FundingPips has quickly become one of the most talked‑about proprietary trading firms, attracting thousands of retail traders seeking capital without risking personal funds. Through structured evaluation challenges and funded account programs, it enables traders to access capital up to $100,000 or more while earning a share of profits. Its impact is evident in the surge of digital traders using FundingPips to build professional trading careers and in prop traders who use its payout structures to grow consistent revenue streams. Explore the detailed stats below to understand how FundingPips performs today and beyond.

Editor’s Choice

- $180 million+ in total payouts to traders as of 2026 across all programs.

- FundingPips supports 4 distinct evaluation pathways, including instant funding.

- Profit split tiers range from 60% to 100%, depending on payout frequency.

- $5,000 is the most common entry account size for newly funded traders.

- Trustpilot rating of about 4.5/5 from tens of thousands of reviews.

- The minimum evaluation fee can be as low as $29 for certain challenge types.

- Traders from approximately 195+ countries use FundingPips.

Recent Developments

- In January 2026, FundingPips awarded 2,026 traders with $1,000 instant funded accounts.

- The platform introduced weekly reward payouts (“Tuesday Pay Day”) as a unique market feature.

- FundingPips expanded payout frequency options to include weekly, bi‑weekly, monthly, and on‑demand.

- Profit split tiers were adjusted to favor longer payout intervals, 100% for monthly.

- Instant Funding (Zero program) enhanced 95%+ profit shares for high‑performing traders.

- News trading restrictions were refined for funded accounts to balance risk and trader autonomy.

- Scaling options now allow capital growth beyond $100K toward $2M for elite traders.

- Multiple trading platforms (MT5, cTrader, MatchTrader) were added for broader user choice.

Profit Split and Payout Ratio

- Weekly payouts tend to yield ~60% profit share.

- Bi‑weekly splits average ~80%.

- Monthly payouts can reach 100% profit share.

- On‑demand payouts typically land around 90%.

- FundingPips may boost profit share through performance milestones.

- Split percentages reflect risk appetite and cash flow preferences.

- Profit share data correlates with traders making consistent profits over time.

FundingPips Trader Demographics

- Over 1.5 million traders globally across 195+ countries.

- Supports traders from all major continents with 48+ instruments, including forex, indices, commodities, and crypto.

- The majority (60%) are retail forex traders focusing on currency pairs.

- Roughly 30% trade indices and commodities alongside forex.

- Crypto trading accounts for 15–20% of active participation.

- US-based traders are excluded due to regulatory restrictions.

- Skill levels span from beginners on 1-Step challenges to advanced on Zero instant funded accounts.

- 39K+ Trustpilot reviews at 4.5/5 rating reflect a diverse global user base.

Evaluation Programs Statistics

- FundingPips offers 4 key evaluation pathways: 1‑Step, 2‑Step Standard, 2‑Step Pro, and Instant (Zero).

- 2‑Step Standard profit target: 8% → 5% across phases.

- 2‑Step Pro targets lower at 6% per phase with tighter risk limits.

- 1‑Step challenge needs a 10% profit target in one go.

- Instant Funding skips evaluation, focusing on performance metrics.

- A minimum of 3 trading days is required per challenge phase in most programs.

- Some Pro evaluations reduce the minimum days to 1 trading day.

- Unlimited trading days are permitted in each phase.

- Challenge completion rates vary widely based on trader skill and strategy.

