Home insurance, often a cornerstone of financial stability for families, saw significant shifts in 2024. Rising natural disasters, an unpredictable economic landscape, and evolving demographics are changing the way insurers approach policies, coverage, and premiums. New trends emerged, highlighting the importance of affordable yet comprehensive coverage for homeowners. This article will explore key home insurance industry statistics, offering a well-rounded understanding of the current landscape and what it means for homeowners across the United States.

Editor’s Choice: Key Market Trends

- The global home insurance market grew by approximately 7–8.6% in 2025, with total premiums surpassing $6.3–7 trillion.

- In the US, home insurance is projected to rise by 8% in 2025, costing the average homeowner about $3,520 annually, up by around $261.

- Global insured losses from natural disasters in 2025 are expected to approach $140–$150 billion, reflecting the upward trend driven by climate volatility.

- Home insurance premiums for mortgage holders reached a record-high penetration of 96%, highlighting their essential role.

- Average deductibles surged by 24.5% from 2024 to 2025, especially in high-risk areas like Florida and Texas.

- American homeowners saw a 24% premium increase over the past three years.

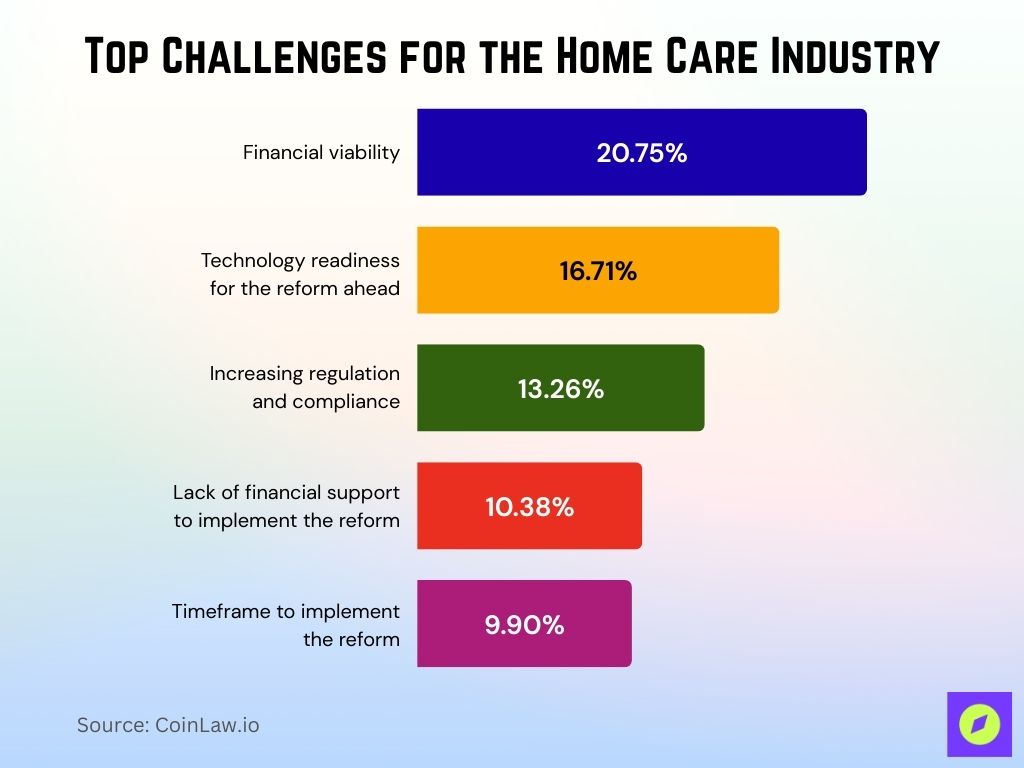

Top Challenges for the Home Care Industry

- Financial viability is the biggest concern, cited by 20.75% of stakeholders.

- Technology readiness for upcoming reforms is a challenge for 16.71% of the industry.

- 13.26% highlight increasing regulation and compliance as a major issue.

- 10.38% report a lack of financial support to implement the reform.

- 9.90% are concerned about the timeframe to implement the reform.

Homeowners Insurance Premiums and Consumer Prices

- The average annual home insurance premium in the US reached $2,110 in 2025, reflecting a 21% increase over recent years.

