The credit card processing industry, a cornerstone of global commerce, has never been more dynamic. As we step into 2025, innovations in payment technology, rising consumer expectations, and changes in regulatory landscapes are reshaping how transactions are processed across the world. From small businesses seeking affordable merchant services to tech giants leading the way in digital wallets and contactless payments, the ecosystem of credit card processing is evolving rapidly. This article dives into key statistics, trends, and insights defining this industry in 2025.

Editor’s Choice: Key Industry Milestones

- Global transaction value in the credit card processing market is projected to hit $16.3 trillion in 2025, fueled by booming digital commerce.

- US credit card transaction volume has risen by 9.7% year-over-year, indicating strong consumer activity despite inflation concerns.

- Visa, Mastercard, and American Express retain a commanding 73% global market share in 2025 despite rising fintech competition.

- Digital wallets now represent 36% of online payments in the US, with growing momentum across Asia and Latin America.

- Global fraud prevention spend has reached $16.1 billion in 2025, driven by AI-based threat detection.

- Buy Now, Pay Later (BNPL) within card ecosystems is expanding by 34% this year, fueled by Gen Z and Millennial adoption.

- EMV chip card compliance remains at 100% among major US retailers, with biometric enhancements now being piloted.

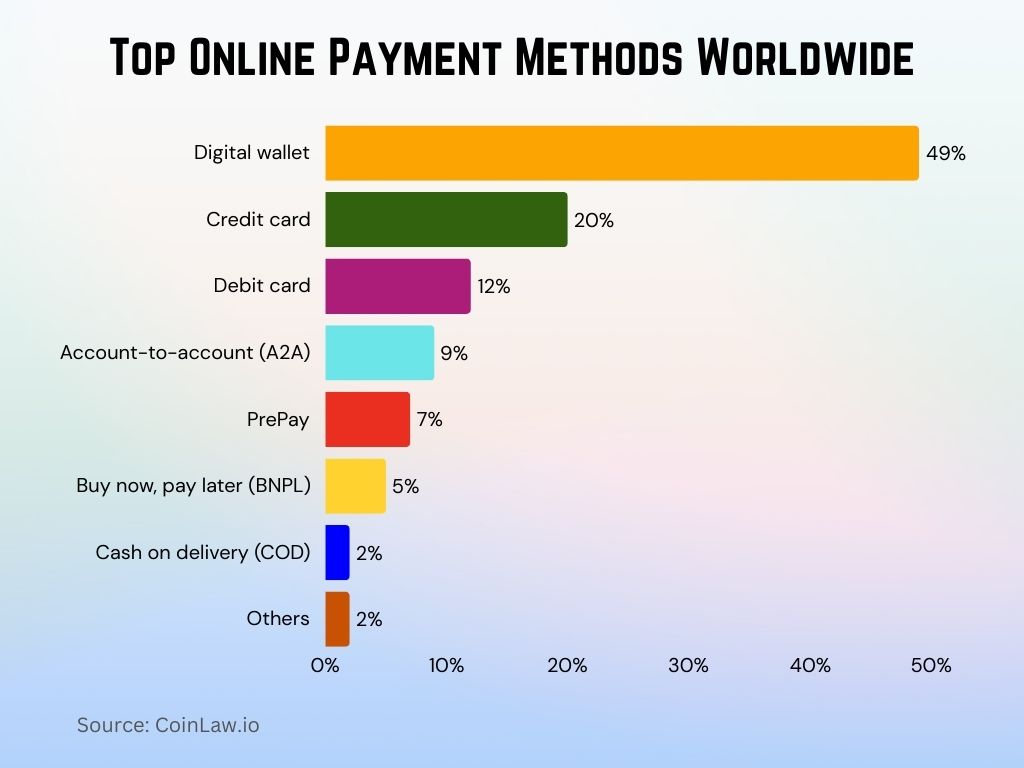

Top Online Payment Methods Worldwide

- Digital wallets dominate global online transactions, accounting for 49% of total payment methods.

- Credit cards are the second most used, making up 20% of online payments globally.

