In recent years, the crypto market has grown from niche to mainstream, capturing the attention of investors, financial institutions, and regulators alike. Amid this expansion, one crucial element defines the market’s functionality: liquidity. Without adequate liquidity, assets become harder to trade efficiently, leading to price volatility and barriers for new investors. Understanding crypto liquidity can help market participants make smarter decisions, ensuring they navigate this ever-evolving landscape with insight. This article will explore critical statistics around liquidity in the crypto market, from key liquidity metrics to trading volume trends and the role of stablecoins in 2025.

Key Takeaways

- 1Bitcoin’s 24-hour trading volume in 2025 averages $38.9 billion, reflecting strong investor activity across major exchanges.

- 2The total cryptocurrency market cap in 2025 stands at approximately $4.2 trillion, driven by renewed institutional and retail momentum.

- 3The DEX-to-CEX spot trading volume ratio hit 24% in Q2 2025, showing a growing shift toward decentralized platforms.

- 4Projections for end-2025 place the global crypto market at $6.8 trillion, with 11.2% of the world’s population owning digital assets.

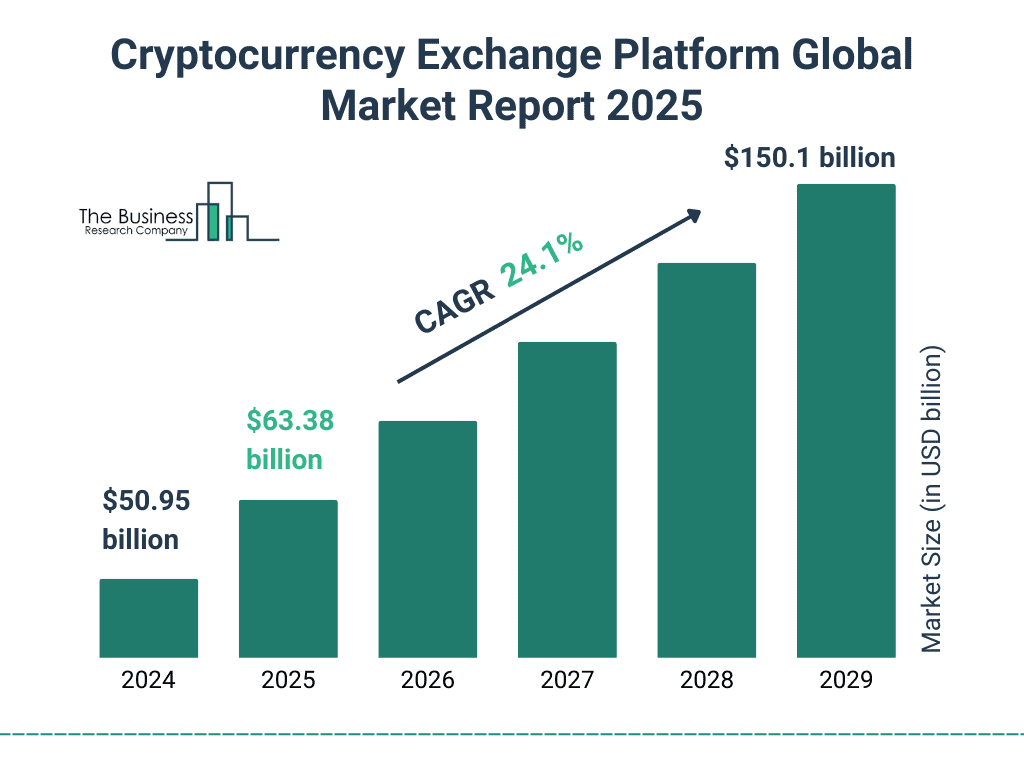

Cryptocurrency Exchange Platform Market Growth

- The global cryptocurrency exchange platform market is projected to grow to $150.1 billion by 2029.

- The market is expected to grow at a CAGR of 24.1% over the forecast period.

- 2025 is estimated to reach $63.38 billion, reflecting increasing adoption and investment in crypto trading platforms.

