The cryptocurrency exchange Bitfinex has long been a key player in digital asset markets, and this year brings fresh data that tells a story of shifting volumes, evolving user bases, and structural pressures. As institutions deepen their crypto activity and regulatory frameworks tighten, Bitfinex’s statistics offer insight into how major exchanges adapt. Real-world examples include hedge funds using Bitfinex’s large liquidity pools for high-frequency trades, and Southeast Asian traders leveraging its platform for margin funding during regional crypto rallies. Explore the full article to see how these numbers shape the future of crypto exchanges.

Editor’s Choice

- CoinGecko data shows $27.37 billion in exchange reserves as of mid-2025.

- Approximately 403,000 BTC is held in Bitfinex cold wallets, placing it among the largest centralized exchange custodians.

- As of March 27, 2025, spot trading volume was around $223 million over a 24-hour period.

- Bitfinex accounts for roughly 0.52% of BTC trading volume relative to leading exchanges.

- Traffic demographics indicate visitors are about 69.38% male and 30.62% female.

- Bitfinex has transitioned to a zero trading fee model, eliminating maker and taker fees across supported spot and derivatives markets to boost liquidity and reduce trader costs.

- As of March 2025, Bitfinex offers support for 250+ cryptocurrencies and more than 400 trading pairs.

Recent Developments

- Bitfinex announced that its “Bitfinex Pay” service is transitioning to Estable Pay on September 15, 2025, aiming to streamline crypto payment infrastructure.

- The exchange published its “Bitfinex Alpha” outlook for 2025, signalling a cautiously optimistic environment with structural challenges ahead.

- On June 2, 2025, Bitfinex moved ≈7,000 BTC to Twenty One Capital, signaling increased institutional activity and possible liquidity implications.

- A recent review noted Bitfinex’s spot trading feature supports high-volume professional users with up to 10× leverage.

- Newhedge reporting lists Bitfinex’s monthly spot volume at $14.05 billion among top exchanges as of 2025.

- Bitfinex was ranked among 2025’s top crypto exchanges due to its advanced trading tools and liquidity offerings.

- A Bitfinex blog noted the company holds some of the largest Bitcoin reserves and remains a go-to for institutional flows.

