Imagine a world where financial transactions are seamless, secure, and borderless. This is not the future; it’s happening now with blockchain payments. Over the past decade, blockchain technology has evolved from a niche innovation to a cornerstone of global finance. From revolutionizing cross-border payments to enabling decentralized finance (DeFi), blockchain is reshaping how value moves around the globe.

Editor’s Choice

- Global blockchain payment transactions are projected to exceed $3 trillion in 2025.

- The average transaction cost on blockchain networks has dropped 60%–70% compared to traditional methods as of 2025.

- About 78% of Fortune 500 companies are exploring or piloting crypto payments in 2025.

- DeFi platforms account for 22% of total crypto transaction volume in 2025.

- Blockchain-based remittances represent 3%–5% of global remittance flows in 2025.

- Bitcoin (BTC) remains among the most used blockchains.

- Solana processed approximately 600 million to 1 billion transactions per day in 2025, depending on network activity.

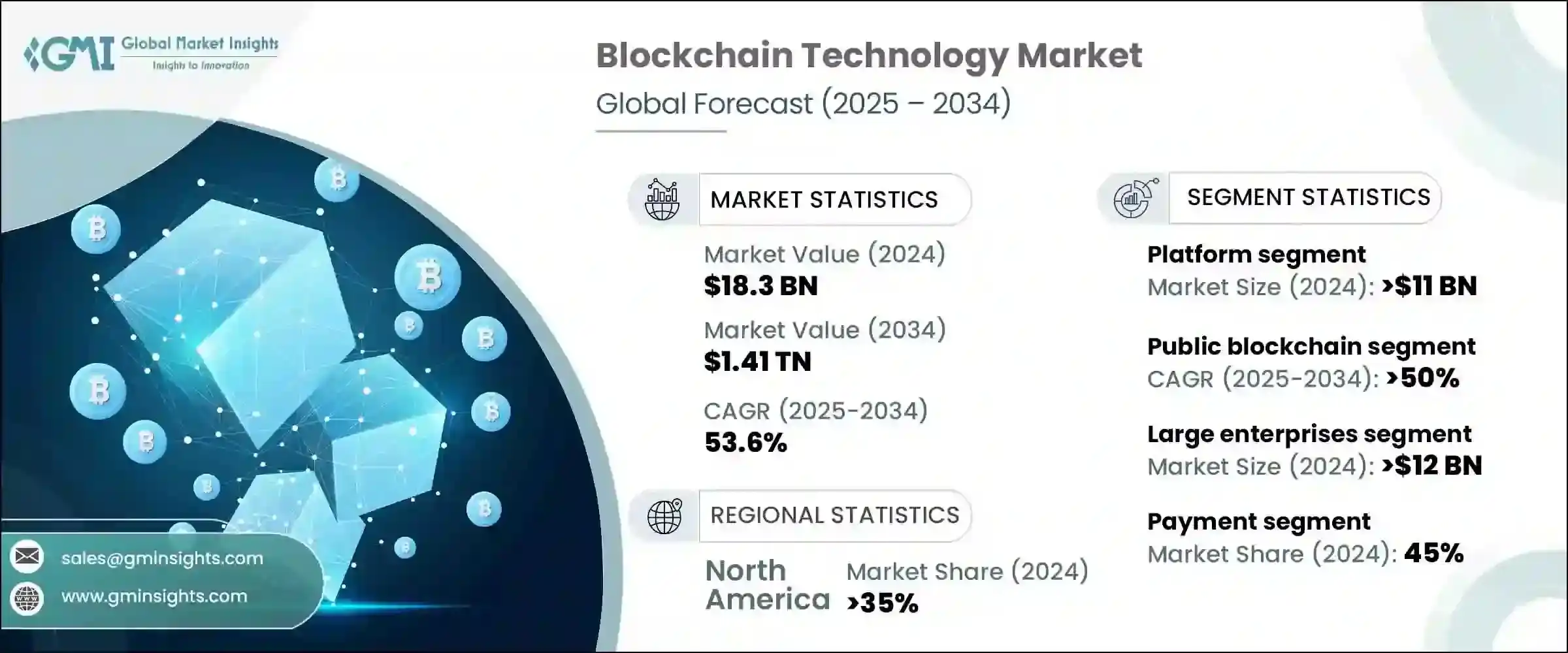

Blockchain Technology Market Outlook

- The global blockchain technology market is projected to soar from $18.3 billion in 2024 to a massive $1.41 trillion by 2034.

- The market is expected to grow at an impressive CAGR of 53.6% during the 2025–2034 forecast period.

- North America will remain a dominant region, holding over 35% of the market share.

- The platform segment leads the space, valued at more than $11 billion.

- The public blockchain segment is set to expand rapidly, posting a CAGR of over 50% through 2034.

- Large enterprises represent a key growth driver with a market size exceeding $12 billion.

- The payment segment continues to be a strong performer, capturing 45% of the market share.

