Imagine sending money to family halfway across the world, bypassing traditional banks, high fees, and lengthy processing times. Cryptocurrency remittances are revolutionizing this process, creating an efficient, transparent, and cost-effective alternative for millions globally. This digital financial landscape continues to evolve, providing a vital remittance channel, especially for those in developing countries with limited banking access. This shift isn’t just about money transfers; it’s about financial empowerment and inclusion.

Cryptocurrencies offer advantages like reduced fees, faster transactions, and direct peer-to-peer transfers. Let’s dive into key milestones in cryptocurrency remittances, where adoption is growing, and how digital currencies are reshaping this space.

Editor’s Choice: Key Milestones in Cryptocurrency Remittances

- 2019 marked a pivotal point with Bitcoin recognized for cross-border remittances, showing how blockchain could transform global payments.

- In 2021, crypto remittances were estimated to exceed $15 billion globally, driven by increased interest in blockchain-based transfers.

- In 2022, El Salvador became the first nation to adopt Bitcoin as legal tender, enhancing remittance accessibility.

- A 2023 Chainalysis report indicated strong crypto remittance usage in Africa, with user preference tied to lower costs and limited access to traditional banking, though precise regional percentages vary.

- Reports suggest crypto remittance volumes in parts of Central America, particularly El Salvador, though exact figures, like 15% are difficult to independently confirm.

- Blockchain integration with MoneyGram and PayPal enabled crypto remittance options in select countries.

- Industry estimates suggest tens of millions may be using crypto for remittances globally in 2024, though specific usage numbers vary by reporting source.

- In 2025, blockchain-based remittances are estimated to account for 3–5% of global remittance flows, reflecting steady but still minority adoption.

- While stablecoin usage in cross-border transactions is rising, total annual volumes are significantly lower than $6.3 trillion and primarily reflect trading activity rather than remittances.

- By April 2025, 26% of U.S. remittance users had adopted stablecoins for transactions.

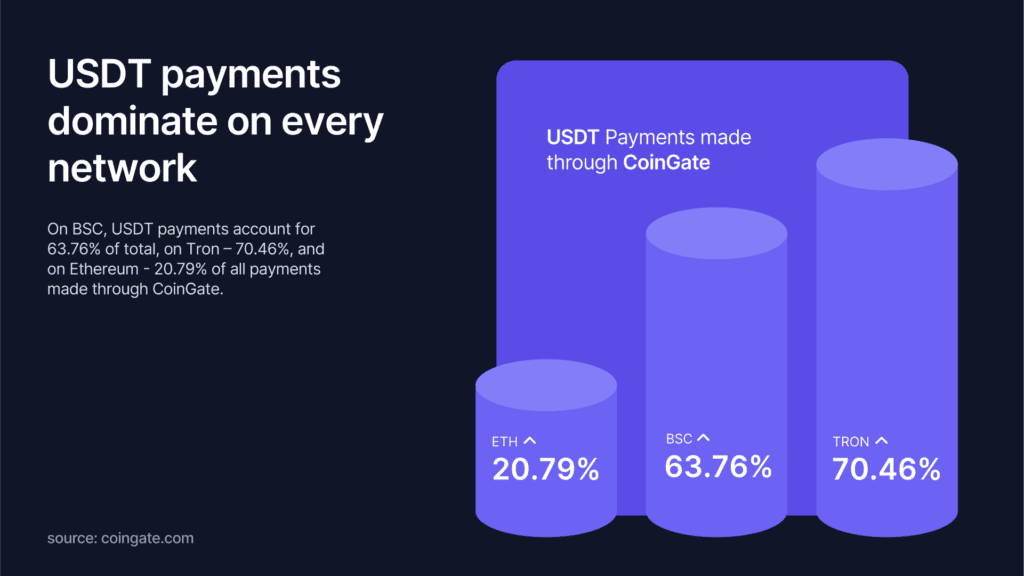

USDT Payment Share by Blockchain Network

- Tron leads with 70.46% of all payments made through CoinGate using USDT.

- Binance Smart Chain (BSC) follows at 63.76%, showing strong adoption of USDT on low-fee networks.

- Ethereum accounts for just 20.79% of USDT payments via CoinGate, likely due to higher gas fees.

Cost Comparison: Cryptocurrency vs Traditional Remittance Methods

- On average, traditional remittance services charge about 6.5 % in 2025, while crypto‑based transfers can cost as little as 1 %.

