Cryptocurrency has transformed the global financial landscape, offering innovation and high stakes. Yet, behind its promise lies a darker reality that impacts investors, exchanges, and even national economies. As digital currency grows, so does the risk of cybersecurity threats targeting this volatile asset.

From high-profile exchange breaches to sophisticated ransomware targeting crypto wallets, this year has already marked itself as a pivotal year for understanding and defending against these threats. This article delves into the statistics and trends surrounding cybersecurity in cryptocurrency, providing a clear picture of where we stand and where vulnerabilities remain.

Editor’s Choice: Key Cybersecurity Incidents in Cryptocurrency

- Industry losses from cryptocurrency-related cyberattacks surged in early 2025, with $2.47 billion lost to hacks and scams in just the first half of the year.

- Lazarus Group executed the largest crypto heist ever, with $1.5 billion stolen from a major exchange in February 2025.

- Over $2.17 billion was stolen from cryptocurrency services by mid-2025, with projections suggesting total thefts may exceed $4 billion for the year.

- Hacks, scams, and security breaches cost the sector more than $2.2 billion in the first half of 2025.

- A U.S. Department of Justice indictment in early 2025 uncovered a coordinated cyber-fraud scheme responsible for $263 million in crypto theft, contributing to broader losses that topped $1.5 billion in Q1.

- In Q1 2025 alone, more than $1.63 billion was lost to crypto thefts, adding to a five-year total of $189 billion in illicit transfers.

- Phishing and address poisoning attacks led to an estimated $83.8 million in misdirected crypto transfers, with forensic firms like Chainalysis reporting impact across up to 17 million addresses.

- Cryptocurrency-related crime is projected to cost the world $30 billion annually by the end of 2025.

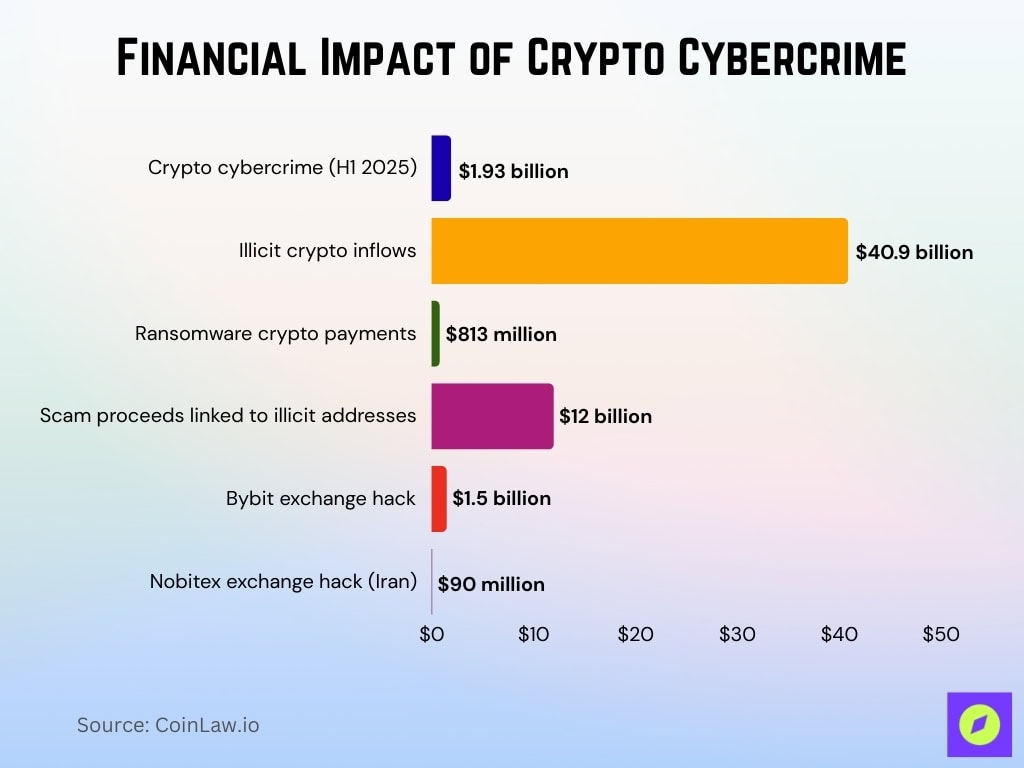

Financial Impact of Crypto Cybercrime

- Crypto-related cybercrime costs approximately $1.93 billion in the first half of 2025 alone.

