Developer participation in blockchain ecosystems is emerging as a key barometer for both innovation and real-world utility. From major protocol upgrades to new toolsets and languages, developer activity signals where momentum is building and where ecosystems may stall. For example, enterprise-grade tokenization initiatives depend heavily on sustained developer engagement, and open-source contributions to foundational chains directly affect dApp rollout in DeFi and NFTs. Explore how developer metrics are shaping blockchain’s evolution.

Editor’s Choice

- Over 23,615 monthly active blockchain developers were contributing to open-source crypto in 2024, down from 25,419 in 2023, a ~7% nominal decline.

- The ecosystem onboarded 39,148 new developers in 2024, compared to 45,580 in 2023.

- One ecosystem, Solana, attracted 7,625 new developers in 2024, the single largest onboarding number for a blockchain that year.

- Developer contributions across the top chains show varying growth; for example, Ethereum reportedly added ~16,181 new devs in 2025.

- Regional on-chain activity in APAC grew 69% year-over-year in the 12 months ending June 2025, a backdrop to developer engagement growth.

- Open-source issue analysis across ~1,209 blockchain projects found that wallet-management and UI-enhancement issues dominate, offering insight into where developer effort focuses.

Recent Developments

- In 2025, Ethereum reportedly added 16,181 new developers while Solana saw ~11,534 new devs, the latter reflecting ~83% year-over-year growth.

- The 2024 data show that monthly active open-source devs in crypto were down to ~23,615, a reversal from growth in prior years.

- Infrastructure tooling and cross-chain compatibility gained emphasis in 2025, driving developer interest in ecosystems supporting multi-network frameworks.

- A large study found that technical events, for example upgrades, trigger increased commits ahead of the event and then reduced activity after.

- Regional growth in chain activity, for example, APAC’s 69% rise, suggests emerging markets may fuel next-wave developer engagement.

- The broader blockchain market is forecast to reach ~$1.43 trillion by 2030, underscoring long-term demand for developer talent.

- Shift toward DeFi, NFTs, and real-world asset tokenization has broadened developer roles beyond pure protocol work into applications and middleware.

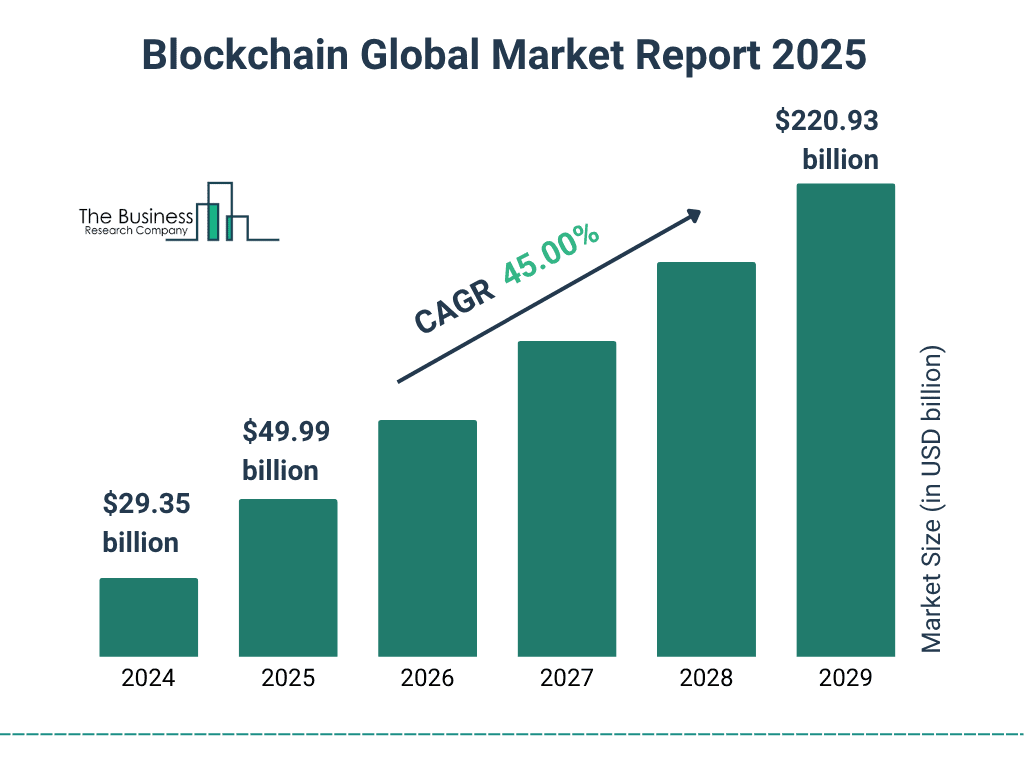

Blockchain Global Market Growth Highlights

- The global blockchain market is projected to surge from $29.35 billion in 2024 to $220.93 billion by 2029.

