In 2009, Bitcoin emerged as a niche experiment discussed mainly in cryptography forums. Fast forward today, and we’re seeing crypto wallets in the hands of ride-hail drivers in Lagos, small business owners in Buenos Aires, and even grandparents in Ohio using stablecoins to hedge inflation.

The landscape of cryptocurrency adoption has dramatically evolved, not just in scale but in character. It’s no longer just about investing; it’s about access, utility, and empowerment in a digital-first financial world. This article unpacks the countries driving that adoption, who’s holding what, and how governments and economies are responding.

Editor’s Choice

- Global crypto adoption reached 21% of the internet-connected adult population.

- Stablecoin usage grew globally by 25%, driven by inflation and remittances.

- Mobile wallet installations linked to crypto platforms rose to 1.1 billion globally.

- The top 5 countries by crypto exchange traffic are the U.S., India, Brazil, Russia, and Turkey.

- Stablecoin market cap surpassed $350 billion amid regulatory advancements.

- Crypto wallet users worldwide exceeded 500 million active accounts.

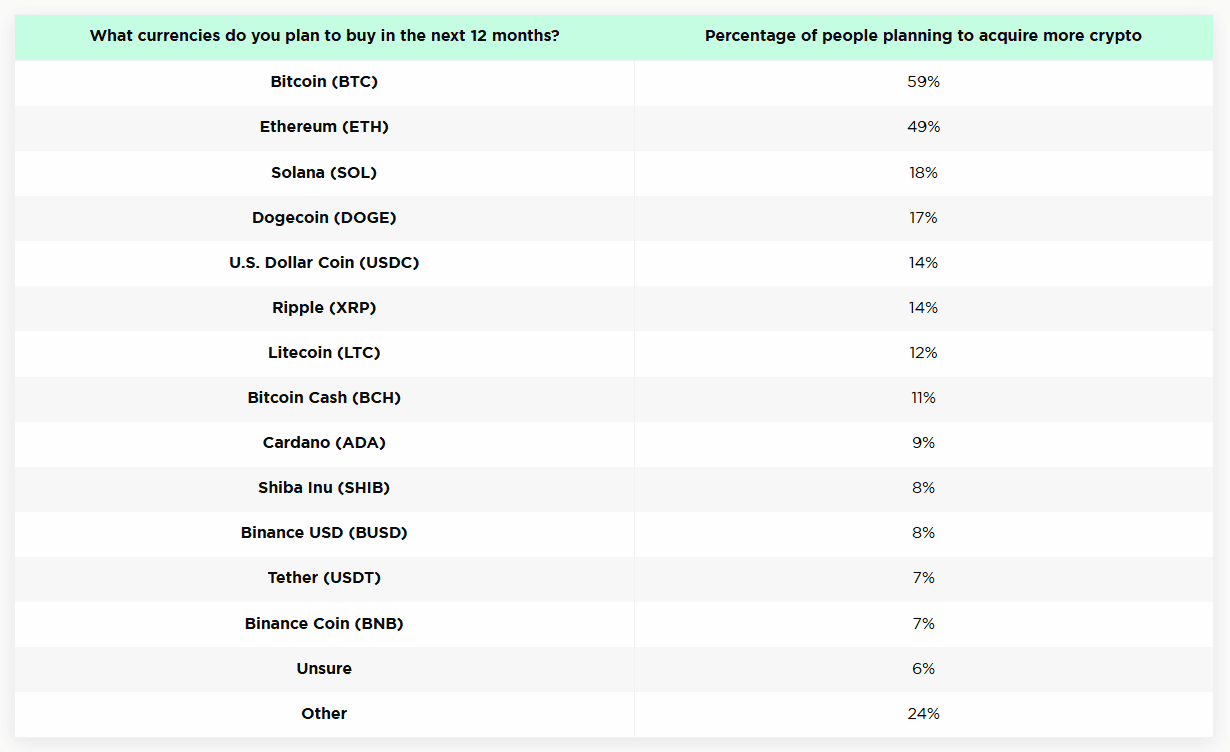

Cryptocurrencies People Plan to Buy in the Next 12 Months

- Bitcoin (BTC) dominates future buying intent, with 59% of respondents planning to acquire more, reinforcing its position as the leading store of value in crypto markets.

