Picture this: a world where every dollar, euro, or yen is digitized and seamlessly accessible through your phone. As financial technology evolves, Central Bank Digital Currencies (CBDCs) are becoming a hot topic, reshaping the future of money. These digital currencies promise to enhance transaction efficiency, financial inclusion, and transparency. With countries across the globe pushing forward with CBDC developments, it’s clear that this innovation is more than just a concept; it’s a revolution in how economies operate.

Editor’s Choice Key Milestones in CBDC Development

- 134 countries, representing over 98% of global GDP, are exploring or developing CBDCs.

- The Bahamas was the first to launch a retail CBDC, the Sand Dollar, in 2020, and it remains operational.

- Jamaica’s JAM‑DEX, launched in 2022, remains active in 2025 with additional utility-bill payment support and increased merchant integration.

- The ECB, having completed its preparation phase in October 2025, is set to decide on launching a digital euro with implementation likely by 2028.

- India’s e‑Rupee pilot saw circulation grow to ₹1,016 crore (~$122 million) by March 2025 and expanded to serve 60 lakh users across 17 major banks.

- The New York Fed’s Project Cedar completed testing on wholesale cross-border CBDC payments, with no public launch planned as of 2025.

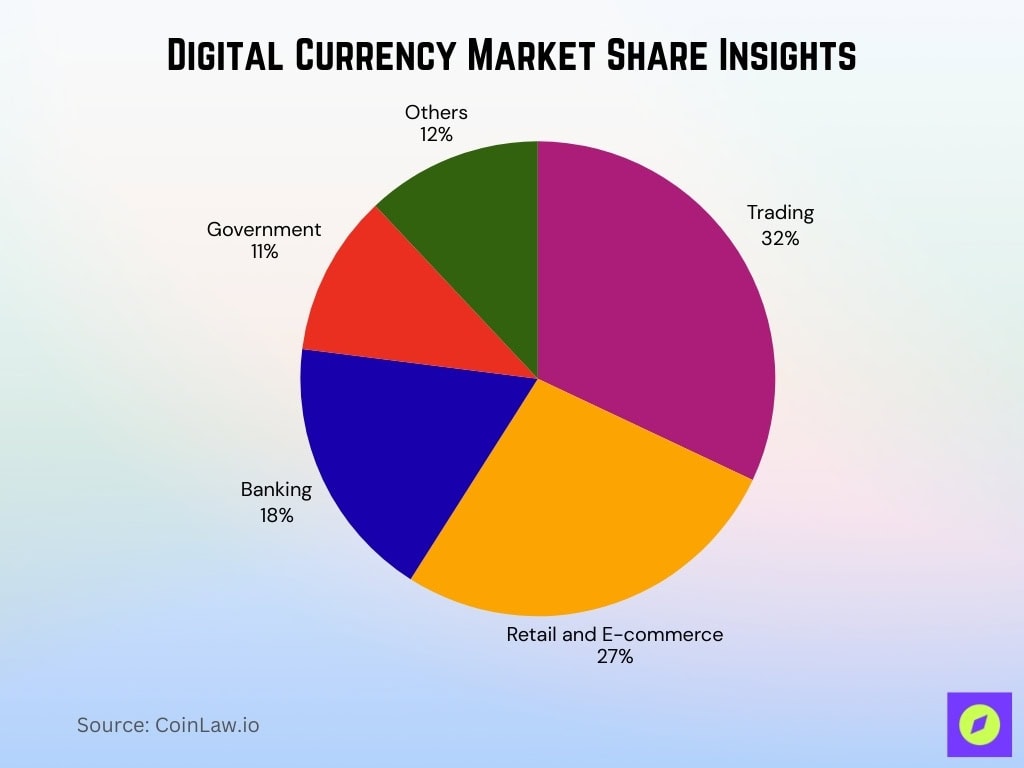

Digital Currency Market Share Insights

- Trading holds 32% of the digital currency market, making it the largest sector for adoption.

- Retail and E-commerce capture 27%, showing strong growth in digital payment integration.

- Banking accounts for 18%, highlighting steady institutional adoption.

- Government usage is 11%, reflecting early steps in public sector adoption.

- Others make up 12%, covering diverse applications beyond mainstream sectors.

Global Adoption Rates and Trends

- As of Q1 2025, 11 countries have fully launched CBDCs, and 49 others are conducting pilots or advanced testing.

- A PwC report indicates that 60% of central banks worldwide are accelerating their CBDC efforts in 2025 compared to the prior year.

