The transformation of traditional banking into a digital-first experience has been rapid and expansive over the past decade. What started as simple online transactions has now morphed into fully digital banking solutions that can be accessed from any location at any time. This shift has been driven by consumer demand for convenience, security, and speed. Today, digital banking is no longer just a novelty; it’s a necessity for millions of users worldwide.

Editor’s Choice

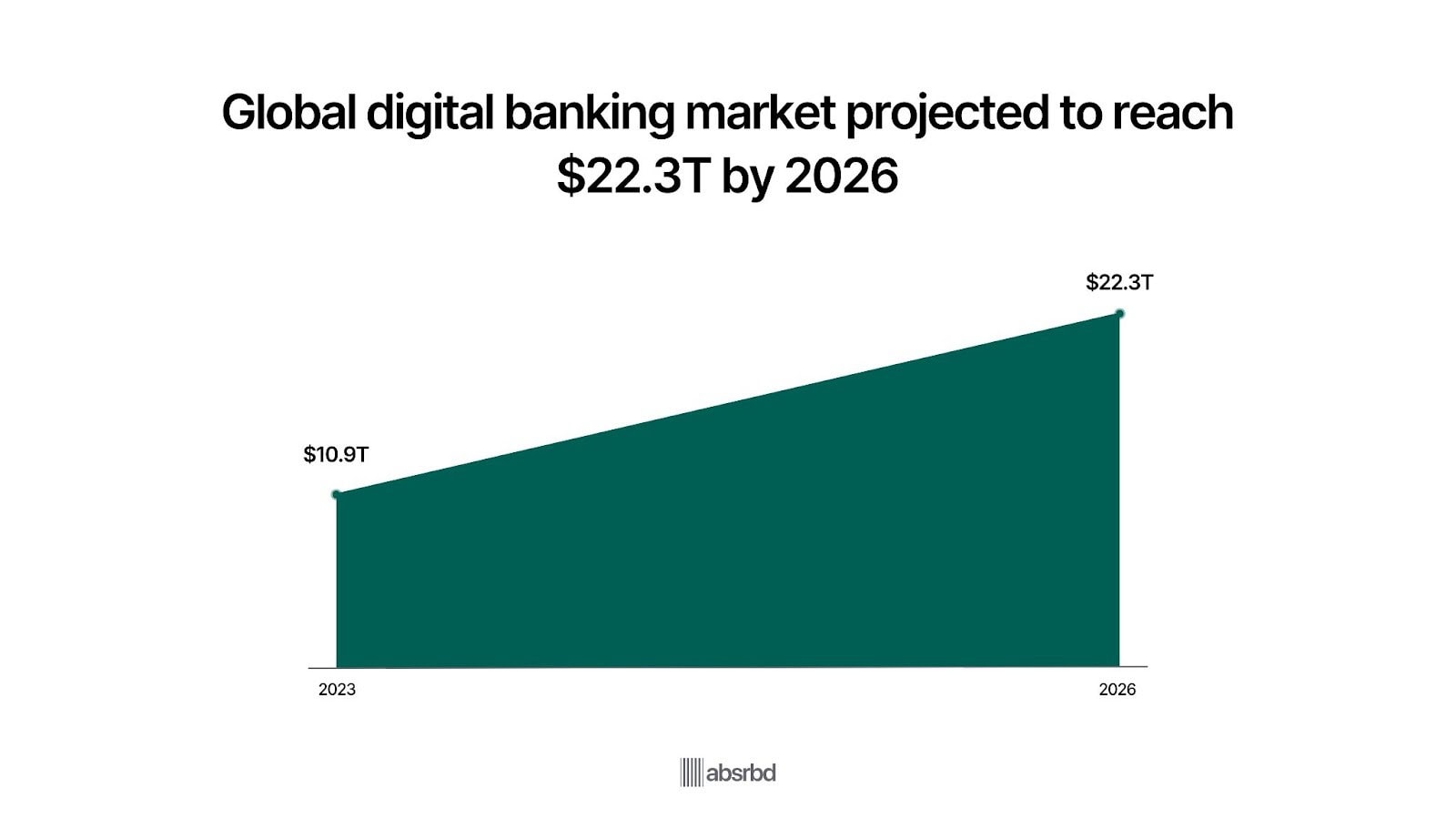

- Over 76% of global consumers now use some form of digital banking, with the market projected to reach $22.3 trillion by 2026.

