Picture this: a small business owner in the United States sends a payment to a supplier in Asia with just a few taps on their smartphone. Not too long ago, such transactions required days, sometimes weeks, to process. Now, with the advent of digital innovations, cross-border payments are becoming faster, cheaper, and more accessible. In 2025, this industry will continue to evolve, fueled by technological breakthroughs and rising global connectivity. From retail to B2B payments, cross-border transactions are reshaping how economies interact, propelling businesses into new global opportunities.

Editor’s Choice

- The global cross-border payments market was valued at over $194 trillion in 2024 and is projected to reach $320 trillion by 2032.

- Cross-border payment volumes are projected to increase by 5% annually until 2027, reaching a market size of $250 trillion.

- In January 2025, Visa reported a 16% increase in cross-border volume, while Mastercard saw a 20% rise, indicating robust growth in international transactions.

- Stablecoins have gained traction, with transaction volumes climbing to $710 billion in February 2025, up from $521 billion in the same period a year earlier.

- The number of unique stablecoin addresses reached 35 million, marking a 50% increase over the previous year.

- Digital services within B2B payments are expected to experience an 8.3% CAGR from 2024 to 2032, outpacing non-digital services, which are projected to grow at 4.8% annually.

- Small and Medium-sized Businesses (SMBs) contributed $13.8 trillion to the B2B cross-border payments market in 2024, with forecasts predicting an increase to $21.2 trillion by 2032, a 5.6% CAGR.

Market Sizing Data and Segment Insights

- In 2024, the global cross-border payments market size is valued at $150 billion, marking a 10% annual growth rate compared to the previous year.

- The APAC region is expected to lead the market with 35% of global transaction volumes, driven by robust trade activity and digital innovation.

- The e-commerce sector is projected to process $6.5 trillion in cross-border payments, reinforcing its role as a major growth driver.

- Bank-based cross-border payments are gradually declining, now accounting for just 30% of transaction volumes as fintech and digital platforms gain ground.

- Real-time gross settlement systems (RTGS) in the cross-border market are estimated to handle $30 trillion in transactions in 2024.

- Emerging markets such as Africa and South America are experiencing a CAGR of 15%, underscoring untapped opportunities in these regions.

- In 2024, the SME segment contributes 25% of cross-border payment revenues, reflecting increasing participation in global trade.

Retail Cross-Border Payments Market: B2B and Consumer Insights

- The retail cross-border payments market is forecast to exceed $45 billion in revenue, driven by a surge in consumer demand for global goods.

- B2B retail payments account for 70% of this revenue, highlighting the significant contribution of business transactions.

- Millennials and Gen Z consumers are fueling the growth of mobile-based payment solutions, which represent 60% of retail cross-border transactions.

- Buy Now, Pay Later (BNPL) solutions have grown by 25% year-over-year, becoming a popular choice for cross-border retail purchases.

- The average cross-border transaction fee in 2024 stands at 1.5%, a reduction from 2.3% in 2022, owing to competition among providers.

- Cross-border e-commerce platforms like Amazon and Alibaba process 20% of global retail payments, showcasing their market dominance.

- In North America, 50% of consumers now prefer digital wallets for cross-border retail purchases, a trend expected to continue.

Revenue Dynamics for International Payments

- B2B cross-border payments remain the primary revenue driver, contributing 85% of the total market’s income, estimated at $40 billion in 2024.

- Revenue from cross-border e-commerce payments is expected to hit $12 billion, reflecting a 15% year-over-year increase.

- The remittance market, largely dominated by migrant workers, is predicted to generate $800 billion globally, with low-cost providers taking an increasing share.

- Banks continue to face revenue pressure as fintech solutions claim 30% of cross-border payment processing revenues.

- Cryptocurrencies are projected to contribute $2.5 billion in revenue by reducing transaction fees and enhancing transparency.

- SMEs (Small and Medium Enterprises) have grown their cross-border payment revenues by 20%, driven by improved accessibility to digital platforms.

