In recent years, cryptocurrency has moved from a niche investment opportunity to a mainstream asset class, especially among institutional investors. What was once the domain of tech enthusiasts and retail investors has drawn the attention of large financial institutions, hedge funds, and corporations. Today, institutional investors’ adoption of cryptocurrency is surging, driven by factors like market maturation, regulatory developments, and increasing product diversification. This evolving landscape highlights a dynamic shift in investment strategies and preferences across financial sectors.

Editor’s Choice

- 1.01 billion people globally are forecast to own cryptocurrency in 2026, equal to 12.24% of the world population and roughly 16% of internet users.

- Around 241,700 individuals worldwide are crypto millionaires as of mid-2025, projected to surpass 260,000 in 2026 if the 12.5% CAGR continues.

- Approximately 145,100 Bitcoin millionaires in 2025 are expected to exceed 160,000 holders in 2026 under the same growth trend.

- About 88% of current crypto holders plan to keep investing over the next year, supporting continued adoption momentum into 2026.

- 86% of surveyed institutional investors either already have digital-asset exposure or plan allocations during 2025, positioning institutions for deeper involvement in 2026.

- 96% of institutional investors believe in the long-term value of blockchain and digital assets, underpinning sustained institutional demand into 2026.

Recent Developments

- Brevan Howard’s BH Digital oversees about $2.4 billion in digital-asset AUM, alongside a tokenized $4 billion master fund that advances its macro–crypto strategy.

- Strategy Inc. completed a $2.0 billion 0% convertible senior notes due 2030 offering, with net proceeds of about $1.99 billion earmarked for Bitcoin purchases.

- U.S. spot Bitcoin ETFs collectively hold over $180 billion in Bitcoin, with BlackRock’s IBIT controlling nearly 60% of all spot ETF assets and approaching $100 billion AUM.

- BlackRock’s iShares Bitcoin Trust currently holds around 784,582 BTC worth over $69.3 billion, representing about 3.74% of the capped Bitcoin supply.

- Bitcoin ETF allocations have pushed IBIT’s share of the global ETF Bitcoin market above 55%, consolidating its lead over Fidelity and Grayscale rivals.

- Strategy has raised more than $20 billion via zero- or low-coupon convertible notes since 2020, using the capital primarily to expand its Bitcoin treasury.

