Imagine stepping into a world where daily transactions, from buying coffee to booking flights, are streamlined by a small plastic card. Credit cards have fundamentally changed the financial landscape, creating a world of convenience, financial flexibility, and reward opportunities for millions of people.

Today, as the credit card industry continues to grow, new trends, technologies, and spending behaviors are shaping its future. This article explores the current state and evolution of the credit card industry, providing a snapshot of key statistics, usage patterns, and market dynamics.

Editor’s Choice

- Over 3.3 billion credit cards are now in circulation globally, including about 203 million U.S. cardholders.

- Visa leads the global credit card market with roughly 52.2% share by purchase volume.

- U.S. consumers held an average of about 4.3 credit cards per person in 2026.

- Around 50% of global consumer payments in 2026 are made using card credentials instead of cash.

- U.S. credit card balances are expected to reach about $1.18 trillion by the end of 2026, up 2.3% year over year.

- Contactless card transactions now account for roughly 70–75% of in-person card payments worldwide.

Recent Developments

- The co-branded credit card market will reach $17.55 billion in 2026, growing at a 10.04% CAGR.

- Sustainable payment cards made from eco-friendly materials will account for nearly 40% of global card shipments by mid-decade.

- The global virtual card market will grow from $565.12 billion in 2025 to $674.47 billion in 2026, expanding at a 19.3% CAGR.

- Virtual card transaction values will hit $6.8 trillion globally by 2026.

- Corporate B2B virtual cards will reach about $27.5 billion in transaction value by 2026, rising at a 20.2% CAGR.

- Co-branded credit card programs currently represent roughly 17% of the market and will increase to about 25% by 2028.

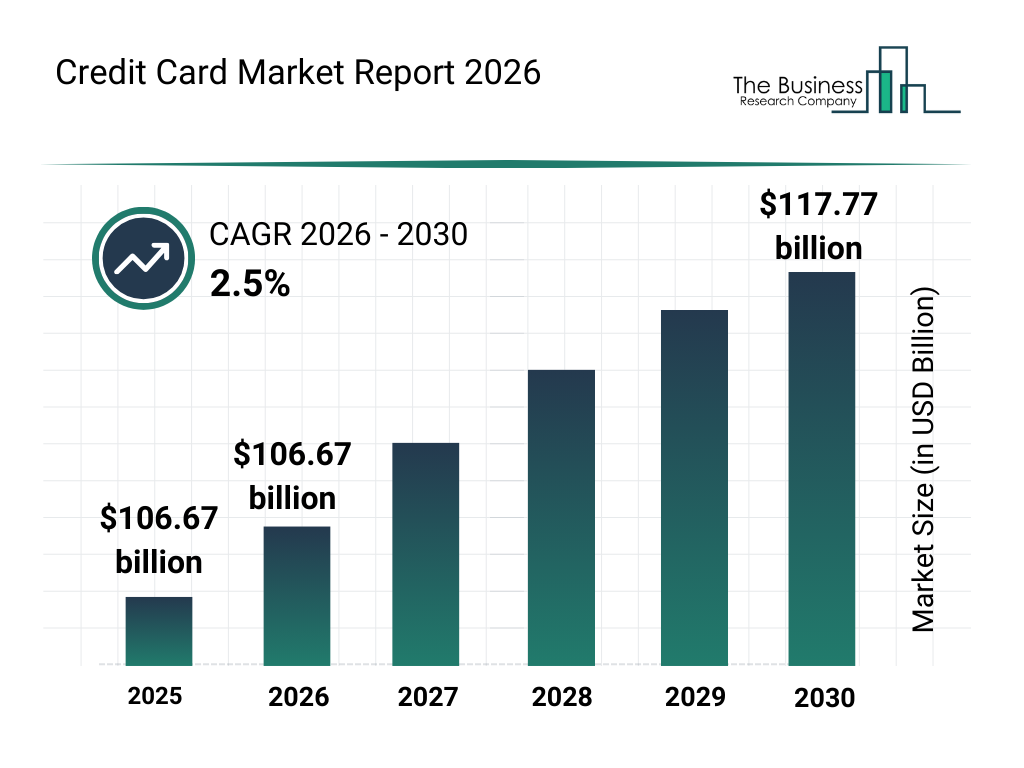

Credit Card Market Size Growth

- The global credit card market will grow at a 2.5% CAGR between 2026 and 2030, signaling steady but moderate expansion.

