In the early 2010s, few would have predicted that a cryptographic curiosity like Bitcoin would spark a global financial revolution. Today, it’s not just Bitcoin that’s made waves, but the wallets people use to store, send, and manage their digital assets. From busy commuters tapping mobile wallets at coffee shops to hedge funds managing cold storage vaults, cryptocurrency wallets have become a linchpin of financial autonomy.

Today, the adoption of crypto wallets reflects not just a technological shift but a deeper trust in decentralized finance. This article breaks down the latest wallet usage trends, who’s using them, how, and why.

Key Takeaways

- 178% of all cryptocurrency users in 2025 report using hot wallets as their primary storage solution.

- 2Cold wallet ownership among retail investors rose by 34% year-over-year in 2025, signaling rising security awareness.

- 3Institutional wallet usage has surged by 51% in 2025, driven largely by demand for custodial solutions.

- 4Mobile wallet usage dominates, with 72% of users preferring mobile-first solutions in 2025.

- 5The number of active crypto wallets globally surpassed 820 million in 2025.

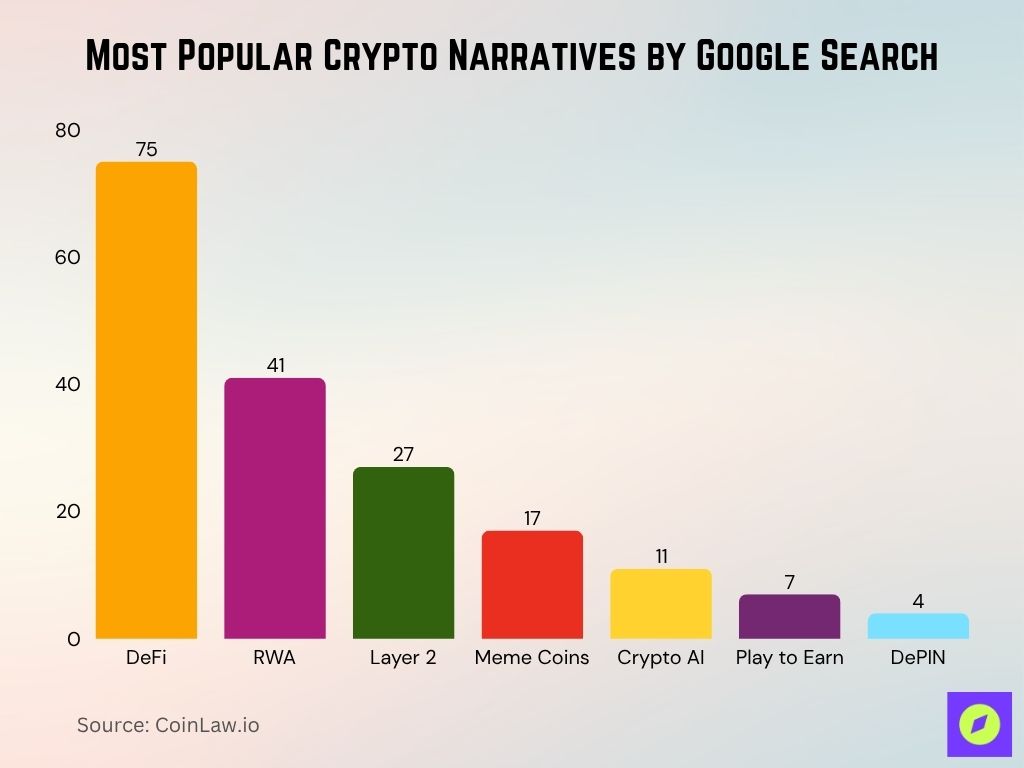

Most Popular Crypto Narratives by Google Search

- DeFi leads as the most searched crypto narrative, scoring a Google Trends indicator of 75, far ahead of the rest.

- RWA (Real World Assets) ranks second with a score of 41, showing growing interest in tokenized tangible assets.

- Layer 2 solutions follow with a score of 27, reflecting rising demand for scalability in blockchain networks.

- Meme Coins maintain buzz in the community with a notable 17 in search interest.

- Crypto AI sees moderate traction, scoring 11, as AI-integrated crypto projects gain attention.

- Play-to-Earn games show a decline in popularity, registering just 7 in search momentum.

- DePIN (Decentralized Physical Infrastructure Networks) rounds out the list with the lowest score of 4, indicating it’s still a niche topic.