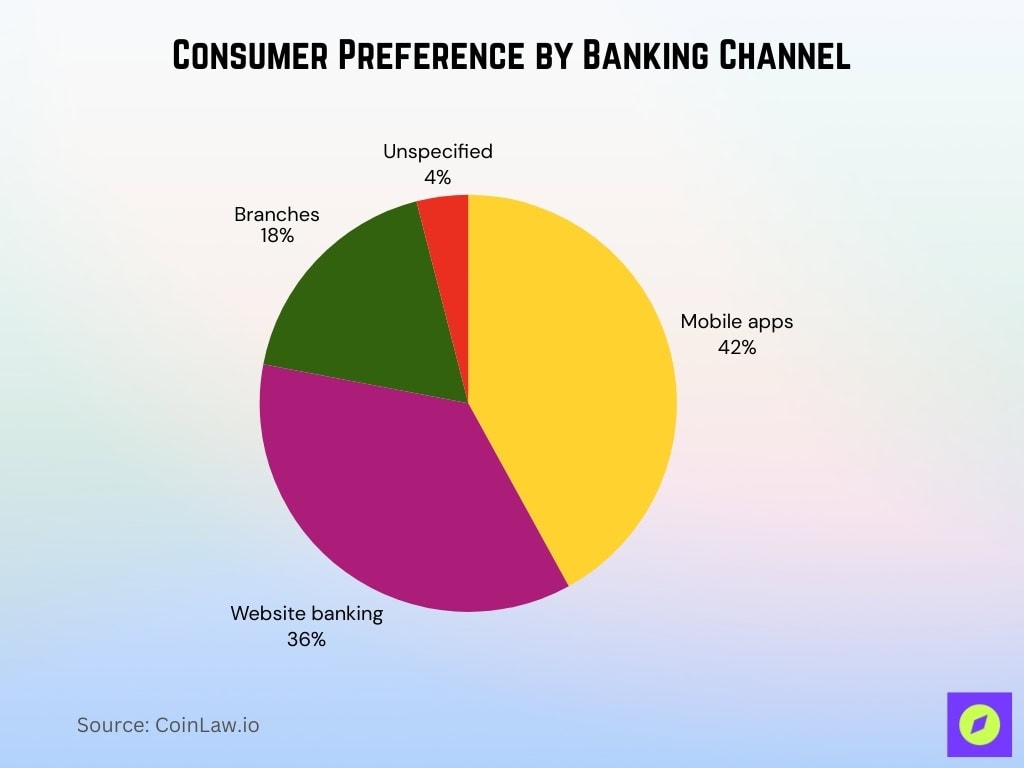

- Around 78% of U.S. adults now favor mobile apps or websites over branches as their primary banking channel.

- Roughly 42% of consumers prefer mobile apps vs 36% websites and 18% branches for everyday banking.

- U.S. neobank account holders are expected to reach about 34.7 million by 2026 amid rapid digital-only adoption.

- Global digital wallet users are projected to reach 5.3 billion by 2026, covering more than half of the world’s population.

- Global digital payments users are expected to process transactions, growing by about 60% by 2026.

Global Digital Banking Market Growth Insights

- The global digital banking market was valued at $10.9 trillion in 2023, reflecting the rapid shift toward online and mobile financial services.

- Market size is projected to more than double to $22.3 trillion by 2026, highlighting strong adoption across consumers and enterprises.

- This growth represents an increase of over $11.4 trillion in just three years, driven by mobile banking, fintech innovation, and digital payment expansion.

- Rising demand for convenience, speed, and 24/7 access continues to accelerate digital banking usage worldwide.

- Banks investing in AI, cloud infrastructure, and cybersecurity are positioned to capture the largest share of this expanding market.

Digital Banking Usage Statistics

- Digital banking accounts worldwide number about 1.75 billion and process roughly $1.4 trillion annually, or about $2.7 million per minute.

- Over 76% of American customers use mobile banking apps for core financial activities.

- Digital banks are expected to serve more than 4.2 billion users, representing about 53% of the global population.

- Banks that invest in digital transformation can cut operating costs by 20–40% through automation and reduced branch reliance.

