The Dow Jones Industrial Average (DJIA) remains one of the most watched gauges of U.S. stock market performance, capturing how blue‑chip companies reflect broader economic conditions. This index helps investors, policymakers, and business leaders understand trends in stock prices, risk sentiment, and capital flows. In practical terms, financial advisors use Dow performance to shape retirement portfolio strategies, while corporate finance teams benchmark executive compensation plans against its returns. As you explore the latest data and trends, you’ll gain insight into how the index has navigated uncertainty and growth throughout the year.

Editor’s Choice

- 2025 YTD return for the Dow stands at approximately 13.1%, showing solid gains year‑to‑date through mid‑December.

- The Dow has traded above 48,000 points multiple times in 2025, setting new intraday and closing highs.

- Over the past year, the 52‑week range has spanned roughly 36,611 to 48,886 points, highlighting volatility and recovery.

- Recent light, post‑holiday trading saw the Dow slip slightly but still finish up ~14.5% for 2025.

- Investor optimism fueled record closes with strong contributions from UnitedHealth, Goldman Sachs, and Nike.

- A death cross technical signal appeared earlier in the year, reflecting short‑term weakness.

- Geopolitical tensions and macroeconomic data have driven bouts of sharp declines and rebounds.

Recent Developments

- On Dec. 26, 2025, the Dow lost nearly 125 points, driven by declines in McDonald’s and Walt Disney shares.

- That same session saw modest declines across major U.S. indexes in light trading.

- From Dec. 23–26, the Dow bounced between record highs and slight dips, reflecting a subdued market tone.

- Light trading volumes around the holidays may dampen volatility but not long‑term trends.

- In October, the Dow hit a record closing high of 46,924.74 points, supported by strong earnings.

- August saw a rally above 45,000, boosted by Fed rate‑cut expectations and trade developments.

- Investor sentiment fluctuated with geopolitical stress, leading to periodic sell‑offs.

- Economic data releases triggered one of the index’s worst trading days of the year early in 2025.

