In 2025, inflation is more than a number on the news; it’s a factor shaping decisions at the grocery store, affecting our travel budgets, and influencing policy decisions from Washington, D.C., to cities around the globe. With price increases impacting essentials like food, housing, and fuel, understanding inflation helps us navigate these changes. This article dives deep into the latest inflation statistics for 2025, offering a closer look at global inflation, key trends, and how these changes influence our daily lives.

Editor’s Choice: Key Inflation Trends

- Global inflation is projected to average around 4.3% in 2025, according to recent estimates from the IMF and other global institutions.

- U.S. inflation is at 2.7%, with core inflation at 3.1%.

- As of mid‑2025, Euro Area inflation stands at 2.0%, while the EU average inflation rate is estimated to be around 2.3%.

- Inflation in Latin America varies widely by country in 2025, with rates exceeding 40% in Argentina, while Brazil and Mexico report inflation closer to 4–6%, making the regional average difficult to estimate precisely.

- U.S. core inflation remains elevated at 3.1%.

- Brent crude has averaged around $67–68 per barrel through most of 2025, with market analysts projecting it may fall below $60 per barrel by Q4 due to easing global demand.

- Global food prices have increased significantly in 2025, with estimates ranging from 5% to 8% depending on the commodity and region, driven by weather-related disruptions and supply chain volatility.

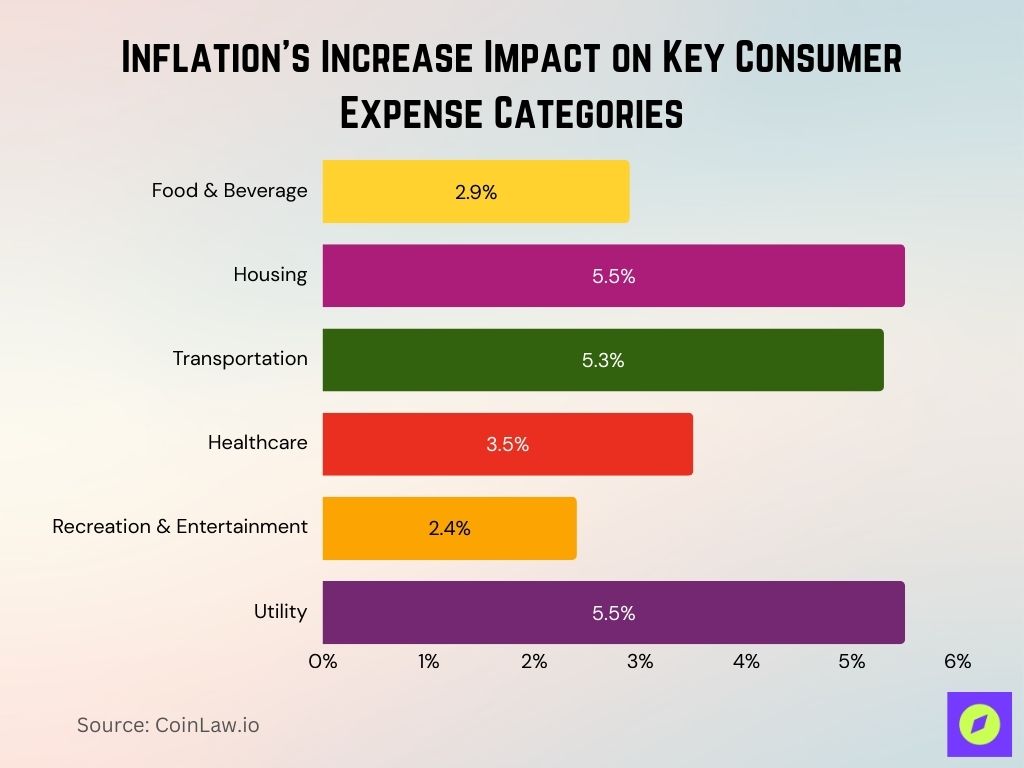

Inflation Breakdown by Product Category

- Food and beverage prices rose about 2.9% in 2025.

- Housing costs increased, with shelter up 3.7% and electricity up 5.5%.

- Gasoline prices dropped significantly by 9.5%, easing transportation expenses.

- Transportation costs, including insurance and vehicle expenses, rose by 5.3%.

- Apparel inflation remained low with minimal price movement overall.

- Healthcare costs increased by 3.5%, driven by services and dental care.

- Education and childcare costs remained stable with slight increases.

- Recreation and entertainment saw a 2.4% price rise across categories.

- Utility costs like electricity and natural gas rose 5.5% due to infrastructure pressures.

The Different Methods of Measuring Inflation: PCE versus CPI

- CPI inflation in the U.S. is 2.7 % year-over-year as of mid‑2025.

