Imagine this: a single fraudulent claim might seem minor, but when thousands of such claims flood the system, the financial impact is staggering. Insurance fraud is not just about individuals trying to cheat the system; it spans global networks, corporate fraud, and even cyber schemes. The importance of detecting and preventing these fraudulent activities is more critical than ever. This article dives into the latest statistics and trends in insurance fraud detection, equipping readers with the knowledge to understand and combat this growing issue.

Editor’s Choice

- Around 10% of all insurance payouts in the U.S. are estimated to be fraudulent.

- Healthcare fraud in the U.S. led to $14.6 billion in losses in 2025.

- AI-powered claims automation can reduce processing time by up to 70%, and early adopters report significant cost savings.

- Property and casualty insurance fraud costs insurers roughly $50 billion each year.

- Cyber insurance fraud attempts are rising sharply, with cyber threats now among the top fraud drivers.

Global Financial Impact of Insurance Fraud

- The U.S. economy suffered $308.6 billion in insurance fraud losses annually in 2025.

- Asia-Pacific saw a 22% year-over-year increase in fraudulent claims continuing into 2025.

- Cross-border collaborations between insurers and enforcement agencies have recovered over $1 billion in fraud-related payouts globally in recent years.

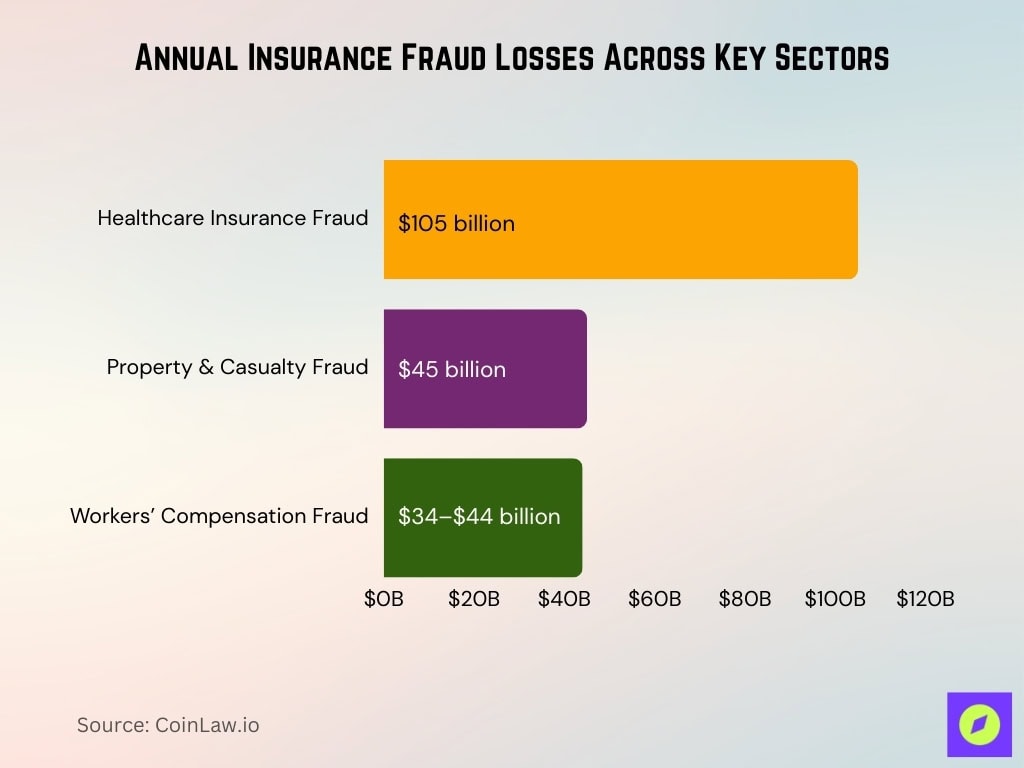

Prevalence of Insurance Fraud by Sector

- Healthcare insurance fraud leads with losses of about $105 billion annually in 2025, accounting for around 34% of U.S. insurance fraud.

- Property and casualty fraud costs insurers about $45 billion per year, with increases near 16% after natural disasters.

- Workers’ compensation fraud in the U.S. results in about $34-44 billion in annual losses.

- Auto insurance fraud increased by 19% in 2025, driven largely by staged accidents.

- Cybersecurity-related fraud makes up around 11% of total claims fraud, with steep growth in incidents.

- Home insurance fraud rose by 14% with many fabricated claims for minor damages.

- Travel insurance fraud increased by 9% driven mainly by false trip cancellation claims.