- Market size in 2025 reaches $49.99 billion, marking one of the strongest year-on-year jumps in early adoption.

- The industry is expanding at an impressive 45%CAGR, reflecting accelerating enterprise and government-level blockchain deployment.

- Market growth between 2026 and 2028 continues on a steep upward curve, with each year showing substantial increases in total valuation.

- By 2029, the market will be over seven times larger than in 2024, signaling blockchain’s transition into a mainstream global technology layer.

Monthly Active Blockchain Developers

- As of 2024, open-source crypto monthly active developers stood at ~23,615.

- That’s a drop from ~25,419 in 2023.

- According to Chainspect as of late 2025, total devs across tracked networks are ~66,000.

- The ~66,000 figure includes ~3.8 million commits and ~633,000 stars across repositories.

- Monthly active developer counts fluctuate annually by ~5–10%.

- Despite the decline in active devs 2023→2024, the overall developer pool remains substantially greater than a decade ago, and growth since 2015 remains ~39% annualized.

- Geographic data suggest growth in non-US regions may offset stagnation in traditional developer hubs.

Leading Blockchains by Developer Count

- Chainspect reports that Solana leads with ~10,736 developers in one snapshot.

- The Polkadot ecosystem is next with ~8,893 developers in the same dataset.

- In 2024, Solana onboarded ~7,625 new developers, topping all ecosystems.

- Ethereum added ~6,456 new developers in 2024.

- Other ecosystems onboarding, Internet Computer ~2,155, Aptos ~1,695, Base ~1,695 in 2024.

- Developer community size is becoming a key competitive metric for chains, beyond just transactions or market cap.

- The lead of Solana over Ethereum in new devs marks a shift in ecosystem attractiveness for builders.

