The fintech lending industry is reshaping how individuals and businesses access capital, creating a more inclusive and dynamic financial ecosystem. Imagine a world where getting a loan no longer requires navigating endless paperwork and weeks of waiting. This transformation is driven by technology-powered platforms that promise speed, convenience, and accessibility. The industry is on the cusp of even more groundbreaking changes. Let’s explore the numbers and insights driving this evolution.

Editor’s Choice: Key Fintech Lending Statistics

- The global fintech lending market is valued at $590 billion in 2025 and is projected to grow significantly by 2033.

- Digital lending represents about 63% of personal loan origination in the U.S. in 2025.

- In 2025, an estimated 55% of small businesses in selected developed regions such as the U.S. and Western Europe accessed loans via fintech platforms, reflecting a regional trend toward alternative lending.

- Peer-to-peer lending contributed to a digital lending sector worth over $19 billion in 2025.

- Asia-Pacific held the largest share in digital lending, accounting for over 21% of the global market in 2025.

- Fintech-originated loans globally surpassed $500 billion in outstanding balances by mid-2025.

- In 2025, approximately 25% of U.S. personal-loan borrowers were classified as financially healthy based on indicators like debt-to-income ratio and emergency savings.

Regional Market Analysis

- In 2025 North America fintech lending market size grew to $332 million, with the U.S. holding about 79% and Canada around 11% of that total.

- The U.S. digital lending market reached $303 billion in 2025.

- Canada’s fintech lending industry climbed to approximately $35 million in 2025.

- Europe’s fintech lending market expanded to $209 million in 2025.

- Asia-Pacific accounted for 21.4% of global fintech lending in 2025, with its segment valued at about $177 million.

- Latin America’s fintech lending grew to $36 million in 2025, representing around 4.4% of the global market.

- The Middle East fintech lending market size reached about $35.7 million in 2025.

- Africa’s fintech lending surged to approximately $37.9 million in 2025.

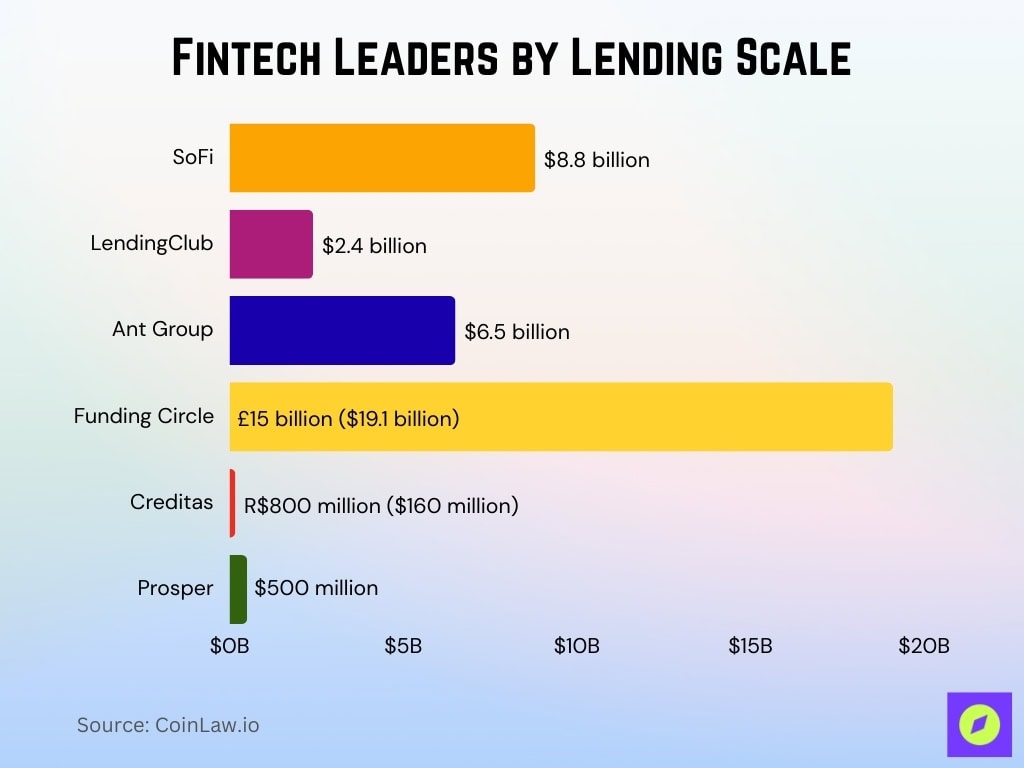

Leading Fintech Companies

- SoFi originations hit $8.8 billion in Q2 2025, marking a 66% year‑over‑year surge in personal loans.