- Debit cards come in third, used in 12% of transactions worldwide.

- Account-to-account (A2A) methods represent 9%, showing growing adoption of direct bank transfers.

- PrePay methods, such as prepaid cards or vouchers, hold a 7% share in online payments.

- Buy Now, Pay Later (BNPL) services are used in 5% of transactions, reflecting their rising popularity.

- Cash on Delivery (COD) still persists with a 2% share, mainly in regions with low digital penetration.

- Other methods collectively account for 2%, including niche or emerging payment solutions.

Credit Card Processing Industry Overview

- Global revenue from credit card processing is forecast to hit $36.4 billion in 2025, reflecting a steady 9.1% annual growth.

- Digital payment transaction value is projected to exceed $9.7 trillion, marking a 17% increase from the previous year.

- Credit card usage among US adults has climbed to 72%, with strong uptake among Gen Z and Millennials due to rewards and cashback.

- Asia-Pacific card processing volume surged by 13.5%, propelled by urban digital wallet penetration and fintech expansion.

- Contactless payments now account for 68% of in-person card transactions in the US.

- The merchant services industry grew by 12% in new vendor entries, largely supporting SMBs and online-first businesses.

- US interchange fees collected by card networks are expected to surpass $86 billion, driven by elevated consumer spending.

Major Card Processing Companies

- Visa Inc. remains the top global processor, handling $10.9 trillion in transactions worldwide as digital payments expand.

- Mastercard reports a 13% increase in transaction volume across Asia-Pacific, Africa, and LATAM, led by fintech partnerships.

- American Express (AmEx) captures 27.4% of US consumer spending, focusing on premium users and business travel recovery.

- Square processes over $163 billion in annual card transactions, dominating mobile POS solutions for SMBs.

- Fiserv handles more than 13.2 billion transactions yearly, supporting over 6 million merchant locations globally.

- Adyen records 21% year-over-year growth in 2025, strengthening its omnichannel payment reach across Europe and APAC.

- Stripe now supports over 3 million businesses worldwide, driving growth via AI-powered checkouts and seamless platform integrations.

Consumer Behavior and Payment Trends

Consumers have shown increased demand for flexible, fast, and secure payment options, shaping the payment processing industry in unexpected ways. Digital payment platforms, rewards, and personalization have become central to attracting new users.

- 56% of US consumers report using digital wallets like Apple Pay and Google Wallet for everyday purchases, reflecting a 20% increase over the past year.

- Contactless payments are the preferred method for 67% of Millennials, up from 58% in 2023, as convenience becomes a top priority.

- Subscription services account for 32% of monthly credit card expenses for US consumers, indicating a shift toward recurring payments.

- The buy now, pay later (BNPL) market is expanding, with 45% of Gen Z and Millennials using BNPL options for online shopping.

- E-commerce transactions make up 21% of all credit card purchases, up from 18% last year, showing strong consumer preference for online shopping.

- Mobile app payments are on the rise, with 43% of consumers preferring to manage credit card payments via mobile applications instead of traditional methods.

- Rewards and cashback cards attract 80% of new credit card sign-ups in the US, especially among younger adults.

Digital Capabilities and Innovation in Digital Payments

As technology advances, digital payments continue to evolve, with innovations that enhance convenience, security, and transaction speed, significantly impacting consumer and merchant behaviors alike.

- Biometric authentication is now used by 45% of consumers for payments, a 15% increase from last year, prioritizing security.

- Mobile POS systems are on the rise, accounting for $2.7 billion in transaction volume in the US alone, benefiting small and medium-sized enterprises.

- AI-driven fraud detection systems are helping reduce fraud losses by $8 billion annually across the payment industry.

- Real-time payments (RTP) are now available through major credit card networks, with 90% of transactions processed within seconds, enhancing customer satisfaction.

- The use of virtual cards has increased by 35% year-over-year, especially among businesses for secure online transactions.

- Cross-border payment innovations have made international transactions faster, with 60% of transactions completed instantly, benefiting global commerce.

- Digital currency payments are gaining traction, with 11% of businesses accepting cryptocurrency as a payment method, meeting the demand of crypto-savvy customers.

