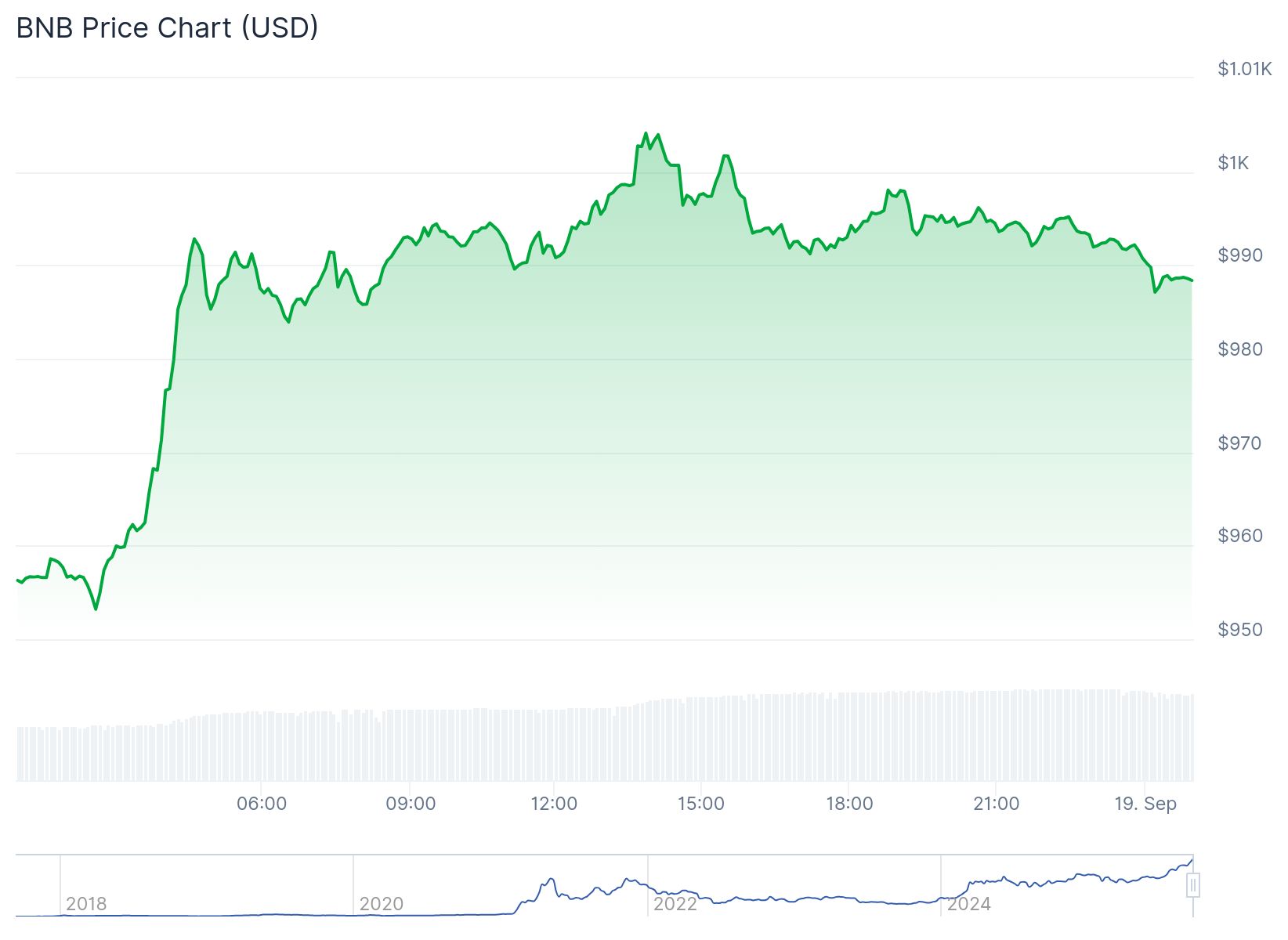

Binance Coin (BNB) has crossed the $1,000 mark for the first time, signaling strong investor confidence and rising institutional interest in the token.

