In recent years, the rise of digital currencies has captured the world’s attention, evolving from niche technological concepts to mainstream financial assets. The journey of cryptocurrencies, from Bitcoin’s launch in 2009 to the explosive market growth and the spread of Central Bank Digital Currencies (CBDCs), is reshaping the financial landscape globally.

With this year poised to bring even more breakthroughs, it’s essential to understand the current statistics and trends that define this dynamic space. This article provides a comprehensive look at the latest data and insights, guiding you through the numbers and key developments shaping digital currency today.

Editor’s Choice

- Crypto assets are most popular in Asia, accounting for 60% of global users, surpassing North America’s base.

- 30% of American adults own crypto, with 61% of owners planning to buy more.

- 741 million people own crypto, or ~9% of the global population.

- The Bitcoin network averages 566,873 transactions per day.

- 38% of individuals avoid crypto investing due to unclear regulations.

Recent Developments

- 27% of central banks have paused their CBDC plans, though many target rollout within 3–5 years.

- Crypto thefts reached $3.4 billion, with North Korean-linked actors stealing $2.02 billion or 59% of total funds.

- Cryptocurrency payment usage in the U.S. grew 82% year-over-year.

- Bitcoin leads 24-hour trading volume at $17.9 billion, outperforming Ethereum ($9.5 billion) and Tether ($42.2 billion).

- Global crypto owners reached 861 million, up 35% year-over-year, led by Asia and South America.

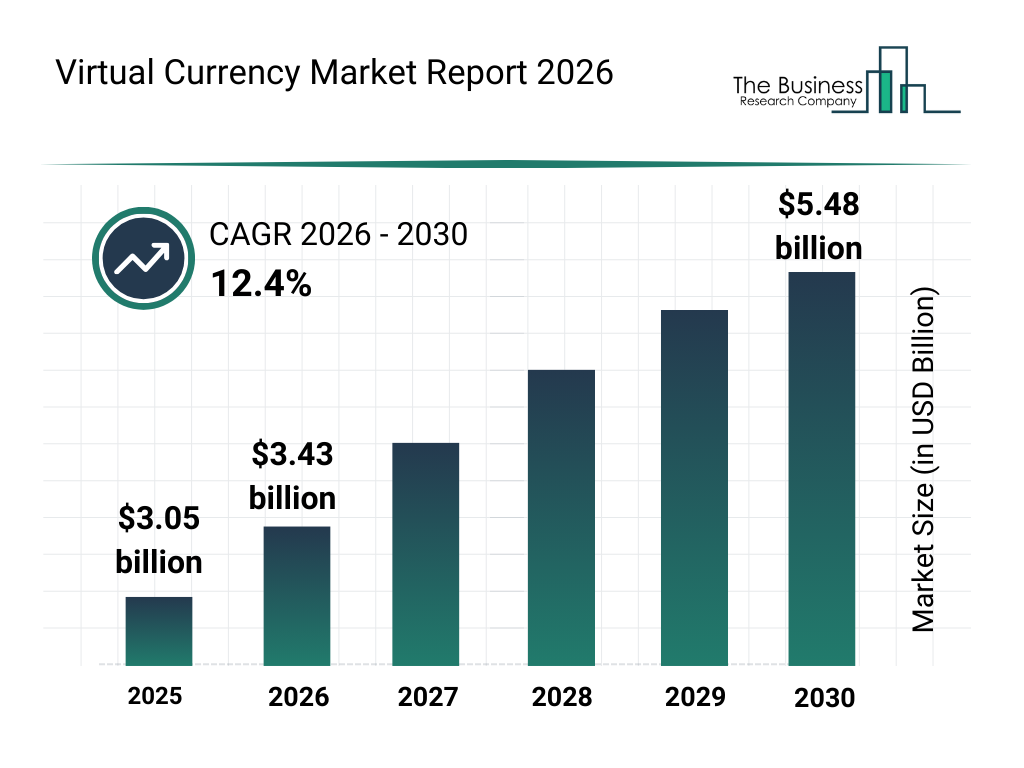

Virtual Currency Market Growth Forecast

- The global virtual currency market was valued at $3.05 billion in 2025, showing strong early adoption.

- The market is expected to grow to $3.43 billion in 2026, indicating steady year-over-year expansion.

