The stablecoin First Digital USD (FDUSD) is emerging as a noteworthy player in the digital‑dollar ecosystem, offering full backing and multi‑chain deployment. In real‑world terms, FDUSD is used by businesses to settle cross‑border payments with near‑instant liquidity, and by DeFi platforms to manage dollar‑denominated collateral. Dive into the detailed numbers and trends behind FDUSD’s rise.

Editor’s Choice

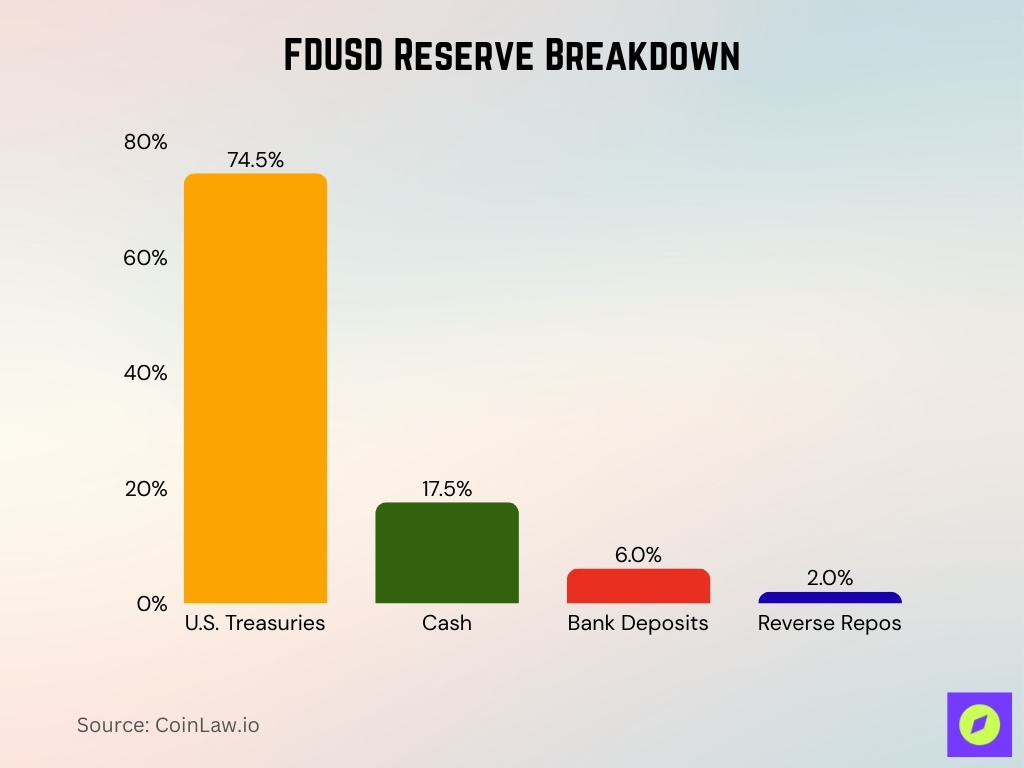

- ~ 74.5 % of reserves in U.S. Treasuries, per issuer transparency page as of Oct 31 2025.

- Average large‐transaction size ~ $2 million, highlighted by a stablecoin‑trend report.

- Available on five blockchains, including Ethereum, BNB Chain, Solana, Sui, and Arbitrum.

- Launched in June 2023, the issuance date of FDUSD.

- Monthly reports typically have a lag time of 30 to 45 days, consistent with industry standards.

Recent Developments

- In April 2025, the issuer faced a short peg deviation and quickly published attestations to restore confidence.

- In June 2025, FDUSD expanded to the Arbitrum network, the fifth chain integration.

- A Q1 2025 industry report found FDUSD’s large‑transaction averages near $2 million, signalling institutional uptake.

- Reserve‐audit discussion, stablecoin audit frequency, and scope remain evolving; FDUSD is cited as still building out full audit practices.

- The global stablecoin market exceeded $200 billion in 2025, with FDUSD gaining visibility in that growth.