Common Types of Insurance Fraud

- False claims make up about 10% of all insurance claim losses in 2025.

- Staged accidents in auto insurance surged by 19% year-over-year in 2025.

- Identity theft-related fraud, including synthetic identity, is rising sharply by about 49% in 2025.

- Inflated property damage claims account for around 35% of detected fraud cases in 2025.

- Premium diversion schemes contribute to losses, with workers’ compensation fraud costing $34-44 billion in 2025.

- Organized criminal networks are involved in about 20% of insurance fraud activities worldwide in 2025.

- Synthetic fraud using AI-generated identities has grown by nearly 49% year-on-year in 2025.

Property and Casualty Insurance Fraud

- U.S. property and casualty fraud costs insurers $90-122 billion annually in 2025.

- About 10% of all property and casualty insurance claims were fraudulent in 2025.

- Inflated property damage claims account for around 35% of detected cases.

- Fake repair invoices appear in about 22% of property insurance claims.

- The property and casualty sector contributes nearly $50 billion to total U.S. insurance fraud losses.

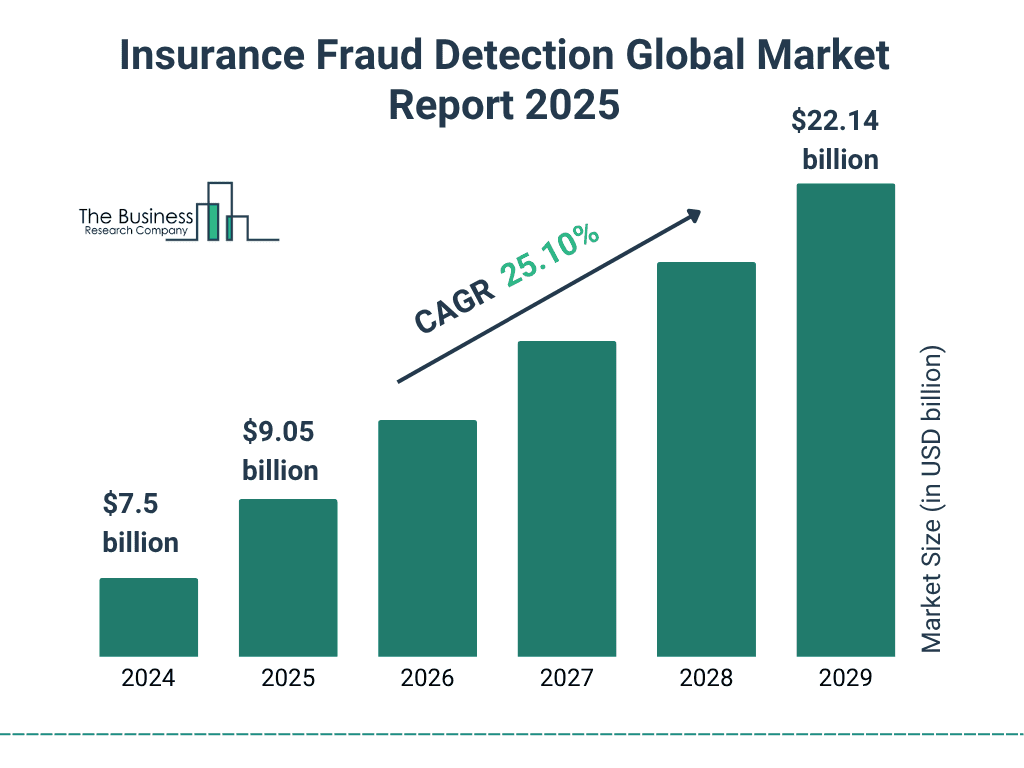

Global Insurance Fraud Detection Market Growth

- The global insurance fraud detection market was valued at $7.5 billion in 2024.

- In 2025, the market is projected to reach $9.05 billion.

- By 2029, the market size is expected to hit $22.14 billion.

- This represents a strong CAGR of 25.10% over the forecast period.

- The market is set to nearly triple in five years, highlighting the rapid adoption of advanced fraud detection technologies.

Healthcare Insurance Fraud

- U.S. healthcare fraud takedowns in 2025 revealed over $14.6 billion in alleged false claims schemes.

- Medicare and Medicaid prevented more than $4 billion in payments tied to fraudulent claims in 2025.

- Organized fraud schemes targeting Medicare submitted over $10.6 billion in false claims in 2025.

- Real-time AI and data analytics systems helped reduce fraudulent healthcare claims in 2025.

Workers’ Compensation Fraud

- U.S. workers’ compensation fraud now costs insurers between $35 billion-$44 billion annually in 2025.

