The global payment landscape continues its shift; cash remains widely used, but digital payments are gaining ground. From everyday retail purchases to online shopping and peer-to-peer transfers, digital methods increasingly define how consumers pay. This shift affects industries from retail and e‑commerce to banking and fintech, shaping everything from point-of-sale infrastructure to financial inclusion efforts. Read on for a detailed look at the latest data and what they mean.

Editor’s Choice

- Global cash usage fell to 46% of worldwide payments in 2025, down from 50% in 2023.

- Digital wallet penetration reached 28% for in‑store purchases in the U.S. by 2024, up sharply since 2019.

- In the euro area, 52% of point‑of‑sale (POS) transactions were still made in cash in 2024, but this marks a decline from 59% in 2022.

- Globally, the digital payment market size was estimated at $114.41 billion in 2024.

- Transaction volume via mobile payments reached $8.1 trillion in 2024.

- By 2024, roughly 9 in 10 consumers in both the United States and Europe reported using some form of digital payment in the past year.

Recent Developments

- A 2025 global survey shows cash usage continuing a downward trend; many economies report cash at only 80% of 2019 levels, with an annual decline of roughly 4%.

- Real-time payment systems, once a niche offering, are now mainstream in many major markets. These systems are displacing checks and cash for frequent retail or bill payments.

- The overall global digital payment market is expanding fast, with a 2024 estimate of $114.41 billion, and forecasts project strong growth through the remainder of the decade.

- In 2024, about 42% of adults worldwide made at least one digital payment to a merchant, up from 35% in 2021.

- Financial services firms and merchants are adapting, with more POS terminals, increased card infrastructure, and growing acceptance of mobile wallets, a shift with implications for sales, accounting, and consumer behavior.

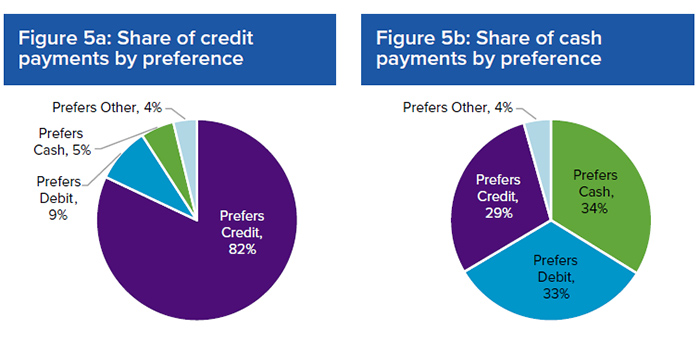

Payment Method Preferences at Point of Sale

- 82% of consumers who pay with credit prefer credit as their primary payment method.

- Just 9% of credit users actually prefer debit, while 5% prefer cash.

- 4% of credit users prefer other methods, showing strong loyalty to credit among its users.

- Among consumers using cash, only 34% actually prefer to pay with cash.

- Nearly equal 33% of cash users would prefer debit, and 29% would prefer credit instead.

- 4% of cash users favor other methods, highlighting how many use cash out of necessity, not preference.

Europe Cash Decline

- In 2024, 52% of all POS transactions in the euro area were still paid in cash. That’s down from 59% in 2022.

- The share of card payments in the euro area rose to 39% in 2024, compared with 34% in 2022.

- Online payments in the euro area grew to 21% of transactions in 2024, up from 7% in 2019.

- Meanwhile, mobile payments (through apps or wallets) doubled to 6% share in 2024.

- In 14 out of 20 eurozone countries, cash remains the most frequent payment method. In these countries, cash accounts for 45–55% of transactions.

- There is notable variation among countries, for example, in the Netherlands, cash use at POS is much lower (around 20%) compared with countries like Malta, where it remains as high as 67%.

- At the same time, contactless and card‑based payments are improving in accessibility, driving the shift away from cash.

Asia‐Pacific Adoption

- Asia-Pacific accounts for nearly two-thirds of global digital wallet spending at $9.8 trillion.

- Digital wallets comprise 66% of POS payments, up from 50% in 2023.