- The IMF projects that by 2030, CBDCs could represent up to 15% of global cross‑border payments.

- 70% of central banks are prioritizing retail CBDC models over wholesale in their pilot programs.

- Developing nations, especially in Africa and Latin America, are at the forefront of adoption, leveraging CBDCs to reduce financial exclusion.

- G7 economies are slower to roll out, but are investing heavily in interoperability standards for tomorrow’s CBDC infrastructure.

CBDC Use Cases

- Cross‑border payments are a primary use case with cost reductions of up to 50% demonstrated in recent multi-jurisdiction pilots.

- In Sweden, the e‑krona supports secure retail transactions, particularly enhancing access in rural areas with limited banking services.

- India’s e‑rupee enables real‑time government subsidy transfers, streamlining disbursements for millions of citizens.

- Jamaica’s Jam‑Dex has helped businesses cut cash-handling costs by 30%, improving operational efficiency.

- Pilot studies in Singapore show CBDCs boost trade finance efficiency by digitizing letter‑of‑credit processes.

- Across Europe, the proposed digital euro is positioned to safeguard monetary sovereignty amid rising private payment alternatives.

- Caribbean nations use CBDCs for disaster relief payments, ensuring immediate fund access during natural or humanitarian crises.

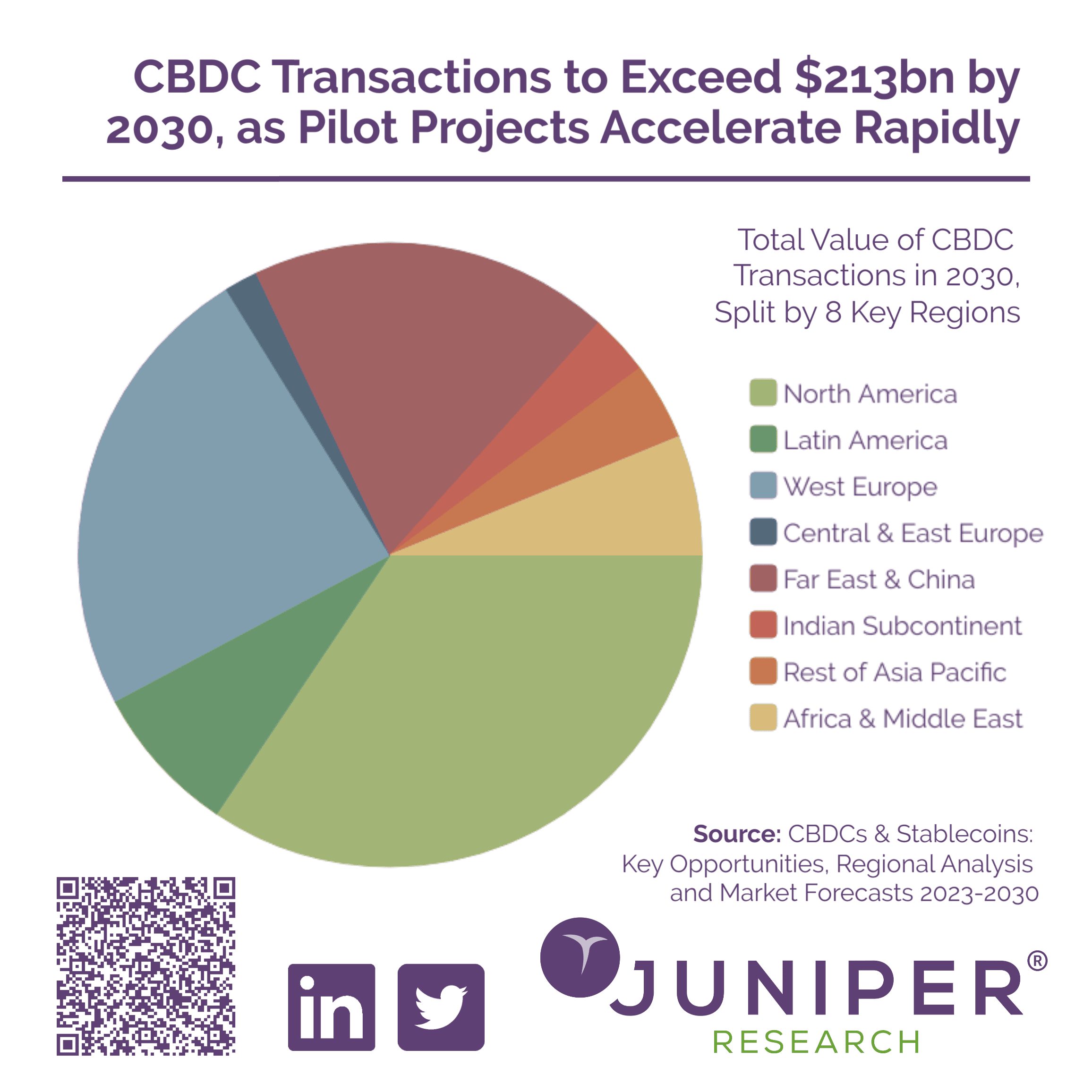

Regional Breakdown of CBDC Transactions

- Far East & China ~40% share, making it the dominant hub for CBDC adoption and transaction value.

- Western Europe ~20% reflects strong regulatory frameworks and cross-border digital payment use.

- North America ~15% shows steady integration of CBDCs in both retail and institutional finance.

- Latin America ~8% highlights growing adoption driven by financial inclusion and remittance flows.

- Central & Eastern Europe ~6% demonstrates expanding pilot projects and regional collaboration.

- Africa & Middle East ~5% marks increasing interest in CBDCs to support cross-border trade.

- The rest of Asia Pacific ~4% contributes modestly but benefits from regional digital initiatives.

- Indian Subcontinent ~2% remains in early stages but could accelerate with pilot rollouts.

CBDC vs Cryptocurrency

- CBDCs are issued and regulated by central banks, while cryptocurrencies operate on decentralized networks beyond government control.

- Unlike volatile cryptocurrencies such as Bitcoin, CBDCs are pegged to fiat currencies, ensuring price stability.

- Governments view CBDCs as a counter to the rising influence of private stablecoins like USDC and Tether, which now represent over $250 billion in circulating supply.

- CBDCs incorporate privacy safeguards in contrast to the often anonymous nature of cryptocurrencies, which can be exploited for illicit activity.