- Fabricated injury claims increased by 22% year-over-year, affecting the right of claim severity in 2025.

- Exaggerated injury reports contributed to over $5-7 billion in overpaid claims in 2025.

- Double-dipping fraud filing claims in multiple states rose by about 15% in 2025.

- Fraudulent temporary disability benefit claims grew by 12% in 2025.

- Employers committing premium fraud caused roughly $9 billion in losses in 2025.

- Data analytics helped flag about 9% of suspicious claims in 2025, leading to notable savings.

The Role of Data Analytics in Insurance

- Customer insights lead with 25%, making it the top use of analytics in insurance.

- Risk assessment and pricing account for 20%, showing strong reliance on data-driven underwriting.

- Fraud detection represents 15%, underscoring its importance in cutting financial losses.

- Claims processing also makes up 15%, streamlining workflows and improving speed.

- Telematics and auto insurance contribute 10%, highlighting connected car data in policy decisions.

- Predictive analytics also stands at 10%, helping insurers anticipate risks and behaviors.

- Operational efficiency is 5%, showing a smaller but growing role in reducing costs.

Cybersecurity and Identity Theft in Insurance

- Cyber insurance claims rose by nearly 50% globally in 2025, with ransomware and data breaches driving growth.

- Identity theft in insurance fraud is projected to increase by 49% by the end of 2025.

- Synthetic identity fraud now makes up about 25% of identity theft-linked insurance cases.

- Phishing attacks targeting policyholders increased by 24% in 2025, often enabling unauthorized claims.

- The average cost per identity theft-related insurance claim reached about $12,000 per incident in 2025.

- Stolen digital identities were involved in nearly 20% of cyber insurance fraud cases in 2025.

- Blockchain-based authentication and real-time analytics reduced cyber and identity theft-related insurance fraud by about 11% in 2025.

Phishing Scams and Fraudulent Claims

- Phishing-related insurance claims surged by nearly 50% globally in 2025, driven by email attacks and credential theft.

- Fraudulent claims originating from phishing emails cost insurers about $10-12 billion globally in 2025.

- Credential theft via phishing was linked to around 25% of all fraudulent claims in insurance in 2025.

- Social engineering scams producing falsified claims rose by about 20-25% year-over-year in 2025.

- Use of AI-generated phishing emails made scams roughly 30% more effective at deceiving policyholders in 2025.

- Fake agents running phishing schemes defrauded 50,000-60,000 policyholders globally in 2025.

- Employee-targeted phishing led to internal fraud cases worth $2.5-3.0 billion globally in 2025.