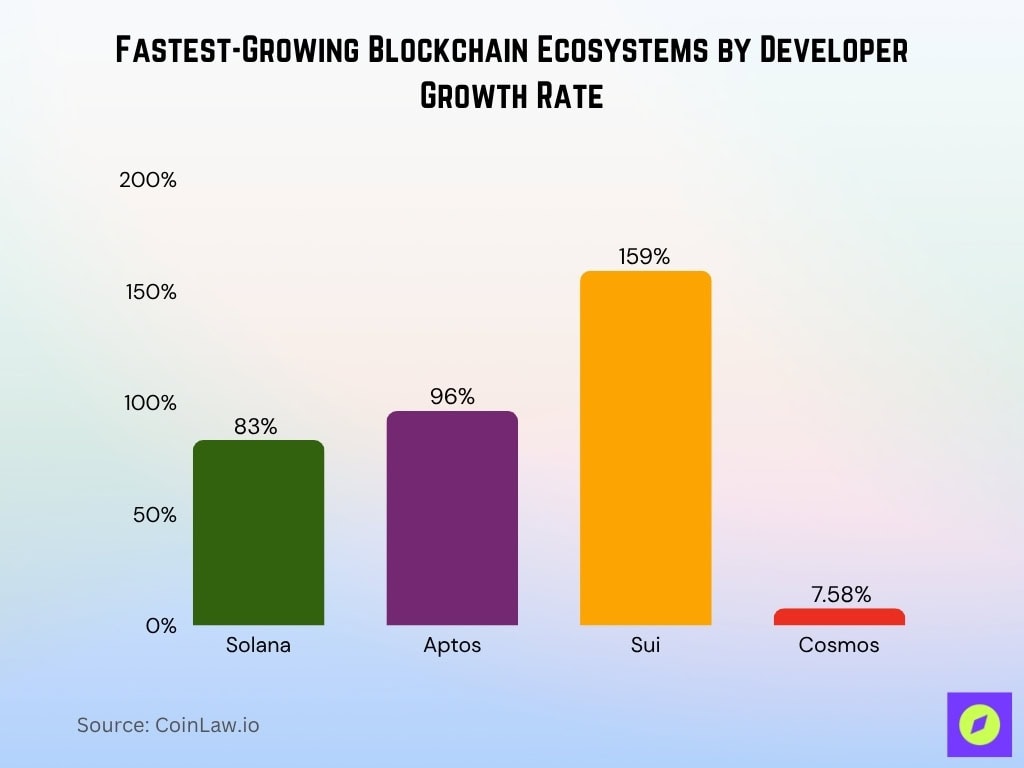

Fastest-Growing Blockchain Ecosystems

- Solana experienced an 83% year-over-year growth in new developers between 2023 and 2024.

- Aptos developer growth reached approximately 96%, marking it as one of the fastest-growing ecosystems in 2024.

- Sui’s developer growth surged by 159% in the past year.

- Cosmos counted a 7.58% increase in developer contributors despite a slight drop in developer events.

- Ethereum onboarded 16,181 new developers in the first nine months of 2025, maintaining strong inflows.

- Base, Coinbase’s Layer 2, had 4,287 active developers in 2024 and accounted for 42% of new Ethereum ecosystem code.

- Avalanche developer events declined by 18.63%, but enjoyed increased developer interest in modularity and interoperability.

- Solana added 11,534 developers in the first nine months of 2025, second only to Ethereum.

New Blockchain Developers by Ecosystem

- In 2024, about 39,148 new developers entered the blockchain ecosystem, down from ~45,580 in 2023.

- The top ecosystem in 2024 for new developers was Solana, with approximately 7,625 new developers.

- Ethereum onboarded around 6,456 new developers in 2024.

- As of September 2025, Ethereum reported over 16,000 new developers for the year.

- Data suggest that ecosystems built on the EVM stack accounted for over 10,110 developers in 2024.

- Developer interest in Solana has grown by roughly 78% over the last two years.

- India is emerging as a major talent source, with over 60,000 engineers contributing to blockchain projects globally.

Blockchain Developer Retention and Churn

- Industry-average retention for software developers, not blockchain-specific, is about 68% annually; one firm reports 95% retention via optimized policies.

- Specific churn rates in blockchain are harder to quantify, but a study shows that many projects see fewer than 30% of users retained beyond a few months.

- A longitudinal study on one major chain found that technical events, for example, upgrades, lead to a spike in commits, but a subsequent drop-off in sustained contributions.

- Among the top ecosystems, the main developer base growth slowed; for example, Ethereum’s monthly active developer count dropped ~17% from 2023 to 2024.

- One metric shows that 79% of those leaving were part-time or one-time contributors.

- The dev churn trend emphasises the importance of community, tooling, incentives, and onboarding to maintain talent.

