Health insurance has become a cornerstone of financial security in the United States, helping individuals manage the rising costs of medical care. Imagine navigating a severe health crisis without coverage – it could lead to devastating financial consequences. Over the years, the health insurance industry has evolved into a dynamic ecosystem influenced by technological advancements, regulatory changes, and shifting demographics. Let’s dive into the latest statistics to better understand this pivotal sector.

Editor’s Choice

- Nearly 93% of Americans had some form of health insurance in 2025.

- Medicare Advantage plans now cover about 34.1 million people, representing 54% of eligible beneficiaries.

- The global health insurance market is projected to reach $3.63 trillion by 2034, growing at a 7.4% CAGR.

- Employer-sponsored premiums are expected to rise 6.5% in 2026, while government exchange plans may see an 18% median increase.

- ACA marketplace premiums are proposed to increase by 15% on average, with some insurers requesting hikes of 20% or more.

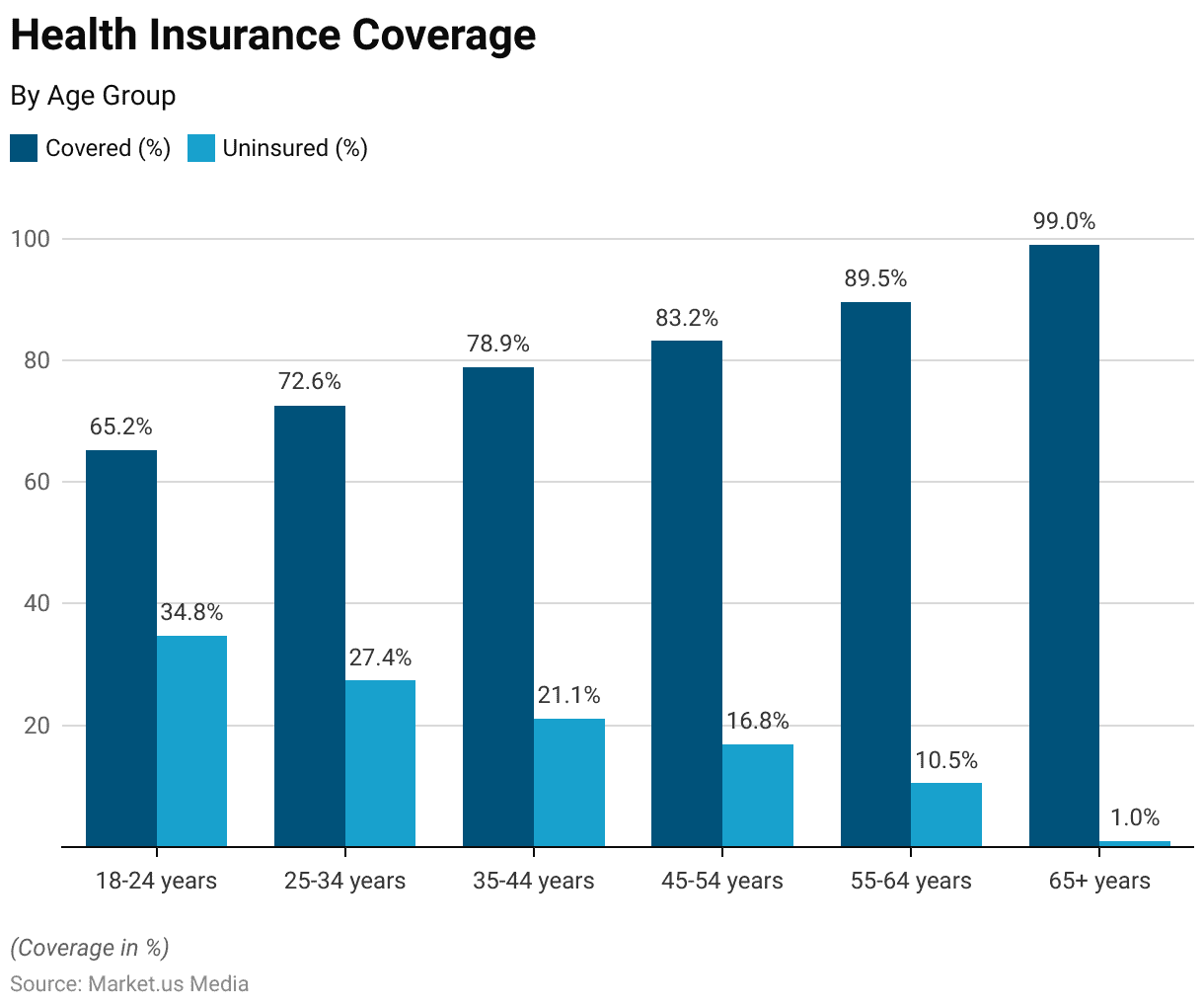

Health Insurance Coverage by Age Group

- 65.2% of those aged 18–24 have health insurance, leaving 34.8% uninsured, the highest uninsured rate among all age groups.

