Imagine a world where blockchains work seamlessly together, each network contributing its unique strengths. In 2025, blockchain interoperability isn’t just a dream, it’s becoming a tangible reality, reshaping industries from finance to supply chains and healthcare. As blockchain adoption grows, so does the need for cross-chain compatibility, enabling data and assets to move across networks securely and efficiently. This article dives deep into the current state of blockchain interoperability and explores key statistics that showcase this technology’s transformative potential.

Key Takeaways

- 1Wormhole has processed over $52 billion through its token bridge since launch, reflecting rising cross-chain activity.

- 2There are now 14.2 billion IoT devices globally, with blockchain interoperability enhancing privacy, identity, and security.

- 3The total value locked (TVL) in cross-chain bridges reached $19.5 billion in January 2025, showing demand for multi-chain transactions.

- 4Axelar recorded a 536% surge in interchain transactions and a 492% growth in active addresses over the past year.

Blockchain Interoperability Market Growth Outlook

- The blockchain interoperability market is projected to grow from $0.7 billion in 2024 to $2.55 billion by 2029.

- The 2025 market size is expected to hit $0.91 billion, showing strong early momentum.

- The market will expand at a Compound Annual Growth Rate (CAGR) of 29.3% over the forecast period.

- This rapid growth reflects increasing demand for cross-chain compatibility and seamless blockchain integration.

- From 2026 to 2029, the market is projected to rise steadily, indicating long-term confidence in blockchain interoperability solutions.

Blockchain Interoperability Segmentation)

- Cross-chain protocols remain the largest segment with 57% of total revenue in 2025, enabling seamless data and asset transfer across blockchains.

- Interoperable DeFi platforms now contribute 38% of interoperability usage, driven by user demand for lending, staking, and DEX flexibility.

- Supply chain interoperability solutions account for 22% of the market, supporting real-time logistics and supplier transparency.

- Data-sharing platforms make up 17% of the segment, led by secure enterprise adoption in healthcare and finance.

- Gaming interoperability has risen to 12%, reflecting growing player demand for cross-platform in-game asset mobility.

- Centralized exchanges with integrated cross-chain support now represent 24% of all exchanges, enabling multi-chain asset trading.

- Regulatory compliance solutions grew by 29% year-over-year, as governments expand interoperable digital oversight.

- Sidechain interoperability adoption is projected to expand by 43% in 2025, boosting scalability and data throughput.

- Multi-chain NFTs have surged by 133% since 2022, as artists embrace network-agnostic ownership and visibility.

- Decentralized identifiers (DIDs) account for 6% of the segmentation in 2025, supporting secure digital identity solutions.