- By 2027, the market size will reach about $3.85 billion, driven by wider use of digital assets.

- Growth continues in 2028, with the market projected at roughly $4.30 billion.

- The industry is forecast to climb to nearly $4.90 billion in 2029, reflecting rising investment and adoption.

- By 2030, the market is expected to hit $5.48 billion, almost doubling from 2025 levels.

- The market is projected to grow at a strong 12.4% CAGR from 2026 to 2030, showing sustained long-term momentum.

Global Adoption Rates of Cryptocurrencies

- Over 741 million people worldwide hold cryptocurrency, with strong growth in Latin America, Africa, and Southeast Asia.

- Vietnam leads per-capita adoption at 21.2% of its population using crypto assets.

- El Salvador sees 35% of its population using Bitcoin, aided by remittances and government programs.

- Nigeria’s crypto usage reaches 41% of adults for inflation hedging and payments.

- U.S. millennials report 36% crypto ownership, leading generational engagement.

- In Africa, 84% of crypto transactions occur via mobile platforms.

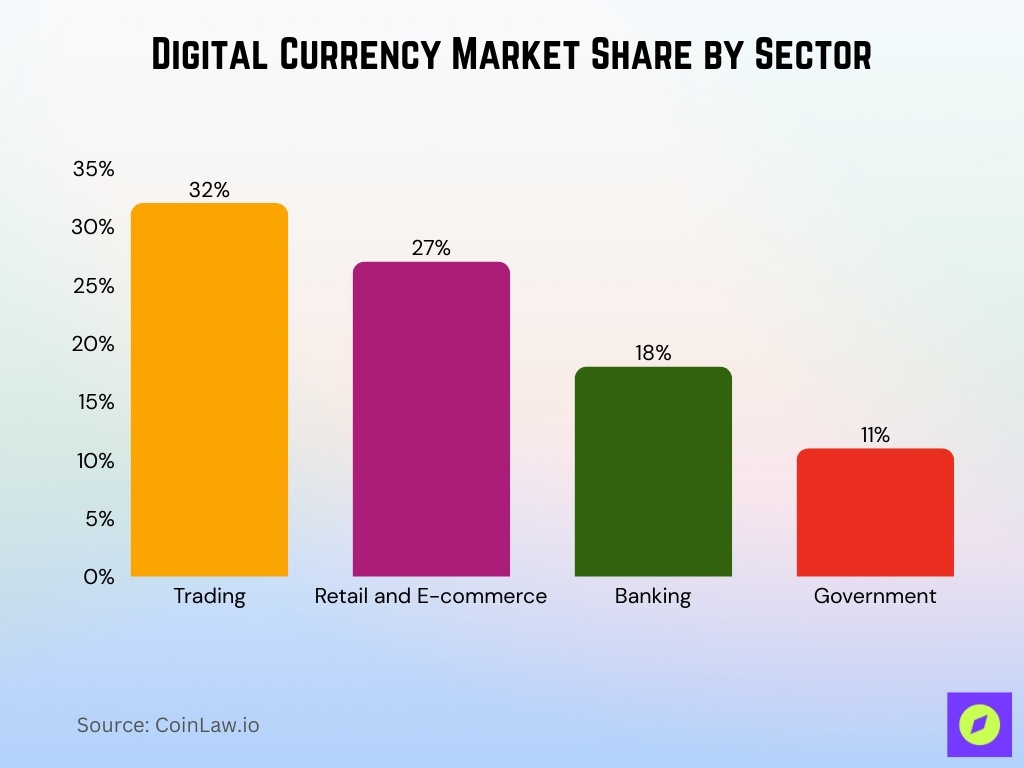

Digital Currency Market Share by Sector

- Trading leads the market with 32%, making it the largest use of digital currencies.

- Retail and e-commerce hold 27%, showing strong growth in online payments and shopping.

- Banking accounts for 18%, as financial institutions adopt digital assets and services.

- Government use stands at 11%, reflecting adoption for regulation, payments, and public services.

- The data shows that commercial activities dominate, while public sector use remains smaller.

Popular Cryptocurrencies by Ownership and Use

- Bitcoin (BTC) is owned by 52% of crypto holders globally as a store of value.