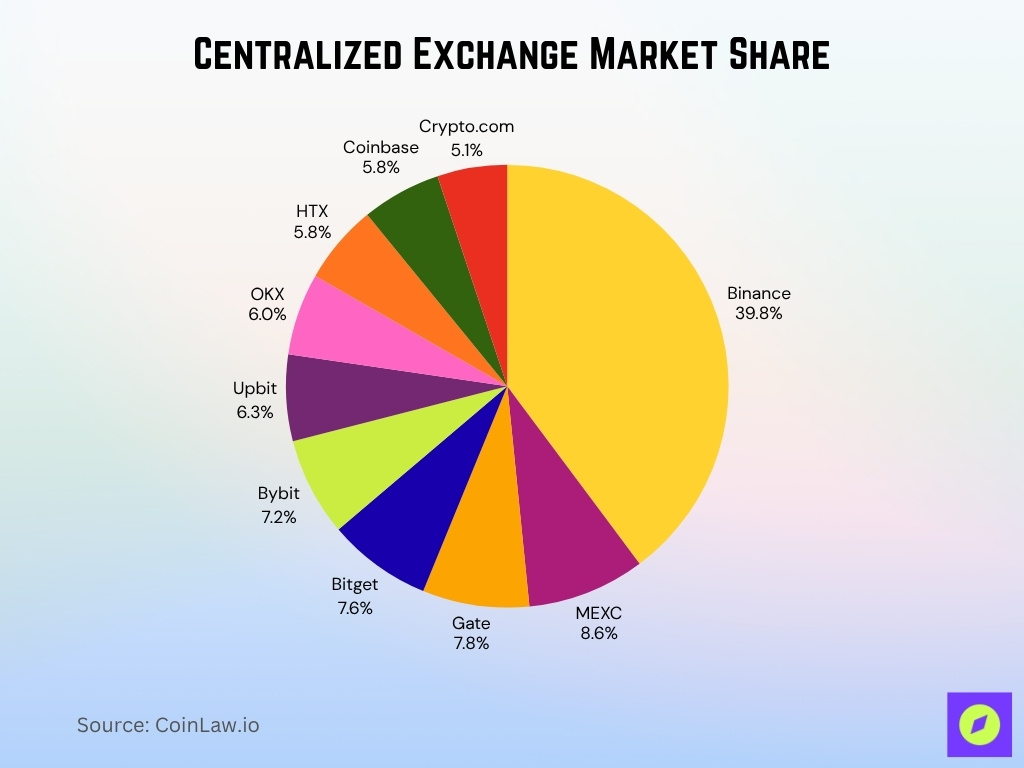

Centralized Exchange Market Share

- The top centralized exchanges by spot trading volume for July 2025, Binance, 39.8%; MEXC, 8.6%; Gate, 7.8%; Bitget, 7.6%; Bybit, 7.2%; Upbit, 6.3%; OKX, 6.0%; HTX, 5.8%; Coinbase, 5.8%; Crypto.com, 5.1%.

- Bitfinex’s share of BTC pair trading volume was estimated at approximately 0.52% according to Newhedge.

- In the broader CEX sector, centralized exchanges are expected to capture 87.4% of market share in 2025.

- A monthly spot volume snapshot placed Bitfinex at $14.05 billion in volume, behind tier-one exchanges.

- Review commentary places Bitfinex among the “top 25 centralized exchanges by volume” as of March 2025.

Proof of Reserves Audit Statistics

- Bitfinex’s reserves were estimated at around $15.2 billion in late 2024, based on publicly tracked balances.

- CoinGecko assigns a Trust Score of 8/10, indicating moderate transparency and reserve reporting.

- Following the FTX collapse, the industry saw a 50% increase in exchanges adopting proof-of-reserves audits, with Bitfinex participating at a partial compliance level.

- Bitfinex reserves are commonly assessed through a mix of on-chain wallet tracking and balance sheet disclosures.

- Independent analysts note that a large reserve value does not automatically ensure full 1:1 backing of all customer holdings.

- By mid-2025, exchange reserves were estimated at $25.7 billion, reflecting ongoing operational liquidity and scaling.

Margin Trading Statistics

- Bitfinex offers leverage of up to 10× on select spot and margin trading markets.

- Maintenance margin requirements generally stay near 15%, with initial margin typically around 30%.

- As of early 2025, bitcoin margin longs on the platform surpassed 60,000 BTC, reflecting significant leveraged positioning.

- Total active margin funding exceeded $200 million in 2025, supporting continued lending activity across markets.

- Margin borrowers may pay interest rates as low as 0.06% daily, depending on funding availability and market conditions.

- The BTC/USD and ETH/USD pairs account for more than 70% of overall margin trading volume, underscoring their central role in platform liquidity.

