FTMO has become one of the most talked‑about proprietary trading firms in the prop‑trading world. By combining structured evaluation stages with generous profit sharing, it allows individual traders to access sizeable simulated capital and real payouts. Tens of thousands of traders globally attempted the Evaluation Process to secure funded accounts and earn real rewards. From benefit highlights to stories of traders on funded accounts, its impact continues to ripple across retail trading and professional prop‑trading communities. In this article, you’ll find the latest statistics, trends, and metrics shaping FTMO today.

Editor’s Choice

- 3.5 million+ traders have used FTMO’s platform globally.

- FTMO has paid out over $450 million to traders since its launch in 2015.

- Traders can keep up to 90% of their profits under the scaling plan.

- FTMO supports traders in 140+ countries worldwide.

- The minimum trading days to pass the FTMO Challenge is 4 days.

- FTMO’s evaluation consists of two phases: the Challenge and Verification.

Recent Developments

- FTMO cumulative trader payouts surpassed $450 million by its 10th anniversary, with monthly payouts peaking above $9.6 million.

- Global reach expanded to traders in over 140 countries, with the biggest single simulated profit reaching $1,206,225.

- FTMO resumed US market access via MetaTrader 5, becoming the only prop firm offering MT5 to US traders at relaunch time.

- Standard FTMO accounts provide up to $200,000 in funding with profit splits up to 90% for successful traders.

- Top performers can scale combined FTMO accounts up to $400,000, with aggressive account types capped at $200,000.

- The platform supports 4 trading platforms (MT4, MT5, cTrader, and DXtrade) and processes bi‑weekly payouts within an average of 8 hours.

- Support operations run 24/7 in 20 languages, with the platform fully translated into 8 languages.

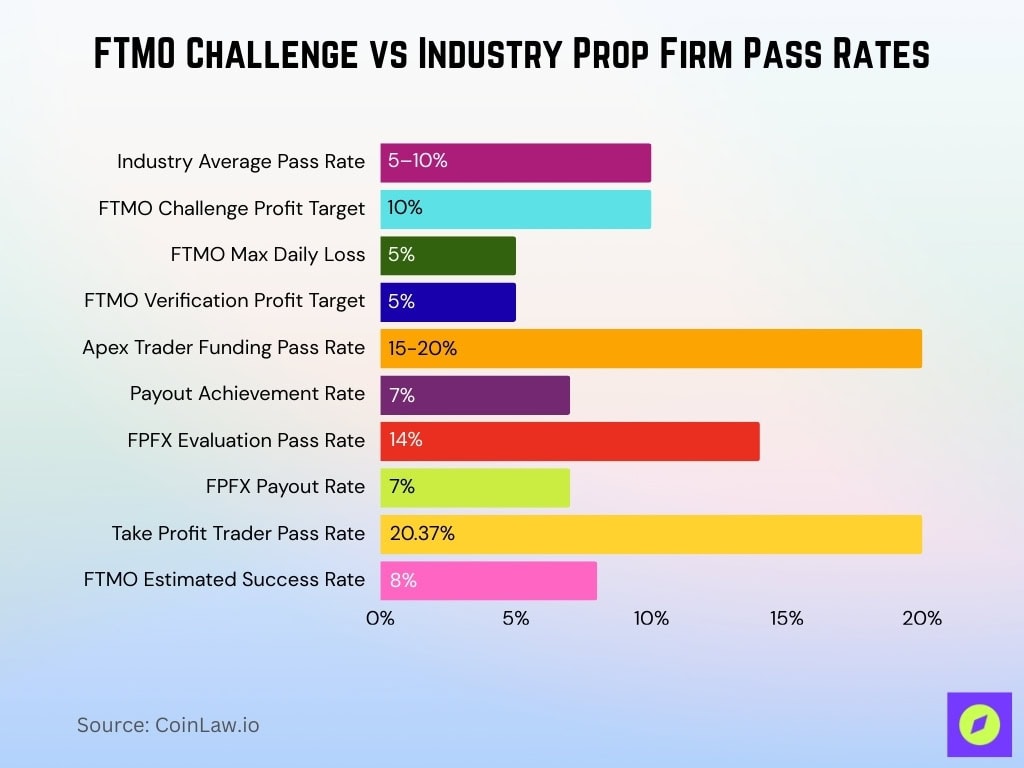

Challenge Pass Rate Statistics

- Industry prop firm pass rates average 5-10% for evaluation challenges.

- FTMO Challenge requires 10% profit target with 5% maximum daily loss.

- Verification phase profit target drops to 5% with identical risk rules.

- Apex Trader Funding reports a 15-20% first-attempt pass rate, double the industry average.

- Only 7% of passers achieve payouts due to long-term consistency failures.

