures, and more.

- Bot traders heavily use backend APIs.

- Rate limits are enforced to control API load.

- System status updates are available online.

Social Responsibility Initiatives

- Maintains $2 billion in reserves under “Trust Project”.

- Public bug bounty program encourages external review.

- Monthly KCS burns are shared with users.

- Reinforces AML and KYC after enforcement cases.

- Media updates show commitment to global compliance.

- Occasionally engages in charitable or public causes.

- Enhances access for developing economies.

- Uses cold storage, audits, and risk controls to protect users.

Frequently Asked Questions (FAQs)

Over 41 million users.

ETH/USDT sees ~$1.08 billion in 24h volume.

About $1.7 trillion in lifetime trading volume.

KuCoin ranked 8th with $262 million in net inflows.

They fell by over 39 % in June 2025.

Conclusion

Over the three sections of this article, we’ve parsed KuCoin’s operational footprint through user numbers, market share, token metrics, fee structures, derivatives, staking, security, partnerships, and more. The data shows an exchange that continues scaling globally, innovating with products like xStocks, and pushing for transparency amid regulatory challenges. Still, gaps in public detail, especially around staff size, mobile usage, and regional volume breakdowns, limit complete clarity. In sum, KuCoin today stands as a complex, ambitious, and evolving platform.