Credit cards and debit cards dominate U.S. payment behavior, and their roles are shifting in 2025. Credit cards offer rewards, borrowing flexibility, and fraud protection, while debit cards provide direct bank access, no-interest spending, and tighter budget control. In industries like e-commerce and travel, cards power huge volumes of transactions and incentivize loyalty programs. Real‑world examples include major retailers pushing cashback offers and banks launching premium travel credit cards. Explore the full article below to see how usage, trends, debt, fees, and fraud compare.

Editor’s Choice

- 631 million active credit card accounts in the U.S. in 2025.

- 90% of American adults had a debit card and 82% had a credit card in 2024.

- Credit card transaction volume increased by approximately 43% from 2019 to 2023, reflecting significant growth in consumer reliance on credit cards.

- Debit card usage declined by less than 1% the same period.

- Average credit card debt among carry balances: $7,321 in Q1 2025, up from $6,921 in Q1 2024.

- Credit + debit cards accounted for 65% of U.S. payments by number in 2024, credit 35%, debit 30%.

- Average credit card transaction: $96.56 in 2024.

Recent Developments

- Capital One’s planned acquisition of Discover could reshape credit‑card networks and expand cross‑selling opportunities.

- Declining interest rates in 2025 may encourage more revolving credit use instead of one‑time spending.

- Cards are expanding beyond transactions; Visa and Mastercard now offer real‑time payments and fraud‑detection services.

- Regulatory scrutiny is increasing around interchange fees and possible fee caps impacting rewards programs.

- Contactless payment adoption continues rising, and NFC and EMV cards are widely in use.

- Some merchants pass card fees to customers or incentivize cash, affecting card usage modestly.

- Slowdown in card‑volume growth relative to overall consumption raises questions about future expansion.

US Primary Payment Card Usage by Income Level

- High-income households earning $150K–$249.9K overwhelmingly favor credit cards (65.1%) over debit cards (33.7%).

- Those making $125K–$149.9K also prefer credit cards (56.5%), but debit card use is still notable at 40.3%.

- $100K–$124.9K earners strongly lean toward credit cards (65.0%), with only 32.0% using debit cards as their primary card.

- Mid-to-upper income group $75K–$99.9K shows credit card dominance (58.3%) compared to 39.9% for debit cards.

- $50K–$74.9K households lean slightly toward debit cards (54.6%) over credit cards (42.9%).

- Lower-middle income earners $25K–$49.9K primarily use debit cards (67.4%), with just 29.6% relying on credit cards.

- Lowest income households under $25K heavily favor debit cards (71.6%), with only 18.3% using credit cards.

Credit Card Usage Statistics

- Active credit card accounts rose from 617M in 2024 to 631M in 2025.

- The average consumer holds 3.9 credit cards in their wallet or digital wallet in 2025.

- Credit card usage increased from 48% 2019 to 2024.

- Credit cards represent roughly 31% of all payment transactions by number in 2025.

- Tap‑to‑pay transactions can be completed in under half the time of traditional chip card transactions, improving checkout speed by roughly 40–60%, depending on merchant and payment terminal type.

- 77% of consumers cite fraud protection as a top reason to use credit over debit.

- Over 80% choose cards based on rewards programs, cashback, points, etc.

- The average monthly credit card spend per holder is roughly $2,500–$3,000 per month.

- The average U.S. credit card transaction size in 2023 was $90–$95, depending on merchant category, with some retail sectors reporting higher averages.

Debit Card Usage Statistics

- In 2024, debit cards accounted for 30% of all payments by number.

- Debit card adoption stands at 90% of U.S. adults in 2024.

- Debit usage declined less than 1% from 2019 to 2024.

- In‑person under‑$25 payments, debit used as often as cash for the first time in 2023/24.

- Average debit cardholder makes ~35 transactions/month, spending ~$1,600 monthly.

- Debit cards are used more often for in‑store vs credit, 14.3% higher preference among shoppers.

- Visa processed $6.02T in consumer debit volume in FY 2024 vs $5.31T credit volume.

- Mastercard handled $4.87T in debit and prepaid transactions vs $3.64T in credit in 2024.

