In the wild world of cryptocurrencies, many investors have faced hacks, fraud, and sudden exchange collapses. Enter MiCA (Markets in Crypto-Assets Regulation), Europe’s game-changing framework designed to bring clarity and security to the crypto industry.

Crypto exchanges operating under MiCA will need to comply with stringent rules governing transparency, operational resilience, and consumer protection. But what do the numbers say? How many exchanges are adapting? What does compliance mean for investors and the broader market? This article breaks down the latest statistics, trends, and challenges shaping the future of MiCA-regulated crypto exchanges.

Editor’s Choice

- Over 65% of European crypto exchanges are expected to be MiCA-compliant by the end of 2025.

- The total European crypto market under MiCA is projected to reach €1.8 trillion in 2025.

- 92% of crypto investors in the EU report feeling safer under MiCA regulation.

- MiCA licensing applications surged 150% in 2025 across crypto firms.

- Fines for non-compliance are projected to exceed €1.2 billion in 2025.

- Institutional adoption continues rising with over 50% of European banks planning MiCA partnerships by 2026.

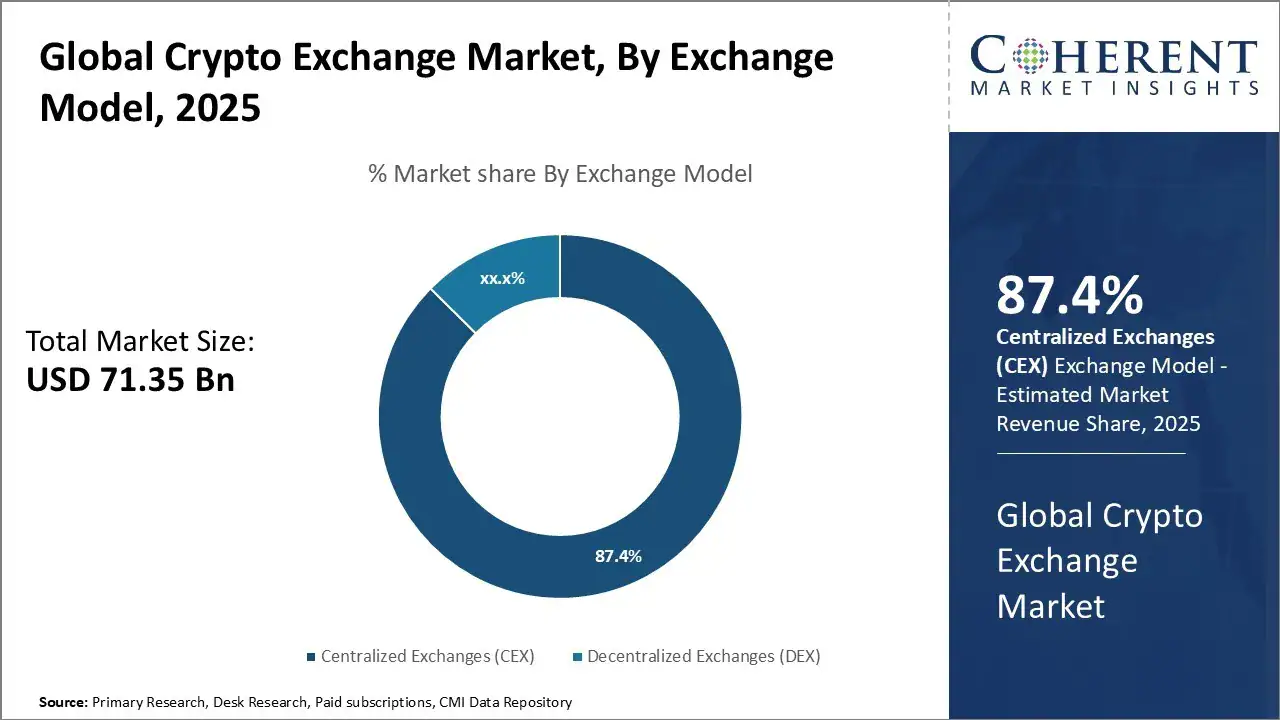

Global Crypto Exchange Market by Exchange Model

- The global crypto exchange market is projected to reach a total size of $71.35 billion in 2025.

