Crypto hedge funds have captivated the financial world, morphing from niche investments into an essential part of modern portfolios. In recent years, institutional and retail interest in these funds has soared, fueled by massive returns, technological advances, and market demand for diversification beyond traditional assets. 2025 is a pivotal year for crypto hedge funds as they mature, face regulatory changes, and adapt strategies in a rapidly evolving financial landscape. As these funds grow, they provide a window into the future of finance, where blockchain technology and cryptocurrencies play a central role in shaping investment strategies and performance outcomes.

Key Takeaways

- 1Crypto hedge fund capital reached an all-time high of $136.2 billion in Q2 2025, driven by renewed investor inflows and strong market performance.

- 2The VisionTrack Composite Index rose by 45%, with many crypto hedge funds reporting double-digit returns year-to-date.

- 3The share of traditional hedge funds investing in crypto rose to 52%, a sharp rise from 29% just a year earlier.

- 4Anthony Scaramucci and other market leaders forecast Bitcoin could climb beyond $220,000 before year-end 2025.

- 5While 52% of traditional hedge funds now hold digital assets, 71% of those not yet invested say they are still unlikely to enter the market in the next three years.

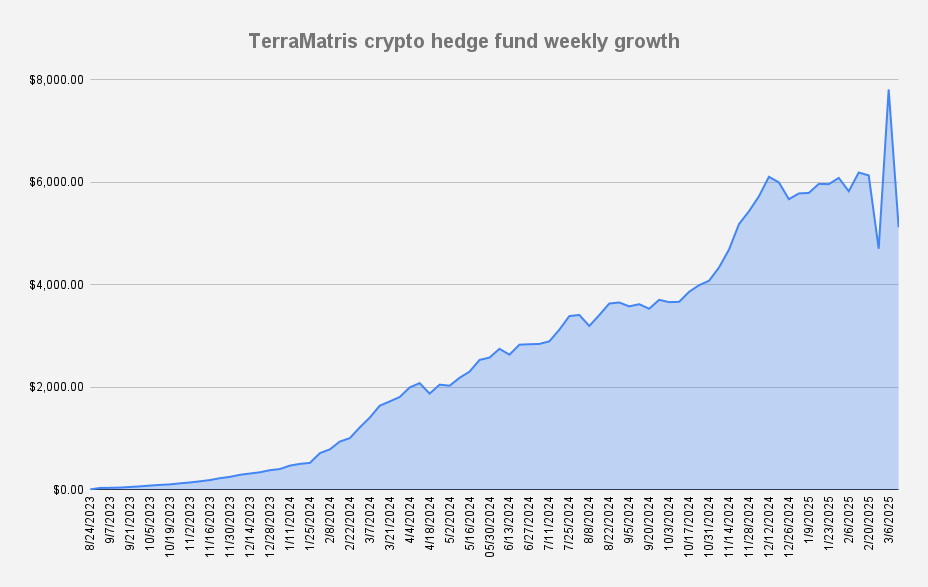

Crypto Hedge Fund Weekly Growth Overview

- The TerraMatris crypto hedge fund experienced steady and impressive growth from August 2023 to March 2025.

- Starting from nearly $0 in August 2023, the fund showed consistent weekly growth over 19 months.

- In March 2024, the fund’s value had crossed the $2,000 mark.

- After a period of steady increases, there was a significant acceleration in growth between October 2024 and January 2025, when the fund reached approximately $6,000.

- In February 2025, the fund spiked sharply, briefly surpassing $8,000, before experiencing volatility and pulling back to around $6,000 by March 2025.

Growth and Assets Under Management (AUM)

- Total crypto hedge fund AUM hit $82.4 billion in 2025, surpassing earlier projections.

- The average fund size climbed to $63 million, continuing the upward trend from 2023.

- Funds managing over $100 million now make up 44% of the market, while those under $25 million represent 27%.

- North American crypto hedge funds hold 57% of global AUM, led by institutional participation.

- Institutional capital inflows rose by 29% year-over-year, signaling sustained interest.

- The number of crypto funds exceeding $1 billion AUM has grown to 22.

