Prop trading has evolved rapidly, and FundedNext has emerged as a dominant player today. From fast payouts to flexible evaluation models, the firm’s appeal spans both seasoned and new traders across the globe. With real-world use cases in high-frequency forex strategies and automated futures trading, FundedNext’s data-driven programs offer unique insights into trader behavior, success rates, and risk controls. This article explores detailed statistics behind FundedNext’s ecosystem, offering you a grounded view of what makes this firm stand out today.

Editor’s Choice

- FundedNext has paid out over $158 million+ in real profits to traders worldwide and funded more than 137.8K+ accounts across 170+ countries.

- The highest single payout to an individual trader reached $346,837.90.

- FundedNext offers profit splits of up to 95% for CFD traders and 100% for Futures traders.

- More than 55,636+ reviews rate the platform 4.6/5 on Trustpilot, confirming its strong reputation among retail traders.

- Traders from 195+ countries actively use FundedNext, showcasing its global reach.

- Evaluation models now include 1-step, 2-step, and instant funding across both CFD and Futures platforms.

Recent Developments

- In 2025, FundedNext launched a Futures Challenge Program, allowing traders to access CME Group products using Tradovate and NinjaTrader.

- The platform introduced instant funding options, enabling traders to skip evaluation phases.

- 15% profit share during the evaluation phase was added, making it one of the few prop firms to offer early returns.

- The introduction of scaling plans up to $4 million gives top performers long-term growth opportunities.

- A new affiliate reward structure pays partners up to 15% recurring commissions.

- Crypto deposits and withdrawals were expanded to include stablecoins like USDT, USDC, and BTC.

- In mid-2025, FundedNext began hosting trader competitions with cash prizes and bonus accounts.

- A multilingual support expansion now serves clients in over 10 major languages.

FundedNext Hall of Fame and Top Trader

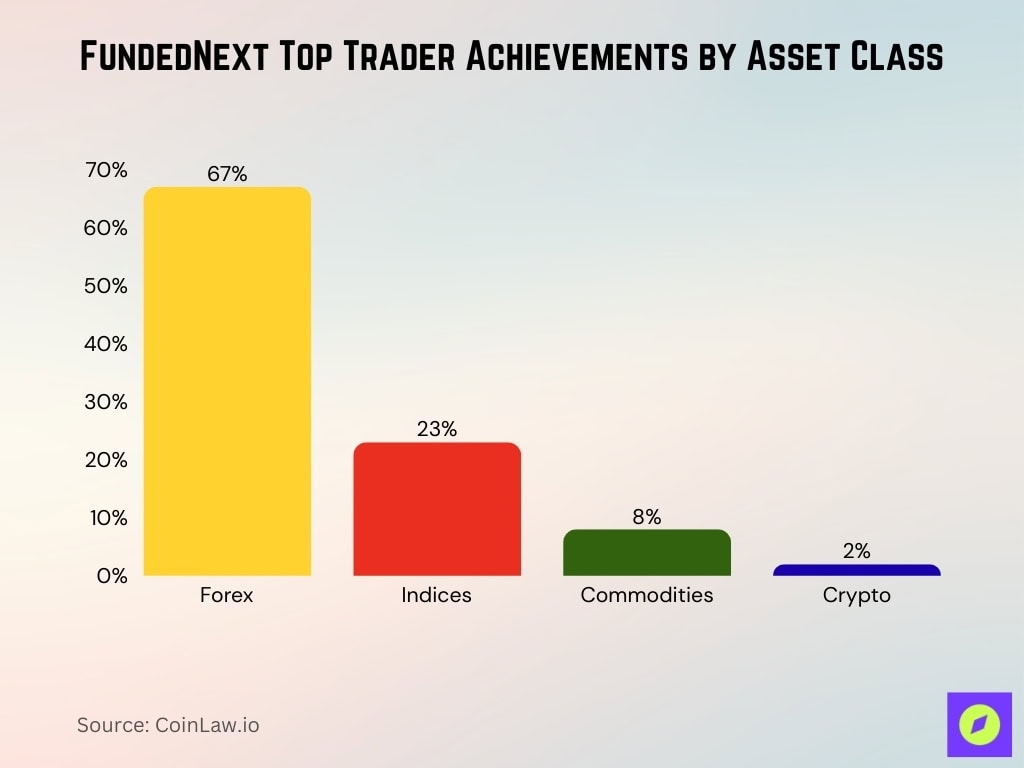

- Achievements span forex (67%), indices (23%), commodities (8%), and crypto (2%).