Adoption Rates in Financial Services

- In 2025, about 85% of U.S. banks are either piloting or fully integrating blockchain solutions into their payment systems.

- In 2025, the Asia‑Pacific region leads blockchain adoption in financial services with 60% of institutions using the tech compared to 55% in North America and 50% in Europe.

- Visa and Mastercard in 2025 have processed over $5 billion in cryptocurrency transactions by partnering with blockchain startups.

- Blockchain‑based cross‑border payments grew at 45% annually and are expected to reach $3 trillion in 2025.

- Insurance firms in 2025 report 35% utilization of blockchain for faster claims settlements, up from 18% in 2022.

- Banks in 2025 save up to 35% on operational costs by adopting blockchain for payments, removing intermediaries, and cutting fraud risks.

- The average blockchain payment transaction speed in 2025 is 10 minutes, a significant improvement over 10+ minutes in 2020.

Business Statistics

- In 2025, about 92% of surveyed executives believe blockchain will significantly disrupt the financial services sector by then.

- Over 75% of Fortune 100 companies in 2025 are using blockchain for payment processing or tracking.

- Businesses using blockchain payments in 2025 report savings of up to 45% on transaction fees, cutting operational expenses.

- Cross‑chain technology adoption rose by 45% in 2025, enabling seamless transactions across different blockchain platforms.

- Blockchain‑enabled smart contracts are used by 30% of global businesses in 2025, automating payments and reducing processing times by 65%.

- Blockchain platforms such as Ethereum host over 3,000 active dApps across DeFi, NFTs, gaming, and payment sectors.

- Blockchain systems in 2025 reduced chargeback fraud by 80% for businesses that adopt them.

Crypto Ownership by Generation in the United States

- Millennials dominate the crypto landscape, making up 57% of all cryptocurrency owners in the US.

- Gen X represents the second-largest group, holding 20% of total crypto ownership.

- Gen Z, the youngest investors, account for 13%, reflecting growing early adoption among digital-native users.

- Baby Boomers contribute 10%, showing slower but steady participation in the crypto space.

- Overall, younger generations (Millennials and Gen Z combined) control 70% of the US crypto ownership, underscoring how digital assets are reshaping wealth trends among tech-savvy investors.

Blockchain in Real Estate: Tokenization and the Metaverse

- Real estate tokenization is expected to hit $1.4 trillion market size by 2025.

- Tokenized real estate transactions in 2025 could total $100 billion, growing ~35% annually.

- Blockchain real estate platforms saw user adoption climb 50% in 2025, especially among millennial and Gen Z investors.

- Use of blockchain in real estate reduced property transaction times by 35% compared to traditional methods as of 2025.

- Metaverse land sales via blockchain payments reached $2.33 billion in 2025.

- Smart contracts are used in 65% of blockchain real estate transactions in 2025, ensuring transparency and cutting disputes.

- The UAE and Singapore lead in blockchain real estate innovation in 2025, with over 50% of developers integrating blockchain technology.

Earning NFTs for Real Money (Blockchain Gaming)

- The blockchain gaming market is projected to reach $21.6 billion in 2025.

- Play‑to‑earn (P2E) games are expected to account for $1.64 billion in NFT transactions in 2025.

- Around 65% of blockchain gamers report earning income via NFT trading in 2025, with average monthly earnings of $250–$350.

- Popular blockchain games like Axie Infinity and others reach over 2.5 million daily active users in 2025, driving $2 billion+ in transactions.

- Gaming token market caps in 2025 surged about 40% year‑on‑year, reaching $14 billion.

- The integration of metaverse elements in blockchain games boosted user engagement by 45% in 2025.

- Asia‑Pacific continues to dominate in 2025, contributing to 50% of global blockchain gaming players and revenues.