Global Cryptocurrency Wallet Adoption Rates

- 820 million unique cryptocurrency wallets are active globally as of 2025.

- Asia-Pacific leads regional adoption with 350 million wallet users in 2025, accounting for 43% of the global share.

- Europe has seen a moderate rise, with 140 million active wallet users in 2025, a 12% YoY increase.

- Africa’s adoption rate has doubled in two years, reaching 75 million wallet users in 2025.

- Latin America shows solid growth with 92 million users in 2025, driven by inflation hedging behavior.

- The Middle East recorded 29 million active wallets in 2025.

- North America holds 134 million wallet users in 2025, making up 16% of global users.

- Cryptocurrency wallets now represent 7.4% of the total number of global internet users in 2025.

Breakdown of Wallet Types: Hot vs. Cold Wallet Usage

- Hot wallets account for 78% of all crypto wallets in 2025, remaining the dominant choice due to accessibility.

- Cold wallets make up 22% of usage, with significant uptake among long-term investors and institutions.

- Hardware wallet sales increased by 31% in 2025, reflecting rising concerns over digital theft.

- Software wallet downloads surpassed 520 million globally in 2025.

- Desktop wallets saw a decline, making up only 9% of hot wallet usage in 2025.

- Custodial wallets are now used by 41% of users, while non-custodial wallets are preferred by 59% in 2025.

- The average transaction volume through cold wallets rose to $5,300 in 2025, up 14% YoY.

- Users report 2.3x higher retention with mobile-first hot wallets compared to browser extensions in 2025.

