Imagine a world where financial tools shape lives in more ways than we realize. This is the story of Discover Card, a significant player in the credit card industry, renowned for its robust benefits and growing user base. As we enter 2025, Discover’s statistics unveil trends and performance metrics that shape the U.S. credit market, offering insights into its contribution to consumer spending, debt management, and rewards programs. In this article, we delve into the latest statistics and explore the broader picture of Discover Card’s financial ecosystem.

Editor’s Choice

- Discover reported $13.9 billion in net revenue in 2025, marking a 9.4% year-over-year growth.

- Discover Card now serves over 51 million cardholders worldwide, continuing to rank high in customer loyalty.

- Its cashback rewards program hit a new milestone with $1.6 billion redeemed by users in 2025.

- Credit card transaction volumes surpassed $442 billion, reflecting a 9.7% increase from the previous year.

- The delinquency rate on Discover credit cards rose slightly to 2.6%, while still remaining below the industry average.

- Discover ranked #2 in customer satisfaction in the 2025 J.D. Power U.S. Credit Card Satisfaction Study.

- The Discover Global Network now spans over 205 countries, supporting 77 million merchants globally.

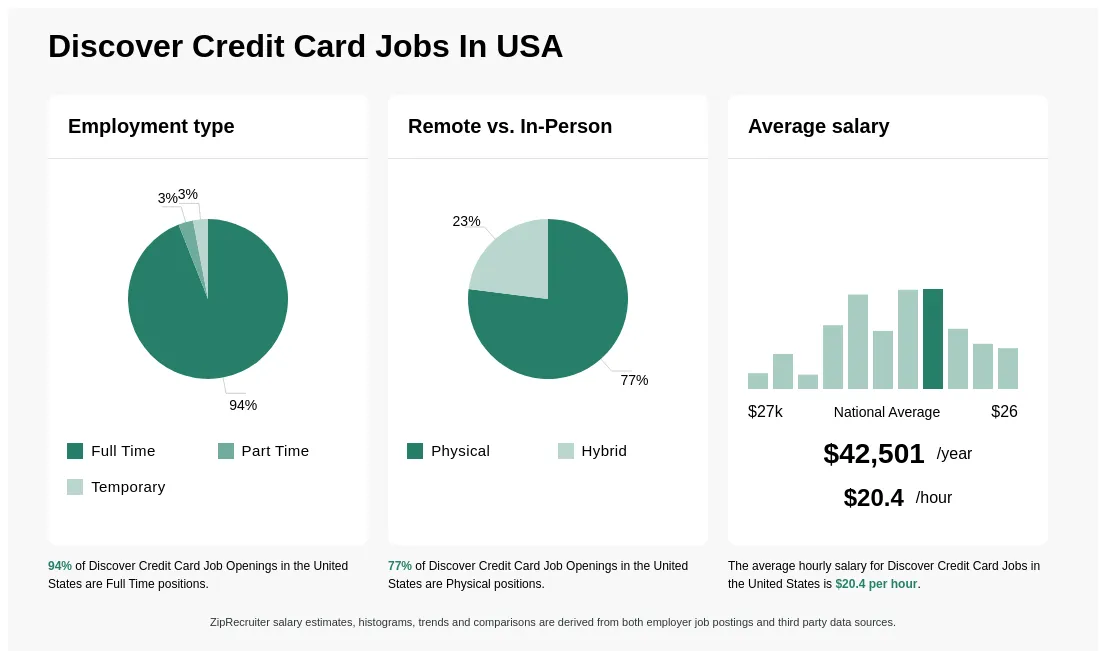

Discover Credit Card Jobs in the USA: Key Employment Insights

- 94% of Discover credit card job openings in the US are Full-Time roles, with only 3% Part-Time and 3% Temporary.

- 77% of these job openings are for Physical (on-site) roles, while 23% offer a Hybrid work setup.

- The average annual salary for these roles is $42,501, equivalent to $20.4 per hour, closely aligning with national averages.

Discover Financial Services

Discover Financial Services, the parent company of Discover Card, continues to demonstrate financial strength and strategic growth initiatives:

- In 2025, Discover Financial Services reached $137 billion in total assets, reflecting a 9.6% year-over-year increase.