- The market reached approximately $106.67 billion in 2025.

- In 2026, the market will remain around $106.67 billion, showing minimal year-over-year change at the start of the forecast period.

- From 2027 onward, the market will increase each year consistently, reflecting a steady upward trend.

- By 2030, the credit card market will reach around $117.77 billion.

- Overall, the market will expand gradually rather than rapidly, highlighting a mature sector with stable demand.

Global Credit Card Payments Market Share by Region

- North America accounts for about 41% of global credit card payment revenue, reflecting high card penetration and spend.

- Europe represents roughly 24% of global credit card payment revenue, supported by strong digital payment and e-commerce usage.

- Asia-Pacific holds about 26% of global credit card revenue and is the fastest-growing region by transaction volume.

- Latin America captures an estimated 6–7% share of global card payment value, led by Brazil and Mexico.

- The Middle East and Africa together account for around 3–4% of global credit card spending, but post the highest growth rates.

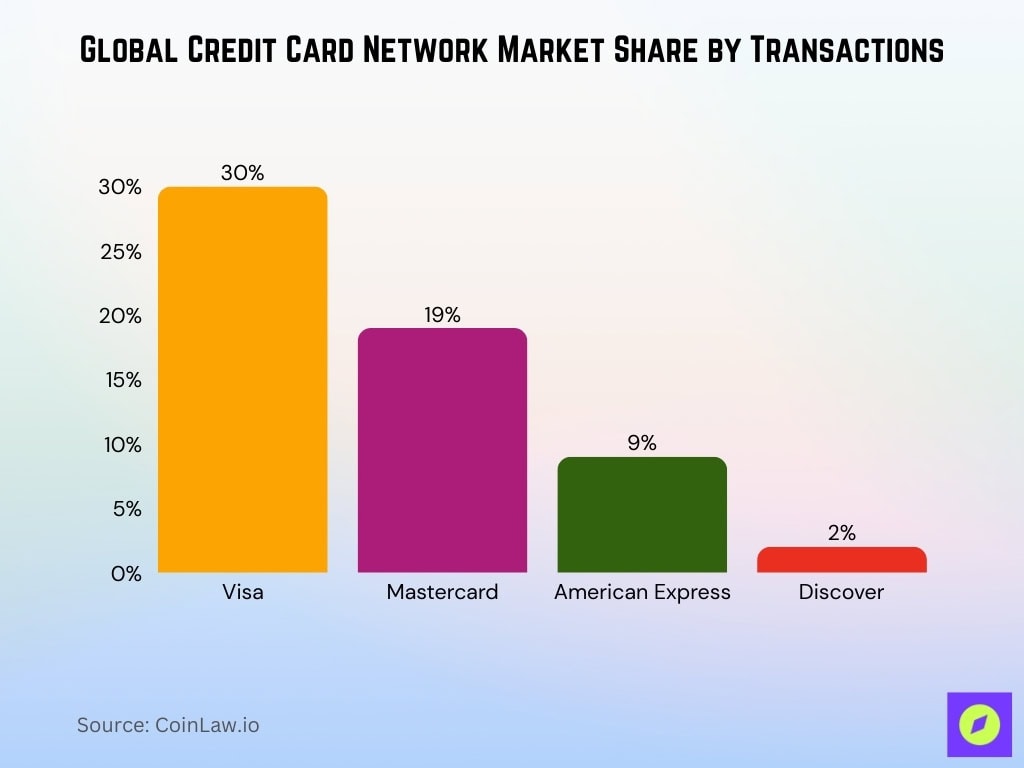

Major Credit Card Networks and Market Share

- Visa processes about 30% of global card transactions and has roughly 3.6 billion cards in circulation worldwide.

- Mastercard handles around 19% of global card transactions with about 2.3 billion cards in use.

- American Express accounts for roughly 9% of global purchase volume by card network, supported by affluent and small-business spending.