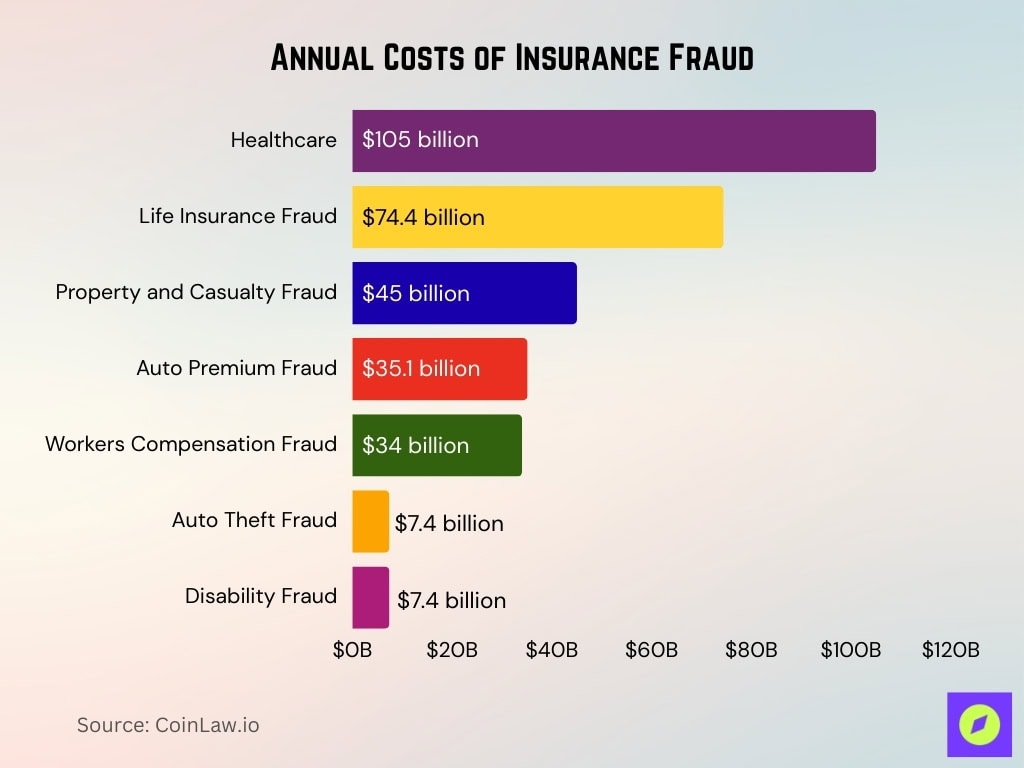

Annual Costs of Insurance Fraud

- Healthcare fraud leads with $105 billion in yearly losses, the single largest contributor.

- Life insurance fraud costs $74.4 billion annually, ranking second in impact.

- Property and casualty fraud results in $45 billion in losses each year.

- Auto premium fraud adds $35.1 billion to the total cost of fraud.

- Workers’ compensation fraud accounts for $34 billion annually.

- Auto theft fraud and disability fraud each cost $7.4 billion per year.

- In total, insurance fraud drains $308.6 billion annually from consumers in the U.S.

Anti-Fraud Technology in Insurance

- Automated claims processing systems reduced fraudulent claims by 22% improving efficiency in 2025.

- Voice analysis tools detected 17% of deceitful claimants during customer interactions in 2025.

- Image recognition AI flagged 25% of falsified documents submitted during claims in 2025.

- Geotagging verification uncovered $500 million in false location claims in 2025.

- IoT devices like telematics helped cut auto insurance fraud by 19% in 2025.

- Fraud detection apps among policyholders grew by 12% adoption in 2025, helping avoid scams.

- Multi-layered cybersecurity measures lowered fraud attempts on digital insurance platforms by 13% in 2025.

Home Insurance Fraud

- U.S. home insurance fraud losses rose to about $45-$50 billion annually in 2025.

- Exaggerated storm damage claims increased by 15% with many minor repairs claimed as total rebuilds in 2025.

- Arson-related fraudulent home insurance claims rose by 10% year-over-year in 2025.

- Fraudulent theft claims involving high-value items made up 25% of flagged cases in 2025.

- False water damage repair claims surged by 18% often involving inflated contractor invoices, in 2025.

- Smart home and real-time monitoring technologies helped cut fraudulent home insurance claims by 14% in 2025.

- Community-based watch and oversight programs prevented about 7% of potential fraud attempts in 2025.

Legal and Regulatory Measures

- The 2025 National Health Care Fraud Takedown charged 324 defendants for schemes involving over $14.6 billion in intended losses.

- The False Claims Act generated nearly $3.8 billion in judgments and settlements in the first half of 2025.

- New legislation introduced in 2025 seeks criminal penalties for brokers submitting false insurance enrollments.

- State regulators in 2025 increased enforcement actions with enhanced penalties and accountability laws for insurance fraud.

- CMS charged a brokerage firm and its CEO in 2025 for a $161 million ACA marketplace enrollment fraud scheme.

Recent Developments

- Global insurance fraud losses are expected to exceed $80 billion annually in 2025.

- Blockchain-based smart contracts are reducing fraudulent claim payouts by about 20% in sectors adopting them.

- Insurers saved around $5 billion globally in 2025 through enhanced fraud detection technologies.

- Phishing-related insurance fraud grew by about 18% year-over-year in 2025, highlighting rising cybersecurity threats.

- Cross-border anti-fraud alliances helped recover around $1.7 billion in fraudulent payouts globally in 2025.

Frequently Asked Questions (FAQs)

About 10% of P&C claims are fraudulent, costing roughly $122 billion annually.

The market is about $9.13 billion in 2025 and is projected to reach $22.92 billion by 2029 at a 25.9% CAGR.

Estimated annual U.S. insurance fraud losses total about $308.6 billion.

Identity-theft-linked insurance fraud is projected to increase 49% by year-end 2025.

Authorities charged 324 defendants tied to $14.6 billion in intended losses, with about $2.9 billion in actual losses identified.

Conclusion

The fight against insurance fraud is evolving as both fraudsters and insurers adopt increasingly sophisticated tools. While this year marked notable progress, with AI and blockchain technologies driving innovation, fraud remains a persistent challenge. The statistics illustrate the necessity for collaborative efforts between insurers, regulators, and policyholders. The industry must stay ahead by leveraging technology, enforcing regulations, and fostering awareness to safeguard the integrity of insurance systems.