- FPFX data shows an average pass rate of 14%, halving to 7% for payouts.

- Take Profit Trader achieved 20.37% pass rate in one-step evaluation.

- Community estimates FTMO success at 8%, with most failing first attempts.

FTMO Evaluation Process at a Glance

- FTMO’s evaluation consists of two stages: the Challenge and Verification.

- In the Challenge phase, traders must reach a 10% profit target.

- The Verification phase requires a 5% profit target.

- Traders must trade on at least 4 different days to qualify.

- Maximum daily loss is capped at 5% of the initial balance.

- Maximum overall loss is capped at 10% of the initial balance.

- There is no fixed time limit to complete the Challenge as of 2026.

- FTMO offers a free trial version of the Challenge for practice.

FTMO Account Types and Capital Allocation

- FTMO offers account sizes ranging from $10,000 to $200,000.

- Under the Scaling Plan, accounts can grow up to $2 million.

- The standard profit split is 80/20 in favor of the trader.

- Profit splits can increase to 90/10 through consistent performance.

- Traders can choose from multiple trading platforms, including MetaTrader and cTrader.

- Larger account sizes may come with tighter absolute risk controls.

- Capital allocation depends on successfully passing both evaluation phases.

- Fees vary based on account size and selected risk profile.

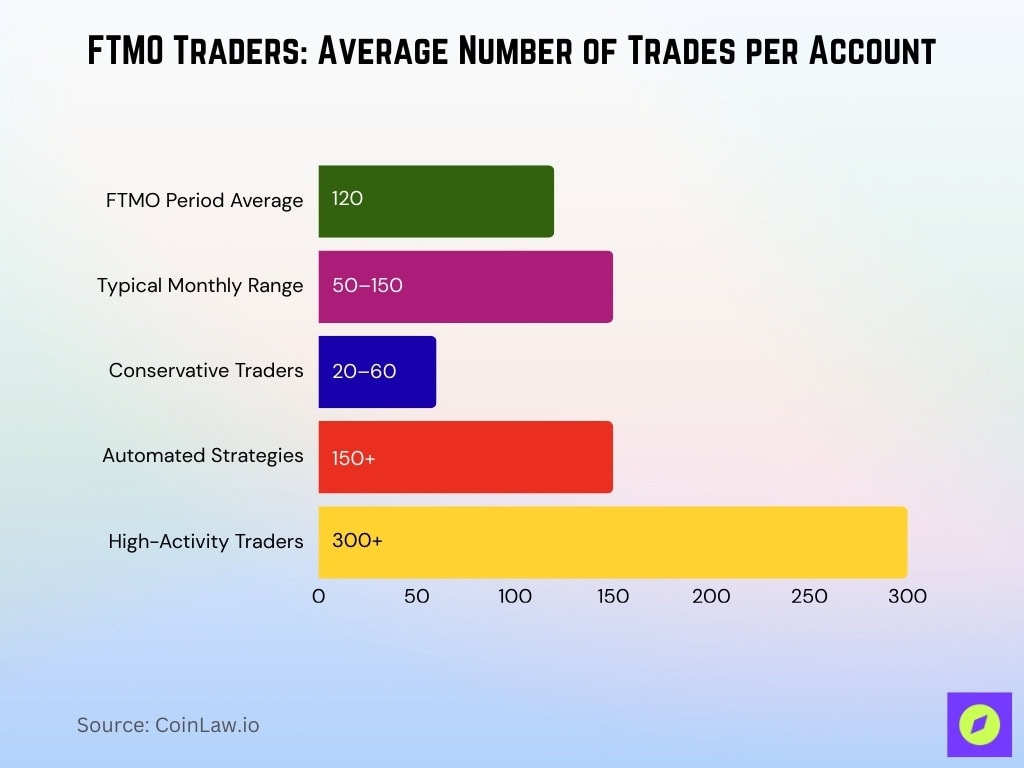

Average Number of Trades per Account

- Active funded traders often execute hundreds of trades per account.

- Historical FTMO data shows averages near 120 trades per trading period.

- Monthly trade counts commonly range from 50 to 150 trades.

- Swing traders typically place fewer trades than intraday traders.

- Conservative traders may average 20 to 60 trades per month.

- Automated strategies can exceed 150 trades per month.

- Some traders record 300+ trades across multiple instruments.

- Trade frequency correlates more with strategy than account size.

Trader Demographics and Global Reach

- FTMO serves 3.5 million+ customers worldwide as of early 2026.

- Traders hail from 140+ countries globally.

- 35,859 verified reviews on Trustpilot reflect broad trader participation.

- Platform fully translated into 8 languages with 24/7 support in 20 languages.

- US traders now access via OANDA partnership, boosting North American participation.