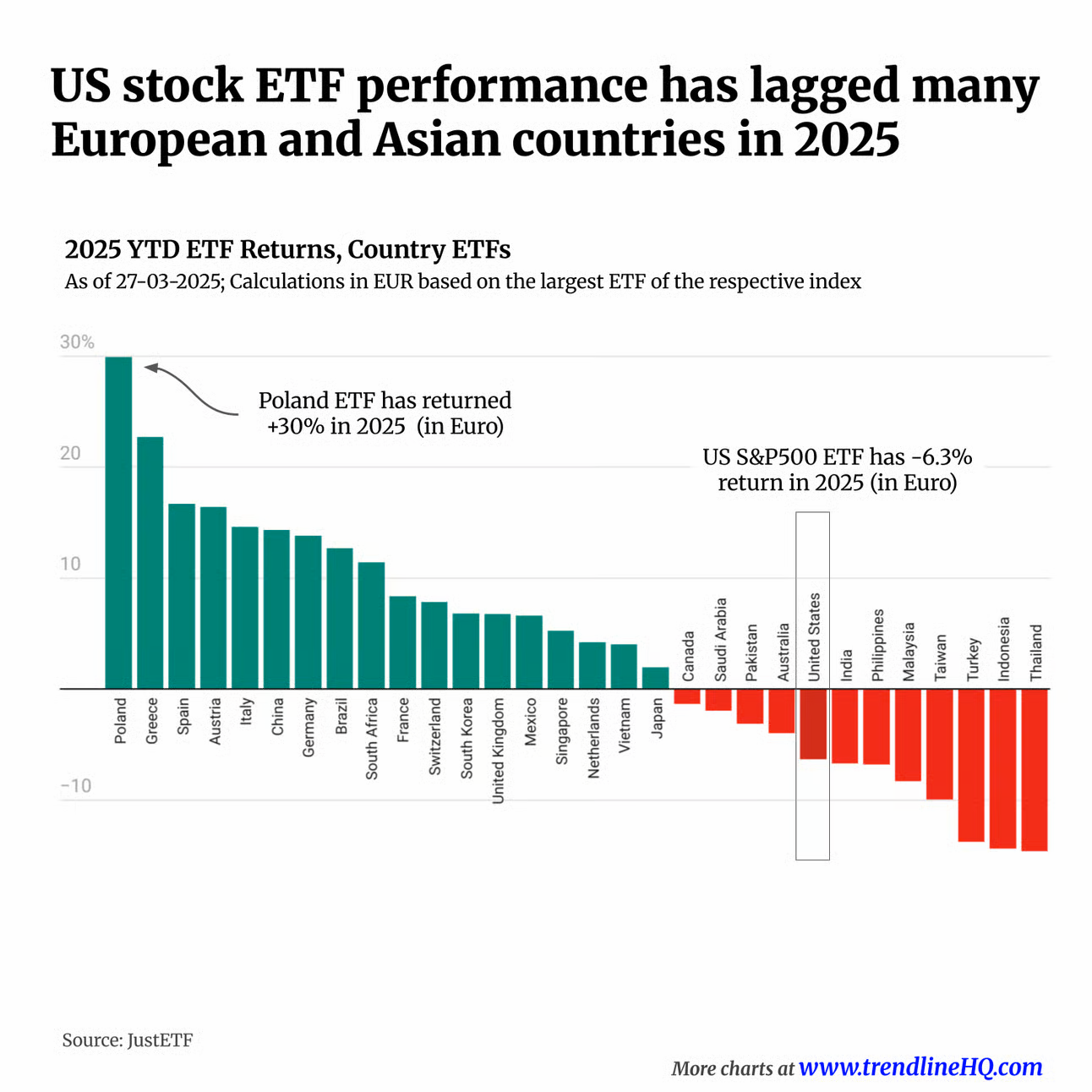

YTD Country ETF Performance Snapshot

- Poland leads globally with a 30.0% YTD return, the strongest performance among all country ETFs shown.

- Southern and Central Europe outperform, with Greece at 22.0%, Spain at 15.5%, and Austria at 15.0%.

- Major European economies remain solidly positive, including Italy at 13.5%, Germany at 12.8%, and France at 7.2%.

- China posts a strong rebound at 13.2%, outperforming most developed markets in 2025.

- Emerging markets show mixed results, as Brazil at 11.5% and South Africa at 10.2% contrast with weaker Asian peers.

- Japan remains barely positive with only a 1.8% YTD gain, lagging regional counterparts.

- North American ETFs underperform, with Canada at -1.2% and the U.S. S&P 500 ETF down -6.3% in euro terms.

- Asian markets dominate the laggards, led by Thailand at -15.5%, Indonesia at -15.2%, and Turkey at -14.5%.

- India and the Philippines post notable declines, falling -7.1% and -7.4% respectively.

- The performance gap between the best and worst markets exceeds 45 percentage points, highlighting sharp global divergence in 2025.

Dow Jones Industrial Average Explained

- DJIA closed at a record 48,731.16 on December 24.

- Year-to-date return stands at 14.49% as of late December.

- The highest closing price reached 48,704.01 during the year.

- The year high touched 48,886.86 on December 12.

- The first close above 47,000 occurred on October 24.

- First close above 48,000 achieved on November 12.

- Total return YTD measures 16.52% including dividends.

- Recorded 19 record closes throughout the year.

- 52-week low stood at 36,611.78.

Index Methodology and Calculation

- Current Dow divisor stands at 0.16242563904928.

- Each $1 stock price change equates to 6.156663 index points.

- Divisor adjusted 12 times for corporate actions this year.

- Goldman Sachs’ share price of $582.34 exerts an outsized influence.

- The sum of 30 component prices totals approximately 7,910 points before division.

- Divisor fell below 1 in 1986 and continues to decline with splits.

- UnitedHealth’s highest-priced component at $610.23 drives 3.76% of index weight.

- The average component stock price measures $263.67.