- Revenue derived from foreign exchange (FX) fees in cross-border payments is expected to decline to $18 billion as more players adopt transparent pricing models.

| Revenue Driver | Value/Statistic |

| B2B payments revenue | $40 billion (85% share) |

| E-commerce payments revenue | $12 billion (15% YoY growth) |

| Global remittance market revenue | $800 billion |

| Fintech revenue share | 30% |

| Cryptocurrency revenue | $2.5 billion |

| FX fees revenue | $18 billion (declining trend) |

Key Trends in Cross-Border Payments for 2025

- Stablecoins are expected to reach peak hype, signaling increased industry experimentation and adoption.

- Blockchain infrastructure will become mainstream, moving beyond innovation to everyday utility.

- Generative AI is set to deliver productivity gains across operations and services.

- Rising interest in quantum computing suggests that long-term disruption potential is on the horizon.

- Data adoption and automation will evolve, boosting efficiency and decision-making.

- Public market delistings will accelerate as firms explore alternate growth paths.

- Private equity will claim a larger industry share, driving consolidation and strategic shifts.

- Cross-border payment IPOs are predicted to make a comeback.

- Pricing regulation becomes a focus area, with policymakers stepping in.

- Interchange fees will face increased scrutiny, pushing for more transparency.

- B2B netting is gaining growing interest as a cost-efficient model.

- Banking specialisation will increase to meet diverse market demands.

- Remittances are hitting a digital tipping point, shifting toward modern platforms.

- Localised e-commerce payments enter their next growth phase, especially in emerging markets.

- B2B2X models will become more interoperable, encouraging ecosystem collaboration.

Future Growth Projections

- The global cross-border payments market is forecasted to achieve a CAGR of 9.5%, reaching $180 billion in annual revenue by 2028.

- Technological advancements, including blockchain and real-time payment systems, are expected to cut average transaction costs by 30% over the next five years.

- Artificial Intelligence (AI) and machine learning applications in fraud detection are predicted to save the industry $10 billion annually by 2026.

- Emerging economies in Africa and Southeast Asia will drive 30% of the total market growth over the next decade.

- By 2030, over 50% of global cross-border payments will be processed through digital channels, reducing reliance on traditional banking systems.

- Consumer demand for eco-friendly financial products could create a niche segment valued at $5 billion by 2025.

- Cross-border remittances are set to grow at 6% annually, reaching a record $1 trillion by 2030, fueled by rising migration trends.

| Projection | Value/Statistic |

| Global CAGR (2024–2028) | 9.50% |

| Revenue target (2028) | $180 billion |

| Transaction cost reduction | 30% (next five years) |

| AI fraud detection savings | $10 billion annually (2026) |

| Emerging economies’ market growth | 30% (Africa and Southeast Asia) |

| Digital channel share of payments (2030) | 50% |

| Cross-border remittance growth rate | 6% annually, reaching $1 trillion (2030) |

Competitive Analysis

- PayPal and Stripe remain leading players, capturing 25% of the global cross-border payments market share through innovative solutions and a strong SME focus.

- Fintech companies like Wise (formerly TransferWise) have grown their user base by 20% annually, driven by transparent fees and ease of use.

- Traditional banks now account for just 35% of cross-border payment volumes, a significant drop from 55% in 2015.

- China’s Alipay and WeChat Pay dominate the APAC region, processing 40% of transactions in cross-border e-commerce.

- Competition in Africa and Latin America has intensified, with platforms like M-Pesa and Mercado Pago experiencing rapid adoption.

- Partnerships between fintechs and e-commerce giants, such as Amazon and Payoneer, have boosted market penetration by 15% in 2024.

- Companies that implement real-time payments have seen their market share increase by 10%, highlighting the demand for instant transaction capabilities.

Technological Innovations: Investment and Real-Time Payments

- Global investment in real-time payments technology reached $15 billion in 2024, a 25% increase compared to 2023.

- Blockchain-based payment systems now process $5 billion annually in cross-border transactions, growing at a CAGR of 17%.

