Imagine an industry evolving faster than most, where fortunes are won or lost within milliseconds. This is the cryptocurrency derivatives market, where traders leverage speculative positions to capitalize on digital assets. With increased institutional involvement and a surge of new financial products, crypto derivatives have expanded far beyond their early niche. As we step today, this article dives into the latest statistics and trends in this dynamic market, from trading volume to institutional adoption, offering a clear picture of where the industry stands today.

Key Takeaways

- 1The crypto derivatives market hit a new record in 2025 with $8.94 trillion in monthly trading volume, surpassing spot trading once again.

- 2Paradigm’s institutional network accounted for 33% to 36% of Deribit’s monthly volume, reinforcing its key market position.

- 3The total crypto trading volume soared to $3.12 trillion, with derivatives making up a dominant 74.2% share.

- 4Spot trading on CEXs comprised just 25.8% of total volume, while DEXs retained a modest slice of the market.

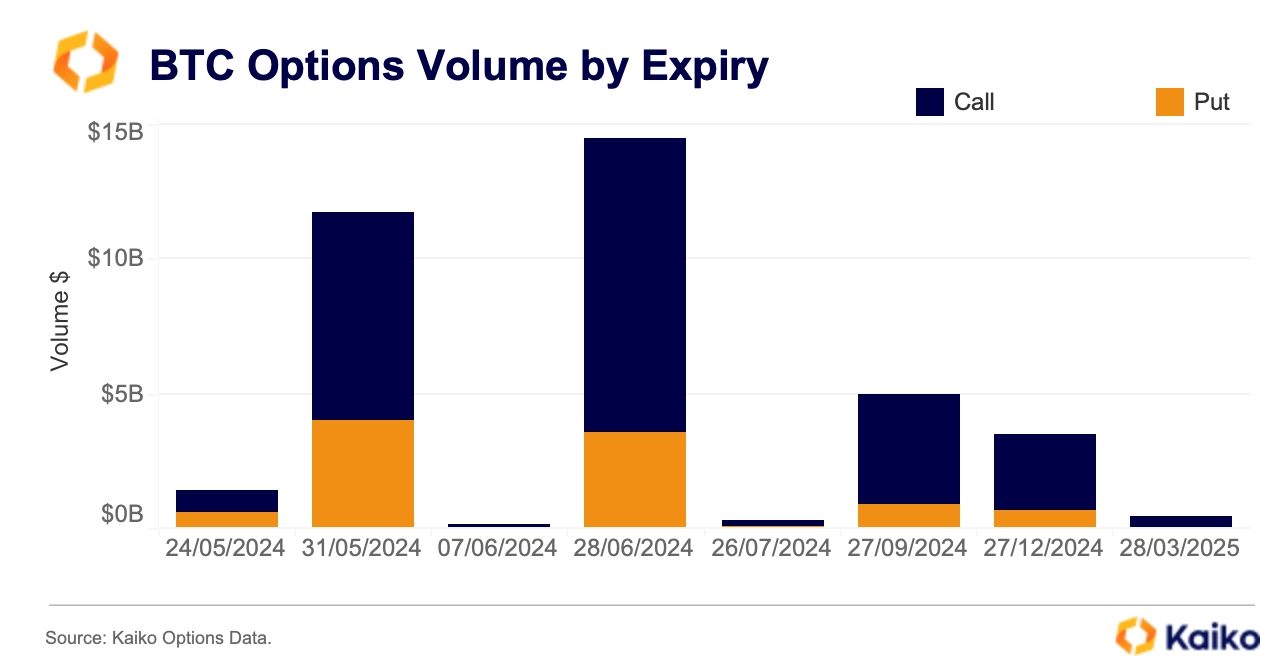

BTC Options Volume by Expiry

- June 28, 2024, has the highest total options volume at ~$15B, with a strong presence in both Calls ($9.5B) and Puts ($5.5B).

- May 31, 2024, follows closely with a combined volume of $11B, split between Calls ($6.5B) and Puts ($4.5B).

- September 27, 2024, and December 27, 2024, show moderate activity with ~$5B and ~$4B in total volume, respectively.

- Short-dated expiries like May 24 and June 7 see significantly lower volumes, with under $2B and $0.2B, respectively.

- March 28, 2025 has the lowest long-term volume, around $0.5B, suggesting limited far-dated options interest.

Crypto Derivatives Market Overview

- The crypto derivatives market is now valued at over $28 trillion annually, making it one of the most active digital finance sectors.