- Price-weighted structure amplifies high-price stocks by 40% more than the cap-weighted.

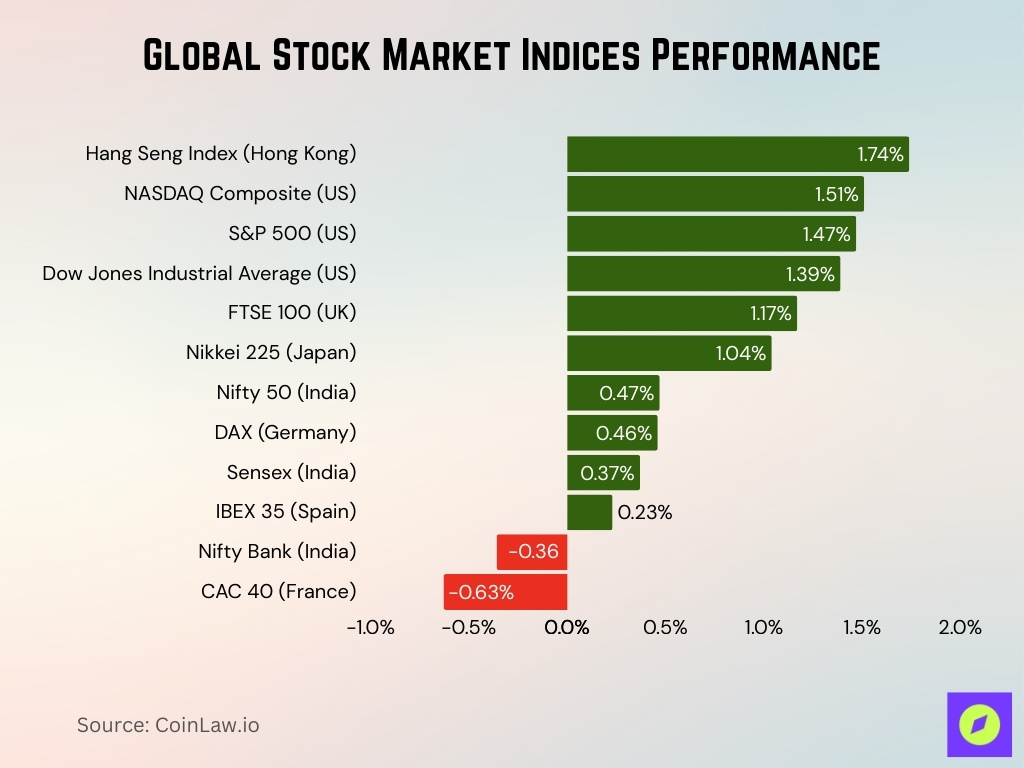

Global Stock Market Indices Performance

- The Hang Seng Index led global markets with a 1.74% daily gain, topping all major indices.

- U.S. equities closed broadly higher, with the NASDAQ Composite up 1.51%, the S&P 500 rising 1.47%, and the Dow Jones Industrial Average advancing 1.39%.

- European markets showed moderate strength, led by the FTSE 100 at 1.17%, while Germany’s DAX gained 0.46% and Spain’s IBEX 35 added 0.23%.

- Japan’s Nikkei 225 recorded a solid increase of 1.04%, reflecting positive momentum in Asian equities.

- Indian benchmarks posted mixed results, with the Nifty 50 up 0.47% and the Sensex gaining 0.37%, while the Nifty Bank declined -0.36%.

- France’s CAC 40 was the weakest performer among tracked indices, falling -0.63% on the day.

- Overall market breadth was positive, with 10 out of 12 major indices finishing the session in positive territory.

Eligibility Criteria and Index Composition

- 30 companies comprise the index representing U.S. economic leadership.

- Financials sector holds 7 constituents, including JPMorgan and Goldman Sachs.

- The technology sector features 4 companies like Microsoft and Apple.

- Combined market capitalization totals $17.2 trillion across components.

- Industrials represent 6 firms, such as Boeing and Caterpillar.