- Illicit cryptocurrency transactions accounted for approximately $40.9 billion in crypto inflows globally, with a large portion linked to scams, darknet markets, and sanctioned entities.

- Ransomware victims paid roughly $813 million in crypto.

- Chainalysis data links nearly $12 billion in scam proceeds to illicit crypto addresses.

- Bybit’s $1.5 billion hack in February 2025 remains the largest crypto exchange theft to date.

- Iran’s Nobitex exchange was hit for more than $90 million in a 2025 cyberattack.

- Global cybercrime damages, including crypto-related fraud, could reach $1.2 trillion annually by the end of 2025.

Growth of Cryptocurrency‑Related Cyber Threats

- Cyberattacks on cryptocurrency exchanges rose by 45% year-over-year, driven by the expanding DeFi sector.

- Cryptojacking malware affected over 4.3 million devices globally through unauthorized crypto mining operations.

- DeFi platforms remained the primary targets, responsible for over 67% of all crypto-related hacks in early 2025.

- Double extortion ransomware incidents increased significantly, with attackers demanding crypto payments after stealing and encrypting data.

- Around 68% of crypto exchanges reported being targeted by cyberattacks within the last year.

- Botnets designed to steal crypto assets surged in complexity and frequency, often spreading through browser extensions and infected websites.

- Cross-chain bridge exploits caused over $1.83 billion in combined losses during the first half of 2025.

Common Attack Vectors in the Crypto Space

- Phishing attacks topped all vectors in early 2025, causing around $410 million in losses across 132 incidents.

- Malicious wallet apps and deceptive browser extensions reached over 35,000 malicious ads, affecting as many as 10 million users worldwide.

- SIM‑swap attacks exploiting SMS‑based 2FA remain common and dangerous in 2025.

- Wallet compromises led to $1.7 billion in losses by mid‑2025 and remain the costliest form of attack.

- Credential stuffing and brute-force login attempts increased across crypto platforms in early 2025, as attackers targeted reused or weak passwords.

- Fake exchange platforms and phishing domains proliferated, deceiving users into depositing funds that became inaccessible.

- Rogue browser extensions, including attacks like the “GreedyBear” campaign, continued stealing wallet data and credentials.

Cyber Threats Rising Rapidly

- 30,000 websites are compromised daily worldwide, exposing users to malware, data theft, and ransomware.

- Cryptojacking incidents surged by 659%, indicating a massive rise in unauthorized crypto-mining attacks.

- Ransomware attacks targeting ICS (Industrial Control Systems) increased by 20%, raising concerns over critical infrastructure vulnerabilities.

Ransomware and Malware Attack Statistics in Cryptocurrency

- Cryptojacking attacks in cloud environments increased by 20% in 2025, exploiting idle computing power for covert mining.

- Total ransomware payments dropped by 35%, falling to around $813 million as fewer victims chose to pay.

- The average ransom payment surged to approximately $2 million, reflecting a focus on high-value targets.

- In Q2 2025, the average ransomware payment climbed to about $1.13 million, with a median payment of $400,000.

- Only 17% of enterprises paid ransomware in 2025 so far, marking the lowest compliance rate recorded.

- While clipboard hijacking malware persisted in targeting crypto users, reports from 2025 show it was eclipsed by more widespread phishing and trojanized browser extensions in terms of financial impact.