- APIs (Application Programming Interfaces) have streamlined cross-border payment integration, with over 60% of fintechs adopting them to enhance user experience.

- Machine learning algorithms used for fraud prevention have reduced losses by 40%, saving the industry $8 billion annually.

- Cloud-based platforms supporting cross-border payments have seen 30% growth, enabling faster and more scalable transactions.

- The adoption of ISO 20022 messaging standards for cross-border payments is expected to improve interoperability across systems by 50% in 2025.

- Real-time gross settlement systems (RTGS) have reduced the average cross-border payment settlement time from 3 days to 12 hours, an efficiency gain of 80%.

Market Drivers and Impacting Factors

- The growth of e-commerce continues to drive cross-border payments, contributing to 20% of global payment volumes in 2024.

- Increasing adoption of mobile payment platforms, particularly in Asia and Africa, has led to a 35% increase in cross-border transactions.

- Cryptocurrency adoption is becoming a key driver, as 15% of global businesses now accept crypto for international transactions.

- Geopolitical tensions and shifting trade dynamics are impacting cross-border payment flows, with businesses seeking alternative currencies and routes.

- Supply chain digitization has improved transaction speeds and transparency, boosting B2B cross-border payments by 12% year-over-year.

- Consumers increasingly demand zero-fee transactions, leading to a surge in the adoption of fintech solutions offering competitive pricing.

- The push for financial inclusion has enabled digital cross-border payments to penetrate underserved markets, such as rural areas in Africa and South Asia.

Regulatory Landscape and Interoperability

- AML (Anti-Money Laundering) and KYC (Know Your Customer) regulations now account for 15% of compliance costs in the cross-border payment industry.

- The adoption of ISO 20022 standards is set to streamline communication across global financial networks by mid-2025, improving efficiency.

- Regulators in the EU and US are increasing scrutiny on cross-border crypto transactions to combat financial crimes.

- Central Bank Digital Currencies (CBDCs) are emerging as a solution to regulatory and interoperability challenges, with over 20 central banks piloting projects.

- Data localization laws, especially in India and Brazil, require companies to store payment data domestically, increasing compliance complexity.

- Enhanced collaboration between SWIFT and blockchain platforms has created a hybrid system, improving regulatory transparency in 40% of transactions.

- Governments are pushing for open banking models to facilitate smoother cross-border transactions while ensuring robust customer protection.