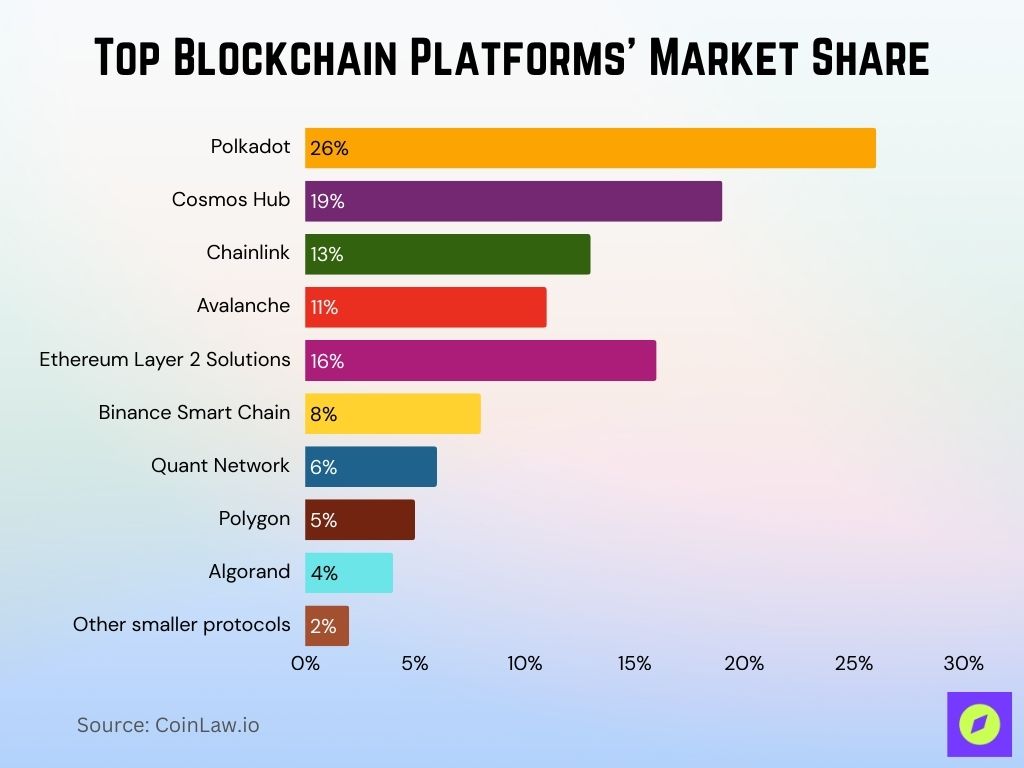

Blockchain Interoperability Market Share

- Polkadot leads with 26% market share in 2025, driven by its scalable parachain architecture for seamless cross-chain communication.

- Cosmos Hub holds 19%, powered by its IBC protocol, enabling interaction across independent blockchains in its ecosystem.

- Chainlink commands 13% by connecting blockchains to external data through its oracle-based interoperability layer.

- Avalanche’s Bridge captures 11%, facilitating multi-chain asset transfers with growing DeFi and dApp usage.

- Ethereum Layer 2s like Optimism and Arbitrum collectively hold 16%, enabling fast, low-cost, and cross-chain compatible transactions.

- Binance Smart Chain (BSC) accounts for 8%, emphasizing cross-chain swaps with Ethereum, Polygon, and other major networks.

- Quant Network’s Overledger secures 6% with its enterprise-grade interoperability in finance and supply chains.

- Polygon has grown to 5%, leveraging its Ethereum-linked cross-chain solutions for asset mobility.

- Algorand now holds 4%, with a focus on real-time payments and cross-chain smart contracts in public-sector use cases.

- Other emerging protocols make up the remaining 2%, targeting niche applications like decentralized identity and data verification.

Cross-Chain Protocols and Blockchain Bridges

- Cross-chain bridges now facilitate over $1.3 trillion in annual asset movement, driven by growing demand for DeFi and multi-chain ecosystems.

- Wrapped Bitcoin (WBTC) still leads as the top cross-chain asset, comprising 82% of BTC on Ethereum for seamless DeFi integration.

- Axelar Network supports interoperability across 18 major blockchains, linking ecosystems like Ethereum, Cosmos, and BNB Chain.

- Synapse Protocol processes more than $2.5 billion monthly, offering low-fee, fast transfers between Ethereum, BNB Chain, and Avalanche.

- Interledger Protocol (ILP) connects fiat and digital currencies, supporting interoperability between blockchain networks and payment systems.

- Portal Bridge by Wormhole enables transfers across Ethereum, Solana, and more, surpassing $6.4 billion in total cross-chain volume.

- Gravity Bridge has processed over $620 million for Ethereum-Cosmos interoperability, with continued adoption in DeFi applications.

- IBC in Cosmos powered more than 7.2 million transactions in 2025, enabling trustless data and asset exchange across chains.

- Multichain (Anyswap) enables cross-chain swaps on over 35 blockchains, with monthly volumes exceeding $4 billion.

- AllBridge has now bridged $12.6 billion in assets, connecting Ethereum, Solana, and BNB Chain with a focus on security and scalability.

Top Barriers to Blockchain Adoption Globally

- Regulatory uncertainty is the biggest obstacle, cited by 27% of respondents as a major barrier to blockchain adoption.