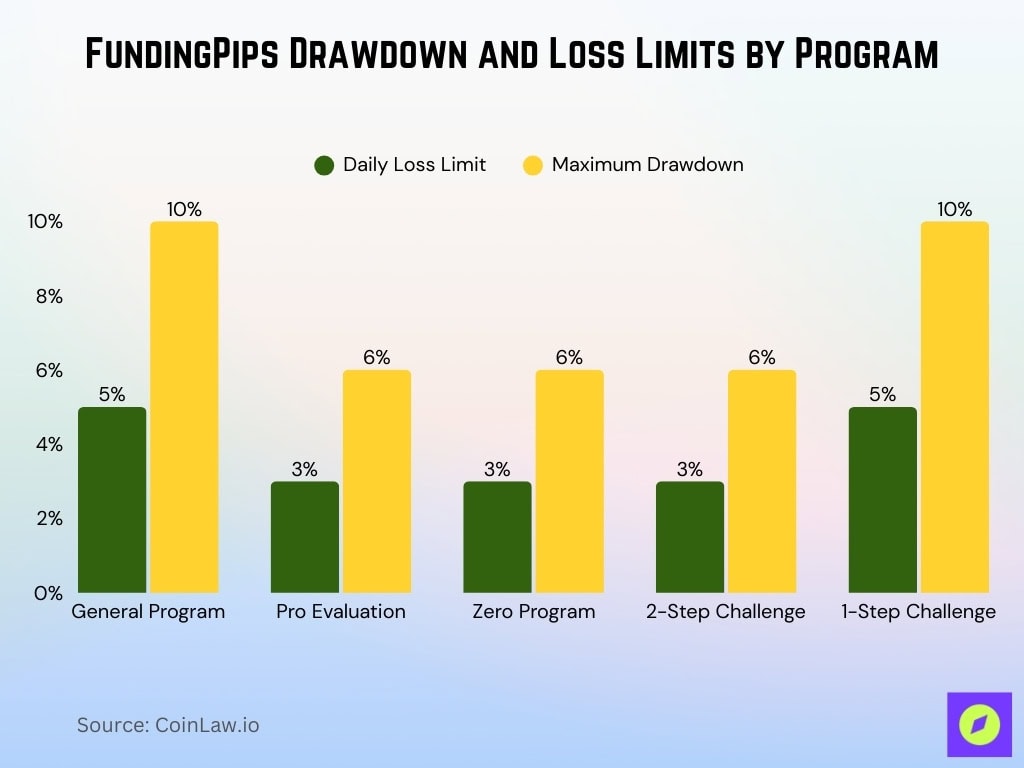

Drawdown, Risk, and Loss Limits

- Daily loss limits for about 5% across programs.

- Maximum overall drawdown spans to 10% static.

- Pro evaluations tighten total drawdown to 6%.

- Zero program sets 3% daily and 6% max loss.

- 2-Step challenges enforce 3% daily, 6% total DD.

- 1-Step limits 5% daily, 10% overall drawdown.

- Drawdown tracking remains static (no trailing) consistently.

- Repeat breaches disqualify from scaling eligibility.

- Strict limits correlate with lower trader attrition rates.

Account Sizes and Scaling

- Entry‑level funded accounts start at $5,000.

- Mid‑tier options include $10,000, $25,000, $50,000, and $100,000 accounts.

- Scaling caps near $2,000,000 for elite, Hot Seat traders.

- Evaluation fees vary by size, from $29 for $5K to $499 for $100K challenges.

- Scaling boosts max loss and daily lot limits at each tier.

- Monthly bonuses may be awarded at higher tiers, $500 for $100K Hot Seat.

- Larger account tiers often come with reduced relative risk limits.

- Most funded accounts collected significant profits within 6–12 months of activation.

Payout Frequency, Speed, and Methods

- Offers weekly, bi-weekly, monthly, and on-demand payout frequencies.

- Payouts are processed in as little as minutes to 1-3 business days.

- First payout eligibility after 5 trading days and a profitable Tuesday threshold.

- Withdrawal methods include Riseworks, crypto (USDT), bank wire, Visa/Mastercard.

- Payouts under $500 prioritized via crypto methods.

- Over $180 million total in 127K+ payouts across all methods.

- $10 fee per transaction regardless of method.