- Energy efficiency is a key advantage of CBDCs, which use centralized systems that consume significantly less energy than Bitcoin’s proof-of-work model.

- CBDCs support legal frameworks and enforce compliance with anti-money laundering and know-your-customer standards.

- Despite key differences, the two technologies could coexist through hybrid models that integrate cryptocurrency features into CBDC ecosystems.

Assessing Potential Transactional Demand for CBDC

- Studies forecast that CBDCs could process 20 % of global domestic transactions by 2030, replacing substantial parts of cash usage.

- In China, the digital yuan (e‑CNY) accounted for 6 % of retail transactions in major cities by mid‑2025.

- A Bank of Canada pilot estimated that 65 % of Canadians would adopt a CBDC if it offered greater convenience than current payment systems.

- McKinsey’s 2025 outlook shows that 75 % of small businesses in Asia favor CBDCs for real‑time payment capabilities.

- CBDCs and distributed ledger technology could reduce clearing and settlement costs by as much as $100 billion annually, though these estimates are based on optimistic implementation scenarios.

- Research suggests that 45 % of unbanked individuals in developing nations would use CBDCs if they were available through mobile wallets.

- Wholesale CBDCs processed over $50 billion in cross‑border transactions as per recent BIS reports.

Global Currency Share Breakdown

- US dollars dominate with 59%, maintaining their role as the world’s leading reserve and trade currency.

- Euro holds 21%, reinforcing its position as the second-most important global currency.

- Japanese yen at 6% continues to play a strong role in regional and international markets.

- Pound sterling accounts for 5%, highlighting its enduring significance in global finance.

- Chinese Yuan at 2% shows gradual but growing international adoption.

- Australian dollars (2%) and Canadian dollars (2%) both contribute modest shares in global usage.

Drivers of Demand for CBDC as a Means of Payment

- Digital transformation across industries is fueling demand for seamless cashless ecosystems that CBDCs enable.

- The global remittance market is projected to exceed $800 billion by 2025, and CBDC-based systems could lower transaction costs by up to 7%, especially in corridor-specific pilots.

- Up to 80% of US consumers are open to using digital dollar solutions, particularly for contactless payments, depending on privacy guarantees.

- Small merchants benefit from instant settlements enabled by CBDCs, avoiding traditional banking delays.

- Blockchain technology used in many CBDC frameworks enhances transparency and helps prevent payment disputes.

- Governments value CBDCs for direct benefit transfers, with India’s e‑rupee trials cutting fraud by 30 %.

- Multinational and e-commerce firms advocate CBDCs to streamline cross-border payments across jurisdictions.