- Lack of trust among users follows closely, with 25% highlighting it as a key concern in adopting the technology.

- 21% of executives believe that the inability to bring the network together hampers progress significantly.

- 11% point to separate blockchains not working together as a challenge, emphasizing the need for interoperability.

- Both inability to scale and intellectual property concerns are tied at 6%, reflecting growing scalability and legal worries.

- Audit and compliance concerns were the least mentioned but still notable at 4%, indicating governance and oversight issues remain relevant.

Interoperability Platforms, Sidechains, and Layer 2 Solutions

- Polygon’s zkEVM solution integrates zero-knowledge rollups for faster transactions, reducing gas fees by up to 90% and making it a top choice for Ethereum-compatible Layer 2 solutions.

- Arbitrum saw transaction volume grow 120% in the last year, offering high-speed, low-cost transactions for dApps requiring cross-chain capabilities with Ethereum.

- Optimism’s Layer 2 solution has facilitated over $4 billion in total transaction volume on Ethereum, emphasizing scalability for DeFi projects requiring cross-chain interactions.

- Loopring, built on Ethereum, uses zkRollups to process transactions off-chain, enabling nearly 2,000 transactions per second (TPS) while maintaining Ethereum’s security.

- StarkNet, a Layer 2 solution for Ethereum, provides decentralized scalability through ZK-STARK technology, enhancing interoperability for DeFi and NFT applications.

- Avalanche’s C-Chain and X-Chain cater to decentralized applications and cross-chain assets, respectively, enabling developers to build and migrate applications from Ethereum seamlessly.

- Harmony’s Horizon Bridge connects Ethereum and Binance Smart Chain, supporting up to 100,000 transactions daily as it grows its footprint in DeFi and NFT ecosystems.

- Skale Network offers a highly scalable Layer 2 solution designed for Ethereum-compatible applications, facilitating cross-chain transfers and reduced transaction fees.

- Near Protocol’s Rainbow Bridge connects Ethereum and Near, allowing assets to be moved between the networks with fees reduced by 30% compared to other bridges.

- Immutable X uses Layer 2 technology to enable fast, gas-free transactions for NFTs on Ethereum, supporting an ecosystem of over 30 games and applications that require interoperable asset transfers.

Blockchain Adoption by Industry

- Banking & Finance leads the way, accounting for 30% of blockchain usage, by far the most dominant sector.

- Government agencies take the second spot with 13%, driven by public records, voting, and identity systems.

- Insurance follows closely at 12%, leveraging blockchain for claims processing and fraud detection.

- Both the Healthcare and Media, Entertainment & Gaming industries each represent 8%, highlighting growing tech integration.

- The “Others” category makes up 7%, indicating a wide range of smaller industry applications.

- Generic and Technology Services each hold 6%, showing moderate but relevant adoption.

- Professional Services represent 4%, while Energy & Utilities and Manufacturing each make up only 3%, showing minimal yet emerging usage.

Industry Adoption and Use Cases

- Finance and Banking lead adoption with 65% of financial institutions using cross-chain tech for secure payments and asset transfers.

- Supply Chain Management sees 44% of logistics firms implementing interoperability to improve visibility and real-time coordination.

- Healthcare blockchain adoption rose to 38% in 2025, enhancing data-sharing and patient privacy across networks.

- Real Estate applications have surged 58% since 2022, focusing on tokenized property transfers and transaction cost reduction.

- Gaming and NFTs now represent 28% of interoperability use cases, driven by cross-game asset movement and NFT trading.

- Government sectors show 33% growth in adoption, using interoperability to improve interagency data sharing and service delivery.

- DeFi continues to dominate with over 54% of cross-chain transactions, offering seamless multi-chain interaction for users.

- Digital Identity Verification now makes up 17% of interoperability use cases, addressing demand for decentralized ID systems.

- Energy and Utility companies report 22% adoption, using cross-chain tech for REC and carbon credit trading.