- 4.8/5 average Trustpilot rating from tens of thousands of global reviews.

Verification Phase Success Rate

- Verification pass rate estimated at 50-70% among Challenge passers.

- Profit target reduced to 5% with a 60-day minimum timeframe.

- 5% maximum daily drawdown and 10% maximum overall drawdown apply.

- Industry overall evaluation pass rates range 5-10%.

- Only 7% of Challenge passers reach the first payout stage.

- Drawdown compliance causes 90%+ of Verification breaches.

- Higher account sizes up to $200,000 heighten risk management demands.

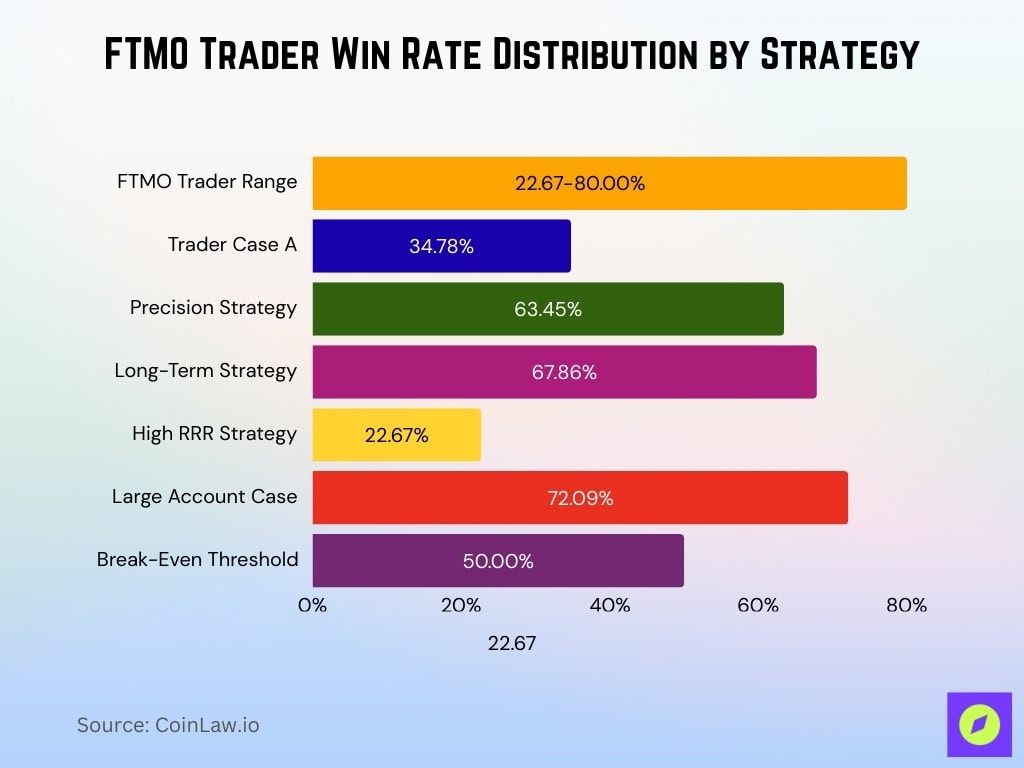

Win Rate and Risk–Reward Ratio Metrics

- Win rates among FTMO traders range from 22.67% to 80%.

- Average RRR reported from 1.0 to 5.21 across successful accounts.

- Trader achieved 34.78% win rate with 4.05 RRR, yielding $23,542 profit.

- Precision strategy delivered 63.45% win rate and $55,460 profit.

- 67.86% win rate paired with 1.30 RRR for long-term profitability.

- High RRR 5.21 with 22.67% win rate generated over €40,000 profit.

- 72.09% win rate and 1.38 RRR produced $20,000+ on a $400k account.

- RRR above 1.0 enables profitability even at 50% win rates.

Instrument and Market Preferences of FTMO Traders

- Gold ranks as the most popular instrument among FTMO traders.

- Forex pairs, indices, commodities, stocks, and cryptocurrencies are available for 100+ assets.

- Leaderboard filters by forex, indices, and commodities.

- Trader diversified across gold, forex pairs, indices, and weekend crypto for $23,542 profit.

- Equity indices are favored for liquidity and volatility.

- Gold shows seasonal price increases in summer/winter due to Asian demand.

- Multi-asset portfolios with high RRR outperform single-market strategies.

- EUR/USD futures are used for precision in leaderboard-topping trades.