- Research suggests crypto-based transfers could reduce global remittance fees by billions annually, with estimates ranging from $10–30 billion in potential savings, depending on market penetration.

- Sending $200 via traditional channels still costs around 6 %, whereas using crypto like stablecoins can cut that down to nearly 1 %.

- In high‑fee corridors such as parts of Africa where rates hit 10 %, crypto remittances can reduce costs by up to 70 %.

- Peer‑to‑peer crypto platforms enable users to negotiate fees directly, often resulting in 50 % lower total costs compared to traditional providers.

Transaction Speed, Delays, and Efficiency Metrics

- Cryptocurrency transfers now settle in minutes, any time of day, while traditional bank wires can take 1 to 5 business days.

- Blockchain delivers 24/7 global settlement, helping users in remote or time-sensitive situations.

- Ethereum and other advanced networks now average under 5 minutes for cross-border transfers.

- In regions with slow banking systems, crypto enables delivery in minutes instead of waiting weeks.

- Over 65% of remittance users in Latin America report faster transfers with crypto than with traditional services.

- The Bitcoin Lightning Network enables instant micropayments, reducing delays to milliseconds.

- In Southeast Asia, 76% of remittance users preferred crypto for its speed and reliability.

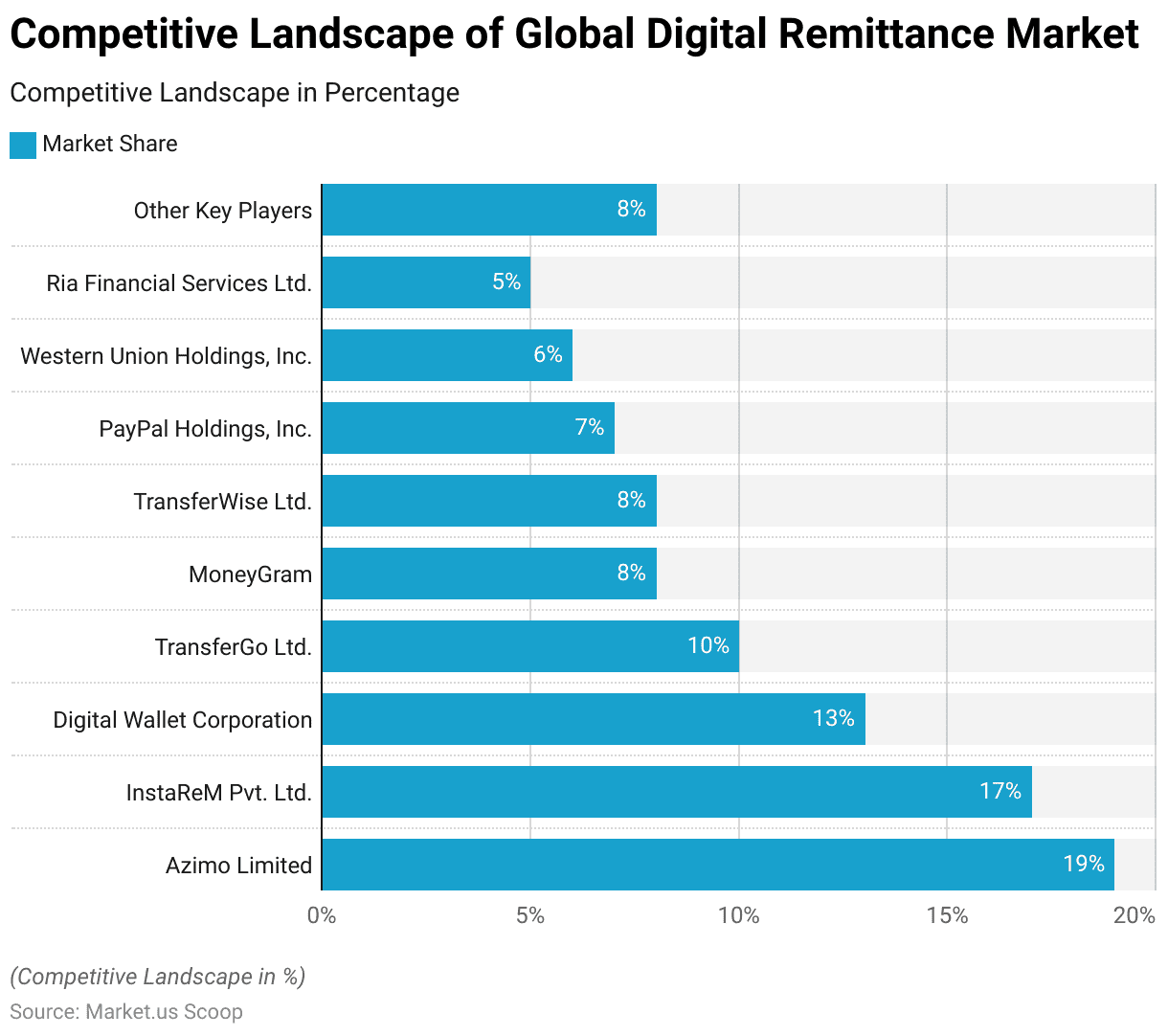

Top Players in the Global Digital Remittance Market

- Azimo Limited leads the market with a 19% share, positioning itself as the top remittance platform globally.

- InstaReM Pvt. Ltd. holds the second-highest market share at 17%, highlighting its rapid global expansion.

