Central bank digital currencies (CBDCs) are gaining real traction. Globally, several countries have moved from research into pilot and launch stages, driven by the need for secure, efficient digital payments and greater financial inclusion. Real-world applications already visible include India’s digital rupee supporting government disbursements in rural areas, and Nigeria’s eNaira serving urban retail payments, with lab tests to broaden accessibility. Readers, keep going to explore deeper insights in the full article.

Editor’s Choice

- 90% of central banks are exploring CBDCs in 2025, compared with last year’s fewer explorers.

- India’s digital rupee in circulation surged to ₹10.16 billion (~US$122 million) by March 2025, up 334% from ₹2.34 billion (~US$28 million) in 2024.

- Global CBDC transaction volumes are projected to jump from 307.1 million in 2024 to 7.8 billion by 2031.

- 60% of central banks accelerated their CBDC initiatives compared to the previous year.

- Nigeria’s eNaira active users doubled, from 5 million in 2023 to 10 million in 2024.

- 70% of central banks in pilot phases prioritize retail CBDCs over wholesale models.

- The IMF’s Virtual Handbook on CBDCs was updated as recently as April 2025.

Recent Developments

- Juniper Research anticipates CBDC transaction counts ballooning from 307.1 million (2024) to 7.8 billion (2031).

- The IMF updated its Virtual Handbook on CBDCs in April 2025.

- The ECB released its third digital euro progress report for the period Nov 2024 to Apr 2025.

- 60% of central banks accelerated their CBDC efforts this year.

- India’s RBI expanded e-rupee retail and wholesale use cases, including offline operations, in 2025.

- BIS study found that countries with higher GDP are significantly more likely to adopt or pilot CBDCs, with adoption probabilities increasing by up to 332% for issuance and 212% for pilots, relative to low-GDP countries.

- Only 13% of central bankers see CBDCs as promising for cross-border payments, down from 31% last year.

- SWIFT plans live trials for CBDC-based transfers in 2025.

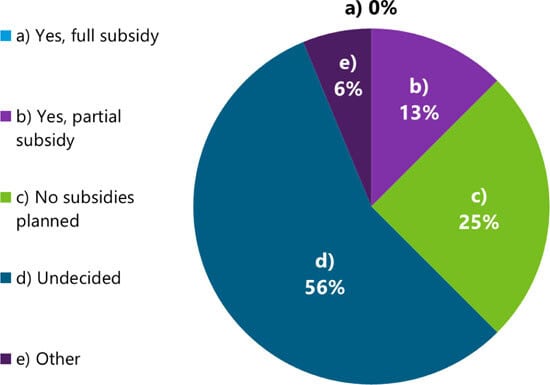

CBDC Adoption Subsidy Plans

- 0% of countries plan to provide a full subsidy for CBDC adoption.

- 13% are considering a partial subsidy model.

- 25% report that no subsidies are planned for CBDC implementation.

- 56% remain undecided, making this the largest share.

- 6% fall into other categories not specifically defined.

Global Overview of CBDC Projects

- Over 90% of central banks around the world are exploring CBDCs in some form.

- In India, the e‑rupee grew to ₹10.16 billion (~US$122 million) by March 2025, +334% from 2024.

- Nigeria’s eNaira counts 10 million active users in 2024, up from 5 million in 2023.

- 70% of pilot programs focus on retail CBDCs, not wholesale.

- Nepal began preliminary CBDC piloting in April 2025, tied 1:1 to the local rupee.

- The UAE completed a cross-border payment with its Digital Dirham to China in January 2024.

- Switzerland and France extended their wholesale CBDC trial, Project Helvetia III, in June 2024.

- Russia began digital ruble testing with banks in early 2022 and continues scaling.

Adoption by Country

- India: e‑rupee circulation soared 334%, reaching ₹10.16 billion (~US$122M) by March 2025.

- Nigeria: eNaira users grew from 5 million (2023) to 10 million (2024).

- Nepal: CBDC piloting initiated in April 2025.

- UAE: Executed cross-border Digital Dirham payment (Dirham 50M, ~US$13.6M) to China in early 2024.

- Switzerland/France: Extended a wholesale CBDC pilot (Project Helvetia III) in mid‑2024.

- Russia: Continued digital ruble testing since 2022, expanding transaction capability.

- China: e‑CNY (digital renminbi) is still in extensive pilot stages across numerous cities.