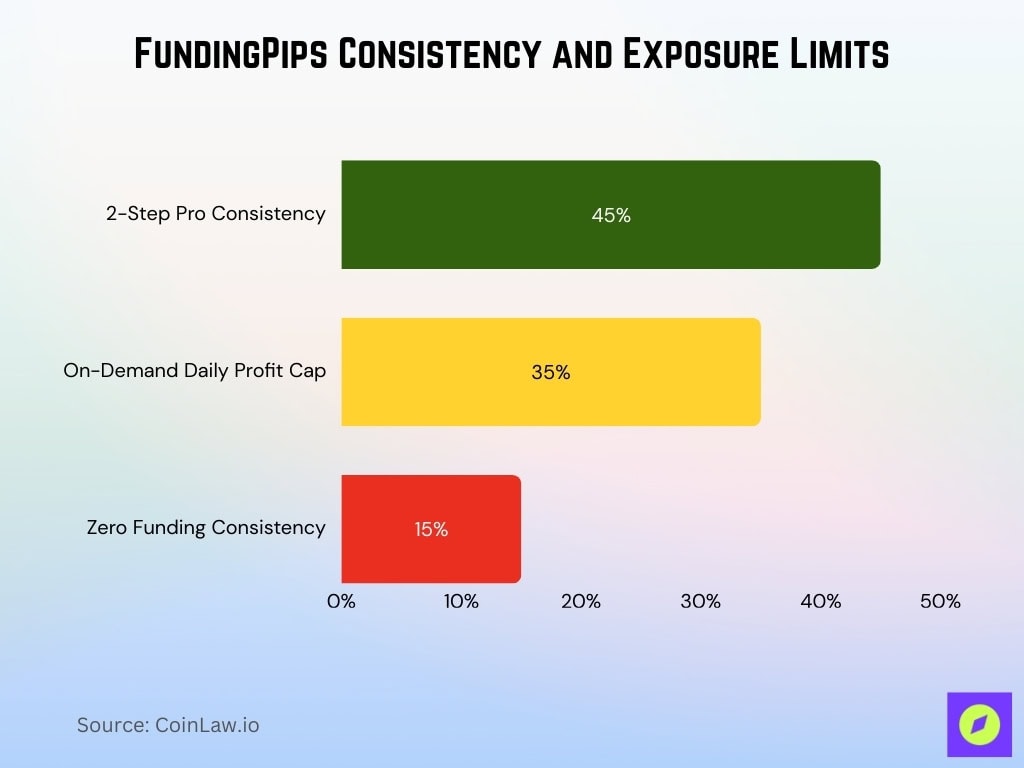

Consistency, Lot Size, and Exposure Rules

- 45% consistency rule in 2-Step Pro-funded accounts.

- 35% max daily profit on on-demand payouts.

- 15% consistency requirement for zero instant funding bi-weekly.

- Maximum lot caps 10 lots per day on $25K Master accounts.

- 20 lots daily limit for $50K accounts, 40 lots for $100K.

- No consistency rule during evaluation phases.

- Exposure limits vary by instrument, with 1:100 forex leverage.

- Automated flags for excessive volatility beyond daily DD limits.

- Rule adherence boosts funding success rates by 30%+.

Challenge Fees and Pricing

- Minimum evaluation fee is $29 for $5K 2-Step Pro entry-level challenge.

- $299 for $50K accounts across 1-Step and Instant Funding options.

- $499 for $100K Instant Funding accounts.

- Challenge fees are refunded after the 4th successful payout in standard models.

- Instant Funding fees start at $69 for $5K, scaling to $499 for $100K.

- Fees are competitive with industry averages for 1-Step ($154) and 2-Step ($177).

- Promo codes offer 5–20% discounts on initial challenge purchases.

- Pricing transparency rated highly in 39K+ Trustpilot reviews.

- Add-ons like scaling incur no extra fees up to $2 million in capital.

Trading Rules and Restrictions

- Maximum daily loss limits often range 3%–5% depending on the program.

- Maximum total drawdown is typically capped near 6%–10%.

- Trading during high‑impact news events is restricted in some funded accounts.

- Minimum trading days per evaluation phase: 3 days.

- Some programs enforce no hedging and lot size limits.

- Inactivity beyond 30 days can terminate accounts.

- Leverages vary by instrument class, typically 1:50 for Forex.