Trading Volume Trends

- Global crypto trading volume consistently exceeds $2.8 trillion per month in 2025, driven by institutional flows and global market integration.

- Centralized exchanges (CEXs) remain dominant in 2025, with Binance handling 62% of total crypto trading volume despite rising regulatory scrutiny.

- Bitcoin’s 24-hour trading volume averages around $38.9 billion, maintaining its lead as the most actively traded crypto asset.

- Altcoin trading volume declined 8% in 2025, as investors continue to rotate toward large-cap and high-liquidity assets.

- DEX trading volume rose 37% in 2025, hitting an average monthly volume of $412 billion, driven by sustained DeFi adoption.

- Ethereum-based DEXs account for 87% of all decentralized trading, reinforcing Ethereum’s dominance as the primary DeFi infrastructure.

- Crypto trading volumes spike 45-65% during bull cycles in 2025, with volatility continuing to be a key catalyst for market participation.

Stablecoin Supply and Its Impact on Liquidity

- Tether (USDT) leads the market in 2025 with a circulating supply of $104 billion, maintaining its role as the primary source of on-chain liquidity.

- USDC and FDUSD together contribute over $82 billion in combined supply, boosting accessibility and depth across trading venues.

- The total stablecoin supply expanded by 18% in 2025, showing its critical role in liquidity provisioning and market stability.

- Over 68% of stablecoin transactions occur on the Ethereum network, driven by its DeFi infrastructure and liquidity dominance.

- Stablecoins are involved in 44% of all crypto trades in 2025, solidifying their importance in mitigating volatility and enabling rapid execution.

- Cross-border stablecoin use surged by 41% in 2025, especially in emerging markets facing inflation and capital control restrictions.

- DAI and other algorithmic stablecoins maintain over $7.8 billion in locked collateral, reflecting the evolution of decentralized liquidity solutions.

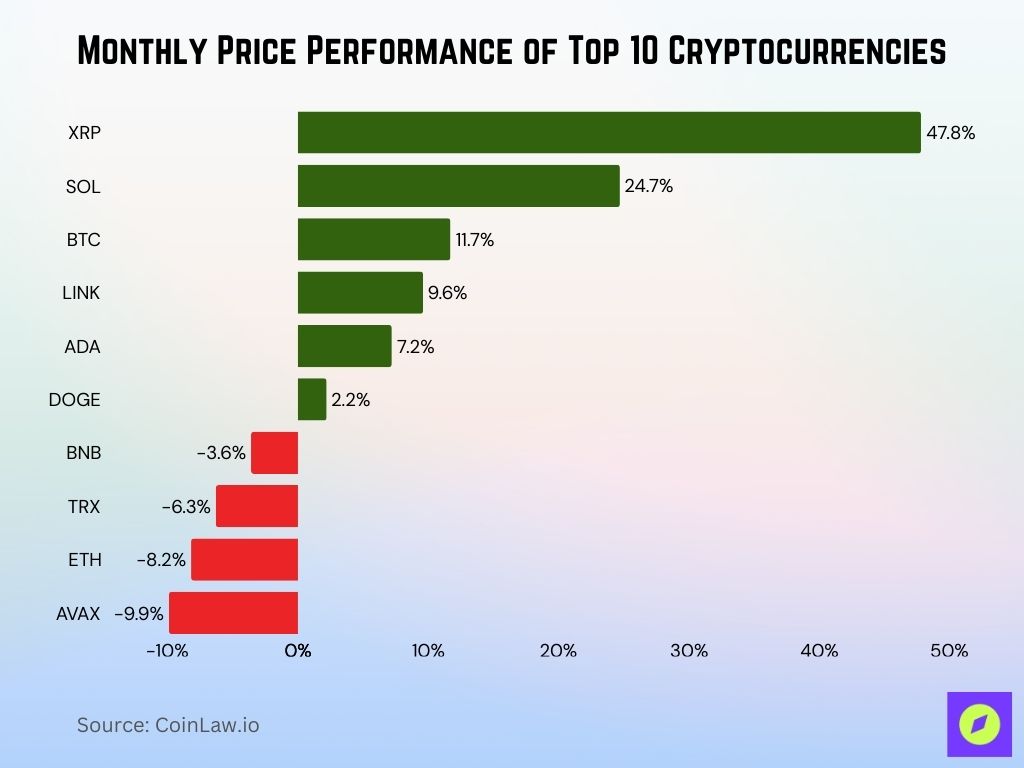

Monthly Price Performance of Top 10 Cryptocurrencies

- XRP led the market with a massive +47.8% price increase in January 2025.