- Healthcare includes 4 members led by UnitedHealth at a $296.7 billion market cap.

- 2 companies were added during the annual review for emerging leadership.

- Consumer sectors account for 20% of the index composition by count.

- Average component market cap reaches $573 billion.

- No small-cap stocks qualify as all exceed the $10 billion threshold.

Major Bull and Bear Market Cycles

- DJIA plunged 1,679 points on April 3 amid tariff shock.

- April 4 marked the largest single-day drop of 2,231 points.

- Year-to-date gain reached 15% despite an early crash.

- Intra-year maximum drawdown hit -10.2% from peak.

- Bull phase post-April recovery gained 20.1% to year-end.

- Santa Claus rally delivered a 1.8% gain from Dec 24-Jan 3.

- 9 consecutive months of ascending channel after Q1 consolidation.

- Record 19 new highs set after mid-year rebound.

- Geopolitical tensions triggered -5.5% correction in Q2.

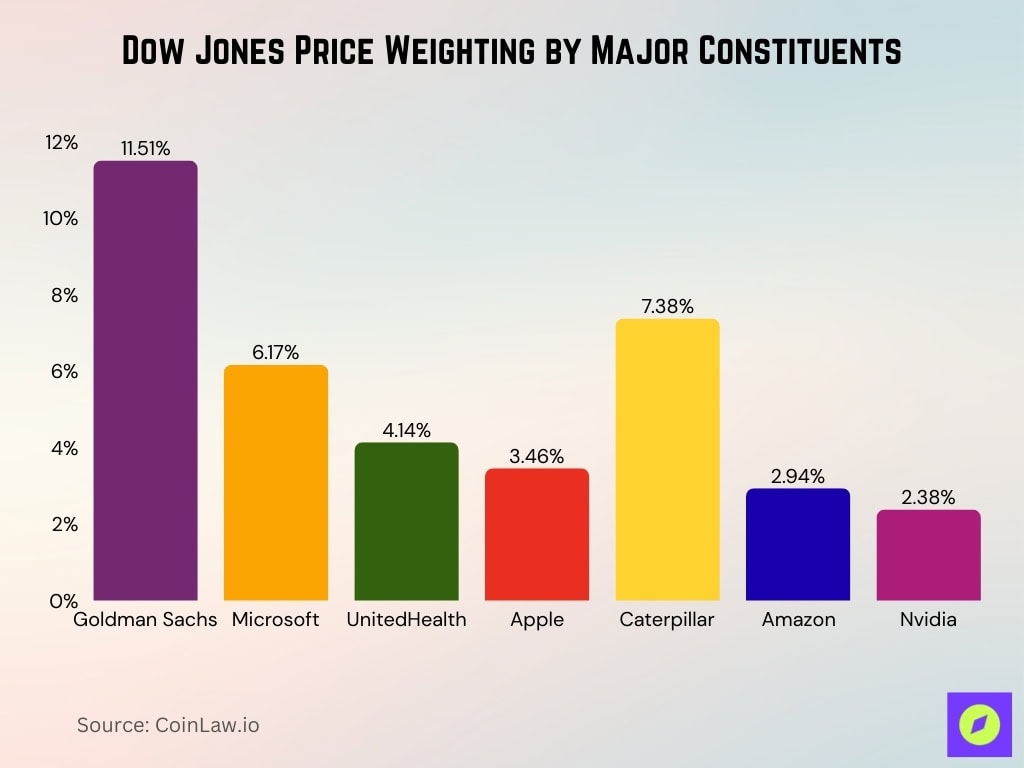

Market Capitalization and Index Weighting

- Goldman Sachs holds 11.51% price weight despite $187 billion market cap.

- Microsoft commands 6.17% weight with $2.33 trillion market cap.

- UnitedHealth $527 billion market cap ranks second, but only 4.14% price weight.

- Apple $3.45 trillion top market cap yields just 3.46% index influence.

- Caterpillar’s 7.38% price weight exceeds Amazon’s 2.94% despite a smaller cap.