- Cryptojacking continued to spread silently across endpoint and cloud systems, draining resources without user awareness.

Phishing Attack Statistics Related to Cryptocurrency

- Phishing attacks targeting cryptocurrency users rose by 40% in early 2025, with fake exchange sites a major factor.

- More than 1 million phishing attacks were recorded in Q1 2025 alone across digital platforms.

- Phishing-related losses amounted to approximately $410 million in the first half of 2025.

- Nearly 70% of phishing schemes now use deceptive QR codes to redirect users to scam sites.

- Advanced AI-powered phishing, including deepfake impersonations, surged by over 450% between mid‑2024 and mid‑2025.

- Ethereum-focused phishing schemes, including payload-based transaction manipulation, were responsible for losses exceeding $341 million.

- Solana-focused phishing (“SolPhish”) attacks resulted in about $1.1 million in losses across roughly 8,000 incidents.

- Blockchain address poisoning targeted around 17 million users, causing at least $83.8 million in misdirected transfers.

Crypto Cybercrime and Digital Asset Insurance Growth

- $1.93 billion in crypto-related cybercrime losses were recorded in early 2025, showing a sharp rise in digital asset vulnerabilities.

- $4.28 billion is the projected value of digital asset insurance by the end of 2025, reflecting heightened demand for coverage against cyber threats.

- The graph reveals a dramatic upward trend in both cybercrime costs and insurance adoption, signaling a shift toward proactive risk management in crypto.

- The rising bars and red trajectory line emphasize the financial pressure on the crypto ecosystem, driven by escalating attacks and high-profile breaches.

- Insurers and exchanges are responding by scaling protection mechanisms, with digital asset coverage becoming a core defense strategy in 2025.

Regulatory Responses and Compliance Measures

- U.S. enforcement actions against crypto misconduct increased substantially in early 2025 with high-profile cases like the takedown of Garantex, signaling a more aggressive posture.

- The U.S. enacted the GENIUS Act in 2025, establishing the first comprehensive stablecoin regulatory framework, including one-to-one USD backing.

- The SEC launched the Cyber and Emerging Technologies Unit in 2025 to specifically address cyber-related crypto threats and protect investors.

- In 2025, the DOJ adopted a more prosecutorial approach to digital asset misuse, as emphasized in internal guidance, focusing on targeting criminal intent rather than relying on regulatory enforcement alone.

- KuCoin pleaded guilty in 2025 to unlicensed money transmission, paying $300 million in penalties and exiting the U.S. market.

- Illicit cryptocurrency transactions dropped to 0.4% of global volume.

- FinCEN reported a sharp rise in crypto-related fraud: a 99% increase in complaints and a 31% increase in victim losses via CVC kiosks.

- In 2025, several SafeMoon executives were found guilty in a multi-million-dollar fraud case, reinforcing regulatory agencies’ growing crackdown on deceptive practices in the crypto industry.

Industry‑Specific Cybersecurity Statistics: Finance and Cryptocurrency

- Crypto crime accounted for over 57% of financial cybercrime losses in 2025, highlighting the ongoing vulnerability of digital assets.

- The crypto insurance market grew to $4.2 billion in 2025 as businesses increased coverage against cyber threats.

- Institutional crypto investments experienced a 40% rise in phishing attacks targeting high-net-worth individuals and corporate accounts.

- Malware attacks on financial services involving crypto transactions rose by 55%, especially through smart contract and DeFi-related vectors.

- Blockchain analytics tools were adopted by 85% of exchanges to detect fraudulent transactions and improve security.

- Crypto lending platforms faced a 60% increase in attempted fraud as hackers exploited weakly regulated systems.

- DeFi represented around 80% of finance-related cyber breaches, driven largely by smart contract vulnerabilities and platform flaws.

How Crypto Funds Were Stolen

- 43.8% of stolen funds resulted from private key compromises, making it the leading cause of crypto theft.