- Ethereum (ETH) follows closely at 49%, highlighting continued confidence in smart contracts, DeFi, and staking-driven demand.

- Solana (SOL) ranks as the top altcoin choice, with 18% of people planning to buy, reflecting strong interest in high-speed and low-fee blockchains.

- Dogecoin (DOGE) remains highly popular among retail investors, with 17% planning future purchases despite its meme-coin origins.

- Stablecoins show steady demand, as 14% plan to buy USDC and 7% intend to acquire USDT, underscoring their role in hedging volatility and facilitating transactions.

- Ripple (XRP) attracts 14% of planned buyers, signaling ongoing belief in its cross-border payment utility.

- Litecoin (LTC) continues to maintain relevance, with 12% planning to increase holdings as a long-standing payment-focused cryptocurrency.

- Bitcoin Cash (BCH) sees 11% purchase intent, indicating sustained interest in lower-fee Bitcoin alternatives.

- Cardano (ADA) draws 9% of prospective buyers, reflecting measured optimism around its long-term development roadmap.

- Meme tokens remain in focus, as Shiba Inu (SHIB) records 8% planned purchases, driven by community and speculative appeal.

- Binance ecosystem assets show mixed demand, with 8% planning to buy BUSD and 7% targeting BNB.

- Uncertainty remains limited, as only 6% of respondents report being unsure about future crypto purchases.

- Altcoin diversity is expanding, with 24% of respondents selecting Other cryptocurrencies, pointing to growing experimentation beyond mainstream assets.

Top 10 Countries by Crypto Ownership

- United Arab Emirates leads with a 30.4% crypto ownership rate, totaling 3 million users.

- Vietnam ranks second at 21.2%, representing 21 million crypto owners.

- United States is third by percentage (15.6%) but tops totals with 53 million users.

- Iran shows 13.5% ownership, equating to 12 million individuals.

- Philippines has 22%–23% adoption, amounting to 16 million users.

- Brazil records a 12.0% rate, approximately 26 million users.

- Saudi Arabia at 11.4%, contributing 4 million holders.

- Singapore with 11.1% penetration, 665,000 active citizens.

- Ukraine sees 10.6% engagement, about 4 million people.

- Venezuela closes at 10.3%, equivalent to 3 million users.

Government Policies and Regulations by Country

- United States has 50 states with crypto-specific laws, Digital Asset Act is advancing federally.

- European Union will fully enforce MiCA across 27 member states by July, with uniform licensing rules.

- Japan requires 100% asset segregation and monthly audits for licensed exchanges.

- El Salvador upholds Bitcoin as legal tender, with 85% small businesses accepting BTC.

- Nigeria issued 25 virtual asset licenses under the regulatory sandbox model.

- India maintains a 30% tax on crypto gains, Crypto Tax Bill proposes an 18% reduction.

- Brazil’s digital real pilot engages 7.5 million test users post-Q2 launch.

- Turkey’s Capital Markets Board oversees legalized exchanges post-2025 act.

- Singapore mandates PSA licensing and AML compliance for all crypto exchanges.

- South Korea enforces real-name accounts via 22 banks for domestic exchanges.