- Others: A broad global wave of CBDC research, pilots, or proofs‑of‑concept continues, reflecting sustained interest.

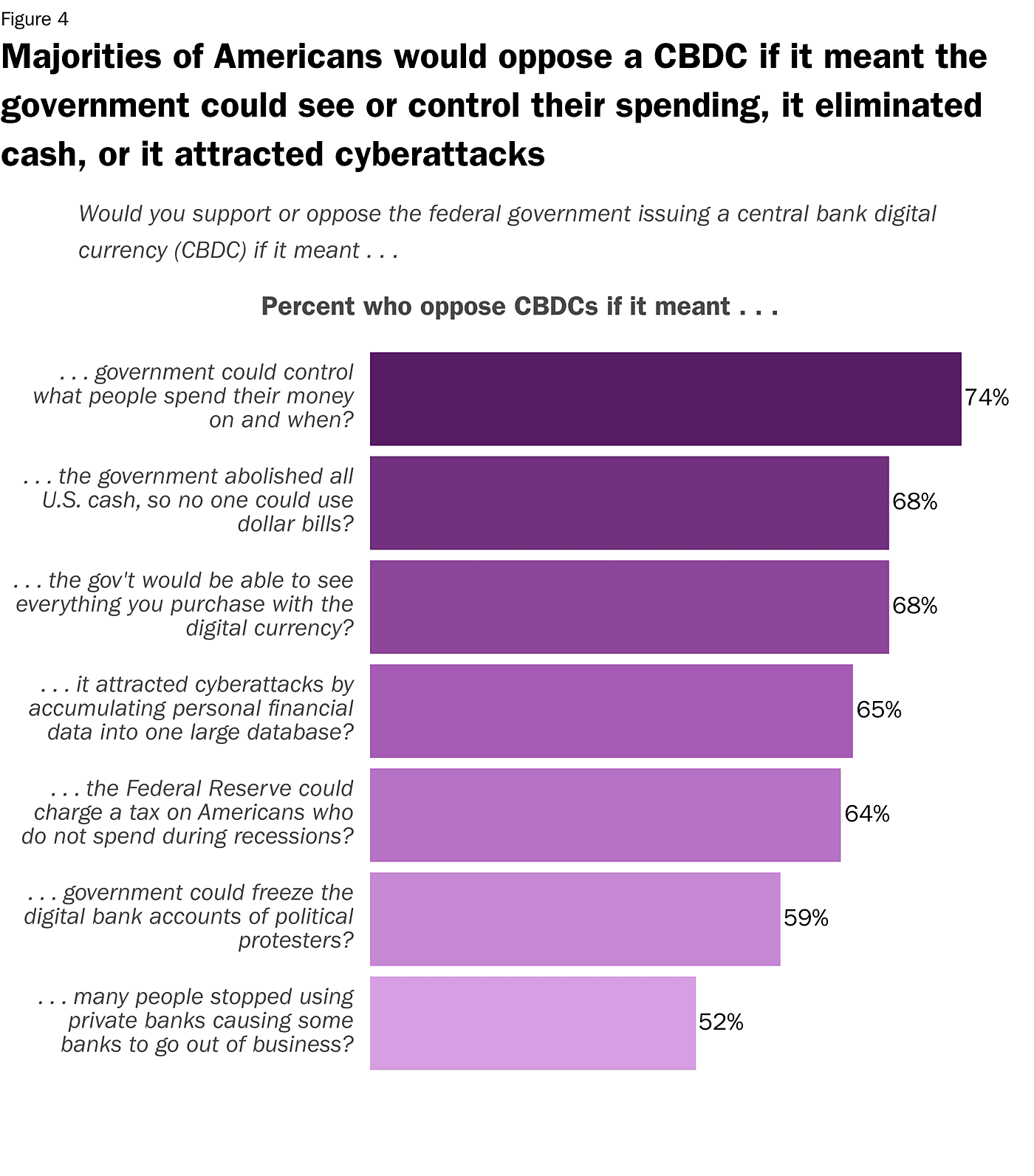

American Opposition to CBDCs

- 74% oppose CBDCs if the government could control how and when people spend money.

- 68% oppose if the government abolished all U.S. cash, eliminating dollar bills.

- 68% oppose if the government could track every purchase made with digital currency.

- 65% oppose if CBDCs attracted cyberattacks by centralizing financial data.

