The crypto exchange landscape continues to shift as established players adapt to regulatory change and evolving consumer demand. Among them, Gemini Trust Company, LLC, commonly known as Gemini, stands out for combining U.S. regulatory compliance with global ambitions. For instance, institutional investors increasingly favour platforms with robust custody frameworks, and retail users are gravitating toward exchanges that transparently disclose reserves. In the U.S., Gemini’s data-driven insights on crypto ownership are already influencing how advisors talk to clients. Globally, its “State of Crypto” survey shows rising adoption rates in the UK and Singapore, underlining a broader shift.

Editor’s Choice

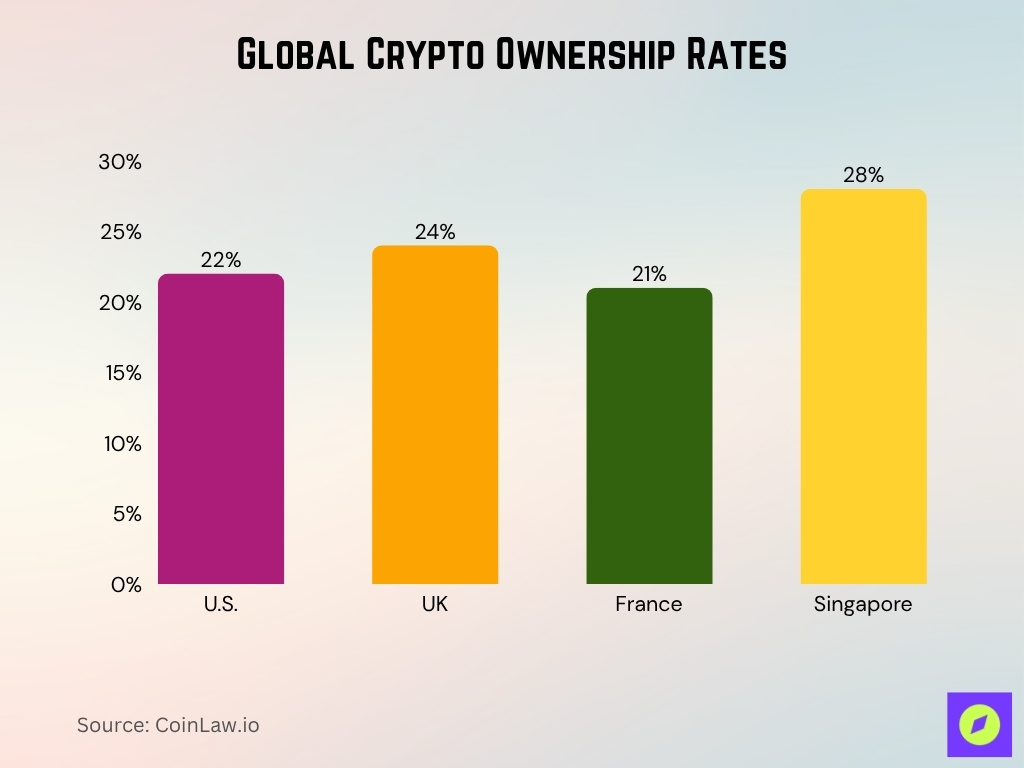

- In the 2025 “State of Crypto” report, approximately 24% of respondents across the U.S., UK, France, and Singapore reported owning crypto.

- The UK saw ownership rise to 24% in 2025, the largest jump in the surveyed nations.