- Centralized Exchanges (CEX) dominate the landscape, accounting for a massive 87.4% market share, equivalent to roughly $62.37 billion in revenue.

- Decentralized Exchanges (DEX) represent the remaining 12.6%, estimated at about $8.98 billion.

- Despite the rise of DeFi, CEX platforms remain the preferred choice for most traders due to higher liquidity, regulatory compliance, and ease of use.

- DEX adoption, however, continues to grow, driven by privacy concerns and self-custody preferences among crypto users.

- The data highlights a clear dominance of centralized models but also signals steady momentum toward decentralization as blockchain technology matures.

Key Statistics on Crypto Exchanges Under MiCA

- By Q2 2025, 67% of major crypto exchanges in Europe will have completed their MiCA registration process.

- Only 40% of global crypto exchanges operating in the EU are currently on track to meet full MiCA compliance.

- The number of crypto-related fraud cases in the EU dropped by 25% in 2024, indicating MiCA’s early impact on investor safety.

- 76% of European crypto traders believe MiCA regulations increase transparency and trust in the industry.

- MiCA registration fees for crypto exchanges range from €50,000 to €150,000, depending on size and complexity.

- In 2025, MiCA-compliant exchanges are expected to process over 90% of all European crypto transactions.

- 73% of crypto businesses in Europe cite compliance costs and bureaucratic hurdles as their biggest challenge in adapting to MiCA.

Market Share of MiCA-Compliant Crypto Exchanges

- By Q3 2025, 92% of all crypto trades in the EU are expected to be processed through MiCA-compliant exchanges.

- Binance, Kraken, and Coinbase are projected to control over 70% of the MiCA-compliant exchange market share in 2025.

- Smaller crypto exchanges face consolidation, with at least 20% of non-compliant platforms expected to shut down or merge by 2025.

- European institutional investors show a 65% preference for MiCA-compliant exchanges in 2025.

- MiCA-compliant platforms report a 40% lower churn rate than non-compliant counterparts in 2025.

- In 2024, only 38% of crypto users in Europe preferred regulated platforms, but in 2025, that had risen to over 80%.

- High-risk offshore exchanges like KuCoin and OKX lost over 50% of their European user base by 2025.

- More than 60 new crypto exchanges applied for MiCA licenses in 2025, signaling a wave of entrants.

The Provision of Crypto-Asset Services

- 80% of European crypto users now use regulated custodial wallets instead of self-hosted wallets.

- Staking services on regulated exchanges saw a 45% increase in adoption following MiCA compliance rules.

- Non-MiCA-compliant DeFi platforms have lost 30% of their European user base as users migrate to centralized, regulated platforms.

- MiCA mandates full transaction transparency, resulting in a 70% increase in on-chain reporting of suspicious activities.

- Crypto insurance is gaining traction with over 60% of MiCA-compliant platforms offering user asset protection policies.

- Cross-border crypto payments within Europe are now 25% faster and 40% cheaper under MiCA’s framework.

- MiCA requires crypto lending services to maintain a 1:1 reserve ratio, cutting off many high-risk lending platforms.

- The number of regulated stablecoin issuers in the EU has doubled, with over 25 licensed providers operating under MiCA.

Trading Volumes and User Adoption Trends

- Total trading volume on MiCA-compliant exchanges is projected to exceed $2.3 trillion in 2025, with ~40% year-over-year growth.

- Retail investors dominate activity, contributing to 65% of all transactions on MiCA-compliant platforms in 2025.

- The number of active daily users on MiCA-regulated platforms grew 35% in 2024 and is expected to rise another 25% in 2025.

- Institutional crypto investments in Europe jumped by 50% year-on-year in 2025, driven by regulated access and lower counterparty risk.

- Bitcoin (BTC) and Ethereum (ETH) account for 74% of total trading volume on MiCA-compliant exchanges in 2025.

- Stablecoin trading pairs (USDT/EUR and USDC/EUR) have increased by 90% since 2023.