- 64% oppose if the Federal Reserve could impose taxes on those who do not spend during recessions.

- 59% oppose if the government could freeze digital bank accounts of political protesters.

- 52% oppose if CBDCs caused banks to lose customers and risk going out of business.

Status of CBDC Initiatives (Research, Pilot, Launch)

- Research: IMF’s Virtual Handbook updated April 2025, many nations remain in desk exploration.

- Pilot: India, Nigeria, Nepal, Russia, UAE, Switzerland/France, and others are conducting live trials.

- Launch: Nigeria’s eNaira (2021) and Russia’s digital ruble prototypes (2023) mark moves into production.

- Retail vs Wholesale: Retail-focused pilots dominate at 70% of active initiatives.

- Cross-border: UAE and Project Helvetia are already handling cross-border or settlement use cases.

- Offline and programmable features: India’s e‑rupee includes pilot features for offline and programmable disbursements.

- Scaling: India scaled e‑rupee retail transactions to 1 million per day by Dec 2023, later averaging 100,000/day by mid‑2024.

- Bank involvement: Russia’s ruble and India’s e‑rupee pilots involve multiple large banks for onboarding and testing.

Transaction Volumes and Values

- Global CBDC payment counts forecasted to jump from 307.1 million (2024) to 7.8 billion (2031).

- India’s digital rupee in circulation reached ₹10.16 billion (~US$122M) by March 2025, a 334% increase over 2024.

- Nigeria’s eNaira grew in user count, but absolute transaction values are not cited here.

- India enabled wholesale e‑rupee bond settlements worth ₹2.75 billion (~US$33M) on launch day.

- India’s pilot retail transactions hit 1 million/day by Dec 2023, and later averaged 100,000/day in mid‑2024.

- India’s digital rupee total value grew from ₹100 crore in Dec 2023 to ₹323.5 crore by 31 May 2024.

- Worldwide, CBDC use remains low but rising; retail pilots still form the majority of use cases.

Projected Most Common Forms of Payment

- 59% expect mobile payments through devices and wearables to dominate.

- 31% believe biometric payments (facial recognition, fingerprinting, retinal scanning) will be widely used.

- 6% predict that crypto payments will become a common method.

- 4% foresee cards remaining a payment option, though less dominant.

User Penetration Rates of CBDCs

- As of early 2025, more than 100 central banks are engaged in some form of CBDC work.

- 81% of surveyed central banks either have issued or plan to issue a CBDC, and 47% expect to launch within five years.

- Nigeria’s eNaira reached 10 million active users in 2024, doubling from 5 million in 2023.

- In India, 4.6 million customers registered to use the digital rupee by April 2024.

- As of late 2024, digital rupee usage accounted for just 0.006% of total banknotes in circulation.

- In Nigeria, 33% of eNaira users previously lacked access to traditional banking services.

- Pilot studies in countries like Ghana and Nigeria show mobile CBDC wallets can improve financial access in rural areas, with some initiatives reporting up to 50% increased reach compared to traditional banking channels.

- Globally, central banks represent nearly 98% of the world’s economy through CBDC exploration initiatives.

Demographics of CBDC Users

- No globally consolidated data on user age or gender for CBDC exists yet.

- Crypto demographics offer context: approximately 580 million users globally in 2025, up 34% from 2024.

- Among crypto users, the 25–34 age group is the largest, comprising 31%, and 61% are male.

- Research indicates lower financial literacy may correlate with higher CBDC usage in some contexts.

- Surveys show consumers prefer simple, cash-like CBDC designs that don’t require traditional banking infrastructure.

- In Europe, explaining CBDC features raised adoption likelihood by about 12 percentage points in experimental studies.

- These findings imply that clear communication and accessible design could broaden demographic reach.

