In recent years, digital lending platforms have transformed the financial landscape, offering quick and convenient access to loans through online platforms and mobile apps. Imagine a small business owner needing immediate funds to cover a sudden expense. Instead of waiting weeks for a traditional bank to process a loan, they can turn to a digital lending platform and receive approval in hours or even minutes. This shift towards digital lending isn’t just about speed; it’s about making financial services more accessible and adaptable to today’s fast-paced world.

As we step into 2025, the digital lending sector continues to evolve, with new technologies and trends shaping its future. Below, we’ll explore the most critical statistics and insights to understand the current and upcoming landscape of digital lending.

Key Takeaways

- 1The embedded lending market will grow from $9.1 billion in 2025 to $45.74 billion by 2034 at a 20.1% CAGR.

- 2BNPL services are projected to expand at a 40.2% CAGR through 2030 as flexible payment demand rises.

- 3Nearly 85% of traditional banks now partner with digital lenders to streamline services and extend customer reach.

- 472% of millennials favor digital lending for its convenience, speed, and transparent processes.

Market Growth Factors

- Convenience and speed remain key drivers, with 92% of digital loan applicants citing ease of access over traditional methods.

- Smartphone penetration continues to fuel adoption as 88% of digital lending transactions in 2025 are initiated on mobile devices.

- AI and machine learning have cut loan approval times by up to 65% compared to traditional underwriting processes.

- In emerging markets, over 46% of digital borrowers were previously unbanked or underbanked, especially in Southeast Asia and Africa.

- Lower operational costs help digital lenders offer rates that are 1.5–2.5% below those of traditional financial institutions.

- 55% of SMEs in developed regions turned to digital lending in 2025 to address funding gaps and working capital needs.

- Government-led financial inclusion efforts in India, Brazil, and Nigeria boosted access to loans via public-private digital lending partnerships.

Global Market Growth of Digital Lending Platforms

- The digital lending platform market is projected to reach $19.37 billion in 2025.

- The market is expected to grow at a CAGR of 23.7% over the forecast period.

- By 2029, the market size is forecasted to hit $45.29 billion.

- The steady annual increase indicates a strong global demand for streamlined, tech-driven lending solutions.

Market Scope and Segmentation

- Digital lending platforms continue to serve a wide range of loan types, each showing distinct 2025 growth trends across global markets.

- Personal loans account for 50% of total digital lending volume in 2025, remaining the most sought-after product.

- Business loans make up 39% of transactions in 2025, largely driven by SMEs seeking fast and flexible funding.

- Student loan refinancing on digital platforms grew by 21% in 2025 as graduates pursue lower interest and extended terms.

- Peer-to-peer (P2P) lending holds a 19% market share, favored by borrowers seeking non-institutional financing.

- Microloans represent 28% of digital loans in Africa and Southeast Asia, expanding financial access for the underserved.

- Digital mortgages are set to surpass $56 billion globally by 2026, thanks to fast processing and competitive rates.

- In 2025, average loan sizes remain at $20,500 for business loans and around $5,200 for personal loans in the US.

- Short-term loans of 1–2 years comprise 67% of issued digital loans in 2025 due to their flexibility and repayment ease.

- Digital auto loans grew by 16% year-over-year, gaining popularity in the US and Europe through simplified online approvals.

- The BNPL segment saw a 49% increase in 2025 transactions, especially among Gen Z and millennial consumers.

Regional Market Share of Digital Lending Platforms

- North America leads the global market with a 35% share, reflecting its mature fintech infrastructure and high digital adoption.

- Europe holds a significant 29% market share, driven by strong regulatory support and rising demand for alternative lending.

- Asia Pacific accounts for 24%, showing rapid growth fueled by increased smartphone penetration and underserved banking populations.

- Latin America contributes 8%, highlighting emerging opportunities in digital lending solutions across the region.

- Middle East and Africa (MEA) represents 4%, indicating a developing but gradually expanding digital lending landscape.

Technological Innovations and Advancements

- Innovation remains central to digital lending as platforms adopt advanced tech to improve risk assessment and approval processes.

- AI-powered underwriting is now used by 93% of digital lending platforms, enabling faster and more precise loan decisions.

- Blockchain technology is integrated by 35% of platforms to boost security and transaction transparency.