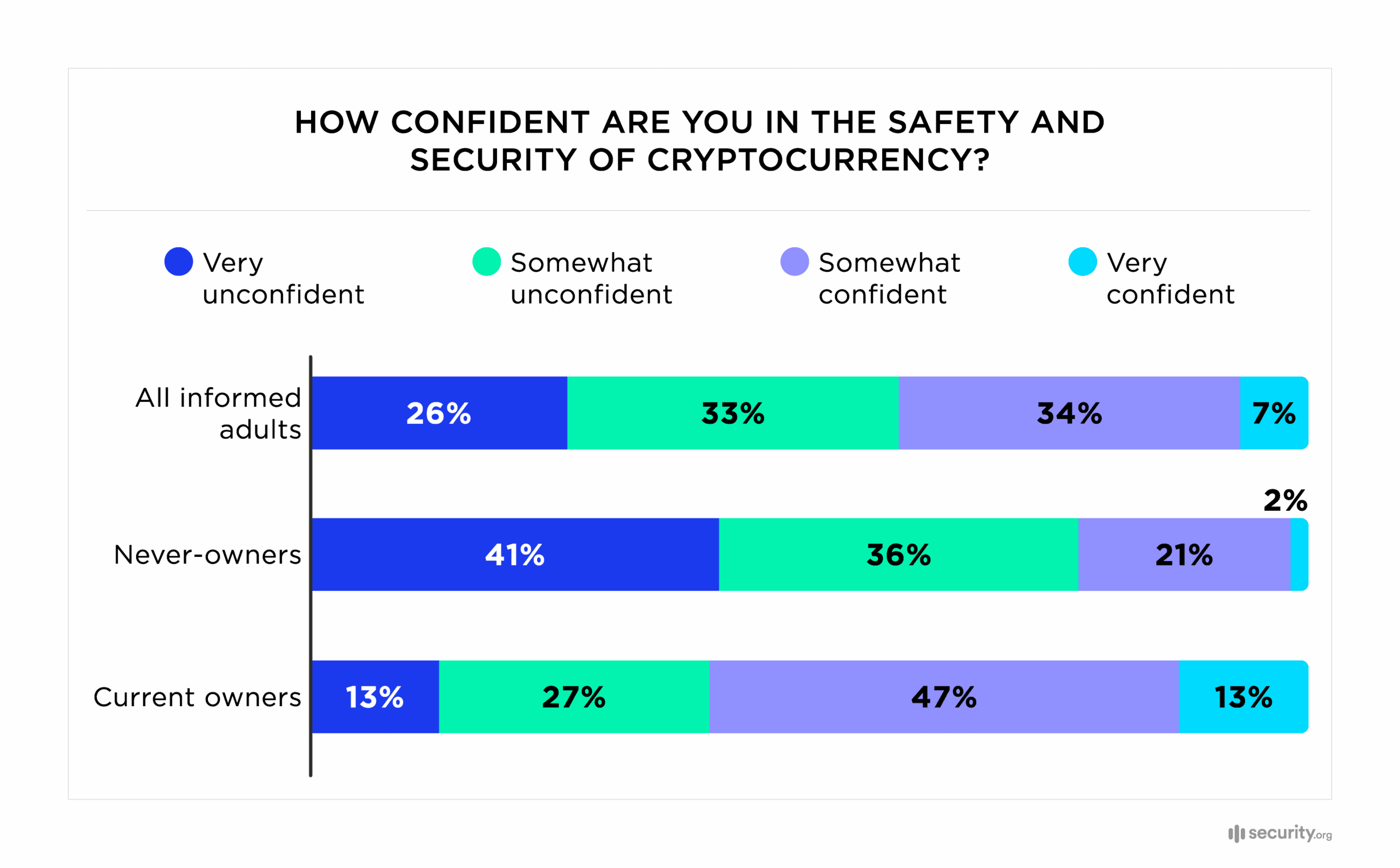

Public Confidence in Cryptocurrency Safety and Security

- Among all informed adults, only 7% feel very confident in crypto security, while 26% are very unconfident.

- Never-owners of cryptocurrency show the highest skepticism, with 41% very unconfident and just 2% very confident.

- Current crypto owners are the most trusting group, with 47% somewhat confident and 13% very confident in crypto’s safety.

- Despite ownership, 13% of current users still feel very unconfident, indicating lingering concerns even among adopters.

- The majority of informed adults fall in the middle, with 33% somewhat unconfident and 34% somewhat confident, revealing a broadly cautious but open-minded sentiment.

Leading Countries by Wallet Penetration

- The United States leads with 27% of internet users owning crypto wallets in 2025.

- South Korea follows with a 24% wallet adoption rate among adults online.

- Singapore has a wallet usage rate of 22%, among the highest in Southeast Asia.

- Brazil boasts a 20% adoption rate in 2025, driven by blockchain-based payment apps.

- In Nigeria, 18% of internet users use crypto wallets, driven by remittance and inflation resistance.

- Germany saw a jump to 17% penetration in 2025, led by interest in tokenized assets.

- India reached 16% wallet usage in 2025, despite regulatory fluctuations.

- Canada registered 15% of its population as active crypto wallet users in 2025.

- Turkey, facing currency instability, has a 14% penetration rate in 2025.

- Australia rounds out the top 10 with 13% wallet adoption among adults online.

Adoption Trends Among Retail vs. Institutional Users

- Retail users continue to dominate, representing 82% of all crypto wallet holders in 2025.

- Institutional wallet ownership grew by 51% YoY, with over 31 million wallets tied to organizations in 2025.

- 43% of institutional wallets are custodial, ensuring compliance with regulatory requirements.

- Crypto hedge funds and asset managers increased wallet adoption by 29% in 2025, primarily for DeFi staking.

- Treasury management among blockchain-native firms now involves crypto wallets in 61% of cases.

- Retail staking wallets, used for earning yield, rose to 68 million globally in 2025, up 22% from last year.

- The average retail user now maintains 2.7 wallets in 2025.

- 52% of institutional wallets interact with smart contracts monthly, highlighting integration into decentralized platforms.

- Enterprise-grade multi-signature wallets reached 9 million deployments in 2025, up 47% YoY.

- Startups raising capital in crypto are now 36% more likely to offer investors dedicated token wallets in 2025.