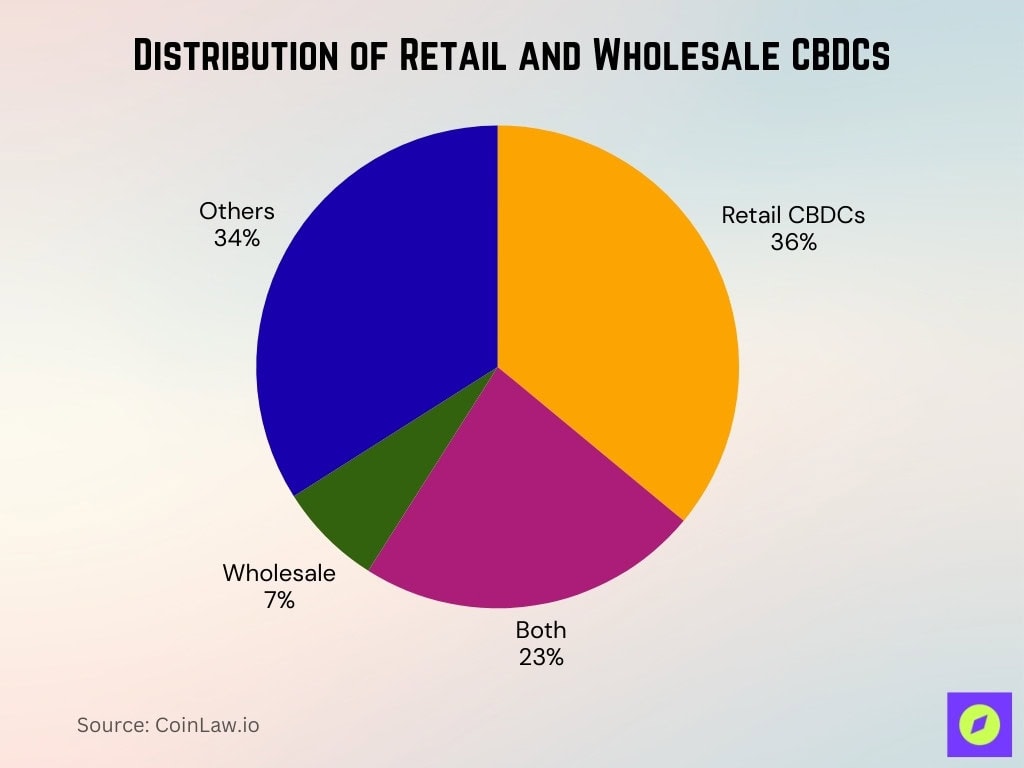

Retail vs Wholesale CBDC Statistics

- 36% of countries focus on retail, 23% on both, and 7% on wholesale CBDCs.

- Wholesale CBDC pilots such as Project Helvetia (Switzerland) and Project Jura (France) demonstrated the potential to settle billions in interbank transactions and reduce settlement times by up to 50%, though global totals like $48 billion remain estimates.

- 68% of retail CBDC pilots include offline payment functionality.

- About 32% of countries offer interest-bearing wallets for retail CBDCs.

- 24% of central banks had initiated retail CBDC pilots, double those in wholesale.

- Wholesale CBDCs modernize financial markets by streamlining large-scale settlements.

- India’s Digital Rupee includes both e₹-R (retail) and e₹‑W (wholesale) variants.

Design and Operational Models

- A 2025 review of 135 research papers revealed that most CBDC models emphasize interoperability and governance.

- IMF analysis highlights the balance between the economic value of CBDC data and user privacy risk.

- India’s digital rupee (e₹‑R) includes offline transaction features for areas with unreliable connectivity.

- Programmable features in CBDCs, such as limiting use by time or region, are also in pilot.

- Wholesale CBDC models, like e₹‑W, serve functions such as government bond settlements.

- CBDCs often integrate with existing infrastructure like wallets and payment platforms to enhance adoption.

Privacy and Data Protection in CBDCs

- The IMF underscores that CBDCs create a digital trail that may help policy but raise privacy concerns.

- Central banks must balance data utility with privacy safeguards; no universal standard yet exists.

- The push for consumer trust leans toward central-bank–issued frameworks over private digital currencies.

- As CBDCs evolve, privacy-focused technologies like anonymization and data minimization may move into pilots.

Impact on Financial Inclusion

- CBDCs could bring 1.4 billion unbanked adults into the formal economy by 2030.

- In Nigeria, 33% of eNaira users lacked prior banking access.

- Mobile wallet pilots in Africa suggest a 50% boost in rural financial accessibility.

- Zero-cost CBDC accounts may bridge access gaps for economically disadvantaged users.

- CBDC features like offline use and programmability can extend economic access to underserved populations.

- Financial literacy strongly influences CBDC adoption; targeted education could expand reach.

Drivers and Motivations

- Geopolitics and payment sovereignty motivate CBDC interest; Europe sees the digital euro as crucial to autonomy.