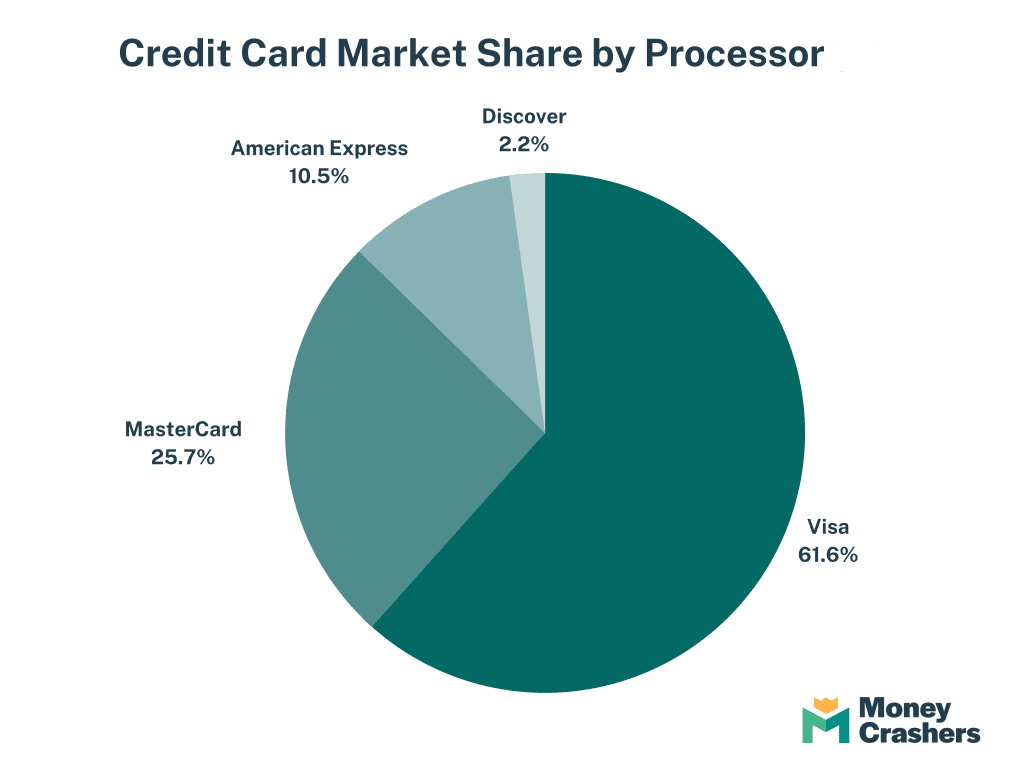

Credit Card Market Share by Processor

- Visa leads the market with a 61.6% share, dominating global credit card transactions.

- MasterCard holds the second-largest market share at 25.7%, widely accepted and used internationally.

- American Express accounts for 10.5% of the market, often favored for premium rewards.

- Discover trails with just 2.2%, reflecting more limited global acceptance.

Digital Currency and Payments

The integration of digital currency into payment systems marks a significant shift in consumer and business payment behaviors. Cryptocurrencies and stablecoins are making an impact, albeit cautiously, in the credit card processing industry.

- 11% of US consumers report using digital currency for purchases at least once, primarily through platforms like PayPal and Square.

- Stablecoins are becoming popular, with 5% of businesses utilizing them for cross-border payments, benefiting from their stability and lower transaction fees.

- Visa and Mastercard have launched pilot programs for cryptocurrency-backed credit cards, signaling broader acceptance of digital currencies.

- $2 billion worth of payments were processed in cryptocurrency in 2023, with Bitcoin, Ethereum, and Litecoin leading in transaction volume.

- Digital wallets that support cryptocurrency now account for 30% of mobile wallet users, as more consumers explore this option.

- Central bank digital currencies (CBDCs) are being tested by 18 countries, with China’s e-CNY leading in terms of adoption and transaction volume.

- International crypto payments have gained traction, with 45% of crypto users willing to transact across borders, driven by lower fees and faster processing times.