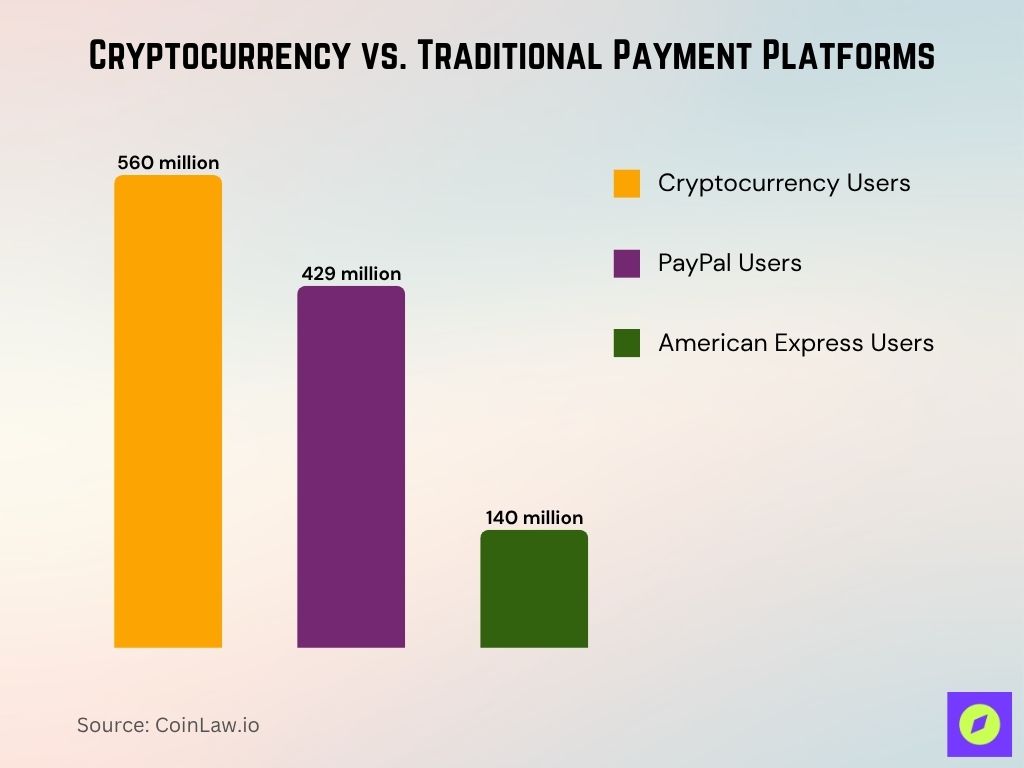

Cryptocurrency vs. Traditional Payment Platforms

- Cryptocurrency users have reached 560 million globally, accounting for roughly 7% of the world’s population.

- PayPal continues to be a dominant digital payment player with 429 million users worldwide.

- American Express maintains a smaller user base with 140 million users, far behind crypto and PayPal.

- Cryptocurrency adoption has now surpassed PayPal and AmEx in global user count, highlighting the shift toward decentralized finance.

Demographic Insights: Age, Gender, and Income of Wallet Users

- 64% of wallet users are aged 18–34 in 2025, with Gen Z making up the fastest-growing segment.

- Usage among those aged 35–44 increased to 19%, reflecting growing mainstream interest.

- The share of female crypto wallet holders rose to 29% in 2025.

- Among Gen Z women, adoption jumped 31% in 2025, driven by creator economy integrations.

- Users earning over $100,000 annually now make up 34% of crypto wallet holders.

- Meanwhile, 42% of users in the $50,000–$99,999 income range actively use wallets in 2025.

- Students and gig workers represent 15% of new wallet users in 2025, using crypto for side earnings.

- 67% of wallet users hold a college degree or higher in 2025.

- In rural and suburban regions, wallet adoption grew by 28%, showing decentralized finance’s wider reach.

- 41% of crypto wallet users also engage in digital asset education platforms as of 2025.

Mobile vs. Desktop Wallet Preferences

- 72% of users prefer mobile wallets in 2025, citing ease of use and real-time access.

- Desktop wallet usage continues to decline, down to 16% in 2025.

- Browser extension wallets make up 12% of usage, especially among NFT traders.

- Android dominates mobile wallet installs with 61%, while iOS accounts for 36% in 2025.

- Cross-platform wallets, those syncing between desktop and mobile, rose by 42% YoY.

- Biometric authentication is now enabled in 84% of mobile wallet apps in 2025.

- QR code-based payments through wallets grew by 39%, driven by the retail and transport sectors.

- In-app browser access is used by 53% of mobile wallet users for DeFi navigation in 2025.

- Wallets that support push notifications and real-time alerts report 2.5x higher user retention.

- 5G connectivity has improved wallet response times by 46%, enhancing mobile UX in 2025.

Crypto Wallet Market Growth Forecast

- The global crypto wallet market size is expected to grow to $57.61 billion by 2029.

- Projected market value for 2025 is $19.03 billion, showing significant year-over-year growth.

- The market is forecasted to expand at a CAGR of 31.9%, signaling strong investor and user demand.

- By 2029, the market is expected to be four times larger than it was in 2024, marking a transformative shift in digital asset storage.

Most Popular Cryptocurrency Wallet Providers

- MetaMask remains the most widely used wallet globally, with 143 million users in 2025.