- The PCE price index is rising at around 2.6 %, reflecting the Fed’s preferred inflation gauge.

- Core PCE, which excludes food and energy, sits near 2.8 %, signaling underlying price trends.

- PCE’s chained formula and substitution effect make it more adaptive than CPI’s fixed basket approach.

- PCE gives greater weight to healthcare, while CPI emphasizes housing costs more heavily.

- Unlike PCE, CPI does not account for consumer substitution toward cheaper alternatives.

- The Fed primarily targets core PCE in monetary policy decisions, though CPI still informs public sentiment.

- Core PCE at 2.8 % is closely followed by policymakers as a measure of persistent inflation.

- CPI data often reveals regional inflation differences more clearly than the national PCE average.

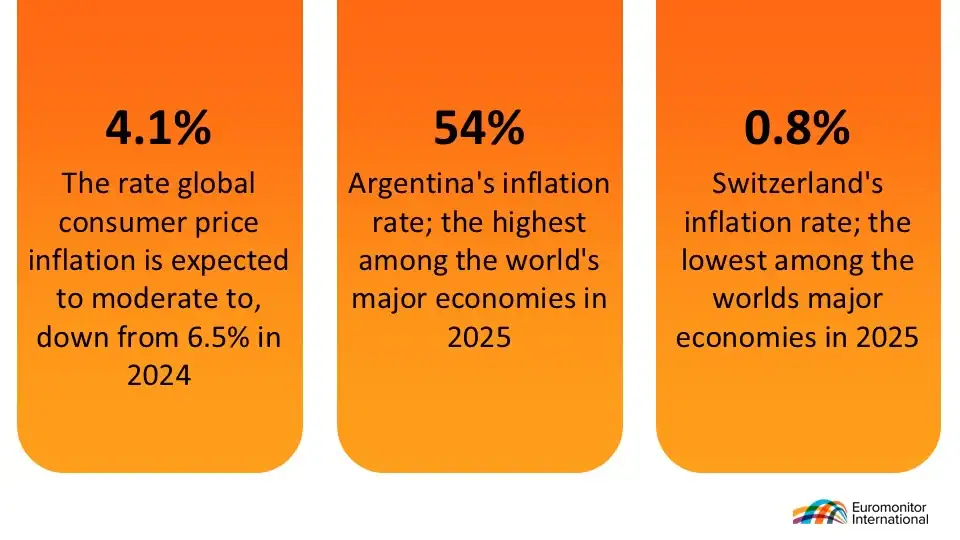

Key Global Inflation Highlights

- Global consumer price inflation is projected to moderate to 4.1% in 2025, a significant drop from 6.5% in 2024.

- Argentina is forecasted to have the highest inflation rate among the world’s major economies at 54% in 2025.

- Switzerland is expected to record the lowest inflation rate among major economies at just 0.8% in 2025.

Factors Driving Inflation

- Supply chain pressures persist in sectors like semiconductors and high-tech manufacturing even as recovery continues.

- Labor shortages in healthcare and education are pushing up wages and service costs.

- Energy costs remain volatile, affecting manufacturing and transportation expenses.

- In 2025, demand for housing continues to outpace supply in many major urban centers, driving sustained rent inflation and supply bottlenecks, as noted by the National Association of Realtors and local housing indices.

- Weather-related disruptions are increasing food inflation in agriculture-heavy regions.

- Rising tariffs are adding to production costs and fueling inflation in consumer goods.

- Interest rates remain around 4.25%–4.50%, raising borrowing costs and slowing housing and auto demand.

- Geopolitical tensions are disrupting trade and raising costs for energy and raw materials.

- Post-pandemic consumer shifts toward services and travel are changing inflation dynamics.

- Businesses are facing rising tech infrastructure and cybersecurity costs, impacting service pricing.

Policy Responses to Inflation

- The Federal Reserve is maintaining interest rates between 4.25% and 4.50%, with potential rate cuts expected later in 2025.

- Treasury officials are advocating for a rate cut as inflation stabilizes around 2.7% and labor markets show signs of softening.

- European central banks are holding rates steady to keep inflation near the 2% target in the second half of 2025.

- Emerging markets like Brazil and India continue using a mix of rate hikes and currency measures to stabilize local prices.

- Governments are issuing tax rebates and direct relief to low-income households to ease inflation pressures.

- The CHIPS Act and similar supply chain initiatives aim to reduce dependency on foreign manufacturing and lower tech-sector inflation.

- The EU is implementing clean energy investments and subsidies to reduce long-term energy costs and improve price stability.

- Rent increase caps are being enforced in countries like Canada to limit housing inflation.

- Price transparency and monitoring programs are being expanded to discourage price gouging and promote fair market practices.