- 72.6% of people aged 25–34 are covered, while 27.4% remain uninsured.

- 78.9% of the 35–44 age group have insurance coverage, with 21.1% still without it.

- 83.2% of individuals aged 45–54 are insured, reducing the uninsured share to 16.8%.

- 89.5% of the 55–64 group are insured, leaving only 10.5% uninsured.

- A remarkable 99.0% of older people aged 65 and above have coverage, with just 1.0% uninsured, the lowest uninsured rate across all groups.

Coverage and Enrollment Figures

- 331 million Americans are covered by health insurance in 2025, leaving about 27 million uninsured.

- Medicaid and CHIP enrollment reached about 78.1 million people in May 2025 (roughly 70.8 million on Medicaid and 7.3 million on CHIP).

- ACA marketplace enrollment hit a record 24.3 million people in 2025.

- Dependent coverage for young adults under parents’ insurance stands at 58 % in 2025.

- Children’s health insurance enrollment remains strong, with around 47.6 % of Medicaid and CHIP enrollees being children as of May 2025.

- Health Maintenance Organizations (HMOs) continue to play a major role in managed care, serving approximately 66 to 70 million Americans.

- The average deductible for individual plans rose to $1,800 in 2025, intensifying affordability concerns.

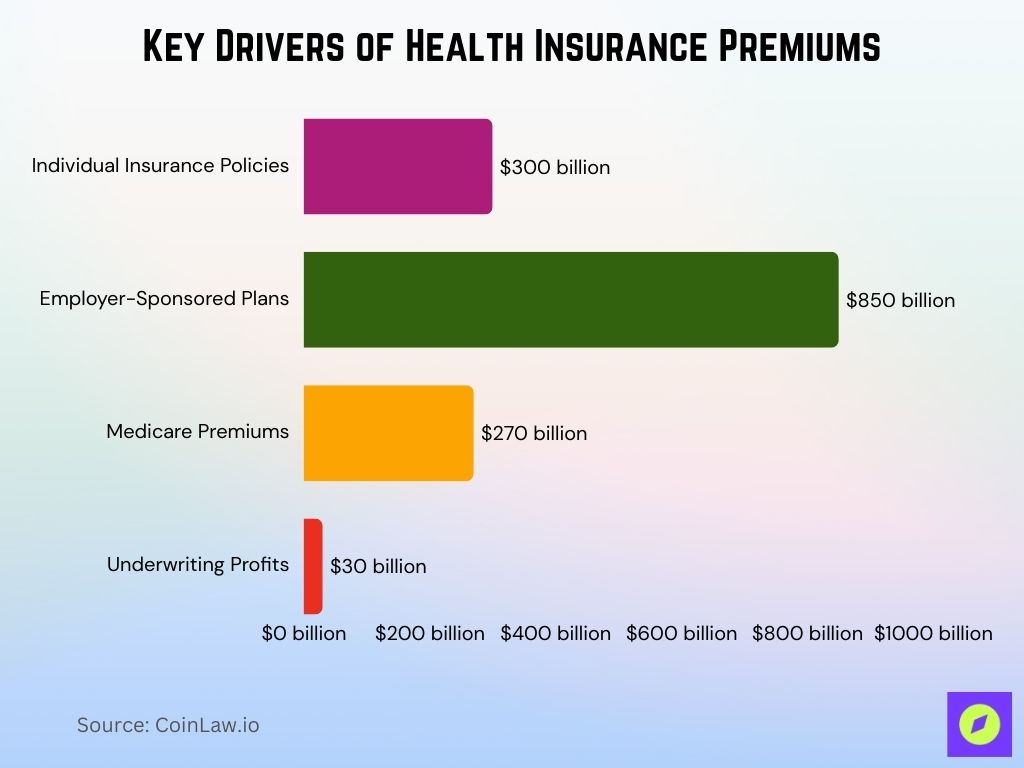

Gross Written Premium

- $1.45 trillion in gross written premiums was recorded for U.S. health insurance.

- Individual plans contributed around $300 billion, indicating growing interest in personalized coverage.

- Employer‑sponsored coverage accounted for approximately $850 billion, remaining the leading premium source.