- AUM volatility remains influenced by macro shifts, policy news, and investor sentiment.

- Crypto funds in emerging markets grew by 47%, driven by regulatory improvements and rising adoption.

- Performance fees remain at 20%, with management fees steady at 2%.

- Crypto hedge fund AUM is expected to reach $100 billion by early 2026 if current trends hold.

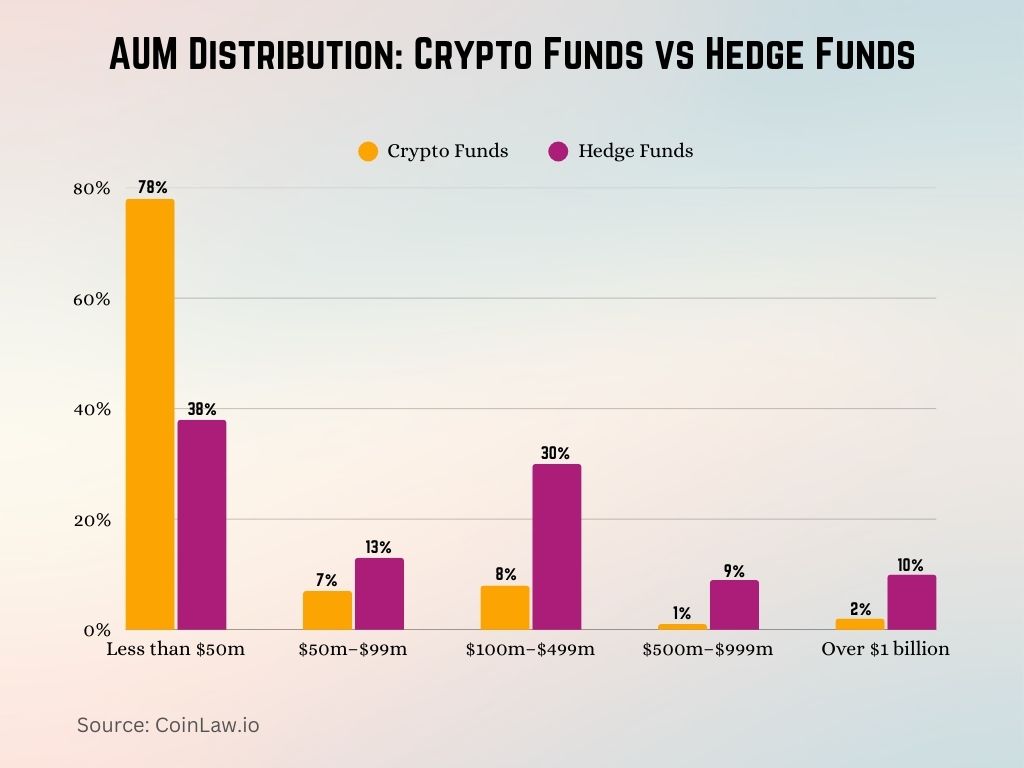

AUM Distribution: Crypto Funds vs Hedge Funds

- Crypto funds are significantly smaller in size compared to traditional hedge funds, with 78% of them managing less than $50 million in assets.

In contrast, only 38% of hedge funds fall into the less than $50 million AUM category, showing a stronger presence in larger asset brackets. - Hedge funds dominate the $100m–$499m range, where 30% of them operate, compared to only 8% of crypto funds.

- A relatively small portion of both fund types manages assets in the $50m–$99m range, with 7% of crypto funds and 13% of hedge funds falling in this bracket.

- In the $500m–$999m AUM range, hedge funds still lead with 9%, while only 1% of crypto funds have reached this scale.

- When it comes to the top tier, over $1 billion AUM, 10% of hedge funds have reached this level versus just 2% of crypto funds.