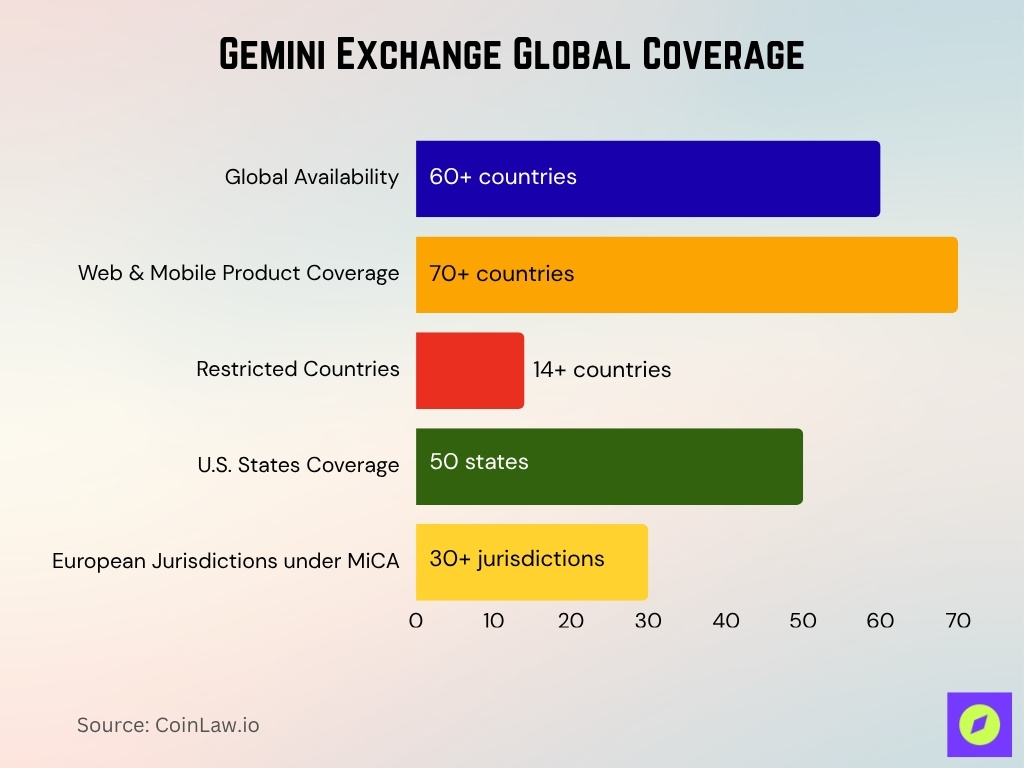

- The exchange is available in 60+ countries, operating across all major regions (Americas, Europe, Asia, Africa, Oceania).

- Gemini supports 76 cryptocurrencies and approximately 390 trading pairs, according to a 2025 review.

- It holds exchange reserves of about $6.24 billion in 2025.

- Institutional trading volume through Gemini surged 60% year-over-year in Q2 2025, reaching roughly $21.5 billion.

Recent Developments

- In May 2025, Gemini published its 2025 Global State of Crypto report surveying 7,205 adults across six countries.

- The company submitted a confidential S-1 registration statement to the U.S. SEC in June 2025 in preparation for an IPO.

- In September 2025, the firm’s IPO was oversubscribed by more than 20 times, signalling strong investor demand.

- The firm raised its IPO target to approximately $433 million, implying a valuation near $3 billion.

- Gemini expanded into Australia with a local entity, “Gemini Intergalactic Australia,” in October 2025 to tap regional growth.

- The firm’s “ActiveTrader” and API infrastructure were upgraded in 2025 to support algorithmic and institutional users.

- The 2025 market-trends report indicates that over 30% of Bitcoin’s circulating supply is held by centralized entities, including exchanges and custodians.

