Imagine a world where your entire financial toolbox fits snugly in your pocket. No bulky wallets, no overflowing purses, just a sleek, secure, and seamless digital solution. This vision is no longer a dream. Digital wallets have evolved from niche tech curiosities to everyday essentials, empowering millions to send, receive, and manage money effortlessly. The adoption of digital wallets continues to soar, fueled by cutting-edge technologies and consumer demand for convenience.

Editor’s Choice

- In 2025, digital wallets are expected to account for 49–56% of global e-commerce transaction value.

- Global digital wallet users are projected to reach 5.2 billion by 2026, representing over 60% of the global population.

- The global mobile payment market is projected to reach $4.97 trillion in 2025, driven by increased smartphone penetration and contactless adoption.

- China has an estimated 956 million digital wallet users in 2025, with 87.3% of smartphone users making proximity mobile payments.

- Southeast Asia records the fastest growth in mobile wallet adoption, with a projected 311% increase by 2025.

- In the U.S., nearly 70% of online adults use digital payments, but fewer than 60% of small businesses accept digital wallets.

- Global crypto transaction volume is projected to reach $10.8 trillion in 2025, highlighting stronger integration between crypto and digital wallets.

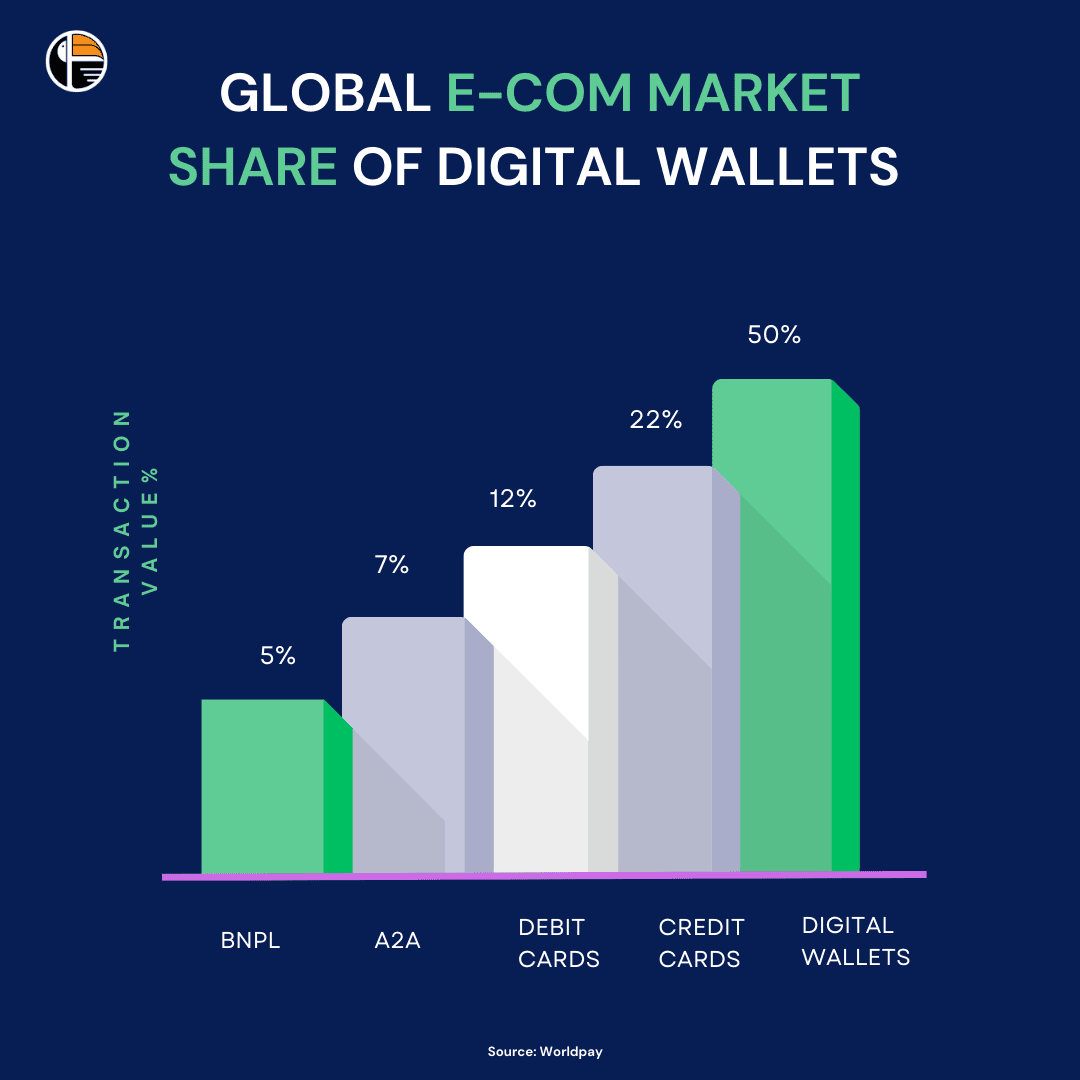

Global E-Commerce Market Share of Digital Wallets

- Digital wallets dominate global e-commerce with a 50% share of total transaction value in 2025.

- Credit cards follow at 22%, maintaining strong use among traditional online shoppers.

- Debit cards account for 12%, showing steady but moderate adoption compared to digital wallets.