- More than 60% of Americans use online or mobile banking, with 48% using mobile and 23% using PCs or laptops.

- New digital payment methods are forecast to account for about 28% of non-cash transaction volume by 2026.

- Generative AI usage in banking chatbots is expected to grow by 85%, and 91% of fintech startups plan to deploy embedded chatbot interfaces.

Why Banks Must Embrace a Digital-First Banking Strategy

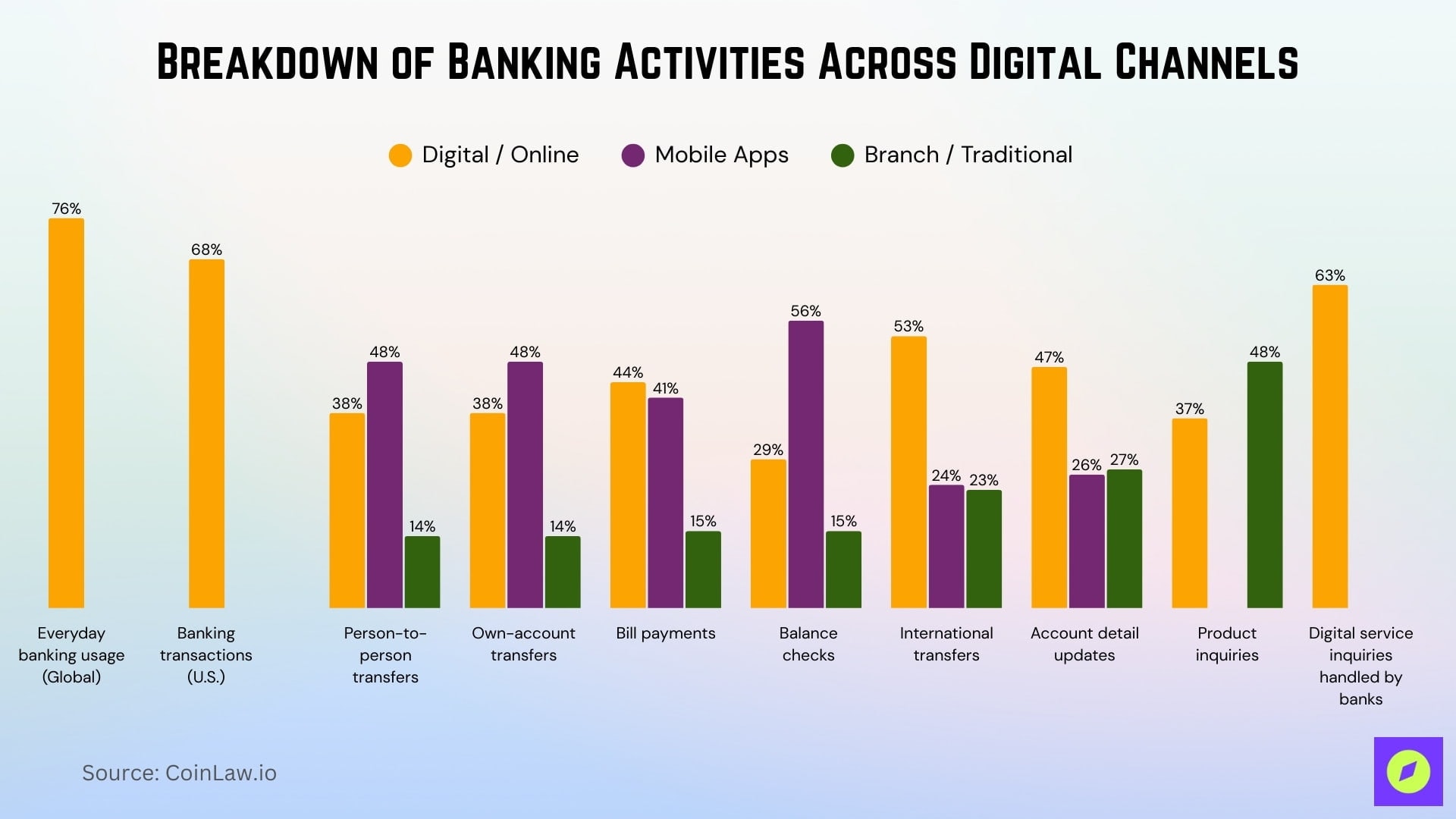

- 76% of global consumers use digital banking for everyday transactions such as transfers, bill payments, and inquiries.

