Unless you have been living under a rock, you have heard of cryptocurrencies before. You might even know a person or two who uses cryptocurrencies for trading or day-to-day transactions. But have you ever thought of what is driving the cryptocurrency ecosystem and market today? If you want to refresh your memory and stay up-to-date, you might want to check out this article on cryptocurrency statistics.

Editor’s Choice

- Bitcoin hit an all-time high of $126,080 in October 2025 before retreating into early 2026.

- At the start of 2026, Bitcoin trades around $93,000 with a market cap near $1.87 trillion.

- The global crypto market cap stands at roughly $3.3 trillion, after rising about 5% from $2.97 trillion at year-end 2025.

- Bitcoin represents about 57% of the total crypto market value, underscoring its dominant share of the market.

- The stablecoin market is approximately $307.6 billion, down slightly from its more than $310 billion peak in December 2025.

- USDT holds around $187 billion in market cap, accounting for roughly 61% of the overall stablecoin sector.

- USDC maintains a market cap near $75.2 billion, giving it close to a 24% share of the stablecoin market.

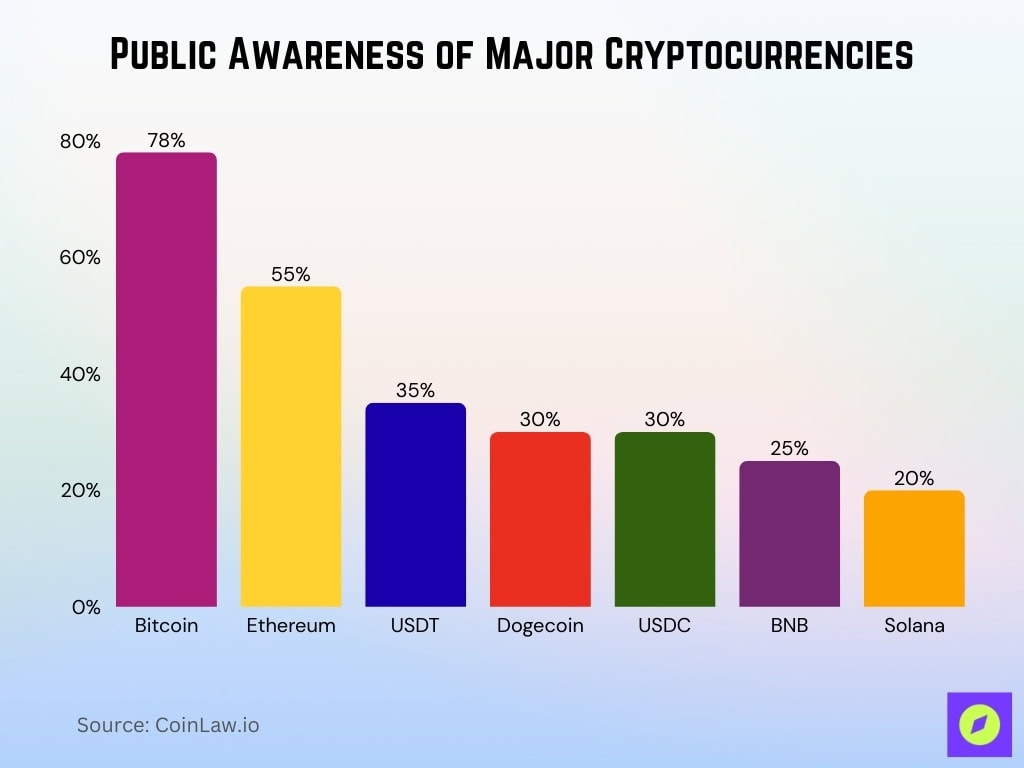

Public Awareness of Major Cryptocurrencies

- Around 93% of people globally are aware of cryptocurrencies, with Bitcoin remaining the top-mentioned asset in unaided recall.

- Roughly 78% of crypto-aware respondents recognize Bitcoin by name, keeping it the most recognized individual cryptocurrency.