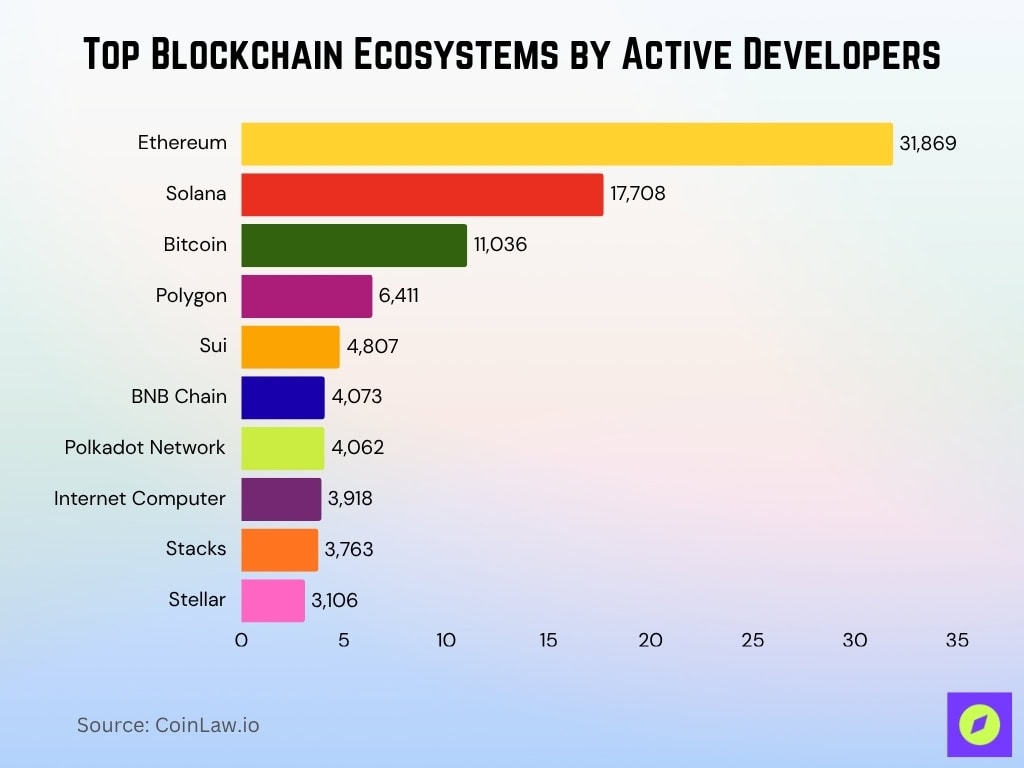

Top Blockchain Ecosystems by Active Developers

- Ethereum leads the global ecosystem with 31,869 active developers, showing its continued dominance in smart contract and Layer 2 innovation.

- Solana ranks second with 17,708 developers, reflecting strong momentum in high-speed, high-throughput blockchain development.

- Bitcoin holds third place with 11,036 developers, supported by renewed activity in L2s, ordinals, and script innovation.

- Polygon records 6,411 developers, highlighting its strong multi-chain ecosystem and enterprise adoption.

- Sui reaches 4,807 developers, signaling rapid growth among next-generation Move-based chains.

- BNB Chain reports 4,073 developers, maintaining a large builder community driven by dApps and Web3 infrastructure.

- Polkadot Network shows 4,062 developers, supported by parachain development and cross-chain tooling.

- Internet Computer has 3,918 developers, anchored by its focus on decentralized computation.

- Stacks attracts 3,763 developers, boosted by Bitcoin L2 expansion.

- Stellar engages 3,106 developers, reflecting its continued relevance in payments and financial tokenization.

Developer Activity on Major Layer 1 Chains

- On Ethereum, the developer count for new contributors in 2025 already exceeds 16,000.

- For Solana, reported builder interest increased by ~78% over two years, making it one of the fastest-growing L1s.

- In 2024, Ethereum held ~6,244 monthly active developers, compared with Solana at ~3,201.

- A portion of Ethereum’s devs (~56%) are now working on its layer 2s rather than the pure base layer.

- Smaller L1s like Polkadot registered ~1,245 developers in 2024.

- The data indicate that dominant L1s still attract the largest builder pools, even with new entrants gaining traction.

- Developer activity on L1 chains remains a leading indicator of where protocol innovation may happen and where ecosystem investment flows.

- The competition across L1 chains is increasingly about developer mindshare, not only about transaction volume or market cap.

Developer Activity on Major Layer 2 Chains

- Layer 2 networks account for over 50% of Ethereum-related commits in 2025.

- Arbitrum‘s daily active addresses reached about 1.37 million in Q2 2025.

- Optimism’s Superchain attracted more than 1,500 developers by mid-2025.

- Base onboarded over 1,600 developers within its first year of launch.

- zkSync developer growth jumped by 230% thanks to rapid zkEVM tool maturation.

- StarkNet developer activity surged by 310%, driven by Cairo bootcamps.

- Over 65% of new smart contracts in 2025 were deployed directly on Layer 2 chains.

- Layer 2 networks processed more than 1.9 million daily transactions in 2025.

- Layer 2 TVL reached approximately $39.39 billion through November 2025.

- Layer 2 ecosystems now contribute to more than 60% of Ethereum’s transaction volume post-Dencun upgrade.