- Total components market cap aggregates $17.2 trillion across 30 firms.

- Nvidia $4.1 trillion cap is underrepresented at 2.38% price weight.

Largest Daily Gains and Losses

- Largest gain +2,500 points on April 9 after tariff delay announcement.

- Biggest loss -2,231 points on April 4 amid tariff implementation shock.

- Second-largest drop -1,723 points on April 8, closing at 37,103.

- +500 point surge on October 24 driven by cooling inflation data.

- The year’s largest intraday swing spanned 3,200 points on April 9.

- +289 points on December 24 marked the 19th record close.

- -320 points on April 8 ranked third-worst in DJIA history.

- Holiday rally gained 1.8% over the final week with +845 total points.

- Volatility index spiked 45% during the April tariff crisis week.

Drawdowns and Volatility Metrics

- Maximum drawdown reached -18.7% during the April tariff crisis.

- DJIA VIX spiked to 36.60 on October 16 amid trade tensions.

- Year-end DJIA VIX averaged 14.5, reflecting subdued volatility.

- April VIX peak hit 52.33 on tariff announcement day.

- Annual volatility measured 6.57% down 61% from the prior year.

- No drawdown exceeded 5% until the November correction.

- VIX retracted 40%+ within 10 days after 6 major spikes.

- Death cross triggered -12.3% drawdown over 3 weeks in Q2.

- Year-to-date max drawdown limited to -19% despite VIX at 60.

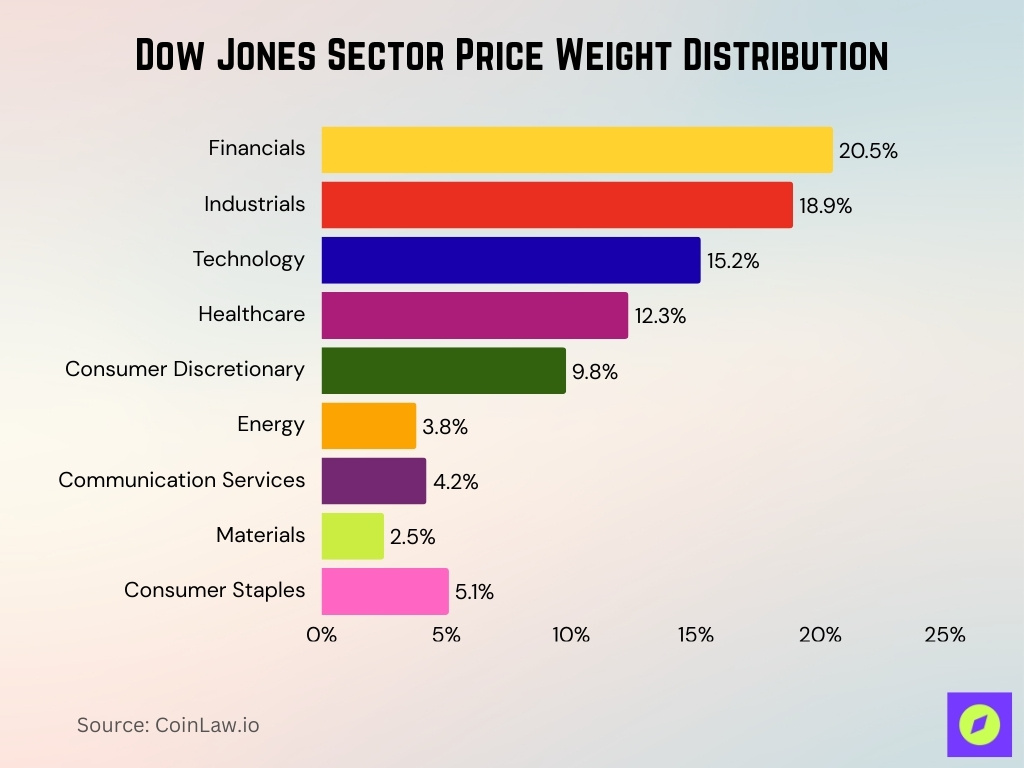

Sector Breakdown and Weights

- Financials sector commands 20.5% price weight with 7 companies.