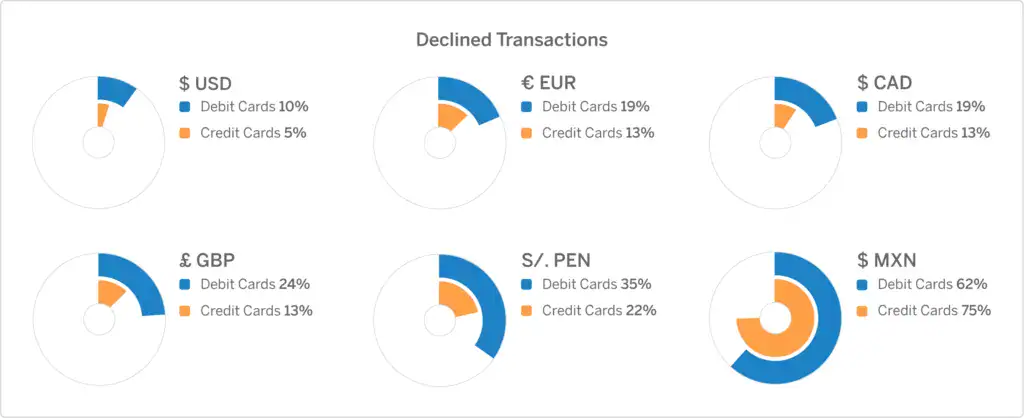

Declined Transactions by Currency and Card Type

- In USD, declined transactions are 10% for debit cards and 5% for credit cards.

- For EUR, debit cards see a 19% decline, while credit cards have 13%.

- In CAD, both debit and credit cards show a 19% and 13% decline rate, respectively.

- In GBP, debit cards have 24% declined transactions vs. 13% for credit cards.

- In PEN (Peruvian sol), debit cards see a 35% decline and credit cards 22%.

- MXN (Mexican peso) shows the highest decline rates, with 62% for debit cards and a striking 75% for credit cards.

Number of Cardholders and Adoption Rates

- In 2025, approximately 82% of U.S. adults had at least one credit card.

- Around 90% of adults held a debit card in 2024.

- By age 25, 73% of Americans have a credit card.

- Credit card adoption has been steadily increasing from 72% in early 2025 to 82% in the 2024 report.

- Debit adoption exceeded credit adoption consistently (~90% vs ~82%).

Average Transaction Value and Volume

- The average credit card transaction in 2024 was $83, compared with $70 for debit cards.

- Credit card payment volume grew 8.2% year-over-year in 2022, outpacing GDP.

- Credit cards account for around 31% of all payment transactions in 2025, while debit cards occupy about 30%.

- Card spend per household rose at an SAAR of 1.6% as of April 2025.

- YoY transaction growth per household has cooled from 2023 into early 2025, suggesting moderation.

- In‑person credit card payments under $25 surged 76% from 2016 to 2024, while debit payments for the same category dropped 13%.

- The median U.S. credit card holder spends approximately $2,500–$3,000 per month, with higher-income households spending significantly more.

- Tap-to-pay speeds checkout by 40-60%, boosting credit card utility.

Market Share of Debit and Credit Card Brands

- Visa dominates debit cards with a massive 76% market share, far ahead of Mastercard (23%) and Discover (2%).

- Credit card usage is led by Visa (57%), followed by Mastercard (25%).

- Discover holds 14% of the credit card market, stronger than its debit card presence.

- American Express has a 4% share in the credit card segment, with no significant debit card presence.

Total Spending by Card Type

- Total credit card debt in the U.S. reached $1.182 trillion in Q1 2025, slightly down from $1.211 trillion in Q4 2024.

- Credit cards handled a larger share of high-value purchases, credit equating to 73% of retail spending by value in 2024.

- Debit card transaction value grew 84% from 2015 to 2021, while credit card volume grew 60%.

- Visa processed $6.02 trillion in debit volume vs $5.31 trillion in credit in FY 2024.

- Mastercard processed $4.87 trillion in debit/prepaid vs $3.64 trillion in credit during 2024.

- Credit cards now account for 31% of all U.S. payments by number, debit cards account for 30%, with cash at 14%.

- Credit card spending growth persistently exceeds debit growth across demographics.

Consumer Payment Preferences by Card Type

- Credit card usage rose 48.11% from 2019 to 2024, and debit card transactions declined 0.98% over the same span.

- Credit card usage surpassed debit for the first time in 2022.

- Among individuals earning over $150K, credit card use is 3× higher than debit, the opposite is true for < $25K households, where debit dominates 1.9×.

