BitMine has added another 32,977 ETH to its treasury, pushing its total Ethereum holdings to a staggering 4.14 million ETH as it marches toward its goal of owning 5 percent of the entire supply.

Key Takeaways

- BitMine Immersion purchased 32,977 ETH last week, bringing its total holdings to 4,143,502 ETH worth around $13 billion.

- The company now controls 3.43% of Ethereum’s circulating supply and aims to reach 5%, or about 6.04 million ETH.

- BitMine has staked 659,219 ETH, with recent growth of 250,592 ETH staked in just one week.

- The firm is preparing to launch its Made in America Validator Network (MAVAN), targeting $374 million in annual staking revenue.

What Happened?

BitMine Immersion Technologies continued its aggressive Ethereum accumulation strategy with a recent $104 million purchase of 32,977 ETH, despite ETH prices climbing nearly 7.8% in the past week. The move reinforces BitMine’s status as the largest Ethereum treasury holder globally, now sitting on over 4.14 million ETH, which represents 3.43% of the entire ETH circulating supply.

Chairman Thomas Lee confirmed the update and emphasized that BitMine remains the world’s largest “fresh money” buyer of Ethereum. The company has outpaced competitors by a wide margin, with its ETH holdings nearly five times larger than its next closest rival.

🧵

— Bitmine (NYSE-BMNR) $ETH (@BitMNR) January 5, 2026

BitMine provided its latest holdings update for January 5th, 2026:

$14.2 billion in total crypto + “moonshots”:

– 4,143,502 ETH at $3,196 (@coinbase)

– 192 Bitcoin (BTC)

– $25 million stake in Eightco Holdings (NASDAQ: $ORBS) (“moonshots”) and

– total cash of $915…

Ethereum Treasury Growth Accelerates

BitMine’s strategy is clear: dominate the Ethereum treasury landscape and build a robust staking infrastructure. The company increased its staked ETH by 250,592 over the past week alone, bringing the total staked ETH to 659,219. These assets are distributed across three staking providers, forming the foundation of BitMine’s upcoming MAVAN (Made in America Validator Network).

- MAVAN is set to launch soon as a U.S.-based validator network.

- BitMine projects $374 million in annual revenue from secure ETH staking.

The move aligns with broader macro trends supporting crypto adoption. BitMine highlighted tailwinds such as U.S. regulatory support, Wall Street’s growing interest in stablecoins and tokenization, and the increasing need for AI-driven digital authentication.

Massive Ethereum Holdings and Growing Influence

BitMine now ranks as the second-largest public crypto treasury overall, just behind Michael Saylor’s Strategy, which holds 673,783 Bitcoin valued at $63 billion. BitMine’s Ethereum stash dwarfs other ETH treasuries like SharpLink’s 863,021 ETH and The Ether Machine’s 496,712 ETH, according to data from SER.

In addition to its ETH position, BitMine’s total assets include:

- 192 Bitcoin worth $17.8 million.

- A $25 million stake in Worldcoin treasury firm Eightco Holdings.

- $915 million in cash reserves.

The firm’s total combined crypto and cash assets now stand at $14.2 billion.

Market Reaction and Shareholder Plans

BitMine’s buying spree followed renewed market optimism. Ethereum has recently flipped its 50-day EMA and tested the $3,260 resistance, riding the wave of $174 million in net inflows into ETH spot ETFs on the first trading day of 2026.

Meanwhile, BitMine Chairman Thomas Lee has asked shareholders to approve an increase in the company’s authorized shares from 500 million to 50 billion to support future share splits and enhance market flexibility.

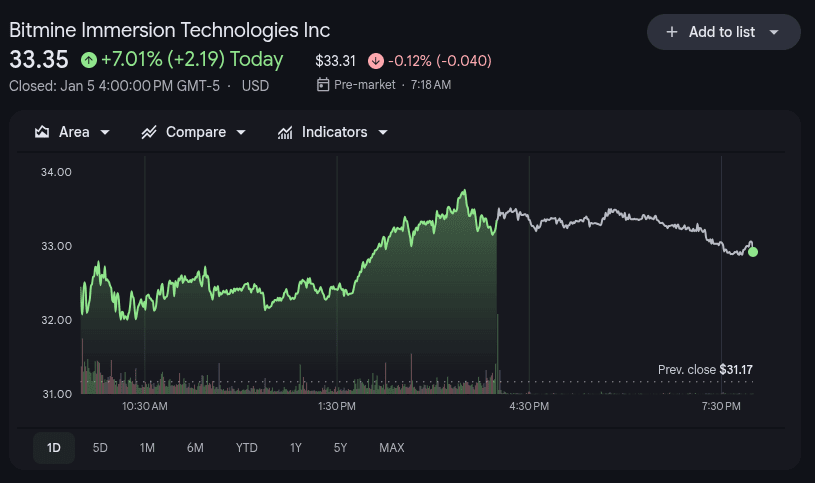

BitMine’s stock (BMNR) reflected investor confidence, rising 14.9% on Friday and trading up 4.2% on Monday at $33.35.

CoinLaw’s Takeaway

In my experience tracking institutional crypto plays, BitMine is pulling off one of the most ambitious Ethereum accumulation strategies we’ve ever seen. What’s impressive is not just the scale of ETH they’re buying, but the long-term infrastructure they’re building around staking with MAVAN. This isn’t a speculative treasury. It’s a deeply strategic move that combines asset accumulation, staking yield, and regulatory-aligned network development. If they hit their 5% target, BitMine won’t just be a big ETH holder. They’ll be a power center in Ethereum’s validator economy. That’s something every crypto watcher should be paying attention to.