- Industrials hold 18.9% weight, led by Caterpillar at 7.4%.

- The technology sector represents 15.2% via Microsoft and Apple.

- Healthcare contributes 12.3% anchored by UnitedHealth at 4.13%.

- Consumer discretionary accounts for 9.8% with Home Depot at 4.38%.

- The energy sector weighs 3.8% through Chevron and ExxonMobil.

- Communication services total 4.2% including Verizon and Disney.

- The materials sector is limited to 2.5% primarily Dow Inc.

- Consumer staples comprise 5.1% via Procter & Gamble and Coca-Cola.

Index Rebalancing and Changes Over Time

- 2 component changes executed during the annual Dow reconstitution.

- Divisor adjusted 12 times to offset corporate actions and splits.

- The average time between index changes stands at 3.7 years historically.

- Revisions impacted 6.2% of total index weight this cycle.

- Stock splits triggered 4 divisor recalculations year-to-date.

- Membership turnover rate has remained below 10% for the past decade.

- Tech and financial shares expanded their combined weight to 35.7% post-review.

- Industrial representation declined 4.1% from the prior weighting adjustment.

- The editorial committee met 4 times for rebalancing deliberations this year.

Dow Jones vs S&P 500 Performance

- S&P 500 gained 17.92% YTD, surpassing Dow’s 14.49% return.

- S&P 500 covers 500 stocks representing 80% of the U.S. market cap.

- Dow tracks 30 price-weighted blue-chip companies.

- S&P 500 posted 11 new record highs vs Dow’s 19 closes.

- The tech sector drove 45% of S&P 500 gains vs 15% Dow weight.

- S&P 500 annualized volatility measured 12.3% below the Dow’s 14.1%.

- Q4 S&P 500 surged 8.7% outpacing the Dow’s 6.2%.

- S&P 500 equal-weight returned 15.2% vs the Dow’s 14.99%.

- Combined market cap of S&P 500 totals $48.7 trillion vs Dow $17.2 trillion.

Dow Jones vs Nasdaq and Other Indexes

- Nasdaq Composite surged 17.34% YTD, outpacing the Dow’s 14.49%.

- S&P 500 gained 13.94% YTD, trailing Nasdaq but ahead of Dow.

- Russell 2000 delivered 9.06% YTD, underperforming large-cap peers.

- Q3 Nasdaq rose 11.1% vs the Dow’s 5.22% quarterly gain.

- Nasdaq-100 achieved a 22.1% total return, exceeding the Dow by 7.6%.

- Dow outperformed the Russell 2000 by 5.43% over the full year.

- S&P 500 Equal Weight returned 13.01% vs the Dow’s 14.99%.

- Tech-heavy Nasdaq posted a 29.57% January gain, dwarfing the Dow.

- Year-end session saw Dow up 0.2% vs Nasdaq 0.6%.

Frequently Asked Questions (FAQs)

The Dow Jones Industrial Average dropped by nearly 125 points (about 0.3%) on December 26, 2025.

The Dow Jones Industrial Average was up approximately 14.5% year‑to‑date in 2025.

The Dow Jones Industrial Average rose by about 1.2% over the holiday‑shortened week.

The Dow Jones Industrial Average recorded 19 record closing highs in 2025.

Conclusion

This year proves to be a notable year for the Dow Jones Industrial Average, marked by record‑level closes, resilient gains, and continued relevance in U.S. market benchmarking. While the Dow’s year‑to‑date rise trailed broader indexes like the S&P 500 and Nasdaq, it nonetheless reflected strength in industrial, financial, and tech‑related components. Cross‑index performance highlighted divergent leadership dynamics in growth vs value stocks. For investors tracking market pulse, the interplay of holiday rallies, macroeconomic data, and index composition underscores the importance of diversified strategies.