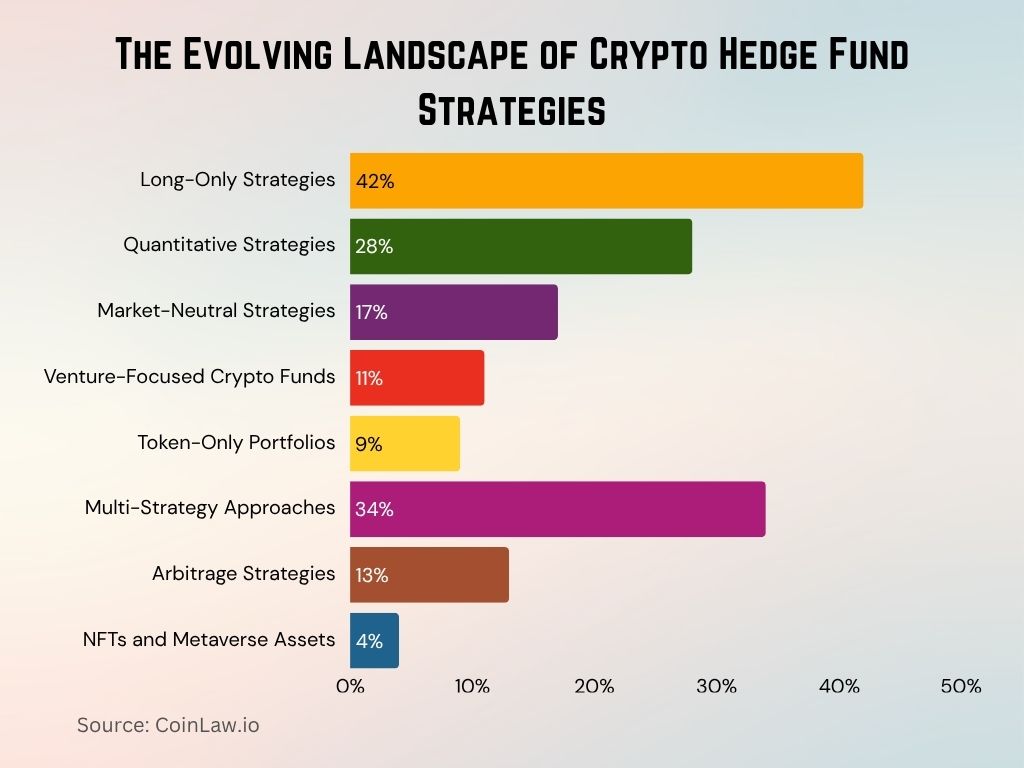

Crypto Investment Strategy Segmentation

- Long-only strategies remain dominant, used by 42% of crypto hedge funds due to continued belief in sector growth.

- Quantitative strategies now account for 28% of funds, leveraging AI-driven models and real-time data analytics.

- Market-neutral approaches are used by 17% of funds aiming to reduce exposure to volatility and short-term risk.

- DeFi-focused funds grew by 22% in 2025, with staking and yield farming still centered on Ethereum and Layer-2s.

- Venture crypto funds represent 11% of the market, backing early-stage infrastructure and Web3 innovation.

- Token-only portfolios are deployed by 9% of funds, focusing solely on digital assets without traditional hedging.

- Multi-strategy models are adopted by 34% of funds, combining diverse methods for improved diversification.

- Arbitrage strategies are used by 13% of funds, profiting from cross-platform and geographic price gaps.

- Funds exposed to NFTs and metaverse tokens account for 4%, down slightly due to market maturation.

- Token staking strategies expanded by 24%, fueled by demand for passive yield in PoS ecosystems.