Institutional Crypto Adoption: Insights from Current Portfolio Positioning

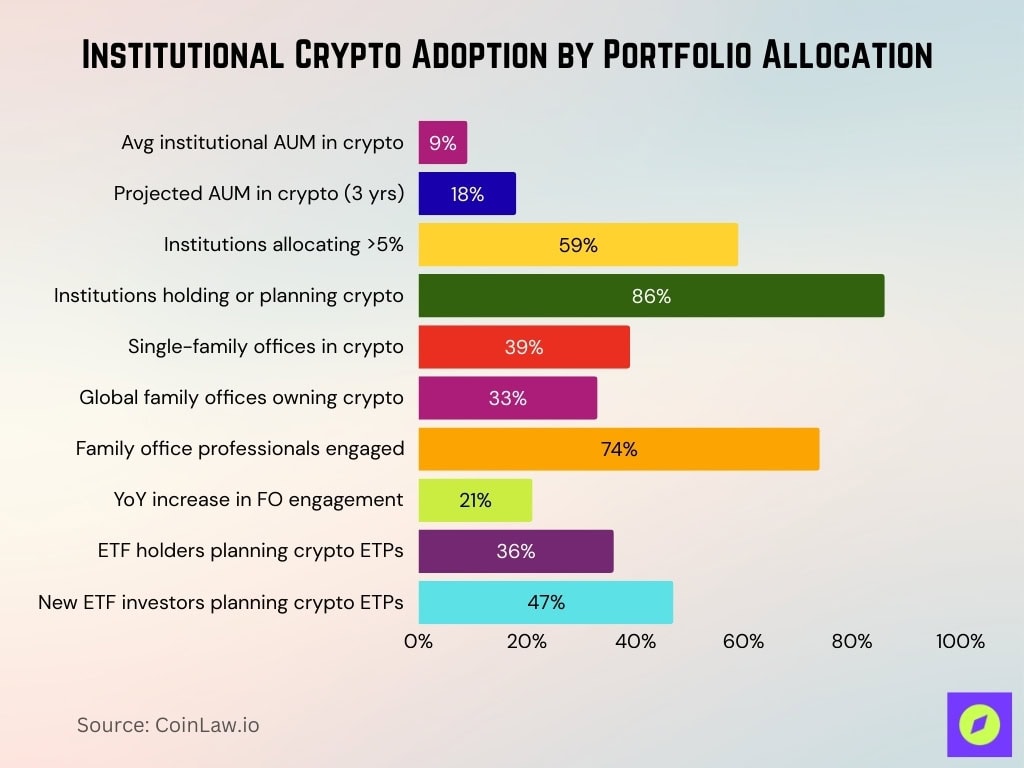

- Institutional investors now allocate an average of 9% of AUM to digital assets, with allocations projected to exceed 18% within three years.

- Around 59% of institutions plan to commit over 5% of their portfolios to cryptocurrencies, reflecting accelerating allocation momentum.

- Nearly 86% of institutional investors already hold or intend to hold digital assets in their portfolios, confirming crypto’s shift into mainstream allocation.

- Roughly 39% of single-family offices now hold or are actively exploring crypto.

- About 33% of global family offices directly own cryptocurrencies, double the penetration seen four years ago, highlighting rapidly rising exposure.

- Nearly 74% of family office professionals have invested in or are exploring cryptocurrencies, a 21% increase in engagement over the past year.

- Among ETF-focused investors, 36% of current ETF holders and 47% of new investors plan to allocate to crypto ETPs, underscoring cross-channel demand.

Addressing Security Concerns

- The global cryptocurrency custody tool market is valued at $2.17 billion in 2025 and projected to reach $4.9 billion by 2029 as institutions harden key management.

- Global cybersecurity spending is expected to hit $240 billion in 2026, up from $213 billion in 2025, reflecting rising investment in digital asset defense.

- The global cyber insurance market reached about $16.3 billion in 2025 and could climb to roughly $23 billion by 2026, closing gaps in crypto-related risk transfer.

- The crypto wallet market was valued at $12.2 billion in 2025 and is projected to grow to $98.57 billion by 2032, underlining the rapid expansion of secure storage solutions.

- Worldwide security spending is on track to reach $377 billion by 2028, with security software representing over 50% of the market and growing at 14.4% annually.

- Theft and cybersecurity coverage accounts for about 38% of total digital asset insurance premiums, reflecting a strong focus on hacking and breach risk mitigation.

- North America holds more than 42% of global digital asset insurance revenue, supported by advanced financial infrastructure and institutional crypto custody.

