In recent years, cryptocurrency has shifted from a niche topic to a global conversation. What once intrigued only tech enthusiasts now impacts national policies and global economies. In 2025, the stakes are higher than ever as governments worldwide grapple with the need to balance innovation with security, transparency, and consumer protection.

With each new regulation, the cryptocurrency landscape evolves, affecting investors, businesses, and economic structures globally. This article dives into key statistics surrounding the regulatory impacts on cryptocurrency, highlighting adoption rates, market capitalization shifts, and regulatory milestones shaping the future of digital assets.

Key Takeaways

- 1The U.S. now imposes up to 39.6% tax on cryptocurrency gains, while Germany still offers 0% tax on assets held over one year.

- 2Over 88% of global jurisdictions have introduced stricter crypto regulations, with 59 countries banning specific crypto-related activities.

- 372 out of 98 countries now enforce the FATF “Travel Rule”, requiring VASPs to collect and share user identity data.

- 451% of tax authorities globally have implemented or drafted crypto exchange reporting rules to boost compliance and transparency.

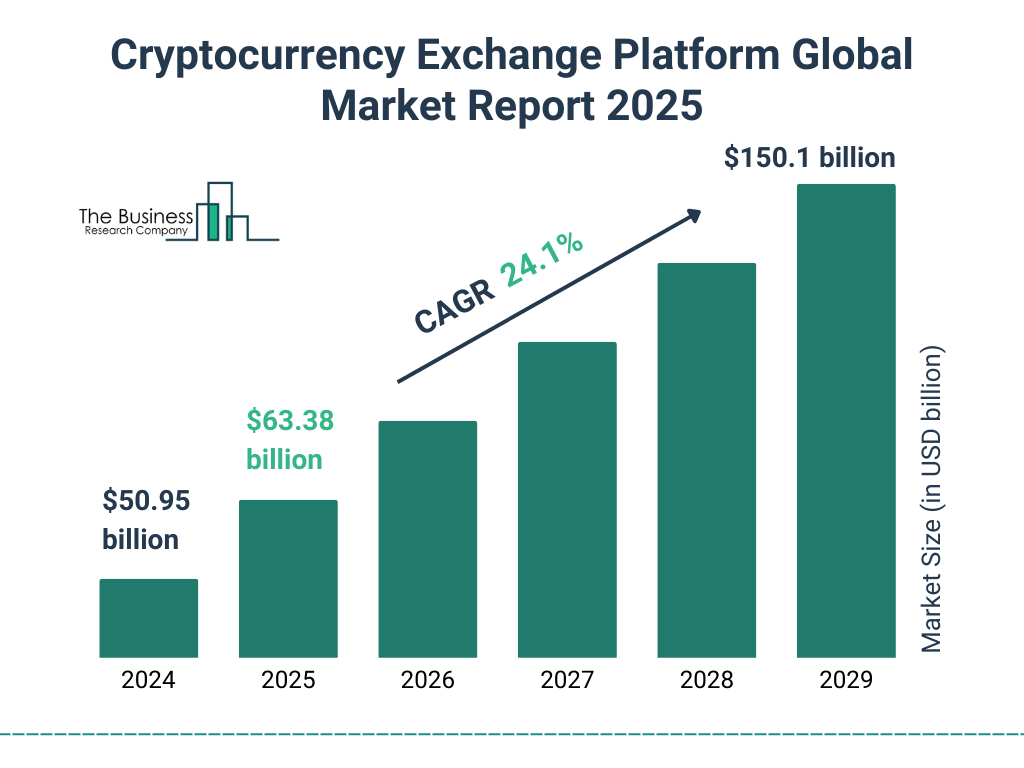

Cryptocurrency Exchange Platform Market Outlook

- The global market size for cryptocurrency exchange platforms is projected to grow to $150.1 billion by 2029.

- This reflects a strong Compound Annual Growth Rate (CAGR) of 24.1% over the forecast period.

- In 2025, the market is expected to reach $63.38 billion, marking a significant year-on-year increase.

This rapid growth highlights increasing adoption, investment, and demand for crypto trading platforms worldwide.

Impact on Market Capitalization

- Global crypto market cap declined by 9% in Q1 2025, now stabilizing near $2.62 trillion amid ongoing regulatory tightening.

- Bitcoin holds a 42% market share in 2025, reaffirming its role as a digital store of value under heightened compliance scrutiny.

- Ethereum’s price fell by 6% in early 2025 after updated staking compliance rules affected institutional staking services.