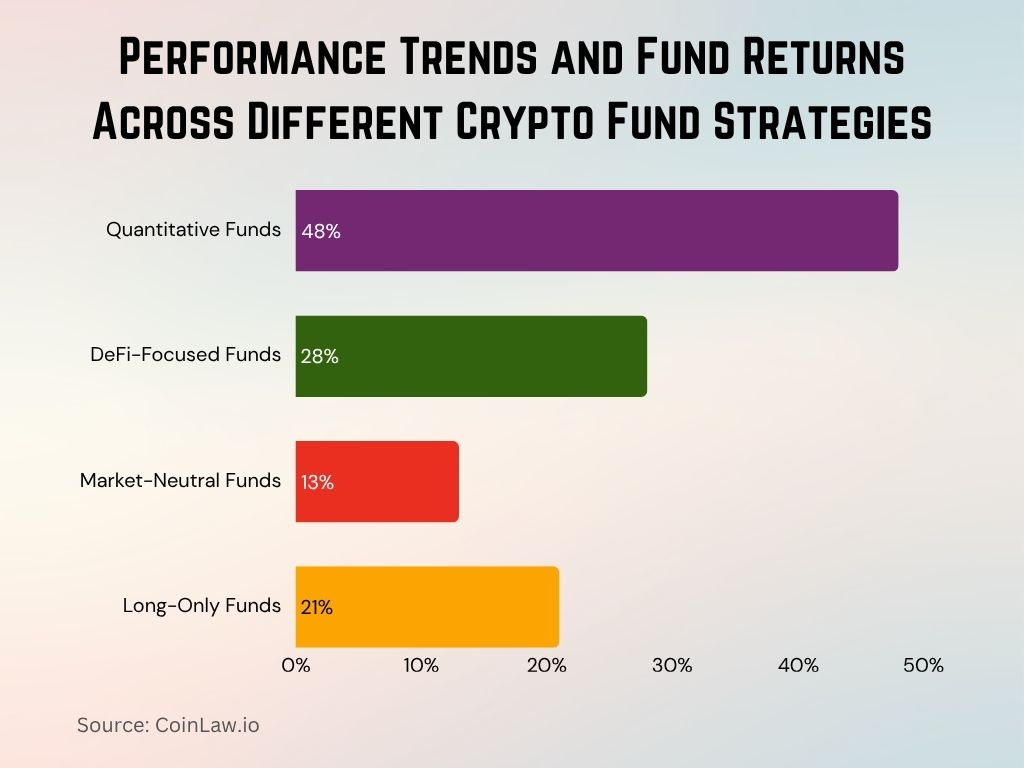

Fund Returns and Performance Measurement

- Average annual returns for crypto hedge funds in 2025 hit 36%, despite macro pressures and regulatory shifts

- Quantitative funds led the pack again with 48% average returns, driven by AI-enhanced algorithmic trading

- DeFi-focused funds delivered 28% annual gains, fueled by staking, liquid restaking, and decentralized lending

- Market-neutral strategies maintained stability with 13% annualized returns, appealing to conservative investors

- Long-only funds posted 21% returns in 2025, riding bullish cycles in Bitcoin and Ethereum

- Crypto hedge funds experienced an average volatility of 46%, still far higher than traditional hedge strategies

- Sharpe ratios averaged 1.6, signaling improved risk-adjusted returns across most major fund categories

- Monthly performance swung between -18% and +52%, underscoring the need for agile portfolio management

- High-frequency trading funds saw 22% returns on average, capitalizing on intraday price inefficiencies

- Over 83% of crypto hedge funds benchmark against BTC, while multi-asset funds adopt broader crypto indices

Investment Strategies and Empirical Results

- Active management strategies now account for 62% of crypto hedge funds, targeting yield in both volatile and trending markets.

- Over 54% of funds use algorithmic trading, increasingly powered by AI-driven predictive analytics.

- Technical analysis remains dominant among 68% of funds, while 37% use fundamental analysis for project valuation.

- Around 42% of funds consider macroeconomic indicators like inflation and central bank moves in shaping strategy.

- 48% of funds use leverage, often up to 3x, amplifying potential returns along with risk.

- Arbitrage-focused funds average 16% annual returns, profiting from persistent price gaps across platforms.

- Staking yields remain steady at 8–11%, with 32% of funds now using it as a secondary income stream.

- Token lending and borrowing strategies grew by 23%, fueled by DeFi collateralization and passive return models.

- Index-tracking funds earned 24% in 2025, favored by risk-conscious investors seeking broad crypto exposure.

- Convertible bond strategies gained traction, offering crypto-backed fixed income while preserving upside participation.