| Regulatory Development | Value/Statistic |

| AML/KYC compliance costs | 15% of costs |

| ISO 20022 adoption | Mid-2025 efficiency improvement |

| CBDC pilot projects | Over 20 central banks |

| Data localization impact | Higher complexity in India and Brazil |

| SWIFT-blockchain hybrid transparency | 40% of transactions |

| Open banking push | Smoother cross-border transactions |

Top Technologies to Solve Cross-Border Payment Pain Points

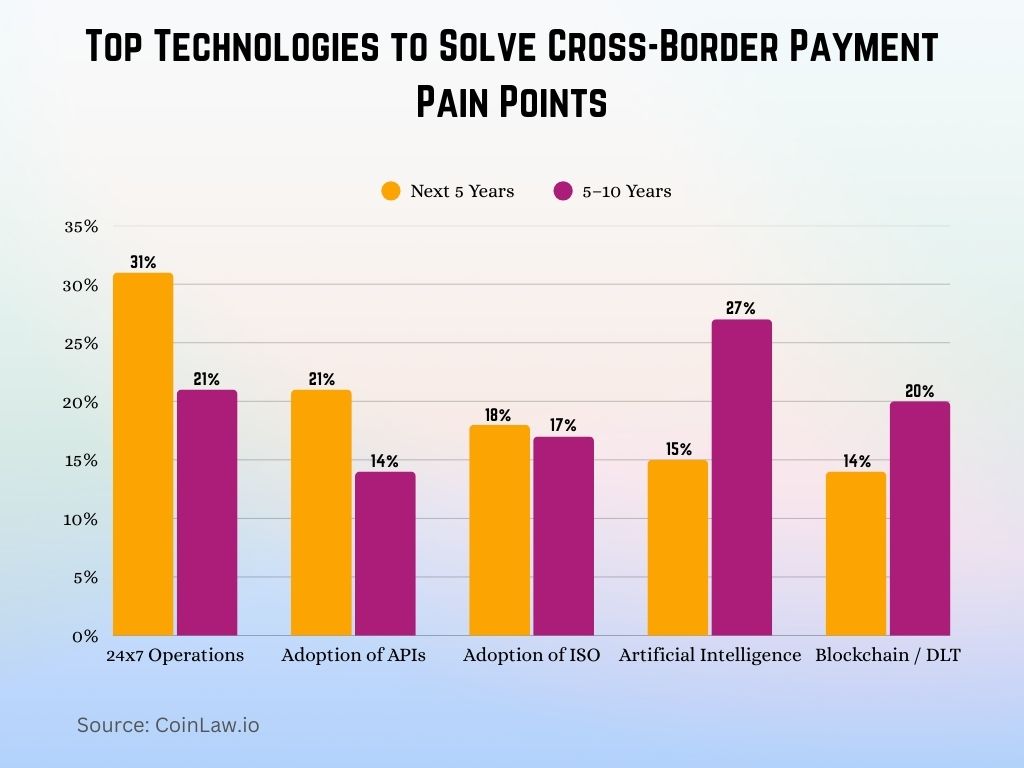

- 24×7 operations are seen as the most important near-term technology, with 31% of banks prioritizing it in the next 5 years.

- API adoption is also a strong focus, with 21% of respondents citing it for the next 5 years, but interest drops to 14% for the longer term.

- ISO standard adoption shows consistent value, with 18% seeing it as key in the next 5 years and 17% over 5–10 years.

- Artificial Intelligence (AI) sees a surge in long-term importance. Only 15% prioritize it in the short term, but that jumps to 27% for 5–10 years, the highest long-term priority.

- Blockchain/DLT lags in the short term (14%), but its perceived value grows in the longer term (20%), showing rising confidence in the technology’s future role.

Recent Developments

- Stablecoin Adoption by Major Financial Institutions: Several major banks and fintech companies, including Bank of America, Standard Chartered, PayPal, Revolut, and Stripe, are entering the stablecoin market. This move aims to reshape cross-border payments by leveraging cryptocurrencies, offering a cost-effective and immediate alternative to traditional banking systems, especially in emerging markets.

- Russia’s Consideration of Cryptocurrency for Sanctions Evasion: In response to Western sanctions affecting cross-border payment flows, Russia is exploring the use of cryptocurrencies to facilitate international transactions. This shift indicates a significant change in Russia’s stance towards digital assets, potentially impacting the global cross-border payments landscape.

- Legal Challenges Against UK Payment Regulations: Revolut and Visa have initiated legal proceedings against the UK’s Payment Systems Regulator (PSR) concerning proposed caps on interchange fees for cross-border online payments. The outcome of this legal challenge could influence the regulatory environment for cross-border transactions in the UK and potentially set precedents for other regions.

- Expansion of UK Fintechs into the US Market: Leading UK digital banks, Revolut and Monzo, are expanding into the US market, aiming to offer integrated banking solutions. This expansion reflects a strategic move to capture a share of the $24 trillion US banking market, potentially increasing competition and innovation in cross-border payment services.

- Regulatory Adjustments on Cross-Border Card Fees in the UK: The UK’s Payment Systems Regulator is considering adjusting proposed caps on fees for cross-border card payments between British merchants and European buyers. This review aims to address concerns from credit card companies and retailers, potentially impacting the cost structure of cross-border transactions.