- Machine learning has cut default rates by 28% by enhancing credit assessments through real-time behavioral data.

- Digital ID verification tools have reduced fraud by 43%, strengthening trust and platform integrity.

- Chatbots and virtual assistants are deployed by 64% of platforms to deliver instant borrower support.

- Voice-based loan applications are being tested by 15% of platforms as part of their user experience upgrades.

- Robotic process automation (RPA) is used by 32% of digital lenders to minimize manual tasks and boost efficiency.

- Predictive analytics is used by 40% of companies to personalize loan offers and predict borrower behavior.

- IoT data integration is helping platforms in credit scoring where traditional data is limited, especially in underserved regions.

- 5G technology is enhancing mobile lending with faster, more seamless user experiences across devices.

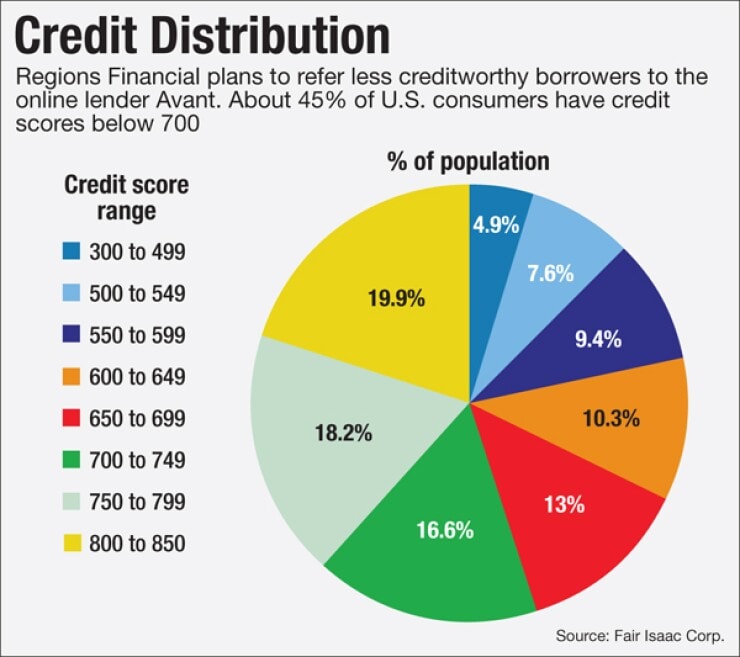

Credit Score Distribution Among U.S. Consumers

- Around 45% of U.S. consumers have credit scores below 700, indicating a large subprime market.

- Only 4.9% of the population has very poor scores between 300 to 499.

- 7.6% fall in the 500 to 549 range.

- 9.4% have credit scores between 550 to 599.

- 10.3% are within the 600 to 649 range.

- 13% are moderately near-prime with scores from 650 to 699.

- 16.6% fall in the 700 to 749 bracket, considered good credit.

- A strong 18.2% of Americans have very good scores between 750 to 799.

- The largest segment, 19.9%, holds excellent credit scores ranging from 800 to 850.

Consumer Adoption and Usage Patterns

- Consumer adoption of digital lending continues to climb in 2025, especially among younger users seeking speed and affordability.

- Millennials and Gen Z now make up 73% of platform users, drawn by instant approvals and easy access to loans.

- Customer satisfaction averages 90% on digital lending platforms due to convenience, transparency, and speed of service.

- The average user age is 34, showing strong adoption among digitally native and mobile-first consumers.

- 52% of borrowers turn to digital platforms for emergency expenses, with others using them for business or debt consolidation.

- Repeat usage hits 68%, proving high trust and reliability among returning digital loan applicants.

- Mobile apps account for 78% of transactions in 2025, emphasizing the need for mobile-first design.

- Rural usage rose by 23% in 2025 as limited banking access pushes users toward digital lending alternatives.

- The average personal loan amount is $5,200, while business loans average $16,000 on digital platforms.

- Approval rates reach 87% as platforms use advanced analytics and alternative data for smarter risk decisions.

- 42% of users first discover digital lenders via social media ads, highlighting the role of targeted digital marketing.