- In the U.S., 68% of all banking transactions run through digital platforms, including transfers, bill pay, and deposits.

- Consumers transfer money to other people using mobile apps (48%), online banking (38%), and branches (14%).

- Consumers move funds between their own accounts using mobile apps (48%), online banking (38%), and in-person channels (14%).

- Consumers pay bills via online banking (44%), mobile apps (41%), and branch visits (15%).

- Consumers check balances through mobile apps (56%), online banking (29%), and in person (15%).

- Consumers complete international transfers through online banking (53%), mobile apps (24%), and traditional channels (23%).

- Consumers update account details via online banking (47%), mobile apps (26%), and branch visits (27%).

- Consumers inquire about banking products using online banking (37%), while 48% still prefer traditional channels for product questions.

- Banks handle 63% of digital service inquiries through AI-powered chatbots, replacing many human-agent interactions.

Digital Banks Market by Region

- North America accounts for 29.2% of the global digital banking market revenue, with the U.S. and Canada driving growth.

- Asia-Pacific leads with 32.7% of the global digital banking market share, driven by China, India, and other fast-growing economies.

- South America’s digital banking revenue reached $1.04 billion in 2025 and is projected to hit $2.31 billion by 2033 at a 10.5% CAGR.

- In South America, Brazil holds 41.64% of regional digital banking revenue, followed by Argentina at 18.40% and Colombia at 14.56%.

- Europe’s online banking market is projected to reach $5.2 billion by 2026, supported by strong digital payment and open banking adoption.

- North America’s retail banking market is forecast to grow within a global sector reaching $4.52 trillion in 2026 and $7.09 trillion by 2034.

- The global digital banking market value is expected to expand from $13.49 billion in 2025 to $36.38 billion by 2033 at a 13.2% CAGR.

- Mobile banking penetration reaches 76% across Europe, over 72% in the U.S., 76% in Brazil, and around 69% in the UK, with top European markets exceeding 87% adoption.

Mobile Banking Usage

- Roughly 42% of consumers prefer mobile apps, versus 36% who favor website banking and 18% who still prefer branches.

- 4.2 billion people worldwide use mobile banking, representing about 66% of the global population.

- 76% of adults in the United States use mobile banking apps as their primary banking method.

- Approximately 60% of US adults now prefer mobile banking overall.

- Around 60% of urban residents worldwide use mobile banking, with China and India’s metro areas among the fastest adopters.

- Roughly 40% of US mobile banking users are aged 25–34, making older millennials the largest single user segment.

- Apple Pay has about 65.6 million active users in the US, compared with roughly 35 million for Google Wallet.

- Apple accounts for about 49% of US mobile wallet users and roughly 54% of in-store mobile wallet taps.

Security Challenges and Fraud Prevention Trends

- Global fraud detection and prevention spending will reach $58.7 billion in 2025 and $146.96 billion by 2030, growing at about 20.1% annually.

- Fraud detection and prevention solutions will climb from $42.8 billion in 2024 to $260.1 billion by 2033 at a 20.42% CAGR, with BFSI remaining the largest segment.

- The broader cybersecurity market will hit roughly $300 billion by 2026 as financial institutions respond to escalating digital threats.

- Account takeover losses in banking will exceed $12.5 billion worldwide, more than doubling within a year.

- Over 33% of banks now deploy or pilot, AI-driven fraud tools, and adoption continues to expand.

- Synthetic identity fraud alone will generate at least $23 billion in global losses by 2030.

- Global fraud losses in financial services will surpass $58 billion by 2030, rising around 150% versus recent levels.