- Net income climbed to $4.6 billion, supported by strong consumer spending and fee-based revenues.

- Discover’s digital push fueled a 17.3% growth in mobile app usage, reinforcing its tech-driven strategy.

- The company invested $880 million in marketing and acquisitions, up 10% from the previous year.

- Loan balances on Discover cards rose to $82 billion, a 6.5% increase in outstanding credit.

- Discover retained its A-credit rating, highlighting consistent financial health.

- The firm’s dividend yield remained attractive at 2.6%, maintaining steady investor appeal.

Discover Global Network

The Discover Global Network continues to expand its footprint and showcase its competitive edge in the payments industry:

- Discover Global Network now spans over 200 countries, partnering with 75 million merchants worldwide.

- The network processed $500 billion in transactions, reflecting a 7% increase from the previous year.

- Pulse, Discover’s debit network, supported over 1 billion transactions in the last fiscal year.

- Diners Club International, part of the Discover Global Network, has gained traction in Asia, recording a 15% growth in acceptance points.

- Over 5,000 financial institutions now issue cards on the Discover Global Network.

- Discover’s partnership with UnionPay expanded cardholder acceptance in China and Southeast Asia, increasing cross-border transaction volumes by 12%.

- The network supports 100+ currencies, enhancing its utility for international travelers and businesses.

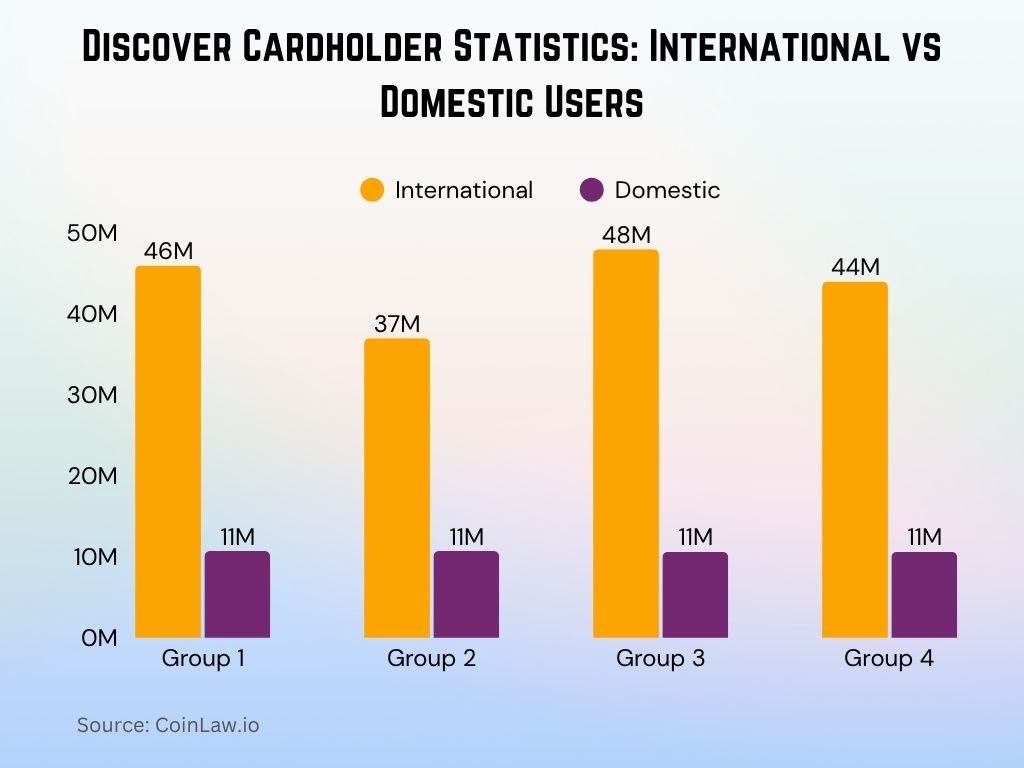

Discover Cardholder Statistics: International vs Domestic Users

- 46 million International Discover cardholders were recorded, compared to 10.7 million Domestic users, highlighting global dominance.

- A dip to 37 million International users occurred, while Domestic users stayed steady at 10.7 million.

- The highest number was seen with 48 million International cardholders, and 10.6 million Domestic users during the same period.