- Discover holds about 2% of global credit cards, with roughly 71.5 million cards in circulation.

- UnionPay’s global transaction volume reached about $35.7 trillion, compared with Visa’s roughly $38.2 trillion and Mastercard’s $21.3 trillion.

Consumer Usage and Spending Trends

- Around 82% of U.S. adults have at least one credit card, and roughly 31–35% of all U.S. payments are made with credit cards.

- Total U.S. credit card spending has surpassed about $6.1 trillion annually, with e-commerce responsible for over 65% of online credit card purchases.

- Roughly 74% of Americans hold a credit card, and the average consumer uses between 3 and 4 active cards.

- About 46% of U.S. cardholders carry a balance month to month, with an average balance of roughly $5,600–$6,600 per borrower.

- Nearly 90% of U.S. consumers have at least one credit card in a typical year, and actively use about 3.7 cards.

- Credit cards account for about 32–33% of monthly purchases for the average U.S. consumer.

- Gen Z shows the fastest growth in credit card adoption, with about 84% of credit-active Gen Z consumers holding at least one bankcard.

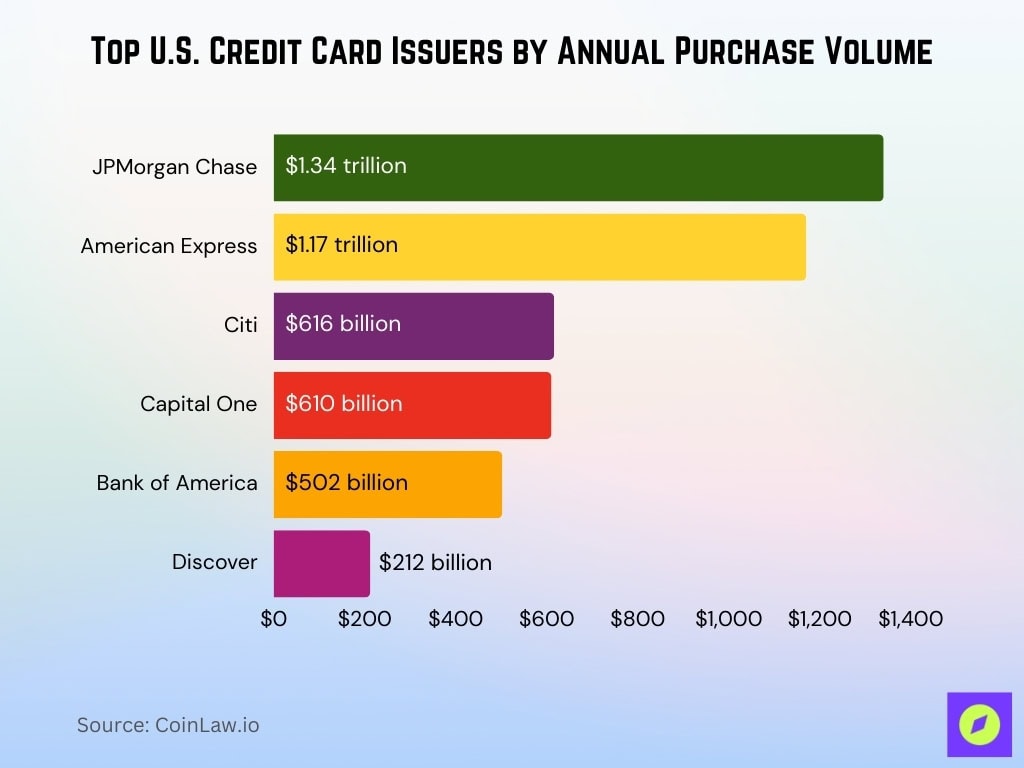

Top Credit Card Issuers by Purchase Volume

- JPMorgan Chase leads U.S. issuers with about $1.34 trillion in annual credit card purchase volume.

- American Express processes roughly $1.17 trillion in purchase volume, ranking second among U.S. issuers.

- Citi generates about $616 billion in annual credit card purchase volume.

- Capital One records roughly $610 billion in purchase volume, positioning it among the top three or four issuers.