- Ethereum (ETH) ranks second, held by 36% of investors for DeFi and NFTs.

- Tether (USDT) sees daily trading volumes exceeding $98 billion for transactions.

- Binance Coin (BNB) drives 20% of Binance trading volume with utility incentives.

- Ripple (XRP) partners with 300+ financial institutions for payments.

- Cardano (ADA) boasts ~4.83 million unique wallets in developing regions.

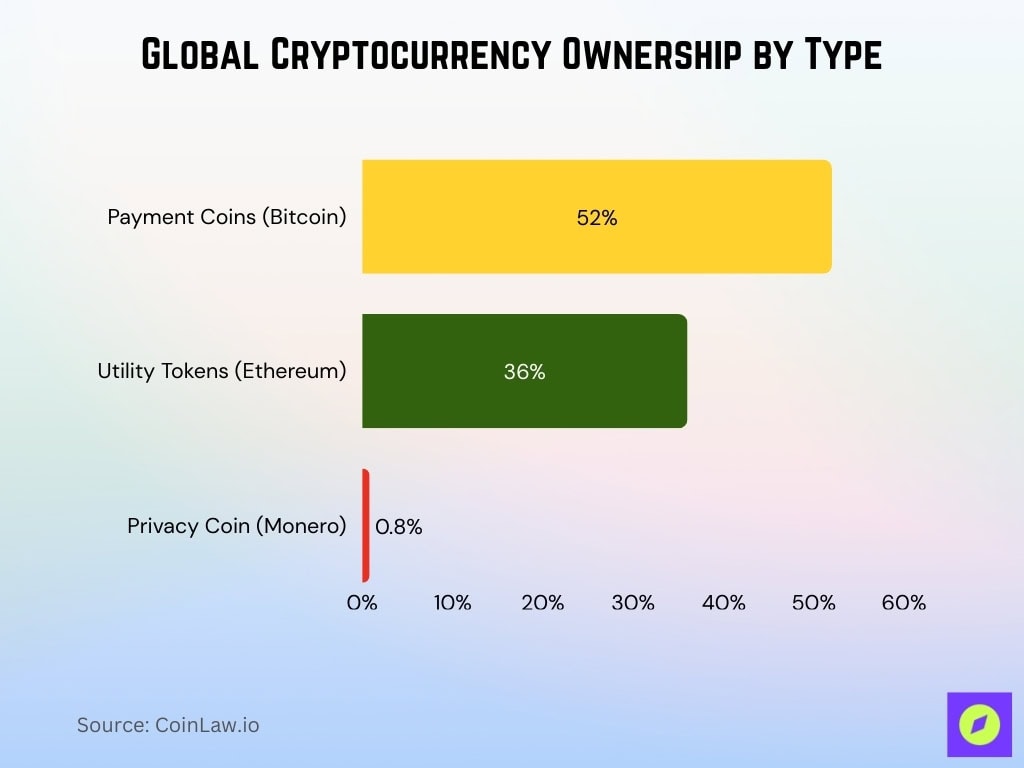

Types of Cryptocurrency

- Payment coins like Bitcoin dominate with 52% global crypto ownership for transactions.

- Utility tokens like Ethereum power 36% of investor portfolios via smart contracts.

- Privacy coin Monero (XMR) leads in anonymity with 0.8% market share.

- Stablecoins, including USDT and USDC, process $98 billion daily volume.

- DeFi tokens like Uniswap (UNI) support $150 billion in locked value.

- NFT tokens FLOW and CHZ enable 2.1 million daily trades.

- Governance tokens MakerDAO (MKR) govern $9.2 billion in assets.

- Memecoin Dogecoin (DOGE) claim 17% retail ownership amid volatility.

Technological Innovations in Digital Currencies

- ZK-rollups on Ethereum handle 2,000+ TPS with full privacy proofs.

- Polkadot connects 100+ parachains for seamless cross-chain transfers.

- Uniswap V4 DEX volume exceeds $300 billion annually, with no intermediaries.

- NFT marketplaces in the Metaverse record 5 million monthly active users.

- Blockchain IDs serve 150 million unbanked with verified identities.