Key Takeaways

- BNB reached an all-time high of $1,005, briefly topping four digits before stabilizing just under the milestone.

- The rally followed the Federal Reserve’s 25 basis-point rate cut, which boosted crypto market sentiment broadly.

- Institutional demand is surging, with major firms and treasury vehicles accumulating BNB for long-term positions.

- Despite technical signs of overbought conditions, analysts predict further gains, eyeing resistance at $1,100 and beyond.

What Happened?

BNB, the native token of Binance, achieved a major milestone by breaking the $1,000 level for the first time. The surge followed favorable macroeconomic news, including the Federal Reserve’s decision to lower interest rates for the first time since December 2024. Alongside this, a wave of institutional demand and bullish technical signals helped propel the asset to a new all-time high.

$BNB breaks $1,000! You know where next. https://t.co/XdDAPnzOPp pic.twitter.com/fUca3UMV6C

— Ali (@ali_charts) September 18, 2025

Altcoins Rally as Fed Cuts Rates

Crypto markets rallied after the Fed cut its benchmark interest rate by 25 basis points, setting a new range of 4 percent to 4.25 percent. The move injected fresh optimism across risk assets. While Bitcoin hovered around $117,300 and Ethereum traded near $4,600, altcoins like BNB and Solana outpaced the broader market.

Nic Puckrin, CEO of Coin Bureau, described the rate cut as a “risk-management” move that encouraged liquidity rotation into altcoins. He cautioned, however, that vague forward guidance could trigger a reversal in sentiment.

Timothy Misir of BRN added that Wednesday’s ETF outflows and rising exchange deposits hint at underlying distribution even amid price rallies. U.S. spot Bitcoin ETFs saw a net outflow of $51.28 million, and Ethereum ETFs experienced minor pullbacks.

Institutional Players Fuel BNB Surge

A key driver behind BNB’s latest rally is the escalating interest from institutional investors. Nasdaq-listed firm B Strategy recently announced plans to raise $1 billion for BNB accumulation through a dedicated treasury vehicle supported by YZi Labs.

Over 50 Digital Asset Treasury (DAT) firms have reportedly expressed interest in gaining exposure to BNB. Some, like CEA Industries, Nano Labs, and Windtree Therapeutics, have already disclosed long-term holdings.

At the same time, the Total Value Locked (TVL) on Binance Smart Chain has risen to $7.93 billion, a sign of growing DeFi activity and real-world use cases for the BNB ecosystem.

Adding to the bullish narrative, reports suggest the U.S. Department of Justice may soon lift compliance oversight on Binance, a potential catalyst for increased investor confidence.

Technical Indicators Suggest Room to Run

BNB briefly hit $1,006 before consolidating around $988.04. While the Relative Strength Index (RSI) has climbed above 77, indicating overbought conditions, the MACD shows strong bullish momentum.

Analysts suggest a minor pullback to the $950 to $970 support zone could strengthen the breakout. Key resistance levels lie ahead at $1,100, $1,200, and possibly up to $1,800 if momentum holds. Ali Martinez, a well-known market analyst, even flagged $2,400 as a potential long-term target.

CZ Reflects on the Journey

Binance founder Changpeng Zhao, also known as CZ, shared an emotional message on X after BNB crossed the $1,000 mark.

Watching #BNB go from $0.10 ICO price 8 years ago to today’s $1000 is something words cannot explain.

— CZ 🔶 BNB (@cz_binance) September 18, 2025

I, not representing any entity or title, as just a community member and a #BNB holder, thank everyone in the #BNB and crypto ecosystem, for your support.

We had our challenges…

He added, “This is just the beginning. To the next 10000x together!”

CoinLaw’s Takeaway

Honestly, this BNB breakout is a big deal. In my experience, when a token crosses a major psychological threshold like $1,000, it’s not just a price event, it’s a trust signal to the broader market. What stood out most to me is the sheer scale of institutional confidence backing BNB now. That’s no small feat for a token that launched at just $0.10. Sure, some technical indicators say we’re in overbought territory, but the long-term structure looks incredibly strong. I’d keep an eye on whether the regulatory environment loosens up, especially with those DOJ rumors. That could take this rally to the next level.