- Bank of America produces around $502 billion in annual purchase volume on credit cards.

- Discover handles approximately $212 billion in purchase volume, reflecting its smaller but significant issuer role.

Credit Card Debt and Delinquency Rates

- Total U.S. credit card balances reached about $1.28 trillion by Q4 2025, up roughly 5–6% year over year.

- Overall credit card loan delinquency at commercial banks is around 3.0–3.1%, higher than pre-pandemic lows.

- American adults carried more than $1.21 trillion in credit card debt by Q2 2025, with an average balance near $5,600 per cardholder.

- New York Fed data show total household debt at about $18.8 trillion in Q4 2025, with credit cards a growing share.

- Analysts project U.S. credit card debt growth to slow to roughly 2.3% in 2026, taking balances to about $1.18 trillion by year-end.

- Among lower-income ZIP codes, 90‑day credit card delinquency rates have climbed from about 12.6% to 20.1% since 2022.

- CFPB rules now cap most credit card late fees at $8, down from an average of around $32, which should cut annual late-fee costs by billions.

Average Number of Credit Cards per Person by Generation

- Baby Boomers now average 4.4 credit cards per person.

- Gen X also averages about 4.4 credit cards per person.

- The Silent Generation holds an average of roughly 3.1 credit cards.

- Millennials carry an average of 3.4 credit cards per person.

- Gen Z has the lowest average, with about 2.1–2.2 credit cards per person.

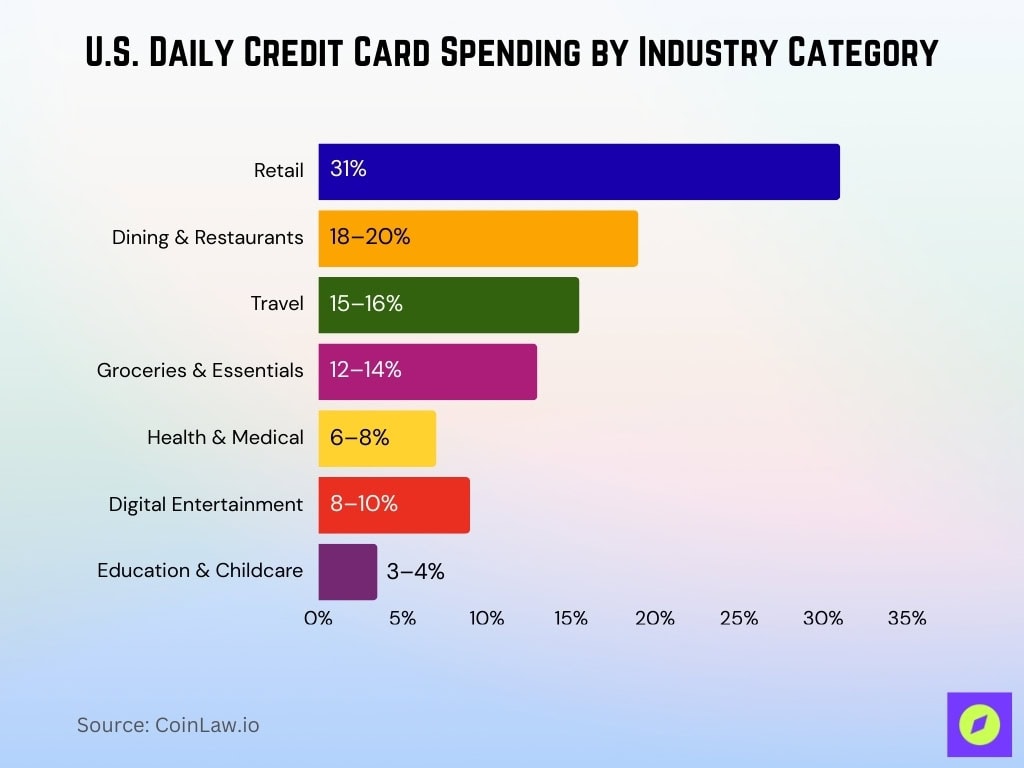

Daily Spending by Industry

- Retail purchases account for about 31% of U.S. credit card retail spending, led by general merchandise and apparel.