- Premiums in hurricane-prone states such as Florida and Louisiana are projected to climb by up to 27%, with Florida averaging around $5,409 annually.

- Around 40% of policyholders saw annual premium hikes exceeding $200, especially in areas with high rebuilding costs.

- The home rebuilding materials price index rose approximately 7–10% year-over-year, increasing insurer and policyholder cost burden.

- Recent insurer reports indicate that 20–30% of new homeowners’ policies in high-risk areas now include deductibles of $2,000 or more, a significant increase from earlier averages of around $1,200.

- Policy bundling between home and auto is up 15%, with average savings ranging from 10–25%.

- Approximately 10–15% of insurers adjusted underwriting criteria in high-risk areas, tightening eligibility and raising premiums, especially in states like Florida and California.

Causes of Homeowners Insurance Losses

- Natural disasters accounted for about 69% of insured catastrophe losses globally in 2025, with the U.S. heavily impacted by wildfire, storm, and flood damage.

- Flood-related claims in 2025 rose by roughly 28%, reflecting intensifying risks in flood-prone regions.

- Wind and hail damage caused an estimated $44 billion in insured losses in the first half of 2025, significantly increasing home insurance costs nationwide.

- Water damage and freezing accounted for about 24.7% of home insurance claims, highlighting the persistent impact of extreme weather.

- Insurer data indicate that property crime-related insurance claims rose between 10–12% in some suburban markets, particularly in areas facing economic pressure or law enforcement resource constraints.

- Wildfire-related claims surged by about 40% in western states like California and Oregon due to prolonged droughts and severe fires.

- About 40% of insurers reduced or limited wildfire coverage in high-risk zones in response to rising claims costs and unpredictability.

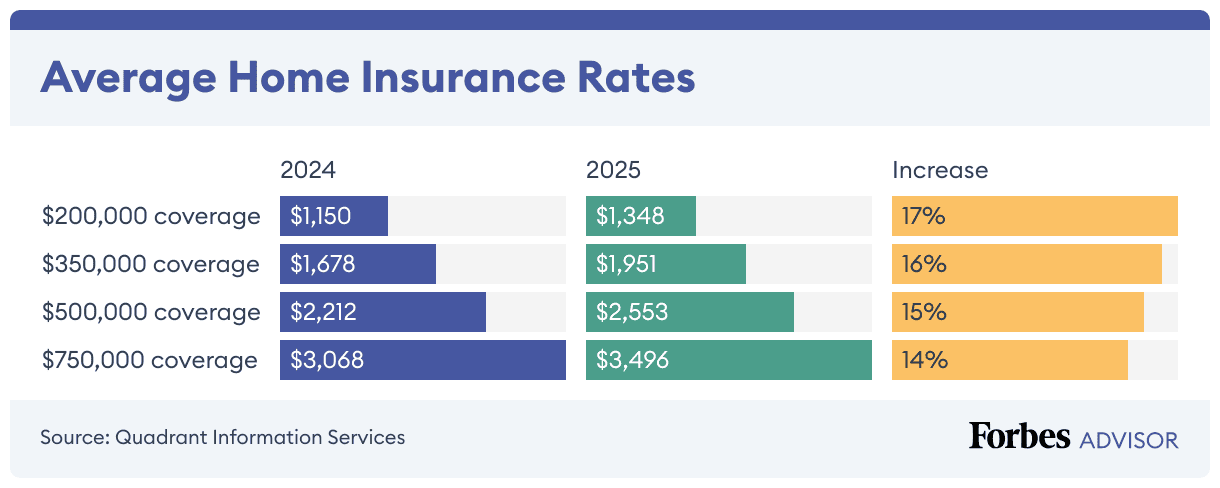

Average Home Insurance Rate Changes

- $200,000 coverage rose from $1,150 in 2024 to $1,348 in 2025, a 17% increase.

- $350,000 coverage increased from $1,678 to $1,951, marking a 16% rise.

- $500,000 coverage went from $2,212 to $2,553, up by 15%.

- $750,000 coverage grew from $3,068 to $3,496, a 14% increase.