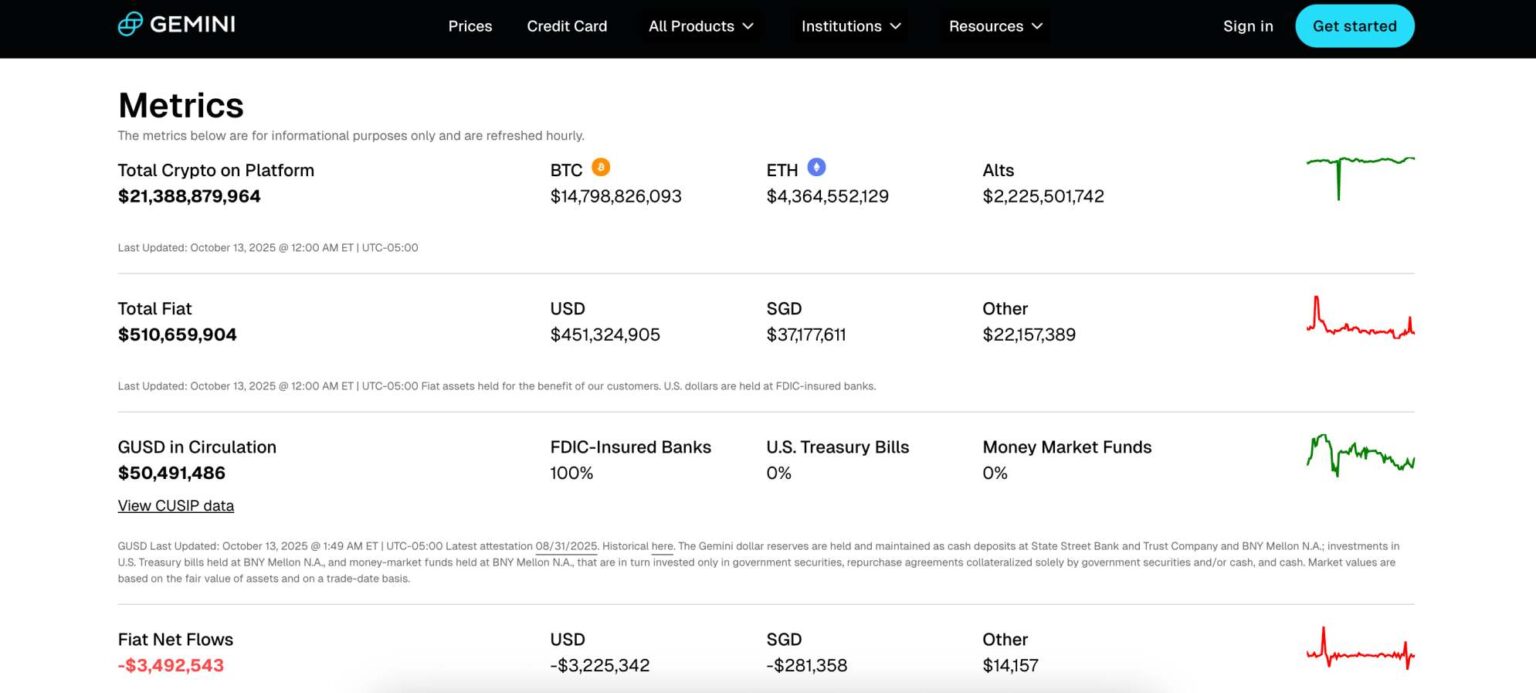

Gemini Platform Metrics

- Total crypto assets on Gemini reached $21.39 billion, showcasing its strong position among global exchanges.

- Bitcoin (BTC) accounted for the majority with $14.8 billion, followed by Ethereum (ETH) at $4.36 billion, and altcoins totaling $2.23 billion.

- Fiat holdings stood at $510.66 million, reflecting user trust in fiat-backed balances on the platform.

- Within fiat reserves, USD deposits made up $451.32 million, while SGD contributed $37.18 million, and other currencies about $22.16 million.

- GUSD (Gemini Dollar) in circulation was $50.49 million, fully backed by 100% FDIC-insured bank deposits, with 0% exposure to U.S. Treasury Bills or money market funds.

- Fiat net flows showed an overall outflow of $3.49 million, largely driven by a $3.23 million USD outflow, with smaller outflows in SGD ($281,358) and a minor inflow in other currencies ($14,157).

