The finance industry is under the spotlight, not just for its economic contributions but for the pressing need to improve diversity and inclusion. For years, finance has been dominated by a largely homogenous workforce, particularly at the executive level. However, as businesses and stakeholders demand change, the financial sector is slowly starting to embrace a more diverse talent pool.

From gender diversity to representation across racial, ethnic, and age groups, efforts are being made to create a more inclusive financial ecosystem. This article explores the key statistics behind these developments, illustrating both progress and challenges.

Editor’s Choice

- Women comprise 47% of the global finance workforce but hold only 23% of executive roles, indicating persistent leadership gaps.

- Black employees account for about 12% of the overall U.S. private‑sector workforce, yet remain significantly underrepresented in senior finance roles, where they typically hold only 4–5% of upper‑management positions.

- Latinx individuals account for about 19% of the overall U.S. labor force, underscoring their growing importance for financial services talent pipelines.

- Only 0.9% of Fortune 500 board seats are held by openly LGBTQ+ individuals, underscoring the need for greater inclusivity in leadership.

- Regulators in major markets now expect diversity policies to cover age, ethnicity, disability, and sexual orientation, pushing more than 70% of large financial institutions to expand D&I criteria.

- Over 50% of listed firms in some markets have adopted LGBTQ+-inclusive board policies, signaling rapid progress in board-level diversity standards.

Recent Developments

- 42% of European financial services boardrooms are female, exceeding upcoming EU quotas.

- New board appointments in European financial services reached 50% female in recent years.

- 83% of employers maintain DEI initiatives, rising from 67% in 2023.

- AI-driven recruitment in organizations yields 35% more diverse candidate pools.

- Gender pay gap in banking, insurance, and finance stands at around 20–22%.

- US financial institutions scale back public DEI commitments amid political scrutiny.

- Goldman Sachs drops explicit race/gender criteria for board candidates.

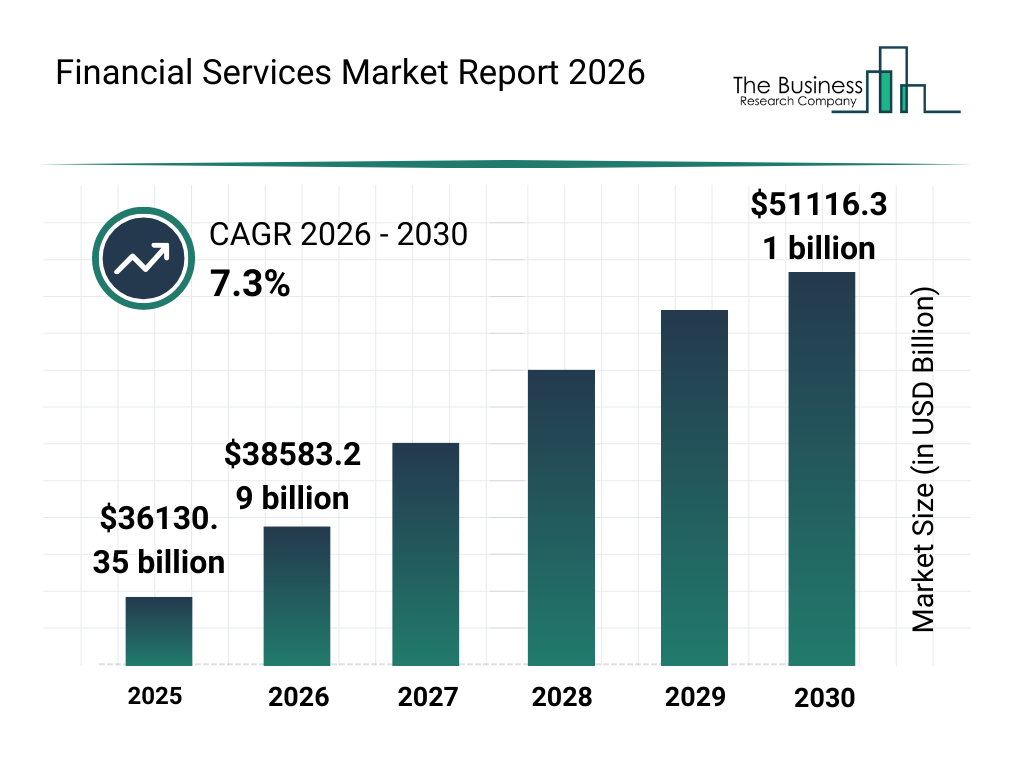

Financial Services Market Growth Forecast

- The global financial services market will grow from $36,130.35 billion in 2025 to $51,116.31 billion by 2030, signaling strong long-term expansion.