- Solana (SOL) followed with a strong gain of +24.7%, showing continued investor confidence.

- Bitcoin (BTC) saw a healthy rise of +11.7%, reinforcing its market dominance.

- Chainlink (LINK) posted a gain of +9.6%, supported by increasing adoption in DeFi.

- Cardano (ADA) added +7.2% to its price, showing moderate upward momentum.

- Dogecoin (DOGE) had a small positive performance at +2.2%.

- Binance Coin (BNB) slipped by -3.6%, entering negative territory.

- TRON (TRX) declined -6.3%, reflecting market cooling.

- Ethereum (ETH) dropped -8.2%, underperforming in the top 10 list.

- Avalanche (AVAX) had the steepest decline at -9.9%, leading the losers.

Exchange Liquidity Analysis

- Binance controls 36% of global crypto liquidity in 2025, maintaining dominance with extensive listings and high institutional participation.

- Coinbase processes 13% of total trading volume, underscoring its relevance in regulated U.S. markets and custody solutions.

- Kraken and Gemini jointly hold 9% of fiat-to-crypto liquidity, favored for their compliance-first models and banking integrations.

- KuCoin and OKX command over 12% of liquidity in mid-cap and emerging altcoin markets, attracting global retail activity.

- HTX (formerly Huobi) saw a 17% drop in trading volume in 2025 due to geopolitical headwinds and operational restructuring.

- 1inch and other DEX aggregators boost user access to liquidity by scanning dozens of DEXs for optimal pricing execution.

- CEXs account for 77% of total crypto trading volume in 2025, while DEXs contribute 23%, driven by DeFi adoption and user sovereignty.

Bid-Ask Spread

- The average bid-ask spread for Bitcoin on major exchanges remains at 0.02%, indicating high liquidity and minimal price slippage.

- Ethereum’s bid-ask spread is similarly low, at around 0.025%, reflecting its strong liquidity across both CEXs and DEXs.

- Lower-cap altcoins often experience a wider bid-ask spread, averaging 0.1% to 0.3%, which can affect trading costs and make them more prone to price volatility.

- During market fluctuations, the bid-ask spread for most cryptocurrencies widens by 50-100%, especially in low-liquidity periods.

- Stablecoins generally maintain the narrowest spread among assets, often below 0.01%, due to their pegged value and high trading volume.

- DeFi platforms exhibit higher bid-ask spreads, typically around 0.05%, as liquidity is distributed across multiple protocols and decentralized pools.

- Arbitrage trading helps to maintain narrow bid-ask spreads on major exchanges, with bots continuously balancing prices between exchanges for efficient trading.