Future Outlook for Blockchain Developer Growth

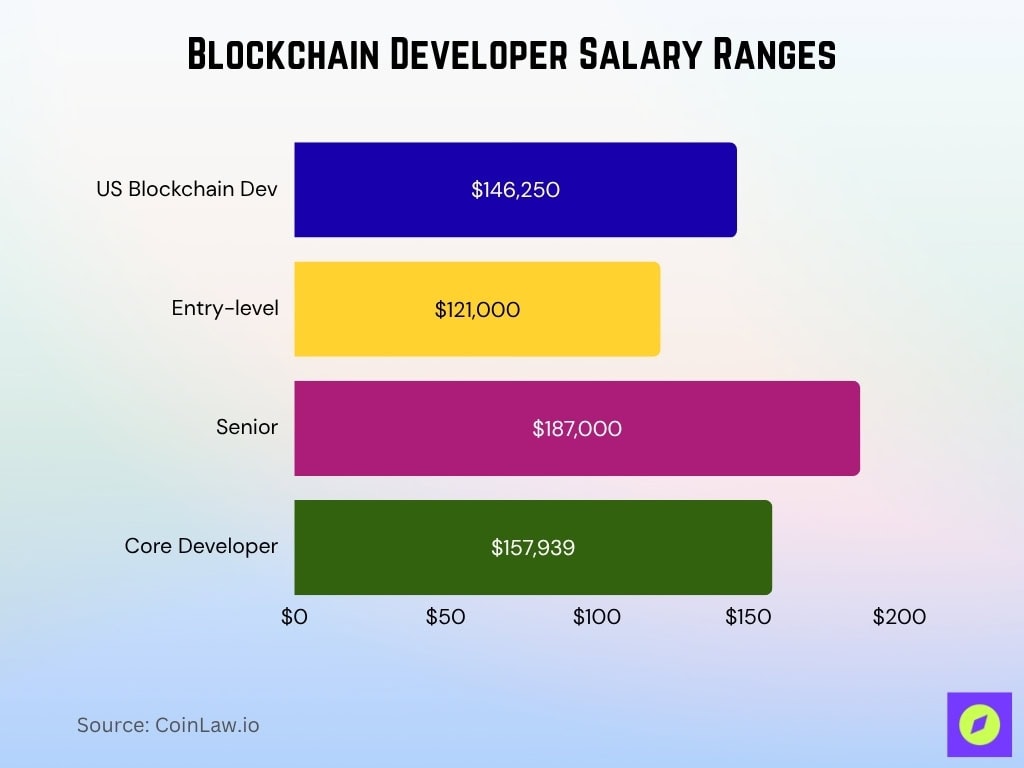

- The average blockchain developer salary in the U.S. is approximately $146,250 in 2025.

- Entry-level blockchain developers earn about $121,000, while senior roles average $187,000 annually.

- Core developer compensation averages about $157,939 annually, approximately 60% below market competitor rates.

- Monthly active blockchain developers dropped about 7% from 25,419 in 2023 to 23,615 in 2024.

- Since 2015, blockchain developer numbers have grown at a long-term average of 39% annually.

- Multi-chain developers increased to 34% of all crypto developers in 2024, up from less than 10% in 2015.

- AI-assisted development tools adoption rose by over 85% in 2025, improving efficiency and lowering entry barriers.

- Developer retention improved with targeted onboarding programs, achieving up to 95% retention after 12 months.

Blockchain Commits and Code Contributions

- Across major ecosystems, total commits in 2025 exceed 3.8 million across ~66,000 developers.

- Ethereum accounts for roughly 40% of these commits due to its large developer base.

- Solana’s code repositories show an average monthly commit growth of 12%.

- Developer contribution rates tend to spike during upgrade cycles, such as protocol improvements or major hard forks.

- Over 1.2 million repositories have at least one blockchain-related keyword.

- Commits related to smart-contract libraries and DeFi protocols form ~60% of all blockchain code activity.

- Forked repositories contribute roughly 15–20% of all commits annually.

- Code review turnaround time has improved by ~23% since 2023, showing ecosystem maturation.

Open-Source Repository Counts by Blockchain

- An analysis of over 1.7 million open-source repositories and 902 million commits across blockchain ecosystems was done in 2024.

- The number of unique blockchain devs grew ~39 % per year since 2015, even while monthly active devs dropped ~7 % from 2023 to 2024 (25,419 → 23,615).

- The dataset tracked by Chainspect shows ~66,000 total developers across chains, ~5,000 repositories, and ~3.8 million commits as of November 2025.

- A recent empirical study found 497,742 issues mined from 1,209 open-source blockchain-related projects, showing the maintenance scale of codebases.

- Projects with fewer than ~1% of contributors making main-branch changes are common.

- Monitoring repository counts and commit frequency gives a proxy for ecosystem health and “bus-factor” risk, single points of failure.