- Medicare premiums, including Part B and supplemental policies, reached about $270 billion, showing steady upward movement.

- Annual family coverage premiums averaged $23,850.

- Premiums for catastrophic health plans rose 12 %, reflecting increased demand for risk‑management options.

- Health insurers’ underwriting profits improved to about $30 billion.

Premium Trends and Cost Analysis

- Average individual plan premiums rose to about $621 per month in 2025, marking a 7% increase from 2024.

- Average family health insurance premiums reached approximately $2,131 per month, reflecting higher group coverage costs.

- High‑deductible health plans now account for about 50% of all private plans, continuing the shift toward cost‑sharing.

- Health Savings Account contributions increased, with HDHP minimum deductibles set at $1,650 for individuals and $3,300 for families.

- Medicare Advantage premiums decreased slightly to an average of $17 per month in 2025.

- Prescription drug premiums under Medicare Part D dropped to $46.50 per month, improving drug affordability.

- The total cost (including employer and employee contributions, premiums, and out-of-pocket expenses) to insure a family through employer-based coverage reached up to $35,000 in some high-cost markets in 2025, although the average premium alone was approximately $23,850.

Global Health Insurance Market Dynamics

- The global health insurance market is estimated at $2.32 trillion in 2025 and projected to reach $4.45 trillion by 2032, growing at a 9.7% CAGR.

- Asia-Pacific markets are expanding rapidly, with China growing at 15.4% and broader Asia posting 12.6% growth in premiums.

- Europe’s health insurance spending is estimated at around $1.5 trillion in 2025, driven by universal coverage models.

- Private insurers in Latin America increased membership by 9%, reflecting higher demand for supplemental coverage.

- Global telemedicine adoption rose by 23%, reshaping patient access and care delivery.

- AI-driven claims processing is expected to save insurers about $9 billion annually by 2025.

- The MENA region is growing at 8.2%, supported by expanded mandatory health insurance laws.

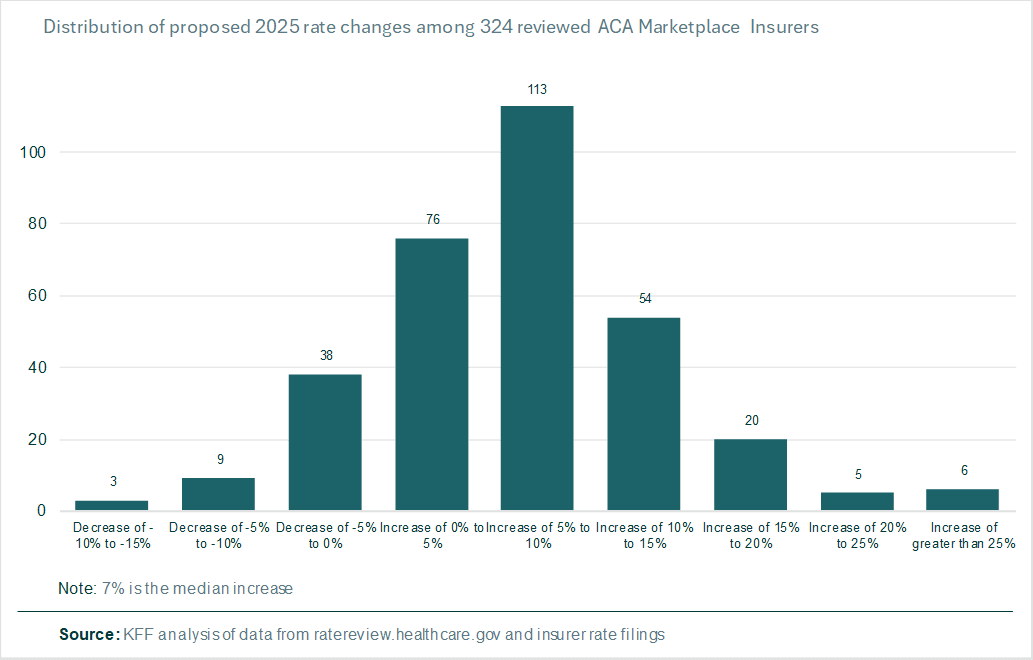

Preliminary Health Insurance Premium Rate Increases

- 113 insurers proposed a 5% to 10% increase, making it the most common rate change bracket in the ACA marketplace.

- 76 insurers filed for a 0% to 5% increase, reflecting a moderate pricing adjustment.

- 54 insurers planned a 10% to 15% premium hike, indicating more significant cost pressures.

- 38 insurers actually proposed a rate decrease between -5% and 0%, suggesting pricing competition in select markets.