- Account-to-account (A2A) payments capture 7%, reflecting growing use of direct bank transfers.

- Buy Now, Pay Later (BNPL) options represent 5%, highlighting emerging but still niche consumer interest.

Global Digital Wallet User Statistics

- The global digital wallet user base hit 5.6 billion in 2025, covering about two-thirds of the world’s population.

- Forecasts now expect 6.2 billion users by 2026, fueled by surging adoption in emerging markets.

- In China, 90%+ of urban adults regularly use a digital wallet, solidifying it as a leading penetration market.

- In India, digital wallet transactions grew by 75% in 2024, largely driven by expanding UPI and fintech adoption.

- In Europe, 52% of online shoppers now favor digital wallets over legacy payment methods.

- African markets continue rapid growth with active mobile money users increasing by 35% in 2024.

- Latin American digital wallet adoption is rising at 50% annually, led by Brazil and Mexico.

Digital Wallet Transaction Volume and Value

- Global digital wallet transaction value is projected to hit $14–16 trillion in 2025.

- The average transaction size per user is estimated to rise by 18% in 2025.

- In Asia, annual digital wallet transactions per capita are expected to reach $3,800 in 2025.

- Cross-border transactions via digital wallets are forecast to grow by 45% in 2025.

- Contactless payments in physical stores are projected to increase by 40% in 2025, with digital wallets accounting for 75% of those.

- In the U.S., digital wallet usage at point-of-sale terminals is predicted to reach 45% in 2025.

- Subscription services globally now see 80% of users paying via digital wallets in 2025.