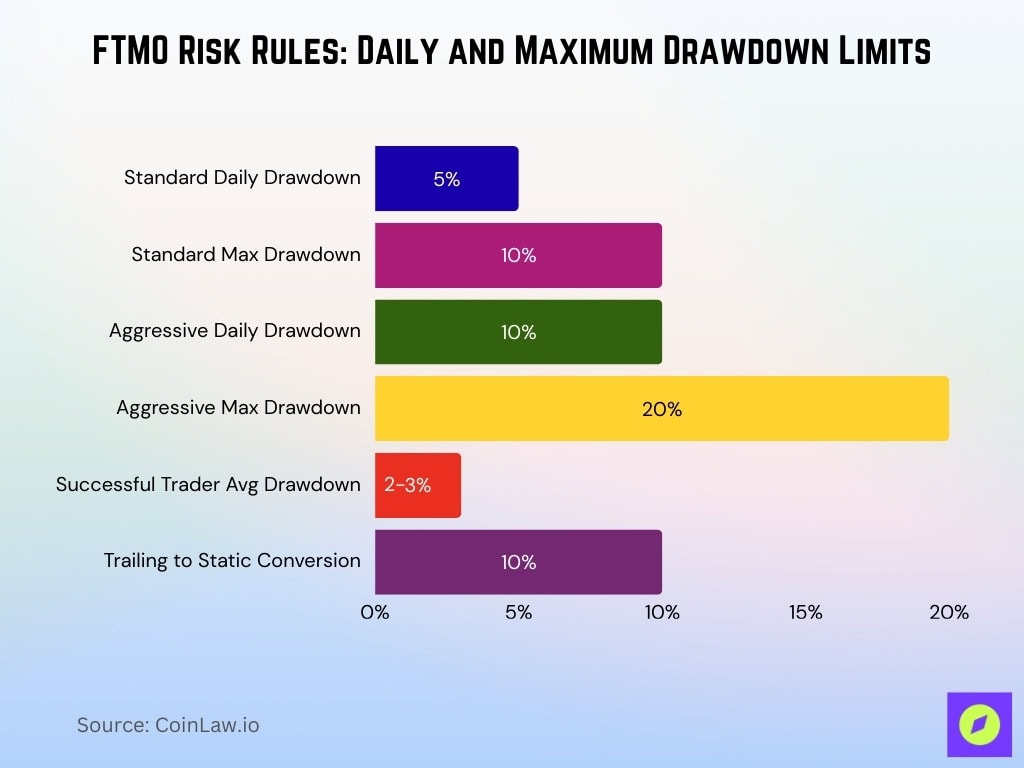

Daily and Maximum Drawdown Statistics

- Standard plans enforce 5% daily drawdown and 10% maximum loss.

- Aggressive accounts permit 10% daily and 20% total drawdowns.

- Drawdown is calculated in real-time based on the equity balance.

- Successful traders average 2-3% max drawdown per cycle.

- Account termination is immediate upon exceeding limits.

- Trailing drawdown converts to static after 10% profit target hit.

- Compliance with thresholds boosts scaling to $2 million.

Time to First Payout Statistics

- First payout request available 14 days after the initial funded trade.

- Average processing time is 8 hours once submitted bi-weekly.

- Realistic time to first payout ~45 days from Challenge start.

- Traders report first payouts in as little as 15 days post-funding.

- 1-2 business days maximum for payout confirmation.

- Monthly payouts peaked at 2,753 in January 2024.

- Daily payouts averaged 196 maximum in early 2024.

- Processing completes the same day for requests before 12 PM CET.

Trading Session and Time‑of‑Day Performance

- London-New York overlap (13:00-17:00 GMT) delivers peak liquidity and volatility.

- US session (8:00 AM-5:00 PM EDT) favored for dynamic price action and news.

- London session accounts for over 30% of daily forex volume.

- Asian session handles 20% daily volume with lower volatility.

- Top 5 trades opened around 3:00 AM CET during session transition.

- London-NY overlap produces the largest pip swings and the tightest spreads.

- Asian-London overlap (07:00-09:00 GMT) is ideal for early breakouts.

- High-liquidity overlaps reduce spreads and slippage risks.

Frequently Asked Questions (FAQs)

FTMO traders receive 80% of simulated profits initially.

Talented FTMO traders can increase their share to 90% of profits upon scaling.

One FTMO trader made $23,542 profit on a $100,000 funded account.

FTMO’s platform supports 3.5 million+ customers globally.

Conclusion

FTMO’s role in the prop‑trading landscape continues to expand, supported by record payouts, global participation, and a clearly defined evaluation structure. The data shows that traders who succeed focus on disciplined risk management, realistic profit expectations, and consistent execution across sessions and instruments. While only a small percentage reach funded status, those who do benefit from scalable capital, frequent payouts, and competitive profit splits. For traders considering or actively pursuing FTMO funding, understanding these statistics provides a clearer roadmap for navigating evaluations and building sustainable, long‑term trading performance.