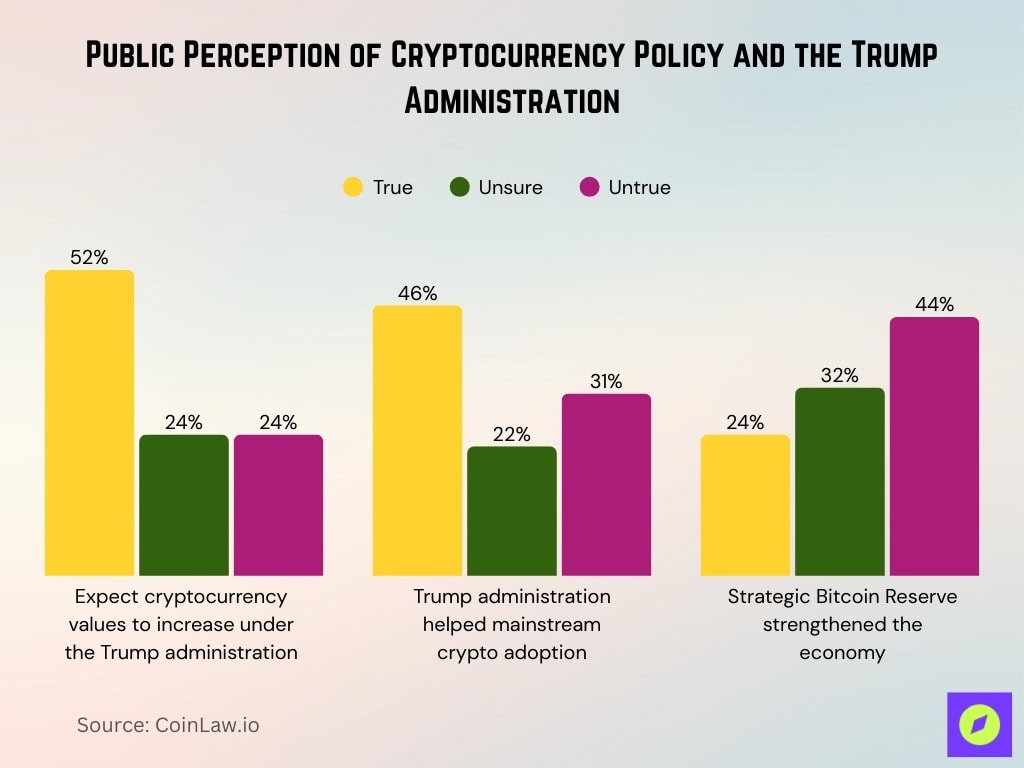

Public Perception of Cryptocurrency Policy and the Trump Administration

- A majority expect higher crypto valuations, as 52% of respondents believe cryptocurrency values will increase under the Trump administration, while 24% remain unsure and 24% disagree.

- Views on mainstream adoption are divided, with 46% saying the Trump administration helped crypto go mainstream, compared with 31% who say this is untrue.

- Economic impact opinions skew negative, as only 24% agree that a Strategic Bitcoin Reserve strengthened the economy, while 44% believe this claim is untrue.

- Uncertainty remains significant, with up to 32% of respondents unsure about the economic effects of Bitcoin reserve policies.

- Sentiment favors market growth over policy impact, suggesting optimism around price appreciation is stronger than confidence in government-led crypto strategies.

- Polarization is evident, as responses show sharp splits between belief, doubt, and rejection across all statements.

Cryptocurrency as a Payment Method: Country Comparisons

- El Salvador leads with 85% of surveyed vendors accepting Bitcoin for payments.

- Japan features over 35,000 retailers accepting crypto, including major chains.

- Germany enables crypto for 10.2% of e-commerce checkouts via 28 fintech partnerships.

- Philippines integrates 1.3 million merchants with processors like Coins.ph.

- United States sees 19.1% of SMBs accepting crypto, mainly USDC stablecoins.

- Brazil boosted crypto POS terminals by 28% to 110,000 installations.

- South Africa records 17.2% of mobile transactions using stablecoins.

- UAE luxury sectors show 48% of 5-star hotels accepting crypto directly.

- Ukraine implements crypto payroll in 950 tech startups for freelancers.

- Thailand supports crypto for travel services via 15 licensed platforms.