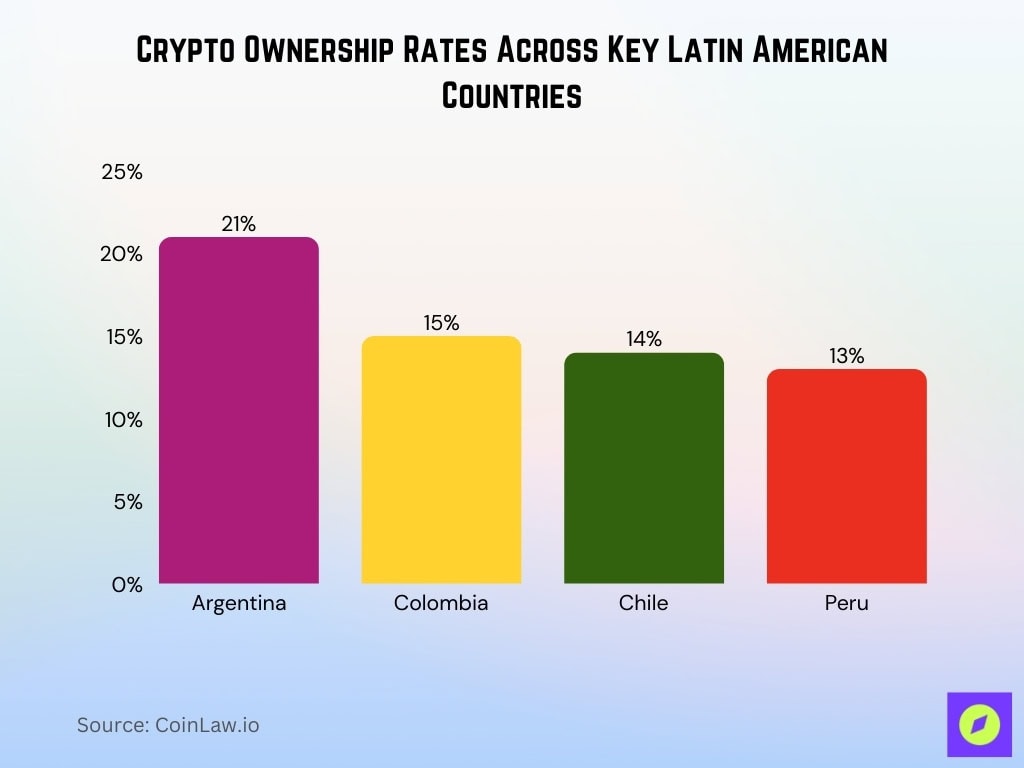

Geographic Distribution of Users

- Latin American countries show crypto ownership rates: Argentina 21%, Colombia 15%, Chile 14%, Peru 13%.

- Bitfinex operates in over 180 countries worldwide, excluding 16 restricted regions.

- The U.S. and Canada are fully restricted from using Bitfinex due to regulatory reasons.

- Central & Southern Asia and Oceania recorded over $750 billion in crypto inflows in one 12-month period.

- North America and Western Europe hold the largest share of on-chain crypto value, accounting for over 50% combined.

- Asia Pacific crypto exchange market revenue share is around 25.35% as of 2025.

- South America holds approximately 5.98% of global crypto exchange revenue.

- Korea, Russia, and Germany are among the top traffic sources to Bitfinex’s website, representing over 30% of traffic.

Bitfinex User Statistics

- According to demographic traffic data for bitfinex.com, 69.38% male vs 30.62% female visitors.

- The largest visitor age group is 25-34 years old.

- Bitfinex supports 250+ cryptocurrencies and 400+ trading pairs, which reflects the breadth of user options.

- The covering number of trading pairs indicates an advanced audience of diversified traders, perhaps suggesting a more professional user base.

- User access from restricted jurisdictions, Bitfinex’s review notes service exclusions for the U.S., Bangladesh, Ecuador, etc.

Derivatives Trading Statistics

- Bitfinex offers perpetual swaps and derivatives denominated in USDT and BTC across “over 60” contracts.

- Leverage for derivatives can go up to 100× for professional users.

- Derivatives trading activity remains a significant component of Bitfinex’s offering, positioned for advanced hedging and speculative strategies rather than casual retail.

- The July 2025 issue of Bitfinex’s “Bitfinex Alpha” newsletter reported that over $1.1 billion of long positions were liquidated across major exchanges during one weekend, underscoring the size of derivatives risk.