- FDUSD’s issuer emphasizes regulatory compliance and monthly attestations as a differentiator.

- CoinMarketCap reported an 18.45 % 24‑hour surge in FDUSD trading volume to ~$3.6 billion in one snapshot.

FDUSD Reserve Backing and Attestation Reports

- FDUSD’s reserve is backed by about 74.5% Treasury assets, not fully cash-backed, posing liquidity risk.

- Other reserve composition includes approximately 17.5% cash, 6% bank deposits, and 2% reverse repos.

- The issuer publishes monthly reserve attestation reports confirming backing.

- After the April 2025 de-peg scare, Binance verified FDUSD’s February attestation report.

- Reserves are held in segregated accounts by the custodian First Digital Trust under Hong Kong regulation.

- Independent audit firm Prescient Assurance conducts attestations validating reserve adequacy.

- Binance’s October 2025 data shows FDUSD reserves with a 125.1% overcollateralization ratio against tokens issued.

Adoption and Exchange Listings

- FDUSD pairs represent approximately 50% concentration of the trading volume on Binance.

- Listings on major centralized exchanges with zero or reduced fees boosted FDUSD liquidity by over 35% in 2025.

- FDUSD is listed on decentralized exchanges across blockchains like Solana and Sui, increasing DeFi access by 20% year-over-year.

- Institutional adoption includes partnerships with payment platforms involving liquidity and settlement capabilities exceeding $500 million in transaction volume.

- FDUSD’s market visibility rose by 40% after the April 2025 peg event with enhanced attestation and transparency.

- Since its mid-2023 launch, FDUSD has sustained an average 25% monthly growth rate in exchange listings.

- Current exchange listings include over 15 centralized and decentralized platforms, with ongoing expansion plans.

- FDUSD’s exchange breadth is 30-40% narrower than major stablecoins like USDT and USDC as of late 2025.

- Trading fees waived or reduced on FDUSD pairs led to a 12% increase in daily trade volume within six months.