- 25.5% of crypto losses came from unknown sources, reflecting ongoing challenges in tracing and attributing cyberattacks.

- 11.2% of stolen assets were linked to other compromise types, such as hybrid or unclassified methods.

- 8.5% were due to contract vulnerabilities or code exploits, highlighting the risks in flawed smart contract deployments.

- 6.3% were caused by general security vulnerabilities, such as poor infrastructure or a lack of multi-factor authentication.

- 4.7% were stolen through market integrity exploits, including manipulation tactics like pump-and-dump schemes.

Geopolitical Influences in Cryptocurrency Cybersecurity

- North Korean-affiliated groups like Lazarus were responsible for over 60% of nation-state crypto thefts in early 2025, highlighted by the record $1.5 billion Bybit hack in February.

- Russian cyber actors increasingly targeted global crypto exchanges, with a notable uptick in offensive operations traced to Russian infrastructure in 2025.

- Iran-linked hackers intensified crypto infrastructure attacks by approximately 40%, shifting funds toward state-backed objectives.

- Crackdowns on domestic crypto activity in China during 2025 reportedly reduced local crime, but some analysts observed a rise in offshore attacks originating from Chinese-linked IP infrastructure.

- Sanctions on Russian and Belarus-based crypto platforms have strengthened enforcement of asset freezes and blocked illicit financial flows.

- The EU is set to enforce cross-border crypto regulations by mid-2025 to curb coordinated cybercriminal activity across member states.

- Nation-state cyber groups increased attacks on decentralized finance platforms by an estimated 25% in early 2025, leveraging the anonymity of cross-chain transactions and weak regulatory coordination.

Technological Advancements and the Potential of Blockchain in Security

- Blockchain analytics is now an established core tool for tracing crypto transactions and investigating financial crime. We see growing adoption across exchanges and regulators.

- AI-enhanced zero-knowledge proofs (ZKPs) are being integrated into systems to enhance privacy while maintaining traceability.

- Decentralized Identity (DID) adoption is on the rise, with a growing number of platforms exploring its role in strengthening user verification.

- Multi-signature wallet usage remains a key security measure for businesses and high-net-worth users, reducing risk from single-point failures.

- Blockchain platforms increasingly adopted AI-based threat detection tools in 2025, enhancing real-time fraud monitoring through anomaly detection and behavior analytics.

- Blockchain firms are increasingly exploring quantum-resistant encryption to future-proof against emerging quantum threats.

- Cross-chain security protocols are maturing, enabling safer interoperability and reducing risk in multi-blockchain transactions.

Recent Developments

- Coinbase integrated AI-driven fraud detection in 2025 with enhanced real-time behavioral analytics and endpoint monitoring to catch suspicious transaction patterns.

- Binance expanded its collaboration with blockchain forensics specialists in 2025 to strengthen international law enforcement support for tracing stolen crypto assets.

- Ethereum’s Shanghai upgrade in 2025 included fortified smart contract security, further reducing vulnerabilities like re-entrancy exploits.

- U.S. regulators ramped up crypto scrutiny in 2025, launching multiple new investigations into exchange security protocols.

- Smart contract audit activity surged by 45% in 2025 as DeFi platforms increased transparency and user assurance.

- NFT marketplaces significantly enhanced security in 2025, with platforms like OpenSea deploying advanced fraud detection systems after major theft incidents.

- Real-time breach notification systems became standard for over 70% of crypto exchanges by mid‑2025, enabling faster incident response and user alerts.

Conclusion

The ever-evolving cryptocurrency landscape offers exciting possibilities but also significant challenges. With cyber threats becoming more sophisticated, individuals and organizations involved in cryptocurrency must remain vigilant and adopt the latest security measures. From advanced blockchain technologies to stricter regulatory responses, the push for secure transactions and safe platforms has never been stronger. As the market matures, cybersecurity will play an even more crucial role, making it essential for stakeholders to stay informed and proactive against potential risks.