Black Friday and Cyber Monday are among the most anticipated shopping events of the year, but they’ve also become prime hunting grounds for cybercriminals. Imagine this: a retailer’s website crashes on Black Friday morning, leaving thousands of customers locked out of their carts and the company scrambling to recover. The culprit? A sophisticated DDoS attack is one of many tactics used by cybercriminals during these high-traffic events. This is the reality businesses face today, with the stakes rising every year. This article delves into the statistics and trends shaping financial cybersecurity during Black Friday and Cyber Monday, offering a comprehensive view of the landscape.

Editor’s Choice

- Cyberattacks surge by 25% during peak holiday shopping over regular days.

- Retail cyberthreats rise nearly 25% during Black Friday season.

- Phishing attacks increase 20-30% during Black Friday week.

- Shopping-related scams grow 30x in fraudulent text messages.

- Credential stuffing surges 80% on Cyber Monday, affecting 40 million accounts.

- 56% of small retailers report attacks during Black Friday sales.

- Friendly fraud rises 25% with an average transaction of $291.

- Canadian online transactions flagged 2.6% as fraudulent during the holidays.

- Darktrace reported a 600% increase in attempted cyber scams targeting the retail sector during Black Friday week compared to the average of the previous month.

- 8.9 million stolen retail gift cards were sold on underground markets.