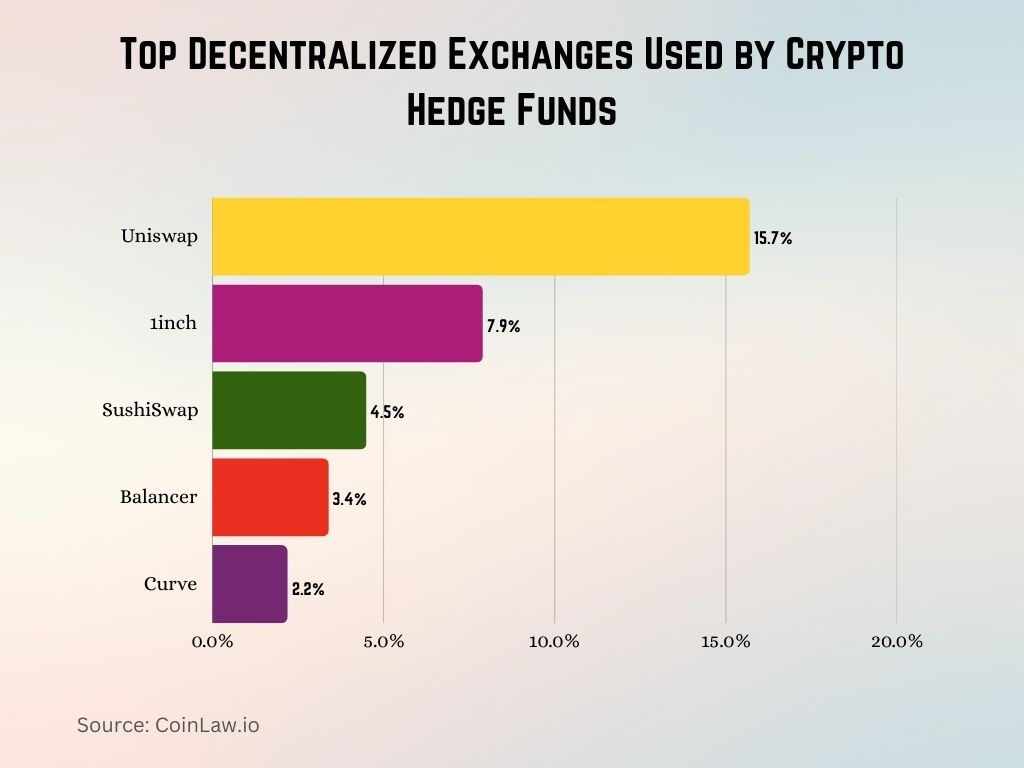

Top Decentralized Exchanges Used by Crypto Hedge Funds

- Uniswap leads the pack as the most used decentralised exchange, with 15.7% of crypto hedge funds actively trading on it.

- 1inch ranks second, used by 7.9% of crypto hedge funds, showcasing its popularity in DEX aggregation.

- SushiSwap comes in third, with 4.5% usage among funds, maintaining its relevance despite newer competitors.

- Balancer is used by 3.4% of crypto hedge funds and is known for its flexible AMM pools.

- Curve rounds out the top five, with 2.2% usage, especially favored for stablecoin swaps.