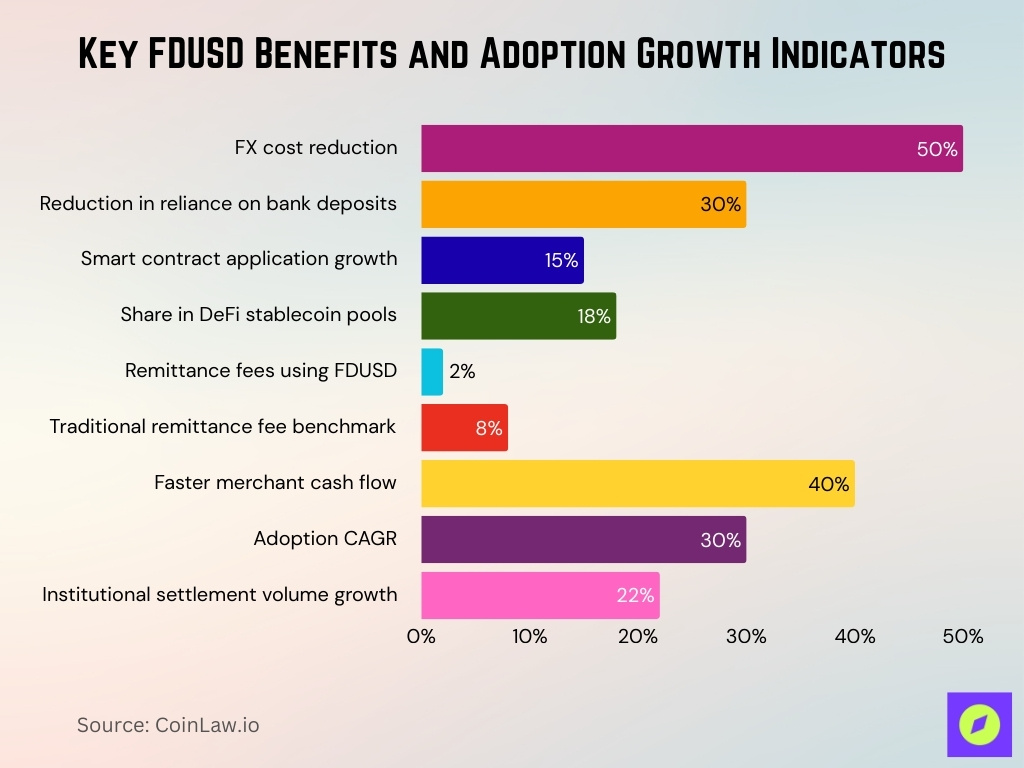

Use Cases and Applications

- FDUSD enables cross-border payments with near-instant settlement and reduces foreign-exchange costs by up to 50%.

- Firms use FDUSD to hold dollar-denominated assets on-chain, reducing reliance on traditional bank deposits by 30%.

- As a programmable stablecoin, FDUSD supports smart contract applications like escrow, payroll, and automated settlements with over 15% growth in 2025.

- In DeFi, FDUSD is used for yield generation, lending, and collateral, with an increasing share of 18% in stablecoin pools.

- Remittance fees drop to below 2% using FDUSD, compared to traditional corridors averaging 8%.

- Retail merchants accepting FDUSD benefit from 24/7 settlement and up to 40% faster cash flow than conventional methods.

- FDUSD’s use case adoption is smaller than legacy stablecoins but is growing at a 30% compound annual rate.

- Institutional settlement adoption is expanding, with transaction volumes growing by 22% in 2025.

DeFi Integration and Partnerships

- FDUSD is integrated on DeFi protocols across Solana and Sui networks, expanding user options by 22% in 2025.

- FDUSD ranks #12 among USD stablecoins in Messari’s DeFi sector ranking.

- First Digital Labs partnered with MetaComp for FDUSD use in the StableX payments platform as of October 2025.

- FDUSD’s multi-chain design enables liquidity provisioning growth of 18% across yield farms and liquidity pools.

- DeFi protocols use FDUSD as collateral, enabling loan leverage with stable-value risk reduction by 30%.

- FDUSD lending and borrowing platforms yield an increase of approximately 20% in 2025.

- Liquidity-incentive programs on DEX platforms have increased FDUSD liquidity by an estimated 15%.

- FDUSD’s DeFi liquidity remains smaller than USDC and USDT, representing 25-30% less depth.

- Broader DeFi protocol integrations could boost FDUSD’s adoption rate by over 35% in the next year.

Remittance and Payment Stats

- Stablecoins accounted for around 30% of all on-chain crypto transaction volume in 2025, reaching over $4 trillion in the year to August.

- Crypto captured ~23% of global remittance flows by mid-2025, rising from ~16% in 2022.

- FDUSD expanded its cross-border adoption through payment-platform partnerships, cutting remittance fees from ~8% to <2%.

- Businesses use FDUSD for payments to gain 24/7 settlement and lower FX-intermediary costs.

- In key remittance corridors such as Southeast Asia, stablecoin fees dropped to under 0.1%, far below traditional rails.

