Ethereum ETFs saw a massive rise in institutional demand this summer, but a sharp pullback this week suggests investors are still grappling with crypto’s volatility.

Key Takeaways

- 1Ethereum ETFs drew more institutional capital in July than all of last year, briefly outperforming Bitcoin ETFs in inflows.

- 2On August 18, Ether ETFs faced $197 million in outflows, their second-largest daily withdrawal ever.

- 3BlackRock and Fidelity led the ETF outflows, while high unstaking demand added pressure on ETH prices.

- 4Despite turbulence, analysts still view Ethereum as gaining ground in long-term institutional adoption.

What Happened?

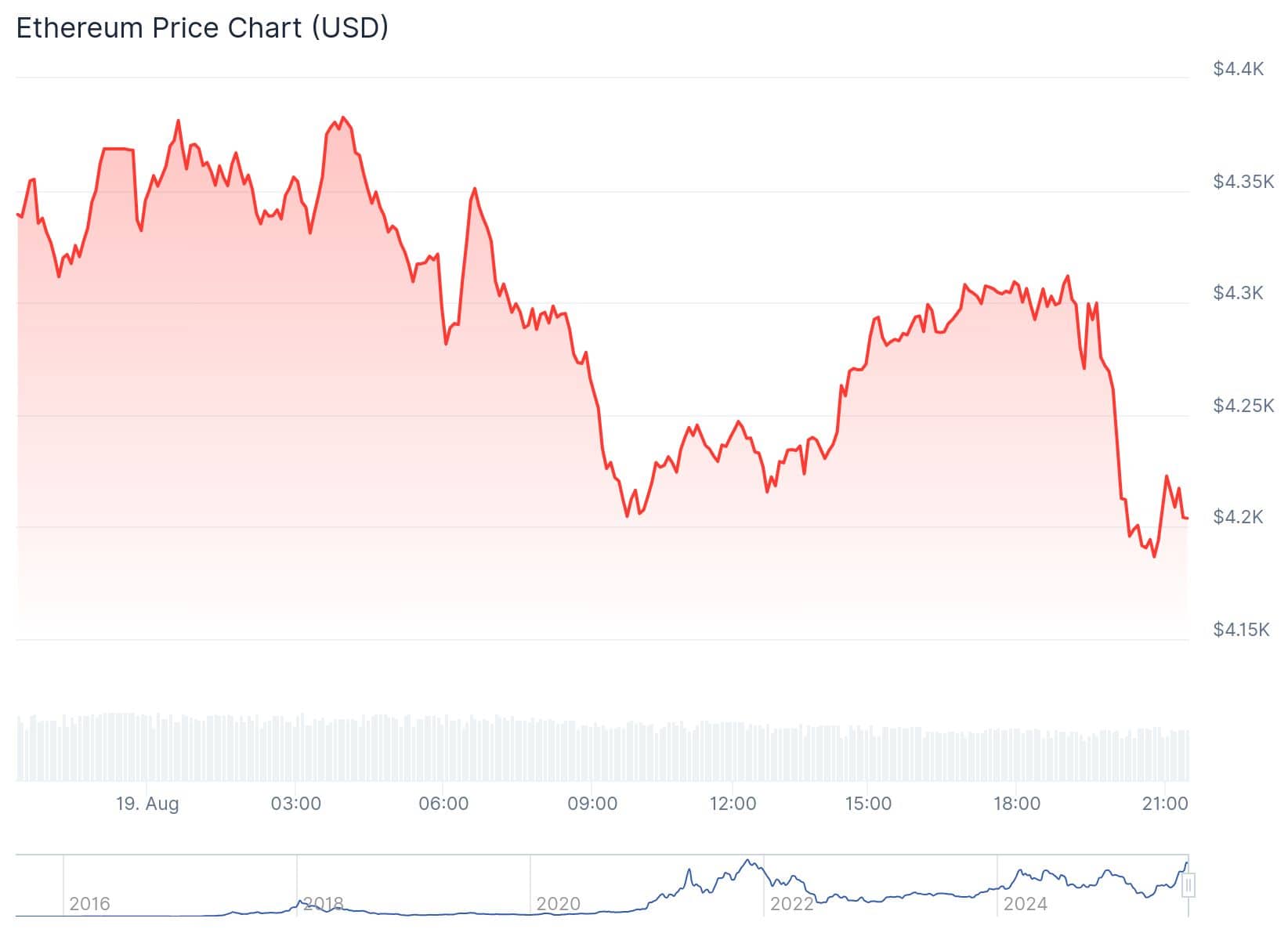

Ethereum exchange-traded funds (ETFs) enjoyed a historic rally in July, pulling in record levels of institutional capital and even surpassing Bitcoin ETFs in net inflows. But by mid-August, sentiment sharply reversed. On August 18 alone, Ether ETFs saw nearly $197 million in outflows, the second-highest daily exit since their launch.

