A major Ripple-backed treasury firm is sitting on massive unrealized losses as XRP struggles to hold key price levels.

Key Takeaways

- Evernorth Holdings, the largest public XRP treasury firm, is facing $225 million in unrealized losses due to a sharp drop in XRP’s price.

- Despite institutional buying through XRP spot ETFs, retail and whale selloffs have kept the token under intense downward pressure.

- Ethereum ETFs also recorded two straight days of net outflows, suggesting broader caution among crypto-focused institutions.

- Concerns are growing that continued selling may push XRP closer to the $1.50 mark, unless strong buying returns.

What Happened?

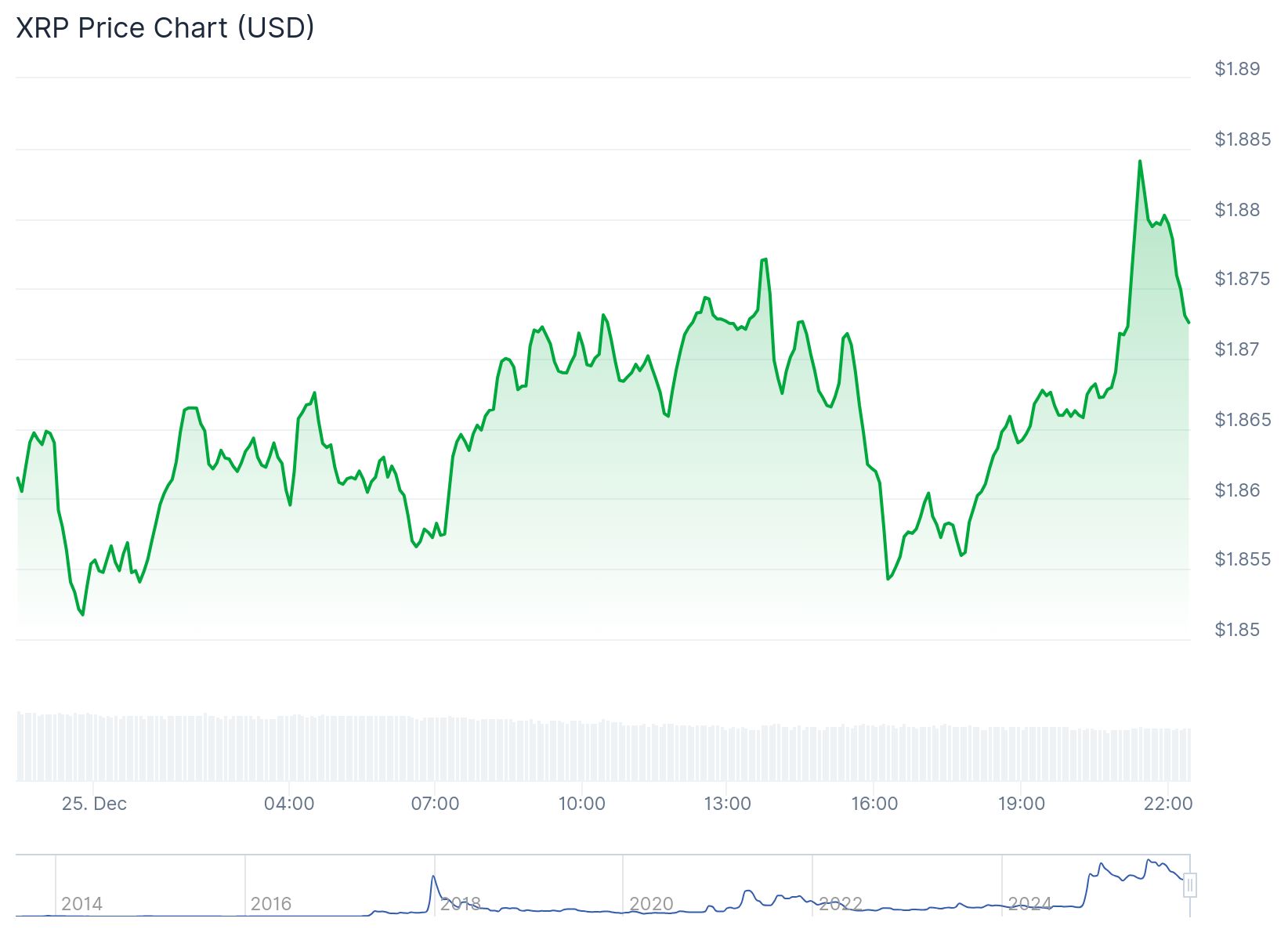

Ripple-backed Evernorth Holdings, which has rapidly accumulated XRP since October, is now grappling with major paper losses as the token’s price declined from $2.60 to $1.80. This downturn comes amid broader market weakness, driven by macroeconomic uncertainty and shifting institutional strategies. At the same time, Ethereum spot ETFs in the US have seen millions in outflows, signaling wider unease in the digital asset space.

💥BREAKING:

— STEPH IS CRYPTO (@Steph_iscrypto) December 25, 2025

EVERNORTH’S $XRP POSITION IS DEEP UNDERWATER DOWN $220M AS VALUE SLIDES TO $724M. pic.twitter.com/yA3wcME2l6

Evernorth’s Risky Bet Turns Sour

Founded on October 20 and led by former Ripple executive Asheesh Birla, Evernorth Holdings positioned itself as a digital asset treasury (DAT) built to accumulate XRP. Backed by Ripple and other firms, Evernorth aimed to give investors a publicly traded vehicle to gain exposure to XRP. Between late October and December 24, the firm bought 388.7 million XRP worth nearly $947 million.

But XRP’s steep 35 percent fall has turned an early $71 million unrealized profit into a $225 million paper loss, according to analyst Maartunn from CryptoQuant. The situation reflects broader market fragility and raises the possibility that even long-term holders might capitulate if losses deepen.

ETFs Show a Mixed Picture

While Evernorth is in the red, XRP spot ETFs have continued to attract inflows. Since their launch, these ETFs have recorded net positive flows every single day, pushing total assets to $1.25 billion. This disconnect suggests that some institutional investors still have long-term faith in XRP’s outlook.