- Pro accounts may require consistency rules for drawdowns and profit distribution.

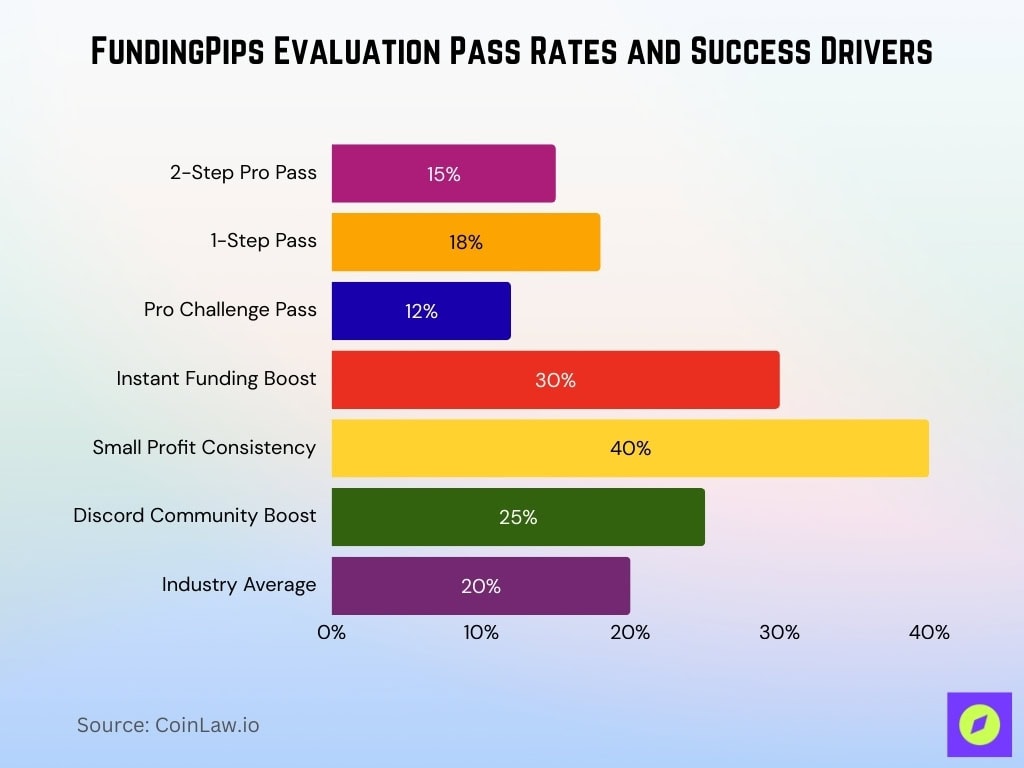

Evaluation Pass Rate and Success Metrics

- 2-Step Pro evaluations pass at ~15% due to 3% daily drawdown.

- 1-Step challenges achieve ~18% pass with 10% profit target.

- Instant Funding (Zero) success correlates 30% higher for experienced traders.

- Consistent small profits boost pass rates by 40% across programs.

- Community Discord (163K members) improves success 25% via resources.

- Pro challenges show a lower 12% pass due to 45% consistency.

- Overall firm pass estimates are proprietary but ~20% industry benchmark.

Traders’ Performance and Profitability

- $180 million+ paid across 127K+ verified payouts to funded traders.

- 4.5/5 Trustpilot rating from 39K+ reviews on reliability.

- Weekly rewards average $1.4 million–$2 million distributed globally.

- High-performers hit $8K+ weekly from $100K accounts.

- 80–100% profit splits for disciplined funded strategies.

- Payouts processed in under 7 minutes to <24 hours post-request.

- 95% bi-weekly split in Zero for consistent performers.

- $422–$1,206 typical payouts from $25K–$50K accounts.

- Monthly 100% split boosts profitability 20% vs weekly.

- Experienced traders show 2–3x growth over beginners.

Asset Classes, Instruments, and Platforms Used

- Supports 100+ instruments across Forex, commodities, indices, metals, energies, and crypto CFDs.