- LendingClub crossed $100 billion in lifetime originations by early 2025 and posted $2.4 billion in loans during Q2, a 32% increase from the prior year.

- Ant Group refinanced an offshore credit line of $6.5 billion in mid‑2025, reinforcing its dominant position in Asia‑Pacific lending.

- Funding Circle secured £15 billion in SME credit extension across the UK by mid‑2025, supported by a £230 million facility that grew its FlexiPay credit to over £1 billion.

- Creditas launched an R$ 800 million (approx. $160 million) auto‑finance fund in mid‑2025, strengthening its Latin America presence.

- Prosper has facilitated nearly $30 billion in total loans since inception and secured a $500 million forward flow agreement by April 2025.

Consumer Adoption and Growth Statistics

- Surveys in 2025 show that over 90% of U.S. millennials have interacted with at least one fintech platform, most commonly for payments and investing.

- As of 2025, fintech adoption reached high levels globally, with studies indicating that more than 75% of internet users used at least one fintech service monthly, such as mobile payments or digital banking.

- The worldwide average fintech adoption rate reached 64% in 2025.

- About 46% of U.S. consumers used digital lending or finance apps in 2025.

- Roughly 34% of U.S. consumers relied on mobile banking apps daily in 2025.

Technological Innovations in Fintech Lending

- AI-powered credit scoring models contributed to a reduction in default rates among certain fintech platforms, with some reporting rates below 1% in targeted use cases.

- By 2025, an estimated 30–40% of fintech lenders globally will have begun piloting or integrating blockchain solutions, particularly in loan verification and smart contract execution.

- AI-driven tools are now used by 38% of consumers for lending and finance decisions.

- Decentralized lending platforms scaled massively, with leaders managing over $25 billion in locked value.

Global FinTech Industry Market Growth

- By 2025, the industry will reach $280 billion, reflecting the accelerating adoption of digital technologies.

- Market size grows steadily, surpassing $477 billion in 2028 and $680 billion in 2030.

- By 2032, the market is projected to hit $969 billion, nearly quadrupling from 2024 levels.

- In 2033, the value climbs further to $1.16 trillion, underscoring strong momentum.

- The industry is forecasted to achieve $1.38 trillion by 2034, powered by blockchain, AI, API, RPA, and other innovations.

- The sector will grow at a CAGR of 19.4% between 2025 and 2034, making it one of the fastest-expanding segments in global finance.

Fintech Application Trends

- Payday lending app downloads rose 50% globally in 2025, driven by a surge in demand for short‑term credit solutions.

- BNPL platforms accounted for 12% of all e‑commerce transactions in 2025.

- Peer‑to‑peer lending apps like Zopa and LendingClub saw 30% growth in active users in 2025.

- Mobile‑first lending platforms achieved 95% customer satisfaction, significantly outpacing traditional banks in 2025.

- In 2025, embedded finance technologies contributed to billions in added e-commerce revenue, with some platforms reporting over $25 billion in transaction value facilitated by embedded lending and BNPL services.

- The number of fintech lending APIs grew by 35% in 2025, enabling seamless third‑party integrations.

- Microloan apps in Africa and South Asia disbursed $5 billion via mobile devices in 2025.

Fintech in Capital Markets: A Land of Opportunity

- Fintech lending platforms are providing over $100 billion in funding to capital markets annually by mid‑2025, driving enhanced liquidity.

- Around 86% of institutional investors have exposure to digital assets or fintech strategies in 2025, with over 59% allocating at least 5% of AUM to these areas.

- Asset‑backed securities issued via fintech channels grew modestly to approximately $85 billion globally in 2025.