- Dining and restaurants represent roughly 18–20% of card spending, remaining a leading discretionary category.

- Travel-related categories make up around 15–16% of credit card spending, including airfare, hotels, and transportation.

- Groceries and everyday essentials represent roughly 12–14% of total card spending.

- Health and medical services account for an estimated 6–8% of household card expenditures.

- Digital entertainment and streaming subscriptions capture about 8–10% of discretionary credit card spend.

- Education, childcare, and related services together represent roughly 3–4% of total card spending.

Technological Advancements in Payment Methods

- Around 68% of U.S. card transactions are now contactless, and 86% of global consumers report using contactless payments.

- More than 4.5 billion people used digital wallets in 2025, rising to a projected 5.2 billion users worldwide.

- In the U.S., 69% of adults have used a digital wallet, and 92% of merchants now accept wallet payments.

- Nearly 90% of U.S. consumers have tried contactless payments, and over 60% of in-store transactions are projected to be contactless.

- About 82% of cardholders with a contactless card have used it at the point of sale, with 53% of U.S. consumers preferring contactless in-store.

- The global contactless payment market is expected to surpass $12 trillion by 2027, growing at over 19% annually.

- Buy Now, Pay Later acceptance has expanded rapidly among online and retail merchants, particularly in e-commerce, though adoption varies significantly by industry and business size.

- Among U.S. adults, over 80% still own at least one credit card, even as wallets and BNPL gain share.

Mobile Payments on COTS Security and Test Requirements

- The mobile point-of-sale market is valued at nearly $14.62 billion in 2025, with a projected 7.99% CAGR through 2033.

- Proximity (tap-to-pay) mobile payments account for roughly 58% of consumer mobile payment value, led by retail and quick-service sectors.

- Nearly 70% of U.S. merchants accepted tap-to-pay by 2024, with contactless transactions making up about 40% of retail volume.

- Retail and FMCG represent about 34.72% of U.S. mobile payment spend, while transportation and mobility lead growth at a 14.34% CAGR.

- EMV chip technology is now widely adopted in the U.S., with most card-present transactions processed through EMV-compatible terminals, supporting secure in-store and mobile NFC transactions.

- Global EMV compliance has reached about 72% of issued cards, driving broader secure mobile and COTS payment acceptance.

Breakdown of Credit Scores Among Cardholders

- Super prime borrowers now represent about 40.9% of U.S. consumers, up from 37.1% in 2019.

- The VantageScore Superprime tier (781–850) accounts for roughly 31.3% of consumers.

- Prime credit tier consumers (around 661–780) have shrunk by about 1.1% year over year.

- VantageScore Subprime borrowers (300–600) increased from 18.5% to 19.0% between 2023 and 2025.

- Broader subprime borrower share across loan markets is about 14.4%, returning to pre‑pandemic levels.

Credit Card Application and Rejection Rates

- Nearly 48% of Americans who applied for any loan or financial product in the past year experienced at least one rejection.

- Applicants with credit scores under 670 faced rejection rates of about 64%, versus 29% for those with scores 800–850.

- Roughly 45% of applicants with “good/very good” scores between 670–799 were denied at least one application.

- Millennials and Gen Z reported some of the highest denial experiences, with rejection affecting about 59–65% of applicants in these groups.

Frequently Asked Questions (FAQs)

Total U.S. credit card spending exceeds $6.1 trillion annually, with e-commerce accounting for over 65% of all online credit card purchases.

There are approximately 500–600 million general-purpose credit cards in circulation in the U.S., depending on how active accounts are measured.

Total U.S. credit card debt is above $1.17 trillion in early 2026, with average interest rates around 22.8% APR.

Conclusion

The credit card industry is evolving rapidly, driven by technological advances, rising demand for flexible payment options, and shifting financial behaviors under economic pressure. Companies now offer mobile payments, contactless transactions, and sustainable card options to meet changing consumer preferences.

With interest rates at historic highs, consumers are managing debt more carefully and seeking rewards that improve financial flexibility. As the year progresses, credit card usage, spending habits, and debt management will continue to reflect broader economic and technological trends, fueling ongoing innovation in this key financial sector.