- Investments in digital infrastructure are helping reduce pressure on urban housing and transportation costs by enabling remote work and services.

Top 15 Worst Inflation Rates in Asia

- China recorded the highest inflation rate at 15.25%.

- Indonesia followed closely with an inflation rate of 13.94%.

- South Korea experienced inflation of 12.90%, placing it third in Asia.

- Israel saw inflation reach 8.61%, while Japan recorded 7.79%.

- Bangladesh had an inflation rate of 6.26% in the same year.

- Turkey posted inflation at 4.70%, and Pakistan at 3.65%.

- Thailand reported 3.37%, and the Philippines registered 3.12%.

- India had inflation at 2.15%, with Oman slightly lower at 2.05%.

- Myanmar posted 1.49%, while Iraq was at 1.36%.

- Singapore had the lowest inflation rate on the list at just 0.33%.

Latest Numbers and News Releases

- U.S. CPI inflation is 2.7% year-over-year as of July 2025.

- As of June 2025, Eurozone inflation is holding at approximately 2.0%, aligning with the ECB’s inflation target.

- UK inflation sits at 3.6%, with food prices remaining a key driver.

- U.S. Core PCE inflation stands at approximately 2.8% as of June 2025.

- Housing costs remain a primary driver of U.S. inflation, with rent prices still elevated.

- Wage growth ranges from 2.8% to 3.4%, varying by income tier and sector.

- Global inflation is expected to decline to around 4.3–4.4% in 2025, reflecting easing energy prices and tighter monetary policies.

- Climate-related disruptions are contributing to inflation, especially in food and resource sectors.

- Inflation in advanced economies is averaging between 2.5–2.9%, while emerging markets face higher rates due to currency pressures and local supply issues.

- Global commodity prices have mostly stabilized, but agricultural items like wheat and coffee stay elevated.

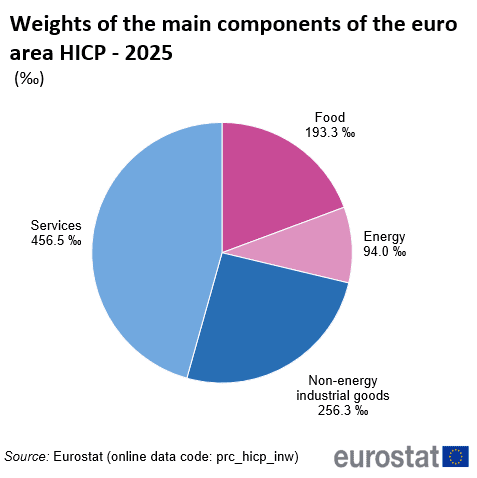

Main Components of Euro Area Inflation (HICP)

- Services make up the largest share of the euro area HICP at 456.5%, highlighting their dominant role in consumer price changes.

- Non-energy industrial goods account for 256.3%, representing a significant portion of inflationary pressures.

- Food contributes 193.3% to the HICP, showing the substantial impact of food prices on overall inflation.

- Energy holds the smallest weight at 94.0%, but still plays a key role in price volatility.

Historical Context and Inflation Comparisons

- 1980 U.S. inflation peaked at 13.5%, one of the highest end‑of‑year rates in modern history.

- By 1983, aggressive Fed policy under Volcker had reduced inflation to 3.6%.

- In the 1990s, U.S. inflation stabilized at an average of 2.6% annually, supported by technology gains and globalization.

- Early 2000s inflation remained near 2.5% until spiking briefly to 3.8% during the 2008 financial crisis.

- The 2010s saw a sustained average inflation of 1.8%, reflecting low interest rates and efficiency in global trade.

- Following the pandemic, inflation surged to 8–9% by 2022, the highest since the early 1980s.

- Inflation declined through 2023–2024, reaching around 2.9% at the end of 2024, showing signs of a return toward pre‑pandemic norms.

- By July 2025, U.S. inflation had eased further to 2.7%.

- Comparatively, Turkey experienced inflation exceeding 85% in 2023 during economic instability.

- Commodity‑led inflation cycles, like oil shocks in the 1970s and early 2000s, typically resulted in temporary surges followed by stabilization.

- Extreme cases like Venezuela’s crisis, with hyperinflation topping 100 000%– serve as reminders of runaway inflation’s severe consequences.

- This historical perspective underscores that while inflation cycles are normal, policy actions, technology changes, and global events critically shape long-term trends.