- Peer-to-peer (P2P) crypto transactions have declined by 32% as European users migrate to regulated exchanges.

- Regulated derivatives trading is projected to surpass $600 billion in 2025, reflecting increased institutional participation.

MiCA Compliance Requirements

- MiCA licensing costs range between €50,000 and €150,000 in 2025, depending on exchange size and complexity.

- Compliance costs for exchanges are expected to rise by 30% to 50% in 2025 due to ongoing audits and mandatory reporting.

- Failure to comply can trigger fines up to €5 million or 3% of annual revenue, whichever is higher, in 2025.

- MiCA mandates exchanges maintain a minimum operational reserve of €1 million to safeguard stability and user funds.

- All MiCA-compliant exchanges must perform KYC and AML checks, reducing anonymous transactions by 20%.

- Exchanges must report any crypto transaction exceeding €1,000 to financial regulators under MiCA in 2025.

- Stablecoin issuers must maintain 100% liquid reserves against their outstanding tokens to ensure redemption.

European VASPs vs. Projected MiCA CASPs

- Around 75% of European VASPs, roughly 2,500 companies, are expected to lose compliance when the MiCA Grandfathering period ends in June 2025.

- As of March 2025, only 12 firms had successfully obtained a MiCA CASP license, reflecting the slow regulatory approval rate.

- By the end of 2025, the number of licensed MiCA CASPs is projected to reach 110–130, signaling early adoption among larger or more compliant exchanges.

- The total number of active VASPs peaked at about 3,100 in early 2025, before falling sharply as MiCA rules tightened.

- A major compliance gap is emerging, as thousands of firms struggle to meet MiCA’s documentation, capital, and consumer protection requirements.

- By 2026, fewer than 500 unregulated VASPs are expected to remain active, while MiCA-regulated CASPs gradually expand toward 150–180 entities.

- The trend highlights a massive consolidation of the European crypto market, where only well-capitalized or fully compliant platforms will survive the post-MiCA transition.

Regulatory Compliance Challenges and Penalties

- Over 40% of crypto exchanges in Europe reported difficulty meeting MiCA’s stringent reporting requirements in 2025 due to high compliance cost burdens.

- At least 25% of exchanges that applied for MiCA licensing in 2024 faced delays or rejections over incomplete AML or documentation issues in 2025.

- The annual cost of full MiCA compliance for large exchanges exceeds €500,000 in 2025, including licensing, reporting, and monitoring.

- Regulatory fines against non-compliant exchanges are projected to surpass €1.2 billion in 2025, with per-violation penalties from €50,000 to €5 million.

- More than 18% of existing crypto platforms in Europe have either shut down or exited the EU market by 2025 over the inability to meet MiCA standards.

- MiCA’s stricter KYC and AML rules have driven a 35% decline in anonymous crypto transactions across European exchanges by 2025.

- Crypto tax evasion cases in the EU dropped by 22% in 2024 as MiCA-compliant exchanges began mandatory earnings reporting.

- European regulators conducted over 100 exchange audits in 2024, uncovering major violations in at least 30% of audited firms.

