Flooding is one of the most catastrophic natural disasters, impacting millions of lives and properties each year. In recent years, the United States has faced an alarming increase in flood-related damages, with 2025 shaping up to be a critical year for the flood insurance industry. Imagine a family losing their home to rising waters, only to discover their standard insurance won’t cover the devastation.

This is why understanding flood insurance trends is crucial, not only for individuals but also for policymakers and insurers working to protect communities. In this article, we’ll explore key statistics, market trends, and the transformative factors influencing flood insurance.

Editor’s Choice

- The global flood insurance market size is projected to reach $25.21 billion in 2025.

- In the U.S., there are about 4.7 million active NFIP policies in force as of 2025.

- The average annual premium for flood insurance through the NFIP is around $899 in 2025.

- Only about 3.3% of U.S. households have NFIP coverage, equal to roughly 4.7 million households.

- The average NFIP claim payment in 2024 was about $33,905 per claim.

- The NFIP provides over $1.3 trillion in total coverage to policyholders as of 2025.

Regional Market Analysis

- North America US leads with 4.7 million active NFIP policies as of 2025, though rural and low-income areas still show large coverage gaps.

- Canada has about 10% of households highly exposed to flooding, yet lacking access to insurance, and only around 54% of homeowners have overland flood coverage in recent years.

- Germany and the Netherlands both have high levels of flood resilience and insurance access; for example, the Netherlands has over 95% of high-risk properties protected through a mix of structural defenses and private insurance, while Germany reports over 90% coverage in some flood-prone areas.

- Eastern European countries still lag with low adoption rates, often under 30% due to public awareness and economic constraints.

- In the Asia-Pacific region, India and the Philippines show less than 10% property coverage in flood-prone areas despite increasing urban flood risk.

- Japan reports that over 75% of homeowners have flood insurance included in standard policies due to regulatory and market norms.

NFIP Flood Insurance Policies and Rates by State

- Average annual NFIP premiums in California are about $938, Florida $865, New York $1,133, and Texas $879 in 2025.

- The NFIP has about 4.7 million active policies as of early 2025, with 3.3% of U.S. households covered by NFIP.

- Louisiana has the highest household coverage rate at 20.9%, followed by Florida at 17.9% and Hawaii at 10.8%.

- States with the largest increases in active NFIP policies from Nov 2023 to Nov 2024 include New Mexico +25.4%, Alaska +21.0%, and Maine +18.5%.

- States with the biggest drops in active policies include Utah −37.5%, North Dakota −10.1%, and West Virginia −7.6%.

Private Flood Insurance

- Only about 4% of U.S. homeowners had private flood insurance in 2025 despite growing risk and exposure.

- Private premiums for residential flood often run from $600 to $2,800 annually, undercutting NFIP in many cases while offering broader coverage.

- Private insurers have underwritten flood risk with loss ratios below 50% in almost all years during the past five years.

- Private carriers routinely offer building coverage limits of $1 million or more, far above NFIP’s $250,000 cap.

- Faster claims processing, more flexible deductibles, and additional coverages like loss of use are driving growth in private flood options.

- Regulatory hurdles, limited availability in high-risk zones, and pricing variability outside FEMA’s mapping remain key constraints.