- Southeast Asia projects 311% growth in mobile wallet adoption, reaching nearly 440 million users.

- Indonesia leads e-wallet adoption at 92%, followed by the Philippines at 87%.

- Mobile wallet market reaches $4.37 billion, growing at 26.47% CAGR.

- Non-cash transactions hit 1.5 trillion by 2028, led by China, Indonesia, and South Korea.

- Asia-Pacific holds 60% of worldwide digital wallet users.

- Digital payments surged to 81% of e-commerce sales from 42% in 2014.

- Mobile payments market generates $31,298.7 million, with 38.9% CAGR.

- Hong Kong achieves 87.9% digital wallet penetration.

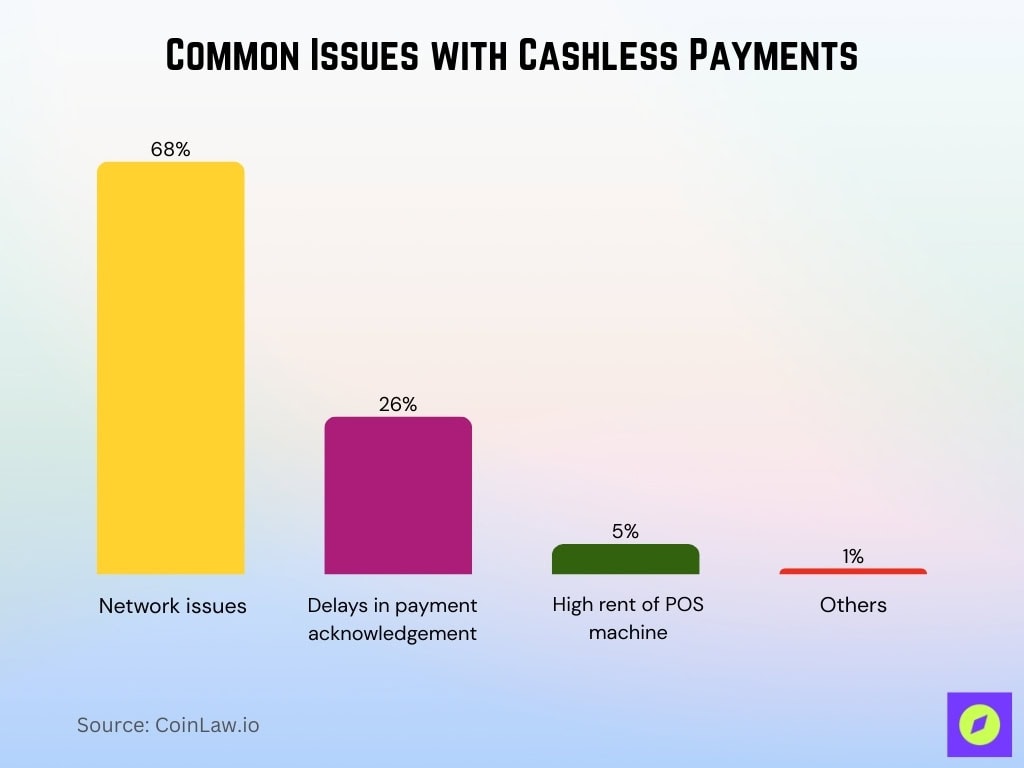

Common Issues with Cashless Payments

- 68% of users face network issues, making it the most reported problem.

- 26% experience delays in payment acknowledgment.

- 5% cite the high rent of POS machines as a barrier.

- 1% report other miscellaneous issues affecting cashless transactions.

Transaction Volume Data

- According to a 2025 global report, digital payments now represent 54% of all payment transactions worldwide, a shift from prior dominance of cash.

- The value of mobile payments globally reached $8.1 trillion in 2024, marking a strong rise in both volume and significance.

- Within the euro area in H1 2024, card payments increased by 10.3% year-over-year to 40.1 billion transactions.

- The total value of card payments in that period rose by 7.0% to about €1.5 trillion.