- Across all age brackets, credit card use is 3–9% higher than debit use.

- In small purchases (< $25), credit usage surged 76% since 2016, and debit usage fell 13%.

- Over 80% of consumers pick credit cards for rewards programs, cashback, points, and travel perks.

- 77% prioritize fraud protection when choosing credit over debit.

Breakdown of U.S. Credit Card Debt by Age Group

- Ages 50–59 hold the largest share of credit card debt at 22.6%.

- Ages 40–49 follow closely with 21.9% of the total debt.

- Ages 30–39 account for 18.0% of debt among U.S. consumers.

- Ages 60–69 hold 17.5% of outstanding credit card balances.

- Ages 70+ carry 12.8% of the debt load.

- Young adults 18–29 have the smallest share, only 7.3% of total credit card debt.

Demographic Differences in Card Usage

- By age 25, 73% of Americans have a credit card.

- Gen Z and Millennials, 41% and 40% respectively, cite building credit history as a reason for credit use.

- Individuals aged 30–39 report the highest incidence of credit‑card-related identity theft.

- Credit card fraud per capita is highest in California (≈ $0.99) and Delaware (≈ $1.49 per person).

- 15% of credit‑fraud victims in 2024 are people aged 80+, while 30‑39 is the most affected cohort (~111,000 cases).

- Cardholders 60–69 reported the greatest total fraud loss ($1.18B) in 2024.

Credit Card Debt and Repayment Trends

- Total U.S. credit card debt $1.182 trillion in Q1 2025, a slight decline from the prior quarter.

- The average credit card interest rate in 2025 stands at 21.3%.

- Less than half of adult cardholders carried a balance over the past 12 months.

- Carrying balances remains common; about 73% of Americans by age 25 have credit cards, and many use them to cover expenses they can’t afford daily.

- Interest rates have outpaced inflation, leading to rising minimum payments and longer payoff periods.

- Rewards-driven spending contributes to escalating balances for those with revolving debt month‑to‑month.

- BNPL via credit cards hit $133 billion in ecommerce in 2024, growing fast.

- BNPL adoption further influences credit card utilization and debt levels among younger consumers.

Declined Card Transactions by Major U.S. Banks

- Chase shows the highest debit card decline rate at 11.5%, with credit card declines at 5.3%.

- US Bank has 10.2% debit card declines and 6.0% credit card declines.

- Citi reports 9.0% debit card declines, but the lowest credit card decline rate at 4.5%.

- Bank of America records 8.2% debit card declines and 5.0% credit card declines.

- Wells Fargo shows 7.8% debit card declines and 5.8% credit card declines.

Rewards, Cashback, and Incentive Statistics

- Over 80% of credit card users choose cards based on rewards programs.

- Rewards yield about 1.6 cents per dollar spent for general-purpose cards.

- Major issuers continue to expand bonus structures tied to travel, groceries, or gas categories.

- BNPL growth via credit cards is encouraged by point-based financing schemes.

- Credit incentives continue drawing higher-income users, over 3× more likely to earn travel rewards.

- Debit cards rarely offer equivalent rewards, making credit the default for incentive-driven consumers.

- Tap‑to‑pay programs also integrate loyalty features, boosting both ease and reward capture.

Card Usage for Online vs In‑Store Purchases

- Credit cards account for about 64% of all U.S. online purchases, while debit cards account for around 28%.

- In‑store purchases remain more evenly split, with debit cards used in roughly 51% of transactions and credit cards in 44%.

- For purchases over $100 online, credit cards are used 3× more often than debit cards.

- Debit cards dominate small in‑store transactions under $25, making up about 55% of those purchases.

- Mobile wallet usage skews toward in‑store payments, but credit cards remain the primary funding method for these transactions.

- Over 80% of online shoppers prefer credit cards for fraud protection and dispute resolution benefits.

- Debit cards are more frequently linked to person‑to‑person (P2P) payment apps for in‑store bill‑splitting and small purchases.

- The average online credit card transaction value is $121, compared to $84 for in‑store transactions.

- The average online debit card transaction value is $76, compared to $42 for in‑store transactions.

Percentage of Active U.S. Credit Cards with a Balance

- 40% of active U.S. credit cards carry a balance.

- 36% of active credit cards have no balance.

- 24% of credit cards are currently dormant and not in active use.