- 134 countries, covering 98% of global GDP, are pursuing or researching CBDCs.

- High transaction costs and delays in cross-border payments prompt interest in CBDC solutions.

- Banks report that CBDCs could lower transaction costs and modernize financial systems.

- Inclusion and closing access gaps drive pilots in emerging economies.

- Data benefits like improved policy insights also motivate central banks, though privacy risks remain.

Cross-border CBDC Payments

- Cross-border retail payments are forecast to rise from USD 200 trillion (2024) to USD 320 trillion (2032).

- Traditional and crypto cross-border payments reached about $1 quadrillion in 2024.

- Project mBridge aims for real-time wholesale CBDC transfers and involves multiple central banks.

- Saudi Arabia joined the mBridge effort in 2024.

- China’s CIPS processed RMB123 trillion (~$17 trillion) in 2023, daily averaging RMB483 billion (~$67 billion).

- Only 13% of central bankers view CBDCs as promising for cross-border use, down from 31%.

- A new cross-border payment data taskforce was formed by the FSB in May 2025 to address payment frictions.

Influence on Financial Markets

- A study of 57 commercial banks (2010–2023) shows subtle shifts in financial metrics post-CBDC launch.

- CBDC-related uncertainty influences equities, bonds, FX, ETFs, commodities, and crypto, increasing volatility.

- A US-based study (2020–2023) found minor effects: a slight S&P 500 uptick, volatility dampening, and minor crypto drops.

- Positive central bank sentiment on CBDCs tends to negatively impact crypto and fintech stocks.

- CBDCs may reduce bank deposit spreads, especially in high-rate environments.

- CBDCs may disintermediate banks, reducing lending capacity.

- G20 modelling shows macro-financial spillovers from CBDC adoption.

Regulatory and Legal Statistics

- Only 12.5% of central banks see CBDC development as a top-five strategic priority.

- 40% see it as relevant in 24 months, 30% see it as important but not urgent.

- The US prohibits digital dollar rollout under the Anti‑CBDC Surveillance State Act.

- The GENIUS Act regulates stablecoins, excludes CBDCs.

- UK’s Bank of England cools on Britcoin, citing privacy and cost concerns.

- Legal frameworks must address privacy, cyber risk, policy, and anti-money laundering.

- OECD recommends tiered privacy models to balance compliance with individual rights.

Public Interest in CBDC (Trends, Sentiment)

- Media sentiment is generally positive, highlighting tech and crypto relevance.

- Sentiment from the Fed, ECB, and PBoC shapes narratives across nations.

- Privacy concerns remain the top deterrent for public adoption.

- In Israel, public openness improves when transparency and privacy are emphasized.

- CBDC news affects market behavior, equities, and crypto volumes modestly.

- U.S. rejection of CBDCs is viewed by some as weakening financial influence.

Central Bank Perspectives on CBDCs

- 98% of global GDP is involved in some stage of CBDC development.

- Over 90% of central banks are running CBDC research, pilots, or plans.

- Research supports CBDCs as policy tools and modern infrastructure enablers.

- Japan’s digital yen pilot aligns with 42.8% national cashless payment growth.

- Only 10% of central bankers are actively developing CBDCs, down from 21% last year.

- Project mBridge lost traction post-BIS withdrawal.

- Central banks favor instant payment systems over full CBDC implementation.

Challenges and Risks in CBDC Implementation

- CBDCs carry operational risks, including cyber threats and infrastructure demand.

- Easy access could trigger bank runs, destabilizing financial systems.

- Rapid CBDC deployment in fragile economies could create shocks.

- Disintermediation risk could shrink traditional bank lending.

- CBDCs might propagate systemic failures across payment networks.

- Balancing privacy, AML, and transparency remains a complex legal challenge.

- Public mistrust and conspiracy theories could stall rollout, e.g., Britcoin hesitancy.

Conclusion

The CBDC landscape today reflects tangible progress tempered by caution. Retail pilots dominate, supported by a growing emphasis on inclusion, innovation, and offline usability. Wholesale systems show promise through efficiency gains in interbank settlements. However, market volatility, institutional hurdles, privacy concerns, and fragmented sentiment highlight that success hinges on balanced design and clear regulation. As central banks weigh policy tools against public trust, CBDCs are poised to reshape payments, but only with deliberate, resilient implementation.