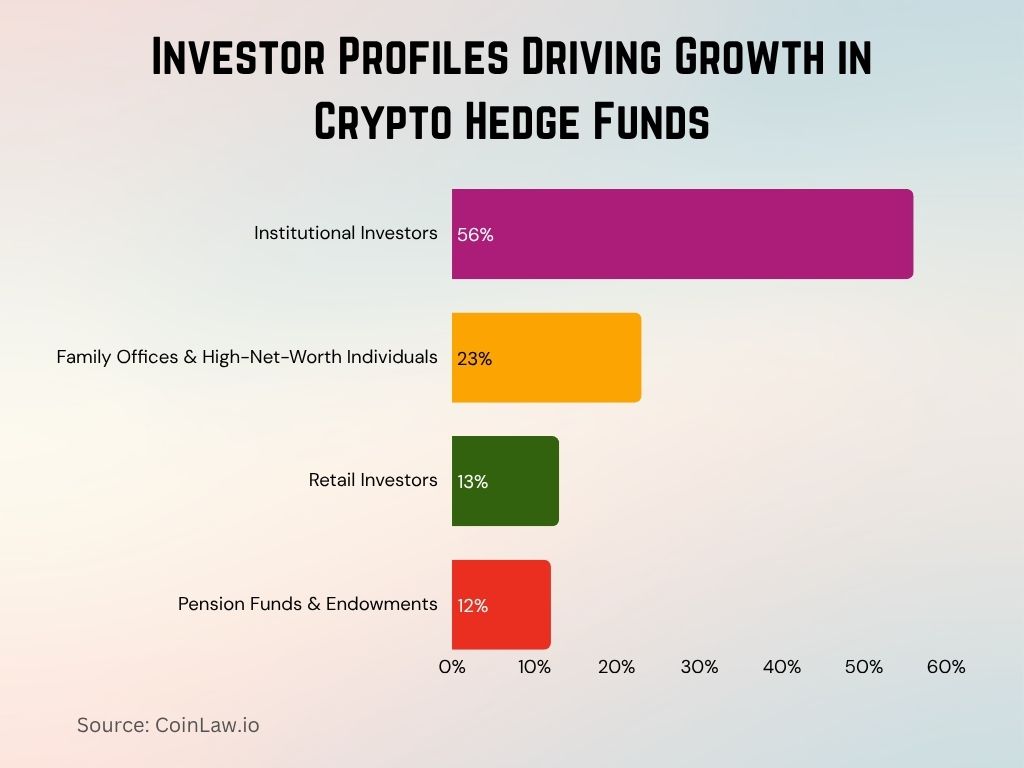

Institutional Adoption and Investor Demographics

- Institutional investment now accounts for 56% of total capital in crypto hedge funds, reflecting deeper trust in the asset class.

- Family offices and high-net-worth individuals make up 23% of the investor base, sustaining strong private wealth interest.

- Retail participation remains limited at 13%, constrained by entry barriers and evolving regulatory frameworks.

- 58% of institutional investors cite diversification as their primary reason for allocating to crypto hedge funds.

- Pension funds and endowments now contribute 12% of institutional capital, signaling growing conservative engagement.

- 62% of crypto hedge funds are domiciled offshore, especially in regions with favorable tax and legal structures.

- The average institutional ticket size has grown to $11.4 million, showing increasing confidence and capital depth.

- US-based institutions contribute 53% of total crypto hedge fund investment, followed by Europe at 31% and Asia at 16%.

- 47% of new capital in 2025 came from institutional sources, affirming crypto’s acceptance among mainstream allocators.

- Women now represent 17% of crypto fund investors, indicating slow but steady demographic diversification.

Technological Innovations and Infrastructure

- Blockchain technology improvements have led to 20% faster transaction speeds for crypto hedge funds, reducing latency in trading and boosting execution efficiency.

- Data analytics platforms specific to crypto markets saw a 40% adoption rate among funds, enabling more accurate predictive models for investment.

- Automated smart contracts are increasingly used, with 30% of crypto hedge funds utilizing them for faster and more transparent transactions, particularly in decentralized finance (DeFi).

- Cold storage solutions are favored by 85% of crypto funds for security, while 15% employ hybrid methods combining hot and cold storage for quick liquidity access.

- AI and machine learning tools saw a 35% uptick in use, helping funds analyze vast amounts of market data and adapt trading strategies in real-time.

- Security enhancements in blockchain protocols have reduced the incidence of fund cyberattacks by 25%, highlighting the strides made in safeguarding digital assets.

- Decentralized exchanges (DEXs) now handle 18% of total trading volumes for crypto hedge funds, an increase driven by the desire for enhanced privacy and lower fees.

- High-frequency trading systems (HFT) are used by 20% of crypto hedge funds, allowing for real-time decision-making and improved trade accuracy.

- Distributed ledger technology (DLT) is a mainstay, with 75% of funds using DLT for record-keeping, ensuring transparency and reducing back-office costs.

- The tokenization of traditional assets, such as real estate and bonds, has grown by 30% within funds, enabling diversified portfolios and broader investment options.