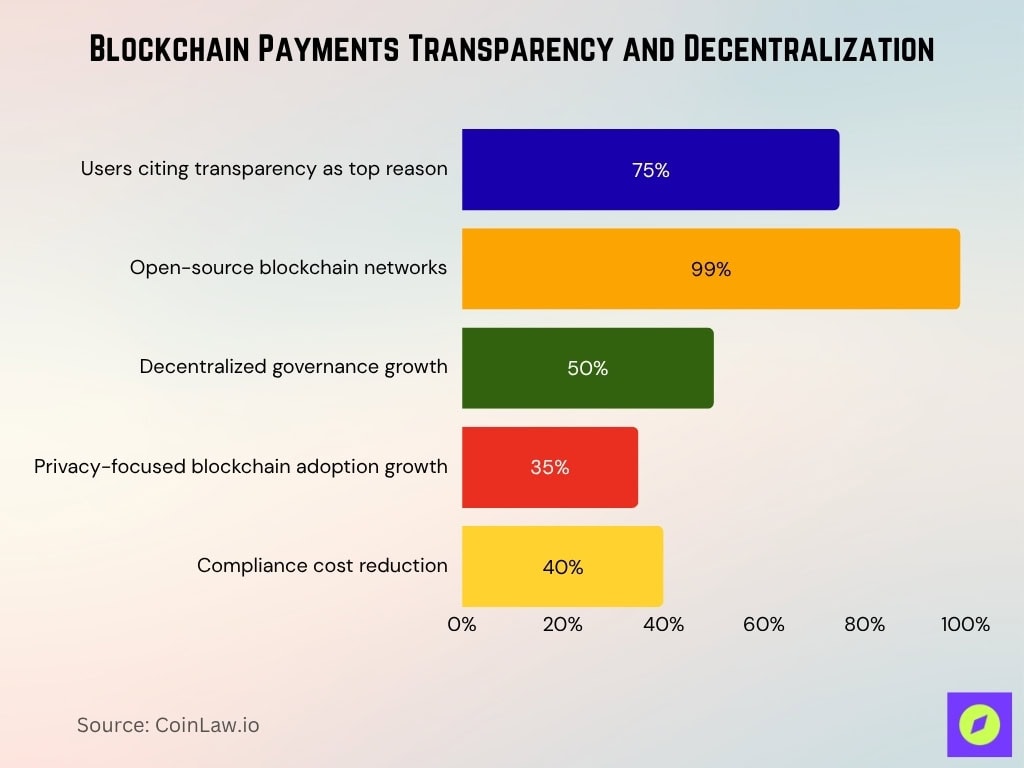

Blockchain Transparency and Decentralization

- In 2025, about 75% of blockchain users cite transparency as the top reason for adoption.

- Around 99% of blockchain networks operated on open‑source protocols in 2025.

- Use of decentralized governance models grew 50% in 2025, empowering users with voting rights.

- Privacy‑focused blockchains saw adoption rise 35% in 2025, highlighting demand for anonymity.

- Blockchain‑based audit tools reduced compliance costs by 40% for businesses in 2025.

- Blockchain technology helped uncover $50 billion in fraudulent activity across financial systems by 2025.

- Decentralized platforms in 2025 have eliminated intermediaries, saving users an estimated $100 billion in fees.

Cross‑Border Payment Applications

- In 2025, blockchain‑based cross‑border payments cut transaction fees by 70%–80% versus traditional channels.

- The total value of cross‑border blockchain payments in 2025 is estimated to reach $2 trillion.

- RippleNet in 2025 processes over $15 billion monthly in cross‑border transactions.

- CBDCs are under active development in 120+ countries in 2025 to accelerate cross‑border payments.

- Average cross‑border blockchain transaction time in 2025 is 3–10 seconds versus 2–5 days in legacy systems.

- In 2025, about 40% of remittance companies use blockchain for cross‑border transfers to gain speed and cost efficiency.

- Africa’s blockchain payment adoption soared 60% in 2025, driven by demand for cheaper remittance rails.

Cryptocurrency Adoption is Growing Worldwide

- In 2025, about 35% of El Salvador’s population uses crypto wallets since BTC became legal tender.

- Nigeria leads global P2P crypto trading in 2025, accounting for 45% of Africa’s total transactions.

- Argentina and Turkey saw crypto adoption jump 60% in 2025 amid high inflation.

- The US and Europe account for 65% of institutional crypto investments in 2025.

Recent Developments

- The Ethereum Shanghai Upgrade unlocked over 17 million ETH in 2025 and boosted network liquidity.

- Major companies in 2025, like PayPal and Square, process more than $12 billion in blockchain payments.

- NFTs expanded into real estate and ticketing in 2025 with $3 billion in utility‑based transactions.

- AI‑integrated blockchains in 2025 enable 100× faster data validation and stronger security.

- Zero‑knowledge proof (ZKP) deployments in 2025 improved privacy on major chains while preserving transparency.

- Cross‑chain bridges in 2025 grew by 80%, enabling interoperability among blockchains.

- Governments in 2025, like Brazil and South Korea, will adopt national blockchain strategies focused on secure payments and fraud prevention.

Frequently Asked Questions (FAQs)

In 2025, there are over 45,000 crypto ATMs globally, reflecting about 17 % growth.

In 2025, 87 % of crypto transactions are processed through mobile devices.

In 2025, 78 % of Fortune 500 companies are exploring or piloting crypto payments.

DeFi platforms account for 22 % of total crypto transaction volume in 2025.

Conclusion

The world of blockchain payments is evolving at an unprecedented pace, reshaping industries and creating new opportunities. Blockchain technology is no longer a futuristic concept but a cornerstone of financial innovation. From seamless cross-border payments to secure real estate tokenization, the integration of blockchain is breaking barriers of speed, cost, and transparency.

Businesses are adopting blockchain to enhance efficiency and reduce fraud, while individuals are increasingly drawn to the benefits of decentralization and privacy. With governments and institutions worldwide introducing regulations and frameworks, the path to mainstream adoption is becoming clearer.