- Ethereum awareness among crypto-aware adults sits near 55%, reflecting its position as the leading smart contract platform.

- Dogecoin awareness is estimated at around 30% among those familiar with crypto, boosted by ongoing meme-driven social media visibility.

- Binance Coin is recognized by roughly 25% of crypto-aware users, supported by Binance’s role as a leading global exchange.

- Tether is identifiable to about 35% of stablecoin-aware respondents, making it the best-known stablecoin brand.

- USD Coin awareness is close to 30% among respondents who know stablecoins, aided by its use on major exchanges and DeFi platforms.

- Solana is known by roughly 20% of respondents aware of crypto, reflecting its growing prominence in DeFi and NFTs.

Cryptocurrency Market Statistics

- Bitcoin trades around $93,000 and maintains market dominance near 58%, underscoring its leading role in the asset class.

- The total number of global crypto owners exceeded 580 million in 2025 and is projected to approach 1 billion by 2028.

- Asia accounts for roughly 43% of all crypto users, while North America and Europe represent about 17% and 15% respectively.

- The global crypto user base grew by approximately 34% year-over-year in 2025, with first-time adopters rising 19%.

- Average global wallet balances reached around $3,560 in 2025, up 11% compared with the previous year.

- By mid-2025, Binance’s spot market share stabilized near 39.8%, while other top exchanges collectively held about 43.8%.

- Decentralized exchange spot volume climbed to roughly $876.3 billion in Q2 2025, pushing the DEX-to-CEX spot ratio to about 0.23

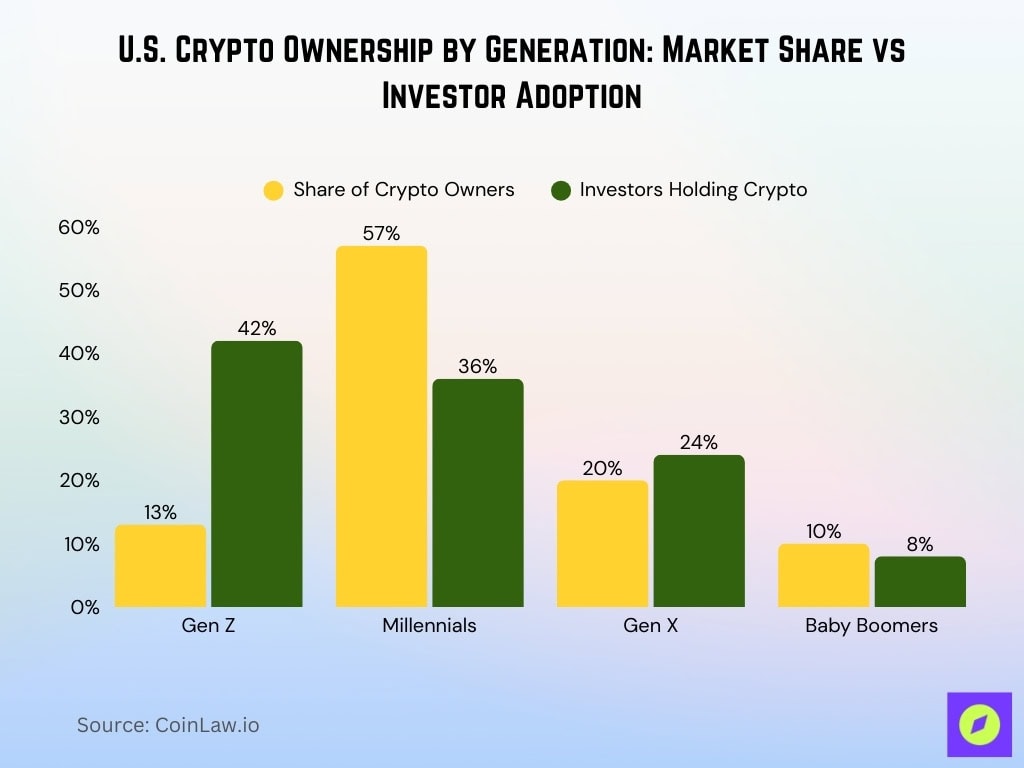

Crypto Ownership by Generation in the U.S.