Demographic Patterns of Crypto Users Across Nations

- Globally, the average crypto user age stands at 34.8 years, median portfolio $1,300.

- U.S. Gen Z adults own crypto at a 28% rate, the fastest-growing bracket.

- Latin America features 61% of crypto users aged 18–34 for remittances.

- India, male ownership dominates at 78%, females at 22%.

- South Korea’s high-income 30–44 professionals comprise 53% of holders.

- Germany’s 55+ age group crypto ownership rose to 9.8%.

- Nigeria’s youth engagement peaks with 74% holders under 30.

- Indonesia achieves 46% female crypto users, the top in Southeast Asia.

- UK freelancers and gig workers now 14.1% of users, up 3.6x since 2022.

- Brazilian users 47% urban middle-class in São Paulo and Rio metros.

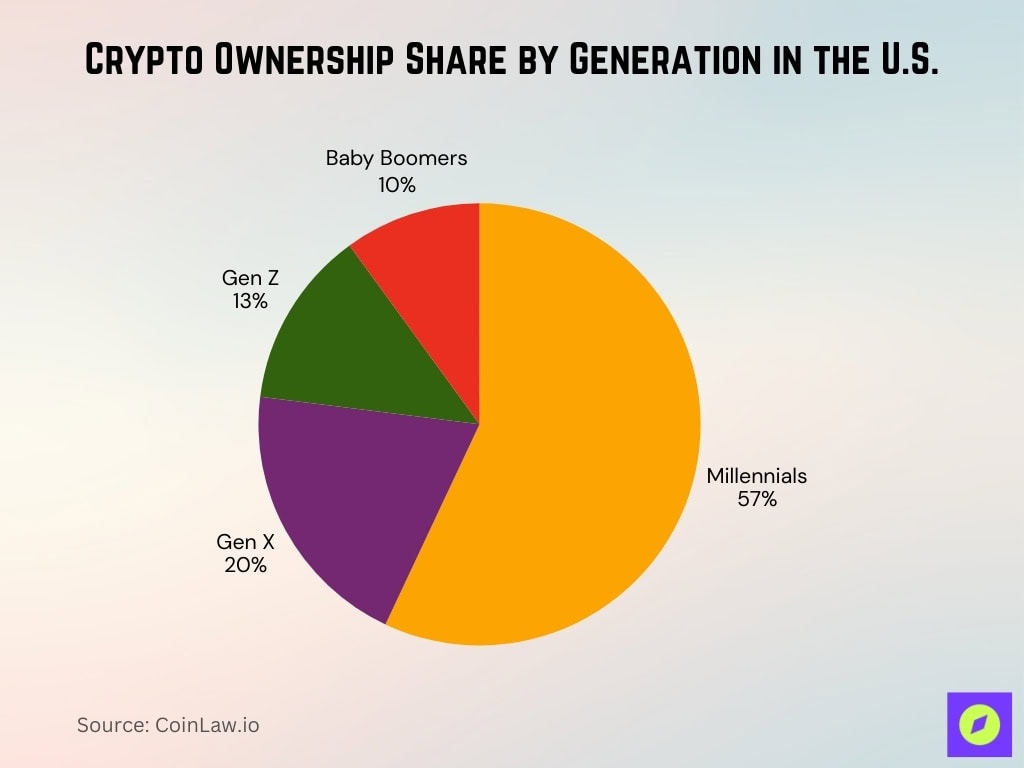

Crypto Ownership by Generation in the United States

- Millennials account for 57% of all U.S. crypto owners.

- Gen X comprises 20% of crypto holders.

- Gen Z represents 13% of crypto users.

- Baby Boomers hold 10% of the crypto ownership share.

Impact of Economic Conditions on Crypto Adoption

- Countries with inflation over 20% show crypto adoption 2.7x higher than stable economies.

- Argentina crypto ownership hits 23%–30% amid 80%+ annual inflation.

- Venezuela, 16.3% households use crypto for daily survival via USDT/BTC.