- FundedNext’s Hall of Fame features recorded lifetime payouts of $158M+.

- It has funded over 137,800+ funded accounts between 2022 and 2025 through its 1-Step, 2-Step, Lite, and Futures models, with this number continuing to grow into 2026.

- Top reward levels reach near $347K for individual trader achievements.

- 11,440 elite traders and 1,372 crown traders are recognized globally.

- Cumulative trading volume hits 4,073,771 lots with XAUUSD leading pairs.

- 15% challenge phase reward share totals $1,538,325 distributed.

- Recent top payouts: $70,28.69 Jiancheng Yu, $20,610.52 Kan Tubtimthong.

Evaluation Program Statistics

- FundedNext offers three main evaluation models: 1-Step, 2-Step, and Instant Funding.

- Instant Funding programs grew by 23% YoY, especially in Latin America and Asia.

- 1-Step evaluations now make up ~35% of new account openings.

- Completion time for 2-Step challenges averages 14 to 21 days.

- Traders who use consistent risk management improve evaluation outcomes by up to 18%.

- About 15% of evaluation participants hit drawdown limits and fail on Day 1.

- Evaluation programs for Futures have a pass rate of 6%, slightly below CFD programs.

- FundedNext now supports demo-to-live transition periods, averaging 3 days post-approval.

Account Size and Scaling

- FundedNext’s maximum scaling plan allows accounts to grow up to $4 million.

- Standard initial account sizes range from $5,000 to $200,000.

- Traders receive scaling evaluations every 30 days, based on consistency and profit.

- Accounts over $400,000 represent the top 2.5% of scaled users.

- The average scaling threshold is 10% profit in a 30-day cycle.

- Instant accounts can scale similarly, though with stricter risk requirements.

- Less than 5% of users reach $1 million in capital scaling.

- About 20% of traders achieve their first scale-up within 90 days of getting funded.

- Scaling eligibility drops by 35% if a trader violates drawdown rules.

- High-frequency traders tend to scale faster but also face higher churn rates.