- Digital Wallet Corporation commands 13%, reflecting strong traction in Asia and cross-border services.

- TransferGo Ltd. captures 10% of the market, leveraging digital-first remittance models.

- TransferWise Ltd., MoneyGram, and Other Key Players each hold 8%, marking a competitive middle tier.

- PayPal Holdings, Inc. maintains a 7% share, bolstered by its global user base and digital wallet integrations.

- Western Union Holdings, Inc. comes in with 6%, showing continued relevance despite rising fintech competition.

- Ria Financial Services Ltd. rounds out the list with 5%, reflecting its regional focus and partnerships.

High Transaction Fees and Lack of Transparency

- Traditional remittance services often impose hidden costs that make real fees around 6.5% higher than quoted.

- Crypto transactions offer clear upfront pricing so users can compare fees across networks.

- In North America in 2025, around 30% of users experienced hidden fees with traditional remittance methods.

- Digital remittances like crypto and mobile money now cost about 5% on average versus 7% for traditional channels.

- Blockchain and stablecoin solutions reduce remittance fees to as low as 1–3%, especially in high-fee regions.

- In India, using cryptocurrency continues to save users 20–25% in transfer fees by avoiding service surcharges.

- Remittance platforms delivering reduced prices could save users up to $16 billion annually with just a 5-point fee reduction.

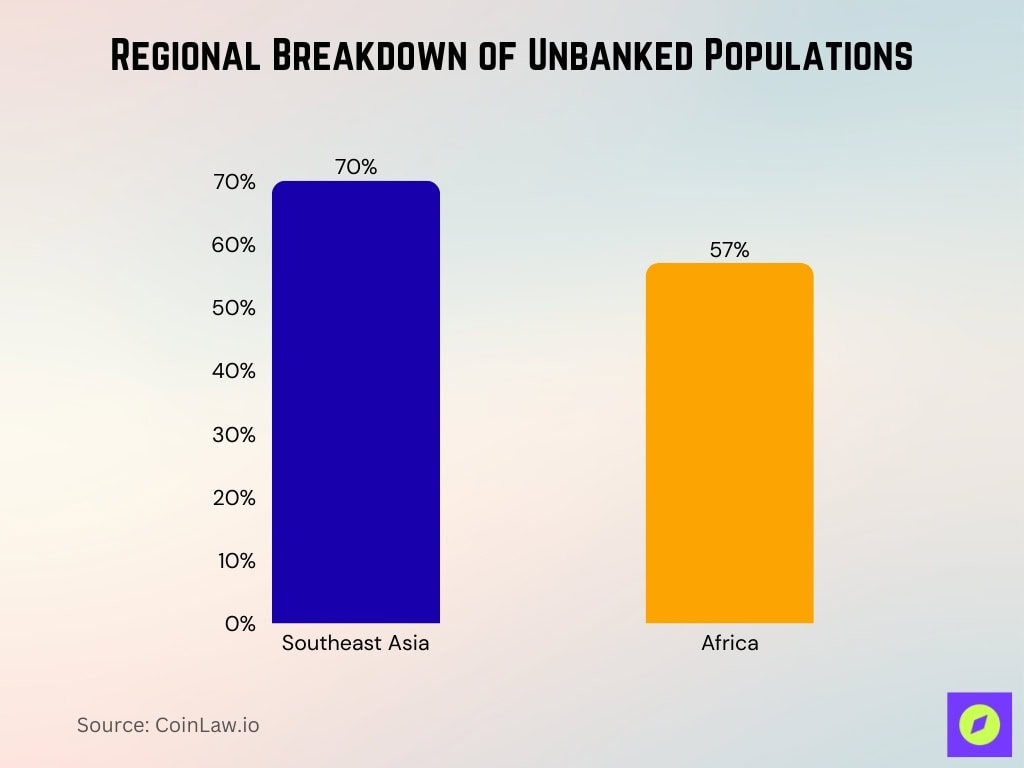

Unbanked and Underbanked Populations: Opportunities and Challenges

- In Southeast Asia, 70% of adults are unbanked or underbanked, offering a significant opportunity for crypto inclusion.