- Stablecoin redemptions jumped 26%, with USDC and Tether facing pressure as investors migrated to central bank digital currencies.

- Ripple’s XRP rose 22% after final legal clearance in major regions, cementing its role in cross-border payment infrastructure.

- DeFi total value locked dropped 12%, especially in lending and derivatives protocols, due to increased reporting and compliance hurdles.

- Emerging market coins like Solana and Cardano saw 25–35% swings in Q1 2025 amid rapid regulatory changes in Asia and Latin America.

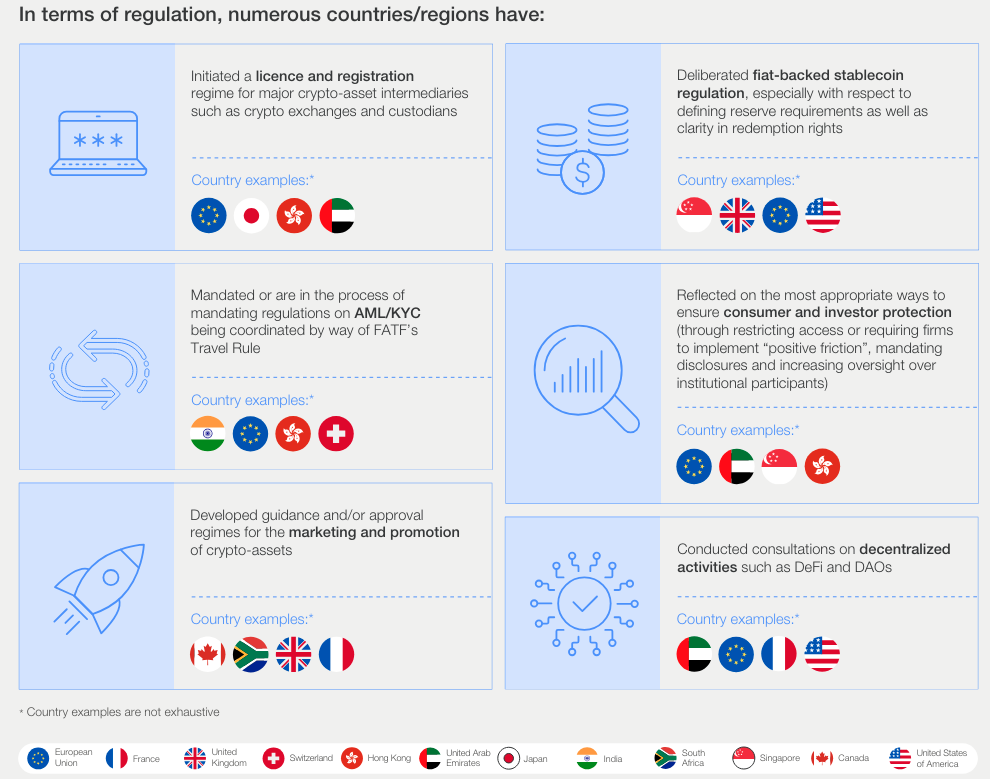

Crypto Regulation Trends Across Key Regions

- Several countries have introduced licensing and registration regimes for crypto intermediaries like exchanges and custodians (e.g., EU, Japan, Hong Kong, UAE).

- Regions including Singapore, the UK, the USA, and Indonesia are actively working on fiat-backed stablecoin regulations, focusing on reserve requirements and redemption rights.

- AML/KYC compliance efforts, aligned with the FATF Travel Rule, are being mandated or developed in countries like India, Hong Kong, and Switzerland.

- Governments are enhancing consumer and investor protection via mandatory disclosures, access restrictions, and institutional oversight (notably in the EU, France, UAE, Hong Kong, and Singapore).

- Countries such as Canada, the UK, and France have released guidance for the marketing and promotion of crypto-assets.

- Consultations on decentralized activities (like DeFi and DAOs) are ongoing in the UAE, EU, France, and the USA.

Compliance Costs for Crypto Businesses

- Average compliance costs rose 28% in 2025, now reaching around $620,000 annually for small to mid-sized crypto firms.

- AML and KYC protocols consume 34% of compliance budgets, remaining the biggest cost center due to global enforcement pressure.

- DeFi platforms saw a 19% rise in operational costs, driven by real-time audit trails and stricter on-chain reporting mandates.

- U.S. exchange registration fees now average $120,000 per state, significantly increasing the regulatory entry barrier for startups.

- 75% of crypto firms increased cybersecurity spending, allocating up to 18% of their annual budgets to meet compliance-grade standards.