Top Reasons for Investing in Digital Assets

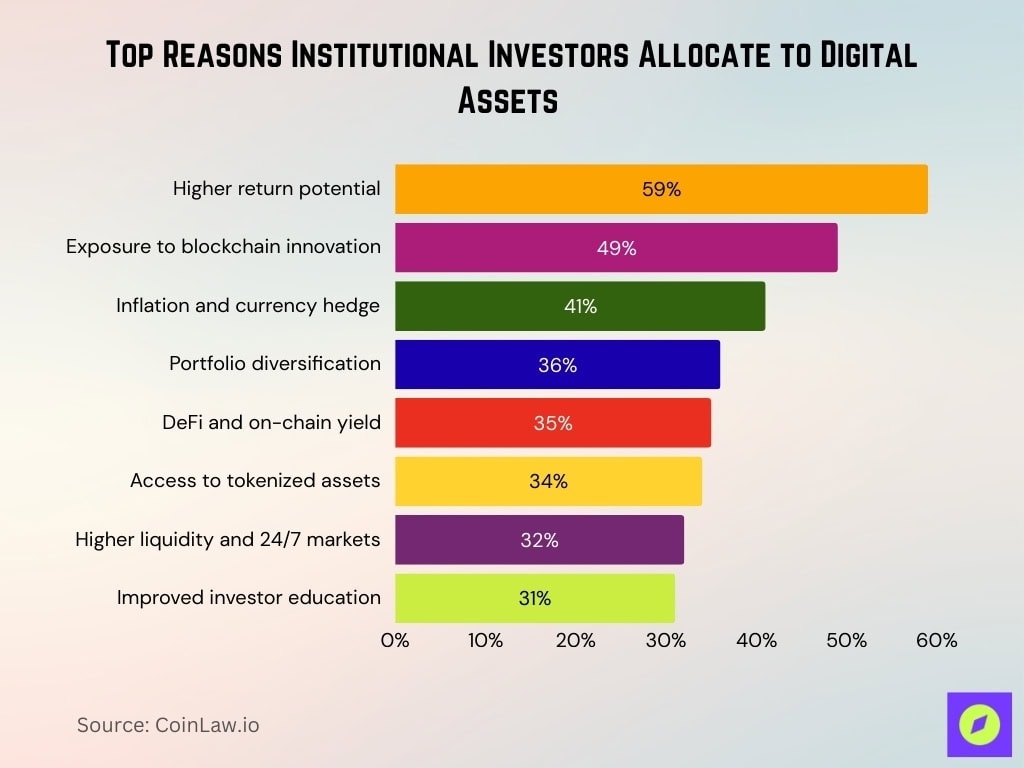

- 59% of institutional investors cite higher returns than other asset classes as their main reason for investing in digital assets.

- 49% are driven by the opportunity to gain exposure to innovative blockchain and digital asset technology.

- 41% view digital assets primarily as a hedge against inflation and currency debasement risk.

- 36% value the low correlation of digital assets with traditional assets for improved portfolio diversification.

- 35% highlight participation in DeFi and on-chain yield opportunities, including staking and stablecoin-based returns.

- 34% point to better access to new asset types and tokenized markets as a key investment driver.

- 32% are motivated by greater liquidity and 24/7 market access relative to many traditional assets.

- 31% emphasize improved investor knowledge and education as a reason for growing comfort with digital assets.

Growth in Institutional Investment

- Institutional digital asset AUM surpassed $235 billion by mid-2025, with institutions now controlling 65% of global crypto investments.

- 55% of traditional hedge funds now have exposure to digital assets, as regulatory clarity improves.

- About 59% of institutional investors plan to allocate over 5% of AUM to cryptocurrencies and related products over the next allocation cycle.

- Over 86% of surveyed institutional investors already have or plan to gain exposure to digital assets in their portfolios in the near term.

- Global Bitcoin and Ethereum ETP AUM reached approximately $200 billion, marking a major institutional milestone for listed digital asset products.

- Digital asset investment products recorded monthly net inflows of $6.03 billion in June 2025, following $7.33 billion in May.

- Around 32% of financial advisors allocated to crypto for client accounts in 2025, an all-time high in survey history.