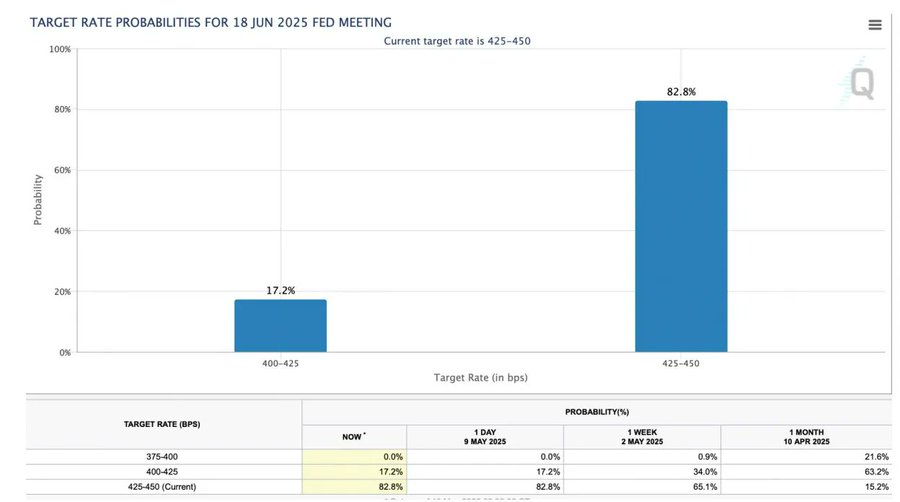

Bitfinex Market Sentiment

- As of June 2025, Bitfinex traders are closely watching Federal Reserve rate expectations, which heavily influence crypto liquidity and funding costs.

- The market assigns an 82.8% probability to the target rate remaining at 425–450 bps, showing confidence that U.S. rates will hold steady.

- A 17.2% probability indicates a possible rate cut to 400–425 bps, representing mild anticipation of easing in the near term.

- The 375–400 bps range shows 0% probability, suggesting investors see no chance of an aggressive rate reduction.

- Compared with a month ago, the probability of maintaining the current rate soared from 15.2% to 82.8%, highlighting a strong shift in market sentiment.

- Meanwhile, expectations for a rate cut fell sharply from 63.2% to 17.2%, reflecting stronger U.S. inflation resilience and reduced pressure on the Fed.

Web Traffic Statistics

- According to SimilarWeb, the visitor distribution to bitfinex.com is 69.38% male and 30.62% female.

- The largest age segment visiting the site is 25-34 years old.

- On CoinGecko, the exchange holds a Trust Score of 8/10, in part based on traffic and volume metrics.

- Traffic ranking metrics (Ahrefs Domain Rating ~78) suggest that bitfinex.com ranks well among crypto-exchange websites.

- The ratio of reported trading volume (~$330.9 million 24-h) to web traffic suggests relatively high interest per visitor.

- Given its professional user focus, the traffic profile implies a heavier leaning toward active/trading-savvy users rather than casual browsers.

Demographic Insights

- Website traffic skews roughly 69.38% male and 30.62% female.

- The most active age group is 25–34, indicating strong usage among younger to mid-career professionals.

- Third-party estimates suggest the platform may have up to ~2 million active users.

- Reviewer feedback frequently notes that its product suite, spot, margin, and derivatives, caters more to experienced rather than beginner traders.

- The overall structure of the platform (advanced margin tools, derivatives markets, and substantial reserve support) aligns with a user base that leans more toward professional and high-frequency traders.