- International usage remained strong at 44 million, with Domestic users consistent at 10.6 million, showing stable local engagement.

Cardholder Demographics and Usage

Discover Cardholders reflect a broad demographic spectrum and are indicative of evolving consumer preferences:

- Millennials and Gen Z now represent 48% of Discover’s cardholder base, boosted by continued digital-first engagement.

- The average Discover cardholder has a $9,300 credit limit and spends $1,320 per month using the card.

- 87% of users say cashback rewards remain their top reason for choosing Discover.

- Zero foreign transaction fees led to a 12% increase in usage among frequent international travelers in 2025.

- Cardholders in California, Texas, and New York now make up 31.5% of total U.S. Discover card spending.

- 62% of new Discover accounts in 2025 were opened by consumers under 40, underscoring strong Gen Z and millennial appeal.

- Retail and e-commerce usage surged by 13.8%, reflecting sustained growth in online shopping behavior.

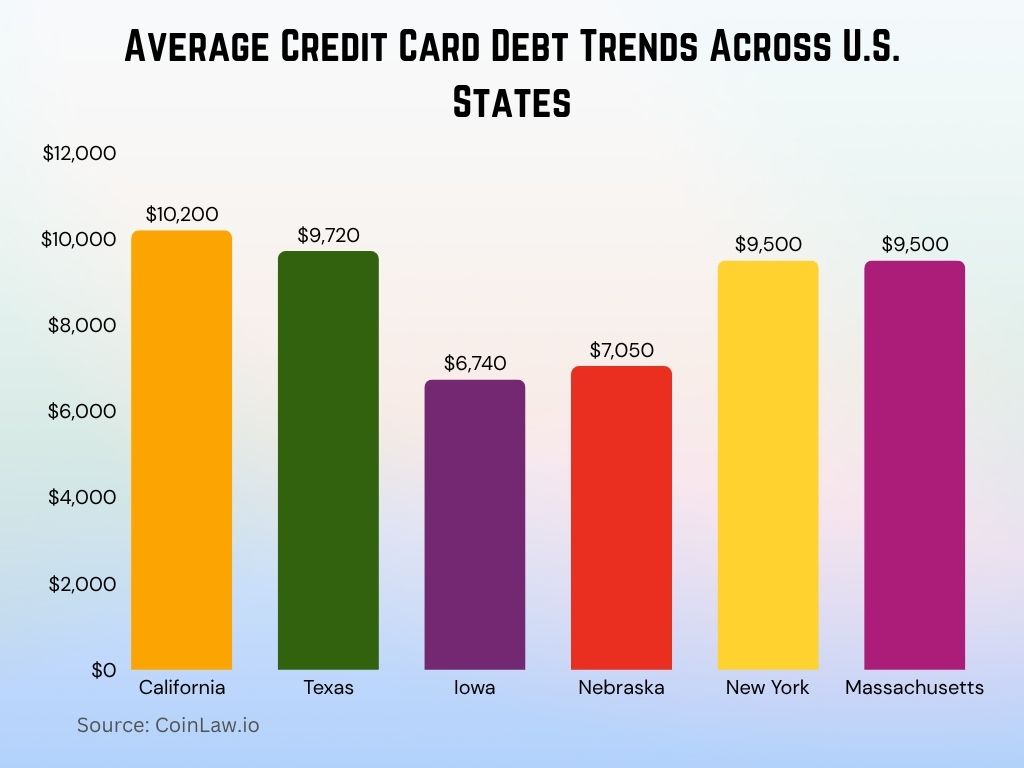

Average Credit Card Debt by State

Discover provides a lens into the credit card debt landscape, which varies significantly across the U.S.:

- The average Discover credit cardholder debt is $8,980, still below the national average of $9,350.

- California leads with an average credit card debt of $10,200, followed by Texas at $9,720.

- Iowa and Nebraska remain lower-debt states with averages of $6,740 and $7,050, respectively.

- High-cost states like New York and Massachusetts report average debts above $9,500 in 2025.

- Washington State saw a 6.2% decline in cardholder debt, aligned with stronger financial education efforts.

- Georgia and Florida experienced a 6.8% increase in debt due to rising consumer spending in 2025.

- Over 53% of Discover cardholders in high-debt states are now enrolled in structured payment plans.