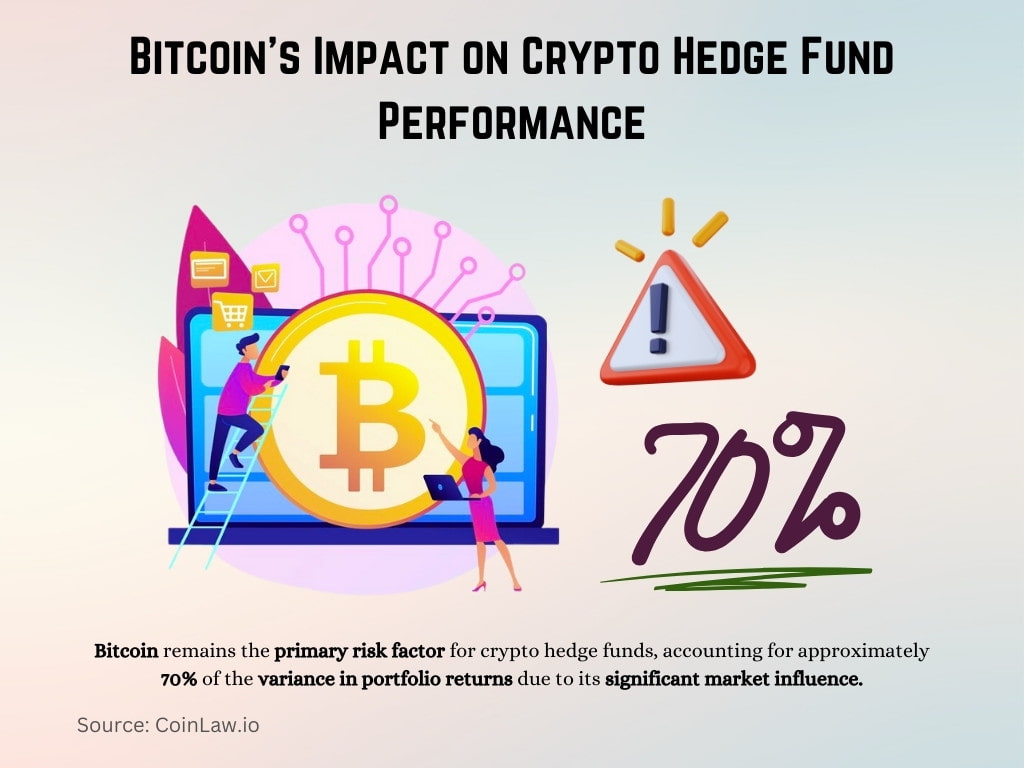

A Factor Model for Cryptocurrency Returns

- Bitcoin remains the primary risk factor for crypto hedge funds, accounting for approximately 70% of the variance in portfolio returns due to its significant market influence.

- Liquidity risk factors in crypto funds are high, with 60% of funds experiencing asset liquidity issues due to market depth and trading frequency.

- Market sentiment analysis, a new factor used by 50% of funds, leverages social media and blockchain data to gauge market emotions, impacting fund decision-making.

- A volatility premium is observed, with funds capturing a 15% return over traditional assets by capitalizing on crypto’s higher risk tolerance.

- Momentum factor models used by 40% of funds provide insights into asset performance, allowing managers to ride uptrends in volatile assets.

- DeFi sector-specific returns contribute 25% of overall fund returns, with funds utilizing liquidity pools, staking, and lending in decentralized markets.

- Regulatory news impact is a key factor; nearly 80% of crypto funds adjust positions based on regulatory developments, which often trigger significant price movements.

- Tokenomics, supply, demand, and burn mechanisms, are factored into 45% of fund models, providing a unique approach to asset valuation.

- Cross-asset correlations are analyzed by 60% of funds to understand the relationship between cryptocurrencies and traditional assets, which has implications for diversification.

- Exchange rate volatility is monitored by 35% of funds, particularly those with international exposure, as currency fluctuations can affect crypto valuation.