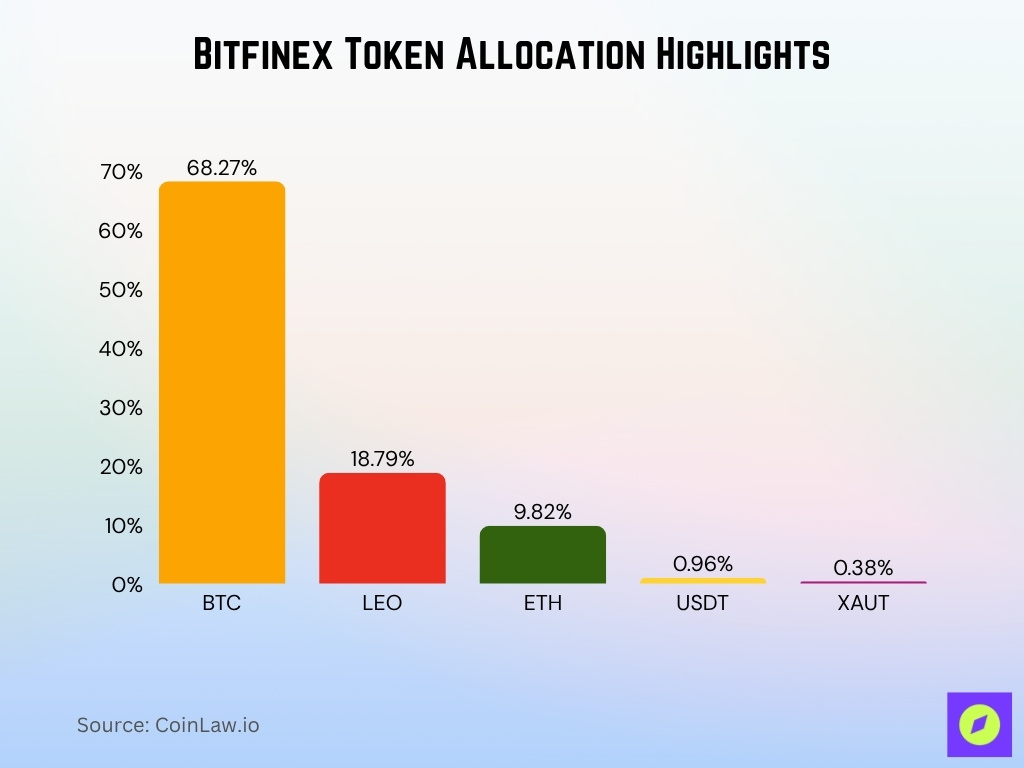

Bitfinex Token Allocation Highlights

- BTC (Bitcoin) makes up the largest portion of Bitfinex’s reserves at 68.27%.

- LEO (Bitfinex Native Token) accounts for 18.79% of total assets, reaffirming its strategic importance to the platform.

- ETH (Ethereum) constitutes 9.82% of reserves, establishing it as the third largest holding.

- USDT (Tether), a stablecoin, holds a 0.96% share, primarily for liquidity purposes.

- XAUT (Gold-backed Token) represents 0.38% of assets, providing some exposure to tokenized gold in the reserve mix.

Bitfinex Security Statistics

- The infamous 2016 breach of the platform resulted in around 119,756 BTC stolen in August 2016.

- The global industry witnessed over $2.17 billion in exchange-related security losses in 2025 (YTD), in the context of exchange risk.

- On CoinGecko’s breakdown, Bitfinex’s “Cybersecurity” score was listed as 0.0 in one evaluation, signalling room for structural transparency improvement.

- The Trust Score’s “API Coverage” component scored 0.5 for Bitfinex, indicating moderate data/API transparency.

- In reviews, Bitfinex is noted to use standard security measures like 2FA, cold-storage wallets, and advanced APIs.

- Despite the past hack, Bitfinex has operated continuously since 2012, which contributes to a trust narrative for some professional users.

API & Developer Usage Statistics

- Bitfinex’s REST API rate limit ranges from 10 to 90 requests per minute, depending on the endpoint.

- WebSocket API allows unlimited order operations but limits to 15 new connections every 5 minutes per account.

- The REST API supports up to 1,000 orders per 5 minutes per user, scaling with trade volume.

- Bitfinex provides SDKs like bitfinex-api-go supporting REST and WebSocket API v1/v2.

- Bitfinex APIs enable advanced features like order management, margin funding, and position tracking.

Frequently Asked Questions (FAQs)

Around $27.37 billion in reserves.

Over 400 trading pairs (with 250+ cryptocurrencies supported).

About $14.05 billion monthly spot volume, placing it among the lower-tier top exchanges.

An estimated 87.4% market share for CEX platforms.

Conclusion

The data on Bitfinex paint a clear picture: this exchange serves a distinct niche in the cryptocurrency ecosystem, one characterised by advanced trading tools, institutional-scale liquidity, and a global but selective user base. Traffic and demographic metrics underscore a younger, male-skewed, and professional audience. Geographic and regulatory factors shape where and how users access the platform.

The security and API-usage evidence show a mature infrastructure, albeit one where external transparency may still trail the highest industry standards. For U.S.–targeted watchers and global stakeholders alike, Bitfinex remains a key player, not always the largest, but significant in depth, breadth, and purpose. If you’re analysing crypto-exchange dynamics or seeking a partner for trading or development workflows, these statistics form a vital baseline.