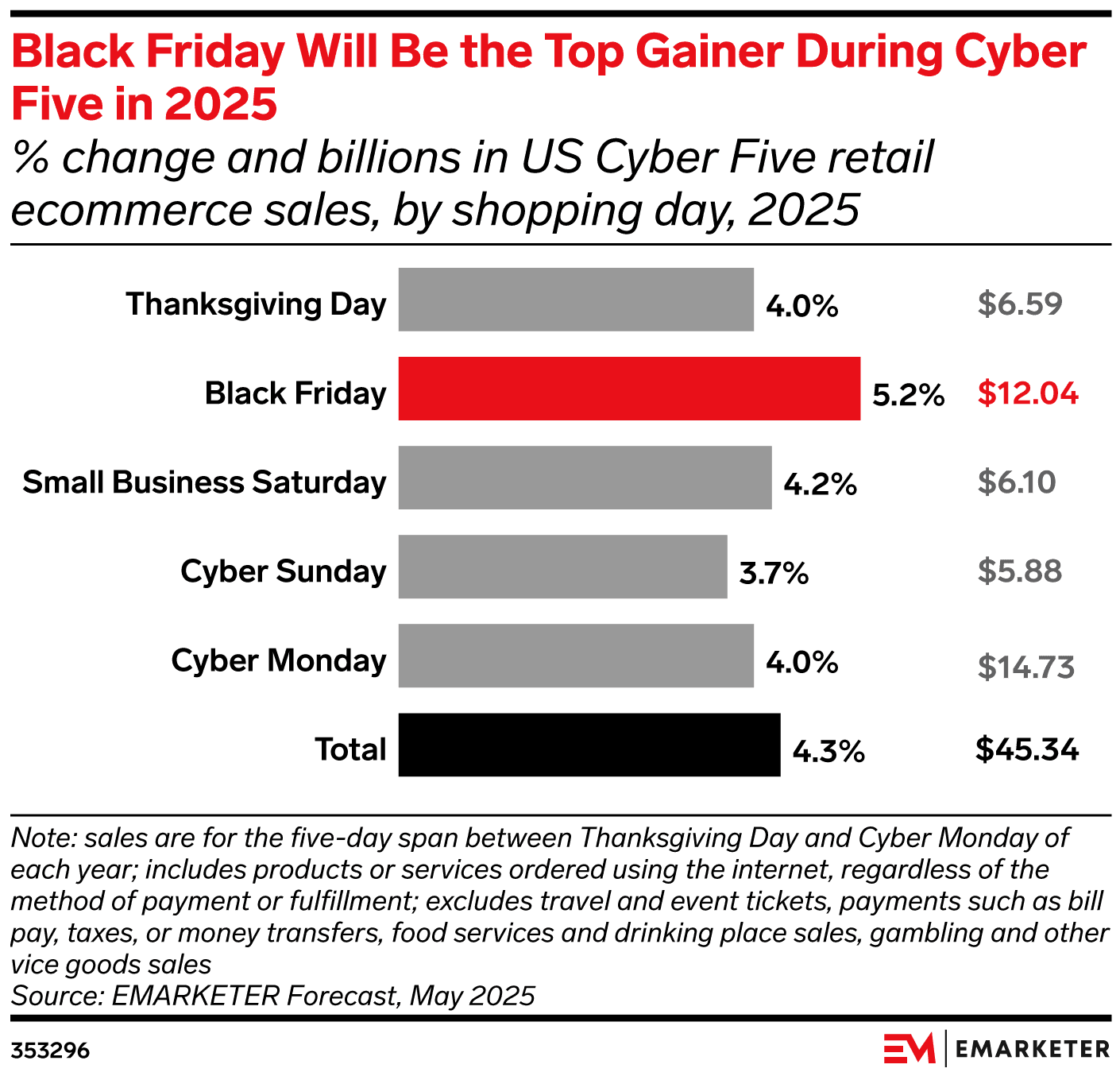

E-commerce Surges During Cyber Five

- Black Friday leads with $12.04 billion in sales, marking a 5.2% YoY increase, the highest among all five days.

- Cyber Monday brings in the largest revenue overall at $14.73 billion, with a 4.0% growth rate.

- Thanksgiving Day shows $6.59 billion in sales, rising by 4.0% year-over-year.

- Small Business Saturday records $6.10 billion in online sales, up by 4.2% from last year.

- Cyber Sunday sees the smallest growth rate at 3.7%, generating $5.88 billion in sales.

- Total Cyber Five sales hit $45.34 billion, with an overall growth of 4.3% across all five days.

Increase in Cyberattacks During Black Friday and Cyber Monday

- Cybercriminal activity against retailers typically increases by 20–30% over the core Black Friday–Cyber Monday window versus normal trading days, driven by higher online volumes and intensified phishing and fraud campaigns.

- 1.8 million DDoS attacks recorded on e-commerce websites, with 70% targeting checkout systems.

- Black Friday-themed phishing emails spiked by 692% in late November compared to earlier in the month.

- Amazon-themed phishing peaks at over 600,000 attempts during sales.

- 48.2% of shopping-related attacks target online shoppers.

- 327% increase in Christmas-themed phishing during Black Friday week.

- Retail cyberthreats rise nearly 25% during Black Friday season.

- During Black Friday, phishing emails impersonating major US retailers like Walmart and Target increased by up to 2,000%.

- Banking Trojans surge with over 1 million attacks during the holiday season.