FundedNext Trader Demographics

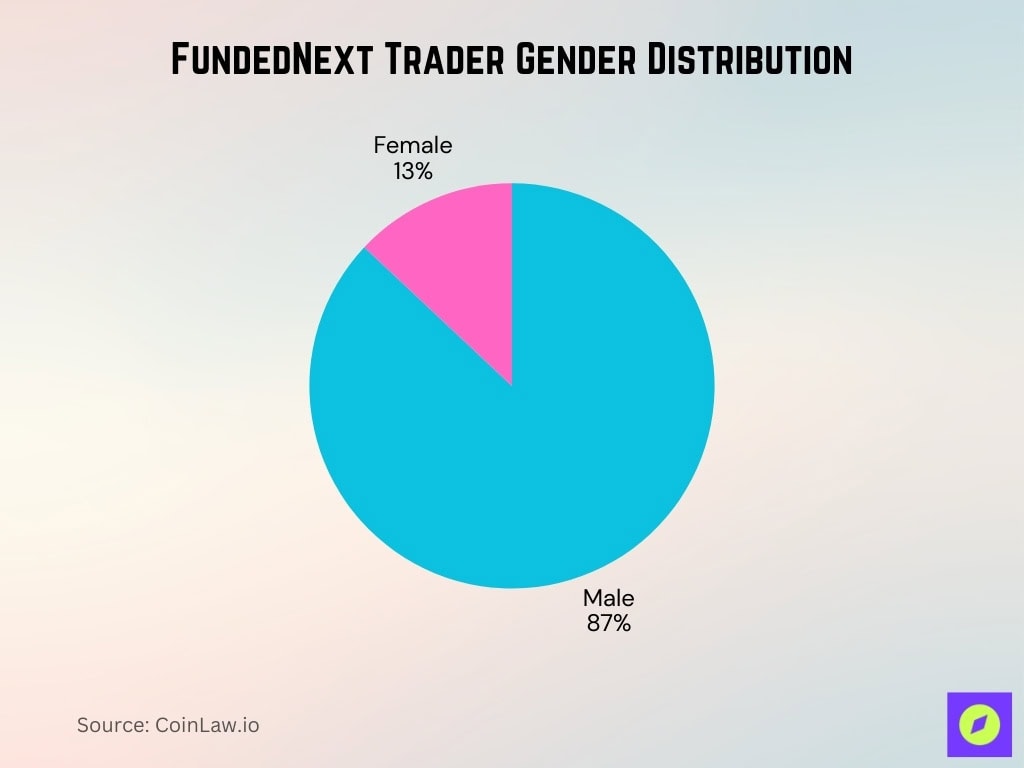

- Gender distribution is still male-dominated, with approximately 87% male and 13% female traders.

- The largest user base comes from India, the USA, the Philippines, Nigeria, and Pakistan.

- Over 30% of newly funded traders in 2025 came from Southeast Asia and the Indian subcontinent.

- 18-34 year-olds represent 65% of FundedNext’s total trader pool.

- A growing number of traders are college students and recent graduates, particularly in India and the Philippines.

- More than 40% of users are employed full-time and trade during evenings or market overlap hours.

- The number of female-funded traders increased by 28% YoY from 2024 to 2025.

- U.S.-based traders make up ~7% of the funded pool, slightly up from 6.4% in 2024.

- Traders from tier-3 and tier-4 cities in India contributed to nearly 40% of total signups from the country.

- A significant demographic uptick was observed in Francophone African nations, particularly Cameroon and Senegal.

Profit Split and Payout Ratio

- Profit splits reach up to 95% on CFDs and 100% on Futures, depending on the program.

- During the evaluation phase, traders earn 15% profit share, a rare feature in prop trading.

- The average payout across all funded traders is around $1,420/month.

- Top 1% of traders average $17,500 per payout.

- The minimum withdrawal threshold is $100, encouraging faster disbursement cycles.

- About 87% of successfully funded traders make at least one payout within 45 days.

- Profit distribution frequency is bi-weekly or faster, depending on trader requests.

- Refunds on evaluation fees are included with the first live payout.

- On average, Futures-funded accounts have higher payout variance due to market leverage.

Payout Speed and Methods Statistics

- Over 85% of payouts are completed within 24 hours of request.

- Supported payout methods include Wise, crypto (USDT, BTC), and direct bank transfers.

- U.S. traders report faster payment times via Wise, averaging 8–12 hours.

- 15% of payouts in 2025–2026 were requested in cryptocurrencies.

- The average payout request is processed in ~10 hours globally.

- No processing fees are charged on most withdrawal options.

- Traders report 98%+ success rate on payout attempts across all methods.

- Instant Payout accounts support on-demand withdrawal and post-profit confirmation.

- Around 28% of African-region users prefer crypto for withdrawals.

- FundedNext’s payout team operates 24/5 to ensure quick processing.