- Contactless card payments at POS terminals in the euro area grew by 13.2% (number of transactions) and 13.1% (monetary value) compared with H1 2023.

- By mid‑2024, 86% of the ~20.8 million POS terminals in the euro area accepted contactless payments.

- Credit transfers and direct debits also increased; credit transfers rose 7.7% in number to 15.7 billion, reaching a value of €105.2 trillion over H1 2024.

- E‑money transactions (wallets, stored‑value accounts) within the euro area dipped slightly in number (‑2.7%) to 4.2 billion in H1 2024, but their total value rose by 6.6% to about €0.3 trillion.

Value of Payments

- In 2024, it was valued at $125.94 billion, showing significant growth as digital acceptance expands.

- The forecast from 2025 to 2034 shows a compound annual growth rate (CAGR) of about 17.1%, with the projected market size reaching $701.5 billion by 2034.

- Meanwhile, the global mobile payment market is projected to reach $116.14 billion in 2025.

- From 2019 through 2024, overall global payments revenue grew on average by 7% annually.

- The slowdown partly reflects a changing mix of payment types, as digital and lower-fee methods grow, revenues from traditional high‑fee payments shrink.

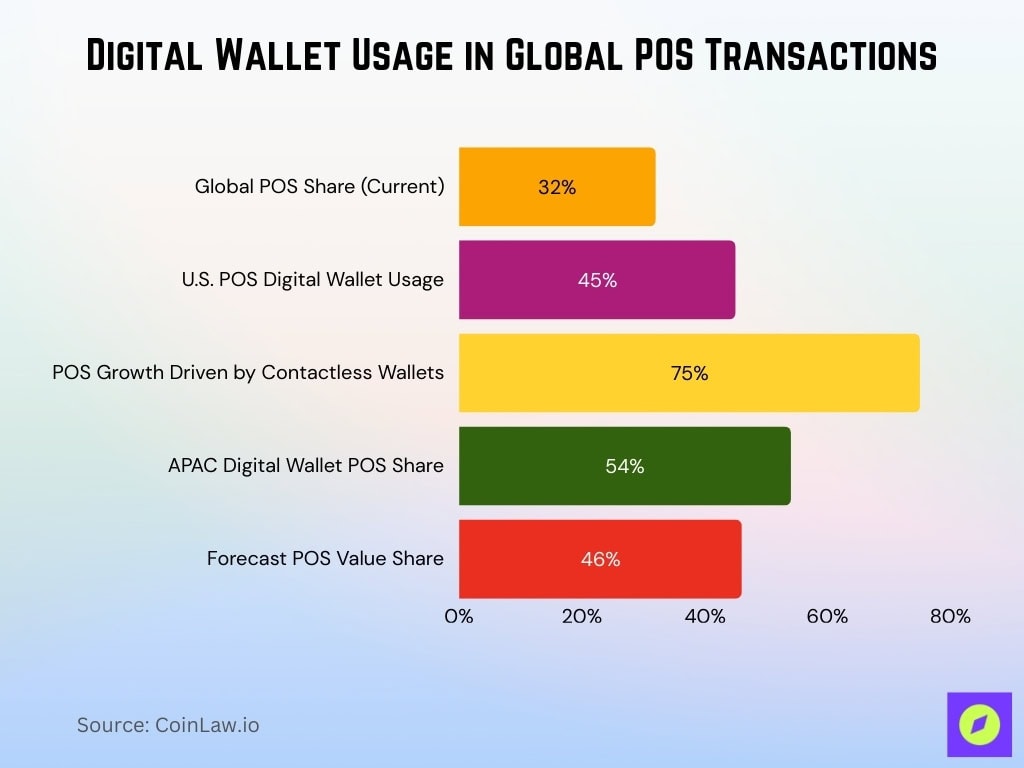

Point-of-Sale Stats

- Digital wallets account for 32% of global POS transactions, surpassing other payment types.

- U.S. digital wallet usage at POS terminals reaches 45%.

- Contactless payments via digital wallets drive 75% of POS growth.

- APAC leads with 54% of POS payments through digital wallets.