- In 2025, crypto derivatives represent approximately 76% of the total cryptocurrency trading volume, up from previous years.

- Bitcoin and Ethereum derivatives still dominate the space, accounting for 68% of all crypto derivatives traded.

- The Asia-Pacific region remains the leader, contributing over 48% of global crypto derivatives volume thanks to supportive regulations.

- Solana and Polygon derivatives grew rapidly in 2025, with options trading volumes rising by 27% and 31%, respectively.

- DeFi derivatives platforms like Uniswap and dYdX saw a 43% increase in trading volumes, reflecting rising user trust and activity.

- Regulated crypto derivatives expanded across the US and Europe, as new rules enforced tighter risk compliance and oversight.

- Institutional investors, including hedge funds and TradFi firms, now contribute approximately 42% of total derivatives trading volume.

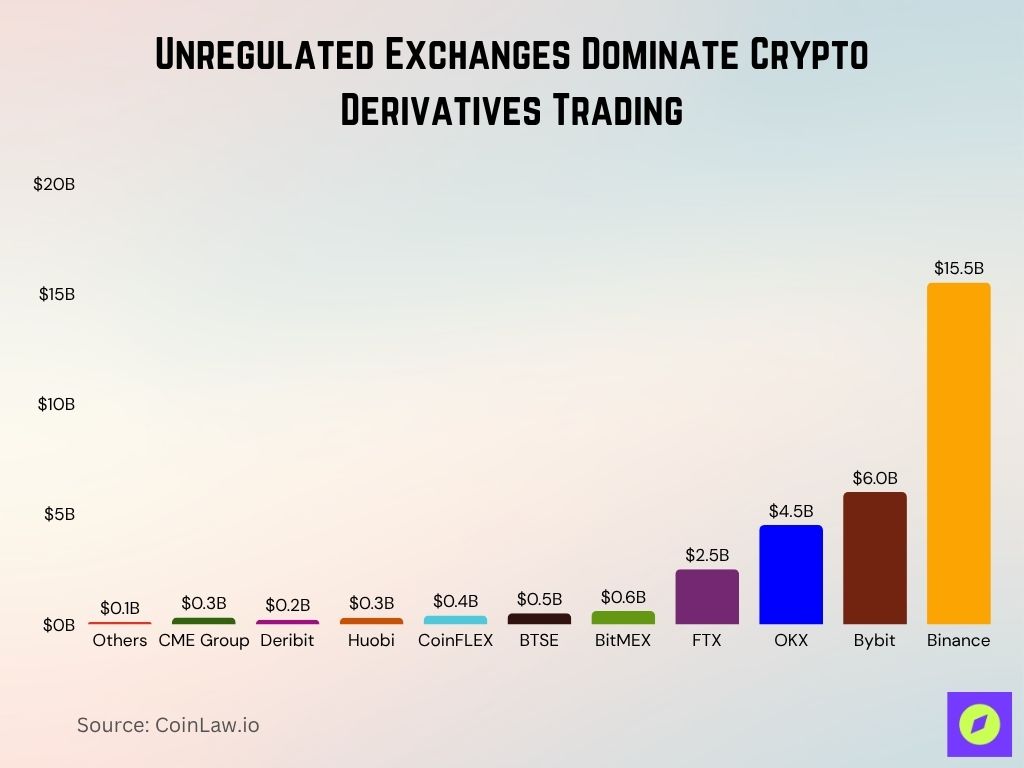

Unregulated Exchanges Dominate Crypto Derivatives Trading

- Binance leads the market with a massive $15.5 billion in daily trading volume, dominating all other platforms.

- Bybit and OKX trail far behind, with $6.0B and $4.5B in daily volume, respectively.

- FTX recorded around $2.5B in 24-hour trading activity prior to its shutdown.

- The regulated exchange CME Group logs just $311 million daily, highlighting the imbalance in volume between regulated and unregulated platforms.

- BitMEX: $0.6B

- BTSE: $0.5B

- CoinFLEX: $0.4B

- Huobi: $0.3B

- Deribit: $0.2B

- 97% of the total crypto derivatives volume is processed through unregulated exchanges, raising regulatory and transparency concerns.

Crypto Derivatives Products and Valuation Considerations

- Perpetual contracts continue to dominate in 2025, accounting for 78% of total crypto derivatives trading volume.

- Futures contracts on Bitcoin and Ethereum recorded a 26% year-over-year growth, showing strong speculative demand.

- Altcoin options markets expanded further, with Solana and Cardano options demand up 35% and 28%, respectively.