- These figures highlight Gemini’s high liquidity, transparent reserves, and continued institutional reliability through fully backed assets and regulated banking partnerships.

Gemini Founders and History

- Gemini was founded in 2014 by Cameron and Tyler Winklevoss.

- The firm received a limited-purpose trust charter from the New York State Department of Financial Services in October 2015.

- Gemini’s IPO in 2025 raised $425 million by selling 15.2 million shares priced at $28 each.

- At IPO, Gemini’s market valuation exceeded $3 billion.

- By 2025, Gemini expanded its services to over 70 countries globally.

- Gemini’s institutional trading volume surged 60% to $21.5 billion in H1 2025, representing 87% of total volume.

- The company generated $68.6 million in revenue during the first half of 2025.

- Gemini’s IPO was oversubscribed 20 times, indicating strong investor demand.

Gemini Dollar (GUSD) Statistics

- Gemini Dollar (GUSD) is pegged 1:1 to USD under NYDFS regulatory oversight.

- GUSD reserves include cash, government money-market funds, and U.S. T-bills in FDIC-insured banks.

- GUSD’s circulating supply is approximately 148 million tokens with a market cap of $148 million in 2025.

- 24-hour trading volume for GUSD hovered around $423,000 as of late 2025.

- The price of GUSD remains tightly stable around $0.9993 to $1.001 through 2025.

- GUSD is recognized as a key regulated stablecoin with strong reserve transparency.

- Independent attestations verify 100% reserve backing in line with NYDFS requirements.

User Base and Geographic Reach

- In the U.S., crypto ownership among respondents reached 22% in 2025.

- France reported crypto ownership at 21% in 2025.

- Singapore’s crypto ownership reached 28% in 2025.

- The UK saw its ownership share to 24% in 2025, the largest year-over-year increase among surveyed countries.

- Gemini’s institutional data shows the company is active across major continents (Americas, Europe, Asia–Pacific, Africa).

Reserve Assets and Proof of Reserves

- Customer funds are maintained 1:1 reserved and are available for withdrawal anytime.

- The platform operates under a New York State Department of Financial Services qualified custodian license.

- As of mid-2025, Gemini holds approximately 4,070 BTC worth $464 million on its balance sheet.

- Gemini uses 100% cold storage for client digital assets, supported by segregated hot wallets.

- Custody customers have up to $200 million insurance coverage on digital assets, combining cold storage and hot wallet insurance.

Cybersecurity and Incident Records

- In December 2022, data from approximately 5.7 million Gemini users was offered on hacker forums following a third-party vendor breach.

- In June 2024, Gemini disclosed a vendor-ACH partner incident affecting 15,000 customers’ banking data.

- Cybersecurity reviews note that Gemini stores the majority of assets offline (cold storage) and uses geographically distributed key-management systems.

- Gemini provides blog posts advising customers on phishing threats and vendor-risk scenarios following incidents.

Global Availability and Restricted Countries

- Gemini is available in 60+ countries across all continents.

- Web and mobile product coverage spans over 70 countries globally.

- Gemini restricts access in 14+ countries, including Cuba, Iran, North Korea, and Russia.

- Gemini operates in all 50 U.S. states, but product features vary by state licensing.

- Institutional and custody service rollouts depend on regulatory approvals in many countries.

- Gemini holds local money transmitter licenses in the U.S., UK, and Singapore.

- Gemini’s global market expansion includes over 30 European jurisdictions under the MiCA license.

Insurance Coverage and Asset Protection

- Gemini Custody® holds $100 million in cold-storage insurance coverage.

- Gemini reported $25 million in commercial crime insurance for hot wallet assets as of March 2024.

- Total insurance coverage can reach up to $200 million, combining captive and commercial policies.

- Insurance covers theft from direct security breaches or hacks of Gemini’s custody systems.

- Eligible USD balances held at partner banks may benefit from FDIC pass-through insurance up to standard limits.