- Worldpay forecasts digital wallets nearing 46% of POS value by 2027.

Mobile Payment Surge

- Over two billion people globally now use mobile payment apps.

- In 2024, global digital wallet transactions reached $10 trillion.

- Mobile payment market valuation is projected to reach $1.7 trillion by 2034.

- Mobile payments represent a substantial portion of e‑commerce and POS sales.

- The global digital wallet user base is estimated at about 4.3–4.4 billion users in 2024–2025 and is forecast to grow by roughly 35% to over 6 billion users by 2030.

- Digital wallets could be used by more than three‑quarters of the world’s population.

Digital Wallet Rise

- Digital wallets are expected to account for 49–56% of global e‑commerce transaction value in 2025.

- Wallet users are expected to rise to 6 billion by 2030.

- In 2024, 57% of U.S. adults used digital wallets.

- Fintech and neobanks are expanding wallet use, especially for the unbanked.

- Wallet adoption improves financial inclusion globally.

- Most wallets are still funded by traditional payment methods.

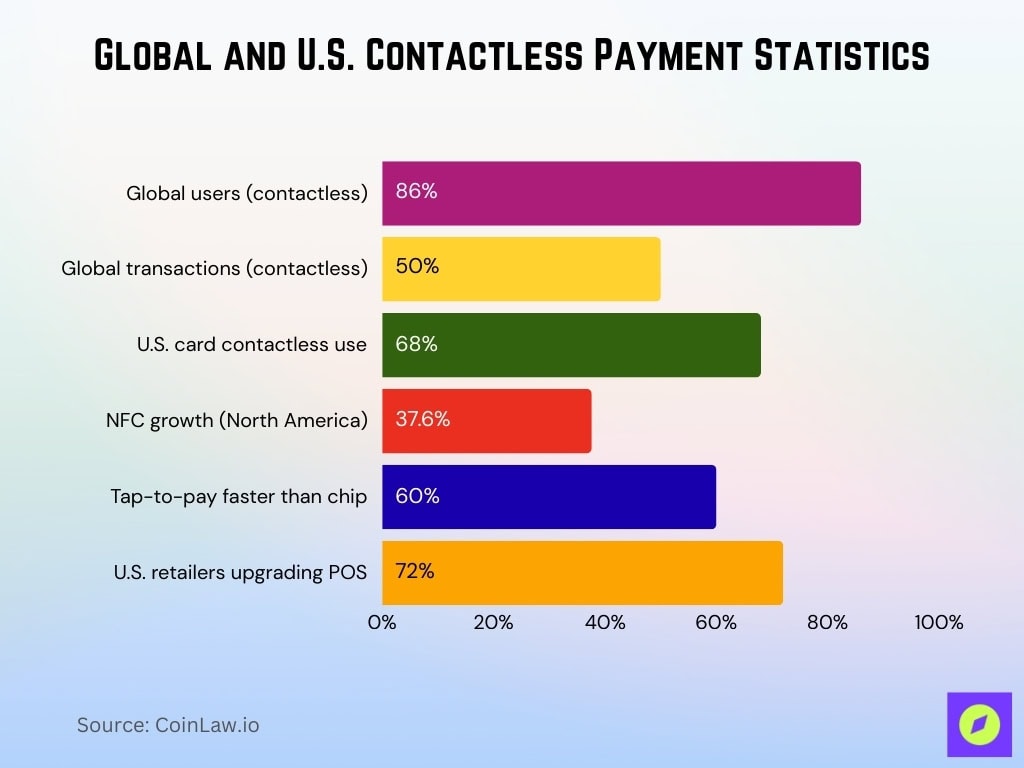

Contactless Trends

- 86% of global consumers use contactless payment methods.

- Contactless payments account for 50% of all global transactions.

- 68% of U.S. card transactions are contactless-enabled.

- NFC adoption rises 37.6% in North America.

- Tap-to-pay transactions are 60% faster than chip-based payments.

- 72% of U.S. retailers upgrade POS for contactless.