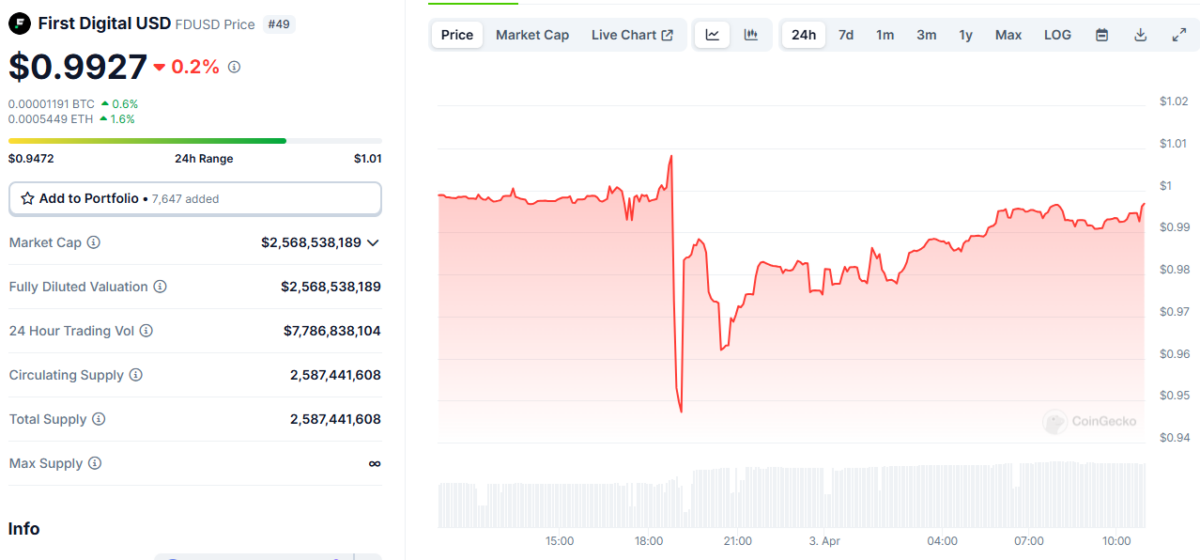

FDUSD Price and Market Snapshot

- Current Price: $0.9927, showing a 0.2% decrease in the last 24 hours.

- 24h Trading Range: From $0.9472 to a high of $1.01, indicating minor volatility.

- Market Capitalization: $2.57 billion, matching the fully diluted valuation.

- 24h Trading Volume: A massive $7.79 billion, reflecting high liquidity.

- Circulating Supply: 2.59 billion FDUSD in circulation.

- Total Supply: Also 2.59 billion FDUSD, with no max cap defined (∞ symbol shown).

- Price Volatility: Brief price dip below $0.95 during the day, quickly rebounding toward $0.99.

Risks and Volatility Metrics

- Stablecoins face an estimated annual run-risk of 3%-4%, much higher than traditional bank deposits.

- Academic research shows stablecoins still fall short of requirements as full monetary substitutes, indicating systemic risk.

- FDUSD’s peg maintenance rating is “constrained” according to S&P’s 2025 assessment.

- Lower exchange liquidity depth raises FDUSD’s risk of slippage during large redemptions.

Geographic Expansion and User Demographics

- FDUSD supports multiple blockchains, expanding global user access across Asia and Europe by over 30%.

- Headquartered in Hong Kong, FDUSD benefits from strategic Asia-Pacific regulatory visibility.

- Stablecoins captured approximately 23% of global remittances by mid-2025, boosting FDUSD’s emerging market potential.

- FDUSD’s acceptance in payment networks and remittance corridors shows growing business and cross-border use.

- Asia-Pacific and Latin America are key growth regions with stablecoin adoption rising 20%-25% annually.

- FDUSD’s multi-chain presence across Ethereum, BNB, Solana, Sui, and Arbitrum enhances wallet and on-ramp connectivity.

- Institutional users employ FDUSD as collateral and liquidity, accounting for about 40% of total volume.