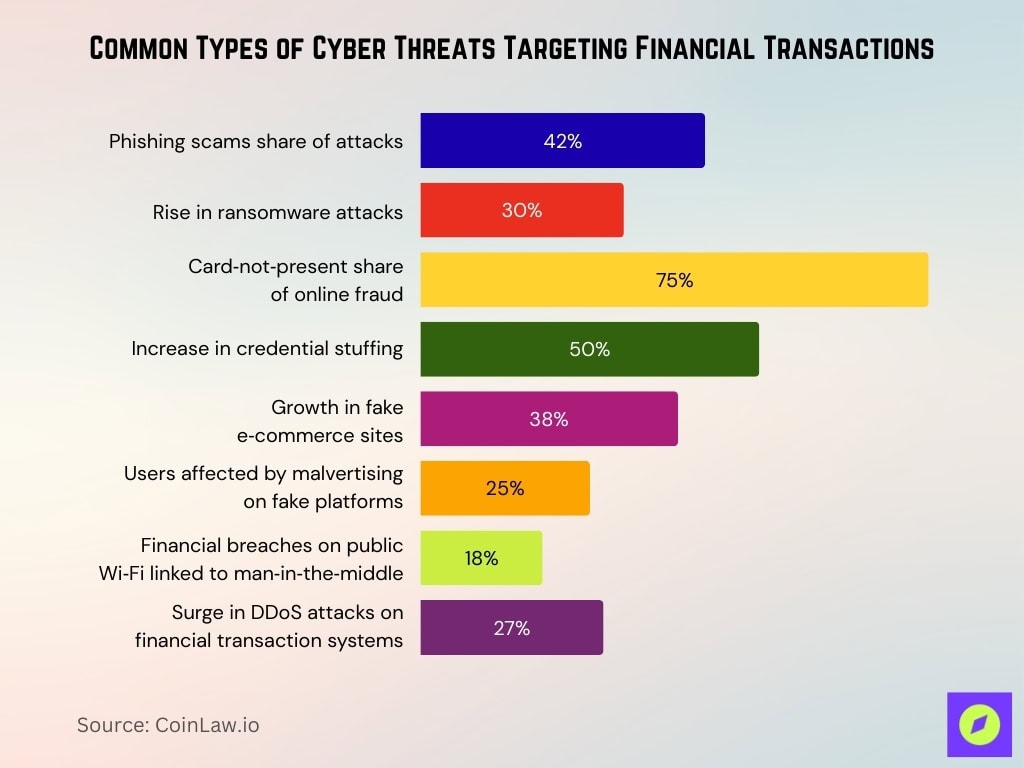

Common Types of Cyber Threats Targeting Financial Transactions

- Phishing scams account for 42% of attacks on financial transactions during holiday sales.

- Ransomware attacks rise 30% targeting customer financial data.

- Card-not-present fraud comprises 75% of online fraud cases.

- Credential stuffing incidents increase 50% using stolen logins.

- Fake e-commerce sites grow 38% capturing payment details.

- Malvertising affects 25% of users on fake shopping platforms.

- Man-in-the-middle attacks link to 18% of financial breaches on public Wi-Fi.

- DDoS attacks surge 27% against financial transaction systems.

Financial Losses Attributed to Cybercrime in the Retail Sector

- Global retail cybercrime losses reach $6.9 billion.

- The US retail sector contributes $2.4 billion to cybercrime losses.

- E-commerce platforms lose $3.5 billion to breaches and fraud.

- Chargeback fraud costs retailers $1.8 billion during the holidays.

- Payment fraud schemes rise 32% affecting 70% of retailers.

- Fake refunds cause $550 million in losses during Black Friday.

- SMBs average $145,000 loss per cyberattack.

- Credit card fraud impacts 22% of retailers, with $750 million global loss.

- Friendly fraud averages $291 per transaction, totaling $2.1 billion.

Impact on Consumer Trust and Spending Behavior

- 48% of shoppers feel unsafe making online purchases during holiday sales.

- 65% of consumers avoid retailers after security breaches.

- 36% of shoppers reduce e-commerce spending due to data breach fears.

- Retailers face a 22% revenue drop post-Black Friday cyberattacks.

- 73% of millennials distrust sites without multi-factor authentication.

- 85% prefer secure gateways like PayPal for financial protection.

- 40% abandon carts due to perceived cybersecurity risks.

Measures Implemented by Financial Institutions to Enhance Security

- Real-time transaction monitoring reduces fraud by 45%.

- Tokenization secures 70% of online financial transactions.

- Biometric authentication is adopted in 55% of mobile banking apps.

- AI fraud detection prevents $1.5 billion in losses.

- 2FA is mandatory for 85% of major US banks.

- Awareness programs educate 1.2 million consumers on threats.

- $2.3 billion invested in cybersecurity enhancements.

- Behavioral analytics blocks 60% of anomalous transactions.