- The global contactless payment market reached $69.7 billion.

- Banks issue over 610 million contactless-enabled cards.

- Mobile wallet users hit 5.6 billion worldwide.

E‑commerce Shares

- Digital payments now account for between 49% and 56% of global e‑commerce transaction value.

- In 2024, digital wallets alone captured 53% of online transactions globally.

- In North America, digital wallets represented 39% of e‑commerce transactions.

- Credit and debit cards in e‑commerce in 2024 globally accounted for 20% (credit) and 12% (debit) of payments.

- Bank transfers and “other” payment methods contributed a smaller share.

- Merchants and consumers increasingly favor wallets or card‑backed digital payments when shopping online.

- E‑commerce growth has driven a rise in payment infrastructure investments.

Age Group Preferences

- Adults aged 18–24 used mobile phones for 45% of their monthly payments in 2024.

- For all U.S. consumers, mobile‑phone payments represented 23% of monthly payments.

- Among Gen Z, 91% use digital wallets, with 41% transacting over 5 times per month.

- Millennials and Gen Z dominate digital wallet and mobile payment usage.

- Many younger users leave home without a physical wallet.

- Older adults (55+) use more cash than younger cohorts.

- Digital payment use is also rising among older demographics.

Income Level Variations

- Lowest-income U.S. households (<$25,000) use cash for 24% of payments.

- High-income U.S. households (>$150,000) use cash for only 9% of payments.

- 91% of U.S. adults aged 18-26 (higher adoption group) use digital wallets.

- 30% of U.S. adults over 60 (lower adoption) use digital wallets.

- Developing economies see digital wallet growth at 311% in Southeast Asia.

- 90%+ urban adults in high-penetration markets like India use digital wallets.

- ~20% of older U.S. users remain unfamiliar with digital wallet technologies.

- African mobile money users grow 35% annually in low-income regions.

- Latin America digital wallet adoption rises 50% yearly across income levels.

Cash Holdings Stats

- U.S. consumers average 7 cash payments monthly.

- Cash comprises 14% of all U.S. payments by number.

- 80% of U.S. consumers hold cash in person at least one day a month.

- Average on-person cash holdings reach $67.

- Cash stored as savings averages $306 per U.S. consumer.

- 98% of Myanmar transactions remain cash-based.

- Low-income U.S. households use cash for 24% of payments.

- 52% of U.S. consumers declare cash as king.

- Cash serves as backup for two-thirds of U.S. cash users.

Future Predictions

- Digital payments market reaches $121.53 billion, growing at 19.43% CAGR to $358.81 billion by 2030.

- Digital wallet users hit 4.4 billion, surging 35% to over 6 billion by 2030.

- Digital wallets capture >50% of global e-commerce transaction value.

- Global digital payment market valued at $114.41 billion, expanding at 21.4% CAGR to $361.30 billion by 2030.

- Digital wallets are forecast to reach 46% of worldwide POS transaction value by 2027.

- Mobile POS payment transaction value projected at $16.75 trillion.

- Asia-Pacific digital payments grow at a 17.3% CAGR through 2030.

- Digital wallet market valued at $56.77 billion, reaching $119.17 billion by 2029 at 20.4% CAGR.

- By 2030, 65% of global online payments will be made through digital wallets.

Frequently Asked Questions (FAQs)

Cash accounted for 46% of worldwide payments in 2025.

More than 2 billion people worldwide used mobile payment apps as of early 2025.

About two‑thirds of adults worldwide reported using or receiving some form of digital payment by 2025.

Conclusion

The data today shows that adoption of digital payments continues to accelerate globally, across age groups, income levels, and regions. Younger consumers and those in digitally connected economies lead the shift, while cash remains relevant for many, especially in lower-income or underserved communities.

Digital wallets and mobile payments are projected to cover a growing portion of transactions, with substantial gains expected over the next few years. Yet, cash and the option of hybrid payment systems retain value, especially for financial inclusion. As the payment landscape evolves, businesses, policy makers, and financial institutions must strike a balance between innovation and accessibility.