In the evolving world of blockchain technology, Ethereum has long been a dominant player, especially when it comes to decentralized applications (dApps) and smart contracts. Yet, for all its influence, Ethereum’s gas fees have often been a point of contention. Imagine trying to buy a small item, only to be charged more in transaction fees than the item itself!

This has been the experience for many Ethereum users, especially during periods of network congestion. As Ethereum transitions and adapts, the landscape of gas fees continues to shift, promising both challenges and opportunities for users in 2025.

Key Takeaways

- 1The cost of a basic ETH transfer on mainnet dropped to $0.67, making it one of the lowest in recent years.

- 2Layer 2 networks now process over 1.9 million daily transactions.

- 3Ethereum network revenue in Q1 2025 reached $1.42 billion.

- 4Daily gas fees fell from a peak of $23 million to just $6.3 million in 2025, improving user affordability.

Ethereum Price & Performance Summary

- Ethereum (ETH) is currently priced at $1,883.3, marking a drop of 1.29% (-$24.7) as of 16:37 GMT+2.

- Gas fees have reportedly dropped by 95%, signaling reduced network activity or increased efficiency.

- The cryptocurrency is ranked #2 and is being tracked on Bitstamp.

Short-term losses:

- -1.23% over the last 24 hours

- -15.90% in the past week

- -29.20% over the last month

Mid to long-term declines:

- -22.81% in the past 6 months

- -43.42% year-to-date

- -52.66% over the last 1 year

Positive long-term trend:

- +1.62% over 5 years

- +66.45 % since inception (All time)

Understanding Gas in Ethereum

Ethereum’s gas system is essential to its functionality, ensuring that the network runs smoothly and securely. Here’s a closer look at what gas is and why it matters.

- Gas is essentially a unit of computational work required to process transactions and execute smart contracts on the Ethereum network.

- Every action on Ethereum, from sending ETH to deploying a complex contract, requires gas, which users pay for in ETH (Ethereum’s native currency).

- Gas limits represent the maximum amount of computational effort a user is willing to pay for. Higher gas limits allow for more complex transactions but cost more.

- Gas prices fluctuate depending on network demand, measured in Gwei, a denomination of ETH. The higher the demand, the more users must pay.

- Increased dApp usage in 2021-2022 drove up gas prices significantly, making it challenging for users to interact with the Ethereum ecosystem affordably.

- Ethereum’s base fee mechanism, introduced with EIP-1559 in 2021, aimed to stabilize gas fees by burning a portion of each transaction fee, reducing volatility.

- The London Hard Fork in 2021 was pivotal, as it introduced a two-part fee model with a base fee and tip, aiming to make fees more predictable for users.