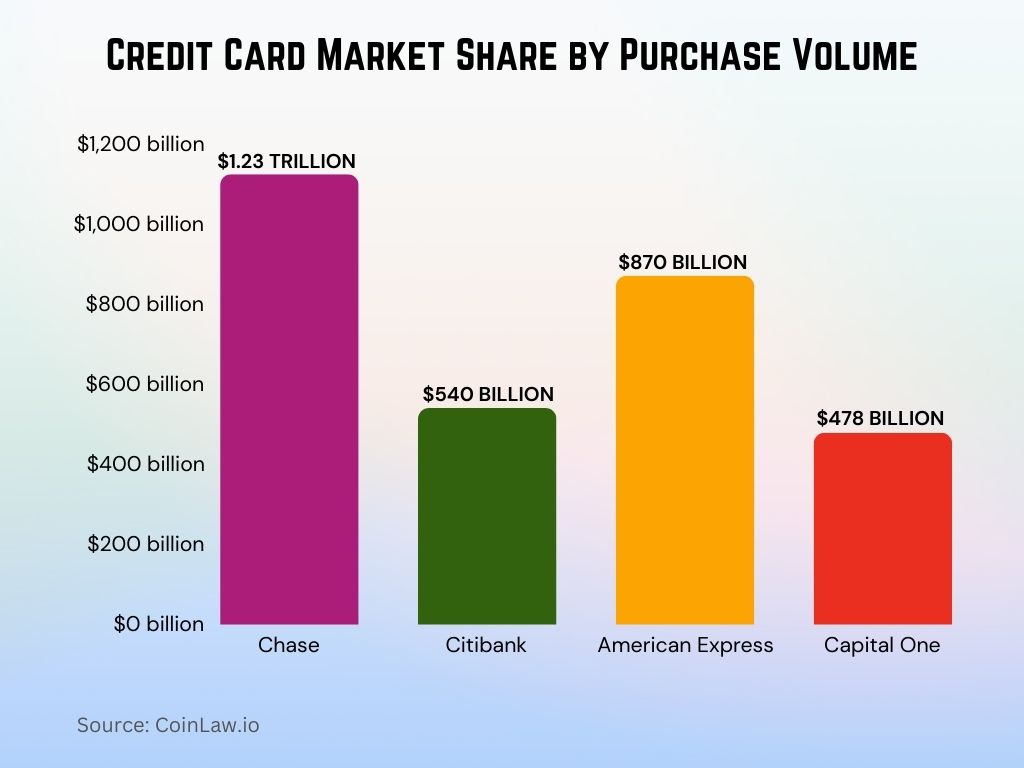

Top Credit Card Issuers by Purchase Volume

- Chase leads with $1.23 trillion in purchase volume, driven by strong uptake of Sapphire, Freedom, and Ink card families.

- Bank of America holds 18.5% of the US credit card market by volume, led by cashback and travel rewards products.

- Citibank processes over $540 billion in annual purchases, boosted by global merchant alliances and co-branded cards.

- Wells Fargo reported a 13.2% increase in purchase volume, following its rollout of new sign-up bonuses and retention perks.

- American Express (AmEx) handled $870 billion in purchase volume, showing a 9% growth in the affluent consumer segment.

- Capital One expanded to $478 billion in card volume, fueled by premium cashback and travel card performance.

- Discover saw an 11.6% growth in purchase volume, with momentum from its cashback match and student card programs.

Processing Fees and Merchant Costs

- Average credit card processing fees for US small businesses now range from 1.6% to 3.6% per transaction, depending on card type and method.

- Interchange fees remain the largest cost, with Visa and Mastercard averaging 1.82% per transaction across most industries.

- Merchant discount rates (MDRs) now average 2.4% in 2025, slightly above the 2024 average of 2.3%.

- Chargeback fees cost merchants $25 to $105 per dispute, with eCommerce platforms facing higher risk from fraud and returns.

- Flat-rate models like Square continue charging 2.6% + $0.10 per swipe, but are evolving to include volume-based discounts.