- In Africa, around 57% of adults still lack bank accounts, but crypto and mobile wallets are emerging as alternatives.

- Approximately 1.4 billion adults remain unbanked worldwide, and in 2025, crypto platforms will offer access using only internet connectivity.

- In 2025, about 15% of unbanked individuals globally use cryptocurrency for transfers due to lower costs and easier access.

- India’s large unbanked population now includes 25 million rural users relying on mobile-based crypto wallets for remittances.

- In the Middle East, crypto adoption among underbanked populations surged by 30% due to mobile-first financial solutions.

- Despite these advances, limited internet access and unclear regulations still slow crypto growth among the unbanked.

P2P Platforms and Decentralized Blockchain Impact on the Remittance Market

- Peer-to-peer (P2P) platforms now handle a growing share of remittances, offering direct transfers that bypass intermediaries and reduce costs.

- Peer-to-peer crypto transfers in emerging markets like Nigeria and Venezuela are significant, with informal P2P volumes contributing to a growing share of crypto-based remittances.

- DeFi tools are powering an estimated 15% of remittances via decentralized apps (dApps), eliminating third-party fees.

- In Nigeria, P2P platforms account for about 80% of crypto transactions, reflecting their popularity amid banking limitations.

- By 2025, around 20% of crypto remittances will go through P2P networks, reducing reliance on centralized institutions.

- The blockchain remittance sector is growing rapidly at an annual rate of 25% CAGR, highlighting demand for decentralized solutions.

- Latin America shows rapid P2P crypto adoption, especially in Venezuela and Argentina, where these platforms offer stability.

Technological Innovations Enhancing Crypto Remittances

- The Bitcoin Lightning Network now processes transactions in under a minute with ultra-low fees, ideal for small remittance payments.

- Smart contracts on Ethereum enable automated and fraud-resistant transfers, improving trust in low-infrastructure regions.

- Layer-2 solutions like Polygon and Arbitrum continue lowering remittance costs to 1–3%, making crypto more accessible.

- Nearly 20% of crypto remittances now use multi-signature wallets to boost security with multiple transaction approvals.

- Binance Smart Chain supports fast and low-cost remittance transfers across Southeast Asia.

- Mobile wallets like Strike and Flexa saw 30% user growth in Latin America, increasing adoption among unbanked users.

- Biometric and wallet integration improvements in 2025 are enhancing usability, privacy, and security for remittance users.