- Updated tax reporting rules raised accounting costs by 13%, especially in Japan, Germany, and newly regulated ASEAN nations.

- Compliance staffing rose 41% in 2025, with many firms creating dedicated compliance departments to manage international obligations.

Cryptocurrency’s Environmental Impact

- Bitcoin mining consumes about 137 TWh annually, comparable to a medium-sized industrialized nation.

- 42% of Bitcoin miners now use renewable energy, reflecting stronger eco-conscious efforts across the industry.

- Carbon offset programs adopted by 16% of crypto firms have reduced emissions by 3.1 million metric tons per year.

- Ethereum’s PoS model continues to sustain a 99.95% energy reduction, making it significantly more sustainable.

- Seven countries now enforce mining restrictions, affecting around 18% of the global hash rate.

- 32% of mining operations use recycled or efficient hardware, reducing operational carbon output.

- Sustainable blockchain pledges are rising, with Cardano and Algorand aiming for carbon neutrality by 2030.

Crypto Ownership Trends Among U.S. Adults

- Crypto ownership in the U.S. saw significant growth from 15% in 2021 to a peak of 33% in 2022.

- In 2023, ownership slightly declined to 30%, suggesting a shift in market sentiment or a plateau.

- The 2024 figure was revised to 27% due to a correction in the original reporting.

- A slight rebound is expected in 2025, with 28% of U.S. adults projected to hold cryptocurrencies.

Despite some year-to-year fluctuation, crypto adoption remains strong and significantly higher than pre-2021 levels.

Legal and Regulatory Concerns for Investors

- 26% of countries still have no clear classification for crypto assets, creating legal uncertainty between commodities and securities.

- Crypto scams rose by 18% in 2025, prompting expanded enforcement efforts from agencies like the FTC and Europol.

- 52% of investors report difficulties with crypto tax compliance, especially involving foreign-held assets and DeFi earnings.

- The U.K. and Canada now require disclosures for crypto investments over $75,000, increasing visibility into high-net-worth portfolios.

- Stablecoin regulation expanded, with 43% of countries enacting consumer protection laws for redemption rights and collateral transparency.

- 21% of NFT holders faced intellectual property disputes, highlighting the urgent need for global digital asset standards.

- 44% of cross-border crypto investors report legal complications due to inconsistent international frameworks and regulatory mismatches.

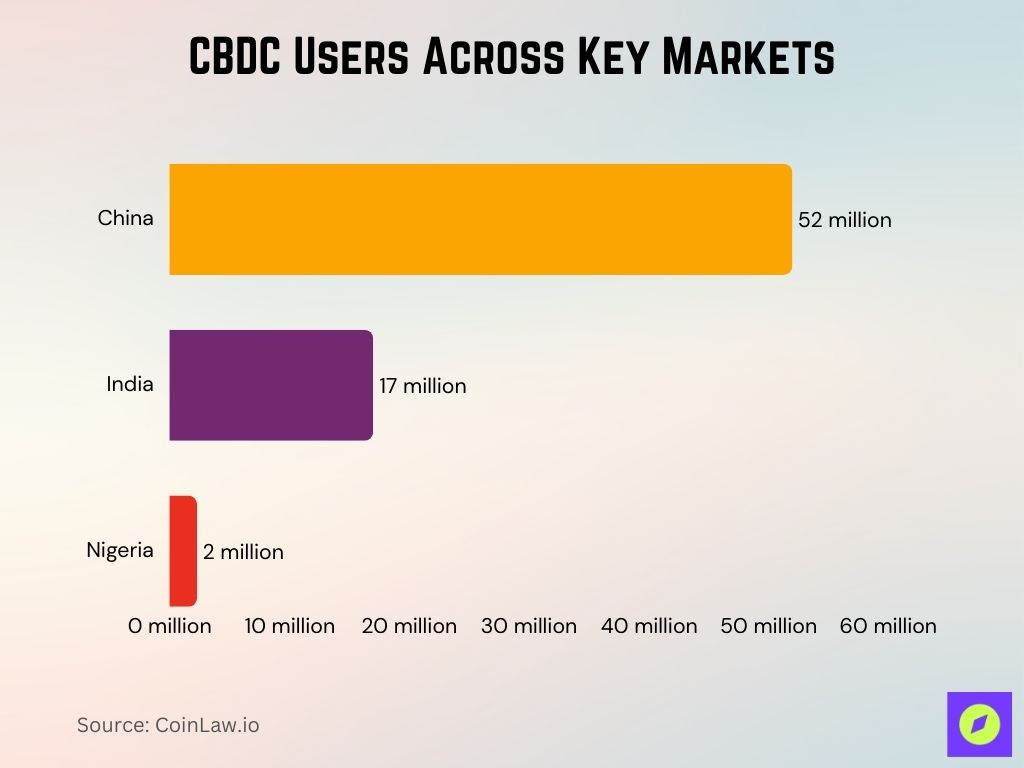

Central Bank Digital Currency Tracker

- 139 countries are now exploring or piloting CBDCs, reflecting a 26% increase from last year as adoption momentum grows.