- The market will reach approximately $38,583.29 billion in 2026, reflecting steady year-over-year growth.

- By 2027, the industry will surpass $41,399.87 billion, crossing the $41 trillion threshold.

- The market will climb to around $44,420.06 billion in 2028, maintaining consistent upward momentum.

- In 2029, financial services revenues will approach $47,662.73 billion, nearing the $48 trillion mark.

- By 2030, the sector will exceed $51.1 trillion, highlighting its massive global economic footprint.

- The industry will expand at a 7.3% CAGR between 2026 and 2030, demonstrating sustained growth across banking, insurance, and capital markets.

Support for Diversity Driving Innovation

- 85% of financial firms acknowledge diversity as a key driver of innovation.

- 62% of financial professionals believe inclusivity improves team productivity.

- Diverse teams are 17% more likely to be high-performing.

- Inclusive teams are 1.7 times more likely to be innovation leaders.

- 89% view generational diversity positively in the workplace.

- Companies with high ethnic diversity are 36% more profitable.

- Diverse investment teams generate 2% higher annual returns.

- 98% of financial leaders are committed to a diverse, inclusive culture.

Gender Diversity in Finance

- Women hold 18% of global C-suite positions in financial services.

- Women comprise 52% of the US financial services workforce, but 31% senior leadership.

- 28% of deputy governors and C-suite roles in central banks are held by women.

- 19% of C-suite positions in commercial banks are held by women.

- Gender pay gap in UK finance and insurance reaches 27.2%.

- Women earn 82–84 cents per dollar compared to men in the US finance sector.

- 18.6% of UK financial services senior executives are women.

Ideal Job Qualities Workers Value Most

- A flexible schedule or remote work option is the top priority, chosen by 53% of workers, highlighting the continued demand for work-life balance.

- Good pay and benefits rank a close second, valued by 50% of employees, underscoring the importance of financial security.

- About 35% of workers prioritize a low-stress job, reflecting growing concerns about burnout and mental health.

- Feeling valued and respected at work matters to 33% of respondents, emphasizing the role of workplace culture.

- A safe working environment is important for 27% of employees, particularly in physically demanding or high-risk roles.

- Only 15% of workers consider a job’s purpose or mission alignment a top factor, suggesting practical needs outweigh ideological ones for many.

- A diverse and inclusive workplace is prioritized by 12% of respondents, indicating it is valued but less decisive than compensation or flexibility.

Racial and Ethnic Diversity Trends in Financial Services

- Black professionals represent 8% of the US financial services workforce.

- Latinx employees comprise ~10% of US finance entry-level roles.

- Asian professionals hold 6.5% of UK financial services senior leadership.

- People of color hold 15% of investment services sector boards.

- Ethnic minority employees are 11.2% of the FCDO Services workforce Q3.

- 20% of Ethnic Minority-led UK businesses are discouraged from accessing finance.

- Racially diverse teams 35% more likely to financially outperform peers.

Impact of Pronouns on a Resume According to Hiring Managers

- 38% of hiring managers are more likely to interview with she/her pronouns.

- 33% more likely to interview candidates listing they/them pronouns.

- 59% say pronouns on a resume have no impact on hiring decisions.

- 25% more likely to hire candidates listing pronouns.

- 15% less likely to hire candidates with listed pronouns.

- 14% less likely for she/her or he/him pronouns on a resume.

- 16% less likely for they/them pronouns on a resume.

- 66% of hiring managers view pronoun sharing positively at work.

- Resumes with pronouns receive 8% less employer interest.