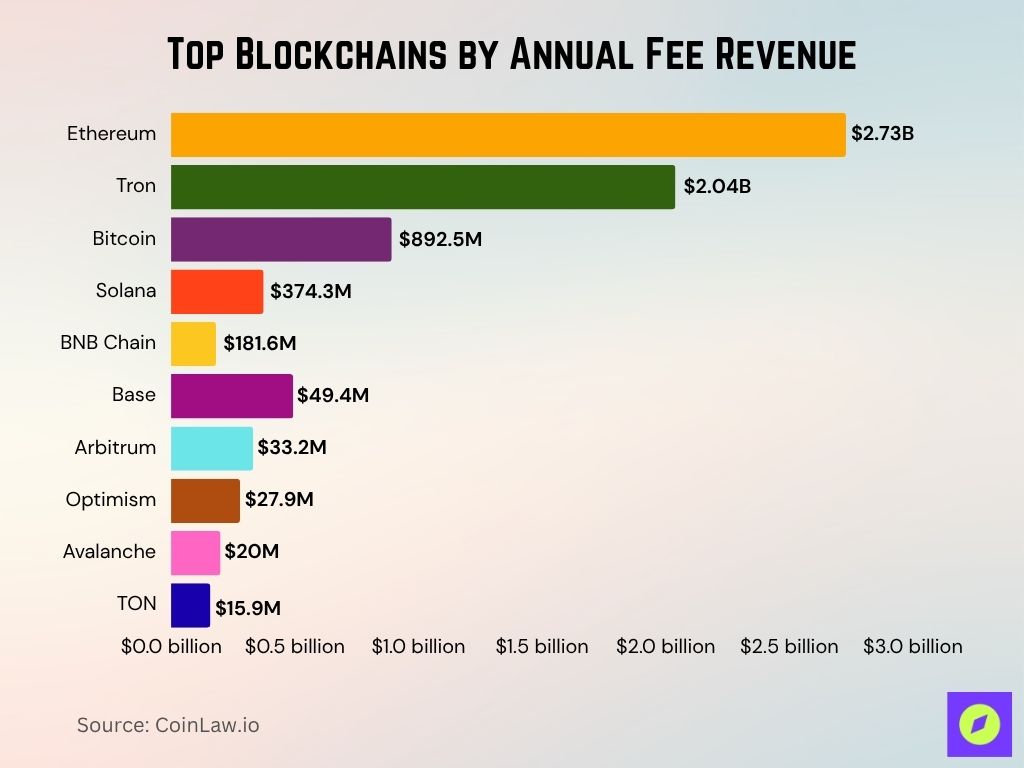

Top Blockchains by Annual Fee Revenue

- Ethereum leads with a massive $2.73 billion in annual fees, the highest among all chains.

- Tron follows closely, earning $2.04 billion, cementing its status as a high-usage network.

- Bitcoin ranks third, bringing in $892.5 million in transaction fees.

- Solana and BNB Chain secured $374.3 million and $181.6 million, respectively.

- Among networks, Base tops the chart with $49.4 million in fees.

Arbitrum and Optimism earned $33.2 million and $27.9 million, respectively, showing strong adoption. - Avalanche and TON round out the top 10, with $20 million and $15.9 million in annual fees.

Gas and the Ethereum Virtual Machine (EVM)

- The Ethereum Virtual Machine (EVM) is the powerhouse behind Ethereum’s smart contract execution, but it’s also central to how gas fees are calculated.

- The EVM operates as a decentralized computing environment, executing smart contracts and allowing for dApp functionality.

- Each operation performed in the EVM, from basic arithmetic to complex contract calls, consumes a specific amount of gas, influencing the total fee of a transaction.

- Complexity matters: more intricate smart contracts consume significantly more gas, leading to higher transaction costs.

- Gas costs are influenced by opcode prices, which are predefined costs for EVM operations. This pricing model is essential for maintaining network security and stability.

- Ethereum’s PoS transition reduced energy consumption by 99.95%, although it didn’t directly lower gas fees since computational costs on the EVM remained consistent.

- Layer 2 solutions interact with the EVM, processing batches of transactions off-chain and submitting them as a single transaction on the mainnet, reducing gas fees for users.

- Innovations in EVM design, including zkEVMs (zero-knowledge EVMs), are anticipated to make Ethereum transactions faster and cheaper, with reduced gas fees projected by 2025.

Historical Trends in Gas Prices

- Ethereum gas prices in 2017 averaged around $0.20, reflecting early-stage adoption and low transaction volume.

- The 2018 ICO boom pushed average gas fees to $1.20, driven by token sales and smart contract usage.

- In 2020, the DeFi surge caused fees to jump to $14 on average, with platforms like Uniswap and Compound leading the way.

- May 2021 marked a peak as gas prices hit $196 per transaction, fueled by NFT hype and congestion.

- In 2022, average fees declined to about $4.50, thanks to The Merge and early Layer 2 adoption.

- The Merge in September 2022 transitioned Ethereum to proof-of-stake, slightly stabilizing fee volatility.

- As of mid-2025, Ethereum’s average gas fees are around $1.85, with Layer 2s offering sub-$0.03 transactions.

Factors Influencing Gas Fee Fluctuations

Understanding the key factors that influence gas fees can help users navigate Ethereum’s fee structure and optimize their transactions.

- Network demand is the primary driver of gas fees. When many users are transacting simultaneously, fees spike due to limited block space.

- Transaction complexity also affects gas fees. Simple transfers consume less gas, while complex smart contracts and dApp interactions require more, increasing fees.