- Trust Wallet follows closely, reporting 115 million downloads and active users.

- Coinbase Wallet has over 70 million users, favored for its regulated and custodial options.

- Ledger Live, used with Ledger hardware, serves 18 million cold wallet users globally.

- Phantom Wallet dominates the Solana ecosystem with 11 million users in 2025.

- Exodus Wallet reports 9 million monthly active users, favored for multi-asset support.

- Trezor Suite, paired with Trezor devices, supports 7 million users, up 21% YoY.

- OKX Wallet usage surged to 6.5 million, driven by integration with OKX’s Web3 ecosystem.

- Newcomer Rabby Wallet, tailored for DeFi, surpassed 4.2 million installs in 2025.

- Argent Wallet, with Layer 2 compatibility, expanded its user base to 3.6 million globally.

Cryptocurrency Stored by Wallet Type (Bitcoin, Ethereum, etc.)

- Bitcoin remains the most held asset, stored in 68% of all active wallets in 2025.

- Ethereum follows with 54% wallet coverage, due to widespread use in DeFi and NFTs.

- Stablecoins like USDC and USDT are stored in 49% of wallets, up 18% YoY.

- Solana (SOL) is stored in 21% of wallets, with rapid growth from the NFT and gaming sectors.

- Polygon (MATIC) appears in 18% of wallets, supporting cross-chain operations.

- BNB Chain tokens are stored in 23% of wallets, driven by retail DeFi usage.

- Cardano (ADA) shows presence in 15% of wallets, often for staking purposes.

- Avalanche (AVAX) wallet penetration rose to 12%, particularly among early adopters.

- Layer 2 tokens like Arbitrum and Optimism now feature in 10% of wallets collectively.

- NFTs are now present in 36% of all wallets, with gaming assets leading growth in 2025.

How People Expect Crypto to Perform

- 83% of current crypto owners believe the market will increase in 2025, showing high confidence among active users.

- Only 3% of current owners expect a decline, while 13% think it will stay the same.

- Among non-owners, 56% predict an increase, but 13% foresee a decline, and 31% believe it will remain flat.

- Across all informed adults, 67% expect growth, while 24% think the market will stay the same, and 9% expect it to decline.

- Overall, sentiment toward the crypto market in 2025 is largely optimistic, especially among those already invested.

Wallet Adoption Driven by DeFi and NFT Growth

- DeFi wallet usage reached 198 million users globally in 2025, accounting for 24% of total wallets.

- 48% of all wallets in 2025 have interacted with at least one decentralized application (dApp).

- Yield farming wallets grew by 37%, driven by Layer 2 and cross-chain protocols.

- NFT-linked wallets now total 294 million, showing a 33% year-over-year increase.

- Gaming NFTs account for 61% of all NFT wallet interactions in 2025.

- Metaverse wallet adoption reached 79 million, largely from VR-based ecosystems.

- Staking-enabled wallets for DeFi protocols rose to 92 million in 2025.

- The average DeFi wallet in 2025 supports 5.4 tokens and interacts with 2.3 chains.

- NFT wallet ownership among Gen Z users surged 42% in 2025, heavily influenced by creator royalties.

- Multisig DeFi wallets rose by 26%, reflecting increased security needs in DAOs.

Security Concerns and Impact on Wallet Usage

- 35% of crypto wallet users in 2025 cite security as their top concern.

- Phishing attacks led to over $1.1 billion in wallet-related thefts globally in 2025.

- Wallets with MFA (Multi-Factor Authentication) show a 62% lower incidence of compromise.

- Biometric authentication is used in 84% of mobile wallets in 2025.

- Hardware wallets are now used by 22% of users, especially for long-term storage.

- Self-custody awareness rose to 71% among crypto users in 2025, aided by global education drives.

- Wallets that offer transaction previews and scam alerts have 1.9x higher trust ratings.

- Browser extension wallets remain the most targeted, comprising 42% of known attack vectors in 2025.

- Social recovery wallets, which use trusted contacts, grew by 44% YoY.

- Global regulators issued 21 new advisories in 2025, specifically about wallet fraud vectors.

Blockchain Dominance in Total Value Locked

- Ethereum dominates on-chain activity, holding 56.8% of total value locked (TVL), making it the clear leader in DeFi.

- Solana ranks second with 7.03%, followed by Tron at 6.54%, showing growing trust in alternative chains.

