Imagine a world where your car, smartphone, or even a fitness app could offer you tailored insurance coverage the moment you need it. Embedded insurance is transforming this vision into reality. By seamlessly integrating insurance options within products and services, this industry is rewriting the rules on how consumers buy, use, and benefit from insurance.

As we head into 2025, embedded insurance isn’t just a trend; it’s a booming market with remarkable growth potential. This article explores the embedded insurance industry’s pivotal statistics and trends, shedding light on why it’s becoming a central element in today’s digital-first economy.

Editor’s Choice Key Growth Milestones

- Embedded insurance market value rose to $116.49 billion in 2025, up from prior years.

- Expected CAGR is around 19.4% from 2024 to 2025, signaling sustained growth.

- Gross written premiums are projected to reach over $210.9 billion in 2025, highlighting rapid expansion.

- Embedded insurance premiums could exceed $70 billion globally by 2030, driven by growth in e-commerce, digital banking, and on-demand services.

- Embedded insurance could represent up to 15% of all insurance distribution by 2026, particularly as digital platforms scale globally.

- About 70% of consumers prefer embedded insurance when integrated into digital platforms.

- Over 74% of embedded premiums now flow through online API channels.

- Around 60% of insurers plan to invest in embedded solutions in 2025.

- InsurTech investments are expected to exceed $1 billion over the next 12 months.

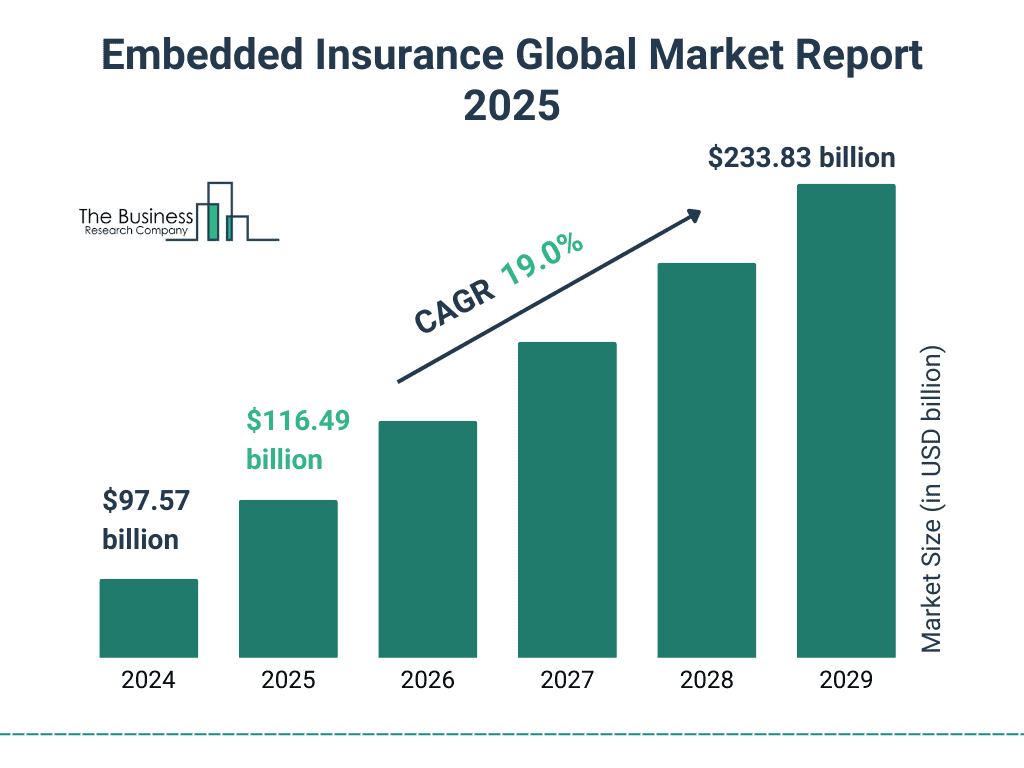

Embedded Insurance Market Growth Outlook

- The global embedded insurance market is expected to grow from $97.57 billion in 2024 to $233.83 billion by 2029.

- The market is projected to expand at a CAGR of 19.0% over the forecast period.

- In 2025, the market size is forecasted to reach $116.49 billion.