Premiums for Homeowners and Renters Insurance

- The average U.S. homeowner’s insurance premium is projected to rise by 8 %, reaching about $3,520 annually in 2025.

- Renters insurance now costs around $23 per month or approximately $276 annually in 2025.

- Around 87 % of insurers continue to offer discounts for safety features like smoke alarms and security systems, saving homeowners up to 20 %.

- Homeowners in hurricane-prone states may face increases of up to 27 %, with average premiums reaching nearly $14,000 annually in places like Louisiana.

- Bundling home and auto insurance remains popular among 65 % of policyholders, saving them an average of $425 annually.

- Nearly 35–40% of insurers revised underwriting standards in 2024–2025, primarily targeting older properties and homes in high-risk areas with more inspections and coverage limitations.

- Over 20 % of renters have added flood insurance riders, particularly in high-risk states such as Texas and Louisiana.

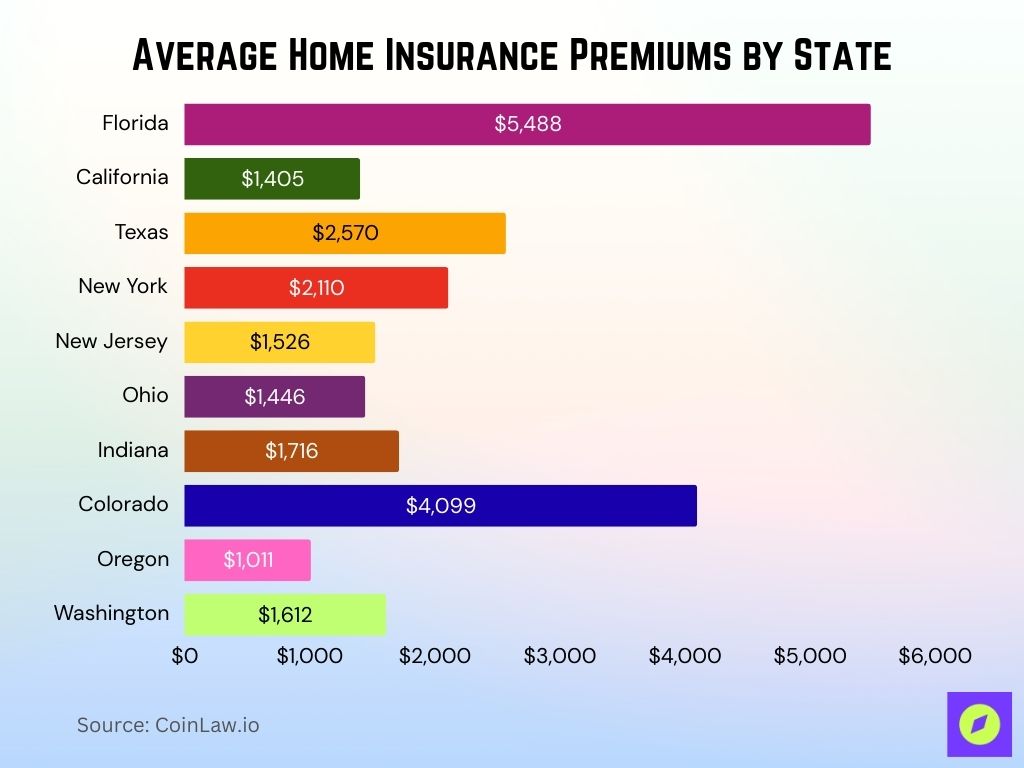

Home Insurance Statistics by State

- Florida remains among the most expensive states for home insurance, with an average annual premium of $5,488 in 2025.

- California’s average home insurance premium is approximately $1,405 annually in 2025.

- In Texas, homeowners face average premiums of around $2,570 per year.

- New York sees average home insurance costs around $2,110, while New Jersey averages about $1,526.

- Midwestern states like Ohio and Indiana have lower-than-average premiums, with Ohio averaging $1,446 and Indiana around $1,716.

- Colorado experiences higher costs with average premiums near $4,099 annually in 2025.

- Oregon remains one of the least expensive states for home insurance, with average premiums of about $1,011, while Washington averages close to $1,612.