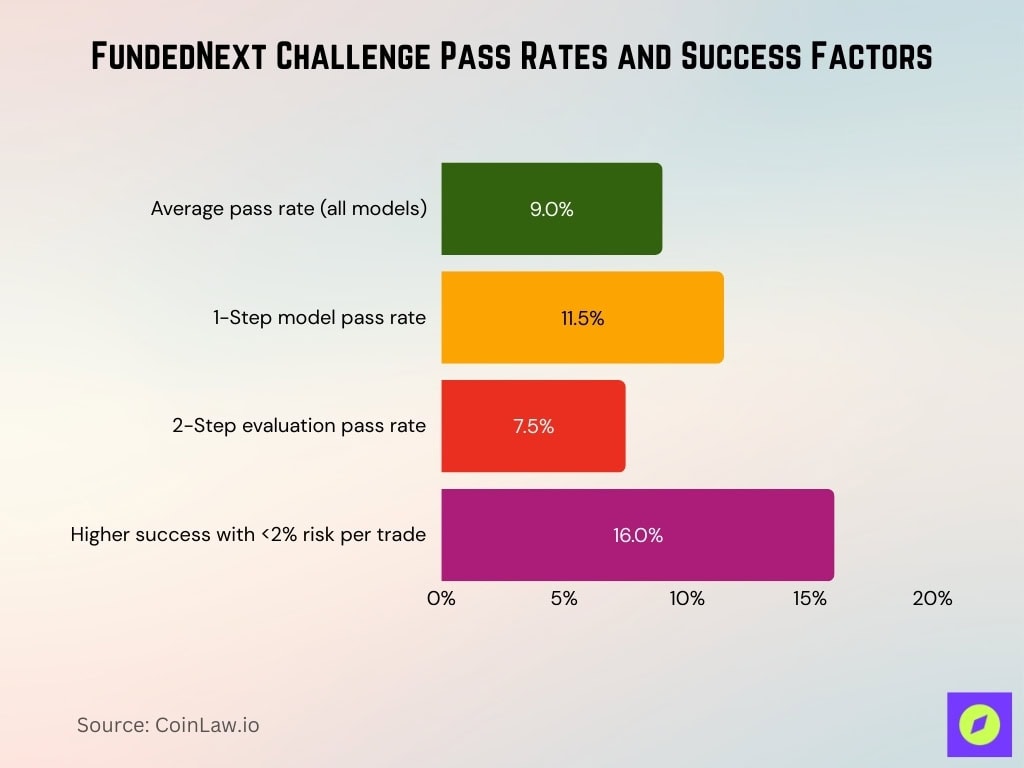

Challenge Pass Rate and Success Metrics

- The average pass rate across all models stands at ~9%.

- 1-Step model boasts a higher pass rate (11–12%) due to simplified structure.

- 2-Step evaluations show pass rates of ~6–9%, depending on region.

- Traders using less than 2% risk per trade have 16% higher challenge success.

- Traders with strong risk management backgrounds are 1.7x more likely to pass.

- Pass rates are higher among users who use automated trading systems with set SL/TP.

- The top 5 performing countries include India, Nigeria, the USA, the Philippines, and Vietnam.

- Pass rate dips during major news events, suggesting volatility impacts performance.

- Instant Funding options show lower failure rates due to no challenge structure.

- More than 10,000+ new funded accounts were issued in 2025 alone.

Drawdown and Risk Management

- FundedNext applies daily drawdowns of ~3–5% and overall drawdowns of ~6–10%, depending on the challenge model.

- In CFD challenges, traders must respect balance-based drawdown rules to safeguard capital and maintain eligibility.

- A 6% trailing loss limit applies in some Stellar Instant accounts, requiring disciplined risk control.

- Maximum drawdown parameters are designed to prevent outsized losses, reflecting industry standards in prop trading.

- Across major programs, risk cost per trade ($5–7/lot for Forex/commodities) averages competitive levels compared with peers.

Trading Rules and Restrictions

- No time limits are imposed on most FundedNext challenge completions, unlike many competitors.

- News trading allowed with a 10-minute window profit split rule (40% profit counted) on funded accounts.

- Algorithmic trading (EAs, bots) permitted on MT4/MT5 up to $300k equity per strategy.

- Account sharing and reversal of positions (copy trading) are strictly prohibited across all accounts.

- Minimum trading days: 1-step requires 2 days, 2-step needs 5+ days, and Instant has none.

- Automated strategies are allowed only when adhering to drawdown rules and consistent use throughout.

- Leveraged positions up to 1:100 are typical across most tradable markets.