- This sharp upward trend highlights increasing integration of insurance offerings directly into digital platforms and services.

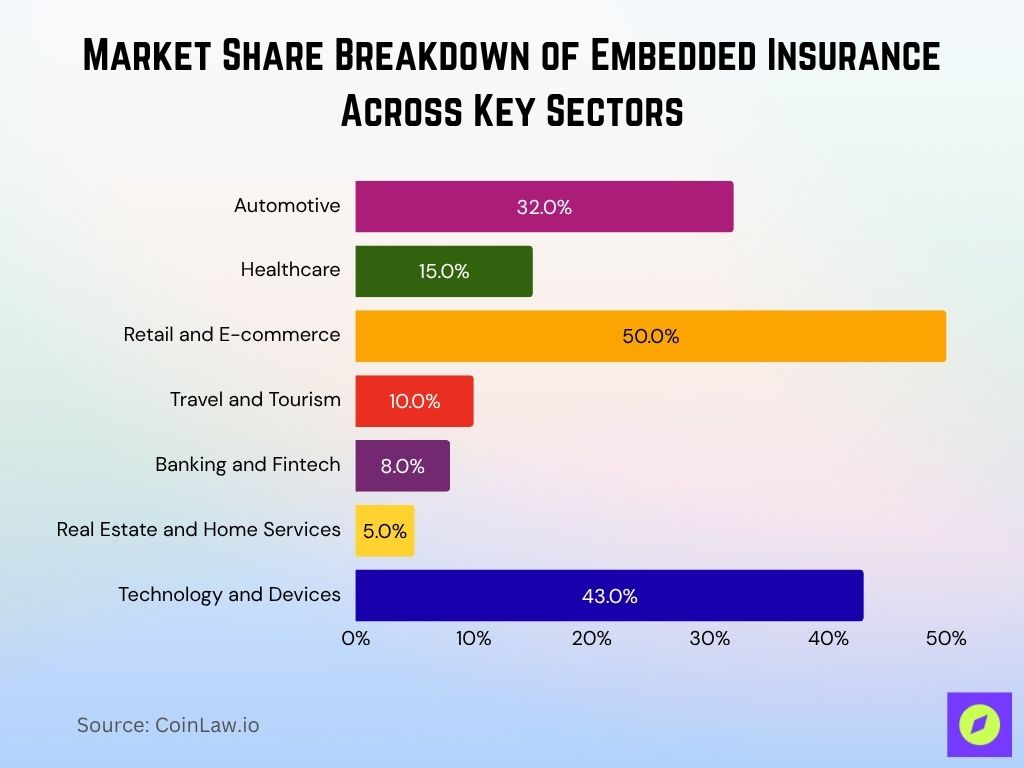

Embedded Insurance Industry Segmentation

- The automotive sector represents around 32% of the market in 2025, with strong growth in embedded auto policies.

- Healthcare holds approximately 15%, driven by digital health and wearable integration.

- Retail and e-commerce are leading sectors for embedded insurance, contributing over 50% of distribution in some markets, though the exact global share may vary by methodology.

- Travel and tourism embedded insurance makes up around 10% of the market and continues to grow rapidly.

- Banking and fintech contribute roughly 8% as digital banks expand their insurance offerings.

- Real estate and home services represent around 5%, with growing adoption via property platforms.

- Technology and devices lead with 43% of embedded insurance revenues, fueled by demand for electronics protection.

Technological Advancements and InsurTech Integration

- Over 73% of embedded insurance providers now use AI to improve underwriting and personalized policy recommendations.

- Adoption of IoT-powered embedded insurance is growing rapidly, with use cases in health and auto segments contributing to growth rates nearing 35% year-over-year.

- Approximately 87% of embedded insurance products now run on API integrations for real-time offers.

- Approximately 20–22% of insurers are experimenting with blockchain to enhance transparency and automation in claims processing, particularly within embedded insurance frameworks.

- Telematics-based policies make up 46% of auto embedded insurance in 2025, enabling behavior-based pricing.

- Predictive analytics and machine learning are credited with reducing fraud by up to 18% in pilot programs, particularly in auto and health embedded insurance.

- Over 75% of insurers use cloud platforms to scale embedded products, improving speed, flexibility, and security.