Flood Risk Zone Categories and Insurance Implications

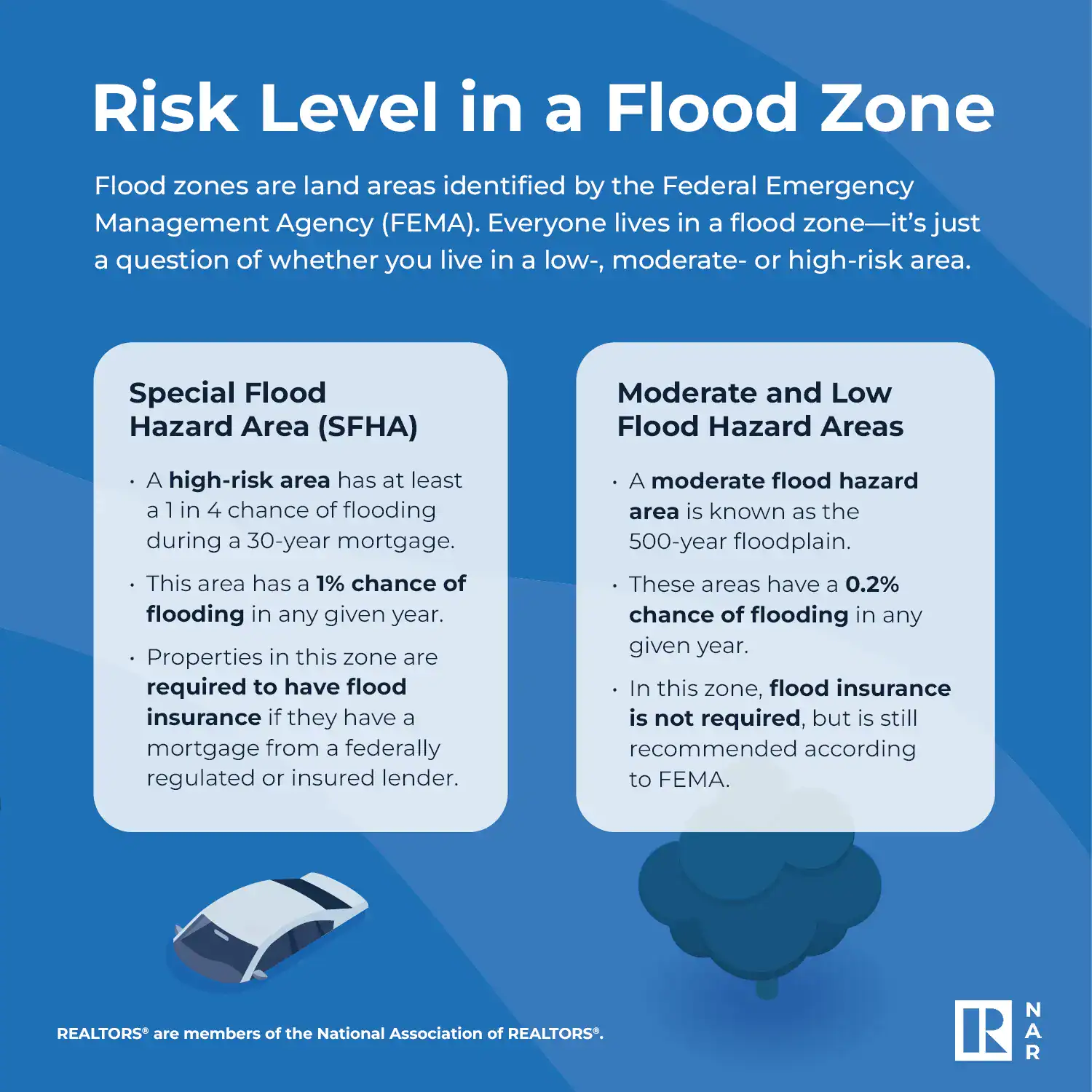

- Special Flood Hazard Areas (SFHA) are considered high-risk zones, with a 1 in 4 chance of flooding over a 30-year mortgage period.

- These areas carry a 1% chance of flooding annually, making flood events relatively frequent.

- Flood insurance is mandatory in SFHAs if the property is financed by a federally regulated or insured lender.

- Moderate flood hazard areas fall within the 500-year floodplain, classified as lower risk.

- These moderate zones have a 0.2% chance of flooding annually, based on FEMA’s estimates.

- In these areas, flood insurance is not required by law, but is still recommended by FEMA for added financial protection.

Coastal State Storm Surge and Hurricane Wind Risk

- More than 6.4 million U.S. residential properties face storm surge risk in 2025 with a reconstruction cost value of about $2.2 trillion.

- Over 33 million homes are exposed to hurricane-force wind risk in 2025, with potential reconstruction costs of around $11.7 trillion.

- Economic losses from natural catastrophes in the first half of 2025 reached $135 billion, of which about $80 billion was insured.

- The total insured value of coastal properties in the U.S. is estimated at $4.3 trillion in 2025.

- States like Florida, Texas, and Louisiana continue to see large exposure with storm surge risks driven by rising sea levels and stronger wind threats.

Flood Resilience and Coverage in Other Countries

- The UK’s Flood Re scheme supported over 660,000 households with subsidized premiums in 2025.

- In Germany, only about 50% of homeowners have natural disaster insurance, including flood risk.

- The Netherlands insures around 60–65% of properties while relying heavily on flood defense systems.

- Japan ensures that about 75% of residential properties have flood coverage through public and private schemes.

- Australia’s Northern Territory mandates flood insurance for new developments, resulting in 20–25% growth in coverage since 2018.

- In India, microinsurance products provide flood coverage for as little as $3 annually for low-income households.

- Canada has expanded private flood insurance, with about 40% of homeowners now able to access coverage.

Flood and Wildfire Risk Exposure Among U.S. Homes

- 6.4% of all homes are located in Special Flood Hazard Areas (SFHAs), indicating high flood exposure.

- 5.8% of homes are in non-SFHA zones but still face high flood risk.

- 4.5% of homes are located in communities with high wildfire risk.