- Tokenized derivatives of traditional assets reached a market value of $3.1 billion, driven by DeFi platform innovations.

- Leveraged tokens make up 18% of retail trading volume, with platforms like Binance and OKX seeing continued traction.

- Crypto volatility indices gained momentum, with average daily volumes exceeding $135 million in 2025.

- Valuation models for crypto options increasingly reflect traditional finance principles, adjusted for crypto’s elevated volatility and risk dynamics.

Trading Volume and Open Interest

- Daily crypto derivatives trading volume averaged $24.6 billion in 2025, reflecting a 16% increase from the previous year.

- Open interest in Bitcoin futures reached $16.3 billion, up from $12 billion in 2024, showing sustained institutional engagement.

- Ethereum futures open interest climbed by 29%, driven by increased utility and speculation around ETH-based DeFi and ETFs.

- Binance and OKX led trading activity, with Binance accounting for 33% of total derivatives volume.

- Retail investors made up over 66% of trading in high-volatility assets such as Dogecoin and Shiba Inu.

- DeFi derivatives platforms like dYdX and Synthetix reached $1.45 billion in active open interest by mid-2025.

- The average holding period for derivatives fell further, with 81% of positions closed within 24 hours, underscoring short-term speculation.

Key Features

Crypto derivatives possess distinctive features that set them apart from traditional financial instruments, catering to a broad spectrum of trading strategies and risk profiles.

- High-leverage options are common, with platforms offering up to 125x leverage on Bitcoin futures, though this feature attracts significant regulatory scrutiny.

- 24/7 trading availability makes crypto derivatives unique, contrasting sharply with traditional assets that operate within standard market hours.

- Low transaction costs on major exchanges like Binance and Kraken keep trading accessible, with fees as low as 0.01% per transaction for high-frequency traders.

- Stablecoin margining has become the standard across major derivatives platforms, reducing exposure to volatile collateral.

- Automated liquidation systems protect platforms from defaults, automatically selling off positions when they reach critical levels, which has been crucial in avoiding major losses.

- Multi-chain derivatives are now available, enabling traders to access contracts across different blockchain networks like Ethereum, Binance Smart Chain, and Solana.

- Portfolio margining systems are gaining traction, allowing users to optimize their margin requirements by offsetting correlated risks across assets.

Leading Exchanges and Market Share

- Binance retains the top spot with a 36% market share, driven by deep liquidity, diverse products, and global user support.

- OKX and Bybit follow closely, each controlling around 21% of the market thanks to efficient platforms and low trading fees.

- dYdX, the top decentralized derivatives exchange, doubled its volume again in 2025, now holding 10% of the DeFi market share.

- FTX’s former market share remains absorbed by competitors like Bybit, Kraken, and OKX, following its 2022 collapse.

- BitMEX holds a reduced yet stable 4% share, still favored by high-leverage traders and legacy users.

- Kraken and CME Group focus on institutions, with CME managing $2.6 billion in Bitcoin futures open interest by mid-2025.

- Regional exchanges like Huobi and Upbit dominate in Asia, securing over 9% combined market share through local regulatory alignment.

Top Cryptocurrency Derivatives Exchanges

The top exchanges in the cryptocurrency derivatives space have become critical players in the financial ecosystem, catering to traders looking for high leverage and access to a wide range of digital assets. Here are the top exchanges making waves in 2024:

- Binance remains the industry leader, boasting $14 billion in daily trading volume and offering a variety of contracts on major cryptocurrencies with up to 125x leverage.

- OKX, a close competitor, serves 20% of the market, with a focus on user experience and robust security, especially popular in Asia.

- Bybit has secured a 15% share in the global derivatives market, known for its zero-downtime trading and focus on retail-friendly features.

- CME Group is the go-to for institutional investors in the U.S., with its Bitcoin and Ethereum futures contracts now comprising a notable portion of open interest in regulated markets.

- dYdX continues to grow in the DeFi sector, capturing 8% of derivatives volume through its decentralized, permissionless platform that appeals to privacy-conscious traders.

- Deribit, the primary exchange for crypto options, maintains dominance in this niche with 85% of options trading volume in Bitcoin and Ethereum.

- Huobi and BitMEX have strong presences in Asia, particularly for traders interested in high-leverage contracts, though BitMEX has decreased in prominence after regulatory issues.

The Impact of Economic Data on Crypto Derivatives Trading

Economic indicators have a profound impact on cryptocurrency derivatives markets as traders closely monitor traditional financial signals to make informed decisions. Here’s how economic data is influencing crypto derivatives in 2024:

- U.S. Federal Reserve rate hikes have significantly impacted Bitcoin futures, with price swings of up to 12% on days with major announcements.