- Crowdfunding platforms raised over $4 billion for startups and SMEs in 2025, accelerating early‑stage capital access.

- Direct lending platforms account for around 14% of private debt market volume in 2025, outpacing traditional bond issuances.

- Fintech‑enabled municipal bonds in the U.S. saw investor participation climb by 25% in 2025, thanks to better transparency.

- Automated underwriting tools in capital markets reduced loan processing times by around 35% in 2025, boosting efficiency.

Lending and Capital Market

- Financing institutions reported an outstanding value of IDR 507.02 trillion, reflecting a 5.92% annual growth rate.

- Non-performing financing in traditional financing stood at 2.87%, indicating moderate risk exposure.

- The average gearing ratio among financing institutions reached 2.20×, signaling active credit expansion.

- P2P lending platforms posted a remarkable 31.06% year-over-year growth, with total loans outstanding at IDR 80.07 trillion.

- There are 97 registered P2P platforms, including 90 conventional and 7 Sharia-compliant providers.

- Non-performing P2P loans remained slightly below traditional rates at 2.78%, highlighting improved credit performance in fintech lending.

- Venture capital outstanding value reached IDR 16.34 trillion, with total assets climbing to IDR 27.07 trillion.

- Microfinance institutions disbursed IDR 1.04 trillion in loans, supported by IDR 1.69 trillion in total assets.

Blockchain in Fintech Lending

- Blockchain-based lending volumes surged to over $50 billion in outstanding loans across DeFi platforms by mid-2025.

- Smart contracts powered more than 45% of DeFi lending operations, reducing reliance on intermediaries.

- The DeFi lending sector reached $123.6 billion in total value locked, growing by over 40% year-over-year.

- Blockchain-driven cross-border loans cut processing costs by 30%, encouraging SME adoption.

- Tokenization of debt assets boosted secondary market liquidity by 20%, enabling loan trading.

- Identity verification via blockchain reduced onboarding time by 50% while improving security.

- Over 80% of fintech lenders using blockchain reported higher efficiency and lower fraud rates.

Challenges and Risks in Fintech Lending

- Cybersecurity threats intensified in 2025, with over 40% of fintech breaches linked to third-party vulnerabilities.

- The average cost of a data breach in financial institutions reached $6.08 million in 2025.

- U.S. leveraged loan default rates rose to between 5.5% and 6.0% by year-end 2025.

- Delinquency rates for fintech personal loans in India increased to 3.6% by early 2025.

- Regulatory compliance costs climbed as new cybersecurity mandates and oversight tightened globally.

- Platform disruptions and IT system failures continued to impact service availability for fintech borrowers.

- Overleveraging risks increased as more borrowers used multiple fintech loans simultaneously.

- Lack of standardization in cross-border lending regulations limited global expansion opportunities.