Total Credit Card Debt Held by Americans

The total credit card debt in the U.S. remains a significant indicator of financial health, with Discover contributing insights:

- Total U.S. credit card debt hit $1.35 trillion in 2025, marking a 12.5% increase from the previous year.

- Discover cardholders now account for 6.7% of the total national credit card debt.

- 42% of Discover users report carrying balances month-to-month, mirroring national financial strain.

- Debt consolidation loans via Discover rose by 18%, helping reduce user interest burdens.

- Balance transfer activity jumped 28%, fueled by Discover’s continued 0% APR intro offers.

- The average household credit card debt for Discover customers reached $17,000, compared to the U.S. average of $16,100.

- 37% of Discover cardholders used cashback rewards to pay down debt, aiding in reducing balances.

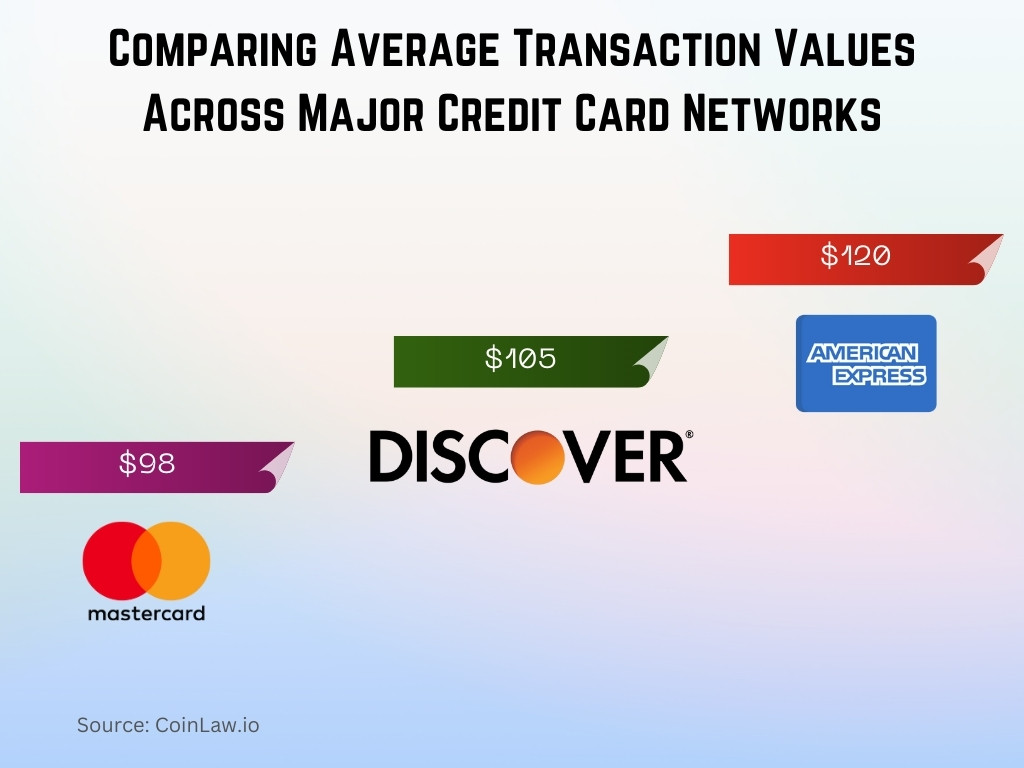

Major Credit Card Networks in the U.S.

Discover’s role in the U.S. credit card landscape aligns it with other significant networks:

- The Discover Global Network remains the fourth-largest U.S. card network, following Visa, Mastercard, and Amex.

- Discover holds 5.9% of U.S. credit card purchase volumes, out of a total of $5.4 trillion in 2025.

- Discover’s market share in card transactions rose by 0.8%, continuing its steady growth trajectory.

- The average Discover transaction value was $105, higher than Mastercard’s $98, but lower than American Express’s $120.

- Discover supports 16% of U.S. e-commerce payments, reflecting its growing adoption among online merchants.

- Unlike Visa and Mastercard, Discover provides full-service issuing and network operations, giving it an end-to-end advantage.

- Discover ranked #1 in customer satisfaction for fraud protection in 2025, ahead of all major competitors.