- Millennials account for 57% of U.S. crypto owners, making them the largest generational group in the market.

- Gen X holds about 20% of total U.S. crypto ownership, reflecting growing adoption among mid-career investors.

- Gen Z represents roughly 13% of American crypto owners, highlighting strong but still emerging participation.

- Baby Boomers make up approximately 10% of U.S. crypto owners, underscoring relatively limited engagement among older adults.

- Among investors specifically, roughly 42% of Gen Z, 36% of Millennials, 24% of Gen X, and 8% of Baby Boomers hold crypto.

- Across generations, about 28% of all American adults, around 65 million people, own some form of cryptocurrency.

- Nearly 94% of recent crypto buyers fall between ages 18 and 40, confirming that Gen Z and Millennials dominate new inflows.

Cryptocurrency Usage Patterns and Statistics

- Global crypto ownership averages 6.8% of the population, or about 562 million users worldwide.

- The United States has roughly 52 million crypto owners, with an estimated ownership rate of 15.6% of its population.

- Asia leads with about 32% of global crypto owners and over $2.36 trillion in annual on-chain transaction volume.

- Men account for around 61% of crypto owners globally, while women represent about 39%.

- Adults aged 25–34 comprise approximately 34% of all crypto owners, making them the largest age cohort.

- Stablecoins represent about 30% of all crypto transaction volume, surpassing $4 trillion in volume between January and July 2025.

- Stablecoin transaction volume rose 83% year-over-year between July 2024 and July 2025, signaling accelerating payment and remittance usage.

- South Asia’s crypto transaction volume increased by 80% year-over-year to roughly $300 billion, making it the fastest-growing region.

- APAC’s total crypto transaction volume climbed from $1.4 trillion to $2.36 trillion, a 69% annual increase.