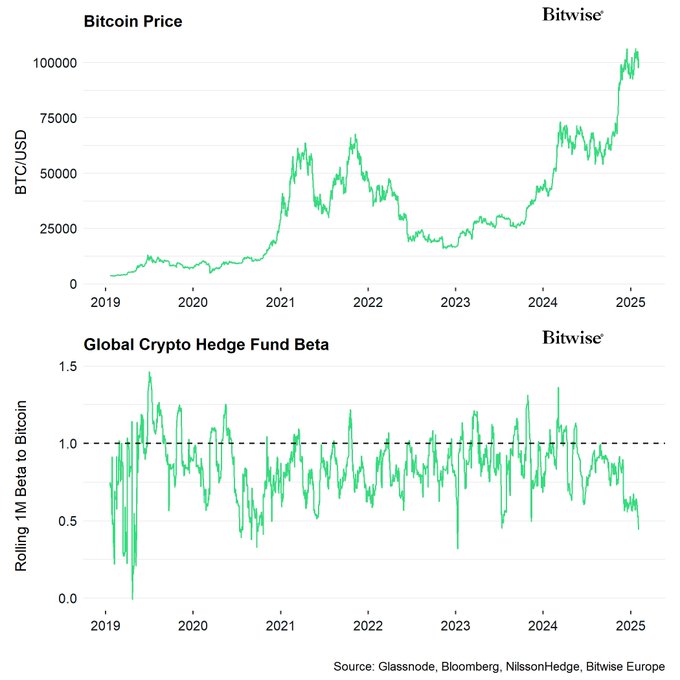

Bitcoin Price Surge and Crypto Hedge Fund Beta Trends

Bitcoin Price (BTC/USD) Highlights

- Bitcoin started 2019 trading below $10,000.

- In 2021, Bitcoin surged past $50,000, peaking at approximately $65,000.

- By 2022, the price dropped sharply, returning to the $25,000 – $30,000 range.

- 2023 saw a period of consolidation, with prices hovering between $20,000 and $30,000.

- A major breakout in 2024 drove Bitcoin above $75,000.

- By early 2025, Bitcoin surpassed $100,000, reaching a new all-time high.

Global Crypto Hedge Fund Beta (Rolling 1-Month Beta to Bitcoin)

- Measures how closely crypto hedge funds track Bitcoin’s returns.

- In 2019, the beta was highly volatile, ranging from 0.0 to 1.5.

- From 2021 to 2023, the beta stabilized around 1.0, with frequent dips toward 0.5.

- During 2024 and into 2025, the beta consistently dropped below 1.0, nearing 0.5 by early 2025.

- This indicates that crypto hedge funds reduced their exposure to Bitcoin’s price movements over time.

Recent Developments

- In Q2 2025, asset managers like hedge funds and pensions expanded U.S. Bitcoin ETF positions, with Wisconsin Investment Board increasing iShares holdings to 6.8 million shares and Tudor Investment Corp to 8.7 million shares worth $454 million.

- In May 2025, crypto hedge funds remained resilient amid geopolitical uncertainty, with Tephra Digital and Pythagoras Investments posting monthly gains of 9.3% and 8.8%, respectively.

- 37% of institutional investors now allocate or plan to allocate to crypto hedge strategies, showing rising traditional sector engagement.

- Total crypto hedge fund AUM reached $30 billion by mid-2025, reflecting a 25% year-over-year increase.

- Stricter global regulations prompted funds to adopt enhanced compliance systems following SEC and EU mandates on transparency and risk reporting.

Conclusion

Crypto hedge funds are at a transformative crossroads, with 2025 marking a year of accelerated innovation, regulatory clarity, and broader acceptance. As institutional and retail investors alike show increasing interest, the landscape continues to mature, blending traditional and decentralized finance approaches. The success of crypto hedge funds will largely hinge on the adaptability of strategies, the adoption of new technologies, and the capacity to navigate the regulatory environment. Moving forward, as technology evolves and institutional interest strengthens, crypto hedge funds are likely to play a foundational role in the financial ecosystem, bridging the gap between the conventional and the digital future.