- Retail and eCommerce adoption reached 21% in 2025, enabling multi-chain loyalty and digital reward systems.

Top Cryptocurrency Exchanges by Trading Volume

- Binance dominates the list with a massive $28.85 billion in trading volume, more than double its closest rival.

- HBTC ranks second, posting a strong $14.44 billion in volume, highlighting its growing influence in the crypto market.

- Hydax Exchange follows with $12.19 billion, showing consistent activity among traders.

- Dsdaq records $11.97 billion, slightly edging out other mid-tier platforms.

- ZG.com handles $11.5 billion in trading volume, maintaining its relevance in the global exchange space.

- Xheta Global rounds out the list at $11.07 billion, proving that even smaller players are commanding multibillion-dollar flows.

Challenges and Security Concerns

- Smart contract vulnerabilities are a key challenge; approximately 60% of interoperability solutions are still vulnerable to code exploits, highlighting the need for robust contract auditing.

- Centralized control in some interoperability platforms presents a challenge for decentralization, with 40% of platforms still relying on centralized validators or oracles, which could become single points of failure.

- Regulatory uncertainty is a barrier to adoption, as 70% of enterprises cite unclear regulations regarding cross-chain data sharing and asset transfers as a significant obstacle.

- Scalability issues affect 50% of interoperability protocols, especially during high-traffic periods, where transaction times and costs rise significantly, reducing user experience quality.

- Cross-chain liquidity remains limited, with only 25% of bridges supporting liquid assets like stablecoins, meaning that users often face high fees and limited options when moving funds.

- Interoperability standards are lacking, with no universal protocol in place, leading to fragmentation. This issue affects 80% of blockchain projects, making cross-chain integration complex and resource-intensive.

- Technical complexity deters smaller businesses, as implementing interoperability solutions often requires specialized knowledge, limiting adoption to larger enterprises with dedicated blockchain teams.

- User experience concerns stem from technical and usability issues; 35% of users report difficulties in navigating cross-chain interfaces, pointing to the need for simpler, more intuitive designs.

- Data privacy risks are growing as cross-chain data sharing increases, with 45% of organizations concerned about compliance with regulations like GDPR and CCPA in blockchain environments.

Recent Developments

- Cross-chain bridges like the Synapse Protocol are enhancing communication between different blockchains, enabling native tokens from one chain to be used on another.

- The mBridge project, a collaboration among central banks from Hong Kong, Thailand, the UAE, and China, is developing a multiple central bank digital currency (CBDC) platform to support real-time, peer-to-peer cross-border payments using CBDCs.

- Polkadot’s Cross-Consensus Message Passing (XCMP) protocol facilitates communication between parachains, allowing for the transfer of arbitrary data across chains and supporting a wide range of applications, including token transfers and smart contract interactions.

- The Blockchain-based Service Network (BSN) in China integrates both private and public blockchain frameworks, aiming to build an underlying development and production environment where enterprises and governmental bodies can develop Blockchain-as-a-Service systems and applications, promoting interoperability across blockchain systems.

- Automated Gateways, a novel framework leveraging smart contracts, have been introduced to facilitate interoperability across diverse blockchain networks. This approach integrates directly with a blockchain’s core infrastructure, enhancing systems with built-in interoperability features and streamlining cross-chain interactions.

Conclusion

Blockchain interoperability is revolutionizing how industries leverage decentralized networks, enabling seamless data and asset transfers across blockchains. From financial services and healthcare to gaming and government, the demand for interoperable solutions has led to groundbreaking developments in protocols, platforms, and cross-chain applications. While challenges like security risks, regulatory concerns, and technical complexity remain, continuous innovation is addressing these barriers. As we progress through 2025 and beyond, blockchain interoperability is set to unlock unprecedented possibilities, reshaping digital interactions and fostering a more connected blockchain ecosystem. This shift is not just a technical evolution; it’s a movement toward a more inclusive, efficient, and accessible decentralized future.