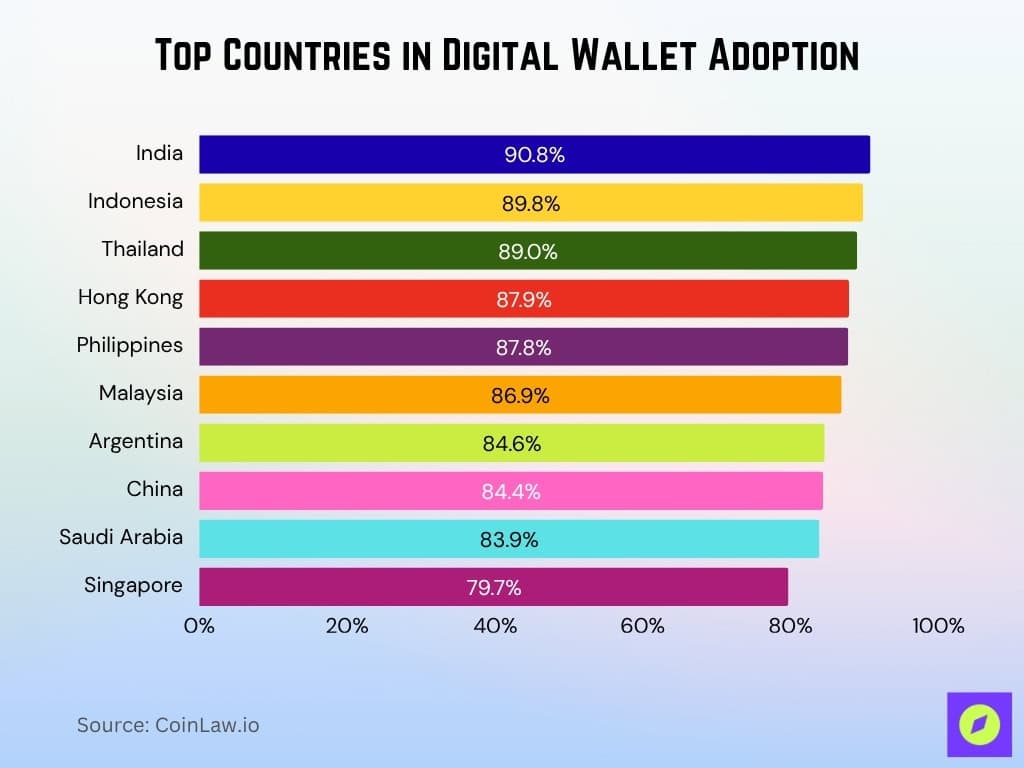

Top Countries in Digital Wallet Adoption

- India leads globally with a 90.8% digital wallet penetration rate, showcasing its rapid fintech integration.

- Indonesia follows closely at 89.8%, driven by widespread mobile payment platforms and e-commerce growth.

- Thailand records an 89.0% adoption rate, highlighting strong uptake among both urban and rural users.

- Hong Kong achieves 87.9% penetration, supported by advanced digital infrastructure and cashless incentives.

- Philippines reaches 87.8%, reflecting a surge in mobile banking and government-led financial inclusion efforts.

- Malaysia reports 86.9% adoption, with users increasingly shifting to QR and contactless payments.

- Argentina shows 84.6% usage, as digital wallets become essential amid inflation and currency volatility.

- China remains a leader with 84.4%, sustained by established ecosystems like Alipay and WeChat Pay.

- Saudi Arabia records 83.9%, fueled by Vision 2030’s cashless economy initiatives.

- Singapore stands at 79.7%, reflecting high consumer trust in secure, multi-platform digital payments.

Digital Wallet Market Share Statistics

- PayPal is expected to maintain around 20–25% of global digital wallet transaction volume in 2025, particularly strong in North America and Europe.

- Apple Pay and Google Pay together capture around 30–35% of mobile wallet transactions globally in 2025.

- In China, Alipay and WeChat Pay retain dominance with a combined share exceeding 90% in the local digital wallet market in 2025.

- In Europe, PayPal leads while Klarna has grown to hold about 12–15% of the wallet market in 2025.

- Startups like Revolut are still expanding strongly, with user bases growing by about 25–30% in 2025.

- Crypto wallets such as MetaMask now hold close to 5–7% of the global digital wallet market in 2025.

- By the end of 2025, digital wallets are projected to manage over 20% of total global consumer spending.

Mobile Payment Market Statistics

- The global mobile payment market size is projected to hit $4.97 trillion in 2025.

- The contactless payment sector is forecast to grow by around 35% in 2025.

- Mobile payments are expected to account for ~63% of all e-commerce transactions globally in 2025.

- In North America, about 78% of smartphone users are projected to make at least one mobile payment in 2025.

- QR code payments remain dominant in Asia, with over 70% of users in China and India depending on them in 2025.

- The peer-to-peer (P2P) payment market is forecast to grow by ~30% in 2025.

- Subscription-based services are likely to have 50% of their payments processed via mobile wallets in 2025.

- In Europe, neobank mobile apps like Monzo and N26 may see 25% user growth in 2025.

- Latin America’s mobile payment market is expected to expand by ~40% in 2025.