- Among low-income housing areas eligible for federal tax credits:

- 5.5% of homes are in SFHAs, facing elevated flood danger.

- 6.1% of homes are in non-SFHA flood-prone areas, indicating underrecognized risk.

- Only 1.7% of homes are in high wildfire risk zones, lower than the national average.

Impact of Climate Change on Flood Insurance

- Global sea level is rising about 3.3 mm per year in 2025, increasing coastal flood risks.

- High-tide flooding days have increased by nearly 200% in many U.S. coastal regions since 2000.

- Insured losses from natural disasters, including floods, reached about $135 billion worldwide in 2024.

- Average premiums in high-risk flood zones have risen by more than 20% in recent years due to risk adjustments.

- About 45% of properties in high-risk flood zones now face unaffordable premiums under climate risk reassessments.

- Global flood damages could exceed $1 trillion annually by 2050 without urgent adaptation measures.

Technological Advancements in Risk Assessment

- AI-powered models in 2025 produce spatial flood predictions with up to 40% higher accuracy and generate flood-depth maps thousands of times faster than traditional methods.

- Real-time flood monitoring using satellite data and digital twins now enables lead-time forecasts at 10-minute intervals in several high-risk regions.

- Machine learning frameworks reduce stream-flow error rates by over 60% in mountainous watersheds while improving the timing of peak flow predictions by several hours.

- Near-real-time detection of flood inundation via satellite sensors has achieved F1 scores of 0.70 or higher in open-area and agricultural zones.

- Urban flood depth estimation tools using vision-language models now operate in near real time, cutting error by about 20% compared to prior methods.

- Digital Twin systems integrated with Earth observation data are extending forecast horizons to up to 30 days with reduced uncertainty.

- Early warning platforms incorporating IoT sensors and real-time data streams are now reaching over 2 million households globally in flood-prone zones.

How Roof Age Impacts Flood Insurance Premiums

- In 2022, homes with roofs aged 11–15 years paid about $1,550 compared to $1,599.

- By 2023, premiums increased slightly to $1,560 and $1,620.

- In 2024, the gap widened, with premiums at $1,580 versus $1,697.

- By 2025, the difference became more significant: $1,600 compared to $1,755.

- Older roof conditions consistently result in higher premiums, with the cost gap growing larger each year.

National Flood Insurance Reform

- NFIP’s Risk Rating 2.0 continues adjusting premiums based on individual property risk, with most annual increases capped at 18% under current law.

- NFIP currently carries about $22.5 billion in debt owed to the U.S. Treasury as of mid-2025.

- Senators are proposing a new affordability program to support low-income homeowners and are discussing options to limit yearly premium hikes.

- Mapping reforms seek at least $800 million per year in funding to modernize flood maps nationwide with full coverage by 2028.

- There is consideration of increasing structural damage coverage limits beyond the existing $250,000 building / $100,000 contents caps for single-family residential properties.

- Elevated construction incentives in flood-prone areas are projected to reduce premiums by up to 20% where adopted.

Recent Developments

- FEMA committed about $1.2 billion in 2025 toward flood mitigation grants focused on infrastructure improvements.

- California expanded private flood insurance access in 2025, with underserved areas seeing up to 30% more providers participating.

- The 2023 storm season led to over 1 million new flood insurance policies in the US by mid-2025.

- Insurers in Europe are trialing pay-as-you-go flood insurance models in 2025 aimed at assisting low-income households.

- The World Bank launched a Global Flood Resilience Program in 2025, offering technical support and funding to high-risk nations.

- Reinsurance rates for flood insurers rose by about 20% in 2024-2025, reflecting escalating climate risk.

- The insurance industry is pushing for uniform global standards in flood risk assessment to streamline policies and pricing worldwide.

Frequently Asked Questions (FAQs)

The market is about $25.21 billion in 2025 and is projected to grow rapidly through 2033.

NFIP has ~4.7 million policies providing ~$1.3 trillion in coverage as of March 31, 2025.

The average NFIP premium is about $899 per year, which is roughly $75 per month.

Private residential flood policies rose to ~569,000 by 2024, with continued growth into 2025.

Global insured nat-cat losses were $137 billion in 2024, with ~$145 billion expected in 2025.

Conclusion

As the flood insurance industry navigates this year, a combination of challenges and opportunities shapes its trajectory. Rising climate risks, advancing technology, and regulatory reforms all play pivotal roles in determining how insurers and homeowners adapt. With global damages climbing and coverage gaps persisting, collaborative efforts among governments, insurers, and communities are essential. By embracing innovation and resilience, the flood insurance industry can continue to protect lives and property in an increasingly unpredictable world.