Recent Developments

- Discover expanded its Crypto Cashback Program, attracting over 120,000 new users and supporting multiple digital assets.

- The Discover Travel Card gained strong traction in 2025 with 5x rewards on travel and dining, appealing to a rising segment of Gen Z travelers.

- Discover’s integration with PayPal saw 31% of cardholders using cashback redemptions directly into their PayPal accounts.

- Discover increased its AI fraud prevention investment to $1.2 billion, helping cut fraud losses by 23% year-over-year.

- The company maintained carbon neutrality in 2025 and committed to net-zero emissions by 2030.

- Discover’s app added advanced real-time spend categorization with alerts, maintaining a 4.9-star rating across app stores.

- Discover’s financial literacy efforts reached 12.5 million Americans, with programs targeting credit repair and responsible borrowing.

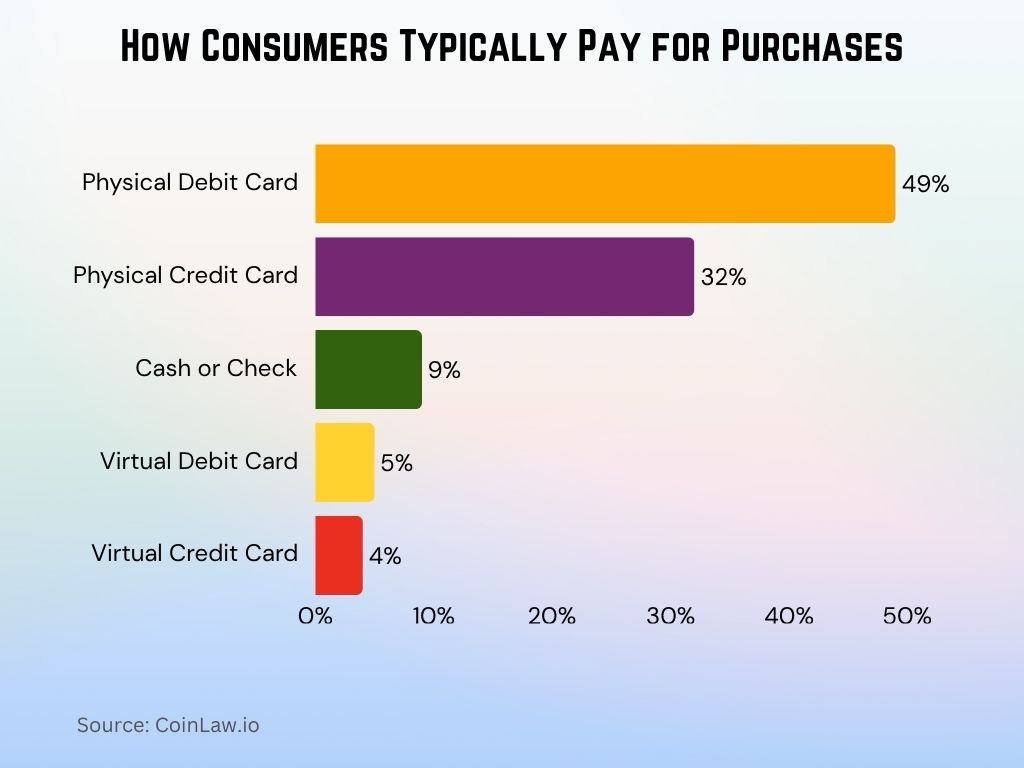

How Consumers Typically Pay for Purchases

- The most common method of payment is the Physical Debit Card, used by 49% of consumers with a bank account.

- 32% of consumers prefer to use a Physical Credit Card for their purchases.

- Only 9% of respondents still rely on Cash or Check as their primary payment method.

- Virtual Debit Cards are used by 5% of consumers, showing limited adoption of digital alternatives.

- The least common option is the Virtual Credit Card, chosen by just 4% of respondents.

Conclusion

Discover Card’s journey illustrates a dynamic landscape shaped by innovation, customer-centric strategies, and a commitment to financial empowerment. As credit markets evolve, Discover’s statistics reflect its significant role in driving consumer spending, managing credit risk, and fostering economic growth. From cashback rewards to sustainable practices, Discover continues to build a robust and forward-thinking presence in the financial sector.