ActiveTrader Platform and Trading Features

- The Gemini “ActiveTrader” platform offers advanced charting, depth-of-book views, and faster execution geared toward experienced traders.

- The platform executes trades with latency as low as 65 microseconds, positioning it competitively among pro-trader tools.

- The number of tradable coins on ActiveTrader is approximately 70+, though still fewer than some competitors.

- The platform supports bots and algorithmic strategies via APIs and integrates with charting tools.

- The 24-hour trading volume on Gemini (overall) stood around $29.4 million, and exchange reserves around $6.24 billion.

- The platform supports fiat trading pairs (USD) and offers limit, market, stop-limit, and other order types.

- Gemini’s liquidity “Trust Score” is 9/10, showing the exchange meets liquidity and operational benchmarks despite smaller volume.

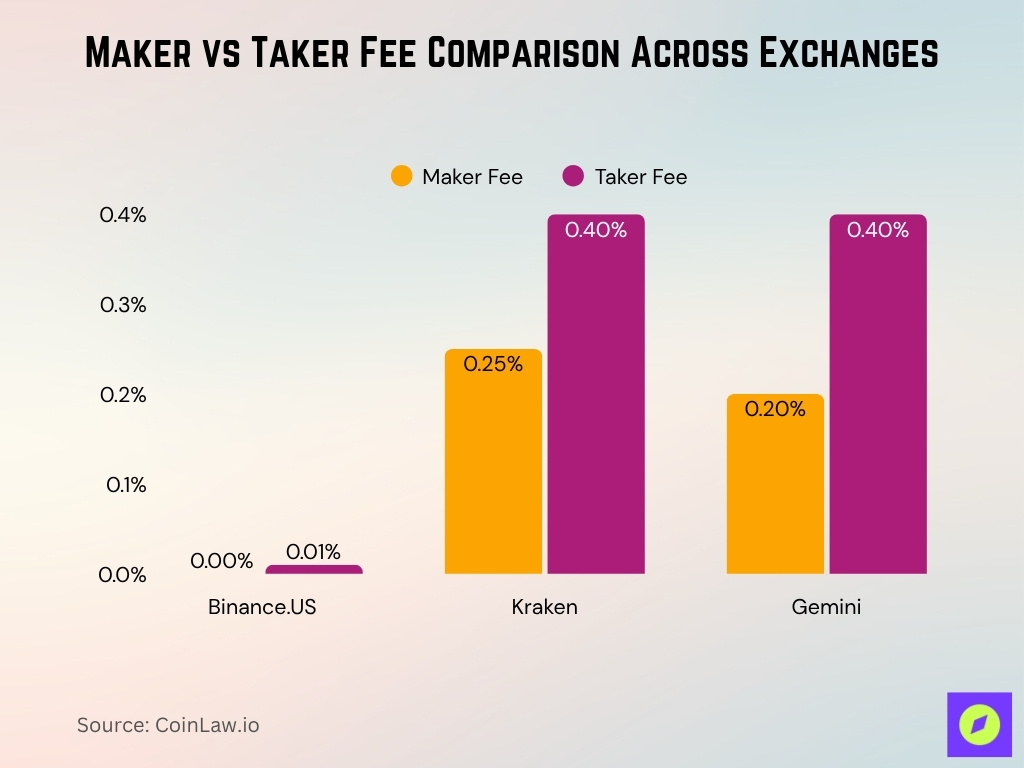

Maker vs Taker Fee Comparison Across Exchanges

- Binance.US offers the lowest trading fees, with nearly zero maker fees and ~0.01% taker fees, ideal for high-frequency traders.

- Kraken charges a 0.25% maker fee and 0.40% taker fee, positioning itself between cost efficiency and liquidity incentives.

- Gemini’s fees stand at 0.20% maker and 0.40% taker, showing parity with Kraken on taker fees but offering a slightly better maker discount.

- The comparison underscores how Gemini balances premium compliance with moderate fee structures, targeting institutional and retail traders seeking reliability over minimal cost.