- Inflation data in the Eurozone has driven increased interest in stablecoin-based derivatives, with 20% more volume on USDT-margined contracts as traders seek stability.

- Global energy prices are affecting the mining costs of cryptocurrencies like Bitcoin, which in turn influences derivatives trading based on the anticipated profitability of mining.

- Interest rate changes have led to increased demand for perpetual contracts as traders hedge against fiat currency depreciation.

- Employment data from the U.S. and China affect crypto derivatives as economic optimism correlates with increased speculative activity.

- The U.S. Dollar Index (DXY) has emerged as a leading indicator for crypto market trends, with significant trading volume spikes in Bitcoin futures when the dollar strengthens or weakens.

- Regulatory updates on crypto tax policies and anti-money laundering (AML) rules drive immediate market reactions, with volatility in derivatives trading spiking on policy announcements.

Product Innovations and Offerings

- Options on altcoins like Solana and Chainlink gained traction, with a 35% increase in options trading volume on these assets.

- Tokenized asset derivatives now include precious metals and real estate, with $500 million in trading volume recorded in tokenized commodities.

- Leveraged and inverse ETFs have been launched by several exchanges, allowing traders to gain or short exposure to crypto without owning the underlying asset.

- Interest rate swaps for stablecoins are a recent addition, allowing investors to hedge against inflation with returns pegged to DeFi lending rates.

- Crypto staking derivatives are emerging, letting users speculate on staking yields without committing assets for extended periods.

- Social trading features are integrated into platforms like Bybit and eToro, where users can follow high-performing traders to replicate their strategies.

- Perpetual swaps with dynamic leverage offer traders flexibility, allowing adjustments to leverage levels based on market conditions to mitigate risk.

Risk Management and Liquidations

- Major exchanges processed over $1.42 billion in liquidations on high-volatility days throughout 2025.

- Insurance funds on platforms like Binance and Bybit now cover more than $670 million to protect against massive losses.

- Trailing stop-loss orders saw a 21% increase in usage as traders aim to preserve gains in unstable market conditions.

- Forced liquidation rates dropped by 13% in 2025 as exchanges improved risk controls and margin monitoring systems.

- Dynamic margin systems on exchanges like OKX adjust based on real-time volatility, lowering overall liquidation exposure.

- Negative balance protection is now standard across major platforms, ensuring traders cannot lose more than their deposits.

- DeFi protocols expanded the use of automated liquidation bots, helping secure nearly $2.1 billion in under-collateralized loans.

Recent Developments

The cryptocurrency derivatives market continues to evolve, with recent developments influencing both market conditions and trader participation.

- Hong Kong is evaluating the approval of new cryptocurrency products, including derivatives and margin lending, aiming to establish itself as a regional digital assets hub. The Securities and Futures Commission has issued nine digital asset trading platform licenses, with eight more under review.

- The crypto derivatives market is projected to experience significant growth in 2025, driven by clearer regulations, advanced trading tools, and broader availability across platforms. Annual trade volumes are approaching $10 trillion, with increased institutional participation and innovative products strengthening derivatives as a major component of the crypto economy.

- Financial institutions are introducing new crypto-based derivative products, such as Bitcoin Friday futures (BFF), to meet the growing demand for advanced trading tools. These offerings aim to provide traders with more options to manage risk and capitalize on market opportunities.

- President Donald Trump’s executive order, “Strengthening American Leadership in Digital Financial Technology,” has reshaped digital asset regulations, promoting the digital asset industry. This policy shift is expected to lead to increased cryptocurrency trading and the creation of new digital assets.

- The Australian Securities and Investment Commission has filed a lawsuit against Binance Australia’s derivatives unit for misclassifying retail customers as wholesale clients, denying them consumer protections. This legal action underscores the importance of accurate client classification in the crypto derivatives sector.

Conclusion

The cryptocurrency derivatives market today is a vibrant and rapidly expanding space, marked by significant institutional interest, innovative products, and evolving regulatory landscapes. With a $23 trillion annual trading volume and increasing adoption across sectors, crypto derivatives have secured their place as a key component of the digital asset ecosystem. As both new and seasoned traders navigate this complex market, understanding the dynamics and trends will be essential for making informed decisions. The ongoing evolution of this sector suggests that crypto derivatives will play a crucial role in the financial landscape for years to come, shaping the future of digital finance.