- China’s digital yuan surpassed 52 million users, processing over $26 billion in cumulative transactions by mid-2025.

- The European Central Bank’s digital euro has entered final pilot testing, with rollout expected in early 2026 across the EU.

- India’s CBDC pilot now includes 17 million users, expanding integration with government subsidies and public banks.

- Jamaica’s JAM-DEX reached 38% adoption among local businesses, strengthening financial inclusion in rural and underserved zones.

- Nigeria’s eNaira now has 2.3 million active users, helping reduce cash usage by 14% nationwide in 2025.

- 47% of CBDC initiatives now operate under formal regulatory frameworks emphasizing cybersecurity, data protection, and fraud prevention.

Future of Money

- 76% of global banks are now investing in blockchain to streamline settlements and security infrastructure.

- Digital payments now account for 49% of all global transactions, with projections reaching 65% by 2030 due to wallet and mobile app growth.

- Five countries, including El Salvador, are actively considering or piloting crypto as legal tender in daily economic use.

- Tokenized real estate now represents 6% of global property holdings, with estimates pointing to 25% tokenization by 2030.

- 51% of financial institutions use smart contracts in 2025, improving efficiency and reducing reliance on manual back-office processes.

- DeFi platforms manage $108 billion in assets, a 35% year-over-year increase, fueled by alternative lending and yield strategies.

- 43% of digital transactions now use blockchain-based identity systems to boost fraud prevention and KYC compliance.

U.S. State Breakdown of Crypto Mining or Related Activity

- Georgia leads the chart with a massive 31% share, making it the top state in this distribution.

- Texas and Kentucky are tied at 11% each, showing strong participation in crypto-related operations.

- New York follows with 10%, maintaining its role as a significant player in the digital asset ecosystem.

- California holds 8%, which is notable given its tech-centric economy.

- North Carolina and Nebraska contribute 5% each.

- Washington and Colorado trail with 4% and 2%, respectively.

- The “Other” states category accounts for 13%, representing smaller-scale participation across the rest of the U.S.

Recent Developments

- SEC Concludes Investigation into Robinhood: The U.S. Securities and Exchange Commission (SEC) has closed its investigation into Robinhood’s crypto trading arm without pursuing enforcement action. This decision reflects a shift towards a more lenient regulatory environment under President Donald Trump’s administration.

- Dismissal of Lawsuit Against Coinbase: The SEC has indicated plans to drop its lawsuit against Coinbase, which sought to regulate the exchange as a securities platform. This move suggests a broader trend of regulatory easing in the crypto industry.

- Executive Order Promotes Digital Financial Technology: On January 23, 2025, President Trump signed an executive order titled “Strengthening American Leadership in Digital Financial Technology,” aiming to support the growth and use of digital assets and blockchain technologies across various economic sectors.

- Establishment of SEC’s Crypto Task Force: The SEC has formed a new Crypto Task Force led by Commissioner Hester Peirce. This initiative seeks to create a more predictable regulatory framework for crypto assets, moving away from the previous “regulation by enforcement” approach.

- Global Regulatory Updates: Luxembourg has enacted the Law of February 6, 2025, incorporating key European regulations on crypto assets and green bonds. This positions Luxembourg as a leading jurisdiction in regulatory compliance and innovation within the crypto space.

Conclusion

Cryptocurrency regulation in 2025 underscores a critical shift toward structured and accountable growth within the industry. As more countries enact comprehensive policies, cryptocurrency becomes increasingly woven into traditional finance while maintaining its innovative potential. From regulatory costs for businesses to evolving investor demographics, each aspect influences how crypto integrates into the global economy. Furthermore, with CBDCs and digital identities on the rise, the very nature of money is transforming, bridging the digital and traditional financial realms. As the landscape evolves, staying informed about these regulatory shifts will be essential for investors, businesses, and policymakers navigating the future of digital finance.