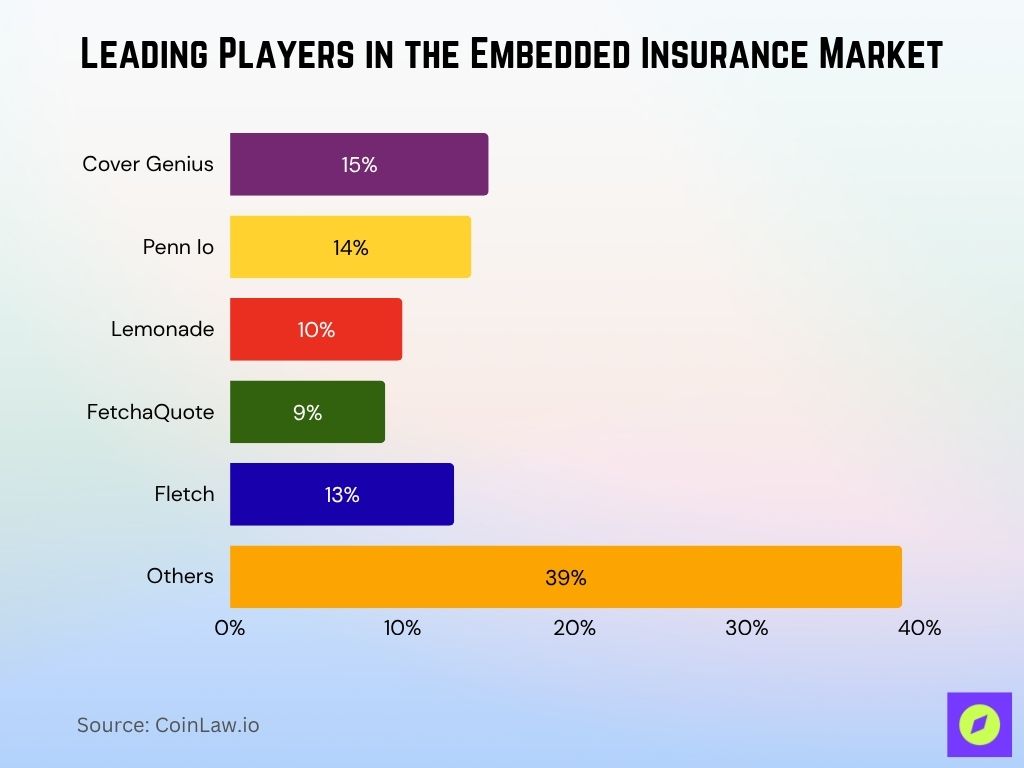

Leading Players in the Embedded Insurance Market

- Cover Genius holds around 15% of the embedded insurance market share.

- Penn Io accounts for approximately 14%, closely following Cover Genius.

- Fletch captures an estimated 13% market share.

- Lemonade represents about 10% of the total market.

- FetchaQuote holds a smaller slice at 9%.

- The Others category dominates with a combined share of 39%, indicating a highly fragmented market beyond the top players.

Geographical Insights and Regional Analysis

- North America holds approximately 35.5% of the market in 2025 and remains the leading contributor.

- Europe accounts for around 25% of global embedded insurance revenues, supported by regulatory adoption.

- Asia-Pacific is the fastest-growing region, driven by digital expansion in countries like China and India.

- Latin America holds about 7% of the market, with strong growth in Brazil and Mexico due to rising digital inclusion.

- Middle East and Africa show accelerating adoption with projected growth above 20% CAGR through 2027.

- Australia and New Zealand contribute a small but growing share, especially in travel and health insurance.

Customer Acquisition and Engagement Trends

- Approximately 73% of consumers are more likely to buy insurance if it’s embedded into their main purchase journey.

- AI-powered personalization tools can improve customer engagement by up to 40%, according to user experience studies in digital insurance ecosystems.

- Subscription-based embedded insurance models represent a growing portion of digital insurance, especially in health tech and device protection, with some sources estimating up to 25% adoption in key verticals.

- Programs leveraging referrals and loyalty see retention rates about 30% higher than traditional insurers.

- Simplified, one-click claims systems deliver a 20% boost in customer satisfaction, with 45% of embedded policies using digital-first claims.