Interest in Tokenization

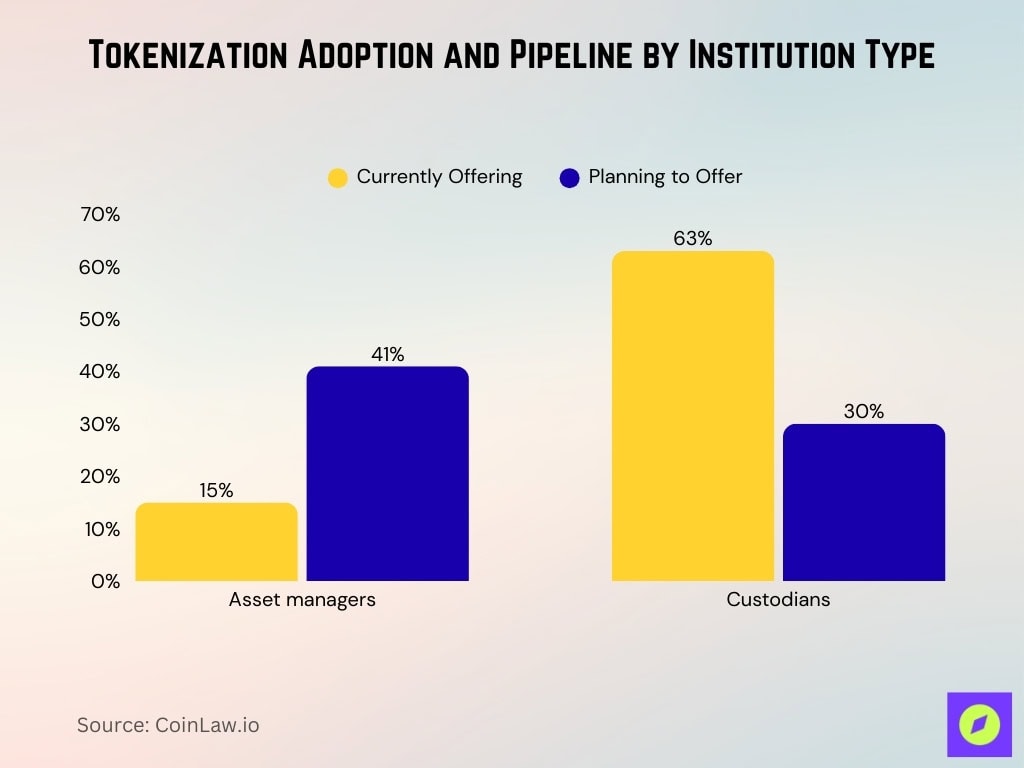

- Only 15% of asset managers currently offer tokenized products, while an additional 41% plan to launch them within two years.

- Custodians lead tokenization, with 63% already offering tokenized assets and another 30% preparing to do so.

- Tokenized real-world assets now total around $24 billion, after growing 308% over the past three years.

- As of mid‑2025, real estate tokens are part of approximately $412 billion in globally tokenized assets across sectors.

- Tokenized Treasury and money-market fund assets reached $7.4 billion in 2025, an 80% year-to-date increase.

- Real estate tokenization alone is estimated at roughly $20 billion in value, with strong momentum toward institutional adoption.

- The dedicated tokenization technology market is valued at about $4.1 billion in 2025 and is forecast to reach $10.46 billion by 2029.

Collaborations with Traditional Finance

- Over 120 banks worldwide now offer live crypto banking services, with crypto-related partnerships growing by more than 50% since 2022.

- BlackRock, Fidelity, and Grayscale together manage about $123 billion in crypto fund AUM, with BlackRock alone near $70 billion across its flagship Bitcoin and Ethereum trusts.

- BlackRock’s broader digital asset portfolio fell from about $104 billion to $78.4 billion in 2025, still representing one of the largest TradFi crypto exposures globally.

- Mastercard now supports crypto and stablecoin payments at over 150 million merchants via more than 100 crypto-focused card programs.

- Visa has facilitated over $100 billion in crypto purchases and more than $25 billion in direct card spending through its crypto-linked card programs.

- Regulatory softening in 2025 prompted a growing share of global banks, representing over 70% of crypto exposure jurisdictions, to expand crypto custody and trading activities.