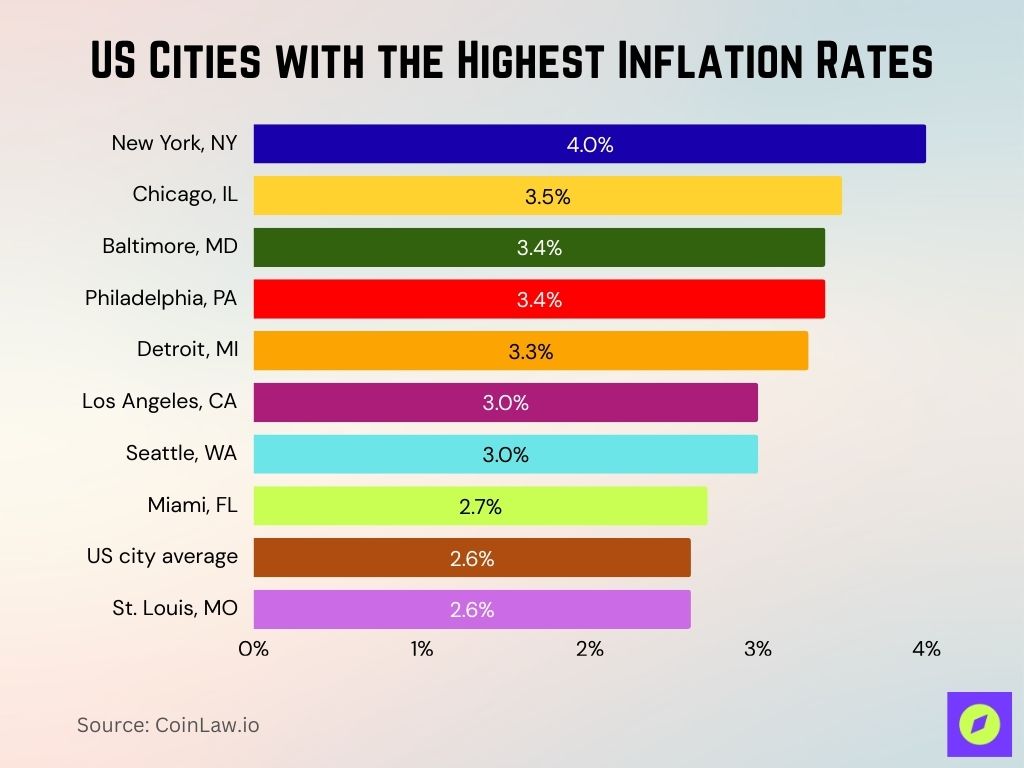

US Cities with the Highest Inflation Rates

- New York, NY leads with the highest inflation rate at 4.0%, well above the national urban average.

- Chicago, IL follows at 3.5%, showing significant cost-of-living increases.

- Baltimore, MD, and Philadelphia, PA, both record inflation rates of 3.4%.

- Detroit, MI, posts an inflation rate of 3.3%, reflecting steady price growth.

- Los Angeles, CA, and Seattle, WA, each report 3.0% inflation.

- Miami, FL, shows a moderate inflation rate of 2.7%.

- The US city average inflation rate stands at 2.6%, matched by St. Louis, MO.

Recent Developments

- The Federal Reserve continues holding rates steady at 4.25%–4.50% as policymakers await more stable core inflation before considering cuts.

- Nations are investing in domestic semiconductor and essential goods production to strengthen supply chain resilience.

- Droughts in South America and Southeast Asia are pushing up prices for coffee and rice, reflecting climate-driven inflation.

- Oil prices are averaging around $67–$68 per barrel in 2025 and are projected to drop below $60 in Q4, easing energy costs.

- The labor market is mixed, with layoffs in sectors like tech and retail and shortages in healthcare and construction raising wage pressures.

- Expanding digital currency use in countries such as China and Nigeria could impact monetary policy tools and future inflation control.

- The IMF’s mid‑2025 update forecasts global economic growth of 3.0%, though the World Bank projects a slightly lower rate of 2.6–2.9%, reflecting regional slowdowns and tightening credit conditions.

- Cooling real estate demand in overheated markets like Canada and Australia is helping ease housing inflation.

- Ongoing geopolitical tensions, especially in Eastern Europe, continue to elevate energy and agricultural price volatility.

- Consumers are shifting toward essentials, reducing spending on travel and dining, prompting retailers to promote value-oriented goods.

- Trade strategies focus on diversifying supply chains, with new tariffs and restrictions aimed at reducing inflation risks tied to reliance on single-region sourcing.

Conclusion

Inflation remains a defining factor in the global economy, impacting consumer prices, wages, and policy decisions across regions. While recent data suggests that inflation is gradually stabilizing in many areas, challenges remain, especially with food and housing prices, climate impacts, and geopolitical instability. Understanding the nuances of inflation by region, category, and policy responses can empower individuals, businesses, and policymakers to make informed decisions as they navigate the changing economic landscape. With a more balanced inflation rate projected in the near future, the key will be implementing sustainable practices to maintain long-term price stability.