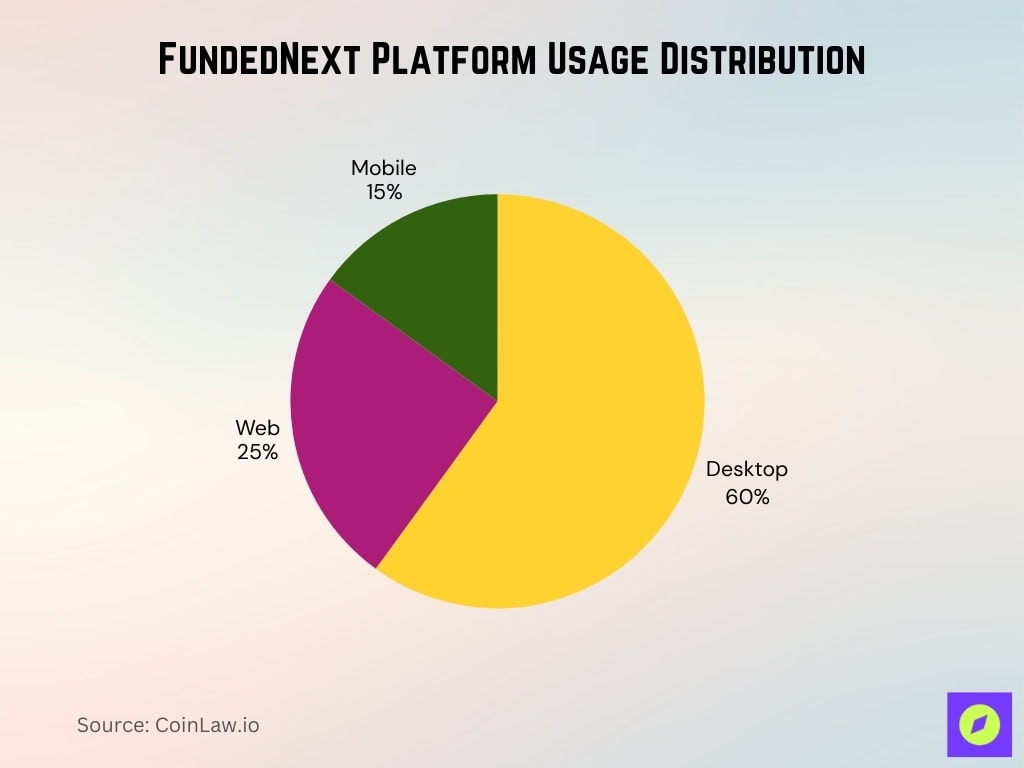

Platform and Technology Usage

- Usage modes: web (25%), desktop (60%), mobile (15%).

- FundedNext supports MT4, MT5, and cTrader for 95% of traders.

- Futures traders use Tradovate, NinjaTrader, and TradingView (Rithmic connectivity).

- No minimum trading days on Instant accounts (100% flexibility).

- Algorithmic trading (EAs, bots) permitted on MT4/MT5 up to $300k equity.

- Platform choice flexibility with 4+ options accommodating multi-strategy styles.

- Integration with TradingView, LuxAlgo enhances analysis for 80% users.

- Execution speeds average <50ms, supporting high-frequency strategies.

Traders’ Performance and Profitability

- FundedNext’s Hall of Fame lists traders with rewards exceeding $158M+ in total payouts.

- The top individual reward reported on the Hall of Fame page was $346,837.90.

- Over 97K+ traders have achieved funded status according to the Hall of Fame overview.

- 11,440 elite traders and 1,372 crown traders recognized for outstanding performance.

- Total challenge phase 15% reward share distributed reaches $1,538,325.

- Cumulative trading volume by traders hits 4,073,771 lots with XAUUSD as the most traded pair.

- Recent payouts include $70,28.69 to Jiancheng Yu and $20,610.52 to Kan Tubtimthong.

- High-performing traders scale accounts multiple times, achieving up to 95% profit splits.

Asset Classes and Instruments Traded

- FundedNext offers 50+ forex currency pairs, including majors (65% volume), minors, and exotics.

- Traders access 10+ indices like SPX500, US30, GER30, and JP225.

- Commodities include gold (XAUUSD) (32% trades), silver (XAGUSD), and oil (USOUSD).

- Popular crypto CFDs: BTCUSD (15% volume), ETHUSD, XRPUSD, DOGUSD.

- Futures markets feature FX futures (6E, 6J) and energy (CL, NG) contracts.

- No limits imposed on instrument or position sizes across 650+ tradable markets.

- Instrument availability spans CFDs and futures on MT4/MT5/cTrader platforms.

Global Reach and Country Coverage

- FundedNext serves traders in 195+ countries worldwide.

- Geographic participation spans North America (15%), Europe (30%), Asia (40%), and Africa/Middle East (15%).