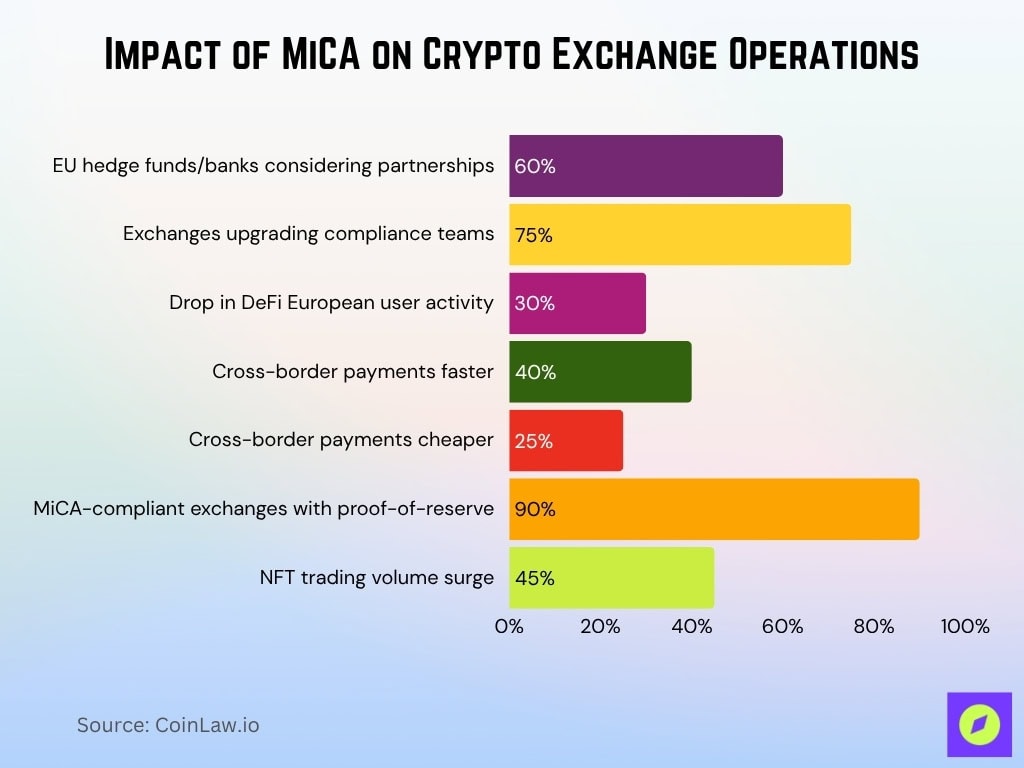

Impact of MiCA on Crypto Exchange Operations

- MiCA has increased institutional participation with over 60% of European hedge funds and banks now considering partnerships with regulated crypto exchanges in 2025.

- 75% of crypto exchanges in Europe have revamped their internal compliance teams by 2025, hiring more regulatory experts and auditors.

- DeFi protocols have seen a 30% drop in European user activity in 2025 as MiCA’s tighter controls push users toward regulated exchanges.

- Cross-border crypto payments within Europe are now 40% faster and 25% cheaper thanks to MiCA’s standardized legal framework.

- NFT trading volumes on MiCA-compliant platforms surged 45% in 2025, driven by institutional investment and regulatory clarity.

- The average processing time for MiCA licensing applications is now 9–12 months in 2025, creating a backlog of over 150 pending approvals.

- 90% of MiCA-compliant exchanges now offer proof-of-reserves transparency, assuring users that actual assets back their funds.

Recent Developments and Updates

- The European Securities and Markets Authority (ESMA) in 2025 requires crypto exchanges to disclose reserve holdings monthly, boosting transparency and investor protection.

- The European Central Bank (ECB) is examining stablecoin integration with existing financial infrastructure to allow regulated banks to hold digital assets under MiCA.

- France and Germany account for over 60% of MiCA compliance penalties issued by regulators in 2025.

- The United Kingdom is negotiating with the EU to adopt a “MiCA-equivalent” regulatory framework permitting cross-border operations.

- Major exchanges are deploying AI-driven compliance tools, automating KYC, transaction monitoring, and fraud detection in 2025.

- Fines for non-compliant crypto advertising reached €200 million in 2024 under MiCA-driven marketing disclosure laws.

Frequently Asked Questions (FAQs)

17 authorized CASPs across the EU.

7 member states.

15 entities, all reported by Italy’s CONSOB.

€412 million cumulative fines.

Conclusion

The introduction of MiCA today is ushering in a new era of transparency, security, and institutional legitimacy for the European crypto industry. While compliance remains a challenge, it is also helping crypto exchanges build stronger reputations and attract long-term investors.

As the crypto industry matures, MiCA will likely serve as a global model for digital asset regulations, influencing how other regions, such as the US, UK, and Asia, develop their compliance frameworks. Whether you’re an investor, trader, or industry professional, staying informed about MiCA regulations is crucial for navigating the evolving crypto landscape.