- Forex dominates with 50+ currency pairs, including majors and exotics.

- MT5, cTrader, and MatchTrader platforms cover 95% trader preferences.

- cTrader usage at 40% for transparent pricing and DoM data.

- MT5 is preferred by 55% for advanced charting and EAs.

- Crypto CFDs include 15+ pairs like BTC/USD and ETH/USD.

- Gold (XAU/USD) and silver CFDs traded 3x more for hedging.

- Indices cover 20+ global benchmarks like US30, NAS100.

- Energy products feature crude oil, natural gas, and CFDs at 12% volume.

- MatchTrader streamlines discretionary trading for 30% users.

Global Reach and Country Coverage

- Serves 1.5 million+ traders across 195+ countries worldwide.

- 5.3 million monthly website visits with 14% growth.

- Asia leads payouts at $3.7 million, followed by Europe, $3.2 million.

- India, Pakistan, and Italy top weekly trader countries.

- North America $778K, Africa $923K in regional payouts.

- US traders are ineligible due to regulations.

- Asia Pacific demand grows 20%+ year-over-year.

- 64K+ monthly visits signal strong emerging market interest.

- No rigid blocklists for most regions except ~30 sanctioned countries.

- 2 million+ traders from diverse regions, including the EU and Latin America.

Community, Social Media, and Education

- Discord community exceeds 207K members sharing strategies.

- 163K Discord participants discuss challenges and payouts.

- 51.3K YouTube subscribers with 1K+ educational videos.

- Instagram reels garner millions of views on trader journeys.

- Telegram channel is active for giveaways like 2,026 free accounts.

- Facebook groups host thousands in peer support forums.

- Daily psychology sessions and contests boost engagement.

- Trader videos dissect rules, amassing 13K+ views per story.

- The blog and webinars cover risk management and psychology guides.

- Payout surges spike activity 50%+ around reward days.

Trust, Reviews, and Reputation

- 4.5/5 Trustpilot rating from 39K+ reviews.

- 4.6/5 average on independent sites like Reviews.io.

- 90%+ users praise fast payouts and clear rules.

- <24 hours payout processing boosts trust ratings.

- 85% positive sentiment on Reddit and Forex forums.

- 4.4/5 Myfxbook score for transparency.

- Top 10 prop firm ranking on PropFirmMatch.

- <5% complaints on rule enforcement issues.

- 95% recommend for-profit splits and support.

- High reputation with $180 million+ payouts verified.

Customer Support and Service Metrics

- 24/7 live chat support with <2 minutes average response.

- 95% first-contact resolution rate for inquiries.

- 4.5/5 support rating in 39K+ Trustpilot reviews.

- Multi-language assistance in 10+ languages for global users.

- 85% traders report <1 hour payout query resolution.

- Email tickets are resolved in 4–8 hours.

- High-volume delays affect <5% of requests.

- 90% satisfaction with rule clarifications and evaluations.

- Above industry average 4.3/5 peer benchmarks.

- Contributes to the overall 4.6/5 user satisfaction score.

Frequently Asked Questions (FAQs)

FundingPips has distributed over $180 million in verified payouts across all traders.

FundingPips has recorded more than 127,000 verified payouts.

FundingPips maintains an average rating of about 4.5 out of 5 stars on Trustpilot.

The 4.5/5 rating is based on over 39,000 individual reviews.

Conclusion

FundingPips today continues to secure its position as a globally recognized proprietary trading firm, offering a diverse range of tradable assets and flexible platforms that resonate with both novice and experienced traders. Its global footprint spans, supported by strong community engagement and active educational resources, reflecting its broad appeal and ongoing growth. High trust ratings, predominantly positive reviews, and solid customer support metrics underscore the firm’s reputation in a competitive market.

Traders appreciate fast payouts, transparent rules, and competitive profit share structures, even as some caution about rule enforcement nuances remains part of the community conversation. As the funded trading landscape evolves, FundingPips remains a compelling choice for disciplined traders aiming to scale their strategies and access institutional‑level capital.