- BSC (Binance Smart Chain) accounts for 4.35%, while Base and Bitcoin closely trail with 2.92% and 2.87% respectively.

- Arbitrum holds 2.53%, and Avalanche has 1.21%, highlighting modest traction among Layer 2 and alt-layer platforms.

- Chains like Sui (1.14%), Hyperliquid (1.1%), and Aptos (0.9%) show emerging presence in the ecosystem.

- The “Others” category represents 12.6%, underscoring that while Ethereum leads, value is still fragmented across multiple blockchains.

Cryptocurrency Wallet Usage in E-Commerce and Payments

- Over 31 million crypto wallets are used for day-to-day payments as of 2025.

- 17% of e-commerce platforms globally now accept payments via crypto wallets.

- Stablecoins make up 68% of transaction volume in wallet-based online purchases.

- Point-of-sale wallet transactions rose by 46%, particularly in LATAM and Southeast Asia.

- QR code usage for crypto payments increased 39%, simplifying checkout processes.

- Crypto cashback via wallets is used by 11 million users in 2025, primarily in retail loyalty programs.

- Food delivery and gig platforms saw 27% growth in wallet-linked payments in 2025.

- Subscription-based services report 2.6 million users paying via recurring crypto wallet billing.

- The average crypto transaction value in retail is $142.

- Wallets with stablecoin conversion tools report 1.7x higher usage in cross-border e-commerce.

Regional Growth Patterns in Wallet Adoption

- Asia-Pacific leads wallet adoption with 350 million active users in 2025, or 43% of the global total.

- Africa saw the fastest YoY growth rate at +38%, led by Nigeria, Kenya, and South Africa.

- Latin America wallet growth reached 92 million users in 2025, fueled by inflationary pressures.

- Europe has diversified adoption, led by Germany, France, and the UK, with 140 million wallets.

- North America holds 134 million wallets, driven by consumer fintech and retirement fund usage.

- Middle East adoption grew 31%, with the UAE and Saudi Arabia pushing Web3 financial inclusion.

- In Central Asia, wallet growth is now 12% higher YoY, largely from Kazakhstan and Uzbekistan.

- Eastern Europe’s wallet penetration remains strong, especially in Poland and Ukraine.

- Island economies like the Philippines and Caribbean nations show high wallet use for remittances.

Regulatory Influence on Wallet Usage and Adoption

- 24 countries introduced new wallet compliance frameworks in 2025.

- KYC-linked wallets now make up 67% of active usage.

- Self-hosted wallets face restrictions or enhanced oversight in 9 nations, including Japan and Canada.

- The EU Markets in Crypto-Assets (MiCA) rules caused 21% of providers to adjust wallet services.

- In the US, new IRS crypto reporting rules prompted 15% of users to shift to compliant platforms.

- Digital identity integrations are present in 22% of wallets in regulated regions.

- Wallet blacklisting tools are now active in over 18 blockchain networks, enabling risk filtering.

- Regulatory-driven education programs increased public wallet literacy by 39%.

- Tokenized compliance tools are embedded in 11% of institutional wallets for audit purposes.

Recent Developments

- MetaMask launched native BTC support in Q1 2025, unlocking broader multi-chain access.

- Apple Wallet added Ethereum and Solana wallet integrations for verified apps in 2025.

- Coinbase Wallet introduced AI-based scam detection and transaction simulation tools.

- PayPal Crypto Wallet exceeded 10 million users in 2025, adding support for multiple stablecoins.

- Visa partnered with Ledger to roll out prepaid crypto cards linked to cold storage devices.

- Uniswap Wallet launched auto-routing gas fee optimization, enhancing DeFi usability.

- Telegram Wallet hit 14 million users, especially in emerging markets using the TON blockchain.

- Robinhood Wallet expanded globally with support for NFTs and Layer 2 tokens.

- Google Chrome extension wallets now require verified dev signatures to operate securely.

- Open-source wallets like BlueWallet and Nunchuk gained traction among privacy-focused users.

Conclusion

The data today reveals one clear truth: cryptocurrency wallets are no longer just digital safes; they are dynamic financial platforms driving inclusion, commerce, and innovation. From institutional-grade vaults to tap-and-go mobile wallets, the ecosystem reflects both the mainstreaming of crypto and the resilience of decentralization. As users grow savvier and regulation finds balance, wallets will become central to how people around the world store, spend, and secure digital value.