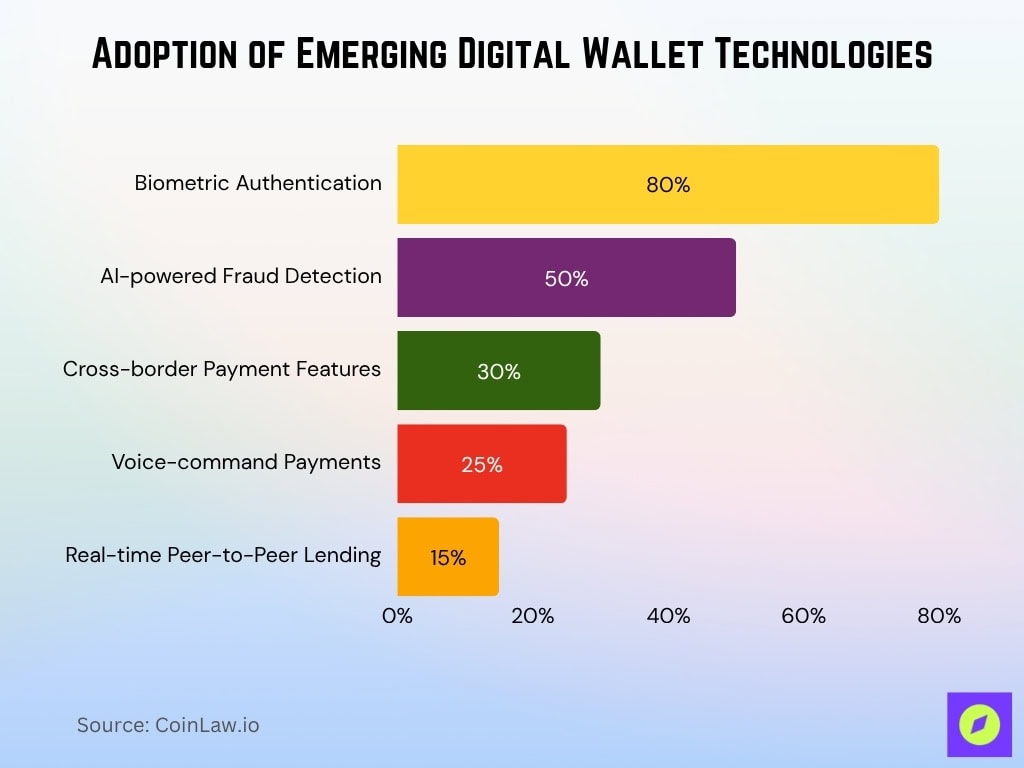

Technological Innovations and Trends in Digital Wallets

- Biometric authentication is adopted by ~80% of digital wallets globally in 2025, improving security.

- AI-powered fraud detection systems are implemented in ~50% of wallets in 2025.

- Cross-border payment features are available in ~30% of wallets offering seamless currency conversion in 2025.

- Voice-command payments reach ~25% adoption in 2025, especially among smart device users.

- Real-time peer-to-peer lending features are integrated in ~15% of wallets globally in 2025.

Consumer Digital Wallet Preferences

- Security and convenience remain top drivers, with ~88% of users in 2025 citing them as critical reasons.

- 70% of global users now prefer wallets that integrate loyalty and rewards programs in 2025.

- Contactless tap-and-pay is the most used feature, with ~75% of users leveraging it in 2025.

- In the U.S., about 65% of consumers expressed strong trust in tech giants like Apple and Google for digital wallet services in 2025.

- Biometric authentication is favored by ~78% of global users in 2025 for improved security.

- Cross-platform compatibility is important to ~62% of users who want wallets working on both Android and iOS in 2025.

- Among U.S. users aged 18-25, ~45% prioritize cryptocurrency integration in wallets in 2025.

- Over 35% of Europeans in 2025 express interest in sustainability features (e.g., carbon tracking) in their wallets.

- Globally, women make up ~57% of mobile wallet users in 2025, influenced by their preference for usability and budgeting tools.