Fraud and Security Statistics

- In 2023, an estimated 43 million U.S. adults were victims of credit or debit card fraud.

- Roughly 63% of U.S. cardholders have been defrauded, and 51% faced fraud multiple times.

- 46% of global credit card fraud occurs in the U.S., and domestic fraud is expected to top $12.5 billion in 2025.

- Card-not-present transactions account for 65% of credit card fraud losses.

- Debit card fraud accounted for roughly 30–35% of reported card fraud losses in 2023.

- Fraud incidents surged, debit-related fraud grew 6%, with check fraud up 5%, and app-based losses up 1%.

- 79% of U.S. organizations were targeted by payments fraud in 2024.

- 73% of U.S. adults have experienced some form of online scam or fraud.

Impact of Fees and Costs

- Credit card processing fees for merchants typically range from 1.10% to 3.15% per transaction.

- U.S. merchants paid a total of $187.2 billion in swipe fees in 2024, up from $172 billion in 2023.

- The average merchant pays around a 2.34% fee per credit card sale.

- Debit card interchange averages 0.73% (~ 34¢ per transaction).

- The average household paid $1,000 in card fees in 2024.

- Credit card swipe fees have increased 50% since the pandemic.

- Visa and Mastercard agreed to cap swipe fees in a settlement worth ~$30 billion.

- Proposed CFPB rules aim to limit overdraft fees to as low as $3 from the current ~$35.

How U.S. Consumers Typically Pay for Purchases

- Physical debit cards are the most common payment method, used by 49% of consumers.

- Physical credit cards are the second most popular choice at 32%.

- Cash or checks remain in use by 9% of respondents.

- Virtual debit cards are used by 5% of consumers.

- Virtual credit cards are the least common, with only 4% usage.

Regional and Country Comparisons

- In 2024, credit cards comprised 35% of U.S. payment transactions, debit cards 30%, and cash 14%.

- Debit card CNP fraud rose steadily in the U.S. from 2011 to 2021.

- The U.S. ranks highest globally in credit card fraud volume.

- Globally, digital wallet share in e-commerce rose to over 50% in 2025.

- U.S. in-store digital wallet transactions jumped 4.3% from 2022 to 2024, reaching ~17% share.

- Mobile wallet adoption, Google Wallet had ~48.6 million users in 2024, projected to reach ~50.9 million in 2025.

Credit Card vs Debit Card Adoption Trends Over Time

- Credit card usage increased by 48% from 2019 to 2024, while debit dropped by ~1%.

- Debit adoption has slightly declined as credit becomes more dominant.

- Credit use overtook debit in total transaction volume in 2022 and has widened since.

Effects of Economic Changes on Card Usage

- Rising grocery and household costs are pushing more Americans toward BNPL services and debit spending.

- Average credit + debit card spending per household rose ~1% YoY in April 2025, with SAAR at 1.6%.

- Higher-income households averaged stronger card spending growth (~2.3% YoY) than low-income households (~1.5%).

Mobile Wallet and Digital Payment Adoption by Card Type

- Nearly 70% of online adults in the U.S. used mobile/digital payments in the past three months as of early 2025.

- Mobile wallets account for 36.7% of online transactions, while 70% of P2P payments in the U.S. are via mobile/digital wallets.

- For in-store purchases, 17% used mobile wallets, still low compared to credit/debit reliance.

- QR-code mobile payments globally projected to hit $5.4 trillion in 2025, rising to $8 trillion by 2029.

Generational Trends in Credit and Debit Card Use

- Millennials and Gen Z cite building credit history (~40–41%) as a key reason for using credit cards.

- Older demographics (30–39, 60–69) are the most frequent victims of fraud.

- Younger adults lean toward digital wallets and BNPL over traditional cards.

Conclusion

Credit and debit cards remain central to U.S. consumer spending in 2025, with credit card usage continuing to grow in transaction volume, value, and market share, while debit usage remains steady or slowly declining. Fraud trends are shifting toward card-not-present transactions, especially affecting debit systems, even as fraud protection remains a strong credit card incentive. Swipe fees and processing costs continue to burden consumers and merchants, raising policy debates and signals of regulatory reforms ahead. Mobile and digital wallets are gaining ground, particularly online and in P2P use, shifting part of the payments mix. Generational preferences and economic pressures are shaping future behavior. Understanding these dynamics now can help consumers, merchants, and policymakers align strategies in a changing payments landscape.