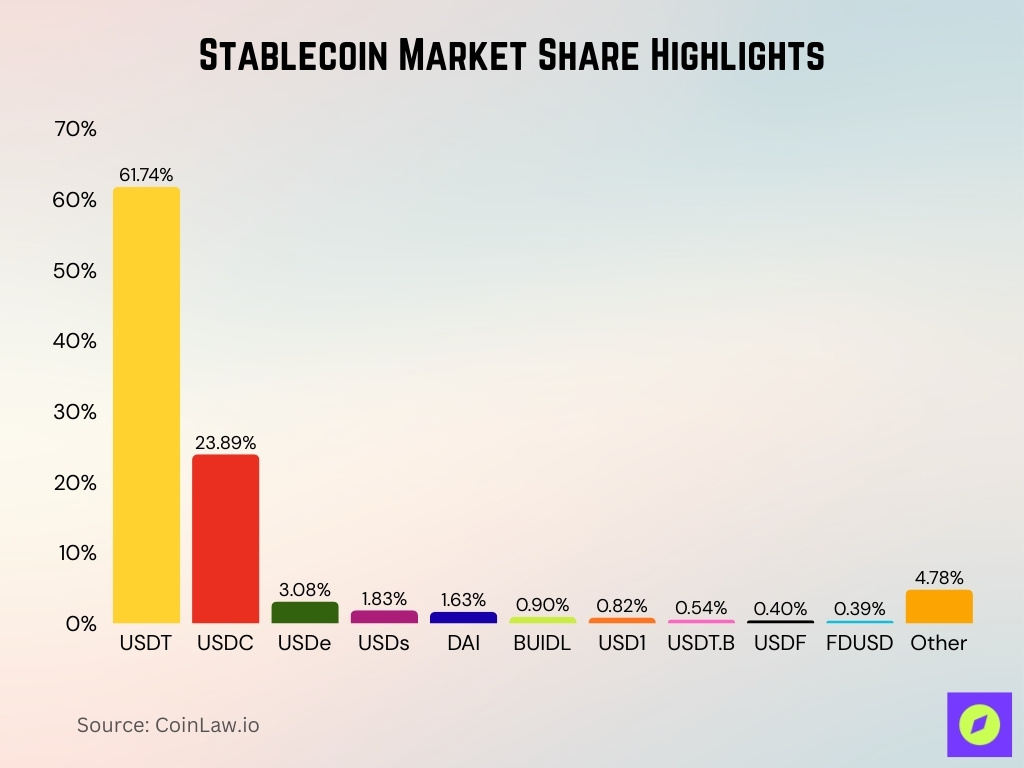

Stablecoin Market Share Highlights

- USDT leads with 61.74% of the market, valued at approximately $164.55 billion.

- USDC holds 23.89% of the stablecoin market, ranking second.

- USDe captures 3.08%, reflecting growing adoption among newer entrants.

- USDs accounts for 1.83%, showing moderate use in select ecosystems.

- DAI holds 1.63%, maintaining relevance across DeFi protocols.

- BUIDL represents 0.9%, marking a newer entrant with rising usage.

- USD1 (0.82%) and USDT.B (0.54%) show minor but notable presence.

- USDF (0.4%) and FDUSD (0.39%) reflect limited penetration but ongoing development.

- Other stablecoins collectively make up 4.78%, showing long-tail diversity in the ecosystem.

Future Projections and Market Outlook

- Industry experts view 2025 as a pivotal year for growth in tokenized cash and stablecoin payment adoption.

- FDUSD’s market cap could surpass $2 billion within 12–18 months if audit frequency increases and more exchanges list the token.

- Expanding use in DeFi, remittance, and enterprise treasury may boost FDUSD’s market share among second-tier stablecoins.

- A major redemption wave would test FDUSD’s asset liquidity and redemption rail capacity.

- FDUSD’s multi-chain access and programmability give developers and institutions a competitive advantage.

- Stablecoin transaction volumes could exceed $10 trillion annually by 2027, with FDUSD likely gaining proportional ecosystem share.

Frequently Asked Questions (FAQs)

5 blockchains (Ethereum, BNB Chain, Solana, Sui, Arbitrum).

~74.5 %.

68.

Conclusion

The statistics for FDUSD today reveal a stablecoin with solid foundations, strong treasury backing, multi-chain deployment, and an emerging global footprint. However, compared to legacy leaders like USDT and USDC, FDUSD remains smaller, less mature in audit infrastructure, and faces elevated systemic and operational risks. Nonetheless, for users and institutions, the promise of FDUSD lies in its programmable design and global accessibility. Moreover, as regulatory clarity improves and stablecoins move further into mainstream finance, FDUSD’s growth potential remains compelling, although its path forward will require greater transparency, scale, and resilience.