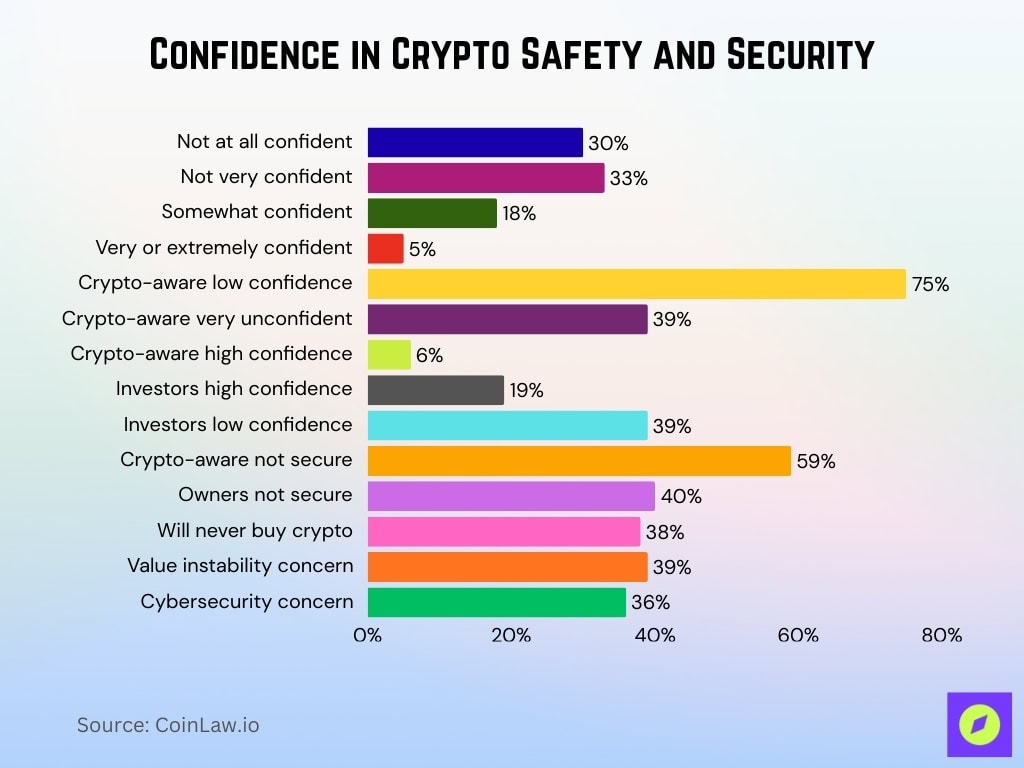

Confidence in Crypto Safety and Security

- About 63% of U.S. adults are not very or not at all confident in the safety and reliability of crypto, while only 5% are extremely or very confident.

- Roughly 30% of adults say they are not at all confident in crypto’s safety, compared with 33% who are not very confident and 18% who are somewhat confident.

- Among Americans who have heard of crypto, about 75% report low confidence in its reliability and safety, leaving roughly 25% at least somewhat confident.

- Around 39% of crypto-aware adults feel very unconfident about crypto safety, versus only about 6% who feel extremely or very confident.

- Among U.S. adults who have invested in crypto, about 19% feel extremely or very confident in its reliability and safety, compared with 39% who are not very or not at all confident.

- Nearly 59% of people familiar with crypto say they are not confident in its security, including roughly 40% of current owners.

- Roughly 38% of non-owners say they will never buy crypto, with unstable value cited as the top concern by 39% and cyberattacks or lost access worrying another 36%.

Cryptocurrency Security and Cyberattacks

- Crypto theft reached about $3.4 billion in 2025, with North Korean-linked hackers responsible for roughly $2.02 billion of the total.

- Hackers stole approximately $2.2 billion from crypto platforms across 303 incidents in 2024, up from 282 hacks the previous year.

- By mid-2025, stolen funds had already hit around $2.17 billion, driven largely by a single Bybit hack worth roughly $1.5 billion.

- Ransomware payments in crypto fell to about $813.55 million in 2024, a 35% decline from the record $1.25 billion in 2023.

- Less than 50% of recorded ransomware attacks in 2024 resulted in victims paying, reflecting stronger defenses and law-enforcement pressure.

- Chainalysis projects that up to $4 billion worth of cryptocurrency could be stolen in a single year if first-half 2025 trends were to continue.

- Personal wallet compromises and physical “wrench” attacks roughly doubled in 2025 compared with the previous high year, targeting higher-value holders.

- Multi-factor authentication adoption in finance and banking reached about 60% of organizations in 2024, with tech-sector usage as high as 87%