However, the contrast between ETF inflows and declining token prices highlights a fragmented sentiment. Ethereum ETFs are showing signs of stress, with $52.8 million pulled out on December 24 alone, mainly from Grayscale’s ETHE and BlackRock’s ETHA.

Why XRP Keeps Falling?

Despite institutional support through ETFs, XRP is facing persistent sell pressure from both small investors and large holders. Capital flow indicators like Capital Flow Strength and Accumulation/Distribution Money Flow (ADMF) have remained negative since late November, pointing to sustained outflows and weak demand.

Key figures as of now:

- Capital Flow: -42

- Capital Flow Strength: -14

- ADMF: Negative trend persists

Analysts warn that if this pattern continues, XRP could drop further to around $1.50. For a real recovery, XRP needs to climb back above $2 and establish it as a strong support level, ideally with backing from institutions rather than just retail activity.

Ripple Effect on Other Crypto Treasuries

Evernorth’s troubles are a sign of the broader risk public crypto treasury firms face. The crypto crash on October 10, sparked by global macro tensions like the US-China tariff conflict, erased over $19 billion from the digital asset market in a day. Since then, recovery efforts have fallen short, putting pressure on other publicly listed crypto firms such as MicroStrategy.

There’s even a risk that companies like MicroStrategy could be removed from major stock indices such as the MSCI USA Index if volatility persists. Such a move would represent a major setback for the trend of corporate crypto adoption.

CoinLaw’s Takeaway

In my experience covering institutional crypto moves, a $225 million unrealized loss is more than just a number. It signals potential panic among investors who once believed XRP could outperform the market. What stands out here is the split personality of XRP’s market dynamics. On one side, ETFs are filling up like there’s no tomorrow. On the other, the largest public XRP holder is drowning in red ink.

This clash tells me that sentiment is fragile and even seasoned institutional players might not have all the answers. If Evernorth blinks and sells, it could shake confidence even further. But if they hold on, they’ll need to weather what looks like an increasingly rough road ahead.