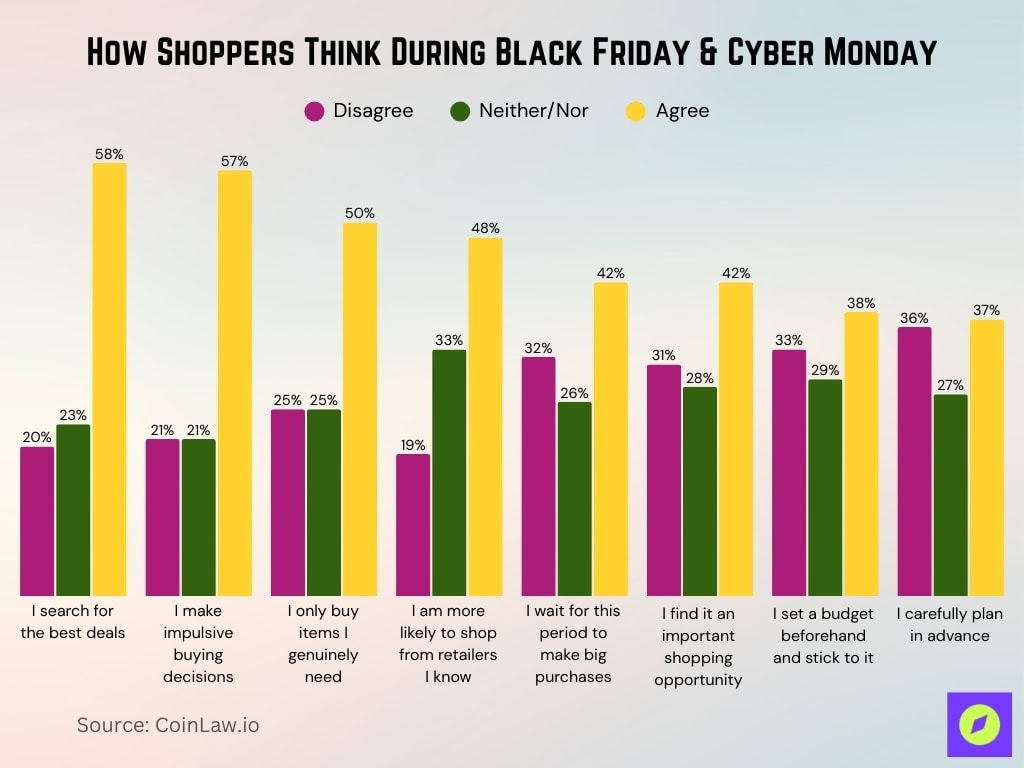

How Shoppers Think During Black Friday & Cyber Monday

- 58% of consumers search for the best deals, showing price sensitivity as a top priority.

- 57% admit to impulsive buying decisions during the shopping period.

- 50% claim they only buy items they genuinely need, highlighting mixed spending motivations.

- 48% are more likely to shop from familiar retailers, emphasizing brand trust.

- 42% wait for this period to make big purchases, reflecting strategic timing.

- 42% consider it an important shopping opportunity, reinforcing its commercial significance.

- Only 38% say they set a budget and stick to it, indicating weak financial discipline.

- Just 37% carefully plan in advance, suggesting many shoppers act spontaneously.

Recent Developments

- Zero Trust architecture is adopted by 60% of financial organizations.

- Blockchain payments reduce fraud risks for 35% of retailers.

- AI chatbots achieve 70% accuracy in real-time fraud detection.

- Cyber insurance adoption rises 25% among retailers.

- Decentralized networks handle 15% of high-volume transactions securely.

- $650 million invested in quantum-safe cryptography R&D.

- Tech-financial collaborations prevent 40% more fraud incidents.

- Edge computing secures 45% of real-time payment processing.

Frequently Asked Questions (FAQs)

Cyberattacks are projected to rise by 20%.

Financial fraud cases account for nearly $8.5 billion annually, with $2 billion in the US.

E-commerce platforms experience a 65% surge in phishing attacks.

45% of holiday shoppers will face some form of attempted cyberattack.

Ransomware incidents have doubled, with average demands exceeding $250,000 per incident.

Conclusion

Financial cybersecurity remains a critical concern for businesses and consumers alike, especially during high-stakes shopping events like Black Friday and Cyber Monday. The rise in cyberattacks underscores the need for robust security measures and consumer vigilance. By investing in cutting-edge technologies, enhancing fraud detection, and fostering trust, the industry can combat these threats effectively. Ultimately, the fight against cybercrime is a shared responsibility that requires ongoing adaptation and innovation.