- Turkey crypto trade volume rises 31.5% YoY from Lira depreciation.

- Egypt’s crypto activity surges 42.8% due to currency devaluation.

- Zimbabwe’s crypto transaction volumes are estimated at 6% of GDP, one of the highest shares among surveyed emerging markets.

- U.S. adds 15.2 million new wallets during Q1 recession dip.

- Lebanon, 19.8% citizens use crypto wallets as a primary value store.

- Pakistan crypto remittances grow 18.7% via Binance P2P.

- Ukraine receives $2.1 billion in crypto aid for defense initiatives.

Mobile Wallet and Exchange Usage by Country

- Global crypto wallet installations reached 1.05 billion.

- Trust Wallet leads with over 130 million active users across 95 countries.

- India WazirX and CoinDCX combined user base hits 60 million.

- Nigeria Binance Wallet surges to 30 million users, 4.5% monthly growth.

- Brazil Mercado Bitcoin attains 20 million users, 35% of the adult online population.

- U.S. Coinbase holds 45 million verified users, 60% active in the past 60 days.

- Turkey Paribu tops finance apps with 8.2 million verified accounts.

- Vietnam VNDC Wallet exceeds 11 million installations for crypto and fiat.

- South Korea Upbit dominates 78% market with 13 million active traders.

- Kenya BitPesa Wallet serves 6.5 million people for remittances.

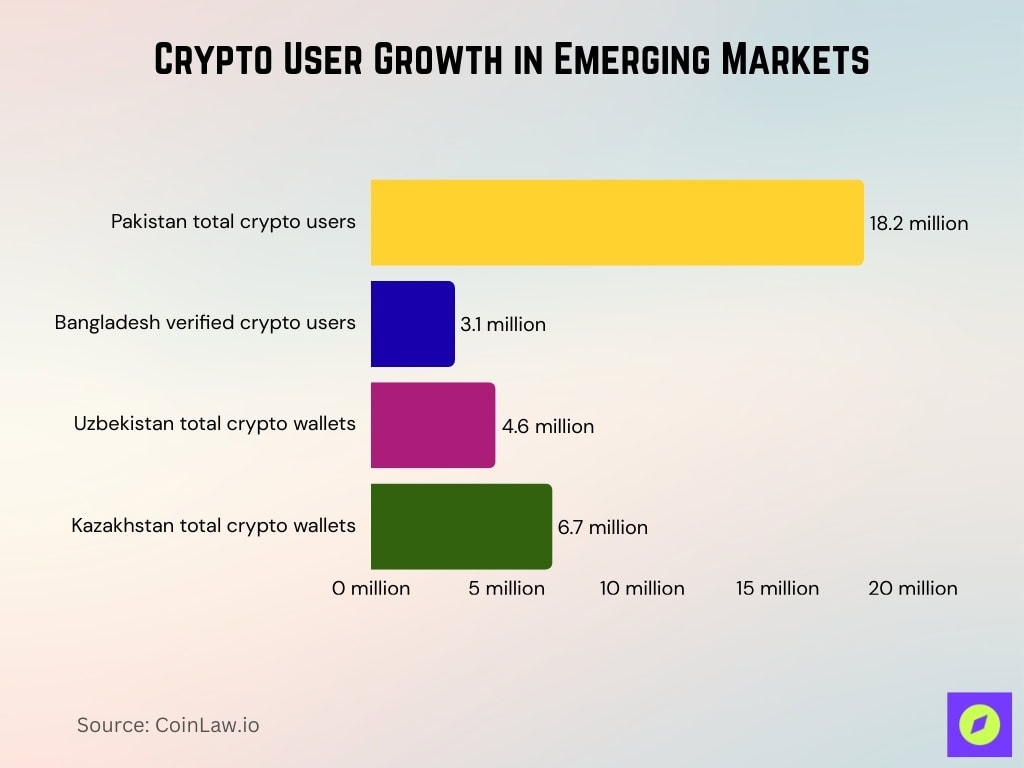

Notable Growth in Emerging Markets

- Pakistan adds 5.4 million new users, totaling 18.2 million.