Impact on Financial Inclusion and Accessibility

- CBDCs have the potential to significantly improve access to the formal financial system for the estimated 1.4 billion unbanked adults globally, particularly through mobile wallet integration.

- In Nigeria, 33% of eNaira users previously lacked access to traditional banking systems.

- Mobile CBDC wallet pilots in Africa increase rural financial accessibility by 50%.

- Retail CBDCs offering zero-cost basic accounts help remove financial barriers for economically disadvantaged users.

- In Bangladesh, linking CBDCs to public utilities reduced payment defaults by 40%.

- Preliminary surveys in India suggest women-led households may be more likely to adopt e-rupee accounts, potentially increasing financial autonomy, though large-scale data is limited.

- CBDCs simplify cross-border remittances for migrant workers, enabling lower fees and quicker delivery of funds.

Global CBDC Development Status

- 46 countries are in the research stage, exploring frameworks for digital currencies.

- 32 countries are in development, actively building and testing CBDC systems.

- 21 countries have launched pilot programs, trialing CBDCs with real-world users.

- 11 countries have already launched CBDCs, marking full-scale implementation.

- 16 countries remain inactive, with no current progress on CBDCs.

- 2 countries have cancelled their CBDC initiatives.

- 2 countries fall under other categories, reflecting alternative digital currency approaches.

Transaction Cost and Time Reduction Benefits

- Pilot studies show CBDCs have the potential to reduce cross-border payment fees by up to 90% under ideal conditions, though real-world implementation may offer more modest savings.

- Wholesale CBDCs cut interbank settlement time from T+2 days to near real-time, greatly enhancing liquidity.

- CBDCs lower transaction fees by an average of 1.5 % per transaction, according to global financial research.

- Retail CBDCs in emerging economies have saved users around $30 million annually in banking fees.

- Peer-to-peer CBDC transfers eliminate intermediaries, enabling instant settlements for small businesses.

- Governments report a 30 % reduction in administrative costs for welfare and subsidy payments through CBDC use.

- A pilot in Singapore showed that CBDCs reduced trade finance costs by 25 %, improving supply chain payment efficiency.

Objections and Concerns Regarding CBDCs

- Critics argue CBDCs might enable surveillance overreach and erode consumer financial privacy.

- Commercial banks express concern over disintermediation as CBDCs could bypass traditional banking roles.

- The high cost of CBDC infrastructure development remains a barrier for emerging economies, with estimates exceeding $200 million.

- 59% of countries developing CBDCs cite cybersecurity risks, highlighting vulnerabilities to hacking and data breaches.

- Public resistance remains strong, with 45% of US respondents unsure about the benefits of CBDCs.

- Regulatory bodies warn that CBDCs may destabilize bank deposit bases and impact lending capacity.

- 40% of central banks acknowledge technical and interoperability challenges to global CBDC integration.

Building Trust in CBDCs

- Transparent operational frameworks are essential, with 80% of surveyed citizens expressing higher trust in CBDCs backed by clear governance.

- Public-private partnerships, such as collaborations with fintech firms, enhance credibility and acceptance.

- Educational campaigns in Sweden and Jamaica increased CBDC awareness by 30% fostering user confidence.

- Governments are addressing privacy concerns by developing zero-knowledge-proof systems that allow secure transactions without disclosing sensitive data.

- Pilots in Singapore and India using smart contracts for secure automated transactions are building trust in CBDC technology.

- Third-party audits of CBDC operations, like those implemented in the Bahamas, have improved public confidence by 25%.

- Trust metrics improved significantly when CBDC frameworks included dual offline capabilities, ensuring functionality even in the absence of internet access.

Recent Developments

- Nigeria’s eNaira expanded integration with over 1,500 merchant platforms, enhancing retail-sector adoption in 2025.

- Jamaica’s Jam‑Dex added utility bill payment support, leading to a 15 % increase in active users.

- Thailand’s Project Inthanon demonstrated real‑time cross‑border payment capability with Singapore, setting a key milestone in regional CBDC collaboration.

- The Bank of Canada’s pilot studies of a digital Canadian dollar revealed $12 million in annual cost savings in interbank settlements.

Conclusion

Central Bank Digital Currencies (CBDCs) continue to reshape the global financial landscape. From enhancing financial inclusion to revolutionizing cross-border payments, CBDCs offer a promising future. However, challenges like privacy concerns, regulatory alignment, and public skepticism must be addressed to unlock their full potential. With innovations and pilot programs gaining traction worldwide, the next decade may witness CBDCs as a cornerstone of a digital-first financial ecosystem.