- ETH price fluctuations impact gas fees, as gas is paid in Gwei (ETH’s smallest denomination). Higher ETH prices mean higher fees in dollar terms.

- EIP-1559, introduced in 2021, implemented a base fee mechanism, making fees more predictable but also burning a portion of ETH, impacting fee dynamics.

- Layer 2 solutions like Optimism and Arbitrum batch transactions and submit them to the Ethereum mainnet, lowering costs by reducing the load on Layer 1.

- Gas fee markets fluctuate seasonally, with high usage periods, such as major dApp launches or network upgrades, leading to increased fees.

- Priority fees (tips) allow users to expedite transactions by paying extra to validators. This mechanism helps users manage fee levels during peak demand periods.

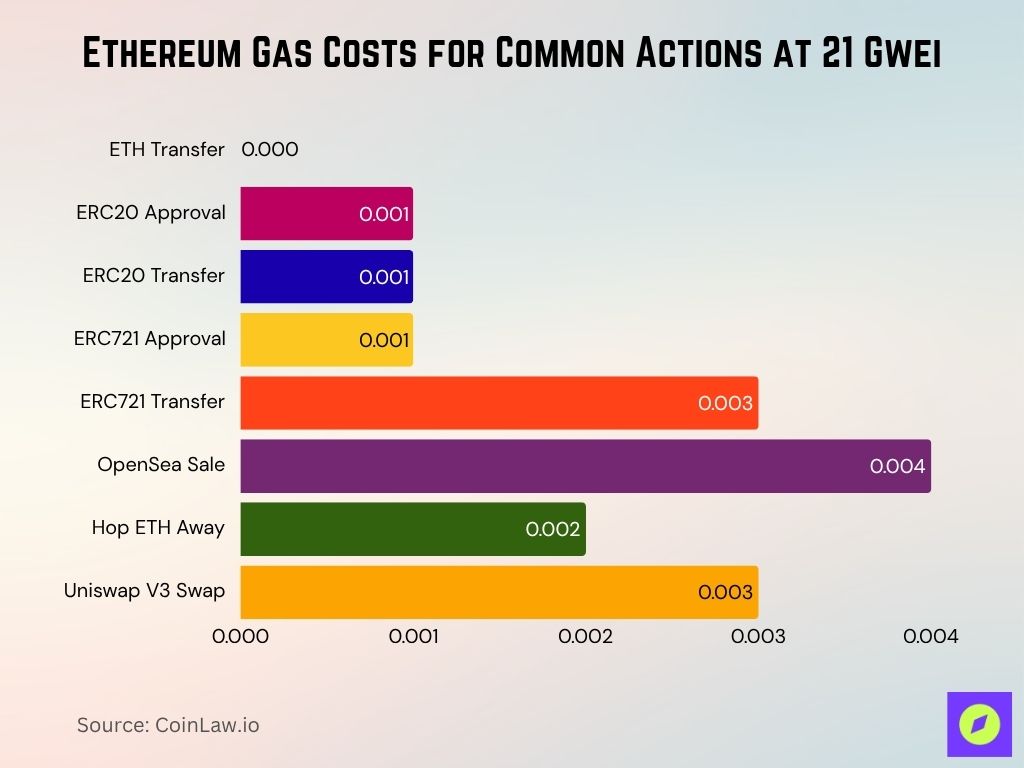

Ethereum Gas Costs for Common Actions at 21 Gwei

- ETH Transfer costs virtually 0 ETH, showing the lowest gas usage among typical actions.

- ERC20 Approval and ERC20 Transfer both cost approximately 0.001 ETH per transaction.

- ERC721 Approval also incurs a gas fee of around 0.001 ETH, aligning with ERC20 transactions.

- ERC721 Transfer is more expensive at 0.003 ETH, reflecting the added complexity of NFT operations.

- OpenSea Sale has the highest gas cost at 0.004 ETH, likely due to contract-heavy transactions.

- Hop ETH Away transactions average around 0.002 ETH, offering moderate gas usage for cross-chain transfers.