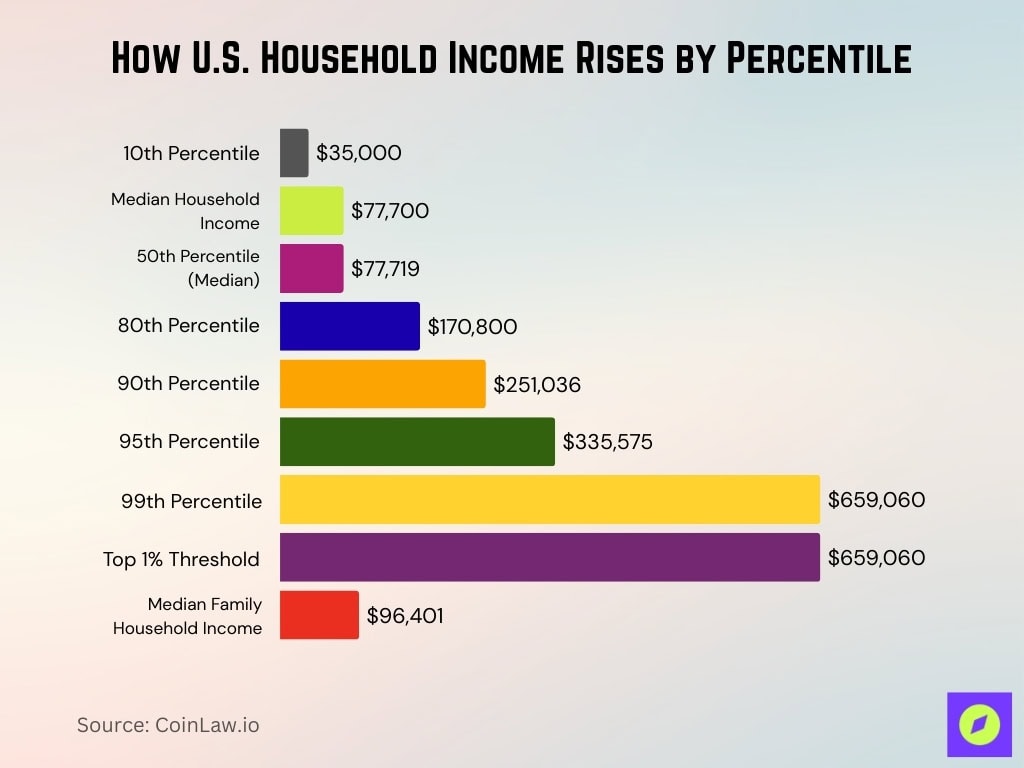

U.S. Personal Finance: Household Income Distribution Overview

- Median U.S. household income stands at $77,700.

- Households at the 90th percentile earn $251,036.

- Households at the 95th percentile earn $335,575.

- The 50th percentile (median) household earns $77,719.

- Households at the 10th percentile earn around $35,000.

- The 80th percentile household earns $170,800.

- Households at the 99th percentile earn $659,060.

- The top 1% income threshold starts at $659,060.

- Median family household income reaches $96,401.

Benefits of Age Diversity in Asset Management

- 34% of investment management employees are under 35 years old.

- 44% of the asset management workforce are women.

- Gender-diverse investment teams outperform by 45 basis points annually.

- 61% of financial advisors are over 40 years old.

- 38% of advisors set to retire within the decade, managing 42% assets.

- Age-diverse companies outperform by up to 20% in profitability.

- 68% CFP exam takers are under 40, 37% under 30.

- 47% financial services workforce is aged 22-35 years.

- Boards with the greatest age variance yield the strongest stock returns.

Organizations Promoting Diversity in Finance

- 25,000+ members in 100 Women in Finance globally.

- 92,000+ professional and student members in ALPFA.

- 150+ companies support NASP through sponsorship and membership.

- 200+ firms signed the CFA Institute DEI Code.

- 16 initial signatories to the CFA DEI Code managing $4 trillion in assets.

- 160 professional chapters and 45 student chapters in ALPFA.

- 25,000+ women members in 100 Women in Finance.

- NASP NorCal advances diversity for financial services professionals.

- NASP Detroit was established in 1990 for inclusion in securities.