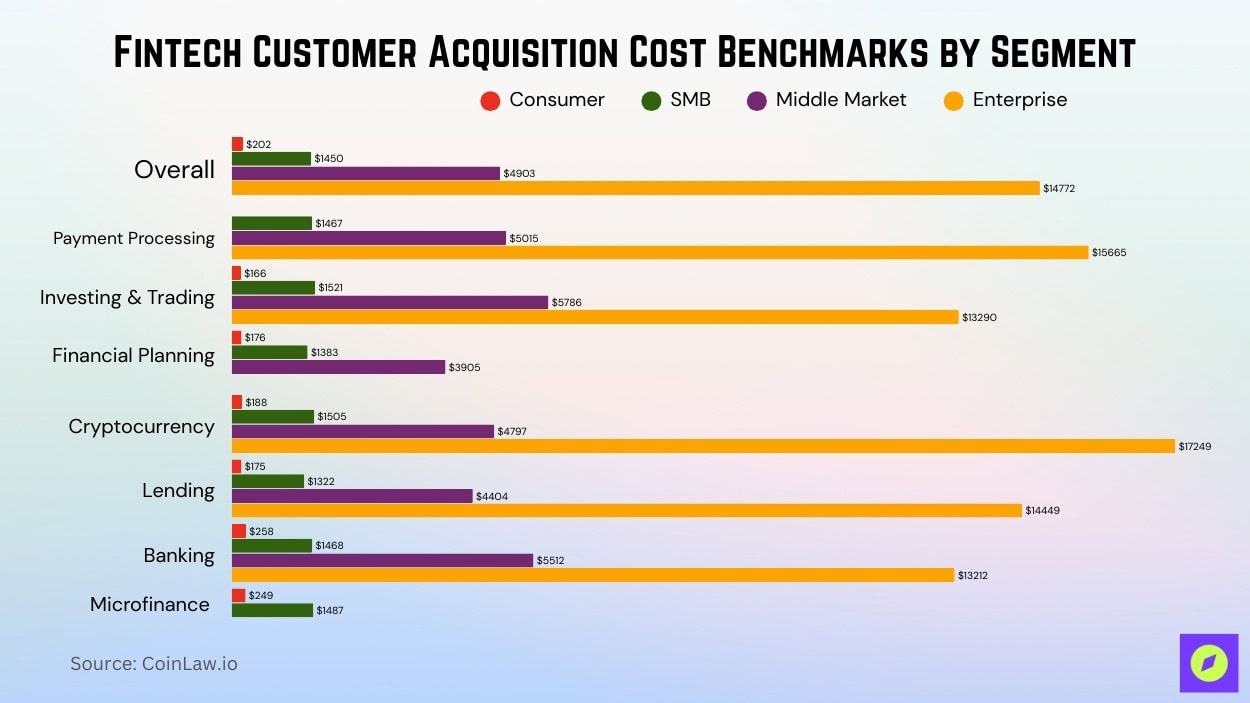

Fintech Customer Acquisition Cost (CAC) Benchmarks by Segment

- The average CAC in fintech ranges from $202 for consumers to $14,772 for enterprise clients across all niches.

- Payment processing firms face the highest enterprise CAC at $15,665, with middle market CAC at $5,015, and SMB at $1,467.

- Investing and trading platforms spend $166 per consumer, $1,521 for SMBs, and up to $5,786 for middle market clients.

- Financial planning services show a CAC of $176 (consumer), $1,383 (SMB), and $3,905 (middle market), but $0 for enterprise, reflecting limited large-scale B2B targeting.

- In cryptocurrency, CAC peaks at $17,249 for enterprise clients, one of the highest in fintech, while consumer CAC is $188.

- Lending services report a relatively lower CAC: $175 (consumer), $1,322 (SMB), $4,404 (middle market), and $14,449 (enterprise).

- Banking platforms face a CAC of $258 per consumer, the highest in the consumer segment, and $5,512 for the middle market, more than double that of lending.

- Microfinance platforms have no CAC data for middle market or enterprise, but spend $249 per consumer and $1,487 per SMB client.

Recent Developments

- Visa launched an AI‑enabled Intelligent Commerce initiative in 2025, enabling AI agents to manage payments securely on behalf of users.

- Stripe expanded its global lending program across 30 countries in 2025, disbursing over $5 billion in business loans.

- Revolut introduced its first small business lending product in Europe in 2025, generating over £1 billion in loans within its launch year.

- India’s central bank finalized regulations in 2025, formalizing digital lending norms, significantly boosting consumer trust in fintech solutions.

- PayPal launched a microloan pilot across underserved markets in Africa and Southeast Asia in 2025, disbursing around $200 million.

- Goldman Sachs’s Marcus platform surpassed 15 million users in 2025 as hybrid banking‑lending adoption accelerated.

- Square Capital integrated blockchain technology into its lending workflow in 2025, reducing processing times by 35%.

Conclusion

The fintech lending landscape today is marked by rapid technological advancements, regional growth, and heightened competition. From AI-powered platforms to blockchain innovations, fintech lending is democratizing access to credit while offering unparalleled efficiency and personalization. However, challenges like cybersecurity risks and regulatory hurdles remind us of the complexities that come with innovation.

As we look ahead, the industry’s ability to adapt to evolving consumer needs and regulatory frameworks will determine its trajectory. The numbers and trends clearly point to a future where fintech lending continues to redefine global finance, creating opportunities for individuals, businesses, and investors alike.