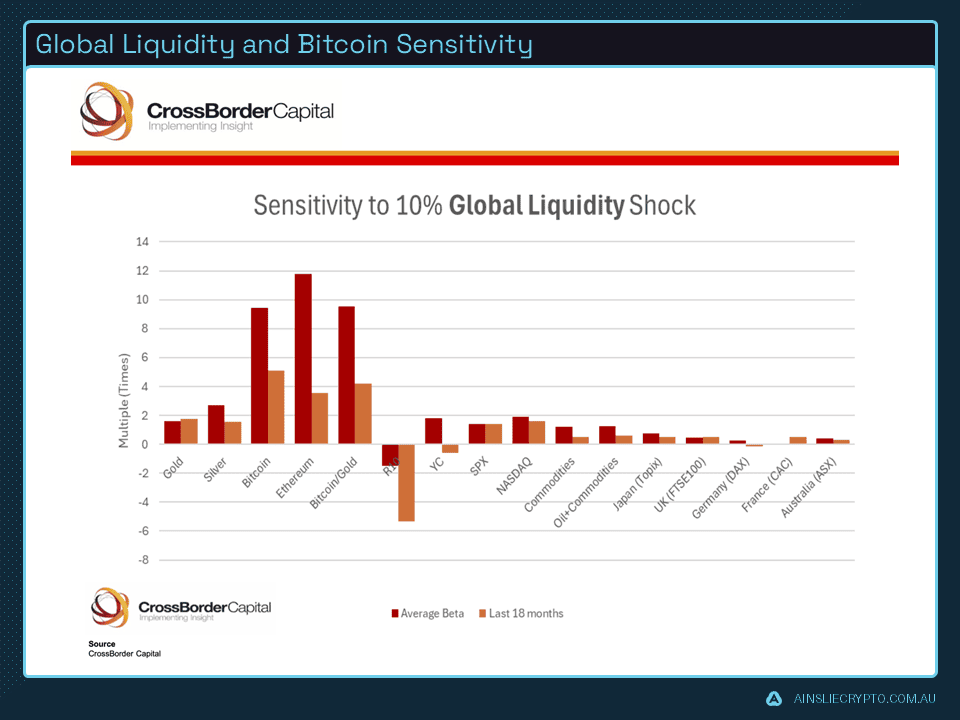

Global Liquidity Shock Sensitivity: Bitcoin vs Traditional Assets

- Ethereum shows the highest sensitivity to global liquidity shocks, with an average beta near 12x.

- Bitcoin and Bitcoin/Gold both reflect strong positive sensitivity around 9x, confirming crypto’s strong liquidity link.

- Gold and Silver show low sensitivity, under 2x, making them more stable under liquidity shocks.

- Real Estate (RE) is negatively impacted, with a beta below -6x, suggesting it suffers in tightening liquidity.

- Equities and indices like NASDAQ, SPX, FTSE100, and DAX show minimal sensitivity, mostly below 2x.

- Oil, commodities, and major markets (Japan, France, Germany) also exhibit low to neutral responses to liquidity changes.

Decentralized Finance (DeFi) Liquidity

- Total value locked (TVL) in DeFi reached $112 billion in mid-2025, marking a 31% year-over-year increase driven by L2 growth and institutional DeFi.

- Ethereum-based platforms still lead with 62% of DeFi liquidity, anchored by Uniswap, Aave, Lido, and Curve dominance.

- BNB Chain (formerly BSC) holds around 13% of DeFi liquidity, appealing to retail users with low fees and fast throughput.

- Cross-chain liquidity expanded 47% in 2025, powered by bridges like LayerZero, Wormhole, and Axelar connecting diverse ecosystems.

- DEX liquidity pools rose 42%, with AMMs fueling seamless swaps across tokens and improved capital efficiency.

- Lending protocols like MakerDAO, Compound, and Spark collectively contribute $28 billion to DeFi liquidity, enabling collateralized crypto loans.

- Stablecoins in DeFi provide $67 billion in liquidity, with growing utility in yield strategies and liquidity provisioning.

Factors Influencing Liquidity in Crypto Markets

- Market sentiment shifts can still cause up to a 35% drop in trading volume within 48 hours during regulatory uncertainty or negative headlines.

- High volatility in assets like Bitcoin and Ethereum continues to boost trading activity, increasing liquidity spikes by 50% during major price swings.

- Institutional investors account for 46% of Bitcoin’s trading volume in 2025, underscoring their growing dominance in liquidity formation.

- Regulatory frameworks in the U.S., EU, and Asia heavily influence exchange activity, with ETF approvals lifting trading volume by 22% on compliant platforms.

- Asia-Pacific markets contribute 38% of global crypto volume, led by trading hubs in Hong Kong, Singapore, and South Korea.

- Stablecoins now support 54% of crypto trades globally, reducing friction in on-chain settlement and enabling round-the-clock liquidity.

- Perpetual swaps, futures, and tokenized options drive deeper liquidity, with derivatives volume exceeding $4.1 trillion monthly in 2025.