- In-app push notifications have been shown to boost insurance app engagement by up to 50%, particularly in policy renewals and quick claims actions.

- Over 60% of embedded insurance purchases are completed on mobile devices, underscoring the need for mobile-first experiences.

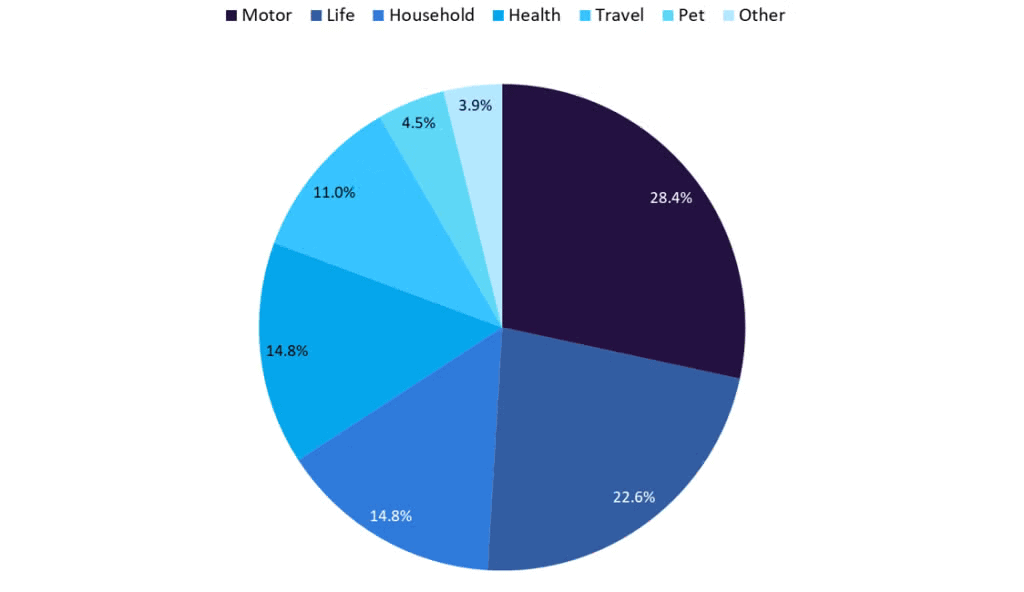

Embedded Insurance by Policy Type (Share Breakdown)

- Motor insurance leads with the largest share at 28.4%, making it the top category in embedded policies.

- Life insurance follows at 22.6%, showing strong demand for digitally integrated life cover.

- Both Health and Household insurance represent 14.8% each of the embedded market.

- Travel insurance accounts for 11.0%, reflecting growth in online booking integrations.

- Pet insurance makes up 4.5%, indicating a niche but growing segment.

- Other policy types contribute the remaining 3.9%, covering miscellaneous or emerging embedded products.

Recent Developments

- Policy‑as‑a‑Service (PaaS) platforms are expanding rapidly with a projected 20% annual growth as insurers increasingly embed customizable policy modules.

- Digital claims processing automation has cut claims settlement time by around 50%, leading the way in customer experience improvements.

- Dynamic pricing models based on user behavior, especially via telematics, have led to premium reductions of up to 25% in auto and health embedded insurance.

- Eco-conscious embedded insurance offerings are on the rise, with about 15% of new policies including green incentives such as rewards for low-emission driving or renewable energy usage.

- Partnerships with e-commerce platforms deliver 50% more embedded insurance options, notably boosting device and returns coverage.

- Micro‑insurance designed for short-term needs has grown by 18%, especially in travel and gadget sectors.

- Regulatory frameworks in key regions have become more robust, with updated guidelines boosting transparency and data protection in embedded insurance.

Conclusion

Embedded insurance has evolved from a niche concept to a dynamic industry reshaping the insurance landscape. By making coverage accessible at the point of purchase, this model addresses consumer demands for convenience, personalization, and seamless experiences. The market is set to grow exponentially, driven by technological advancements, strategic partnerships, and expanding global reach. As embedded insurance continues to flourish, it offers a promising pathway for businesses across sectors to enhance customer value, improve engagement, and innovate the traditional insurance model. The future of embedded insurance looks bright, with more industries and consumers set to benefit from its transformative potential.