- Cross-border transaction fees range from 1.6% to 3.2%, significantly affecting global e-commerce and tourism merchants.

- Alternative payments such as ACH and digital wallets carry lower fees between 0.6% and 1.4%, ideal for subscriptions and recurring billing.

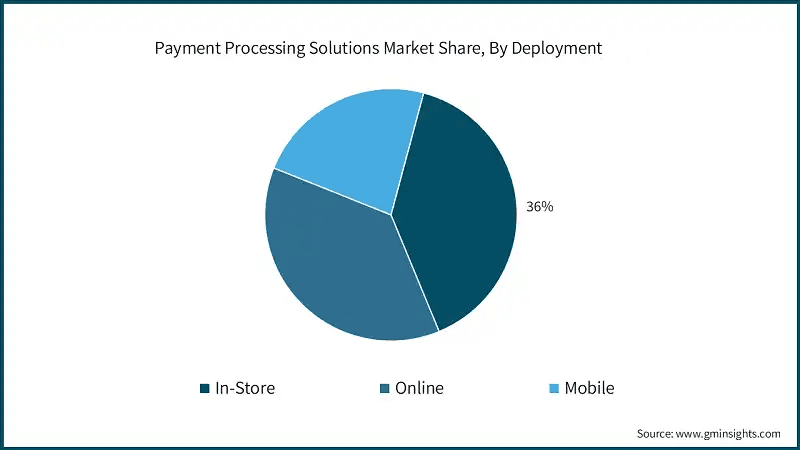

Payment Processing Market Share by Deployment

- In-Store payments lead with the largest share at 36%, indicating the continued dominance of physical retail transactions.

- Online payment solutions follow closely, showing strong demand in e-commerce and digital services.

- Mobile payments represent a growing segment, driven by smartphone adoption and contactless trends.

Security and Fraud Prevention Measures

- Global fraud losses tied to credit card transactions are projected to surpass $39.4 billion in 2025, with digital channels still the main target.

- EMV chip adoption has led to a 78% drop in in-person fraud since rollout, reinforcing card-present transaction security.

- 3D Secure 2.0 is now used by 88% of US merchants, enhancing authentication for online card transactions.

- Tokenization secures over 66% of mobile payments, shielding card details during digital purchases.

- AI-driven fraud prevention is estimated to prevent $12.7 billion in losses annually, using real-time behavioral analytics.

- Biometric security adoption has reached 33% of digital wallet users, with face and fingerprint ID becoming mainstream.

- Data encryption protocols are upheld by 100% of leading card processors, ensuring end-to-end security for all transaction types.

Recent Developments in Payment Regulations

- Durbin Amendment updates now cap small-ticket debit interchange fees at 1.9%, easing cost burdens for micro-merchants.

- PSD2 enforcement continues to impact international eCommerce, with 99% of EU merchants now compliant with SCA mandates.

- Regulation Z enhancements in 2025 require real-time APR disclosures and clearer fee breakdowns in all digital credit card offers.

- G20 cross-border rules now target a 50% reduction in remittance fees by 2027, accelerating settlement time across currencies.

- CCPA and expanded state-level privacy laws mandate stricter opt-in consent and data minimization by all payment platforms.

- Federal Reserve regulation has prompted issuers to lower average interchange fees by 0.08%, citing increased transparency mandates.

- Anti-fraud compliance rules now carry penalties of up to $300,000 for violations, with mandatory AI-driven monitoring systems in place.

Conclusion

The credit card processing industry in 2025 is marked by unprecedented growth and change. Driven by consumer demand for convenience, enhanced security measures, and innovative technologies, the industry is navigating a digital transformation with agility. While major players like Visa, Mastercard, and Square continue to lead, advancements in digital currencies, contactless payments, and fraud prevention redefine the payment landscape. Merchants benefit from a growing array of payment options and tools, meeting the needs of a digital-savvy clientele while mitigating risks associated with fraud and regulatory complexities. As the industry adapts to new consumer behaviors and regulatory demands, its future will be shaped by both innovation and the continuous pursuit of security.