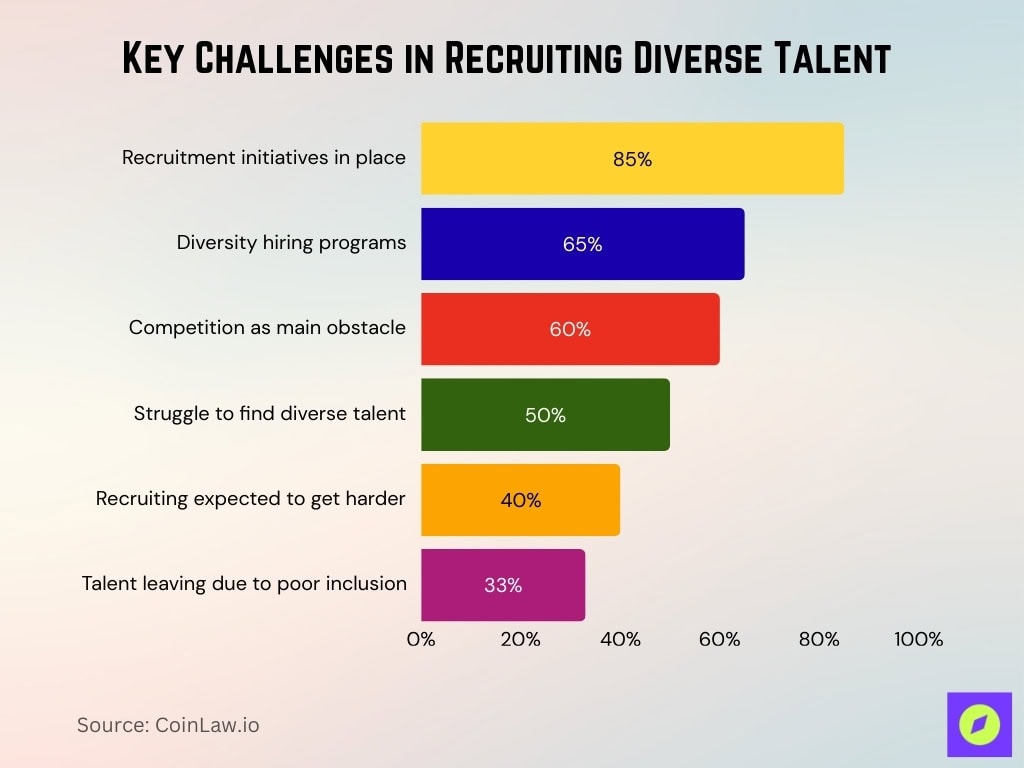

Challenges in Recruiting and Retaining Diverse Talent

- 33% of executives report diverse talent leaving due to a lack of inclusion.

- 85% of financial services companies implement diverse recruitment initiatives.

- 50% of financial institutions struggle to find skilled, diverse candidates.

- 60% of firms see competition as the biggest diverse talent hiring obstacle.

- 40% of CEOs expect harder recruiting for talented, diverse people ahead.

- 65% of executives have programs to recruit diverse employees.

The Benefits of Diversity to Business

- Diverse companies 70% more likely to capture new markets.

- Top quartile ethnic diversity firms 39% more profitable.

- Top quartile gender diversity firms 27% more likely to outperform.

- 10% ethnic diversity raises EBIT 0.8%.

- Gender-diverse boards yield 2-5% higher annual returns.

- Diverse executive teams 9% more likely to outperform peers.

- Diverse firms 35% more likely to financially outperform.

- Top diversity quartile firms 36% more likely to outperform in profitability.

Diversity and Financial Performance

- Top quartile ethnic diversity firms 27% more likely to outperform financially.

- Top quartile gender diversity firms 39% increased likelihood of outperformance.

- Top quartile ethnic diversity 39% more likely to outperform peers.

- Top quartile gender diversity executive teams 21% more likely to have above-average profitability.

- Ethnic diversity in the top quartile 33% likelihood of outperformance on EBIT margin.

- The top quartile board-gender diversity 27% more likely to outperform.

- The top quartile of ethnic diversity 36% more profitable.

- Diverse executive teams 9% more likely to outperform peers.

- Bottom quartile, both genders/ethnic 66% less likely to outperform.

Investor and Government Actions

- 33.70% average female representation on the US 30% Club member boards.

- 24.7% female directors on S&P 100 boards.

- 100% of S&P 100 boards have at least one female director.

- BlackRock removes 30% diversity aspiration from voting guidelines.

- State Street shifts from specific board diversity targets.

- 68% ESG investors plan to vote against non-diverse boards.

- Vanguard emphasizes cognitive diversity over specific metrics.

- ISS retains minority director expectations for Russell 1000.

- Major investors drop explicit quantitative board diversity thresholds.

Frequently Asked Questions (FAQs)

Women comprise 46% of the global finance workforce.

Companies with high ethnic diversity are 36% more profitable.

60% of financial employees feel their organization progresses on DEI.

Women earn 20% less than men on average in finance.

Conclusion

As the finance industry evolves, diversity and inclusion are no longer optional; they are business imperatives. These statistics show progress, but they also reveal the challenges that remain in creating a truly inclusive environment. Firms that embrace diversity will not only enhance their financial performance but also foster innovation, build stronger teams, and create a more equitable industry for all. The data suggests that while efforts are being made, the journey toward full inclusion in finance is far from over, but the future looks promising.