Trends in Blockchain Development Tools and Languages

- Solidity accounts for about 65% of smart contract deployments on EVM and compatible chains in 2025.

- Rust is the preferred language for Solana, Polkadot, and NEAR ecosystems.

- Cairo usage surged by 145% in 2025 due to StarkNet’s ZK-rollup adoption.

- Move language adoption increased by 120% driven by Aptos and Sui ecosystem growth.

- Hardhat remains the top testing framework with 72% developer usage in smart contract deployment.

- Truffle & Ganache are used by 55% of developers for local testing environments.

- AI-assisted tools grew by 85% in adoption for smart contract scaffolding and vulnerability detection.

- Multi-chain tooling demand rose by 40% in 2025 as developers seek cross-protocol portability.

- Developer experience (DX) improvements attracted 68% positive feedback in 2025 tooling surveys.

- Approximately 65% of new continuous integration (CI) Actions replicate existing functions across development tools.

Impact of Developer Activity on Blockchain Adoption

- A strong correlation (r ≈ 0.954) was found in 2025 between weekly developer counts and code commit frequencies across blockchain ecosystems globally.

- Ecosystems with higher developer activity tend to attract more infrastructure investment and integrations. For example, chains with >5,000 monthly active devs show more dApp launches.

- Protocols top in developer activity, for example, Ethereum, also typically lead in ecosystem growth, though causation may run both ways.

- Lower developer churn and strong tooling support correlate with higher retention of enterprise blockchain projects.

- Conversely, developer dips of ~7 % (2023-24) signal some consolidation in ecosystems and may affect adoption momentum.

- For enterprise decision-makers, developer activity metrics serve as a predictive indicator of which blockchains are likely to deliver ongoing innovation and support.

Blockchain Developer Community Engagement

- Over 50% of blockchain developers contribute part-time or as occasional contributors.

- More than 55% of major OSS blockchain communities experience “activity cascades” where developer participation rapidly increases after initial edits.

- Around 89% of blockchain projects have lost at least one core developer over their lifecycle.

- Hackathons increase developer retention by over 50% in ecosystems like Solana.

- Blockchains with multi-language tooling show a 30% higher developer onboarding and engagement rate.

- Only about 15% of contributors make meaningful commits regularly, reflecting high churn.

- Multi-chain active developers have grown by 42% year-over-year, promoting knowledge cross-pollination.

- Community engagement spikes by 35% around major protocol upgrades focusing on core infrastructure.

- Forums and ecosystem grants boosted participation rates by at least 40% in the last two years.

- Developer participation in open-source blockchain initiatives follows a Pareto distribution, with 5% of developers contributing over 80% of commits.

Blockchain Developer Activity in DeFi and NFTs

- The DeFi ecosystem surpassed $123.6 billion TVL in 2025, up 41% year-over-year.

- Over 85,000 smart contracts were deployed monthly on Ethereum in 2025.

- More than 85 million NFTs were minted globally in the first half of 2025.

- NFT daily active wallets averaged around 410,000, a 9% increase year-over-year.

- DeFi developer activity is concentrated in yield protocols and lending platforms, which comprise 78% of protocol activity.

- Developer churn in DeFi/NFT projects exceeds 30%, higher than base-layer protocols.

- Retention rates in NFT projects positively correlate with project maturity and revenue, reaching up to 70% in top projects.

- Ecosystems with strong full-stack tooling experience have 45% higher combined developer engagement in NFT projects.

- Resource-oriented NFT languages like Cadence and Move saw a usage rise of 120% in 2025.

- Specialized NFT tooling adoption increased by 38%, facilitating growth in niche developer activities.

Frequently Asked Questions (FAQs)

Solana onboarded ~ 7,625 new developers.

~ 65% of smart-contract deployments.

~ 69% year-over-year growth.

Conclusion

Developer activity on blockchain ecosystems has entered a more mature phase. While some headline numbers show a slight decline in monthly active developers, the broader indicators, repository counts, language/tool diversification, DeFi/NFT activity, and enterprise adoption, point to ongoing structural growth. For industry watchers and decision-makers, tracking developer metrics offers a meaningful lens into ecosystem health, innovation potential, and competitive positioning. The numbers don’t just tell us what’s already happened; they help forecast where the next wave of builders and use cases will emerge.