Most Interesting Cryptocurrencies Revealed

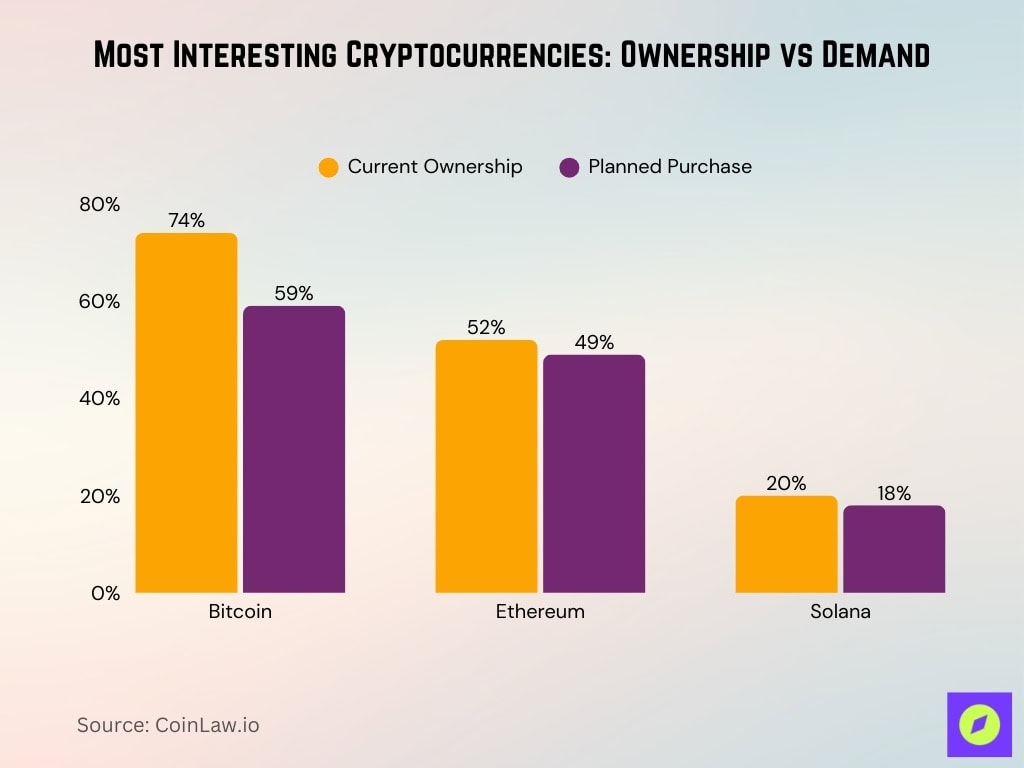

- Bitcoin is held by 74% of crypto owners, keeping it the most widely owned and closely watched cryptocurrency.

- Ethereum is owned by 52% of crypto investors, maintaining its position as the leading smart contract platform.

- Solana ownership among crypto holders climbed to 20%, making it one of the fastest-rising primary coins.

- 59% of prospective buyers plan to purchase Bitcoin in the next 12 months, confirming its dominance in future demand.

- 49% of would-be buyers intend to acquire Ethereum, underscoring its continued appeal for new capital.

- 18% of planned buyers are targeting Solana, signaling strong forward interest in this newer blockchain.

- Ripple (XRP) is held by 11% of U.S. crypto owners, reflecting sustained interest despite regulatory challenges.

- Cardano (ADA) ownership stands at 13% of crypto investors, indicating steady engagement with its ecosystem.

Institutional Trading Strategies and Preferences

- Quant strategies drive 64% of crypto hedge funds, split between 33% long/short and 31% market neutral.

- Spot trading fell to 25% of hedge fund activity, from a 69% peak as derivatives took over.

- Dedicated crypto hedge fund AUM sits near $10–15 billion, while broader managed digital assets are in the low hundreds of billions.

- North American institutional staking revenues hit about $2.5 billion, versus $1.7 billion in Europe.

- CeFi crypto borrows reached $24.37 billion in Q3 2025, up 37.11% quarter-on-quarter and 239.4% from Q4 2023.

- Over 80% of on-chain borrowing now comes from lending apps, with CDP stablecoin debt near 16%.

- Institutions now hold 24% of BTC and 10.72% of ETH supply through staking, RWAs, and ETFs.

Country-wise Adoption

- The United States processes about $2.3 trillion in annual crypto transaction value, remaining the largest institutional market.

- Singapore’s digital asset custody and tokenization market is valued at roughly $1.3 billion, led by institutional custody.

- Over 200 Singapore financial institutions are actively exploring blockchain and digital assets under MAS oversight.

- Hong Kong attracted roughly HK$62 billion (about $8 billion) in new virtual asset investments in 2023.

- Institutional participation in Hong Kong digital assets increased by about 38%, cementing its regional hub status.

- Around 80% of reviewed global jurisdictions saw financial institutions launch digital asset initiatives in 2025.

Frequently Asked Questions (FAQs)

86% of surveyed institutional investors have exposure to digital assets or plan allocations in 2025.

71% of hedge funds with digital asset exposure plan to increase it within a year.

59% of institutional investors planned to allocate over 5% of AUM to cryptocurrencies in 2025.

Conclusion

The institutional adoption of cryptocurrency is transforming the financial landscape, creating new opportunities and challenges for both investors and institutions. With the implementation of regulations, secure custodial solutions, and new trading instruments like spot Bitcoin ETFs, digital assets are more accessible than ever. Tokenization, cross-border payments, and the development of robust security frameworks are just a few examples of how digital assets are integrating into mainstream finance. Institutional cryptocurrency adoption is expected to deepen, shaping the future of the global financial system and expanding access for retail and institutional investors alike.