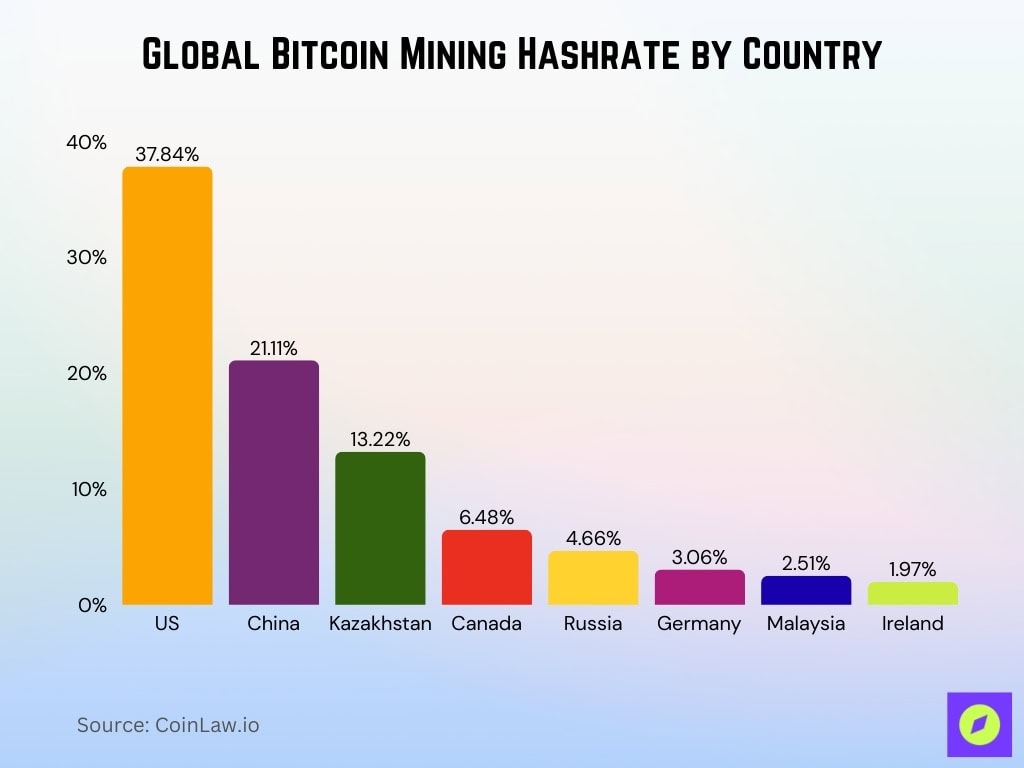

Cryptocurrency Mining Statistics

- The U.S. leads Bitcoin mining with about 37.84% of global hashrate, followed by China at 21.11% and Kazakhstan at 13.22%.

- Canada contributes roughly 6.48% of global Bitcoin mining hashrate, while Russia and Germany provide about 4.66% and 3.06% respectively.

- Combined, Malaysia and Ireland account for roughly 4.48% of Bitcoin hashrate, with 2.51% and 1.97% shares respectively.

- Bitcoin’s network hashrate averages about 1.08 exahash per second, up roughly 150% compared with 18 months earlier.

- Daily Bitcoin miner revenue is around $39.26 million, down about 20% from roughly $49.03 million a year ago.

- Bitcoin’s network hash rate first surpassed 1.047 exahash per second in October 2025 and is projected to exceed 2 exahash per second by 2026.

- Mining profitability fell in late 2025, with daily block reward revenue dropping about 7% month-on-month and roughly 32% year-on-year.

- An ASIC-focused Bitcoin mining data center can cost around $1 million per megawatt of electricity capacity to build and operate.

Recent Developments

- The global crypto market cap is around $3.3 trillion, with Bitcoin consolidating above $90,000 and Ether above $3,200 after a strong start to the year.

- Bitcoin is up roughly 7% and Ether about 9% since January 1, while several large-cap altcoins have posted double-digit weekly gains.

- Short-term forecasts see Bitcoin trading between about $92,800 and $99,300 in January, with an average projected price near $96,100.

- Analysts now project medium-term Bitcoin targets around $132,000 by 2026, with more optimistic scenarios pointing toward $150,000–$163,000.

- Regulatory momentum accelerated in 2025, with the U.S. GENIUS Act and CLARITY Act creating federal frameworks for stablecoins and market structure ahead of full implementation by January 2027.

Frequently Asked Questions (FAQs)

Stablecoin market cap reached roughly $283.7 billion in September 2025, with monthly transaction volumes projected to climb from about $739.2 billion to nearly $980 billion by December 2026, a 32% increase.

Stablecoins account for about 30% of all on-chain crypto transaction volume and processed over $8.9 trillion in the first half of 2025.

In the latest period, North America processed over $2.2 trillion and Europe $2.6 trillion in crypto volume, while APAC volume grew 69% year-over-year.

Bitcoin received over $1.2 trillion in fiat inflows, about 70% more than Ethereum’s roughly $724 billion over the same period.

Conclusion

I hope these statistics allow you to understand the breadth and the size of the growth that cryptocurrencies and other crypto assets are facing. Depending on these insights, you can decide whether you want to invest in this situation or stay away until a new trend occurs.