Most Common Types of Homeowners Insurance Claims

- Wind and hail remain the most frequent claim types, accounting for around 41% of all homeowners’ insurance claims.

- Water damage and freezing (excluding flooding) account for approximately 28% of total claims.

- Fire and lightning claims represent about 22% of losses, with average claim values exceeding $83,991.

- Liability claims, such as bodily injury or property damage to others, make up around 1.6% of all claims.

- Theft claims are relatively rare, comprising just 0.7% of claims, with average payouts near $5,024.

- Other property damage (e.g., vandalism, miscellaneous incidents) accounts for about 6.9% of claims.

- Medical payments and minor causes represent roughly 0.5% of total claims.

Regional Differences: Least Expensive and Priciest Areas for Home Insurance

- Hawaii offers the lowest average home insurance premium at $1,224 in 2025.

- North Carolina remains relatively affordable, with premiums around $1,192, and Delaware at about $964 per year.

- Idaho maintains low rates near $1,293 annually.

- Oklahoma stands among the priciest states, with average premiums climbing to $4,643.

- South Carolina sees elevated rates, estimated at $1,432, due to its coastal hurricane exposure.

- Massachusetts experiences moderate costs averaging around $1,595, influenced by rising rebuilding expenses.

- Illinois and Wisconsin remain moderately affordable with average premiums near $2,265 and $780, respectively.

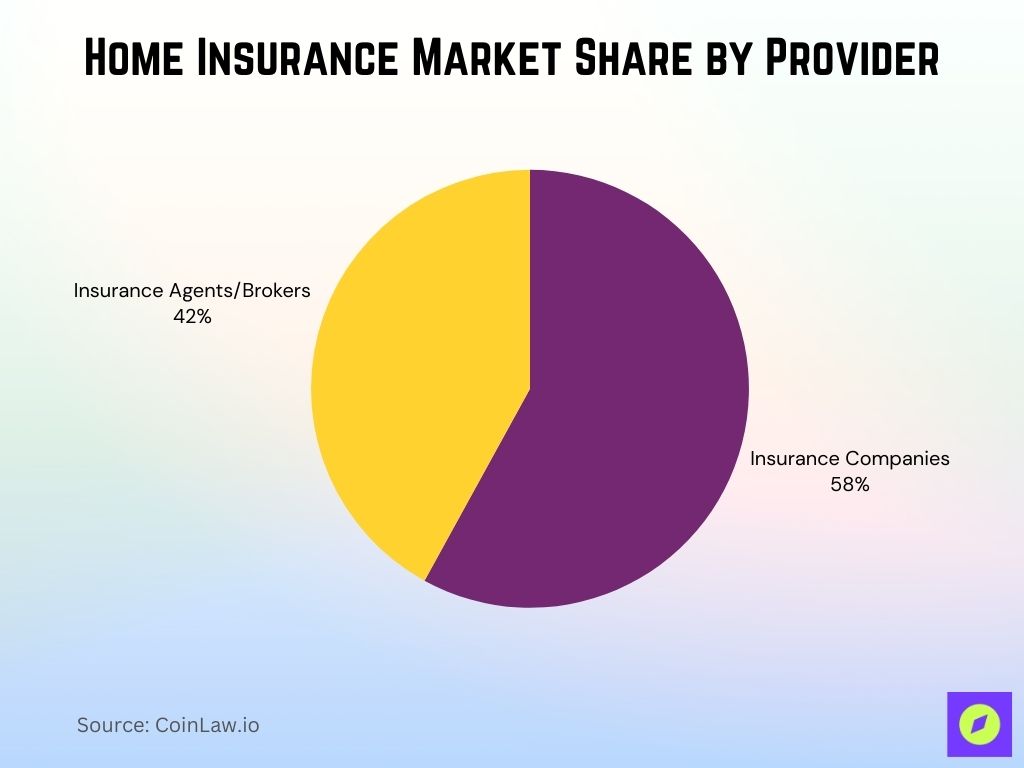

Home Insurance Market Share by Provider

- Insurance companies hold the largest share of the market at 58%.

- Insurance agents and brokers account for the remaining 42% of the market.

High-Risk Markets and Where Costs Could Rise the Most

- California’s wildfire-prone areas could see premium increases up to 21%, with average annual home insurance costs nearing $2,930 by the end of 2025.