The contrast reveals a market still figuring out how to price long-term growth against short-term uncertainty.

Ethereum Outpaced Bitcoin ETFs in July

July marked a milestone month for Ethereum ETFs. According to Bloomberg’s Eric Balchunas, ETH products like BitMine’s $6.6 billion ETH treasury gained popularity among institutional investors. This surge in activity saw Ethereum outpace Bitcoin ETFs in inflows, earning it the informal title of “ETF of the Month.”

Ether ETFs Turn Bitcoin Into ‘Second Best’ Crypto Asset in July.. new from @SirYappityyapp and myself who awarded Ether ETFs as our ETF of the month for July. Normally we just pick one but the whole category caught fire pic.twitter.com/o9yql2hDHM

— Eric Balchunas (@EricBalchunas) August 18, 2025

Bitget Wallet’s CMO Jamie Elkaleh noted that “institutional flows are proving more resilient than in previous cycles,” despite some profit-taking along the way.

Key takeaways from July:

- Ethereum ETFs brought in more money in six weeks than they did in all of 2024.

- Wholesale distributors began scaling Ethereum-based products.

- Funds like NEOS’ High Income Ethereum ETF pushed into yield-focused strategies.

- Analysts described this phase as Ethereum’s institutional breakout.

August Pullback Raises Concerns

Despite the bullish momentum, Ethereum ETFs hit turbulence in mid-August. On August 18, ETH ETFs recorded $197 million in outflows, second only to the $465 million on August 4.

Breakdown of August 18 outflows:

- BlackRock’s ETHA: $87 million

- Fidelity’s FETH: $78 million

- Grayscale’s ETHE: $18.7 million

- Total two-day outflows (including Aug. 16): $256 million

Ethereum ETF prices slipped slightly:

- ETHA dropped 0.54% to $32.97

- FETH fell 0.66% to $43.51

- ETHE declined 0.77% to $35.94

Despite the pullback, trading volume remained strong, suggesting that investors are repositioning rather than abandoning ETH exposure entirely. BlackRock’s ETHA posted $1.41 billion in daily trade volume, and Grayscale saw over $200 million in turnover.

ETH Unstaking Queue Hits All-Time High

Further complicating matters is the growing Ether unstaking queue, which broke a record with over 910,000 ETH (worth $3.9 billion) awaiting withdrawal as of August 19.

- Validators now face a wait time of 15 days and 14 hours to exit.

- The rise in the queue has sparked fears of a looming “unstakening” that could increase sell pressure.

As ETH price dropped around 6.5% recently, concerns about validator exits and price stability intensified.

ETH vs BTC: ETF Battle Continues

Even with the recent turbulence, Ethereum ETFs continue to gain ground relative to Bitcoin ETFs. According to data analyst Hildobby, the supply held in ETH ETFs could soon surpass BTC ETF holdings in relative terms.

at current pace, % of ETH in ETFs will exceed BTC’s in september

— hildobby (@hildobby) August 18, 2025

srcs: https://t.co/jW6Of0S51K, https://t.co/0uASMTncJf pic.twitter.com/LzVIceXlha

- BTC supply in ETFs: 6.4%

- ETH supply in ETFs: 5%

- ETH ETF growth pace suggests it could overtake BTC ETFs by September

Meanwhile, both Bitcoin and Ethereum ETFs saw pressure on August 18:

- Bitcoin ETFs recorded $122 million in outflows, with Bitwise’s BITB being the only one to register inflows.

- This suggests that market volatility and shifting sentiment are influencing both major crypto assets.

Current Market Snapshot

As of August 19:

- Ethereum (ETH) is trading at $4,208.41, down 2.5% in the last 24 hours.

- Bitcoin (BTC) is trading at $114,143, down 1.3% over the same period.

Both assets are under pressure from global macro factors and internal market dynamics.

CoinLaw’s Takeaway

In my experience, these kinds of sharp ETF inflows followed by steep outflows are typical in a maturing asset class like crypto. What stood out to me was not just the record-breaking buying spree, but the fact that even after such a big pullback, trading volumes stayed high. That tells me institutions are not walking away, they’re just adjusting. I found the ETH unstaking surge especially concerning, and it’s definitely something to watch in the coming weeks. If sentiment steadies, Ethereum could emerge even stronger from this.