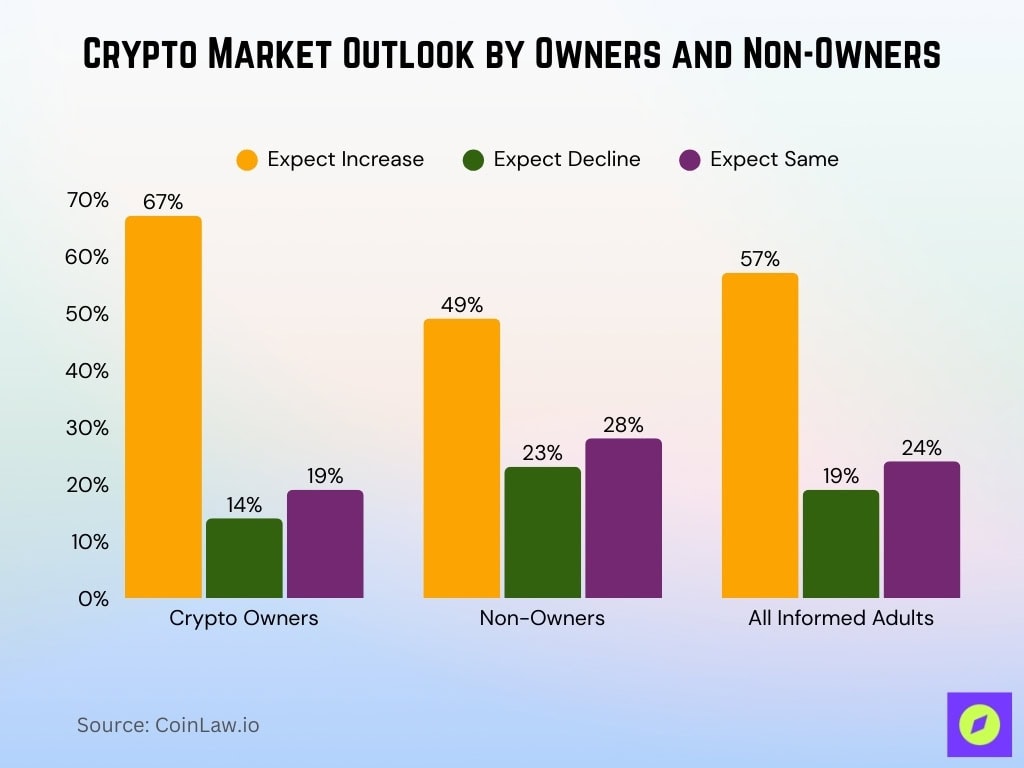

Crypto Market Sentiment

- 67% of crypto owners expect the market to increase.

- 14% of owners believe the market will decline.

- 19% of owners think the market will stay the same.

- 49% of non-owners anticipate an increase.

- 23% of non-owners foresee a decline.

- 28% of non-owners expect stability.

- 57% of all informed adults expect market growth.

- 19% of all predict a drop.

- 24% of all expect the market to stay the same.

Cryptocurrency Statistics: Investors and Demographics

- Millennials comprise 57% of U.S. crypto owners, Gen Z 13%.

- 39% of global crypto holders are female, up from prior years.

- Institutional holdings reach $1.2 trillion, led by BlackRock ETFs.

- Retail investors represent 72% of global crypto trading volume.

- In Africa, 65% of crypto users are under 30, hedging against inflation.

- 88% of crypto users reside in urban metropolitan areas.

- 35% of U.S. crypto holders earn over $100,000 annually.

Frequently Asked Questions (FAQs)

Only 2.6% of the population is expected to use cryptocurrency payments in 2026.

Stablecoins are on track to exceed $500 billion in market capitalization by 2026.

Roughly one in five U.S. adults has invested in, traded, or used cryptocurrency at some point.

Conclusion

The digital currency has transformed from a speculative asset class to an influential financial force with far-reaching impacts on global finance, technology, and culture. Digital assets are becoming more integrated into everyday financial activities, regulatory frameworks are solidifying, and new technologies are enhancing blockchain’s efficiency and security.

While challenges like environmental impact and regulatory uncertainty remain, the shift towards sustainable practices and widespread adoption signals a positive future for the digital currency ecosystem. Whether it’s institutional investors, retail adopters, or national governments, stakeholders worldwide are taking steps to harness the potential of digital currency, positioning it as a key driver in the future of finance.