- Coastal regions of Florida are expected to face a 9% rise in premiums, with the average annual cost climbing from $14,140 to about $15,460 in 2025.

- U.S. homeowners’ insurance premiums grew roughly 10.7% in Q1 2025 compared to the same period in 2024.

- State Farm in California has requested an average emergency rate hike of 22% for homeowners’ policies due to wildfire-related losses.

- Rising risks and catastrophic claims, especially from severe wildfires in early 2025, continue to drive upward pressure on premiums and coverage restrictions in high-risk zones.

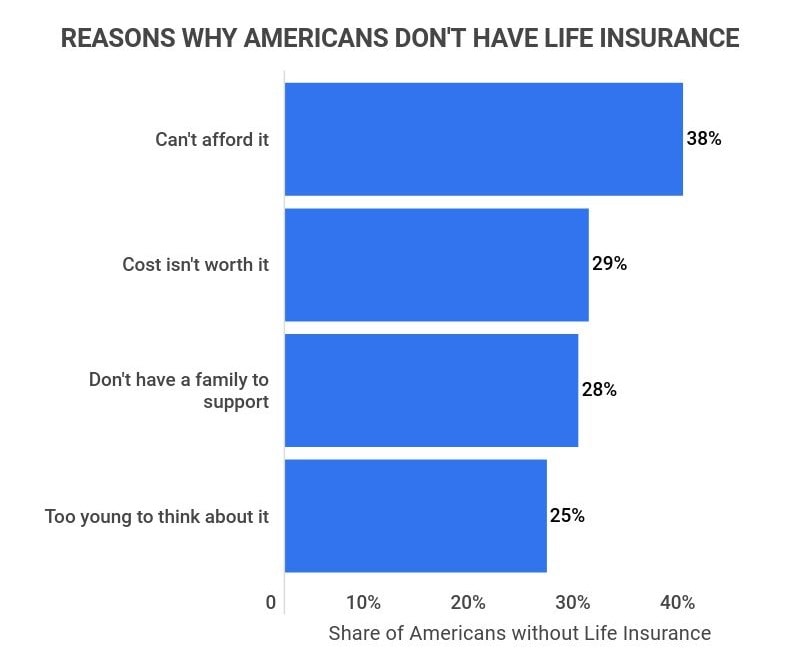

Top Reasons Why Americans Don’t Have Life Insurance

- 38% say they can’t afford life insurance.

- 29% believe the cost isn’t worth it.

- 28% don’t have a family to support, so they see no need.

- 25% feel they are too young to think about life insurance.

Recent Developments and Industry News

- California’s insurance regulators now require providers in wildfire‑prone areas to expand policy writing, potentially increasing premiums by 30 – 40 % as part of the new Sustainable Insurance Strategy.

- State Farm in California is pursuing a 17 % interim rate hike, potentially rising to 30 %, to offset soaring wildfire‑related losses.

- Insurers are increasingly withdrawing coverage from high‑risk areas across the U.S., leaving many homeowners to turn to state‑backed plans amid escalating natural disasters.

- Insurer of last resort plans in California now carry massive exposure, with payouts potentially reaching $4 billion, leading the FAIR Plan to levy a $1 billion assessment passed on to homeowners.

- Insurance claims processing has accelerated thanks to AI and automation, improving efficiency and helping companies manage surging wildfire and catastrophe losses.

- QBE is leveraging AI to enhance underwriting productivity by 10 – 50 %, supporting sustained premium growth in the Asia-Pacific region.

- Global insurers remain resilient with strong solvency and profitability mid-year, despite rising climate risks and economic turbulence.

Conclusion

As home insurance premiums continue to rise in response to economic and environmental factors, homeowners face new challenges in securing comprehensive yet affordable coverage. Key drivers like natural disasters, inflation, and policy changes will likely keep influencing insurance costs in the coming years. Understanding the regional differences in insurance expenses, as well as staying informed about new developments, can help consumers make more informed choices about their coverage. Looking forward, home insurance companies may increasingly leverage technology and offer climate-resilient discounts, giving policyholders more options to adapt to this evolving landscape.