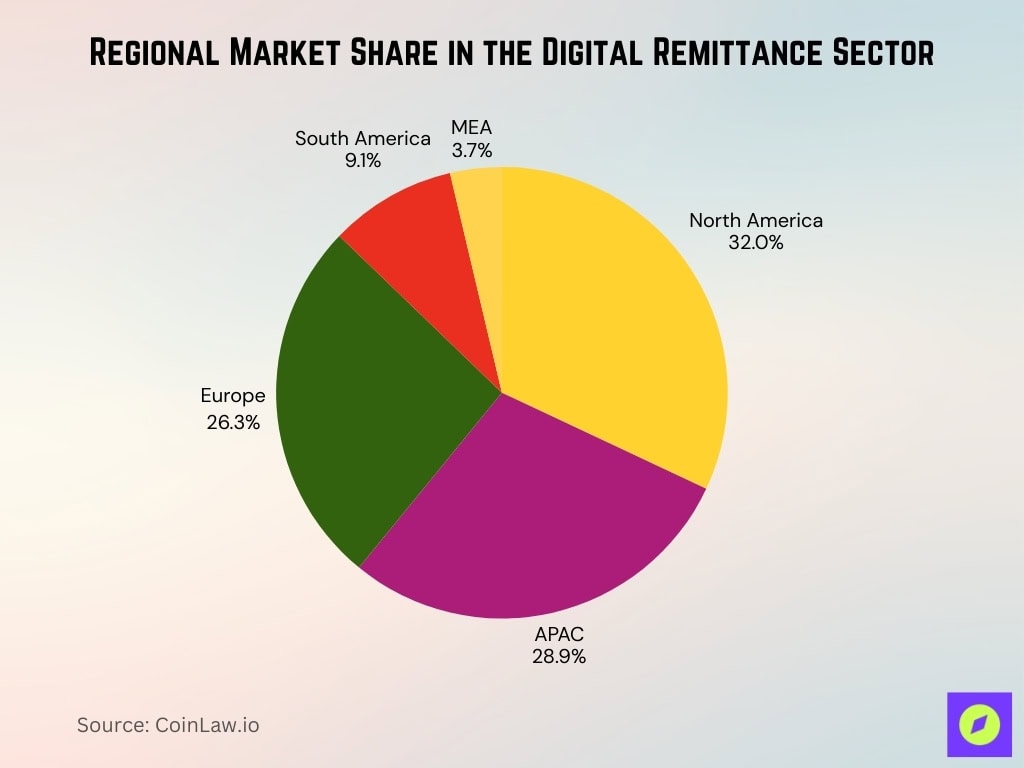

Regional Market Share in the Digital Remittance Sector

- North America holds the largest share at 32%, driven by high digital wallet usage and fintech penetration.

- APAC follows closely with 28.9%, reflecting strong remittance corridors and mobile-first economies.

- Europe accounts for 26.3%, supported by cross-border labor migration and regulatory fintech frameworks.

- South America represents 9.1% of the market, with growing adoption in underserved banking regions.

- MEA (Middle East & Africa) has the smallest share at 3.7%, despite rising demand for cross-border solutions.

Wealth Preservation and Financial Inclusion

- Stablecoins like USDT and USDC remain popular for remittances, offering a 1:1 USD peg that safeguards recipients against local currency instability.

- In 2025, about 40% of surveyed remittance users in Latin America preferred saving with crypto, particularly Bitcoin and stablecoins.

- Over 35% of crypto remittance recipients in Nigeria held their funds for six months or longer as a hedge against high inflation.

- Approximately 60% of unbanked adults using crypto for remittances cited it as a key path to financial independence.

Cryptocurrencies as a Potential Game-Changer in Remittances

- Most estimates suggest crypto remittances represent 3–6% of the global remittance market in 2025, with potential for growth depending on regulation and infrastructure.

- Over 50% of countries across the US, EU, and Latin America are now exploring regulatory frameworks to integrate cryptocurrency into their financial systems.

- Some estimates project billions in remittance cost savings from cryptocurrency use, potentially reaching $7 billion annually, contingent on adoption and regulation.

- 85% of remittance users can now receive crypto payments directly via mobile wallets thanks to widespread smartphone adoption.

- Crypto remittances improved financial security for 75% of low-income households in Southeast Asia.

- Remittance transaction volumes in high-adoption regions such as Latin America and Africa are growing by around 50% annually.

- Based on current adoption and growth trends, blockchain-based remittances could approach a significant share of the global remittance market, possibly nearing $1 trillion by 2028.

Recent Developments in the Cryptocurrency Remittance Sector

- Western Union is piloting stablecoin remittance settlements across key corridors in South America and Africa.

- MoneyGram’s wallet launched, enabling remittances in USDC with cash pick-up in over 180 countries.

- In the Philippines, stablecoin remittances have reduced fees from around 6% to nearly 1%, speeding up transfers to minutes.

- Coins.ph introduced a government-backed blockchain remittance service that simplifies fund transfers with stablecoins.

- El Salvador reformed its Bitcoin law in 2025 and launched new Bitcoin-based financial tools for families receiving remittances.

- In Central America, local banks began accepting Bitcoin directly for remittance payments, expanding access in El Salvador and Honduras.

- Morocco’s central bank is exploring a CBDC for peer-to-peer and cross-border payments in partnership with global institutions.

Conclusion

The growth of cryptocurrency in the remittance sector offers a promising shift toward greater financial accessibility and independence. With reduced fees, increased speed, and transparent processing, crypto-based remittances provide a powerful alternative to traditional channels, especially for underbanked and unbanked populations in developing countries.

As technological innovations and regulatory frameworks evolve, cryptocurrencies are poised to redefine the future of cross-border payments, bringing more financial freedom to millions. This transformation not only saves money but also empowers individuals to manage and preserve their wealth, helping them build a more stable financial future. Cryptocurrency remittances aren’t just a trend; they’re reshaping the global financial landscape.