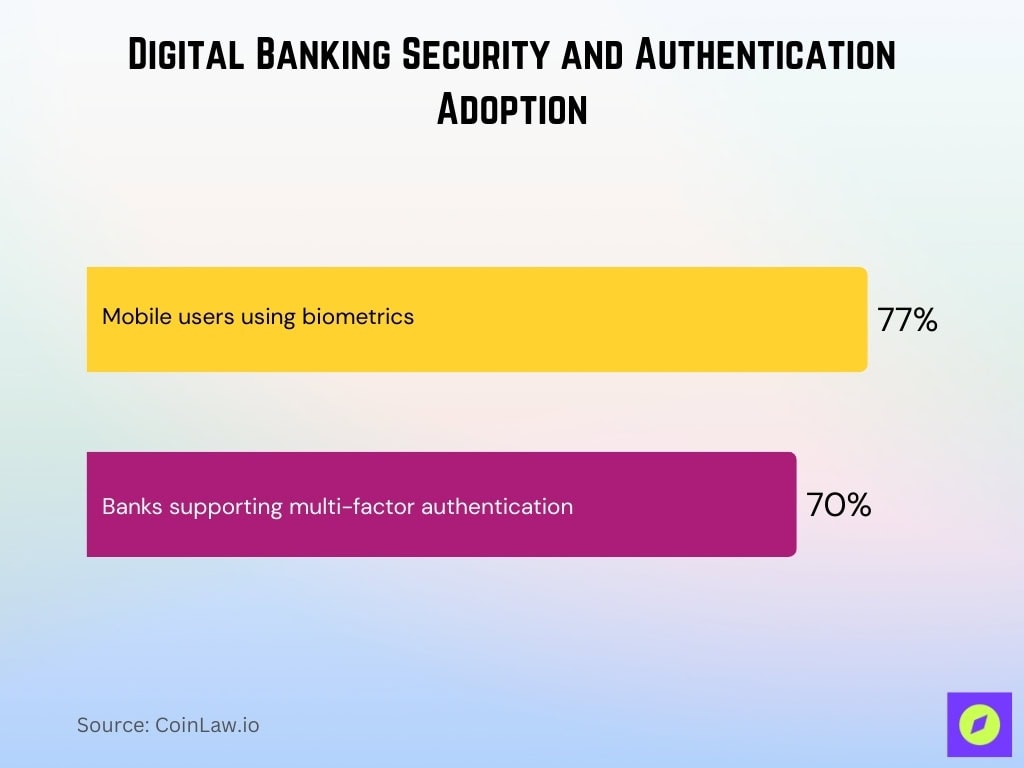

Digital Banking Security and Authentication Adoption

- 77% of mobile banking users now rely on biometric authentication, underscoring strong consumer preference for fingerprint and facial recognition security.

- Biometrics have become the primary login method for mobile banking due to faster access and reduced password fatigue.

- Around 70% of banks currently support multi-factor authentication, strengthening account protection against fraud and unauthorized access.

- The combination of biometrics and MFA significantly improves digital banking security, lowering the risk of account takeovers.

Recent Developments

- Analysts project the global neobanking market to reach $333.4 billion by 2026, expanding at a 47.1% CAGR as players like Revolut, N26, and Monzo scale internationally.

- Forecasts show the neobanking market growing from about $382.8 billion in 2025 to $5,151.5 billion by 2032 at roughly 45% annual growth, reflecting massive digital-first adoption.

- Central bank reports indicate that around 134 countries, representing nearly 98% of global GDP, are exploring CBDCs, with over 65 in advanced development or pilot phases.

- Analysts forecast the global wearable payment device market to rise from about $80.9 billion in 2026 to significantly higher levels by 2034, driven by strong APAC-led adoption.

- Revenue forecasts suggest the global neobanking sector will surpass $5,382.6 billion by 2033, with Europe capturing over 30% of the market.

- Retail surveys show that about 67% of retailers already accept contactless or wearable payment technologies, accelerating no-touch commerce.

- Cybersecurity analysts expect quantum- and AI-era cyber risks to push the cybersecurity market toward roughly $300 billion by 2026, driven heavily by financial sector demand.

Frequently Asked Questions (FAQs)

The digital banking market is expected to reach about $22.3 trillion by 2026.

From $37.49 billion in 2025, the digital banking platform market is projected to reach $155.44 billion by 2033 at a 19.8% CAGR.

76% of global consumers use some form of digital banking application.

Conclusion

Digital banking continues to revolutionize how consumers interact with financial services. With more users migrating to mobile platforms, the future promises even more personalization, security, and convenience. AI, automation, and blockchain are set to redefine the financial landscape, enabling banks to meet evolving customer demands while combating emerging threats. As adoption rates rise globally, digital banking is poised to remain at the forefront of innovation and user-centered banking solutions.