- U.S. traders are allowed in all CFD/Futures challenges via Match-Trader.

- Top countries by rewards: Italy $401K, India $195K, Pakistan, Nigeria, Brazil.

- ~25 restricted countries, including Russia, Iran, Syria, and North Korea.

- Regional payment methods: crypto (50%), bank transfer (30%), cards (20%).

- Operations from 5 countries: UAE, Malaysia, Bangladesh, Sri Lanka, and Cyprus.

- 137.8K+ funded accounts reflect rising global prop trading interest.

Trust, Safety, and Reputation

- FundedNext holds a 4.6/5 Trustpilot rating from 55,636+ reviews.

- Sitejabber rates 4.7/5 from 799 reviews praising support and payouts.

- Overall, FundedNext has rewarded traders with $158M+ in payouts to 47.3K+ traders and funded 137.8K+ funded accounts, making it one of the highest-paying prop firms in 2026.

- 202.1K+ accounts powered with a 24-hour payout guarantee or $1,000 extra.

- 90% profit split post-first payout, 15% challenge phase share.

- Support response times average <10 minutes via live chat for 95% queries.

- 6% 1-star reviews mainly cite support delays, 94% positive on transparency.

- Independent review sites list FundedNext among the top prop firms, while Trustpilot shows a 4.6/5 rating from 55,636+ reviews and extensive payout proof shared online.

Awards and Industry Recognition

- Ranked top 3 paying prop firms 2026 with 95% CFD splits, 100% Futures.

- Won Global Prop Firm of the Year 2025 at Finance Magnates Awards.

- #1 for payout speed with a 24-hour guarantee or $1K bonus.

- 4.6/5 Trustpilot from 55K+ reviews, top-rated prop firm.

- Top 5 in Prop Firm Match for $180M+ payouts to 60K+ traders.

- Best Scaling Plans noted by Trading Finder with 150% add-on.

- #1 Futures Prop by DailyForex for US access, low fees.

- Community awards: Trader’s Choice on Forex Factory, Reddit favorite.

Customer Support and Service Metrics

- Support available 24/7 via live chat, email, and Discord (<10 min avg response).

- Trustpilot 4.6/5 from 55,636+ reviews praising support (92% positive).

- Help Center features 200+ articles with 98% rule coverage.

- Discord community exceeds 100K members for peer support.

- Sitejabber 4.7/5 from 799 reviews on quick resolutions.

- Peak hour delays affect <5% queries, avg 12 min response.

- FAQ satisfaction scores 4.4/5 for self-service resolution.

- 95% payout queries are resolved within 24 hours.

Compared to Other Prop Firms

- FundedNext 95% CFD/100% Futures splits vs FTMO 80–90%.

- Payouts in 24 hours (or $1K extra) vs FTMO 1–2 days post-14-day wait.

- 15% evaluation profit share, unique vs 0% at FTMO/FundingPips.

- Challenge fees $49–$999 vs FTMO higher averages, 100% refundable.

- No time limits vs FTMO, none but stricter 4 min days/phase.

- 650+ instruments vs FTMO ~300, broader asset access.

- Serves 195+ countries vs FTMO ~150, broader global acceptance.

- 4.6/5 Trustpilot (55K reviews) has higher satisfaction than FTMO 4.8 (25K) peers.

Frequently Asked Questions (FAQs)

FundedNext Express accounts start at 60% reward share on first withdrawal and can increase to 75% and 90% on subsequent withdrawals.

FundedNext offers profit splits ranging from 80% up to 95%, depending on performance and add‑ons.

The maximum funded account allocation that can be active on FundedNext is $300,000 per trader.

FundedNext serves traders in 195+ countries worldwide.

Conclusion

FundedNext stands as a statistically significant player in the proprietary trading space, combining competitive profit splits, fast payout speeds, and a broad global reach with solid customer support metrics. Traders benefit from diverse platform access, inclusive rules, and evolving technology integrations that support both manual and algorithmic strategies. Across independent reviews and real user feedback, FundedNext consistently rates highly for reliability, transparency, and service quality. As the prop trading ecosystem expands, these statistics show how the firm continues to refine its offerings and deliver value to a growing base of funded traders.