- Only 9 insurers filed for a -5% to -10% reduction, while just 3 insurers aimed for a -10% to -15% drop.

- 20 insurers are seeking a 15% to 20% rate hike, showing a smaller group facing higher cost inflation.

- 5 insurers proposed premium increases of 20% to 25%, and 6 insurers went even further with hikes above 25%.

- The median proposed increase is 7%, highlighting a general upward trend in health insurance premiums for 2025.

Medicare Advantage and Public Health Exchange Markets

- Medicare Advantage enrollment rose to 35.7 million beneficiaries in 2025, representing 51 % of all Medicare beneficiaries.

- Public health exchanges under the ACA now serve 24.3 million Americans as of 2025.

- Older people aged 65+ account for 54 % of Medicare Advantage enrollments, drawn by the plan’s comprehensive coverage.

- MA penetration is about 35.3 % in urban areas versus 21.5 % in rural areas, highlighting persistent geographic disparities.

- State-run health exchanges saw enrollments increase by 65 % in automatic re‑enrollments during the 2025 open enrollment period.

- Subsidized ACA exchange plans now cover over 50 % of marketplace enrollees, enhancing affordability.

- Medicare Part D coverage now reaches about 50 million older people, ensuring broader access to prescription medications.

Technological Innovations and Digital Transformation

- Telehealth utilization among insured individuals remains substantially higher than before the pandemic, though recent monthly usage has slightly declined from 14.9 % to around 14.2 % of patients in early 2025.

- The use of AI in claims processing has shortened average resolution times by approximately 30 %, boosting operational efficiency.

- Wearable devices are now integrated into insurance wellness programs and are expected to be central as the wearables market surpasses $60 billion in value by 2025.

- Blockchain adoption in secure medical records management is projected to deliver annual savings of around $2 billion in administrative costs.

- Insurance-supported mobile health apps now serve an expanding demographic, with 120 million active global users accessing services such as fitness tracking and virtual consultations.

- Digital health insurance platforms experienced a 30 % spike in enrollment, notably favored by younger customer segments.

- Predictive analytics tools are being used more widely to identify high‑risk individuals earlier, aiding better care outcomes and reducing costs.

Public Health Insurance Coverage

- 21.4% receive coverage through Medicaid and CHIP, making it the largest public source.

- 42.9% of children under 65 have some form of public coverage, indicating broad eligibility.

- 39.7% of children are specifically covered by Medicaid or CHIP, showing strong program reach.

- Only 0.4% of children are covered through Medicare, reflecting limited eligibility.

- 2.8% of children receive military-based coverage, such as TRICARE.

- Among working-age adults, 20.4% rely on public coverage, including various programs.

- 14.6% of working-age adults are enrolled in Medicaid/CHIP, while 3.8% are on Medicare.

- 3.3% of working-age adults benefit from military health coverage.

- Overall, Medicare coverage accounts for 2.9% of the under-65 population.

- Military health coverage applies to 3.2% of people under 65, across both age groups.

Recent Developments

- The Inflation Reduction Act caps insulin costs at $35 per month and limits annual Part D out-of-pocket spending to $2,000 in 2025.

- Medicaid programs now cover 71.4 million Americans, and an additional 7.3 million children receive coverage through CHIP.

- About 84% of employer-sponsored health plans now include mental health services in their coverage.

- Insurers allocated roughly $500 million to health equity programs targeting underserved communities.

- Compliance with the mental health parity law rose to 92%, ensuring broader access to behavioral health services.

- Emerging insurer–pharmacy partnerships reduced out-of-pocket prescription drug costs, with some pilot programs and integrated models delivering up to 12% savings, though national averages vary.

- Virtual-first health plans now account for about 5% of policyholders, offering a tech-driven care model.

Frequently Asked Questions (FAQs)

$2.32 trillion (global market size in 2025).

$25,572 average annual family premium in 2024.

The total U.S. population’s uninsured rate was 7.6% with 25.3 million nonelderly people uninsured in 2023.

9.7% CAGR projected from 2025 to 2032.

About a 9.3–9.5% increase in employer health insurance costs projected for 2026.

Conclusion

Technological advancements, regulatory reforms, and a focus on equity and accessibility actively shape the evolving landscape of the health insurance industry. Medicare Advantage enrollment grows at an unprecedented pace, and providers widely adopt telehealth services, showing how the sector embraces innovation to meet modern consumer needs. Rising premiums and regional disparities, however, expose ongoing challenges that demand continuous improvements. Looking ahead, the industry will keep adapting to ensure health coverage remains a cornerstone of Americans’ financial and physical well-being.