- Uniswap V3 Swap costs around 0.003 ETH, showing typical DEX trading gas usage.

Concerns About Ethereum Gas Fees

- High transaction fees still make Ethereum impractical for micro-payments, with basic transfers often exceeding $1.50 on mainnet.

- DeFi and NFT users continue to face elevated costs, with complex transactions peaking above $95 during network congestion in 2025.

- ETH price volatility affects gas fees in fiat terms, making transaction costs unpredictable for everyday users.

- Scalability remains limited, with Ethereum handling around 25–35 TPS, still far behind high-throughput competitors.

- While The Merge cut energy use, high transaction volume on Layer 1 still raises questions about sustainability and energy efficiency.

- High fees reduce accessibility, making Ethereum less viable in developing regions and for users with limited digital budgets.

- Low-fee blockchains like Solana and Cardano offer sub-cent fees, increasing pressure on Ethereum to remain competitive.

Strategies for Users to Optimize Gas Costs

Despite fluctuating fees, users can take several steps to optimize their gas costs on the Ethereum network.

- Use Layer 2 solutions like Arbitrum and Optimism, which offer significantly lower gas fees by processing transactions off-chain.

- Timing transactions strategically during low-traffic hours, such as weekends or late nights, can reduce fees by 30-40%.

- Gas fee prediction tools (such as ETH Gas Station or Blocknative Gas Estimator) help users gauge optimal times to transact and minimize fees.

- Batch transactions or combine multiple actions into a single transaction to save on cumulative fees.

- Adjusting gas limits carefully to avoid overpayment without risking transaction failure is essential, especially for complex smart contracts.

- Utilize gas-saving protocols like the ERC-20 gas token (CHI), which lets users “store” gas during low-cost periods and “spend” it when fees are high.

- Explore alternative wallets that offer customizable gas fees, allowing users to prioritize speed or cost-efficiency based on their needs.

How Ethereum Gas Powers Transactions

- When a user sends 1 ETH to a friend, they also pay gas fees to process the transaction.

- The sender loses 1 ETH + gas fees, while the receiver gets 1 ETH.

- The sender submits a request to the Ethereum network, which routes it to a miner.

- Miners use computational power to verify and execute the transaction, earning gas fees as compensation.

- The Ethereum network, being decentralized, ensures the transaction is validated and secure.

- This process illustrates how gas fees incentivize miners and fuel the Ethereum ecosystem.

Recent Developments

- On February 26, 2025, the average gas price on the Ethereum network was 3.146 Gwei, representing a 38.16% decrease from the previous day and a 93.96% drop compared to the same date last year.

- The average transaction fee has fallen to $0.41, a level not seen in four years. This is a substantial reduction from the $15.21 average fee recorded two years ago.

- Daily gas fees have decreased from a peak of $23 million to $7.5 million in February 2025, indicating a 70% decline.

- The adoption of Layer 2 networks, such as Arbitrum and Optimism, has contributed to this decline. These solutions process transactions off the main Ethereum chain, reducing congestion and lowering fees.

- Despite the overall downward trend, there have been instances of increased fees. For example, on February 19, 2025, transaction fees surged to $50 per swap, indicating periods of high network usage.

Conclusion

Ethereum gas fees have long been both a challenge and a catalyst for innovation within the blockchain community. With the introduction of Layer 2 solutions, major updates like the Merge, and upcoming advancements like proto-danksharding, Ethereum is on a promising path toward more accessible and affordable transactions. As developers, users, and stakeholders adapt, Ethereum’s fee structure is likely to become more user-friendly and inclusive, fostering broader adoption and usability. While challenges remain, the roadmap ahead suggests a future where gas fees are less of a barrier and more of a tool for sustainable network growth.

SPSamantha P.

Interesting take on the factors influencing gas fee fluctuations. Thank you.

ARAlex R.

I’ve noticed gas fees have been kinda unpredictable lately, makes planning when to make a move a bit tricky. Barry, your piece on gas fees after The Merge caught my eye. Gives a solid overview without getting too into the weeds. Hang tight, folks. It’s all part of riding the crypto wave.