Institutional Services (Clearing and Custody)

- Institutional trading volume surged 60% to $21.5 billion in H1 2025, constituting 87% of total trading volume.

- The clearing service partnership with Nasdaq includes collateral management and staking services for institutional clients.

- Custodial clients consist of asset managers, hedge funds, and proprietary trading firms globally.

- Gemini offers a custody fee of 0.4% annually or $30 monthly per asset, whichever is higher.

- Gemini Custody allows view-only auditor access, sub-accounts, and institutional reporting features.

- Institutional business revenue was $68.6 million in H1 2025, with steady growth despite overall market volume declines.

Notable Products and Services

- Gemini supports approximately 76 cryptocurrencies and around 390 trading pairs on its platform.

- Gemini offers its proprietary stablecoin, the Gemini Dollar (GUSD), pegged 1:1 to USD.

- The Gemini crypto credit card allows users to earn up to 3% Bitcoin back on dining and other purchases.

- Gemini’s Exchange App targets casual and intermediate users, while ActiveTrader targets advanced traders.

- Gemini’s mobile and desktop apps support recurring buy plans, staking, and wallet functionality.

- Institutional clients access services like Gemini Custody®, Gemini Clearing®, and Gemini Pay®.

- Recent additions include support for spot crypto ETFs and new credit services features.

- Gemini emphasizes regulatory compliance and multi-jurisdiction product availability.

- Gemini’s crypto credit card has attracted over 500,000 sign-ups for its waitlist.

Regulatory and Legal Challenges

- Gemini filed for its IPO with the U.S. SEC in 2025, reporting a net loss of $282.5 million in H1 2025.

- Revenue fell to $68.6 million in H1 2025 from $74.3 million in H1 2024.

- Nasdaq invested $50 million to support Gemini’s custody and staking services.

- Gemini holds a New York trust charter and incurs higher compliance costs than offshore competitors.

- Gemini secured a MiCA license in 2025 to operate across 30+ European countries.

- Critics say Gemini’s compliance-first approach increases overhead and limits agility.

- Most crypto exchange growth shifts toward derivatives, staking, and institutional services amid unclear regulations.

- Regulatory enforcement risks are elevated with Gemini’s increased disclosure obligations due to IPO status.

- Gemini settled with U.S. regulators, paying $37 million to NYDFS and $5 million to CFTC over past compliance issues.

Recent Performance and Financials

- Gemini’s S-1 filing reveals that for the first half of 2025, the net loss was approximately $282.5 million, up significantly year-on-year.

- For the full year 2024, revenue was $142.2 million and net loss $158.5 million.

- Roughly 87% of trading volume in Q2 2025 came from institutional clients.

- The IPO valuation target is around $3.1 billion with an expected raise of $433 million.

- Exchange reserves are approximately $6.24 billion.

- The broader crypto exchange sector is projected to $54.8 billion in industry revenue in 2025.

- Analysts issued a market-perform rating with a price target of about $27 for Gemini’s IPO stock.

Frequently Asked Questions (FAQs)

Roughly 78 to 89 coins and 98 to 107 trading pairs.

Approximately 10,000 institutional clients.

Approximately $282.5 million in net loss.

Conclusion

The exchange sector is evolving, and the Gemini platform embodies many of the dynamics. From advanced trading tools like ActiveTrader and strong institutional services to a compliance-first product suite and heavy financial losses, Gemini presents both opportunity and risk. Its global reach, API integrations, custody capabilities, and regulatory strategy position it for growth, particularly in the institutional segment.

At the same time, mounting losses and stiff competition reflect the challenge of scaling sustainably in a regulated environment. For U.S. audiences and global participants alike, Gemini’s story highlights how mainstream crypto infrastructure is maturing. If you’re evaluating exchanges for trading, institutional usage, or custody, the detailed statistics above provide a grounded foundation.