- Bangladesh verified crypto users reach 3.1 million via stablecoins.

- Uzbekistan wallets grow 19.5% to 4.6 million post-mining laws.

- Kazakhstan wallet usage up 23.1% to 6.7 million.

- Philippines crypto ownership rises to 22%–23% from 17.8%, driven by remittances.

- Peru adoption surges 40.6% via stablecoin retail integrations.

- Tanzania DeFi activity grows 6.8x, wallets from 120k to 820k.

- Ghana crypto users increase 38.2% targeting youth.

- Morocco licenses 7 crypto projects, with adoption at 5.4%.

- Cambodia Bakong integrates crypto, 740k hybrid wallets.

Influence of Internet Penetration and Digital Literacy

- Countries with internet penetration over 85% average 14.3% crypto adoption vs 6.7% below 60%.

- South Korea, with 98.2% internet access, has a 12.8% crypto usage rate.

- Sweden reports 93.4% digital literacy and 11.1% crypto ownership.

- Kenya, despite 49.6% internet shows 13.4% crypto usage via mobile.

- UAE, with 100% adult internet access, has 9/10 crypto users on smartphones.

- Vietnam reaches 79.3% internet penetration and 27.1% crypto ownership.

- Estonia exceeds 90% digital literacy with 8.7% blockchain transactions.

- India’s rural internet at 51.5% drives 33.1% YoY crypto growth outside metros.

- Indonesia’s crypto education aids rural broadband, adding 13.6 million new wallets.

- Colombia fintech program boosts crypto holdings to 10.2% of adults.

Countries with Declining or Slowing Adoption Rates

- China crypto ownership drops to 5.2% under ongoing restrictions.

- UK active crypto users decline 2.6% due to KYC and delistings.

- Germany DeFi wallet activity falls 7.3% due to staking regulations.

- France’s transaction volume decreases 14.2% post-exchange failures.

- South Africa’s new wallet signups slow to 2.1% growth.

- Canada crypto ETF flows dip 5.4% amid market shrinkage.

- Japan’s retail trading volume declines 3.2% lacking innovation.

- Norway and Finland’s wallet growth is under 1.5%, and their legacy holdings are.

Recent Developments

- Stablecoins represent over 50.1% of global crypto transaction volume.

- IMF issued guidance in May encouraging regulatory clarity for exchanges.

- El Salvador launched a second Bitcoin bond, raising $753 million for infrastructure.

- Visa and Mastercard support crypto payments in 43 countries, with USDC leading.

- Binance resumes Canada operations post-compliance with regulations.

- BlackRock launches 3 tokenized ETF products in 7 countries.

- Ethereum Cancun upgrade cuts gas fees by 37.9%, boosting NFTs.

- Ripple expands ODL to 14 corridors, $1.9 billion remittances.

- Robinhood and PayPal enter 8 EU markets, 17.6% wallet download rise.

- Circle USDC wallet reaches 6.3 million users in Latin America.

Frequently Asked Questions (FAQs)

Asia had 7 countries ranked in the top 10 in the 2025 crypto adoption index.

About 25.6% of Turkey’s population owned cryptocurrency as of 2026 data

The top 10 countries accounted for about 39.35% of all global crypto users in 2025.

Conclusion

The global crypto ecosystem today reflects a story of resilience, adaptation, and diversification. Emerging markets are no longer just catching up; they’re leading innovation in usage models, remittances, and mobile-first ecosystems. Meanwhile, mature economies are transitioning from hype to infrastructure, with increased institutional involvement and tighter regulatory guardrails. As macroeconomic challenges persist and digital transformation accelerates, cryptocurrency is cementing itself not just as an asset class but as an integral tool in daily commerce, savings, and international connectivity.