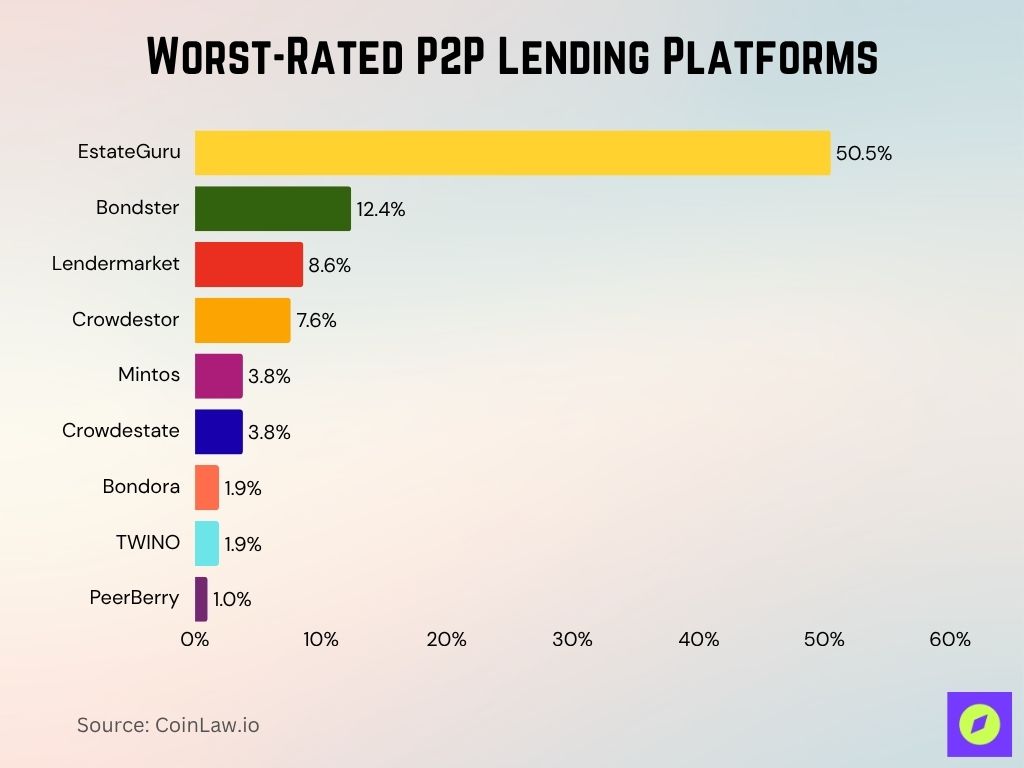

Worst-Rated P2P Lending Platforms

- EstateGuru was voted the worst P2P platform, receiving a staggering 50.5% of the negative feedback from the P2P Empire community.

- Bondster followed with 12.4%, signaling widespread user dissatisfaction.

- Lendermarket came third with 8.6%, raising red flags for potential investors.

- Crowdestor received 7.6%, pointing to notable concerns among users.

- Mintos and Crowdestate both garnered 3.8% each in negative ratings.

- Bondora and TWINO had equal criticism at 1.9%.

- PeerBerry was the least criticized, but still appeared on the list with 1.0%.

These results are based on a May 2025 community poll, highlighting platforms with persistent performance or trust issues.

Recent Developments in the Digital Lending Market

- Block Inc. shares dipped 7% amid consumer spending concerns, but its BNPL unit remains key with the market projected to hit $165 billion by 2032.

- Monzo posted a £22 million pre-tax profit in 2025 and now targets global expansion with a revised valuation of $6.3 billion.

- Bankwest launched a digital-only app for older Australians, reinforcing its branchless strategy to streamline mobile banking experiences.

- Private credit is going mainstream as Australia’s $4.2 trillion superannuation sector fuels retail investor interest in this space.

- The embedded finance market is on track to grow at a CAGR of 37.2%, reaching $695 billion by 2030 as demand rises for seamless financial services.

Conclusion

Digital lending platforms are revolutionizing the financial sector by making credit more accessible, fast, and tailored to individual needs. As we move through 2025 and beyond, the industry is poised for further expansion and transformation. The rise of AI, blockchain, and alternative data sources is not just a trend; they’re reshaping how lending operates worldwide. As regulatory frameworks evolve and more consumers shift online, digital lending is set to become even more integral to the global economy. For borrowers, this means faster, more customized, and increasingly secure financing options that align with their digital-first lifestyles.