Major Digital Wallet Providers and Market Penetration

- Apple Pay leads in the U.S. with about 49% market penetration in 2025.

- Alipay and WeChat Pay dominate China with a combined share exceeding 90% of that market in 2025.

- In Europe, PayPal holds around 25% of the digital wallet market share in 2025.

- In India, PhonePe and Google Pay collectively capture about 75% of the market in 2025.

- Samsung Pay maintains popularity in South Korea, holding around 18% of users in 2025.

- In Latin America, MercadoPago leads in markets like Brazil and Mexico with rising dominance in 2025.

- In Africa, M-Pesa reports 50 million active users in 2025, reflecting about 22% year-over-year growth.

- In the U.S., Cash App remains favored by Gen Z, with 64% of under-25 users actively using it in 2025.

- Crypto wallets like MetaMask and Trust Wallet grew ~35% in user count globally in 2025.

Challenges and User Experience in Digital Wallet Usage

- 27% of users in 2025 cite interoperability as a barrier and favor wallets that function across multiple platforms.

- Limited internet access affects ~25% of potential users in developing and rural regions in 2025.

- 35% of users report difficulty recovering wallet access after losing their devices in 2025.

- Transaction delays remain a top complaint, cited by ~18% of cross-border wallet users in 2025.

- Onboarding complexity is flagged by ~22% of first-time users in 2025, underscoring the need for simplified UI.

- ~5% of wallet users globally in 2025 experienced failed payments due to system outages.

- High transaction fees deter about 15% of users from frequent low-value wallet transactions in 2025.

- ~40% of consumers express concern over limited merchant acceptance of digital wallets in smaller towns in 2025.

- Educating older users remains difficult, with ~20% of old people in the U.S. still unfamiliar with wallet technologies in 2025.

Security, Privacy, and Regulatory Landscape

- In 2025, around 88% of users globally list digital wallet security as a top priority.

- Two-factor authentication (2FA) is standard in ~98% of major wallets in 2025.

- European regulations (e.g., PSD2 updates) will continue enforcing strong authentication for all payment providers in 2025.

- The U.S. reports a ~30% decline in digital payment fraud cases in 2025 following advanced security measures.

- Privacy remains important, with ~65% of users preferring wallets that minimize data collection.

- In 2025, over $1.5 billion is estimated to be spent globally on improving wallet security systems (e.g., encryption, secure protocols).

- Biometric privacy laws have expanded in regions like Canada and the EU, ensuring ethical use of facial/fingerprint recognition in 2025.

- Crypto wallets saw ~4% of them compromised in 2025 due to vulnerabilities in smart contract integrations.

- Tokenization technology is implemented in ~60% of wallets globally in 2025 to anonymize and secure payment data.

Recent Developments

- Digital wallets are projected to make up > 50% of global e-commerce transaction value in 2025.

- The global mobile wallet user base is forecasted to reach 4.3 billion in 2025, surpassing half the world’s population.

- In Southeast Asia, mobile wallet usage is expected to grow by ~311% by 2025, driven by e-commerce and super-apps.

- Apple Pay is projected to process $1.2 to $2 trillion in annual transaction volume by 2025, based on current growth rates and market penetration.

- Real-time payments gains with digital wallets are highlighted by a record $10 million instant payment in February 2025 via The Clearing House’s RTP®.

Frequently Asked Questions (FAQs)

About 5.2 billion users worldwide.

53% of e-commerce transactions were paid with digital wallets.

2.1 billion registered accounts and $1.68 trillion in annual transaction value in 2024.

14.22% market share of online payments.

Conclusion

The digital wallet revolution is here to stay, with adoption rates and technological advancements reshaping global finance. The focus is on enhancing user experience, security, and inclusivity while tapping into untapped markets. With innovations such as AI-powered fraud detection, blockchain integration, and biometric security, the future of digital wallets is both exciting and promising. As consumers demand faster, safer, and more convenient solutions, digital wallets are set to redefine how the world manages money in the years ahead.