ETHZilla has launched a bold $250 million stock buyback program, funded by a $40 million Ethereum sale, to close the gap between its share price and asset value.

Key Takeaways

- ETHZilla sold $40 million worth of Ethereum to fund a major share repurchase plan totaling $250 million.

- The company has already bought back 600,000 shares for $12 million, with further repurchases expected.

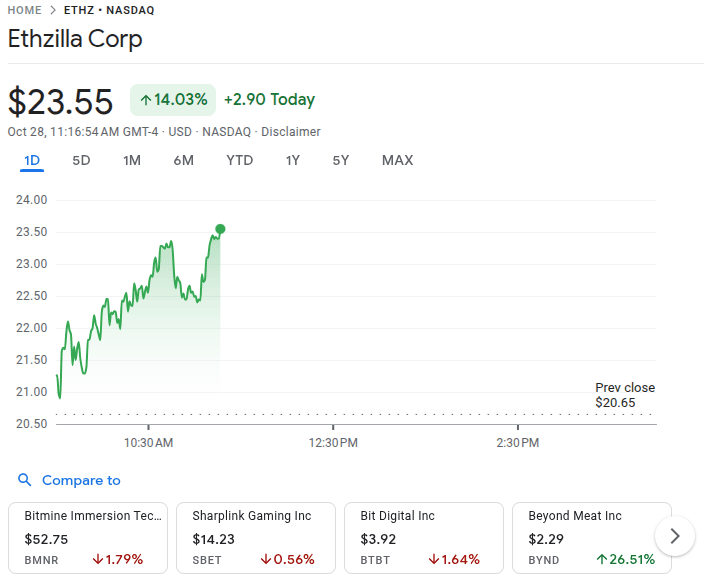

- ETHZilla’s stock rose 14.5% after the announcement and saw an additional 9% after-hours boost.

- Shareholder pressure and undervaluation of the stock prompted the move, signaling a shift in digital treasury strategy.

What Happened?

ETHZilla, a blockchain infrastructure firm, announced that it has begun executing a $250 million share repurchase program, starting with the sale of $40 million in ETH from its treasury. The move was made to address what the company views as a “significant discount” between its share price and its net asset value (NAV). The firm has already spent $12 million to repurchase approximately 600,000 shares since October 24.

0/ ETHZilla today announced share buyback of approximately $40 million as ETHZ trades at a significant discount to NAV. Since Friday, October 24, we have repurchased ~600,000 shares for roughly $12M under the $250M buyback authorization, and plan to continue to repurchase our…

— ETHZilla (@ETHZilla_ETHZ) October 27, 2025

ETH Sale Powers Share Buybacks

ETHZilla confirmed that its $40 million Ethereum sale took place on October 24, 2025. Just days later, the company used a portion of those funds to buy back common stock under a repurchase strategy approved by the board in August.

- Remaining ETH sale proceeds will continue funding future buybacks.

- The company plans to keep buying as long as shares trade below NAV.

- These buybacks are aimed at boosting NAV per share and reducing share count.

The company still holds $400 million in ETH post-sale, maintaining one of the largest Ethereum treasuries among publicly traded firms.

Stock Price Surges on News

Following the announcement, ETHZilla’s stock jumped 14.03% to close at $23.55 on October 27. After-hours trading added another 9% gain, pushing optimism among investors who had been concerned about the stock’s underperformance relative to its crypto assets.

This move reflects ETHZilla’s proactive capital management, using digital assets in a strategic way that mirrors traditional finance methods. The decision to sell ETH and fund buybacks shows a growing trend in Web3 companies adapting conventional financial strategies.

Balancing Blockchain Vision With Capital Efficiency

ETHZilla’s leadership emphasized that the repurchase program is flexible and opportunistic, meaning it will respond to market conditions as they evolve. The firm aims to improve shareholder value not only through technology innovation but also by being agile in treasury management.

- ETHZilla wants to reduce stock loan and borrow activity.

- Each buyback enhances the per-share NAV, increasing value for remaining shareholders.

- ETHZilla continues to evolve as both a blockchain innovator and capital allocator.

Shareholder Pressure Sparks Fast Action

The aggressive buyback plan also came on the heels of activist investor Dimitri Semenikhin’s open letter, in which he urged ETHZilla to unlock value by utilizing its Ethereum reserves. His call to action, backed by a 2.2% stake, added urgency to the firm’s capital reallocation.

The company’s rapid response underscores a new standard for crypto-native public firms: respond to shareholder demands swiftly and strategically. With this move, ETHZilla has aligned itself with both investor sentiment and broader market trends, establishing a framework that others in the blockchain space may follow.

CoinLaw’s Takeaway

I really like what ETHZilla is doing here. In my experience, crypto companies often sit on massive digital reserves without doing much to benefit shareholders directly. ETHZilla’s move is smart, timely, and sends a clear message: crypto assets can be financial tools, not just speculative holdings. They saw their stock was undervalued, listened to investors, and took decisive action. That’s the kind of governance I want to see more of in the Web3 world. If others follow suit, we might just see a maturing of crypto-finance practices across the board.