Consumer Intent to Increase Cross-Border Transactions

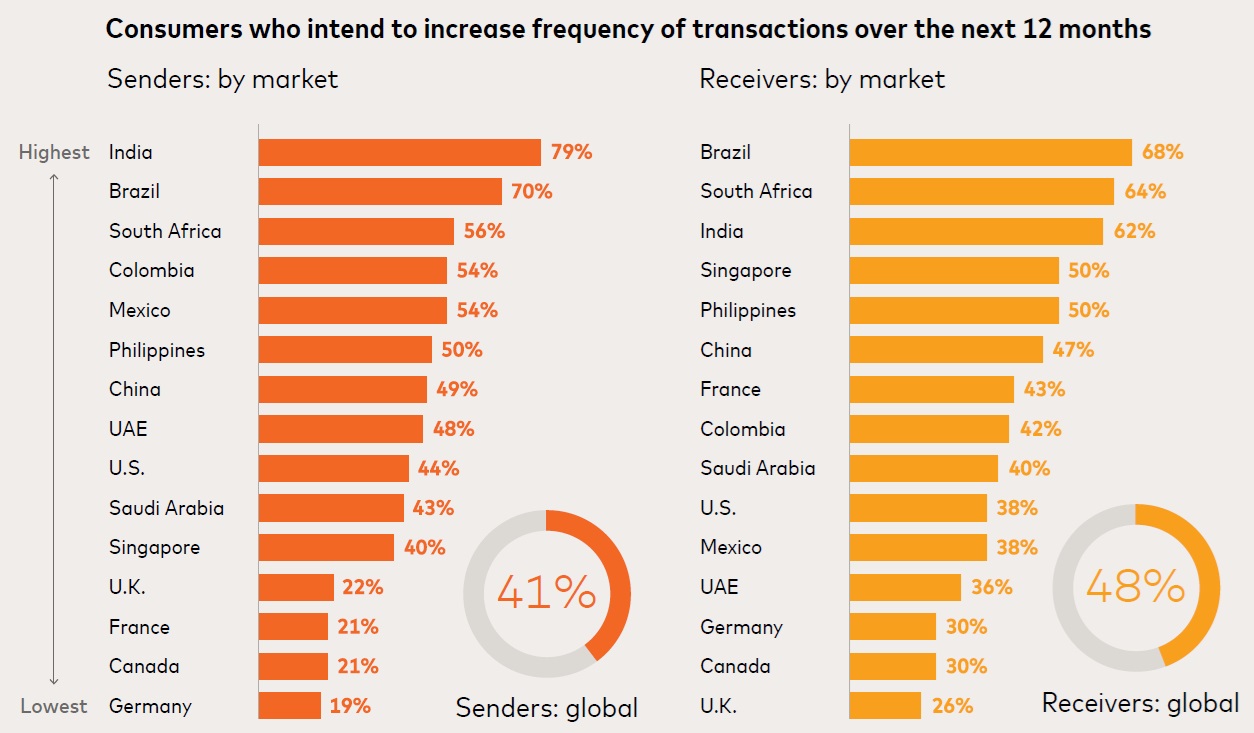

- India leads globally in sender intent, with 79% of consumers planning to increase transaction frequency.

- Brazil ranks high for both senders (70%) and receivers (68%), showing strong two-way demand.

- South Africa shows notable momentum, with 56% of senders and 64% of receivers expecting more activity.

- Philippines, Colombia, and Mexico also see over 50% intent from both senders and receivers.

- Artificial Intelligence (AI) is more of a long-term priority, jumping from 15% (next 5 years) to 27% (5–10 years).

- Germany, Canada, and the UK report the lowest sender intent, ranging from 19% to 22%, and receiver intent from 26% to 30%.

- The global average intent to increase transactions stands at 41% for senders and 48% for receivers.

Conclusion

The cross-border payments industry stands at the forefront of innovation, bridging the gap between traditional finance and cutting-edge technology. With global transaction volumes surpassing $250 trillion and advancements in real-time systems, the industry is adapting rapidly to meet the demands of businesses and consumers alike. While challenges like regulatory compliance and geopolitical factors persist, they are being addressed through collaboration, technology adoption, and robust standards like ISO 20022.

Looking ahead, the integration of blockchain, AI, and open banking promises to make cross-border payments faster, more secure, and increasingly transparent. As global commerce thrives, the industry’s role in connecting economies and enabling seamless transactions will only grow stronger.