Onchain TVL Dominance: A Few Chains Hold the Majority

- Ethereum dominates the landscape with 56.8% of the total value locked (TVL) across all blockchains.

- Solana and Tron follow far behind, holding 7.03% and 6.54% of TVL, respectively.

- BSC (Binance Smart Chain) captures 4.35%, maintaining a steady position in the DeFi ecosystem.

- Newer entrants like Base (2.92%) and Bitcoin (2.87%) show rising influence in locked value.

- Layer-2 and alt chains such as Arbitrum (2.53%), Avalanche (1.21%), Sui (1.14%), and Hyperliquid (1.1%) each hold small but noteworthy shares.

- Aptos rounds out the list with 0.9%, while “Others” collectively account for 12.6%, reflecting the fragmented nature of the remaining DeFi space.

How Cryptocurrency Exchanges Manage Liquidity

- Market-making is a key strategy, with exchanges employing bots or partnering with market makers to maintain tight spreads and depth in order books.

- Major exchanges, like Binance and Coinbase, maintain liquidity through extensive asset listings, ensuring that users have multiple trading pairs.

- Liquidity pools on decentralized exchanges allow users to provide liquidity for trading pairs in return for rewards, distributing liquidity management among participants.

- Stablecoin partnerships with issuers like Tether and Circle ensure ample liquidity, allowing users to seamlessly convert between fiat and crypto.

- To manage liquidity during high volatility, exchanges sometimes temporarily freeze withdrawals or restrict certain trading activities to maintain stability.

- Cross-exchange arbitrage helps balance liquidity by enabling traders to exploit price differences between exchanges, ensuring that no exchange is significantly over or under-supplied.

- Insurance funds are utilized by exchanges, especially in derivatives trading, to cover losses during extreme events, helping maintain liquidity for riskier trades.

Impact of Liquidity on Price Stability and Volatility

- High liquidity contributes to price stability; for instance, Bitcoin, with its large liquidity pool, often has less severe price fluctuations compared to lower-cap assets.

- Low liquidity can lead to price slippage, where large orders can significantly impact an asset’s price, particularly in smaller-cap cryptocurrencies.

- Stablecoins help reduce volatility in the crypto market, accounting for over 60% of volume in high-stability trades.

- High liquidity is associated with narrow bid-ask spreads, making it more cost-effective for investors to trade without incurring significant losses.

- During periods of high demand, liquidity helps mitigate drastic price increases by providing ample supply, keeping prices closer to their baseline.

- Decentralized exchanges (DEXs) often face greater price volatility due to fragmented liquidity across pools, impacting slippage rates during high trading activity.

- Market depth, or the volume of buy and sell orders at various price levels, directly influences liquidity and stability, with deeper markets experiencing less extreme price volatility.

Recent Developments

- Bitcoin rose 3.2% to $102,480 in July 2025, reversing earlier losses triggered by interest rate speculation and geopolitical tensions.

- XRP surged 21% to $3.78 before correcting to $3.62, while Litecoin climbed 18% to $144, fueled by altcoin rotation and network upgrades.

- Stablecoin market capitalization hit $254 billion in July 2025, signaling strong capital reserves and risk-off positioning amid volatile conditions.

- Solana DEX volumes exceeded Ethereum’s by 185%, maintaining dominance since late 2024 due to lower fees and memecoin-driven activity.

- Traditional financial institutions expanded crypto offerings in 2025, contributing to greater liquidity and institutional-grade infrastructure growth.

Conclusion

Liquidity remains a fundamental aspect of the crypto market, directly affecting trading efficiency, price stability, and accessibility. As the crypto ecosystem evolves, factors like stablecoin growth, DeFi protocols, and regulatory shifts continue to shape liquidity. In 2025, innovations like cross-chain interoperability and the adoption of Layer 2 scaling solutions promise to further enhance liquidity, making crypto more resilient and accessible to a broader audience. With increasing institutional and retail interest, the crypto market is set to deepen its liquidity, fostering a more robust financial landscape for years to come.